Discover how GIFT City is redefining India’s financial landscape with easier regulations, lower taxes, and access to global capital markets.

GIFT City: India’s First Global Finance Hub

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Ever wonder what would happen if someone built a mini-Singapore right in the heart of India? That’s exactly what’s happening with GIFT City, Gandhinagar, which is transforming how global finance connects with the Indian economy!

Welcome to this deep dive into one of the most fascinating yet under-discussed developments in the global financial landscape. Whether you’re a finance professional looking for the next big opportunity, an investor curious about new horizons, or someone who loves staying ahead of economic trends, this guide to Gujarat International Finance Tec-City (GIFT City) is for you.

The Vision Behind GIFT City

Picture this: It’s 2007, and while the rest of the world is focused on traditional financial centers like London, New York, and Singapore, someone in India is dreaming bigger. “What if India had its global financial hub? What if we could keep our financial talent and business right here instead of watching it flow overseas?”

This wasn’t just idle daydreaming. Fast-forward to today, and that vision has materialised into GIFT City—a gleaming metropolis rising from what was once empty land.

Indeed, early visitors to the GIFT City site in the late 2000s would have seen little more than barren land on the outskirts of Gandhinagar. Skepticism was rampant—many industry experts dismissed it as an overambitious project destined to remain half-built. Mukesh Aghi, President of the US-India Strategic Partnership Forum, recalls: “When I first heard about GIFT City in 2010, I thought it was just another government announcement that would take decades to materialise, if at all. Visiting it today shows how wrong that assessment was.”

Nikhil Kamath, co-founder of Zerodha and prominent investor, captured this evolution perfectly: “GIFT City has rapidly changed, from my first visit many years ago, where I saw more cows than humans, to today witnessing bustling high-rises filled with thousands of people… GIFT is changing. This is one train you don’t want to miss.”

But GIFT City isn’t just about impressive buildings and modern infrastructure. It represents something much more profound: India’s declaration that it’s ready to play in the global financial big leagues.

The numbers tell a compelling story: According to recent estimates, India loses approximately $50 billion annually in business to offshore financial centers – that’s business that could be happening on Indian soil, creating Indian jobs, and contributing to the Indian economy. GIFT City aims to recapture this massive economic opportunity by providing something that never existed before – a financial ecosystem that combines global regulatory standards with the advantages of being physically located in one of the world’s fastest-growing major economies.

Walking Through GIFT City: Features That Make It Special

What exactly makes GIFT City Gandhinagar stand out? Here’s a walkthrough of the impressive infrastructure that’s been developed:

First off, the physical infrastructure is mind-blowing. Spread across 886 acres, GIFT City is a mini-metropolis with top-notch office spaces, residential areas, and public amenities. The skyline is already dotted with modern skyscrapers that wouldn’t look out of place in Manhattan or Hong Kong. Currently, over 16 million square feet of development has been completed or is under construction, with a total plan for 62 million square feet.

The attention to detail in planning is remarkable. GIFT City boasts:

- District cooling systems that reduce energy consumption by 30-40%

- An underground utility tunnel system spanning 12 kilometres that eliminates the need for road cutting

- Automated waste collection systems processing up to 10 tons of waste daily

- Smart city features, including integrated building management across 130+ buildings

- A dedicated Command and Control Center for centralized monitoring with over 1,000 monitoring points

The digital infrastructure is equally impressive. High-speed connectivity with redundant 10 Gbps links, tier-4 data centres, and disaster recovery facilities make it a tech-savvy financial hub ready for the digital age.

But what makes GIFT City truly special is not just the fancy buildings and impressive tech. It creates an entire ecosystem that facilitates financial innovation and growth.

