Learn about insurance claims fraud types—inflated claims, staged events, fake claims—and how AI-powered verification prevents fraud with Decentro’s offerings.

Fraud Claims in Insurance: Types & How to Prevent Them

An engineer by culture, but a Marketer by choice. Loves building great products that create a difference. On the lines of being a full-stack marketer.

Table of Contents

India’s insurance ecosystem is on an aggressive upward trajectory. With digital-first distribution, embedded insurance becoming mainstream, and customer expectations around speed and convenience rising sharply, insurers and intermediaries are scaling faster than ever. India’s insurance market is projected to more than double by 2030, with premiums expected to touch nearly ₹25 lakh crore, mainly driven by health and general insurance growth.

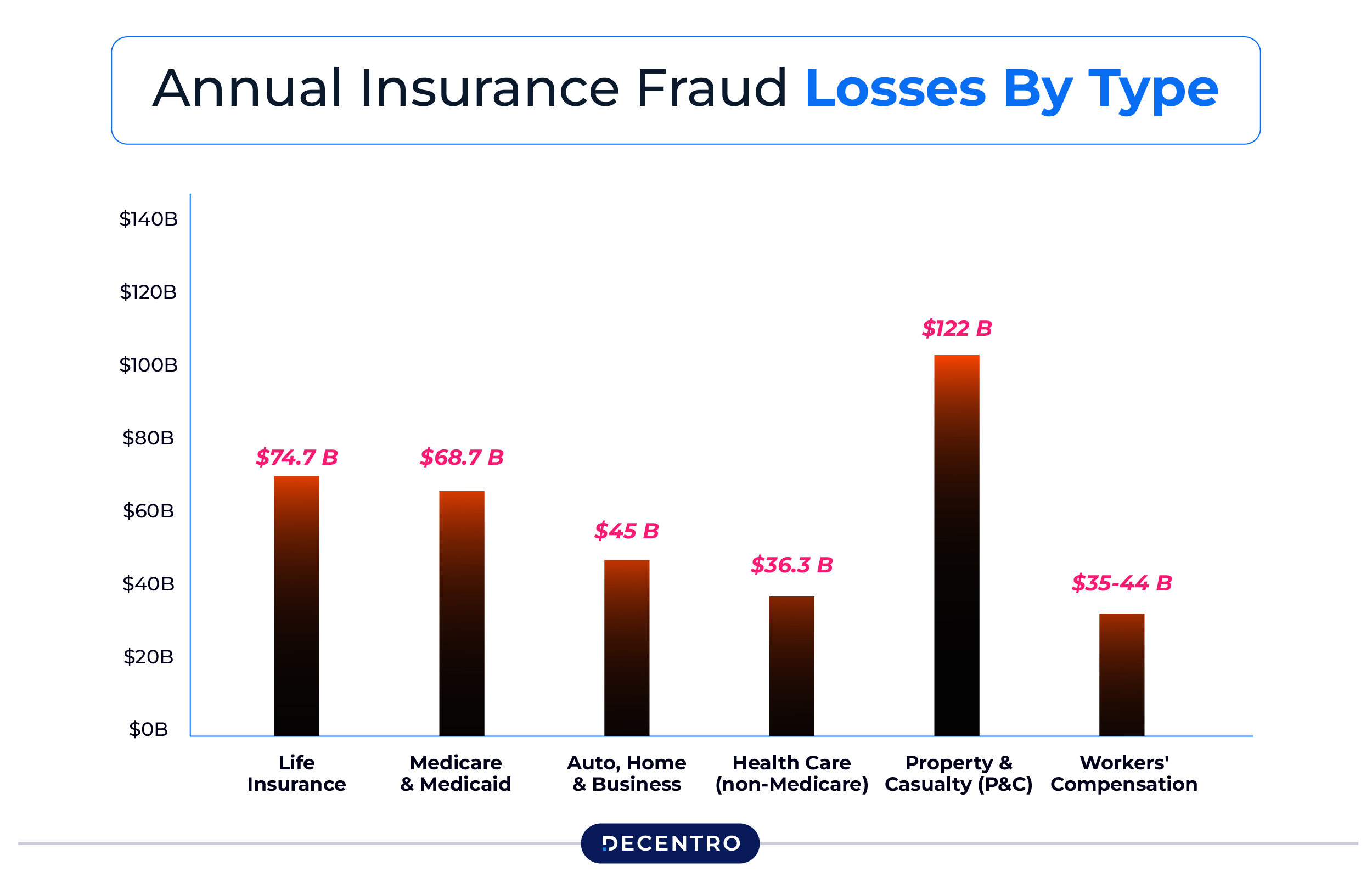

