Our guide to liveness checks for enhancing security in identity verification. Enable it for your business with Decentro and get started within minutes.

Liveness Check Explained: A Guide to Secure User Verification

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

We live in a time when identity documents have a remarkable hold over everyday life. An endless trail of signatures, passport-sized photos, KYC forms, scans, and other proxies is necessary to vote, pay taxes, open a bank account, access welfare scheme loans, send parcels, and get a cell phone.

From a stamp on a sheet of paper to a blue checkmark on a screen, we have witnessed unprecedented evolution in the identity verification realm. So much so that globally, the number of digital identity verification checks will surpass 70 billion in 2024, growing 16 percent on the previous year’s number of 61 billion, a new report by Juniper Research showed.

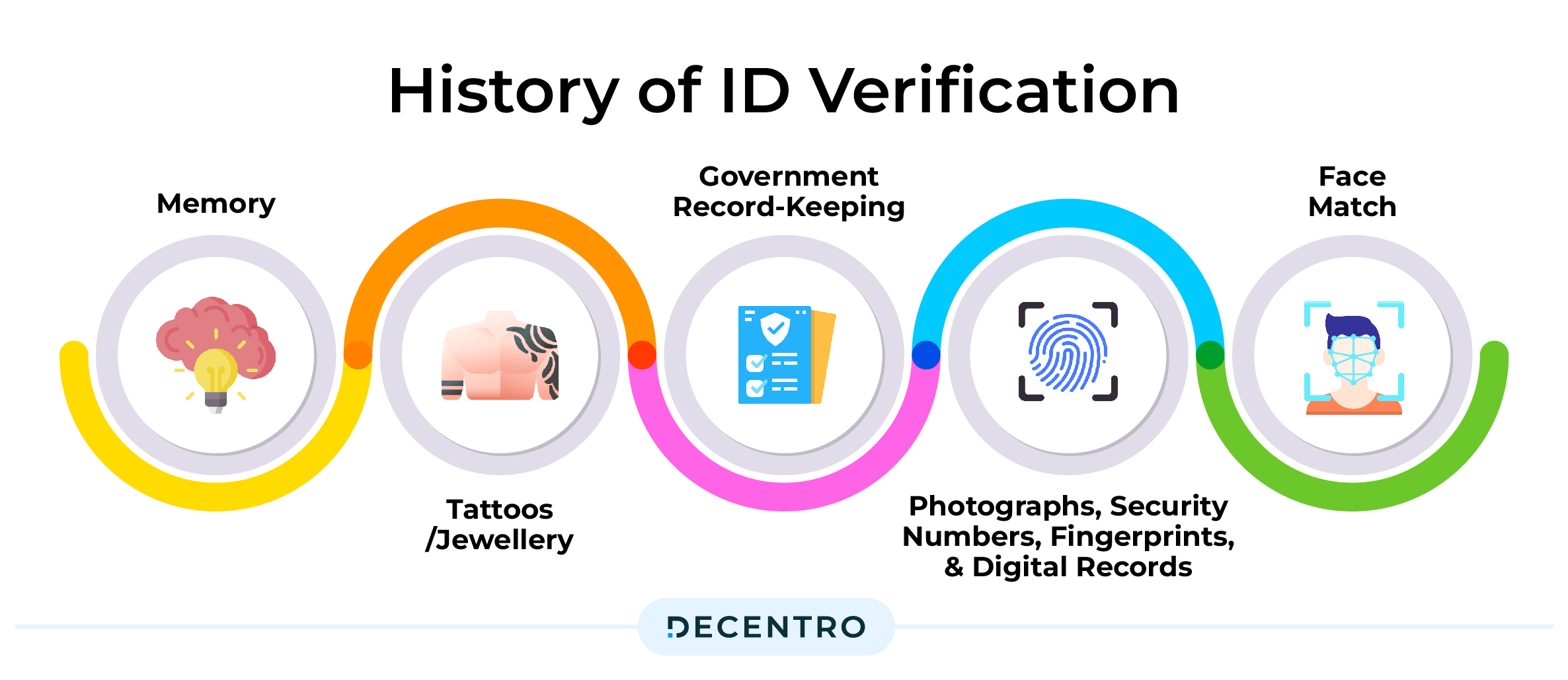

A number so high requires a bit of backtracking. The evolution of identity verification can be broadly mapped in the following way.

