Discover the 10 best loan management systems in India for 2025 to streamline lending, boost efficiency, and ensure compliance

10 Best Loan Management System Platforms in 2026

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

A Quick Glance

| Company | Main Takeaway |

| Synoriq | Fast implementation specialist with 70% customisation capability |

| FinBox | Market leader with the strongest funding and an extensive ecosystem |

| Biz2X | AI-powered SME lending expert with proven scale |

| AllCloud | Industry-specific solutions with rapid deployment guarantee |

| CloudBankIN | Cost-effective all-in-one solution with 10-minute disbursement |

| Finflux by M2P | Strong M2P ecosystem backing with microfinance expertise |

| FinnOne Neo | Enterprise-grade solution for large institutions |

| Nelito Systems | Award-winning modular architecture with strong customization |

| CredAble | Working capital and supply chain finance specialist |

| LoanPro | International platform with complex loan management capabilities |

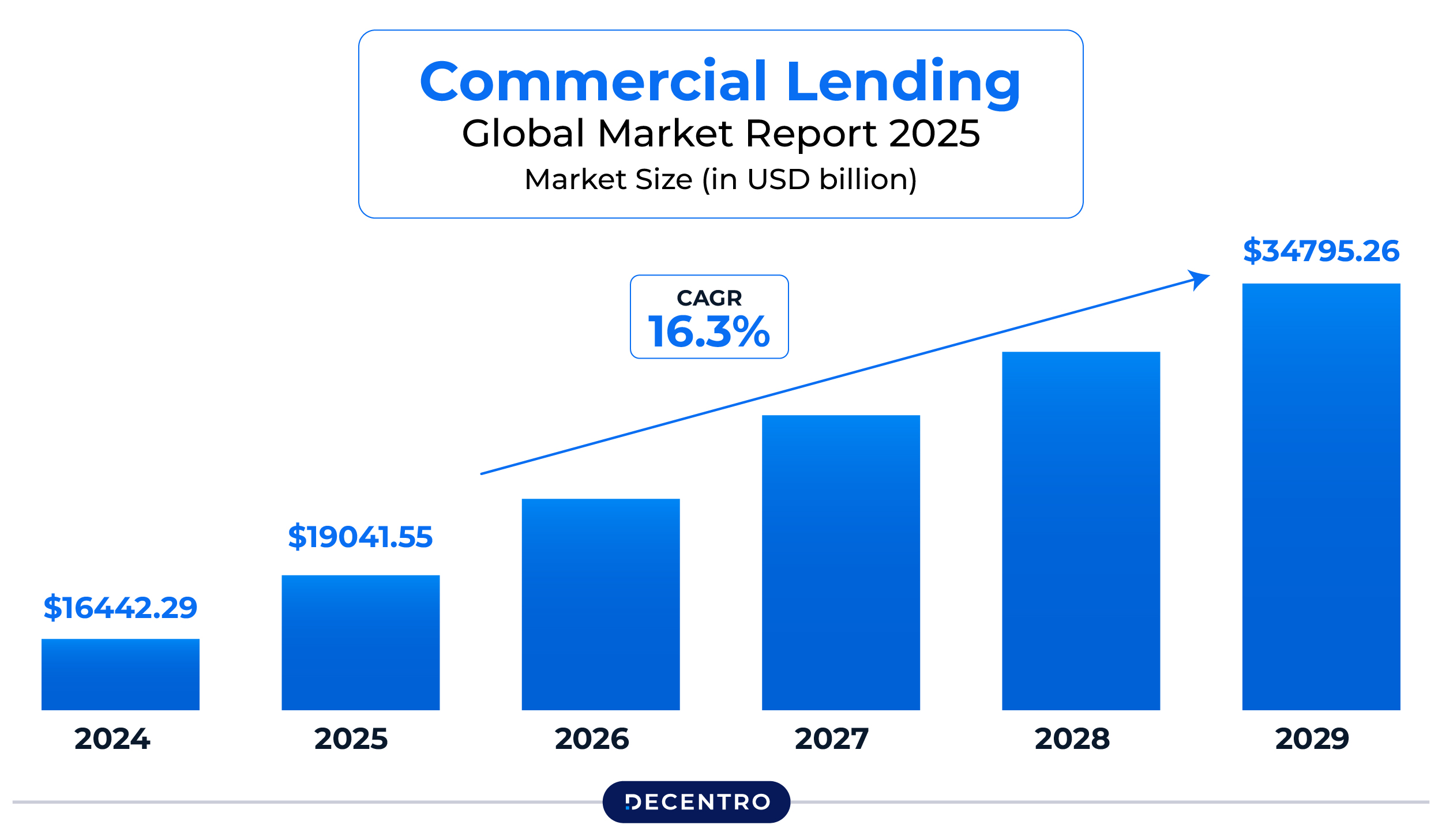

The lending landscape in India is undergoing a remarkable digital transformation. With the loan management software market projected to reach $29.86 billion by 2031 at a CAGR of 17.8%, financial institutions are increasingly adopting sophisticated platforms to streamline operations, enhance customer experiences, and ensure regulatory compliance.