However, with growth comes risk. Fraudulent claims, a specific type of insurance fraud, are becoming a significant challenge. Globally, insurers lose over $80 billion annually to fraudulent claims, and India is seeing a similar upward trend as insurance penetration rises from ~3.7% of GDP. Fraudulent claims erode trust, inflate loss ratios, and increase operational burden—ultimately affecting policyholders and businesses alike.

This deep dive explains the types of fraud, dives into a specific type of Insurance fraud known as Claims Fraud, and explores how fraudsters operate, new-age detection frameworks, and, most importantly, how Decentro helps insurers and platforms create secure, compliant, and fraud-resistant insurance workflows.

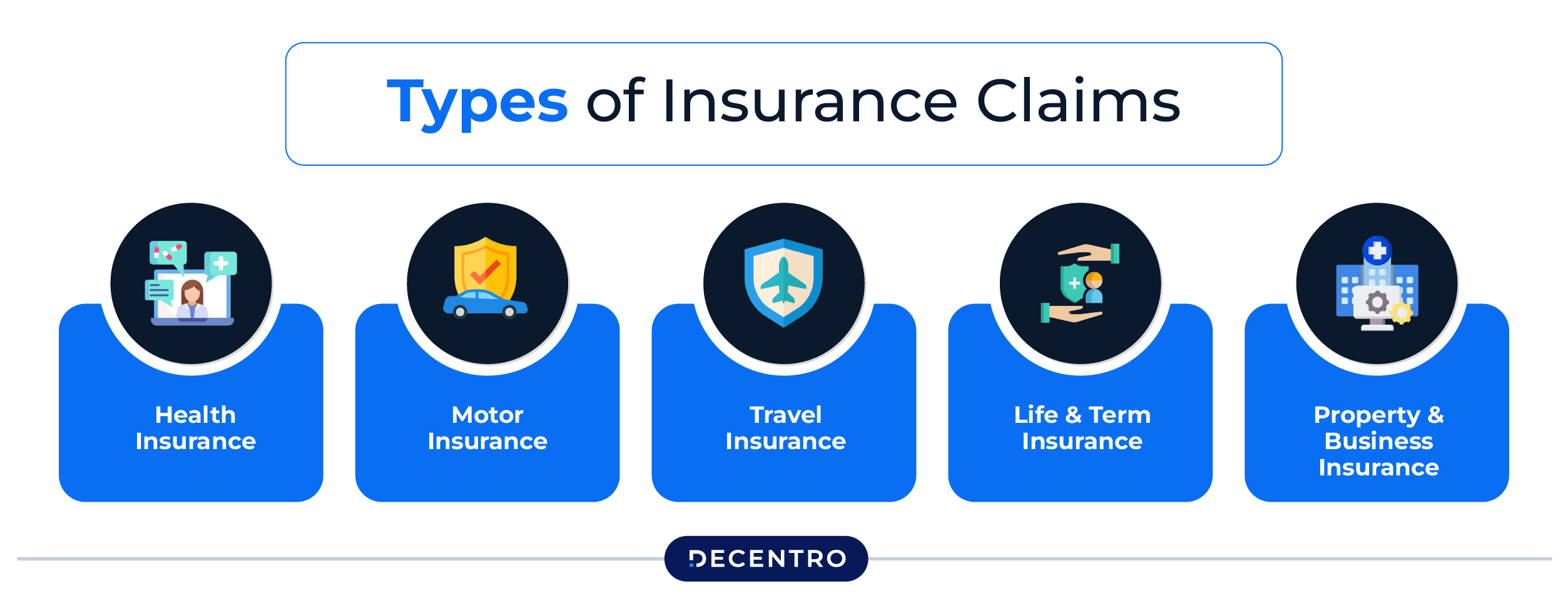

What Are Insurance Claims?

An insurance claim is a formal request by a policyholder to receive benefits covered under an insurance policy. Claims are the mechanism by which insurance fulfils its promise, whether for:

- Health Insurance: Hospitalisation, surgery, and outpatient expenses.

