Get a comprehensive idea of the loan disbursement process, including its key steps, factors influencing disbursement timelines, types of loan disbursements, and more.

Loan Disbursement Process: What is It, What are the Steps

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

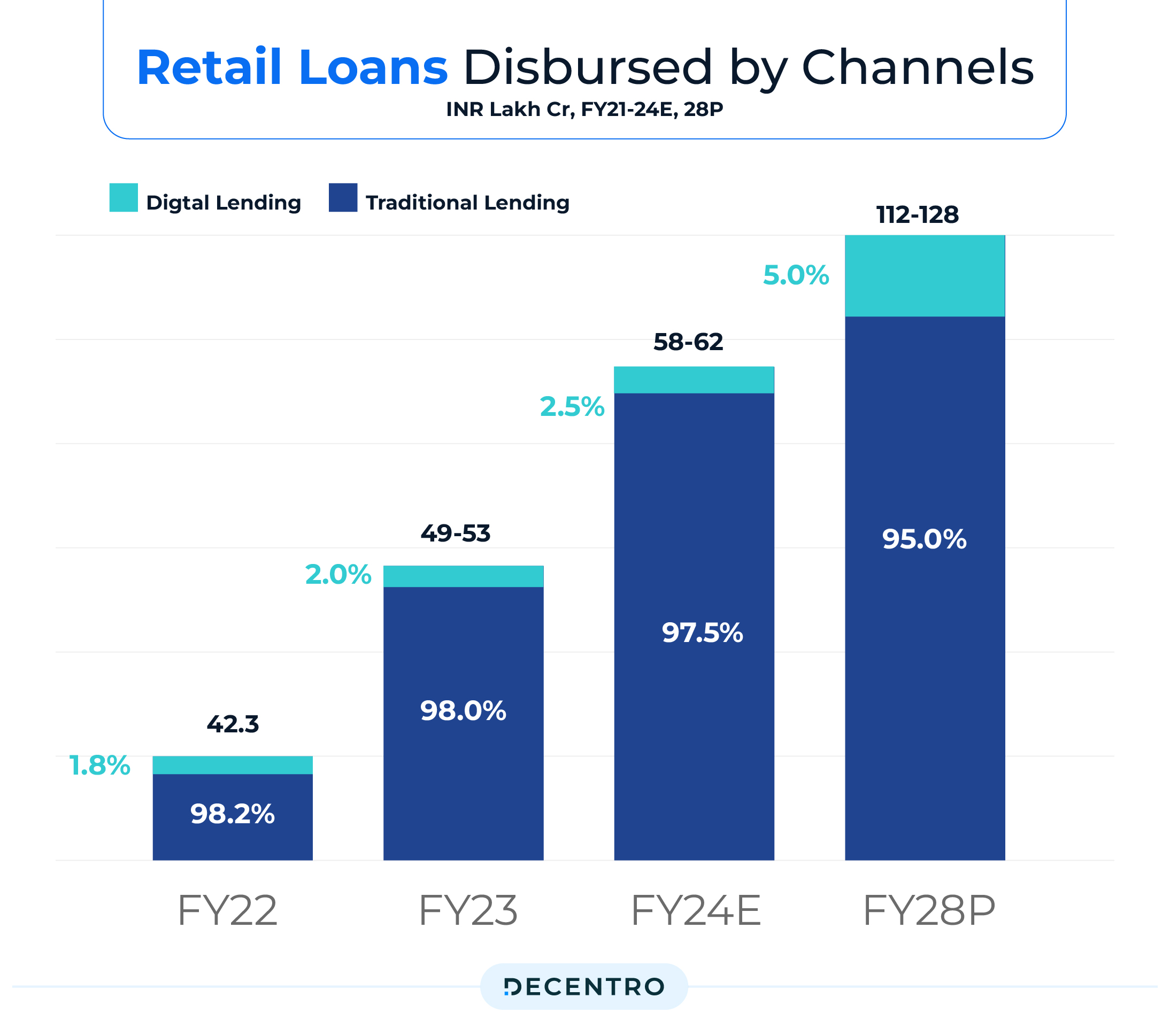

Between FY22 and FY24, the market share for digital loans has risen from 1.8% to 2.5% and is predicted to occupy almost 5% of total retail loans by FY28.

