Discover the top 15 digital gold investment apps in India for 2025 and start your journey with as little as ₹1. Get insight into the features, pros, and cons of each app to help inform your decision.

16 Best Digital Gold Investment Apps in India in 2025

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

A Quick Glance

| Platform Name | Value Proposition |

| Jar | Avail of daily savings schemes and invest the funds in digital gold. |

| Fiydaa | Invest in 24K digital gold from ₹5 with India’s highest leasing returns up to 6% annually. |

| Spare8 | Buy, sell or redeem digital gold without any additional charges. |

| PhonePe | Invest in digital gold offered by reputed providers like SafeGold and MMTC-PAMP |

| Paytm | Store your digital gold units for a maximum of 5 years without any charges. |

| Google Pay | Store your digital gold for as long as you want without any additional charges. |

| Amazon Pay | Start investing with just ₹5. |

| Groww | Zero account opening fees, along with no storage charges. |

| DigiGold | Start investing with just ₹1. |

| Jupiter Money | Offers numerous auto-saving digital gold investment schemes with lifetime free storage. |

| MMTC-PAMP | Start investing with as low as ₹1. |

| Gullak | Flexible digital gold investment options, such as top-up, save on every spend, and daily savings, are available. |

| Airtel Payment Bank | Invest with a minimum amount of ₹1. |

| Tanishq | Buy and sell digital gold online or redeem from any Tanishq/Caratlane store across India. |

| Pluto Money | Wide range of digital gold savings schemes along with no storage charges. |

| FinPlay | Zero registration fees for Gold Accumulation Plans. |

Thanks to a lower entry ticket, standardisation, and 24/7 availability, digital gold investments in India have grown by 70% after the pandemic. Thus, an increasing number of individuals are looking for online gold investment platforms to kickstart their investment journey. Here are the 16 best gold investment apps in India in 2025 to help you decide.

Individuals can start investing in digital gold with as low as ₹1.

Platforms offering this asset will store the investor’s gold in secure vaults, thus negating locker charges and security risks. They can easily exchange digital gold for physical gold, bullion, and coins and even have it delivered to their doorstep.

Every unit of digital gold is 99.999% 24K gold, and a government-licenced organisation verifies its purity. This negates the chances of fraud and serves as a reliable hedge against inflation akin to its physical counterpart.

What’s more, individuals can convert their digital gold to cash at a 24/7 live market-linked rate and get the funds transferred to their bank accounts. Also, due to its 24K purity, some lenders accept digital gold as loan collateral.

Listed below are the 16 best gold investment apps in India in 2025:

Jar

Jar is an online investment app that allows you to invest in 24K digital gold with as little as ₹10. This platform provides features that help you save daily and invest your funds in digital gold.

For instance, its Round Off feature detects your expenses from your phone’s message folder, rounds it off to the nearest 10 and invests the balance in digital gold. What’s more, you can use your Jar savings to buy gold jewellery right from the platform.

Features:

- 99.9% 24K gold insured by top Indian banks and fully secured in high-security vaults.

- Pause or cancel investments whenever you want.

- Easily sell your gold for cash or get physical gold.

Pros:

- No minimum lock-in period.

- Options to withdraw just after 24 hours of investment.

- GoldX’s gold leasing feature allows you to earn up to 14% per annum.

Cons:

- Lacks options to invest in other assets.

Fiydaa

Fiydaa is an investment platform that lets you buy 24K digital gold starting from as little as ₹5. Designed specifically for middle-class savers, Fiydaa provides flexible options to invest regularly including SIPs and gold leasing to maximize your wealth.

Personalized SIP Features:

- Lease SIP: Invest ₹1,500 or more per installment; your gold is automatically leased on Fiydaa X, earning you an additional 4% in grams each month.

- DigiGold SIP: Start your SIP at just ₹100 and invest regularly in 99.99% pure digital gold, with instant buying and selling at live market rates.