- Motor Insurance: Accident repairs, third-party liability.

- Travel Insurance: Trip cancellations, lost baggage, and medical emergencies abroad.

- Life & Term Insurance: Death or critical illness payouts.

- Property & Business Insurance: Theft, fire, and natural disaster claims.

Each claim type has unique documentation, validation requirements, and risks. But fraudulent activities often exploit high-volume claims, manual verification gaps, or digital onboarding weaknesses, making it critical for insurers to understand claims-specific vulnerabilities.

Across all these claim types, the fraud itself may look different, but the underlying enablers remain the same: weak identity verification, forged documents, poor behavioural visibility, and unsecured payouts.

This brings us to the various frauds that can occur when a claim is submitted to insurers. Let’s understand them below.

Types of Claims Fraud in Insurance

Claims fraud is one of the most financially damaging categories and includes inflated hospital bills, exaggerated damages, staged accidents, unnecessary treatments, and completely fabricated claims.

Fraudsters exploit high claim volumes and time-pressured settlement processes, particularly in health and motor insurance. This not only leads to financial leakage but also slows claim settlements for genuine policyholders, thereby impacting trust and the customer experience.

This results in massive financial leakage and delays in processing claims for genuine customers. Here’s a closer look at the most common types:

1. Inflated Claims

What it is:

Submitting claims for amounts higher than the actual cost of services or goods. This can happen in hospital bills, repair invoices, or service receipts.

Example:

- A hospital may add unnecessary lab tests or inflate the cost of procedures on a health insurance claim.

- A car repair shop may report extra parts replaced to increase a motor insurance payout.

Impact:

- Leads to higher payout obligations for insurers.

- Raises loss ratios and indirectly increases premiums for genuine customers.

- Creates delays as insurers need to verify inflated amounts.

Why does it happen:

- Claim verification is often manual or semi-automated, leaving room for subtle exaggerations.

2. Staged Events

What it is:

Fraudsters deliberately stage an event, accident, or hospitalisation to submit a claim that wouldn’t have otherwise occurred.

Example:

- Organising a car accident with minor or no actual damage to claim motor insurance.

- Planning hospital admissions for fake injuries or illnesses to claim health insurance benefits.

Impact:

- Causes substantial financial loss since insurers may pay out for services that never happened.

- Disrupts claim processing and resource allocation.

Why does it happen:

- Low initial detection due to time-sensitive claim settlements.

- Collaboration between claimants and service providers (hospitals, repair shops) often masks fraud.

3. Fake Claims

What it is:

Claims that are completely fabricated with no underlying incident or service. This is outright deception.

Example:

- Claiming theft of goods that never existed.

- Submitting medical bills for treatment that never happened.

Impact:

- Direct financial loss to the insurer.

- Damages trust in digital-first claims processes.

- It can affect actuarial calculations and premium pricing if widespread.

Why does it happen:

- Exploitation of poor document validation or lack of real-time identity verification.

4. Duplicate Claims

What it is:

Submitting multiple claims for the same incident, either to the same insurer or across different insurers.

Example:

- Claiming the same hospital bill twice under two separate policies.

- Reporting the same motor accident to multiple insurers to receive multiple payouts.

Impact:

- Causes operational inefficiency and increases unnecessary payouts.

Often requires manual investigation to detect duplicate submissions.

Why does it happen:

- Multiple policies held by a single customer or overlapping policy coverage.

- Lack of centralised claim tracking or cross-insurer data sharing.

5. Beneficiary Fraud

What it is:

Diverting legitimate claim payouts to unauthorised or fake bank accounts. Fraudsters may impersonate the claimant or manipulate payment details.

Example:

- Changing beneficiary bank details after claim approval.

- Using stolen identity information to receive payouts intended for someone else.

Impact:

- One of the most costly types of fraud, since payments are released directly.

- It can go unnoticed until post-payout reconciliation, leading to recovery challenges.

Why does it happen:

- Weak payout verification systems.

- Limited real-time validation of bank accounts and account-holder identity.

How Fraudsters Exploit Claims

Fraudsters are no longer dependent on crude, low-quality forgeries. Their tactics have evolved in both sophistication and scale.

1. Manipulating Documents with AI Tools

Bills, PDFs, discharge summaries, and ID images are edited using high-quality digital overlays that often escape manual checks.