Now, apart from their flexible eligibility criteria and minimal documentation requirements, one of the major reasons why both individuals and businesses prefer digital loans over their traditional counterparts is the faster disbursal times.

Thus, for businesses planning to enter this sunrise segment, having a comprehensive understanding of the loan disbursement process and its associated aspects is an absolute must.

Keep reading for detailed insight!

What is Loan Disbursement? Understanding the Final Step in Borrowing

There are many reasons why a person may need to apply for a loan. It can be to cover major expenses, buy property or other assets, start a business, or more. Whatever the cause, the loan application process remains more or less similar across banks.

The person needs to visit the bank’s website or branch and file a loan application. Now, when a borrower applies for a loan, a plethora of processes are performed in the background by the lender before the funds are credited to their bank accounts.

Firstly, the borrower must provide all the relevant details in the loan application and submit all the required documents.

Then, the lender assesses the borrower’s eligibility criteria, determines the appropriate loan amount, drafts the loan’s terms and conditions, approves the application, and makes a loan offer. If the borrower accepts the loan, several other steps come into play, eventually leading to loan disbursement.

Now, the timeline for disbursement can often differ due to the regulations set by the Reserve Bank of India (RBI) and the lender’s policies. Also, the borrower’s eligibility criteria and loan repayment history can play a major role.