- Gold Coin SIP: Select your preferred gold coin (e.g., 5g, 10g), accumulate funds via your DigiGold SIP, and redeem physical coins once you reach your target.

Fiydaa X – Exclusive Gold Leasing:

- Frozen Lease: Earn India’s highest leasing returns—up to 6% per annum when locking your gold for 1 year.

- Unfrozen Lease: Stay flexible, lease without lock-in periods, and earn up to 4% per annum.

All gold investments on Fiydaa are securely stored in fully insured, high-security vaults and can be redeemed instantly for cash, or physical gold delivery at your doorstep. Fiydaa also recently launched its exclusive jewelry store called Elegance.

Pros:

- Lowest minimum investment in the market (₹5).

- Highest returns on gold leasing in India.

- Multiple SIP options catering specifically to the middle class.

Cons:

- Limited currently to gold investments.

Spare8

Spare8 is a gold leasing platform that simplifies investing, leasing, and other activities in digital gold. By leveraging an asset class that is familiar and trusted by Indians, Spare8 has created the entire financial inclusion stack with gold.

Features:

- Gold Leasing: Spare8 offers a unique gold leasing feature, allowing users to earn up to 16% per annum. This makes it one of the highest-performing asset classes available.

- Gold-Backed Investments: Every unit on the platform is backed by 24K 99.9% pure gold bars. Users can sell these units for cash, convert them into physical gold for delivery, or use the app to gift gold to loved ones.

- API for Businesses: Spare8 is Asia’s first platform to offer gold leasing APIs. This enables businesses to seamlessly integrate gold offerings into their services, providing a plug-and-play setup for various customer needs.

Pros:

- State-of-the-art 256-bit encryption.

- Start investing with as low as ₹10.

- Buy and sell gold 24/7.

Cons:

- Lacks options to convert digital gold to jewellery.

Spare8 uses Decentro’s KYC capabilities to streamline its onboarding process, and Christon Mascarenhas, Head of Strategic Alliances & Marketing, has this to say about the association,

As Fintech innovators, ensuring a seamless and secure user onboarding process is critical to our success. Since integrating Decentro’s KYC stack, we’ve observed a 40% reduction in our customer onboarding time and a 50% decrease in our drop-off rates. The ability to onboard new users quickly, accurately and at scale has given us a significant competitive edge in the market. The integration was seamless and quick, fitting perfectly with our existing systems, making it a game-changer of a partnership in the truest sense.

Christon Mascarenhas, Head of Strategic Alliances & Marketing, Spare8

PhonePe

PhonePe is a leading online payments platform that has partnered with SafeGold and MMTC-PAMP to offer digital gold investment services to investors. You can easily buy digital gold backed by 24K gold bullions of 99.9% purity.

You can store your assets digitally in a bank-grade locker, which you can convert to gold coins or bars whenever you wish. What’s more, you can link your bank account to the app and get instant cash by selling your digital gold to cash.

Features:

- Buy digital gold with your PhonePe balance.

- The minimum requirement is 0.05 grams of digital gold to convert into coins.

Market Share:

Pros:

- Avail options to invest in digital gold and other assets from a single app.

- Invest in digital gold in just 4 simple steps.

Cons:

- Charges minimal delivery and making charges.

Paytm

Paytm is another online payment platform that enables investors to buy digital gold. You can purchase 24K 999.9 gold at live prices 24/7 and store them in bank-grade high-security storage units without any additional charges.

Also, you can store your digital gold in your online account for a maximum of 5 years and get it converted to gold bars or coins for a minimum charge.

Features:

- Store gold securely in the most secure and 100% insured facilities.

- Get your gold delivered to your doorstep in a premium tamper-proof package.

- MMTC-PAMP gold-backed units are on par with international standards.

Pros:

- Buy and sell digital gold in just a few simple clicks.

- Options to withdraw assets after 24 hours of investment.

Cons:

- Lacks options to convert digital gold into jewellery.