2. Identity Masking & Synthetic Identities

Fraudsters combine real and fake data, such as a genuine PAN matched with a forged Aadhaar, to create identities that look legitimate.

3. Multi-Claim Fraud

Using the same phone number, bank account, or device fingerprint to submit multiple claims across insurers or platforms.

4. Staged Events

In motor and health insurance, staged accidents or pre-planned hospital admissions are often engineered for inflated payouts.

5. Fake Agents & Intermediaries

Unauthorised sellers issue deceptive policies or collect premiums without remitting them to insurers.

6. Digital Footprint Manipulation

Using VPNs, device farms, or disposable emails to mask fraudulent behaviour during onboarding or claims submission.

This is why behavioural intelligence, identity triangulation, and real-time verification have become non-negotiable pillars for fraud control.

Prevention Strategies

Fraud prevention is no longer an option. It’s a competitive necessity. Insurers and platforms must modernise their risk frameworks across every customer touchpoint.

1. Strengthen KYC at Onboarding

Use a multi-layered approach:

- Aadhaar (Online/Offline XML)

- PAN verification

- Face match

- DigiLocker-based document pulls

- Address verification from trusted sources

This eliminates the possibility of identity inconsistencies early.

2. Enforce Strong Claims Scrutiny

Deploy automated checks for:

- Altered discharge summaries

- Duplicate bills

- Reused medical documents

- Mismatched hospital metadata

- AI-based Document Scanner to detect tampered PDFs/images

AI-driven forensics outperforms manual review significantly.

3. Deploy Behavioural Intelligence

Behaviour-based risk scoring helps flag unusual patterns like:

- Multiple claims from the same device

- Suspicious mobile number usage

- High-risk geolocation patterns

- Synthetic identities

- Video KYC to verify claimant presence and intent

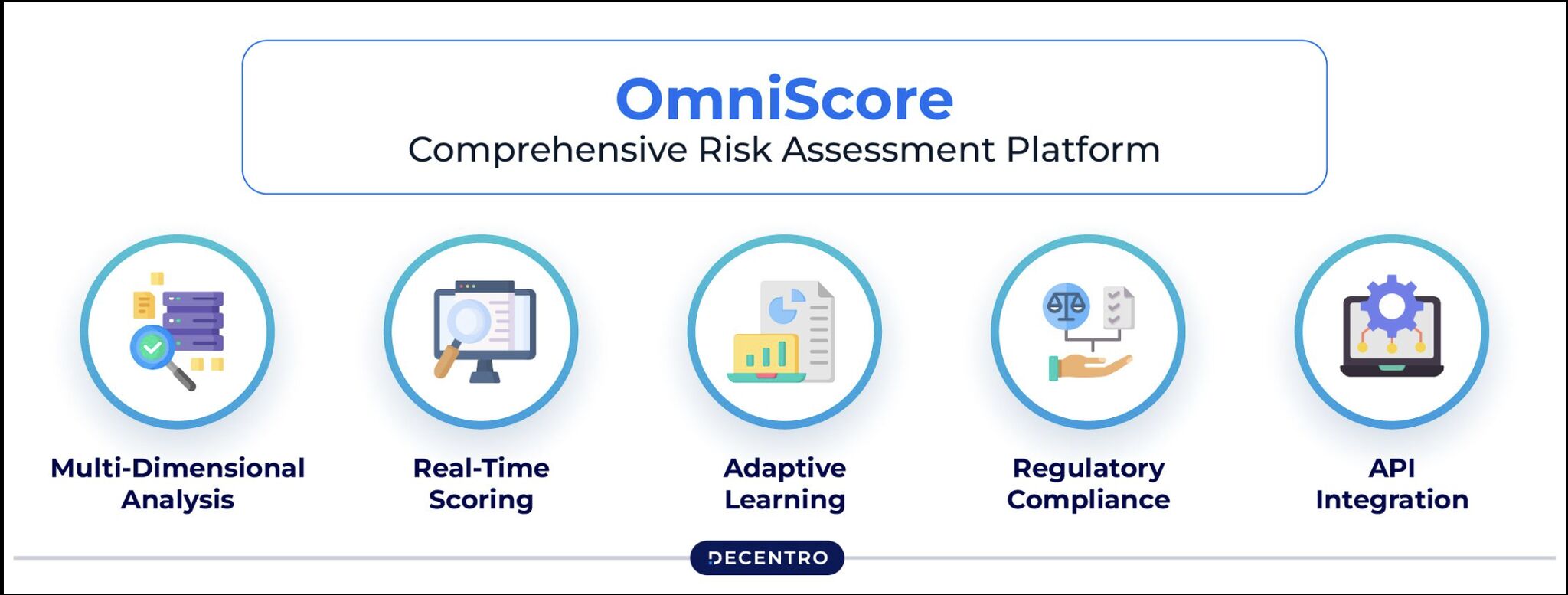

Decentro’s OmniScore tracks over 100 signals to provide an accurate risk assessment.