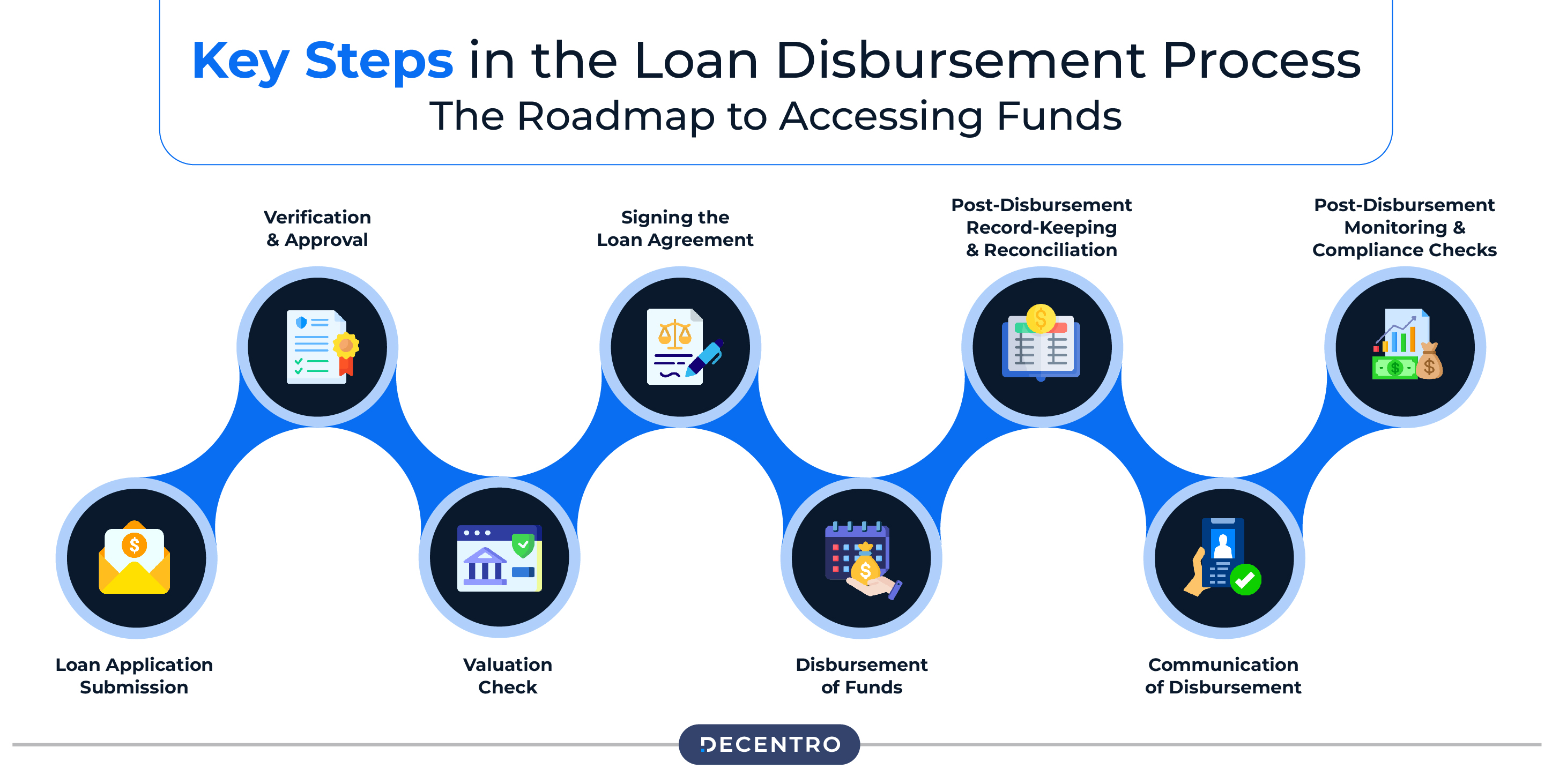

Key Steps in the Loan Disbursement Process: The Roadmap to Accessing Funds

Following is a detailed breakdown of all the steps that lead to loan disbursement and access to funds by the borrower:

- Loan Application Submission

After the borrower submits the loan application and required documents, the lender assesses the individual’s application based on factors such as creditworthiness, loan repayment history, reason for taking a loan, age, annual income, employment status, current outstanding debt, and several others.

- Verification and Approval

The lender also verifies the applicant’s identity details, ensuring compliance with the Know Your Customer (KYC) and Anti-Money Laundering (AML) guidelines. After this, the bank or financial services institution’s underwriting or disbursement team determines the risk associated with offering credit to the borrower.

The lender offers a loan if the borrower satisfies all the eligibility criteria.

- Valuation Check

In the case of a secured loan, the lender performs an additional verification process to assess the collateral value. This may include asset evaluation for business loans and property evaluation for home loans.

The financial institution also verifies all the documents related to the collateral for completeness and accuracy. Thus, borrowers need to ensure that they submit all the required documents, as they will remain with the lender until they have repaid the loan.

- Signing the Loan Agreement

In this step, the borrower needs to review the loan sanction letter and approve the associated terms and conditions to obtain the loan amount. This process involves signing a loan agreement containing the loan amount, interest rate, repayment period, penalties, and other terms and conditions.

- Disbursement of Funds

After all the loan terms are met, the lender disburses the loan amount to the borrower as mentioned in the loan agreement. Regarding home loans and education loans, the financier credits the funds to the designated party, the builder and educational institution, respectively.

However, the lender disburses the amount to the borrower’s chosen bank account for personal loans.

- Post-Disbursement Record-Keeping and Reconciliation

After the funds are disbursed to the borrower, the lender maintains a detailed account of the disbursement. This includes both documentation and transaction details. Furthermore, they conduct a reconciliation process to ensure that the loan disbursement is at par with the loan agreement and maintain the accuracy of the financial records.

- Communication of Disbursement

In this step, the borrower and any involved third party are notified of the loan disbursement. The lender confirms that the funds have been released from their end, including the transaction details and any associated instructions.

- Post-Disbursement Monitoring and Compliance Checks

After the loan disbursement process, the lender monitors the borrower’s fund usage to ensure that it aligns with the loan agreement. This includes periodic checks or requests for updates from the borrower.

These processes are usually conducted to prevent misuse of funds by the borrower and ensure compliance with the loan’s terms and conditions. Furthermore, the lender ensures that the loan disbursement complies with the regulatory standards and internal policies.

To do so, they generally compile reports for review by their internal teams and external regulatory agencies, as necessary.