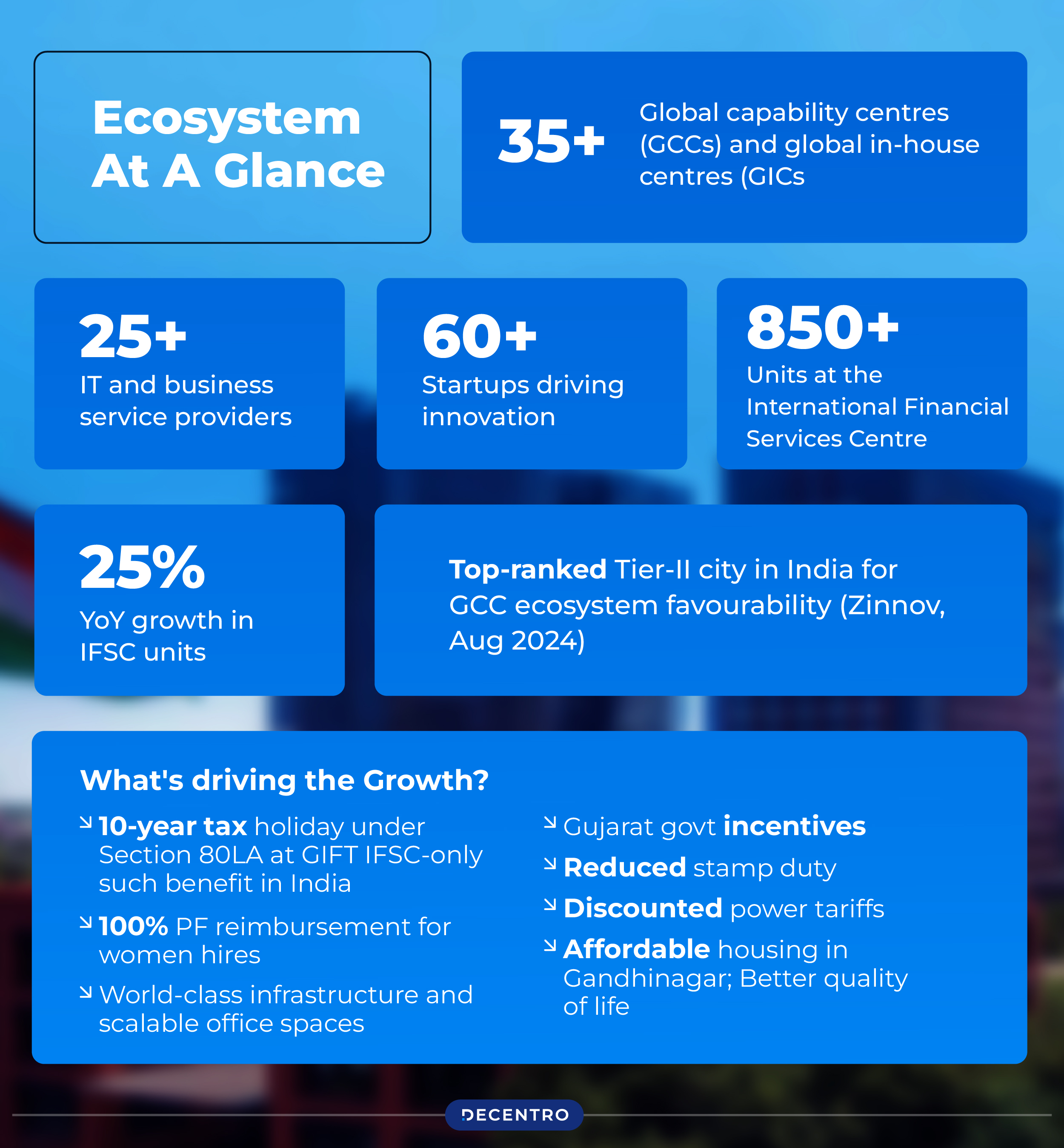

The International Financial Services Centre (IFSC) at GIFT City, Gandhinagar, is the first of its kind in India. It allows businesses to operate in a global regulatory environment while physically remaining in India. Over 480 entities have already registered.