4. Verify Bank & Beneficiary Details

Before releasing payouts, validate the beneficiary’s:

- Name

- Account status

- IFSC

- Bank match

- Penny Drop / Bank Account Verification to ensure payouts go to legitimate beneficiaries

This stops fraudulent redirection of claim payouts.

5. Vet All Partners & Sellers

Insurers must verify:

- Agents

- Corporate intermediaries

- Brokers

- TPAs

- Aggregator platforms

KYB + GSTIN + CIN verification significantly reduces intermediary-level fraud.

6. Maintain Continuous Fraud Monitoring

Real-time alerts for:

- Device shifts

- IP anomalies

- Sudden behaviour changes

- Suspicious login attempts

A dynamic rules engine must supplement static checks.

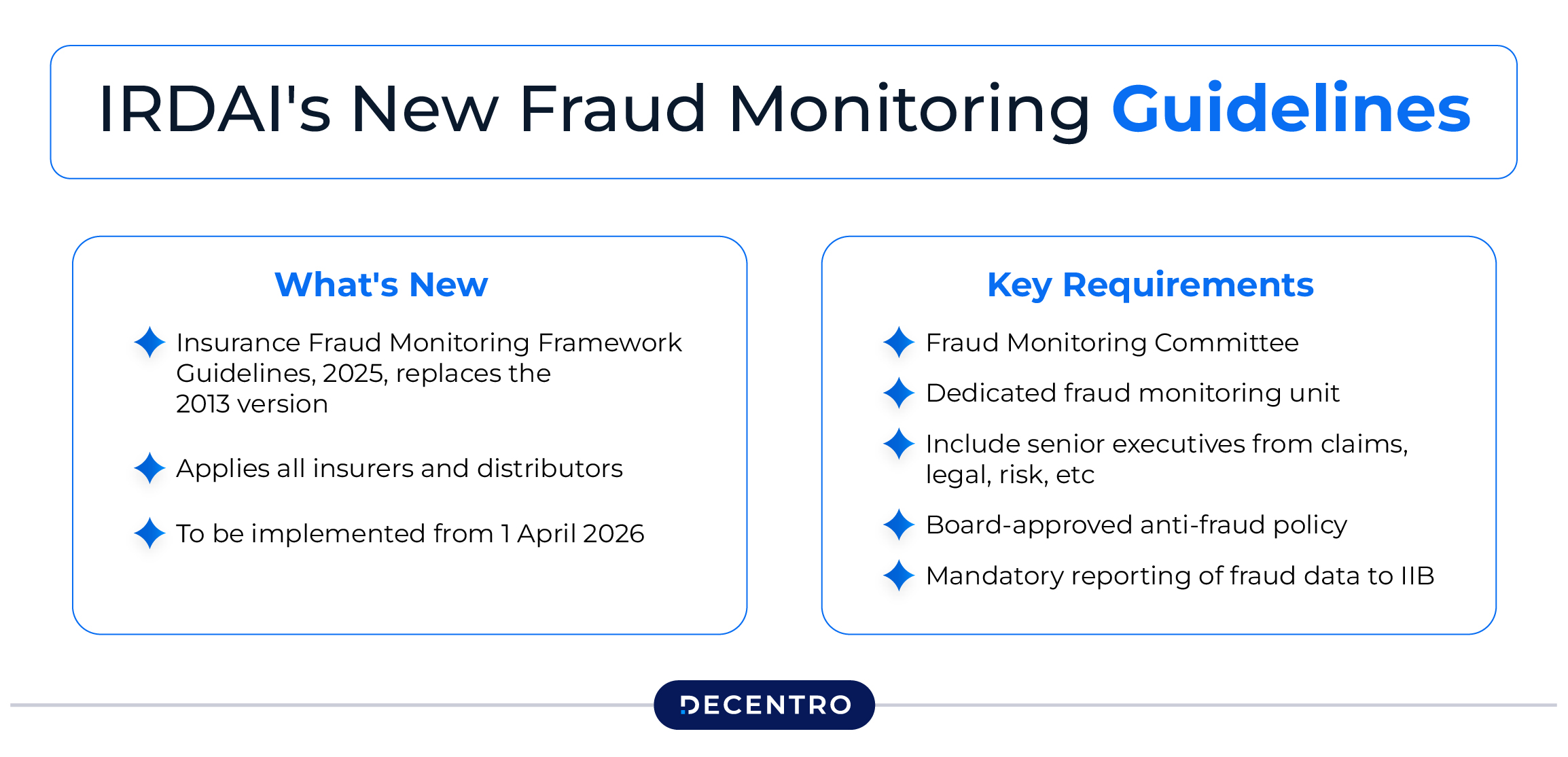

IRDAI’s New Anti-Fraud Guidelines (2025-26)

India’s insurance regulator, IRDAI, has introduced a strengthened set of anti-fraud guidelines for 2025-26, marking one of the most decisive shifts in how fraud must be detected, monitored, and prevented across the industry. These guidelines are designed to build a real-time, data-driven, and accountability-heavy fraud management culture for insurers, TPAs, brokers, and every participant in the insurance value chain.

At its core, the new framework mandates multi-layer verification, continuous monitoring, and higher compliance visibility, ensuring that fraud prevention is no longer a reactive process but a built-in obligation.

- Real-Time Monitoring & Reporting

- Mandatory Identity Verification at Multiple Stages

- Partner & Intermediary Vetting

- Document Authentication for Claims

- Strengthened Internal Fraud Control Units

Why This Shift Matters

These guidelines represent IRDAI’s move toward a zero-tolerance, real-time fraud governance model.

Insurers who fail to comply face operational scrutiny, financial risks, and potential regulatory consequences.

On the other hand, companies that strengthen their verification and monitoring layers stand to gain:

- Lower loss ratios

- Faster, cleaner claim settlements

- Reduced operational leakage

- Higher trust with customers and partners

How Decentro Helps Reduce Insurance Fraud

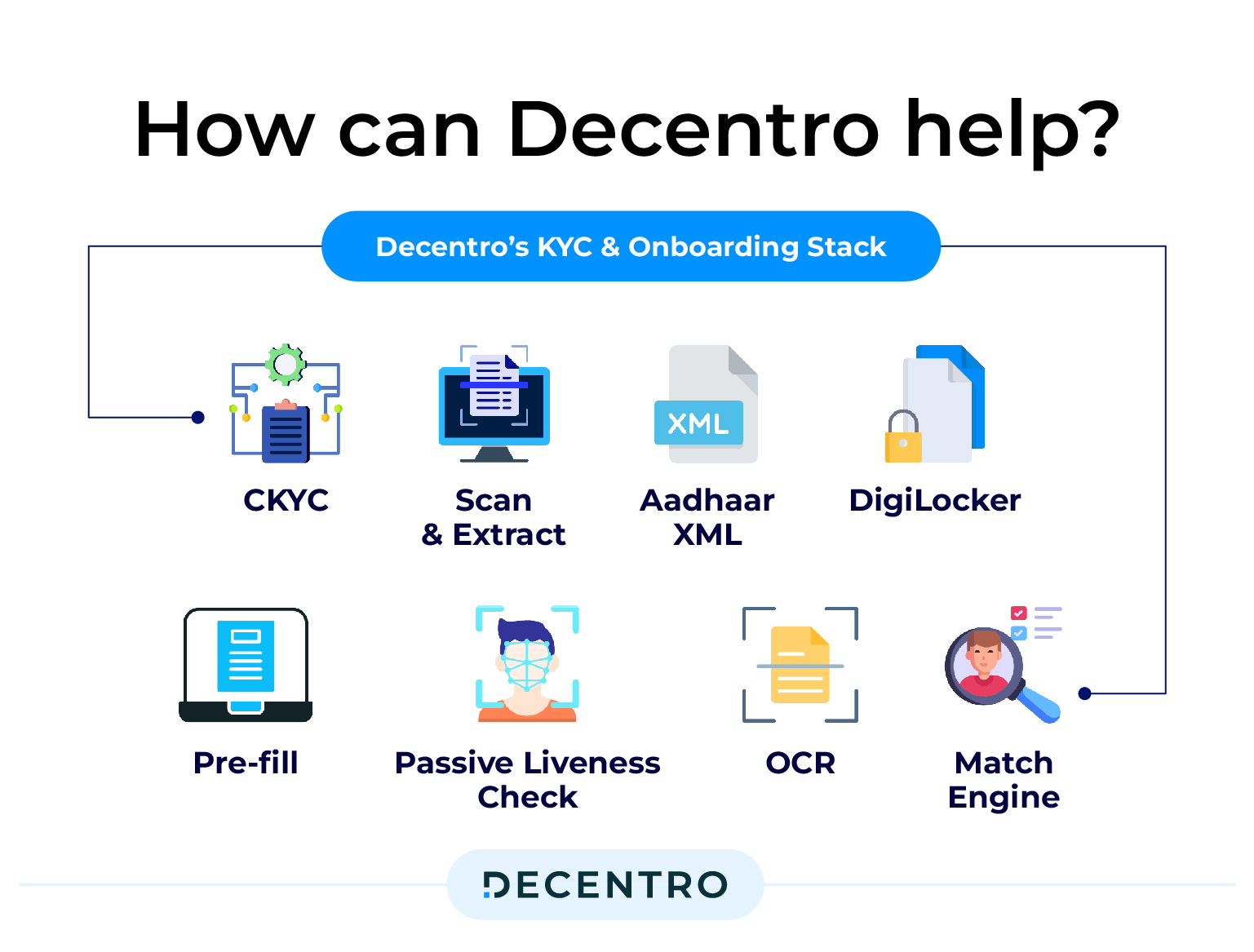

Decentro offers a comprehensive Insurance Verification Layer that combines KYC, KYB, document forensics, behavioural scoring, and payout validation, explicitly built for high-volume insurers, TPAs, and fintech platforms.

Here’s how Decentro aligns with IRDAI’s new mandates and modern fraud patterns:

1. Identity Verification: The Foundation Layer

At the very first touchpoint, whether it is a policy purchase or onboarding in the system, the system must verify that the person is honest, reachable, and traceable.

A strong identity flow today looks like this:

Customer enters details → System auto-fetches and validates ID → Face match for liveness → Address clean-up and confirmation.

Technologies such as Aadhaar and PAN verification, DigiLocker document retrieval, and face matching ensure the applicant is who they claim to be.

This identity layer is the single strongest defence against application fraud, identity theft, and synthetic profiles, three categories that IRDAI is specifically tightening in 2025–26.

2. Behavioural Risk Intelligence: Moving Beyond Static KYC

Fraud today rarely slips through because of fake documents alone; it slips through because the behaviour appears normal at first glance.

This is why insurers are increasingly relying on behavioural intelligence models that score risk using 100+ signals.

Think of it like this workflow:

User attempts to sign up → Device and network fingerprinting begin → Email/phone age is checked → Repeat identity or suspicious pattern matches are triggered → A dynamic risk score is generated.

Signals such as device fingerprinting, phone/email age, login velocity, geolocation anomalies, and repeat-identity use help flag:

- Fraud rings using the same devices

- Mule accounts filing coordinated claims

- Recycled email IDs used across multiple insurers

- Bots or programmatic attacks

This layer is what helps insurers catch fraud networks, not just individuals.

3. Document Fraud Detection: Where Most Claims Fraud Lives

Document fraud remains one of the most significant sources of leakage, especially in health and motor insurance, where PDFs, images, and medical records form the core of the claim.

A modern document fraud workflow looks like:

Customer uploads document → System scans metadata → Tampering markers detected → Hospital bill authenticity checks → Decision engine flags suspicious items.

This isn’t simple “image checking.”

It includes:

- tampered bill detection

- metadata mismatch analysis

- image manipulation tracking

- signature or header inconsistencies

This layer is exceptionally effective at catching inflated bills, fake treatments, and manipulated hospital records, all of which spiked post-pandemic.