A robust Loan Management System (LMS) is no longer just a back-office tool. It’s a strategic differentiator that shapes borrower experiences, drives operational excellence, and enables lenders to scale efficiently. Whether you’re a bank, NBFC, fintech, or microfinance institution, selecting the right LMS can make or break your lending operations.

In this comprehensive guide, we’ve analyzed the top 10 loan management system platforms available in 2025, with a strong focus on Indian companies leading the charge in digital lending innovation.

Synoriq

Company Overview

Founded in 2017 and headquartered in Jaipur, India, Synoriq has emerged as a leading provider of lending technology infrastructure. The company offers SynoFin, a comprehensive single-code SaaS platform that combines a loan origination system (LOS), a loan management system (LMS), collection, and customer service into a seamless ecosystem. With 35+ clients and managing ₹30,000+ Cr in AUM, Synoriq has positioned itself as a formidable player in India’s lending tech space.

Pros:

- Highly configurable system with 70% customisation capability

- Fast implementation – vehicle loans go live in record time

- Strong domain expertise with a team of 150+ professionals

- Excellent customer support rated as responsive and proactive

- Integrated suite covering the entire loan lifecycle

Cons:

- Relatively more minor team compared to enterprise-level competitors

- May experience occasional implementation delays during rapid scaling

Top Features:

- Single-Code SaaS Platform: Unified architecture supporting 15+ loan products, including personal, commercial, vehicle, and housing loans

- Advanced NPA Management: Automated asset classification with “once an NPA, remains an NPA” logic until regularisation

- Mobile-First Design: Comprehensive mobility app for field officers with offline capabilities

- Rich Rescheduling Capabilities: Supports instalment changes, part payments, rate changes, tand enure modifications

- BRE Integration: Business Rules Engine for quick credit decisioning

- Accrual Accounting: Sophisticated accounting for loans with cash-based charging

FinBox

Company Overview

Established in 2015 and headquartered in Bengaluru, FinBox has evolved into India’s leading credit infrastructure company. Recently securing $40 million in Series B funding led by WestBridge Capital, FinBox powers the digital lending operations of prestigious institutions including HDFC Bank, Kotak Mahindra Bank, Poonawalla Fincorp, and Tata Capital. With 130+ partners and 2,000+ integrations, FinBox provides end-to-end API infrastructure that enables any enterprise to launch and scale credit offerings.

Pros:

- Strongest investor backing with Series B funding of $40M

- Extensive integration ecosystem with 2,000+ connections

- AI-native platform with Account Aggregator-based underwriting

- Proven track record with tier-1 banks and NBFCs

- Modular, API-first architecture for seamless integration

Cons:

- Premium pricing may be prohibitive for smaller institutions

- A complex feature set requires training and onboarding

- Still ramping up international expansion

Top Features:

- BankConnect Score: Proprietary credit scoring overlaying bureau data with bank statement analysis

- Journey Builder: Drag-and-drop interface for creating custom application flows without coding

- Sentinel BRE: AI-powered business rules engine for real-time decisioning

- Prism Partnership Stack: Complete co-lending and partnership management solution

- DeviceConnect: Alternative data underwriting using digital footprints

- Account Aggregator Integration: 35% improvement in conversion with 45% fraud reduction

Biz2X

Company Overview

Biz2X is a global SaaS platform and subsidiary of Biz2Credit, specifically designed to empower financial institutions with customised online lending experiences for SMEs. Operating extensively in India, Biz2X facilitated loan disbursements of ₹14,000 crore through its Indian operations in FY25, with projections to reach ₹17,000 crore in FY26. The company employs 1,000+ professionals and is actively expanding its AI-driven solutions across the MSME lending ecosystem.