Google Pay

Google Pay is another leading payment platform that allows individuals to buy digital gold hassle-free. You can keep the assets stored in your Gold Locker, convert them to physical gold bars or coins, and have them delivered to your doorstep for a minimal fee.

What’s more, Google Pay does not charge storage fees, making it an excellent choice for individuals who wish to invest in this asset class without incurring any extra costs.

Features:

- 24K 99.99% purity MMTC-PAMP international grade gold backing digital gold units.

- Options to gift digital gold to friends.

Pros:

- Store your digital gold as long as you want in high-security 100% insured lockers.

- Buy and sell digital gold in a few simple steps.

Cons:

- The minimum gold buying requirement is 1 gram.

Amazon Pay

Amazon Pay has also entered the digital gold segment by partnering with SafeGold. Users can buy assets directly through the app and sell them at live international gold rates 24/7.

What’s more, you can convert your digital gold to gold coins, bars, or jewellery of your choice via Tanishq/Caratlane (either online or through store walk-in).

Features:

- Options to sell assets after 24 hours of investment.

- Start investing with just ₹5.

- Maximum investment threshold of 5 grams of digital gold per day.

Pros:

- Gift digital gold to friends via the Amazon Pay app.

- Assets backed by 24K 99.99% purity gold bullion stored in 100% insured vaults.

Cons:

- Lack of options to buy digital gold with Amazon Pay balance.

Groww

When it comes to stock market investments, Groww is one of the top-ranking apps. Now, thanks to its partnership with Augmont Gold, investors can buy digital gold right from the same platform and even track the growth of their assets.

Your assets are stored in highly secure and insured facilities, where you can keep them for as long as you wish. Moreover, there are no additional charges for asset storage, making it a viable option for new investors.

Features:

- Live track the price of gold in the international market.

- Options to withdraw assets after 48 hours of investment.

- Start investing in small denominations.

Pros:

- Zero account opening fees.

- Buy, redeem and sell digital gold in just a few clicks.

Cons:

- No option to convert digital gold into bars or coins.