4. Claims & Payout Integrity: Ensuring Money Goes to the Right Person

Even after a claim is approved, the risk isn’t over. Fraudsters often divert payouts using:

- wrong bank accounts

- mule accounts

- minor variations in name spellings

- compromised UPI handles

A clean payout integrity flow looks like:

Claim approved → Bank account verified in real-time → Name matched with beneficiary → UPI handle validated → Leakage prevented.

This prevents one of the most expensive forms of fraud: payout redirection, where money is siphoned away despite a legitimate claim.

5. Partner & Agent Validation: Strengthening the Distribution Side

One of the least-discussed fraud vectors lies not with customers, but with intermediaries.

Unverified agents, unknown brokers, or loosely vetted distribution partners can create:

- fake policies

- inflated premiums

- forged proposals

- mis-selling that turns into future claims disputes

A robust partner-onboarding workflow uses:

KYB checks → GSTIN + CIN lookup → Director verification → Bank account checks for commission flows.

This ensures that insurers onboard only authentic entities, reducing fraud at the point of sale.

6. Compliance Support: Where Technology Meets Regulation

Finally, a modern anti-fraud framework must create tamper-proof, audit-ready verification trails.

IRDAI’s 2025 – 26 guidelines explicitly mandate:

- real-time logs

- monitoring alerts

- fraud flagging

- identity verification audit trails

- transparent, reconstructable workflows

A compliant system automatically stores the entire verification journey for each policy or claim, helping insurers sail through regulatory reviews with ease.

Future of Combating Insurance Fraud

The coming decade is set to transform insurance fraud management more deeply than any shift we’ve seen in the past. Fraud detection will move far beyond static checks, evolving into a dynamic, intelligence-led system that understands intent as much as identity.

As insurance weaves itself more tightly into everyday products and platforms, verification will no longer be a single step at onboarding; it will become a continuous process that spans every interaction across the customer journey. Regulators, too, are likely to push the ecosystem toward real-time information exchange, where suspicious profiles and emerging fraud typologies are shared instantly to stop repeat offenders from exploiting gaps between insurers. Those who modernise early will enjoy lower fraud losses, smoother onboarding, and a fundamentally stronger competitive edge.

The next decade will redefine insurance fraud management. Several innovations are already reshaping the battlefield:

- Rise of AI + Behavioural Intelligence Over KYC Alone

- Embedded Insurance Will Increase Verification Layers

- IRDAI Will Push Toward Real-Time Fraud Sharing

- Automated Claim Assessment Will Dominate

- Unified Identity Graphs Will Emerge

- Verification Infrastructure Becomes a Competitive Edge

Conclusion

Insurance fraud isn’t just an operational challenge; it’s an ecosystem-level threat impacting pricing, customer experience, and trust. With digital insurance adoption at an all-time high, fraudsters have become more sophisticated than ever, using advanced tools, forged identities, and coordinated networks.

That’s why insurers, TPAs, healthtech platforms, and embedded insurance players must adopt a multilayered defence system that combines identity verification, behavioural intelligence, document forensics, and secure payouts.

With Decentro’s Insurance Verification Layer, which consists of Scanner, KYC & KYB verifications, and others, businesses can build workflows that are:

- Faster

- Smarter

- More compliant

- Exceptionally fraud-resistant

Frequently Asked Questions

What is claims fraud in insurance?

Claims fraud occurs when a policyholder or third party submits false, exaggerated, or duplicate claims to receive payouts they are not entitled to. It includes inflated bills, staged accidents, fake claims, and beneficiary manipulation.

Which types of insurance claims are most vulnerable to fraud?

Health, motor, and travel insurance claims are particularly at risk due to high volumes and complex documentation. Life, property, and business insurance can also be targeted, but digital verification gaps make certain claims easier to exploit.

How do fraudsters exploit claims?

Fraudsters use sophisticated techniques such as AI-manipulated documents, synthetic identities, multi-claim submissions, staged events, fake agents, and digital footprint manipulation to bypass traditional verification checks.

What are the consequences of claims fraud?

Claims fraud increases operational costs, inflates loss ratios, delays genuine claim settlements, and erodes trust in insurers and digital-first ecosystems. It can also indirectly raise premiums for honest policyholders.

How can insurers prevent claims fraud?

Fraud prevention requires modern infrastructure: multi-layer KYC/KYB checks, document forensics, behavioural intelligence, real-time bank and payout validation, and continuous monitoring. Tools like Decentro’s Insurance Verification Layer help detect and block fraudulent claims effectively.