What started off as a simple method of relying on someone’s memory advanced to associating jewellery pieces attached to the person. We then had tattoos as identifiers, only to be replaced with Government record-keeping in the form of consensus, owing to the advances in the written language and record-keeping technologies. What followed was a long tryst with photographs, security numbers, fingerprints, and digital records, a phase that still holds immense relevance in the identity verification ecosystem.

In the present day, identity verification, beyond the realm of individuals, has become the reality of any business operating within the ecosystem, especially for banks. A report on identity verification suggests that in 2022, around 94% of banking organizations will have experienced identity fraud. In the past year, an overwhelming 95% of enterprises have encountered identity fraud within their organization. These incidents have become alarmingly frequent, surpassing an average of 30 cases per company in 2022.

The numbers so high paint the need for identity verification APIs, which have penetrated the market globally today. This piece will concentrate on India’s journey with Identity Verification.

Liveness Detection APIs

The introduction of API-based ID and face checks are flooding the Indian market, allowing digital finance, insurance, crypto exchanges and many other industries to scale and secure their user platform seamlessly.

KYC verification usually includes verifying a user’s presence and verifying an ID check against a genuine Indian government ID document like an Aadhaar or PAN card. Combined with the rapidly digitising landscape of Indian businesses and finance platforms, ID verification APIs in India are undeniably crucial for regulatory compliance and fraud deterrence.

Now, there is an added layer of security on the Know Your Customer verification with liveness detection that is poised to enable users to authenticate their identities within seconds.

Understanding Liveness Detection

Liveness detection, also known as “proof of life,” is a technology that verifies the presence of a live person during the identity verification process. It ensures that the biometric data being captured, such as facial recognition or fingerprint, belongs to a genuine person and not a fraudulent replica or spoof. By adding an additional layer of security, liveness detection addresses the limitations of static biometric data, significantly reducing the risk of identity fraud.

The Need for Liveness Detection

Traditional identity verification methods often rely on static biometric data, such as photographs or scanned documents. However, these methods are susceptible to various fraudulent techniques, including deepfakes, spoofing attacks, or the use of stolen biometric data. Liveness detection overcomes these vulnerabilities by requiring users to provide dynamic proof of their presence, making it significantly more difficult for fraudsters to deceive the system.

Types of Liveness Detection Systems

Liveness detection systems are classified into two categories based on the input needed from the end-user:

Active Liveness Detection

This method requires the user to perform an action or a gesture to verify whether the user is physically present for verification. In the market, one can find systems that:

- Ask the user to speak out the text displayed on the screen

- Ask the user to hold a piece of paper where they write down some verification text

- Ask the user to perform gestures such as moving their head up and down, left and right, blinking, etc.