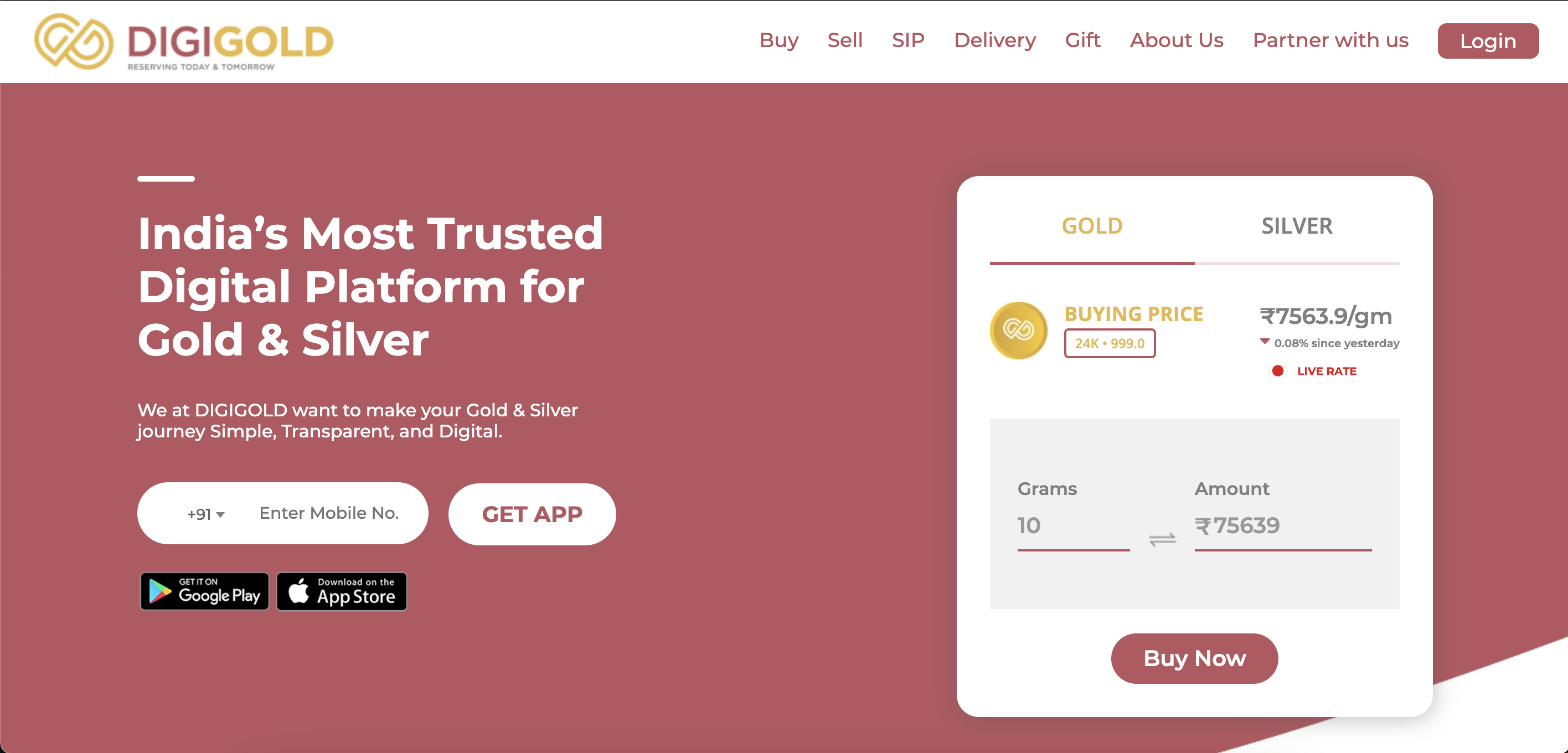

DigiGold

DigiGold is one of the best gold investment apps in India. It enables you to invest in digital gold, digital silver, and even gold SIPs. Every unit of digital gold you buy is backed by 999-purity 24K gold bullions stored in government-trusted Brink’s vaults.

You can sell your assets at the live gold rate 24/7 and get them delivered in physical form to any address across India for free.

Features:

- Start investing with just ₹1.

- Start SIP in gold at just ₹500 with no lock-in period.

- Free storage for up to 1 year.

Pros:

- No maximum limit for gold investments.

- Send digital gold to friends having an active DigiGold Wallet.

Cons:

- Making charges applicable on physical gold conversions.

Jupiter Money

Jupiter Money is a money management platform that allows you to track your expenses and grow your wealth by offering a plethora of investment alternatives.

It has partnered with MMTC-PAMP, enabling you to invest in digital gold backed by 24K gold bullions of 99.9% purity.

Features:

- Options to buy gold once or auto-save on a daily, weekly, or monthly basis.

- Lifetime free storage in 100% insured vaults.

- Start investing with just ₹11 daily.

Pros:

- Options to convert digital gold into bars and coins.

- Availability of several alternate investment options, the earnings from which you can redirect to buying digital gold.

- Intuitive user interface.

Cons:

- No option to convert digital gold to jewellery.

MMTC-PAMP

MMTC-PAMP is a digital gold and silver investment platform jointly run by MMTC Ltd. (a Government of India Undertaking) and PAMP SA (Switzerland-based bullion brand). You can invest via a single lump sum or opt for SIPs at a duration of your choice.

What’s more, you can sell your assets 24/7 at the live market price and take physical delivery in the form of bars and coins to any address across India.

Features:

- Store your assets free for up to 5 years.

- Options to gift digital gold to friends and family.

- Start investing with as low as ₹1.

Pros:

- Digital gold units backed by 24K gold of 99.99% purity.

- Assets are stored in 100% insured bank-grade vaults.

Cons:

- No option to convert digital gold to jewellery.

Gullak

Gullak is another leading platform on the list of best gold investment apps in India in 2024. It allows you to invest in digital gold units backed by 24K 999-purity gold bullions through flexible investment options like top-up, saving on every spend, and daily savings.