Pros:

- Proven track record with ₹14,000 Cr disbursed in FY25

- Strong AI and machine learning capabilities

- Comprehensive end-to-end lending stack

- Global expertise with localisation for the Indian market

- Excellent scalability for growing institutions

Cons:

- Complex pricing structure without fixed rates

- It may be over-engineered for very small lenders

- Requires significant customisation for unique use cases

Top Features:

- AI-Powered Underwriting Agent: 30-40% reduction in loan approval time with 40-50% improvement in credit assessment

- Dynamic Loan Pricing: Real-time interest rate adjustments based on business performance

- Automated EMI Management: Effortless repayment scheduling and tracking

- Real-Time Payment Reconciliation: Seamless integration with UPI, NEFT, IMPS

- RBI Compliance Framework: Regulation-adaptive workflows with moratorium and restructuring support

- Biz2X AI CRM: Predictive analytics for lead qualification and scoring

AllCloud

Company Overview

AllCloud is an Indian fintech company providing unified lending technology built for hyper-scale operations. The platform powers leading automobile financiers and lending institutions across India and Africa, with over 400 lending companies standardized on the AutoCloud platform. AllCloud offers comprehensive solutions covering loan origination, management, and collections through a cloud-deployed, API-first architecture.

Pros:

- Industry-specific solutions (auto loans, microfinance, MSME)

- Rapid implementation – successful deployment in 45 days for major banks

- 75% configurability for customization

- Strong integration with wallets and payment channels

- Excellent mobile-based lending support

Cons:

- Primarily focused on specific verticals (vehicle, MSME)

- Support documentation could be more comprehensive

- Limited presence in enterprise banking segment

Top Features:

- Omnichannel Origination: Support for walk-ins, DSA, and API-based journeys

- End-to-End Automation: e-KYC, credit approval, instrument authorization

- Fraud Detection: Pre-defined parameters with rating agency integration

- ACE Mobile Application: Field data capture at remote locations

- Auto Loan Software: Specialized vehicle financing with asset tracking

- 99.5% Uptime Guarantee: Auto-scalable infrastructure with bank-grade security

CloudBankIN

Company Overview

Founded in 2008 and headquartered in Chennai, CloudBankIN (now CloudBankin) is a comprehensive SaaS banking engine offering savings, deposits, loan management, collections, accounting, and mobile banking functionalities. Seed-funded with $400K from Upekkha and Kube VC, CloudBankin is widely utilised in the Indian lending sector to digitise loan processes. The platform has been recognised as Momentum Leader and High Performer by G2.com.

Pros:

- All-in-one banking solution beyond just lending

- Rapid loan disbursement (within 10 minutes)

- Cost-effective for co-operative banks and smaller NBFCs

- Strong customer reviews on ease of use

- Recognized by G2.com for excellent service

Cons:

- Smaller funding compared to competitors

- Limited global presence

- May lack some advanced AI features of larger platforms

Top Features:

- 10-Minute Loan Disbursement: Comprehensive automation from KYC to disbursement

- 12 Loan Product Support: Personal, business, vehicle, gold, line of credit, payday, microloans, agri loans, LAP, microfinance

- Co-Lending Software: End-to-end support for co-lending partnerships

- DPD-Based Tracking: Days Past Due monitoring with automatic provisioning

- Configurable Product Parameters: Principal/interest ranges, calculation methods, NPA setup

- GST and TDS Automation: Built-in tax compliance and reporting

Finflux by M2P

Company Overview

Finflux, acquired by M2P Fintech in July 2022 for an estimated $15-20 million, brings over 12 years of lending industry leadership. Now part of M2P’s comprehensive fintech solutions portfolio, Finflux offers cloud-first lending solutions including LOS, LMS, debt collections, and microfinance platforms. The platform serves banks, NBFCs, and financial institutions with a focus on rapid deployment and extensive third-party integrations.

Pros:

- Backing of M2P Fintech’s extensive ecosystem

- 50+ in-built third-party integrations

- Rapid deployment capabilities

- Strong in microfinance and co-lending

- Excellent API integration capabilities

Cons:

- Integration complexity with legacy systems

- Post-acquisition transition still ongoing

- Limited standalone brand presence after M2P acquisition

Top Features:

- Low-Code Journey Builder: Drag-and-drop interface with 100+ parameters for custom onboarding

- Automated Underwriting: BRE integration with multiple scoring models

- Loan Simulator: Interactive tool for prospect engagement

- LAMF Module: Specialized Loans Against Mutual Funds with DP integration

- Microfinance Suite: Group and individual loan management with center meeting alignment

- Flexible Reporting: Custom report creation based on loan type, demographics, payment history

FinnOne Neo by Nucleus Software

Company Overview

FinnOne Neo is the flagship loan management solution from Nucleus Software Exports Ltd., a well-established player in the financial software industry. FinnOne Neo LMS is an AI-powered, enterprise-grade platform trusted by financial institutions globally for over 12 years. The solution offers true digital lending with unprecedented insight, transparency, and control throughout the loan service lifecycle, serving banks, NBFCs, and housing finance companies.