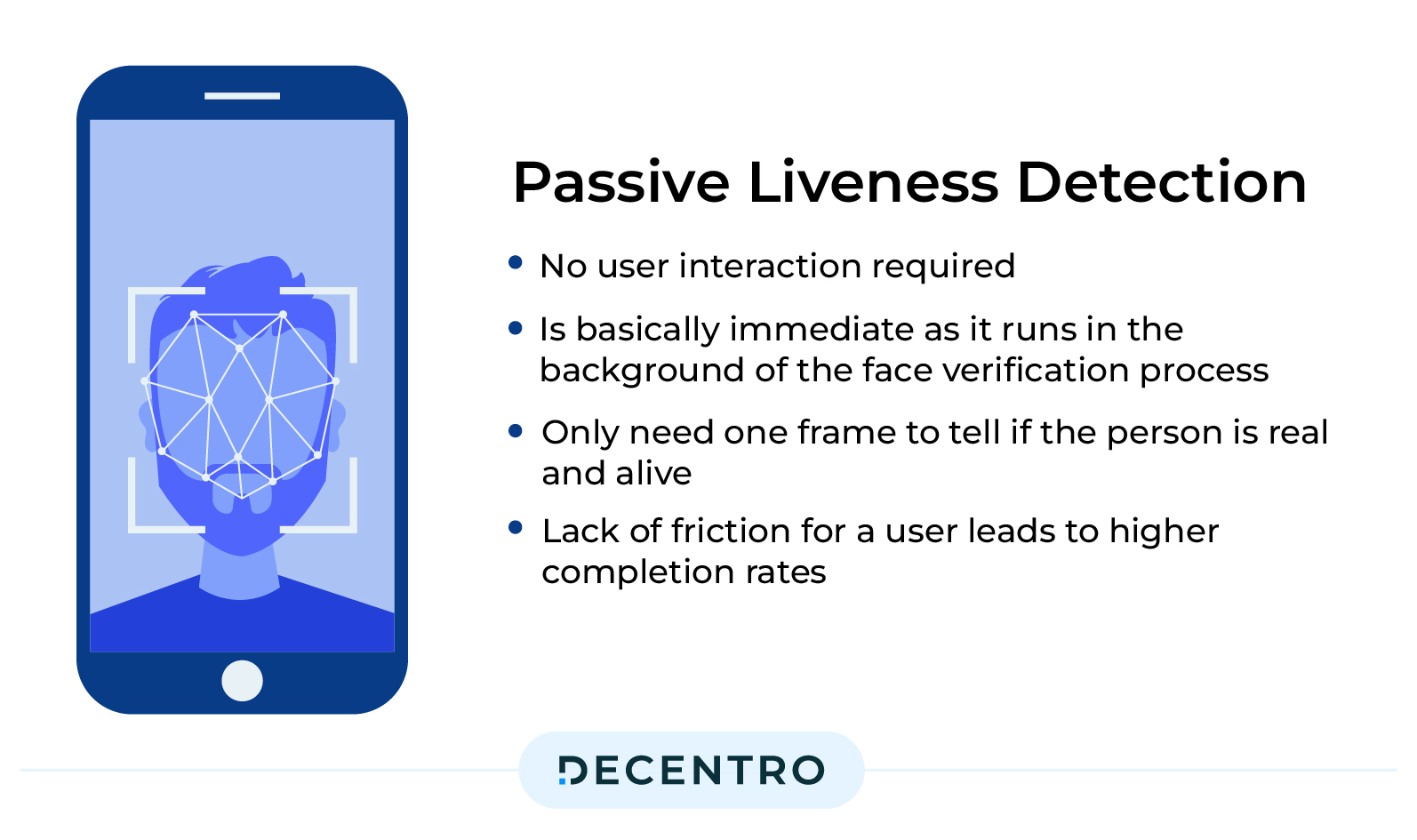

Passive Liveness Detection

This advanced technique detects whether a user is physically present without requiring explicit action or gesture. These systems typically use a fixed-length video capture of the user, which is then analyzed for properties such as light, skin texture, micro-motions, and other characteristics to determine if a live person is present in the capture.

A more advanced technique requires capturing a single image, which is analyzed for an array of complex characteristics to determine if a live person is present.