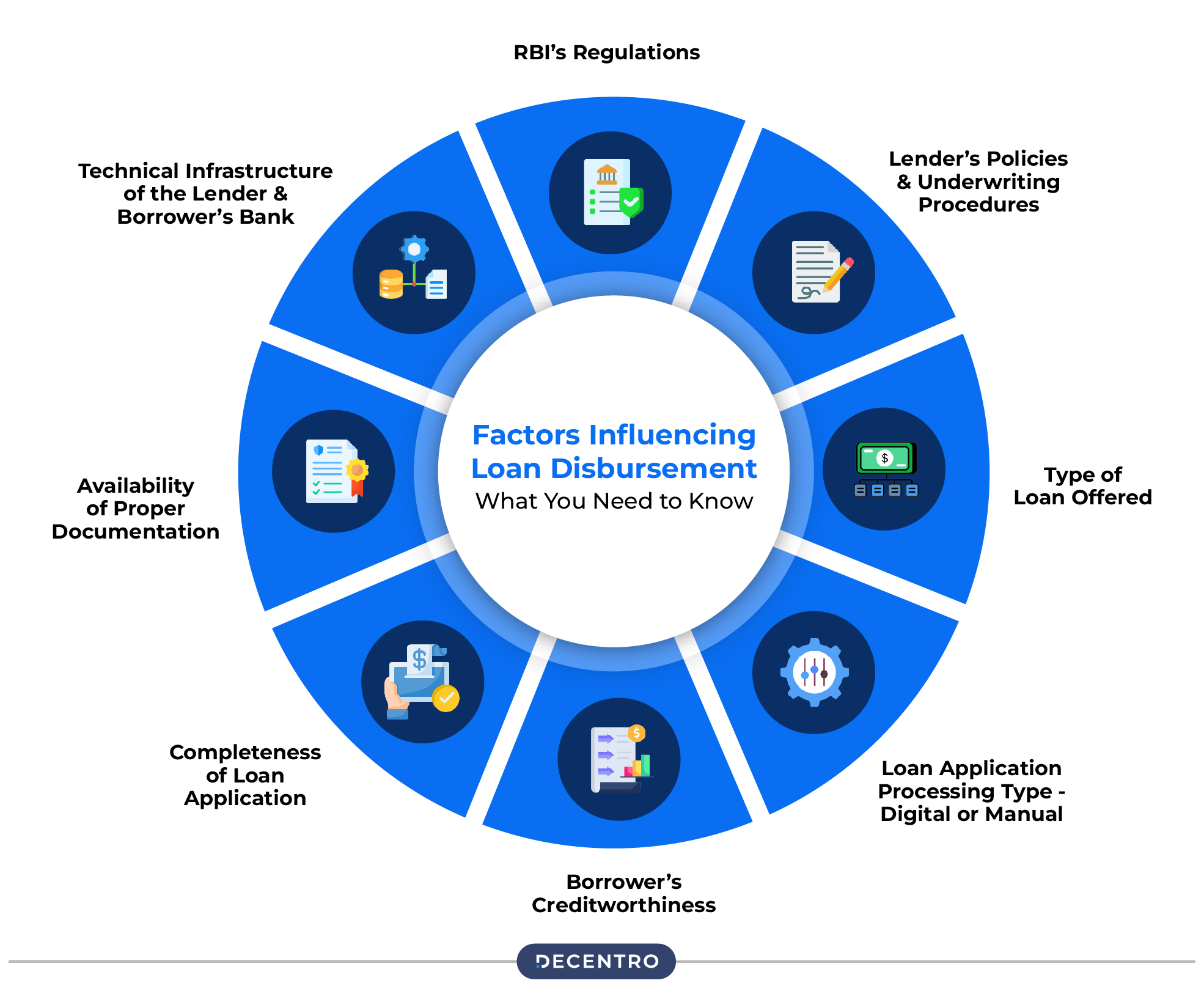

Factors Influencing Loan Disbursement: What You Need to Know

The time a bank or financial services institution takes to complete its loan disbursement process tends to depend on several factors. Find a detailed overview below:

RBI’s Regulations

The RBI has a strict set of regulations that lenders must follow when disbursing loans. These generally include guidelines regarding loan-to-value ratios, interest rates, repayment schedules, and more.

Thus, maintaining compliance with these regulations often takes up much time, exacerbating the loan disbursement process.

Lender’s Policies and Underwriting Procedures

Each lender has unique internal processes for loan disbursement. Some may have a fully automated and paperless workflow, enabling them to process the loan application digitally and facilitate quick disbursements.