Pros:

- Enterprise-grade solution with 12+ years proven track record

- Strong presence in Southeast Asia and Middle East

- Comprehensive AI and automation capabilities

- SOA-based architecture for easy integration

- Cloud-ready with platform-agnostic deployment

Cons:

- Higher cost structure suitable for larger institutions

- May require extensive customisation for niche use cases

- Implementation timelines can be longer for complex deployments

Top Features:

- AI-Powered Risk Management: Early identification of distressed loans to reduce NPAs

- Value Added Products (VAP): Insurance, additional covers, and financing for increased margins

- Configurable Asset Classification: Mitigates credit risk by managing portfolio quality

- Self-Service Solutions: FinnOne Neo mServe (mobile) and eServe (web) for end customers

- myLoan on OTT: Personalised loan services on messaging platforms

- Straight Through Processing: Automated EOD processing and bulk operations

Nelito Systems (FinCraft LMS)

Company Overview

Nelito Systems is a leading global loan management software provider with a modular API-based methodology and highly customizable product suite. Founded in India, Nelito has won multiple awards, including IBS Intelligence Global FinTech Innovation Awards and IMC Digital Technology Awards. The FinCraft Integrated Lending Management Solution (ILMS) supports banks, NBFCs, and MFIs with end-to-end loan portfolio management from prospecting to closure and monitoring.

Pros:

- Multiple industry awards and recognitions

- Highly customizable and modular architecture

- Strong customer testimonials from major banks

- Cloud-ready with scalable infrastructure

- Comprehensive solution for all loan types

Cons:

- May require technical expertise for full utilisation

- Implementation complexity for smaller institutions

- Limited marketing presence compared to newer fintech startups

Top Features:

- FinCraft ILMS: End-to-end integrated lending management solution

- API-Based Methodology: Easy integration with third-party applications

- Mobile Application Suite: Field operations support for microfinance

- Comprehensive Loan Product Suite: All types of loans and advances

- Superior Credit Rating Process: Advanced risk assessment capabilities

- Tech-Enabled Lending Processes: Improved productivity throughout loan lifecycle

CredAble

Company Overview

Founded in 2017 and headquartered in Mumbai, CredAble is a working capital financing and supply chain finance platform that has evolved into a comprehensive lending solution provider. With $62 million in funding across 10 rounds, CredAble serves 35+ lending partners across seven countries. The company facilitated loan disbursements of ₹45,000 crore in CY23 and operates its own NBFC for direct MSME lending.

Pros:

- Strong focus on working capital and supply chain finance

- Extensive funding and financial backing

- Own NBFC for direct lending capabilities

- 35+ lending partner network

- Specialised in the MSME segment

Cons:

- Primarily focused on working capital rather than diverse loan types

- A complex product suite may overwhelm simpler use cases

- Newer to pure loan management compared to specialised LMS providers

Top Features:

- Low-Code Loan Origination System: Highly parameterised with 100+ configurable parameters

- Digital KYC and Onboarding: Reduced manual intervention for faster processing

- Anchor-Led and Vendor-Led SCF: Complete supply chain finance platforms

- Embedded Finance Platform: Integration capabilities for B2B marketplaces

- Revolving Short-Term Loans: Novel product combining term and working capital demand loans

- Pre-Shipment and Deep-Tier Financing: Specialised supply chain products

LoanPro

Company Overview

LoanPro is a leading US-based loan servicing and management platform that has expanded its presence globally, including in India. The cloud-based solution is designed to create, service, and collect loans, with high configurability and real-time data capabilities. Banks and lenders choose LoanPro for its ability to handle complex loan structures and to grow as their business needs evolve.