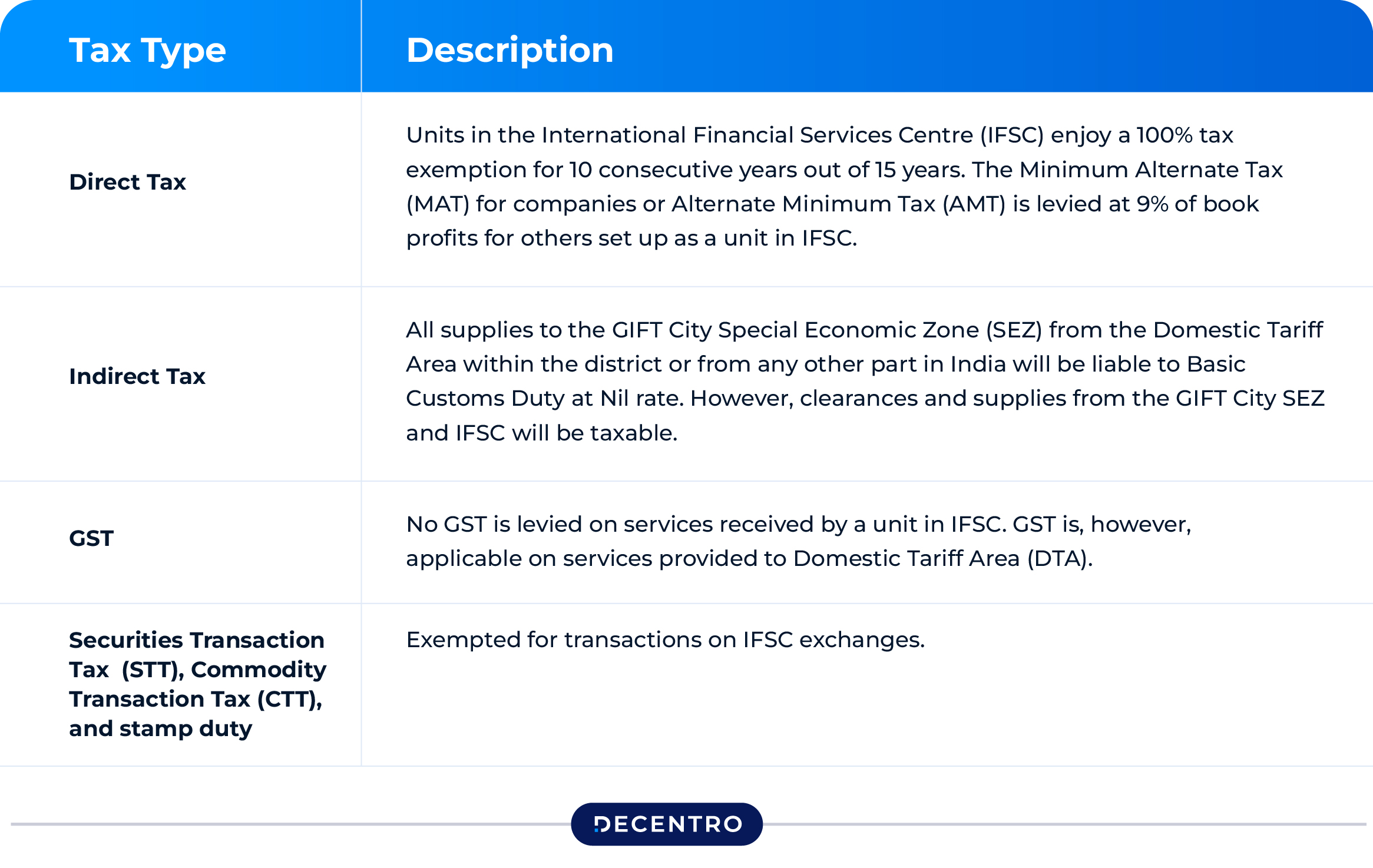

The Differentiator: Regulatory and Tax Benefits

Now, let’s talk about what really excites the finance folks—the regulatory and tax benefits. These are where GIFT City truly shines, and honestly, they’re what set it apart from other financial centers in India.

