Discover how to streamline your onboarding process this festive season with our guide. Learn how automated KYC/KYB and scalable fintech solutions can boost onboarding efficiency.

The Ultimate Guide to Fast & Efficient Onboarding During Festive Season

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Online marketplaces in India sold goods worth $6.5 billion in 2023, or almost Rs 55,000 crore, in one week of festive sales, marking a 26% increase from last year. Mobile phones, electronics, consumer durables, home, and general merchandise accounted for three-fourths of the total sales.

According to data from Momentum Commerce, sales for some sellers during Amazon Prime Big Deal Days grew 42% year over year.

If the statistics displayed above didn’t indicate, the festive fervour within the market has officially set in! Just two weeks into October, the ecosystem is churning out numbers that haven’t been seen before.

Some of the key insights are here as follows,

- Surge in Online and Offline Sales: Indian e-commerce platforms have reported a 20% increase in order volumes and a 24% rise in gross merchandise value (GMV) within the first four days of the festive season sales. This growth spans across sectors, with categories like fashion, beauty, and health showing remarkable expansion. For example – Swarovski earrings have become a popular choice in the fashion space, reflecting the rising demand for stylish and affordable luxury. Offline retailers are also anticipating strong growth driven by a 5-7% increase in foot traffic and enhanced customer engagement during this period

- Consumer Trends: The festive season, especially around major holidays like Diwali, is witnessing a 54% rise in makeup sales and a 33% jump in nutraceuticals. Other sectors such as electronics and household goods are also performing well, capitalising on discounts, offers, and easy payment options.

With the festivities officially kicking in, businesses are gearing up for a surge in customer activity. This means now, more than ever, having a smooth onboarding process is vital. Bottlenecks during festive onboarding can significantly hinder a business’s ability to capitalise on the seasonal rush. Here are some common issues businesses face:

- Lengthy Verification Processes: Extended KYC and KYB processes can frustrate customers and cause them to abandon their applications. Automating these processes can help speed up onboarding.

- Document Submission Delays: Customers may struggle with submitting the required documents in the correct format. Offering multiple upload options and clear instructions can mitigate this issue.

- Inadequate Infrastructure: High traffic volumes can overwhelm existing systems, leading to slowdowns. Upgrading infrastructure or leveraging scalable fintech solutions can ensure seamless operations.

- Limited Payment Options: A lack of diverse payment methods can deter customers from completing transactions. Providing multiple payment options can enhance customer satisfaction and conversion rates.

- Poor Communication: Lack of timely updates during onboarding can lead to confusion. Regular communication and status updates can keep customers informed and engaged.

Addressing these bottlenecks is crucial for businesses looking to maximise their potential during the festive season. For fintechs and merchants, making onboarding hassle-free ensures operational efficiency and a better customer experience. The proper fintech infrastructure can be the magic tool that simplifies onboarding, reduces delays, and gets your business up and running faster during the busiest time of year.

So, if you are a business looking to streamline your onboarding, the following key metrics have to be part of your checklist from an infrastructure perspective,

Effective Business Verification

One of the critical steps in onboarding, especially in the fintech industry, is Know Your Business (KYB). As businesses gear up for the bustling festive season, implementing robust Know Your Business (KYB) processes during onboarding is crucial. Here’s why KYB matters and how it can enhance your onboarding experience:

Automated KYB Processes: Implementing automated KYB systems that verify business information in real-time can significantly reduce onboarding time. By utilizing multiple data sources—such as government databases, and credit bureaus—businesses can quickly validate the legitimacy of applicants, enabling faster decision-making.

Instant Verification with APIs: Leveraging APIs for document authentication and identity verification can streamline the process, providing results in under a minute. This speed is especially beneficial during high-traffic periods, as it helps improve conversion rates and reduces drop-offs.

Integrated Compliance Checks: Ensure your KYB processes include automated compliance checks to adhere to industry regulations. This will protect your business and build trust with customers who expect secure transactions.