Pros:

- Highly configurable for complex loan products

- Real-time data and analytics capabilities

- Strong automation for collections (reduced workforce by 90% for some clients)

- Global best practices and proven track record

- Scalable cloud-based architecture

Cons:

- International platform may require localization for Indian regulations

- Premium pricing suitable for larger institutions

- Learning curve for comprehensive feature set

Top Features:

- Custom Online Application Forms: Flexible borrower onboarding

- Advanced Communication Features: Multi-channel borrower engagement

- Automatic Payment Processing: Seamless collection automation

- Complex Loan Management: Handles intricate loan structures and modifications

- Real-Time Analytics: Instant insights into portfolio performance

- API-First Architecture: Easy integration with existing systems

How to Choose the Right Loan Management System

When evaluating loan management systems for your institution, consider these critical factors:

- Scalability: Can the platform grow with your business?

- Integration Capabilities: Does it seamlessly connect with your existing tech stack?

- Compliance: Is it aligned with RBI guidelines and local regulations?

- Customization: Can it adapt to your unique lending processes?

- Implementation Time: How quickly can you go live?

- Total Cost of Ownership: Beyond licensing, consider maintenance and support costs

- Customer Support: Is 24/7 support available during critical operations?

- AI and Automation: Does it leverage modern technologies for efficiency?

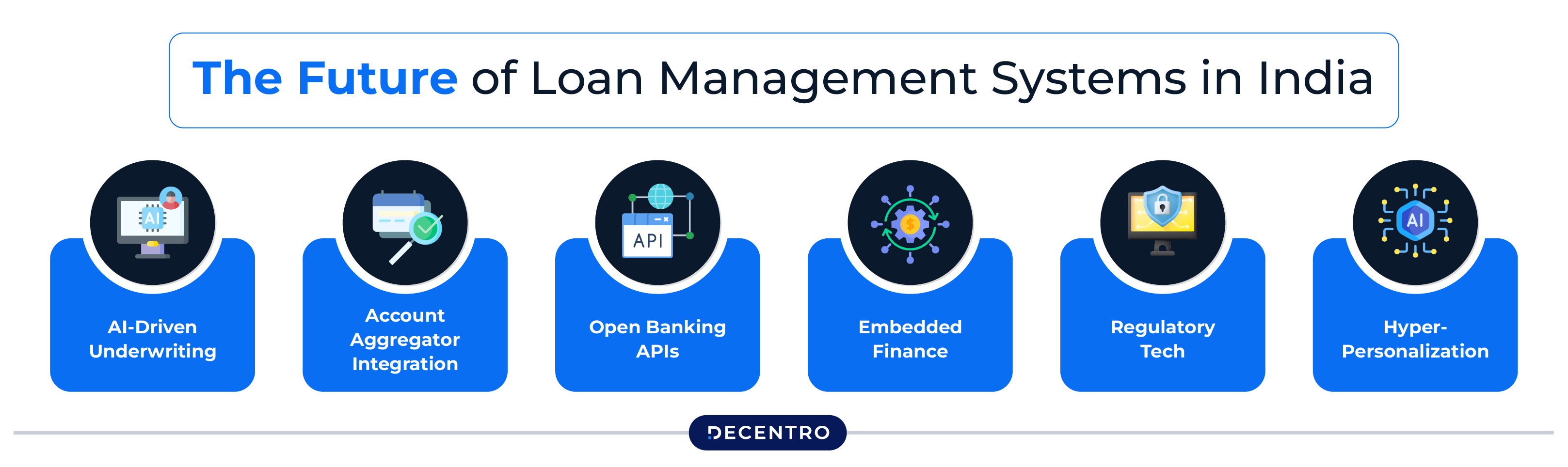

The Future of Loan Management Systems in India

The Indian lending landscape is evolving rapidly with several key trends shaping the future:

- AI-Driven Underwriting: Machine learning models analyzing alternative data for better credit decisions

- Account Aggregator Integration: Real-time financial data access for faster loan approvals

- Open Banking APIs: Seamless ecosystem integration for embedded lending

- Embedded Finance: Non-financial platforms offering credit products

- Regulatory Tech: Automated compliance with evolving RBI guidelines

- Hyper-Personalization: Tailored loan products based on individual borrower profiles

