Learn how money mules operate, their risks to your finances, and how you can protect yourself from falling victim to financial fraud with our comprehensive guide on money mules.

Understanding Money Mules: How They Impact You and Your Finances

Avi is a full-stack marketer on a mission to transform the Indian fintech landscape.

Table of Contents

The term ‘money mule’ cleverly combines carrying heavy burdens, like a mule, with the secretive act of transporting illegal money. This analogy underscores individuals’ exploited role in moving stolen or fraudulent funds for criminals.

There is a rising menace of mule accounts and money mules in India. In the past year, the Government of India froze around 4.5 lakh “mule” bank accounts, typically used for laundering proceeds of cyber crimes.

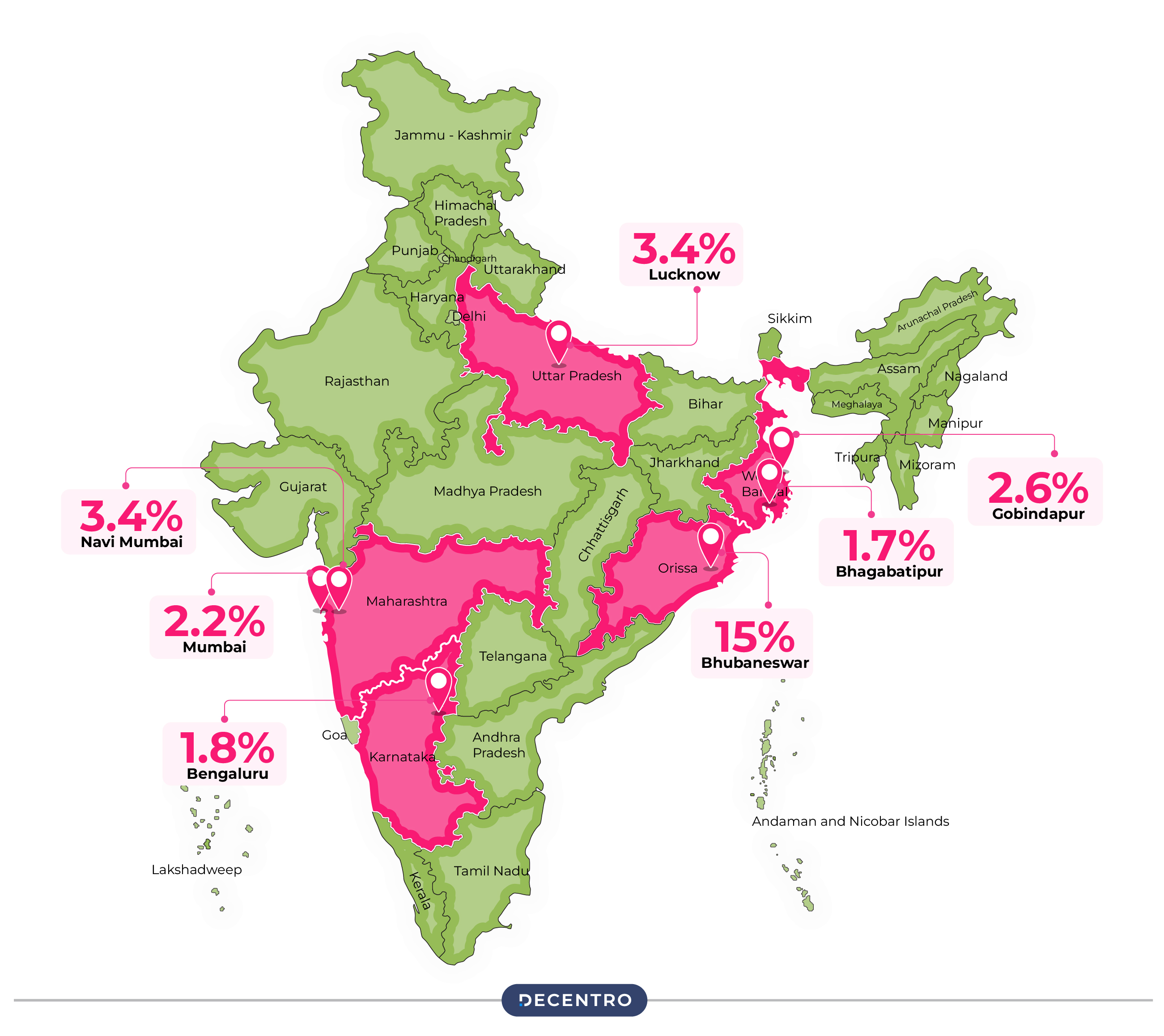

As per the data, around 40,000 mule bank accounts were detected in branches of the SBI. While most mule account activity—15% —happens in Bhubaneswar, Lucknow and Navi Mumbai also account for 3.4% each. Two cities in West Bengal – Bhagabatipur and Gobindapur—recorded 1.7% and 2.6% of mule account activity respectively, whereas Mumbai and Bengaluru reported 2.2% and 1.8% of mule account activity, respectively.