What’s more, there is no minimum lock-in period, and you can redeem your assets by selling them at the live market rate or having physical gold delivered to your doorstep in the form of coins.

Features:

- Earn up to 5% extra per annum with Gold+.

- Start investing with just ₹50 per day.

- Assets backed by 24K Augmont gold of 99.99% purity.

Pros:

- Options to set up automatic payments.

- Invest the balance on everyday spending in digital gold by rounding it off to the nearest 10.

- Pause, change or stop your automated savings plans whenever you wish.

Cons:

- Lacks a transparent pricing policy.

Airtel Payment Bank

Another reputed platform that allows individuals to invest in digital gold is Airtel Payment Bank. It allows you to buy, hold and sell digital gold with no minimum lock-in period through flexible investment options like lump sum and SIP.

Moreover, the assets you buy are backed by 24K 995 purity gold bullion, which is safely stored in government-trusted vaults.

Features:

- Invest with a minimum amount of ₹1.

- Sell assets at any time at the most competitive international rates.

Pros:

- No storage hassles, as your assets are secured by the platform itself.

- Intuitive user interface.

Cons:

- Lacks a transparent pricing policy.

Tanishq

Tanishq, one of the biggest jewellers in India, partners with SafeGold to enable customers to invest in digital gold. Users can buy digital gold units at the best international prices and sell them on the platform for cash 24/7.

What’s more, you can redeem your assets by converting them to physical gold online or at any of the 350+ Tanishq/Caratlane stores across India, making it one of the best gold investment apps in India in 2024.

Features:

- Start investing with as low as ₹100.

- Store assets for a maximum of 10 years, with the first 5 years free of charge.

Pros:

- Minimum making and delivery charges of digital gold conversions.

- Assets are backed by the Trust of Tata, reducing the chances of fraud and theft.

Cons:

- Assets are redeemable only after 3 working days of purchase.

Pluto Money

Pluto Money is an online investment platform that offers a wide array of low-risk options, including digital gold. All your digital gold units are backed by 24K 999-purity Augmont gold bullions, which you can buy and sell 24/7 at the latest international prices.

What’s more, you can get your digital gold converted to physical gold and delivered to any address across India.

Features:

- Set up automatic gold savings schemes across daily, weekly, monthly or lump-sum options.

- Track the value of your gold investments and profits over time.

- Get the best price for your assets based on real-time market rates.

Pros:

- Store your digital gold without any charges for the lifetime of your investment.

- Assets are stored in ultra-secure vaults by top international banks.

Cons:

- Lacks options to exchange for jewellery at online or offline stores.

FinPlay

FinPlay is a digital investment platform that enables individuals to buy, sell and redeem digital gold on MMTC-PAMP. All your assets are backed by 24K 99.99% pure gold bullion, which you can sell at the latest international prices 24/7.

Furthermore, you can convert your digital gold to gold coins and other minted products and get them safely delivered to your doorstep.

Features:

- Start investing with as low as ₹1.

- Accumulate digital gold up to ₹2 Lakh without PAN.

- No registration fees for Gold Accumulation Plans.

Pros:

- Assets are stored in bank-grade vaults free of cost.

- Options to make investments via SIPs or one-time investments.

Cons:

- Lacks options to exchange digital gold for jewellery.

The Future of Digital Gold Investment Apps

As economic uncertainties continue to prevail globally, an increasing number of investors will look for assets that can provide stable returns and also effectively hedge against inflation.

In this regard, digital gold can be a viable choice. Individuals can enjoy the safety of traditional gold investments while avoiding the costs that come with storage and security.

Moreover, according to reports, the Indian digital gold market is predicted to reach $100 billion by 2025. Thus, digital gold investment platforms have excellent room for growth in the long run, both globally and locally.

This is also a big chance for new businesses to enter and expand in this segment. However, to be listed among the best gold investment apps in India, having a dedicated payment collection and disbursement solution is a must.