Optimise KYC and Identity Verification

Post-business verification, the natural progression brings us to KYC (Know Your Customer) and identity verification. As the festive season approaches, businesses must ensure their verification processes are secure and efficient to avoid delays. Here are some features to help streamline verification and validation:

- Automated KYC: Implementing automated KYC processes that verify customer information in real-time using multiple data sources, such as Aadhaar, and PAN, can drastically reduce onboarding time.

- Simplified Document Uploads: Ensure your onboarding system supports a wide range of document formats and provides seamless document upload options to customers.

- Instant Verification: APIs allow businesses to authenticate documents and verify identities in under a minute, improving conversion rates during high-traffic periods like the festive season.

Accelerate Merchant Onboarding

Merchants are at the heart of most businesses during the festive season. A fast and frictionless merchant onboarding process ensures they are ready to serve customers quickly. The faster merchants get onboarded, the sooner they can accept payments and fulfil orders.

- Instant Verification and Approval: Leverage APIs that automate the verification process of business documents, reducing manual checks and errors. Use digital infrastructure to instantly verify PAN, GST, and business registration details.

- Automated Documentation: Automate document collection and verification processes to avoid delays, which is critical when businesses experience high onboarding volumes.

Enable Digital-First Onboarding

As digital platforms become the primary touchpoint during festive seasons, businesses must provide a mobile-first, user-friendly onboarding experience. Fintech players offering digital-first onboarding solutions make it easy for companies to handle the festive rush efficiently.

- Mobile-Friendly Onboarding: Ensure the onboarding interface is mobile-responsive to accommodate the growing number of mobile users during the festive season.

- Omnichannel Support: Provide seamless onboarding across various digital channels, allowing customers to switch between devices without losing progress.

- Interactive Onboarding Flows: Use guided onboarding flows with clear prompts and real-time feedback to help customers complete onboarding steps quickly and correctly.

Leverage Pre-Filled Data for Faster Onboarding

One way to expedite the onboarding process is to use pre-fill APIs that can pull relevant data from verified sources, reducing the need for manual data entry. This enhances the user experience and minimises the chances of data entry errors.

- Pre-Fill Data from Multiple Sources: Use pre-fill APIs to automatically populate fields with data from reliable sources such as NSDL, MCA, and CKYC. This reduces the time customers and merchants spend entering information and ensures accuracy.

- Reduce Drop-offs: Pre-filling crucial details such as PAN, company registration number, or business address can help reduce drop-offs during onboarding.

Integrate Seamless Payments

If the start of the leg sets the tone for customer experience, the check-out seals the deal. During the festive season, businesses experience a surge in payment transactions. Simplifying the payment onboarding process for merchants ensures they can start accepting payments instantly without cumbersome delays, reflecting on customer retention.

- Unified Payments Interface (UPI) Integration: Offering UPI-based onboarding allows businesses to facilitate payments quickly, which is crucial during the high-transaction festive period.

- Automated Payouts: Offer instant payouts for merchants once transactions are completed, eliminating waiting times and reducing the operational burden.

- On-Demand Payouts: Merchants can request on-demand payouts at any time, ensuring that they can replenish their stock and handle festive season sales spikes smoothly.

Focus on Scalability and Security

During the festive season, businesses often experience exponential increases in onboarding volumes. Partnering with a fintech infrastructure provider that can handle high volumes without compromising security or performance is essential.

- Scalable Infrastructure: Choose a fintech platform with scalable API infrastructure that can handle large volumes of customer and merchant onboarding requests.

- Data Security: Ensure customer and merchant data is encrypted and handled in compliance with local regulatory requirements such as GDPR or PCI DSS for payment data security.

Simplify User Experience with Personalization

A personalised onboarding experience can enhance user satisfaction, especially during busy festive seasons. Customising onboarding flows based on customer preferences can create a more engaging experience.

- Segmented Onboarding Journeys: Tailor the onboarding journey based on user segments (e.g., individual customers vs. merchants), displaying relevant information at each step.

- Dynamic Forms: Use dynamic forms that adjust based on the user’s information, creating a streamlined and efficient onboarding experience.