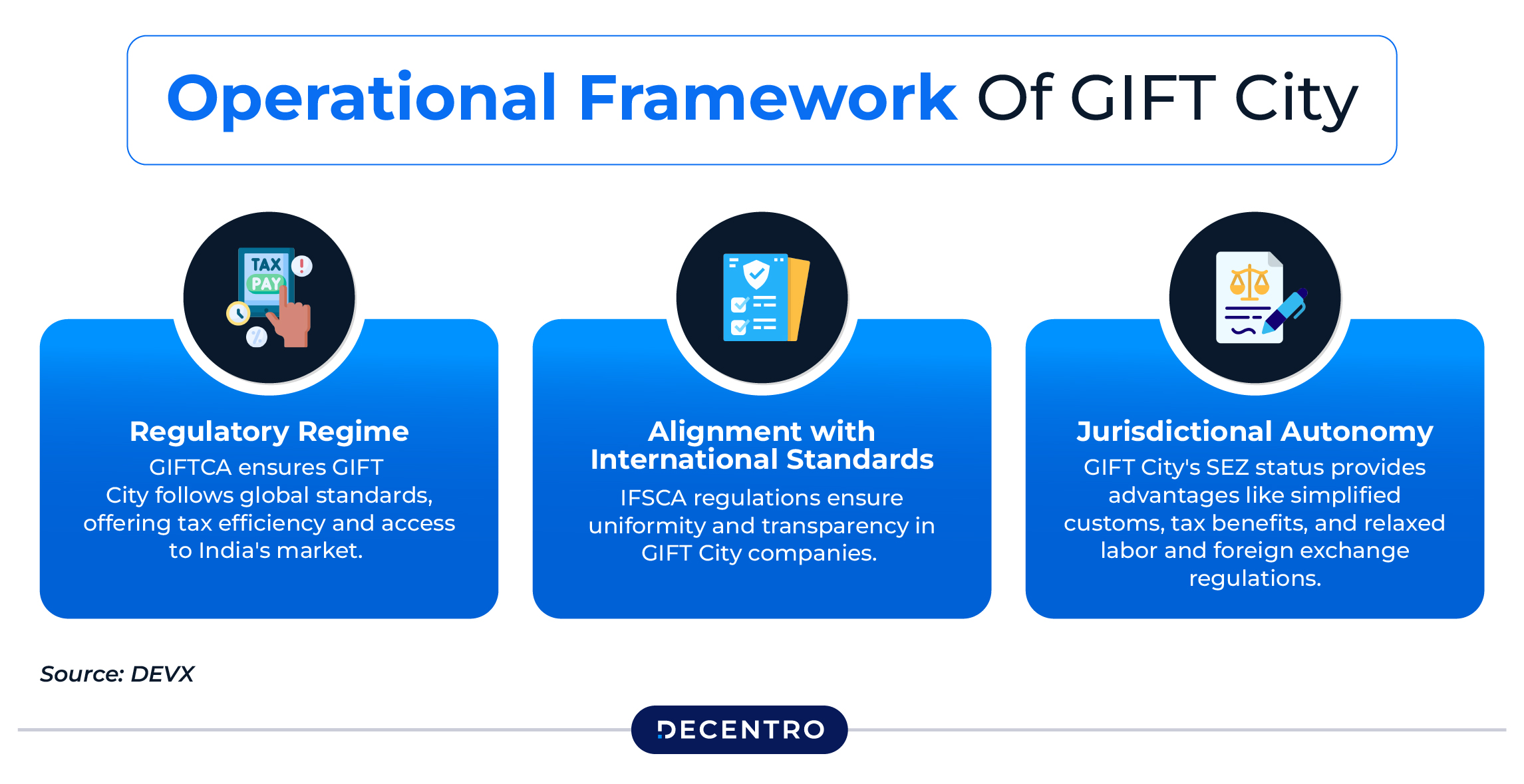

Special Economic Zone (SEZ) Status

GIFT City, Gandhinagar enjoys SEZ status, which means it operates under special economic regulations different from the rest of the country. This creates a business-friendly environment with streamlined procedures and reduced bureaucracy. If you’ve ever dealt with paperwork in traditional Indian financial centres, you’ll appreciate how significant this is!

Some key SEZ benefits include:

- Single-window clearance for setting up operations

- Exemption from state sales tax and service tax

- Freedom from various state-level inspections and acts

- 100% income tax exemption on exports for the first 5 years

Unified Regulatory Framework

Let’s move onto the unified regulatory framework under the International Financial Services Centres Authority (IFSCA). Established in 2020, the IFSCA acts as a unified regulator for all financial services and products in GIFT-IFSC.

This is revolutionary for India! Instead of dealing with multiple regulators like RBI, SEBI, IRDAI, and PFRDA separately, businesses in GIFT City, Gandhinagar interact primarily with IFSCA. This means less regulatory overlap, faster approvals, and more consistent policies.

The regulatory framework also allows:

- Direct access to international financial markets

- Ability to deal in foreign currency

- Liberal financial regulations compared to the rest of India

- Easier movement of capital and reduced restrictions

For anyone who’s tried to navigate India’s complex financial regulatory landscape, this streamlined approach feels like a breath of fresh air!