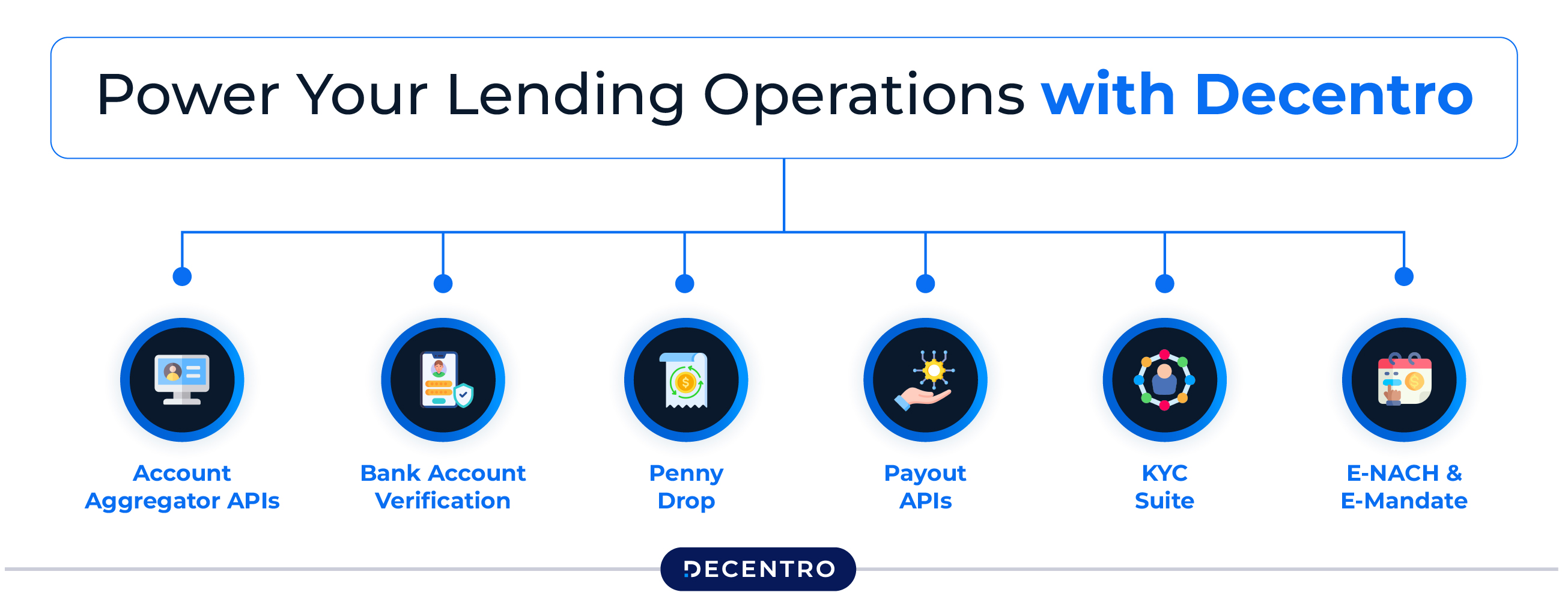

Power Your Lending Operations with Decentro

While choosing the right loan management system is crucial, integrating it with a robust financial infrastructure is equally important for seamless lending operations. This is where Decentro comes in.

Our comprehensive API suite complements your loan management system by providing:

- Account Aggregator APIs: Instant access to consented financial data for faster underwriting

- Bank Account Verification: Real-time penny drop and IFSC verification

- Payment Collections: UPI, NEFT, RTGS, and e-NACH for automated EMI collections

- Penny Drop: Verify bank account details in real-time

- Payout APIs: Instant loan disbursements to borrower accounts

- KYC Suite: Aadhaar, PAN, and video KYC for digital onboarding

- E-NACH and E-Mandate: Automated recurring payment collection

By integrating Decentro’s APIs with your chosen loan management system, you can:

- Reduce Time to Market: Go live with new lending products in weeks, not months

- Improve Approval Rates: Access to comprehensive financial data for better credit decisions

- Automate Collections: Set up recurring mandates and reduce default rates

- Enhance Customer Experience: Seamless digital journey from application to disbursement

- Ensure Compliance: Built-in regulatory compliance with RBI guidelines

Ready to transform your lending operations? Connect with us to discover how our banking APIs can supercharge your loan management system and create a truly digital lending experience for your customers.

Conclusion

The loan management system landscape in India is vibrant and competitive, with both established players and innovative startups offering compelling solutions. Whether you’re a large bank requiring enterprise-grade capabilities, an NBFC focused on specific verticals like vehicle financing, or a fintech building embedded lending products, there’s a solution tailored to your needs.

The key is to align your choice with your institution’s size, lending focus, technical capabilities, and growth ambitions. With India’s digital lending market projected to reach $350 billion by 2023 and the MSME credit gap at $380 billion, the opportunities are immense for institutions that leverage the right technology infrastructure.

Remember, your loan management system is not just software. It’s the engine that will drive your lending business forward in an increasingly digital and competitive marketplace. Choose wisely, implement thoroughly, and watch your lending operations transform.