Now that we have a checklist in place, it is only fair to map these points to providers that can fulfil one, if not all, of the criteria. Interestingly enough, we at Decentro offer a comprehensive suite of APIs designed to simplify and automate onboarding processes for businesses, especially during peak seasons like festivals. Here’s how,

We have APIs between the two comprehensive modules, Flow and Fabric, to ensure your business is ready for the festive season with scalable, secure, and efficient onboarding solutions. Just to name a few, we have,

- Automated KYC & KYB: Enable secure identity verification utilising government and financial institution databases.

- UPI Payment Solutions: Facilitate quick and easy payment collections to enhance the customer experience.

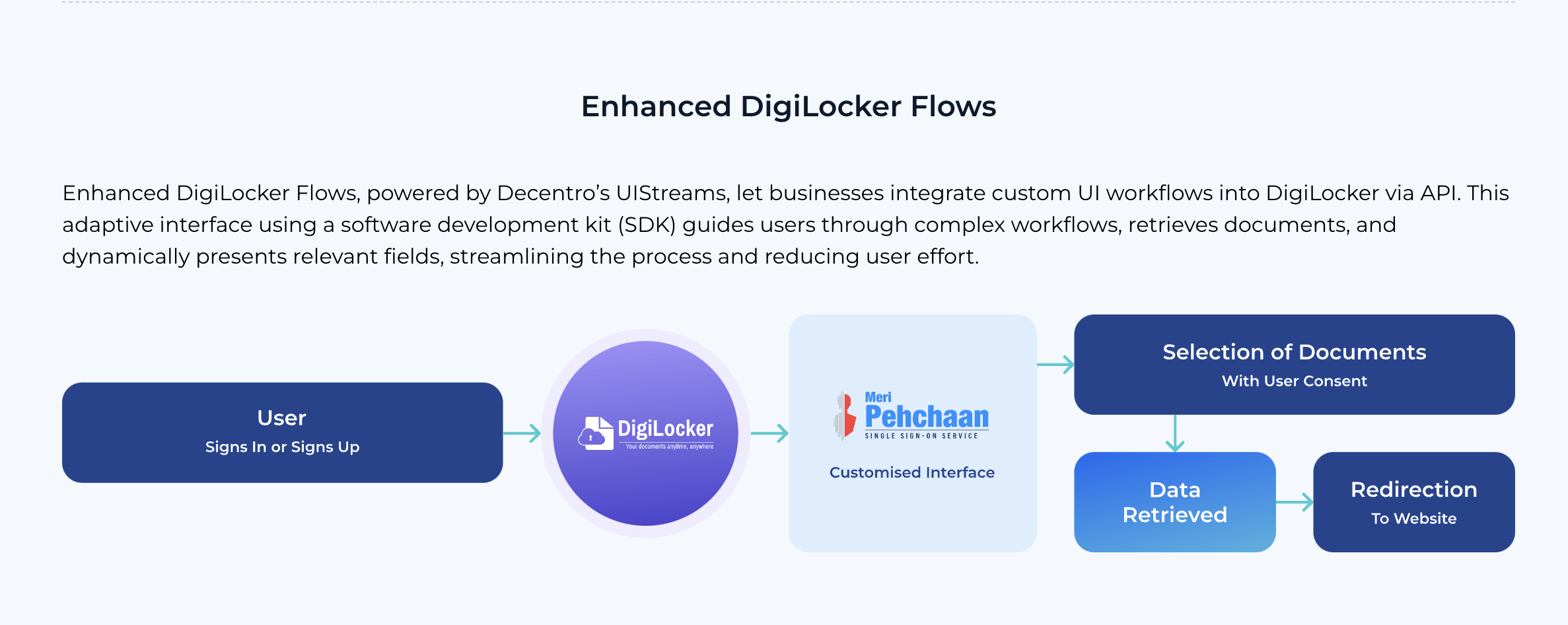

- Digilocker Integration: Securely share and verify customer documents for a smooth KYC process.

- Prefill API: Fetch and pre-fill customer and business details from verified sources like NSDL, MCA, and CKYC.

Are you ready to transform your onboarding journey? Partner with Decentro today and experience the power of frictionless verification and validation.