Understanding Money Mules

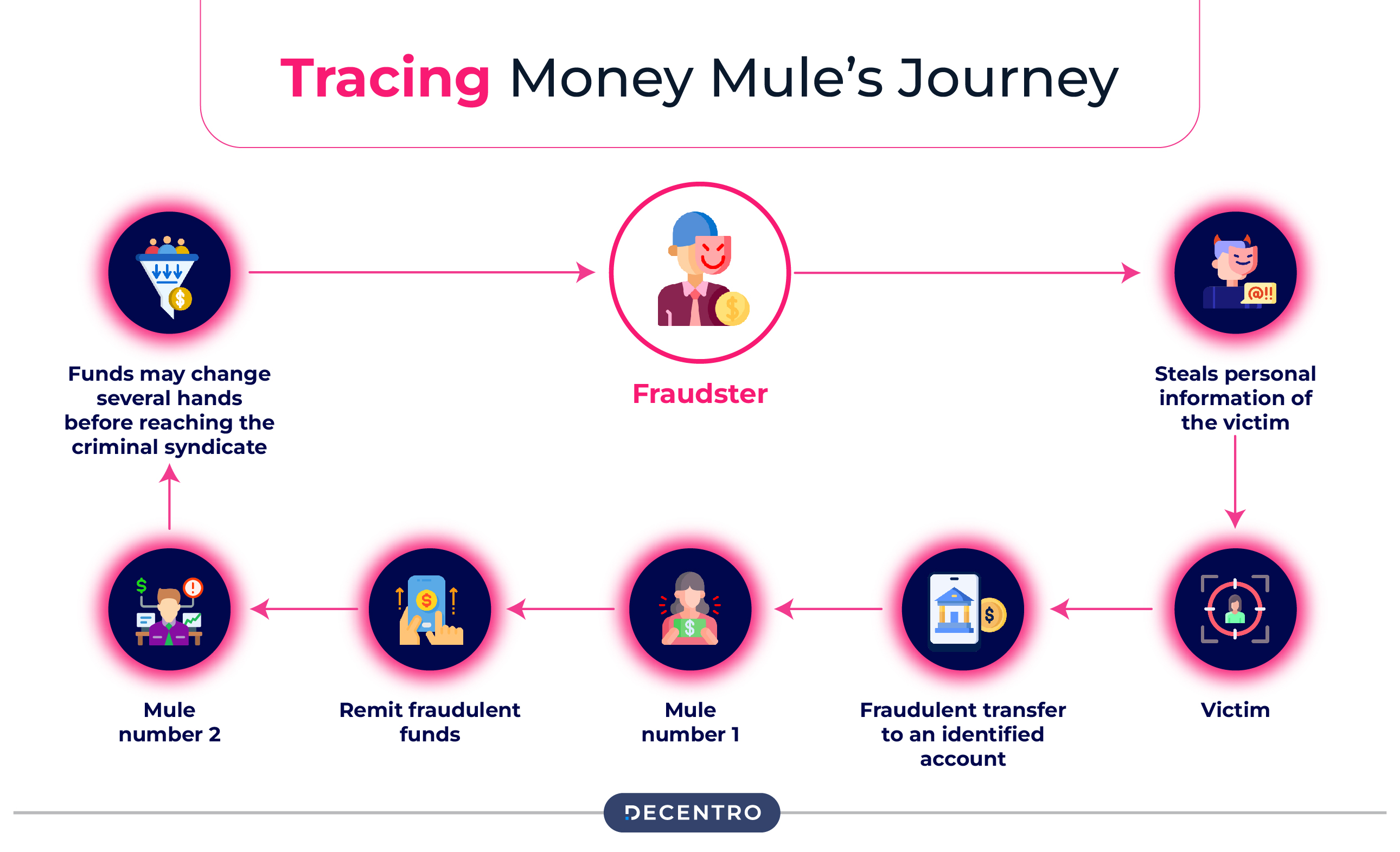

A money mule is a person who transfers illicit money acquired through theft or fraud. The transfer can take place through various means, such as bank accounts, virtual currencies, or prepaid debit cards. Such persons are generally paid a percentage or cut of the money successfully moved or laundered.

Money mules are usually of three types:

- Unwitting Mules: Unknowingly participate in schemes like online romance or fake job offers, using their bank accounts to transfer funds, motivated by trust in the scheme’s legitimacy.

- Witting Mules: Ignore red flags, continue involvement despite warnings, open multiple accounts, and are driven by financial gain or willful ignorance.

- Complicit Mules: Actively participate in criminal operations, open accounts across borders, recruit others, and manage funnel accounts motivated by profit or loyalty to criminal networks.

Money mules add a layer of complexity to fraud identification algorithms as legitimate accounts and account holders undertake most actions. Hence, ~90% of KYC checks cannot detect these anomalies normally.

Difference between Money Mules and Social Engineering

Money Mules and Social Engineering are both tactics often used in financial crimes, but they serve distinct purposes and operate differently:

Purpose and Role

- Money Mules: Individuals who transfer stolen or illicit funds, knowingly or unknowingly, for criminal organisations. They act as intermediaries to launder money and obscure its origins.

- Social Engineering: A method used to manipulate individuals into divulging confidential information or performing specific actions, such as revealing passwords or authorising fraudulent transactions.

Awareness of the Victim

- Money Mules: These can be unwitting participants (believing they’re performing legitimate tasks), witting participants ignore red flags, or fully complicit actors in the fraud.

- Social Engineering: The target is always a victim, tricked into compromising their own security or assets without direct involvement in transferring illicit funds.

Outcome

- Money Mules: Facilitate the laundering or transfer of stolen money, making them a tool in the criminal operation.

- Social Engineering: Acts as the entry point to initiate fraud, often preceding activities like recruiting money mules.

While these concepts are interconnected in financial crime, understanding their differences helps recognise and combat them effectively.