Industry Verticals: Where the Action Is Happening

GIFT City isn’t just a concept anymore – it’s buzzing with real business activity across multiple verticals. Let’s look at what’s happening in each sector:

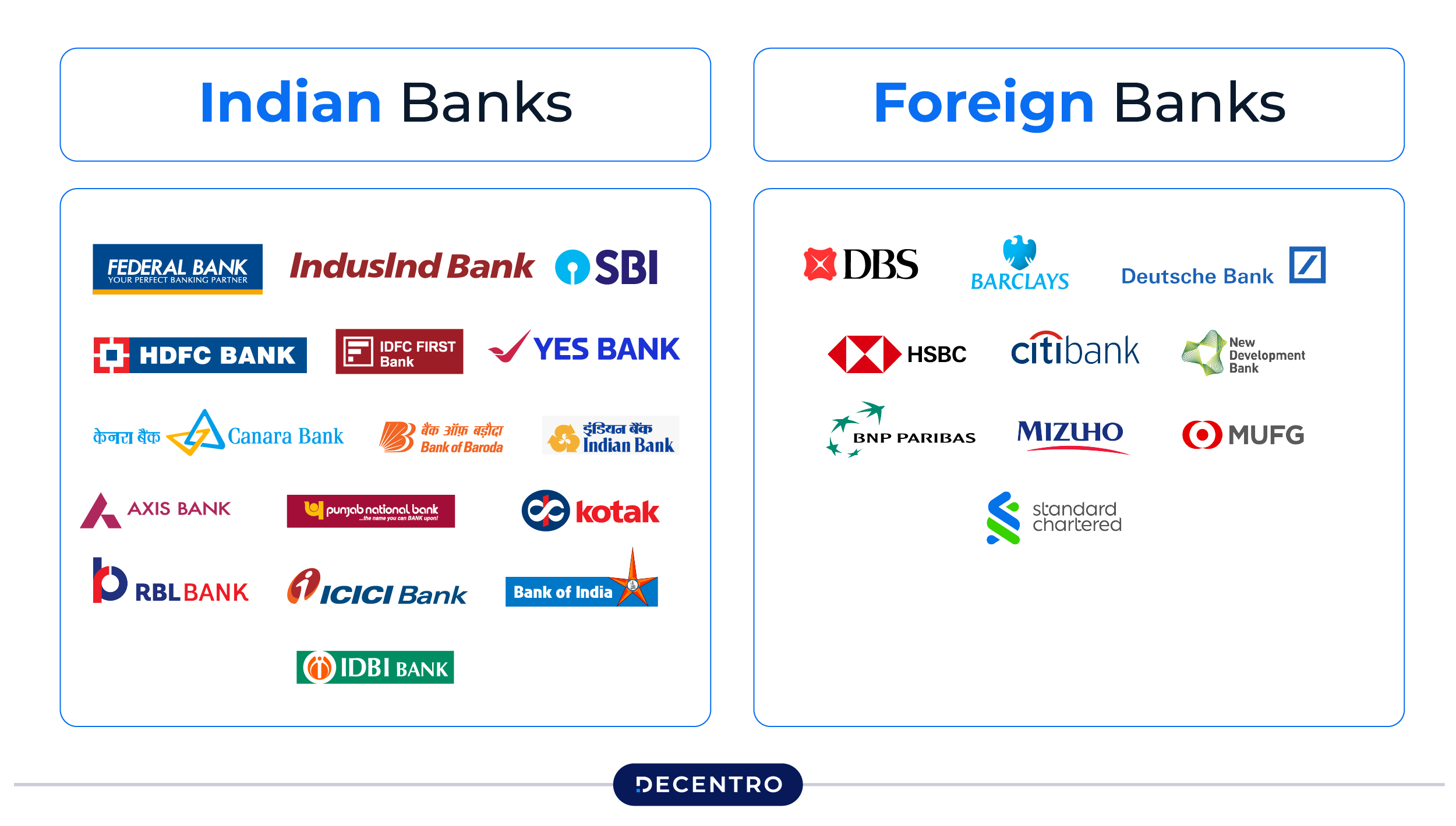

Banking and Financial Services

Banking was among the first sectors to establish a presence in GIFT City, and for good reason. Banks operating here can offer services in foreign currencies that they can’t offer from their domestic branches.

Currently, 23 major banks have set up operations, including ICICI Bank, SBI, HDFC Bank, and international players like Standard Chartered. These banks can:

- Offer dollar and other foreign currency loans

- Provide trade finance services

- Handle cross-border transactions more efficiently

- Service NRIs and international clients with specialized offerings

These banking units have facilitated over $28 billion in business loans already, with total banking assets in GIFT City exceeding $42 billion as of early 2025.

The banking transactions through GIFT City grew by approximately 62% in the 2024 fiscal year alone.