Other lenders may require borrowers to send physical copies of their documents for verification or appear for in-person meetings, which can effectively elongate the disbursal process.

Furthermore, the financier’s underwriting process also plays a major role in the disbursement timelines. Their internal team may take some time to determine the associated risk and whether the applicant can get a loan.

Type of Loan Offered

Loan disbursement timelines tend to differ based on the type of loan offered. For instance, personal loans taken out on digital platforms are usually processed quicker than other loans.

However, in the case of home or business loans, the lender will take some time to assess the collateral value, perform legal checks, verify additional documents, and conduct other related processes, which can elongate disbursement timelines.

Loan Application Processing Type – Digital or Manual

In digital loan applications, disbursements are usually faster due to online document uploads and automated data verifications and approvals, which minimise the need for physical paperwork and offline procedures.

Alternatively, manual loan processing involves submitting physical documents and branch visits. Moreover, the bank or financial institution may remain closed on weekends, further extending the process.

Borrower’s Creditworthiness

The borrower’s creditworthiness and loan repayment history can majorly determine the loan disbursement timelines. Usually, if the applicant has a higher credit score, the financier perceives that individual as low risk and thus takes less time to process the loan disbursal.

Inversely, if the borrower has a lower credit score, the financial institution must spend more time assessing the associated risk level and determining whether to provide a loan.

Completeness of Loan Application

If there are discrepancies or errors in the loan application, the lender takes more time to verify the data. Also, it may lead to rejection of the loan application, requiring the borrower to reapply for the loan by making the changes needed.

Such situations usually enhance the loan application process, thus further delaying disbursement.

Availability of Proper Documentation

Documentation is a key factor in loan processing. It is a legal requirement to verify the applicant’s identity, adhere to the KYC and AML guidelines, and conduct the loan underwriting process.

So, if the applicant does not submit all the required documents or there are some discrepancies, they need to file the loan application again, which significantly delays disbursement timelines.

Technical Infrastructure of the Lender and Borrower’s Bank

The lender and borrower’s bank use technical infrastructure to process the loan and receive the funds upon disbursement. If both are compatible with the latest fund transfer mechanisms, they can process instant disbursals.

However, if they rely on traditional banking systems, it can take up to a few days.

Types of Loan Disbursement: Finding the Right Fit for Your Needs

Based on the type of loan your business is processing, the disbursement type will also tend to differ. Here are some of the common ones:

Full Loan Disbursement

In case of full loan disbursement, the lender transfers the entire loan amount in a lump sum to the borrower’s bank account or to the designated third party. This makes the funds available for direct use, enabling the borrower to withdraw and utilise cash as per their requirements.

Examples: Personal loans, gold loans, loans against mutual funds, business loans, etc.

Direct Payment Loan Disbursement

Direct payment loan disbursements credit the loan amount directly to the service provider’s bank account. The funds are not available to the borrower for withdrawal and usage.

Examples: Home loans and student loans. In such cases, the financier disburses the loan amount directly to the real estate developer or the educational institute to cover the cost of buying property or enrolling in a particular course.

Partial Loan Disbursement

When lenders initiate partial loan disbursements, they release the loan amount in small chunks on a necessity basis. This is usually done to prevent the misuse of funds.

Examples: Home loans and construction loans usually come with partial disbursement. The financier releases the funds based on how far the property’s construction has progressed or how much the borrower needs as per the construction’s current phase.

Balloon Payment Loan Disbursement

In balloon payment loan disbursement, the lender gives out only a small portion of the loan amount and holds back the more significant chunk to be released at the end of the loan tenure. This usually happens in the case of some real estate loans or business loans, in which the borrower assumes that a huge cash flow is due in the upcoming years.

Examples: A real estate developer takes out a loan with a balloon payment loan disbursement. At first, the financier disburses only a tiny amount and releases the major chunk only when the property has been leased or sold.

Common Challenges in the Disbursement Process: Navigating Potential Pitfalls

Following are some of the common challenges faced by lenders in the loan disbursement process and their suggested solutions:

Manual Data Entry Errors

Loan processing involves dealing with data like account numbers, payment amounts, etc., which, if handled manually, is highly susceptible to human errors. Thus, it can often lead to scenarios like incorrect disbursements, resulting in a delay in the loan disbursal.