Workings of a Liveness Detection

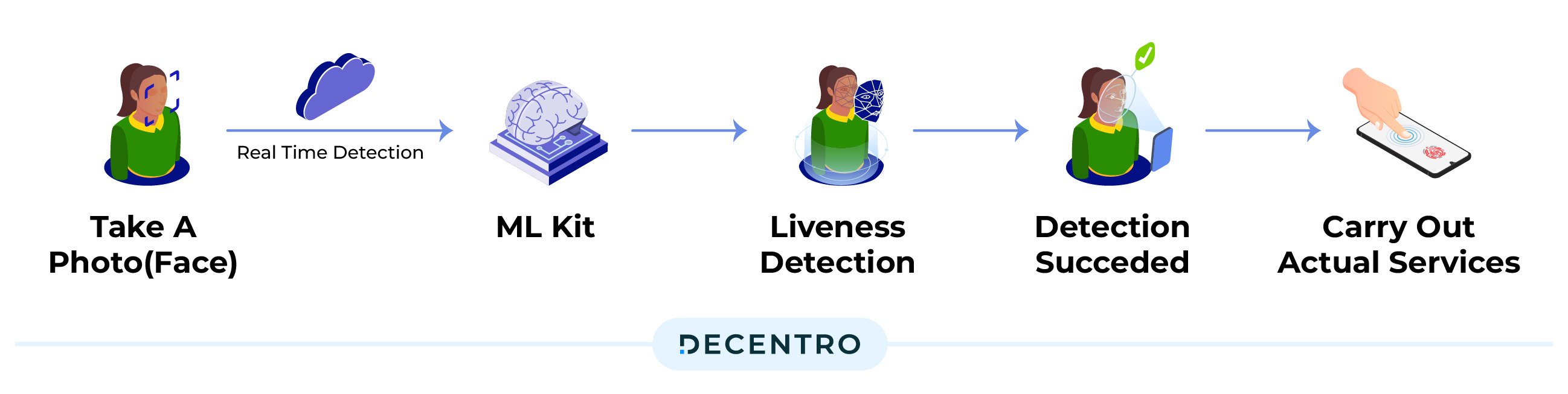

Implementing an intelligent and customer-friendly liveliness check mechanism can play a key role in preventing crime while offering the user a convenient video verification experience. There are multiple technologies at play whenever a liveness detection takes place. Here is a simplified flow of the same:

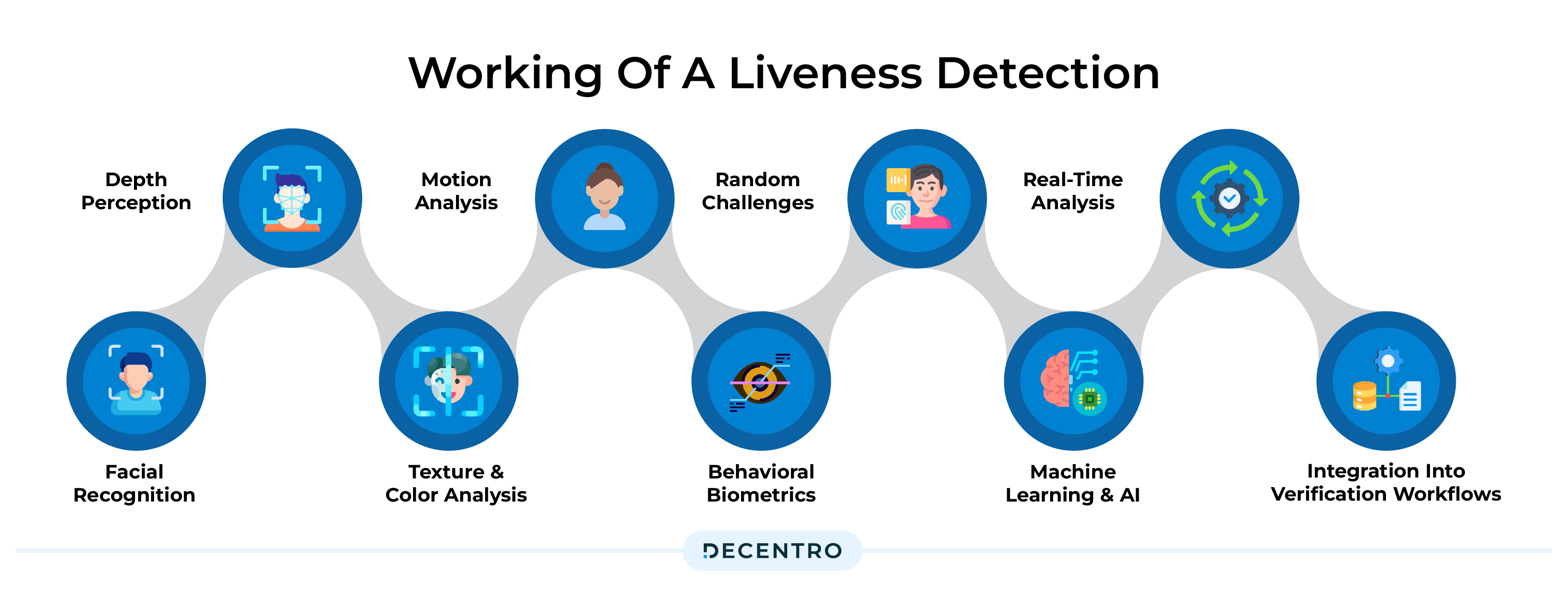

Facial Recognition:

Liveness detection often begins with facial recognition technology. The system captures and analyzes facial features from the provided image or video, creating a unique biometric template.