Fintech and Innovation

The fintech scene in GIFT City, Gandhinagar, is still developing but shows incredible promise. The IFSCA has been actively working to create a conducive environment for fintech innovation through:

- A regulatory sandbox for testing innovative products, which has already admitted over 35 fintech startups

- Specific frameworks for RegTech and SupTech solutions, with 12 successful implementations

- Support for blockchain and distributed ledger technologies, with 5 pilot projects underway

The newly established fintech innovation hub, called “GIFT Fintech,” is expected to accelerate growth in this sector by providing incubation support, funding access, and collaborative spaces for startups.

This hub aims to host 100+ fintech startups by 2027 and has already secured commitments for $120 million in venture funding specifically targeting GIFT City-based fintech innovations.

Capital Markets and Investment Funds

This is where things get exciting! GIFT City, Gandhinagar, has emerged as a hub for setting up and managing global funds, with several advantages:

- Tax benefits for fund management

- Ability to invest globally without domestic restrictions

- Access to sophisticated market instruments

The two international exchanges at GIFT City—India INX and NSE IFSC—offer trading in equity derivatives, currency derivatives, commodity derivatives, and debt securities. Trading hours are aligned with global markets (22 hours a day!).

Combined daily trading volumes on these exchanges have reached $15.7 billion, representing a 183% increase since 2023.

Alternative Investment Funds (AIFs) and mutual funds operating from GIFT City can invest in India and globally, with simplified regulatory requirements.

As of early 2025, over 95 funds are operating from GIFT City, and the assets under management exceed $18.3 billion. Fund registration applications grew by 74% in 2024, indicating rapidly accelerating interest from global fund managers.

Insurance and Reinsurance

The insurance sector in GIFT City, Gandhinagar has been gaining momentum, with 21 insurance and reinsurance entities establishing operations. Key activities include:

- Direct insurance business with international clients

- Reinsurance services for global risks

- Specialised insurance products are not available in domestic markets

Companies can operate with relaxed net-owned fund requirements and enjoy tax benefits specific to insurance businesses. The GIFT City insurance sector has already underwritten premiums worth over $3.2 billion, with a premium growth rate exceeding 45% year over year. Reinsurance capacity within GIFT City has expanded to handle risks valued at over $7.5 billion.

Aviation and Ship Leasing

One of the newer and more interesting developments is the push to make GIFT City, Gandhinagar a hub for aircraft and ship leasing. This sector holds enormous potential considering:

- India is one of the fastest-growing aviation markets, projected to need over 2,200 new aircraft worth $320 billion over the next 20 years

- Currently, most aircraft leasing happens from locations like Ireland and Singapore

- Bringing these operations to GIFT City could save substantial foreign exchange, estimated at $4.5 billion annually

The framework for aircraft leasing was introduced in 2021, with tax benefits and simplified regulations to attract global lessors. In just three years, 14 aircraft leasing companies have established operations, collectively managing a fleet of 65 aircraft with asset value exceeding $2.1 billion. The first ship leasing company started operations in 2023, with three more companies in the registration pipeline.

Bullion Trading

The latest addition to GIFT City’s offerings is the India International Bullion Exchange (IIBX), India’s first international bullion exchange. This allows:

- Direct import of gold by qualified jewelers

- Trading in gold and silver derivatives

- Development of new bullion-based financial products

This exchange is set to transform how India, one of the world’s largest gold consumers (annual demand exceeding 800-900 tonnes), participates in the global bullion market.

Since its launch, IIBX has facilitated trades worth over $3.7 billion, with 115 qualified jewellers and 27 international suppliers actively participating. Trading volumes have grown at approximately 38% quarter-over-quarter since inception.

Looking Ahead: What’s Next for GIFT City?

The development of GIFT City, Gandhinagar, is far from complete, and that’s what makes it so exciting! The master plan envisions development in three phases, with the current phase focusing on core financial infrastructure.

Some developments on the horizon include:

- Expanded residential facilities to create a live-work-play environment, with plans for 25,000+ residential units

- Educational institutions specialising in finance and technology, including partnerships with 5 international universities

- Expansion of sustainable infrastructure, including renewable energy projects, targeting 60% green energy usage

- Enhanced connectivity, including a possible high-speed rail link reducing travel time to Mumbai to under 2 hours

The vision is to increase employment to 500,000+ professionals and achieve a built-up area of 62 million square feet by 2030. Current employment stands at approximately 15,000 professionals, with a projected CAGR of 42% in the workforce over the next five years.