Solution:

An effective countermeasure can involve leveraging automated workflows for data entry, implementing robust data verification systems, and double-checking data.

Lack of Seamless Integration Between Systems

If the financier’s loan disbursement process is fragmented among different systems, it can lead to inefficiencies and, as a result, significant delays.

For example, suppose the lender stores the disbursement data on one platform while the payment instructions are generated in another. This can often lead to a lack of integration between systems, hindering the smooth flow of funds.

Solution:

Financial service providers should consider integrating their loan-related data across multiple platforms. By doing so, they can ensure a smooth information flow, drastically reducing the chances of errors and delays and thus speeding up the loan disbursement process.

For example, they can integrate accounting software with their disbursement system, which can help them benefit from auto-reconciliation, real-time payment updates, and more, thus streamlining the loan disbursement process.

Adhering to the Changing Regulatory Compliances

Abiding by the AML and KYC guidelines is mandatory for financial services. The RBI updates these regulations to reduce instances of financial fraud and enhance the security of money-related transactions.

Thus, lenders are legally bound to monitor and follow changing regulatory requirements to conduct operations. Failure to comply can result in hefty penalties and reputational damage.

Solution:

Partnering with a reliable payments platform that adheres to all the latest AML and KYC guidelines can be an ideal choice. They can tackle the hassles of abiding by the latest regulations while the financier can solely focus on their operations.

Safety Concerns

The loan disbursement process involves sensitive financial data, making security a top concern. Lenders often have to deal with issues like unauthorised access, fraudulent activities, and data breaches, which threaten the integrity of the process.

Solution:

An ideal countermeasure for such issues will be integrating AES256 and RSA4096 encryption, secure data transmission protocols and multi-factor authentication. Also, they should conduct regular security audits and employee awareness programs to create an atmosphere of awareness within the company.

In this regard, partnering with a payments solution provider that offers such high-level security features can be ideal. This will also reduce the lender’s expenditure, enabling them to allocate their funds elsewhere.

Streamlining Loan Disbursement Through Decentro’s APIs

The secret to running a successful online lending platform is facilitating quick disbursals. However, you need to adopt innovative solutions to abide by all the regulations, maintain safety, and speed up the loan disbursement process in one go.

Enter Decentro’s APIs.

Decentro is India’s leading fintech solution provider, offering sophisticated lending solutions that automate the entire lending process while improving operational efficiency. Our comprehensive approach covers every aspect of the lending journey:

Secure Disbursement & Recovery:

- Front-end: Robust API banking stack with 99% uptime for secure loan disbursements

- Back-end: AI-powered debt collection through Neowise to protect and recover your lending investments

Neowise – AI-Enhanced Debt Collection Excellence

Complement your secure disbursement processes with Neowise’s revolutionary AI-powered debt collection platform that ensures optimal loan recovery:

- AI-Driven Recovery: Neobot (AI Calling Bot) automates and personalizes borrower engagement, delivering ~5% improvement in recovery rates through intelligent conversations

- Smart Analytics: Neosight (AI Calling Analytics) provides real-time call monitoring and outcome optimization with behavioral pattern detection

- Predictive Intelligence: Early warning systems detect borrower distress before escalation, protecting your loan portfolio proactively

- Operational Excellence: 40% boost in collection efficiency and 20% increase in customer engagement through advanced AI automation

Integrated Technology Stack:

API Banking Excellence: Decentro’s API banking stack offers single API documentation for several banking partners with industry-leading 99% uptime, ensuring reliable and secure fund transfers with robust validation mechanisms.