Depth Perception:

One key aspect of liveness detection is assessing depth perception. Traditional photos and videos lack depth, so systems use techniques like 3D depth mapping to analyze the spatial information of facial features.

Motion Analysis:

Liveness detection involves prompting the user to perform specific actions, such as blinking, smiling, or turning their head. The system captures and analyses these dynamic movements to ensure they are consistent with natural, live behaviour.

Texture and Color Analysis:

The system examines the texture and colour patterns on the face to ensure they exhibit realistic characteristics. Static images may lack the subtle skin tone and texture changes that occur with live movements.

Random Challenges:

Liveness detection systems often present users with random challenges to prevent spoofing attempts. For example, the system might request that the user mimic a specific expression or perform a random gesture. This unpredictability enhances the security of the process.

Behavioral Biometrics:

Liveness detection may incorporate behavioural biometrics, such as analysing unique patterns in how an individual blinks, smiles, or moves their head. These behavioural cues add an extra layer of verification.

Machine Learning and AI:

The system learns and adapts over time using machine learning algorithms. Based on a growing dataset, it continually refines its understanding of live behaviour, improving accuracy and adaptability to new challenges.

Real-Time Analysis:

Liveness detection is often performed in real-time, allowing immediate feedback during verification. This ensures that the individual being verified is actively participating and is not a passive representation.

Integration into Verification Workflows:

Liveness detection seamlessly integrates into broader identity verification workflows, such as Know Your Customer (KYC) processes or user onboarding. The outcome of the liveness check contributes to the overall decision regarding the authenticity of the individual.

PS: With over 400+ identity validations, 250+ image recognitions, and 300+ repository fetches happening via Decentro’s KYC stack per hour, we at Decentro are more than equipped to enable your verification and validation journey.

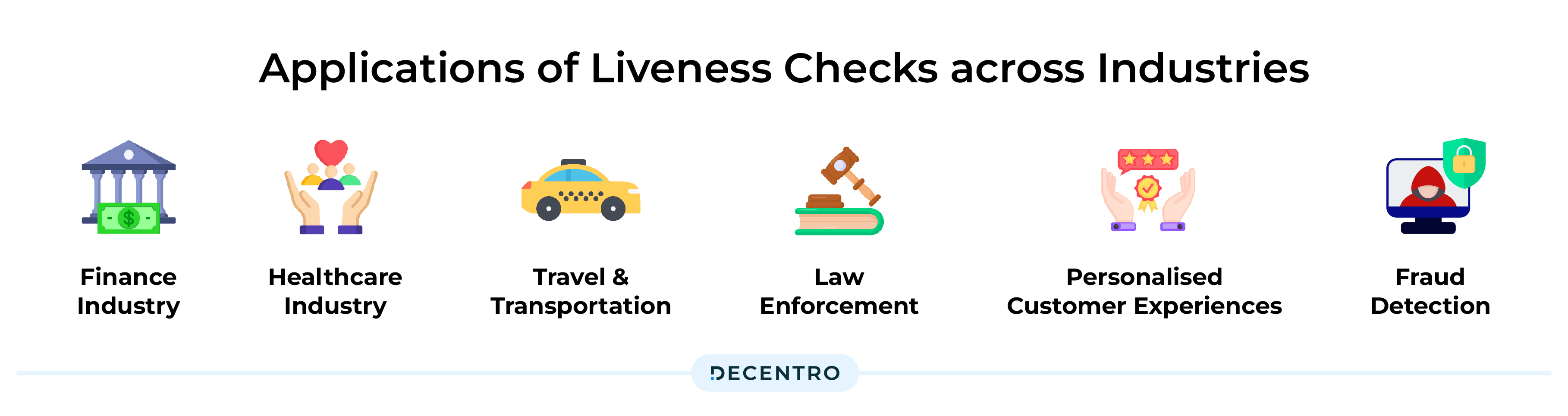

Applications of Liveness Checks across Industries

The need for identity verification is sector-agnostic. However, if we have explored the diverse applications of liveness checks across industries, we have

Finance Industry:

- Identity verification during online transactions and mobile banking

- Secure access control for banking and financial institutions

- Reduced risk of fraudulent activities and protection of sensitive financial information

Healthcare Industry:

- Accurate patient identification and access control in hospitals

- Streamlined administrative processes and enhanced patient safety

- Prevention of medical identity theft and ensuring appropriate care

Travel and Transportation:

- Efficient passenger management and enhanced security at airports

- Automated check-in processes and expedited security screenings

- Reduced wait times and improved airport security measures.