What’s particularly promising is how GIFT City is adapting to emerging trends. For instance, there’s growing interest in sustainable finance, with discussions about creating frameworks for green bonds and sustainable investment funds. The planned green bond market aims to reach $5 billion by 2028.

The rise of financial technology is also being embraced, with initiatives to support innovations in payments, blockchain, and artificial intelligence. Digital banking and finance will likely see significant growth here, with 40+ fintech projects currently in development.

There’s also an interesting development in the banking technology space, with various infrastructure providers exploring opportunities to support the banking ecosystem. This is part of a broader trend of specialised infrastructure providers entering GIFT City, with multiple companies receiving regulatory approvals to operate in GIFT City in the past year alone—something that we at Decentro are particularly excited about!

Final Thoughts: Why GIFT City Matters

As this exploration of GIFT City concludes, it’s impossible not to feel excited about what this means for India’s position in the global financial landscape.

For decades, Indian businesses have had to route international transactions through places like Singapore, Dubai, or London. With GIFT City, we’re witnessing the beginning of financial independence – the ability to conduct global financial business from Indian soil. Financial services worth $70+ billion that previously went to offshore centers are now being gradually repatriated to India through GIFT City.

The unified regulatory framework, world-class infrastructure, and tax benefits create a compelling proposition not just for Indian companies but for global players looking to access the Indian market. The tax incentives alone are projected to save businesses operating in GIFT City approximately $1.8 billion annually by 2027.

Is GIFT City perfect? No, it’s still evolving and faces challenges like any ambitious project. Building a vibrant ecosystem takes time. Attracting top talent will require great offices and a high quality of life. And competing with established global financial centers won’t happen overnight.

But the progress so far is impressive, and the trajectory is promising. The human stories behind GIFT City’s rise are the most compelling indicators of its success. Consider the experience of Aditya Birla Sun Life AMC, one of the early movers into GIFT City. Their GIFT-based fund management team has grown from just 3 people in 2021 to over 35 specialists today, many returning NRIS bringing global expertise back to Indian shores.

Even international players are taking notice. Christine Lagarde, President of the European Central Bank, during her 2024 visit remarked: “What’s happening at GIFT City represents exactly the kind of financial innovation and infrastructure development that emerging economies need to fully participate in the global financial system.“

As Deepak Bagla, former CEO of Invest India, puts it: “GIFT City isn’t just changing India’s financial landscape—it’s changing the narrative about what’s possible in India. We’re no longer just talking about potential; we’re showcasing execution at a world-class level.“

Perhaps most tellingly, property prices in and around GIFT City have increased by over 300% since 2015, with residential occupancy rates now exceeding 85%—clear market signals that this is indeed, as Nikhil Kamath warned, “one train you don’t want to miss.”

Current growth metrics show a 57% year-on-year increase in registered entities and a 78% increase in transaction volumes. GIFT City represents something important – India’s ambition to become not just a participant but a leader in the global financial system.

So, whether you’re an investor, a financial professional, or someone interested in India’s economic journey, GIFT City is worth watching.

If you wish to know more about operating in this economic zone, email us at hello@decentro.tech, and we will get in touch!

Frequently Asked Questions

GIFT City is India’s first international financial services hub that allows businesses to conduct global financial transactions in foreign currencies with reduced regulations, significant tax benefits, and unified oversight through IFSCA—essentially a mini-Singapore located in Gujarat, India.

Not entirely, but close. Businesses enjoy 100% income tax exemption on exports for the first 5 years (50% for the next 5), exemptions from GST and transaction taxes, no capital gains tax for non-residents, and no dividend distribution tax.

Incorporate under Companies Act 2013 or register a branch

Apply for space allocation and IFSCA licenses

Obtain SEZ unit approval

Complete registration and sign lease agreement

Begin operations after receiving approval

The streamlined single-window process typically takes 4-6 weeks.

Both Indian and international entities can invest, including banks, insurers, capital market players, fintech companies, aircraft/ship leasing firms, trading companies, and professional services. 100% foreign ownership is permitted in most sectors, and individuals can participate through GIFT City-based funds and exchanges.

GIFT City aims to grow from 15,000 to 500,000+ professionals by 2030, expand from 16 to 62 million square feet, develop 25,000+ residential units, establish fintech and educational hubs, and create a $5 billion green bond market. With 57% yearly growth in registered entities, it’s working to repatriate $70+ billion in financial services previously conducted offshore.