AI-Powered Collection Ecosystem: Neowise’s comprehensive platform manages the entire debt recovery pipeline through:

- Omnichannel AI communication across multiple languages and channels

- Intelligent legal workflow automation with compliance monitoring

- AI-enhanced field operations with predictive insights

- Managed services with 24/7 AI-powered monitoring

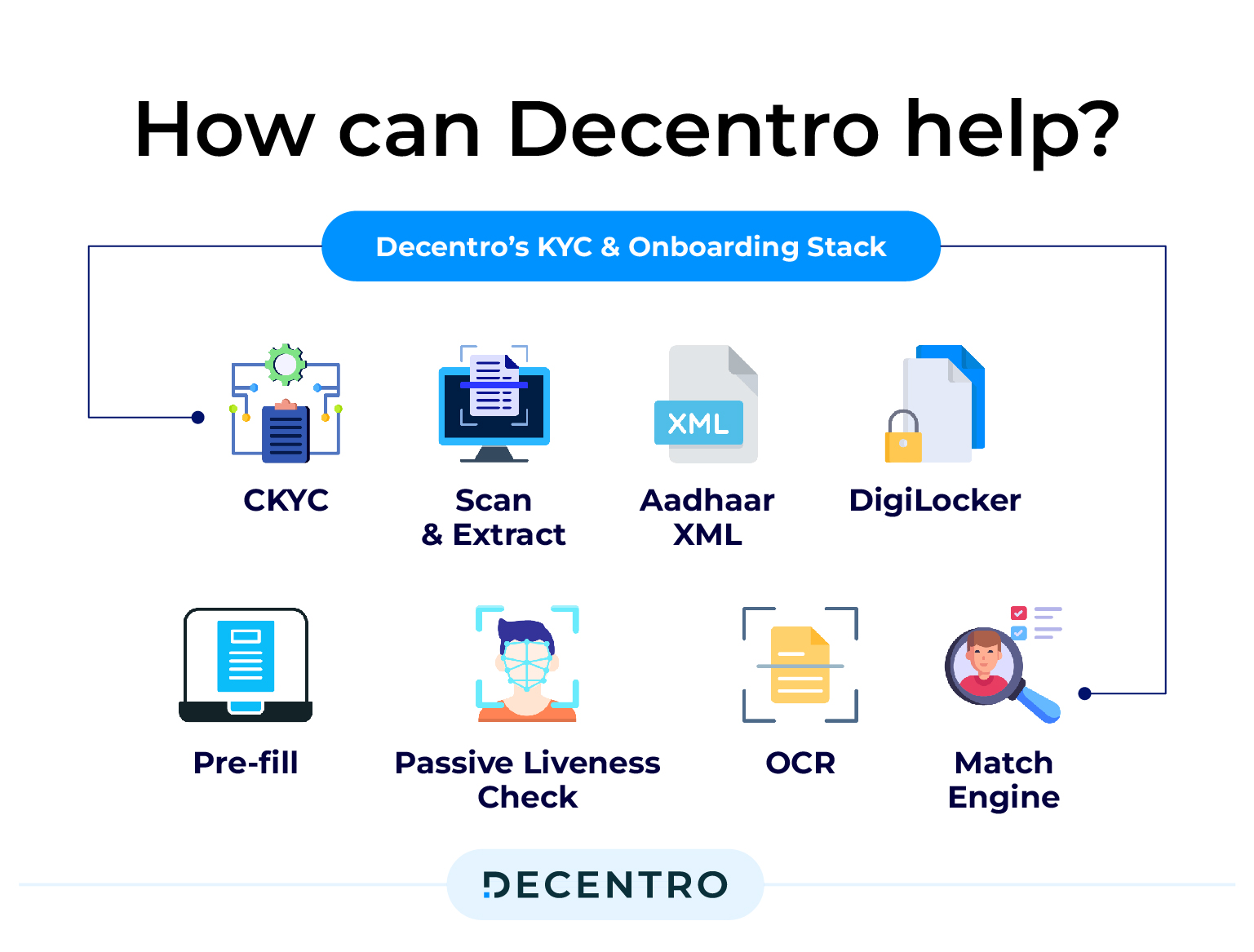

Leverage our KYC Verification APIs to conduct KYC and AML checks in real-time, while our Credit Bureau APIs allow you to perform hard and soft pulls and determine the applicant’s creditworthiness with ease.

Also, our Instant Payout APIs enable you to disburse real-time payments to any bank account or UPI ID, including support for bulk payouts, multiple payment methods (NEFT, IMPS, RTGS, or UPI), auto reconciliation, and automated payments via escrow accounts.

Wondering what else we can do to streamline your business’s loan disbursement process?