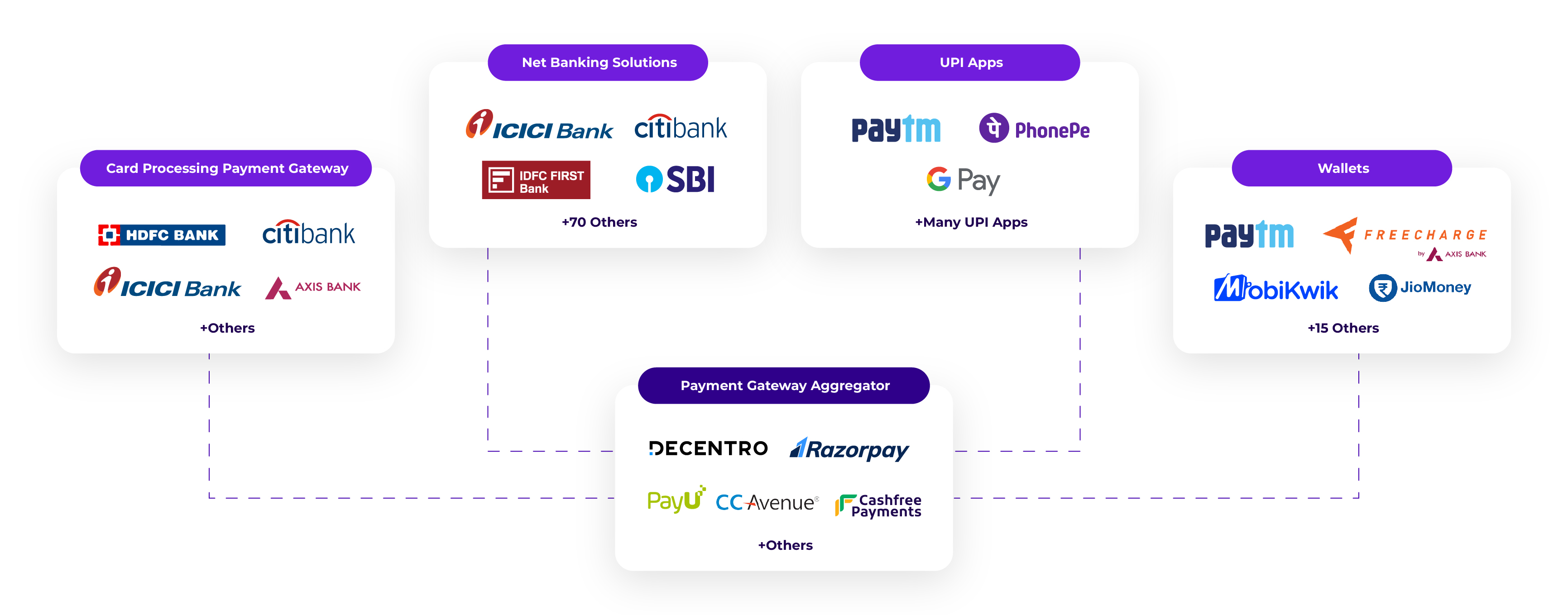

This is where Decentro’s payment APIs come in!

You can leverage our multi-collect feature to collect funds across various payment methods and reconcile them directly through your business’s virtual account.

Moreover, customers’ payments get instantly settled to your bank account, and you can facilitate instant payouts via your dashboard through a payment method of your choice.

What’s more, you can set up recurring payments with a single click, enabling you to handle SIPs and other investment plans with ease.

Ready to explore how Decentro can accelerate your collections and onboarding process in a compliant manner?

Frequently Asked Questions

All digital gold units are backed by 24K gold bullions of 99.99% or 99.95% purity. Moreover, you can buy and sell them at the latest international rates and even convert them to physical gold and get them delivered to your doorstep.

The maximum limit for investing in SafeGold is 20 grams, while the minimum is 0.5 grams.

No, you do not need a demat account to buy digital gold.