Law Enforcement:

- Identification and tracking of individuals involved in criminal activities

- Faster suspect identification and assistance in solving crimes

- Enhanced public safety through facial recognition technology

Personalised customer experiences:

- Identifying loyal customers and delivering customised services

- Tailoring marketing campaigns based on customer profiles

- Greeting customers by name and providing personalised experiences

Fraud Detection:

- Comparing live facial features with stored biometric data

- Detecting fraud attempts while implementing account takeover prevention measures.

- Flagging suspicious activities and protecting against financial losses.

User Journeys with Liveness Checks: The Onboarding Connect

Liveness detection makes the identity-proofing process more robust and secure so new customers can use their biometrics instead of passwords for more secure and convenient authentication. The intuitive and convenient nature of liveness checks makes it a no-brainer to integrate them right at the onboarding.

Liveness detection acts as a potent deterrent against fraudulent activities during customer onboarding. By requiring users to perform dynamic actions, such as blinking or smiling, the system ensures that the individual is physically present, mitigating the risk of identity theft or the use of spoofed images.

While enhancing security, liveness detection is designed to seamlessly integrate into the onboarding workflow, ensuring a smooth and user-friendly experience. Prompting users to perform natural actions creates an interactive and engaging onboarding process.

There is also a promise of scale. Liveness detection solutions are designed to scale with the growing user base. Whether onboarding a handful of customers or managing a large influx, the technology adapts to accommodate varying onboarding volumes.

Incorporating liveness detection in the onboarding process demonstrates a commitment to security and the protection of customer information. This builds trust among users, assuring them that their identities are being verified with the utmost care.

Active vs Passive Liveness Detection – Which is better?

| Functionality | Passive Liveness | Active Liveness |

| User Experience | Requires no action by the user | Requires users to perform a “challenge-response” |

| Developer Requirements | API/SDK Integration | API/SDK Integration |

| Analysis Methodology | Real-time AI-based processing of images captured at an instant | Involves analysing a series of images or videos to detect the requested movement. |

| Bandwidth Requirement | Low | High |

| Speed | Real-Time | Active liveness increases user effort, resulting in a more extended liveness check. |

| Response to Spoofing | High immunity to spoofing | High immunity to Spoofing |

| Integration | Supports both API & SDK Integration | Additional front-end to capture video separately and stream processing to transmit the video, then |

| Connectivity | Works with & without an active internet connection | Works with & without an active internet connection |

Why Choose Decentro as Your Liveness Detection Partner

When choosing a liveness detection partner, there are several factors to consider, from the accuracy of the technology at hand to the customisation of the journey to best suit your needs. This is where Decentro’s KYC Farsight, with its advanced image recognition and machine learning capabilities, enables precise document forensics, classification, extraction, masking, and fuzzy matching.

Apart from the liveness engine, we also have a cluster of other products in the form of APIs, SDKs and Hyperstreasms that come under Decentro Farsight, built to enable your verification and validation journey.

- Liveness Engine: This API allows businesses to check the liveness of their customers by capturing a short video or a photograph of the customer. Our product suite covers you whether you have a use case catering to active liveness or require passive liveness for your onboarding journey. Read more about this capability here.

- Image Recognition: This API allows businesses to scan, classify, and extract information from a standard government-issued ID number and verify the same from its source repository as well (optional). This also includes additional capabilities such as image transformation and masking. Read more about this capability here.

- Face Match: This API allows businesses to match two faces passed by the customer by giving a match percentage and failure or success based on a threshold. Read more about this capability here.

Maximum scrutiny, with minimum hassle.

Result? An elevated user experience that is driven by an efficient, customizable solution that allows you to:

- Accelerate onboarding by 10X

- And reduce customer acquisition costs by 2X

Do you wish to get this integrated into your product flow?