How Money Mules are Recruited

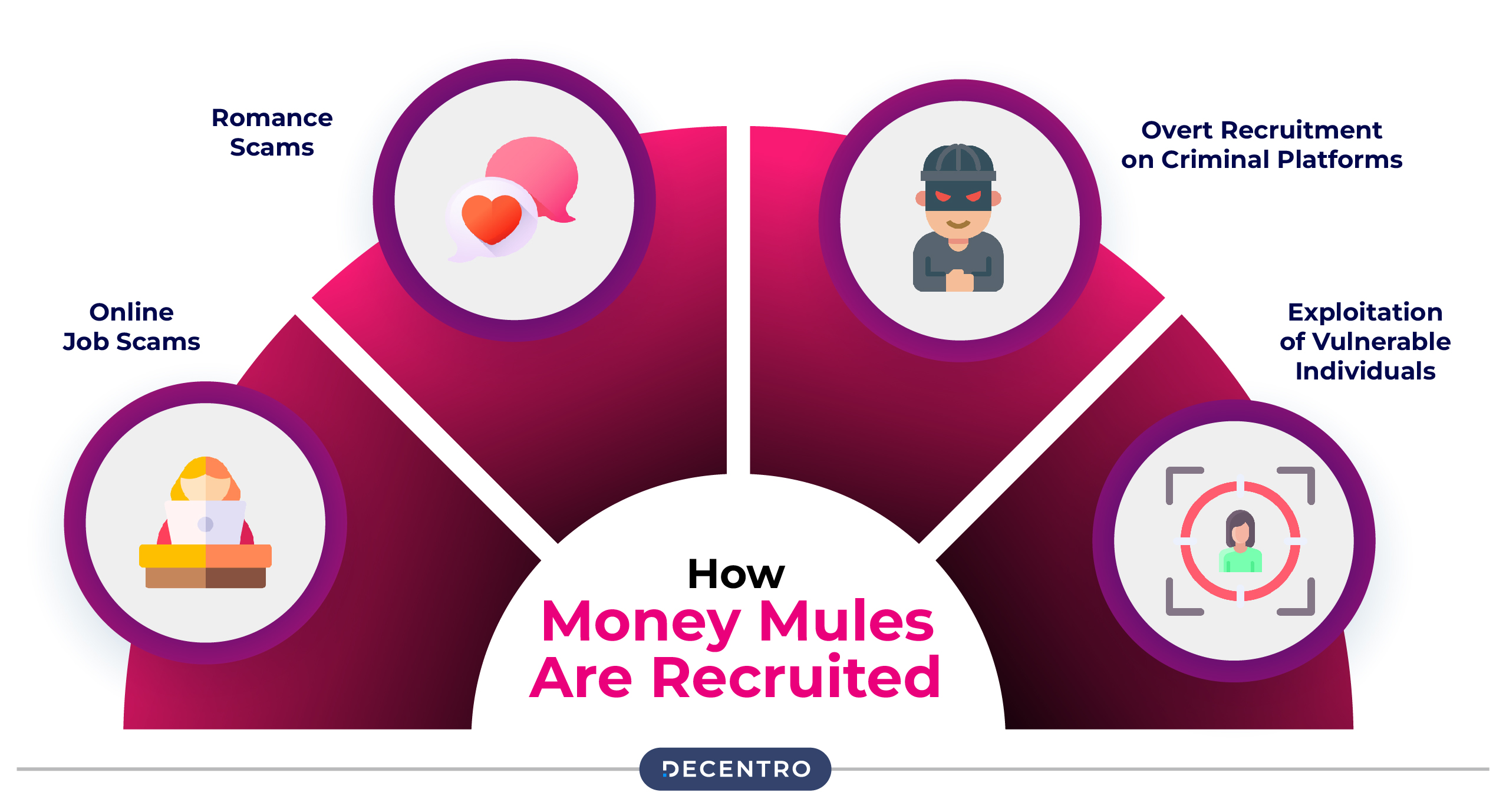

Fraudsters use various strategies to recruit money mules, often leveraging trust, desperation, or ignorance. The recruitment process typically falls into the following categories:

- Online Job Scams – Fraudsters post fake job ads on social media, job boards, or email campaigns. Roles often include vague descriptions like “payment processing” or “financial management.” Targets are promised high pay for minimal effort, making the offer appealing.

- Romance Scams – Scammers establish emotional connections through dating websites or social platforms. Victims are asked to transfer or receive money under the guise of helping a loved one. Emotional manipulation and urgency are used to gain compliance.

- Overt Recruitment on Criminal Platforms – Criminal networks openly advertise mule roles on forums or messaging platforms. Detailed information, including risks, rewards, and tasks, is shared with willing participants. Compensation structures may be offered, targeting those knowingly participating in illegal activity.

- Exploitation of Vulnerable Individuals – Targets include people in financial distress or lacking stable employment. Recruiters offer quick cash or solutions to financial problems, exploiting their desperation. Grooming techniques or long-term psychological manipulation are often employed to secure cooperation.

Each recruitment method is designed to deceive or incentivize individuals into facilitating illicit financial transactions, which form a crucial link in criminal operations.

Type of Mule Accounts

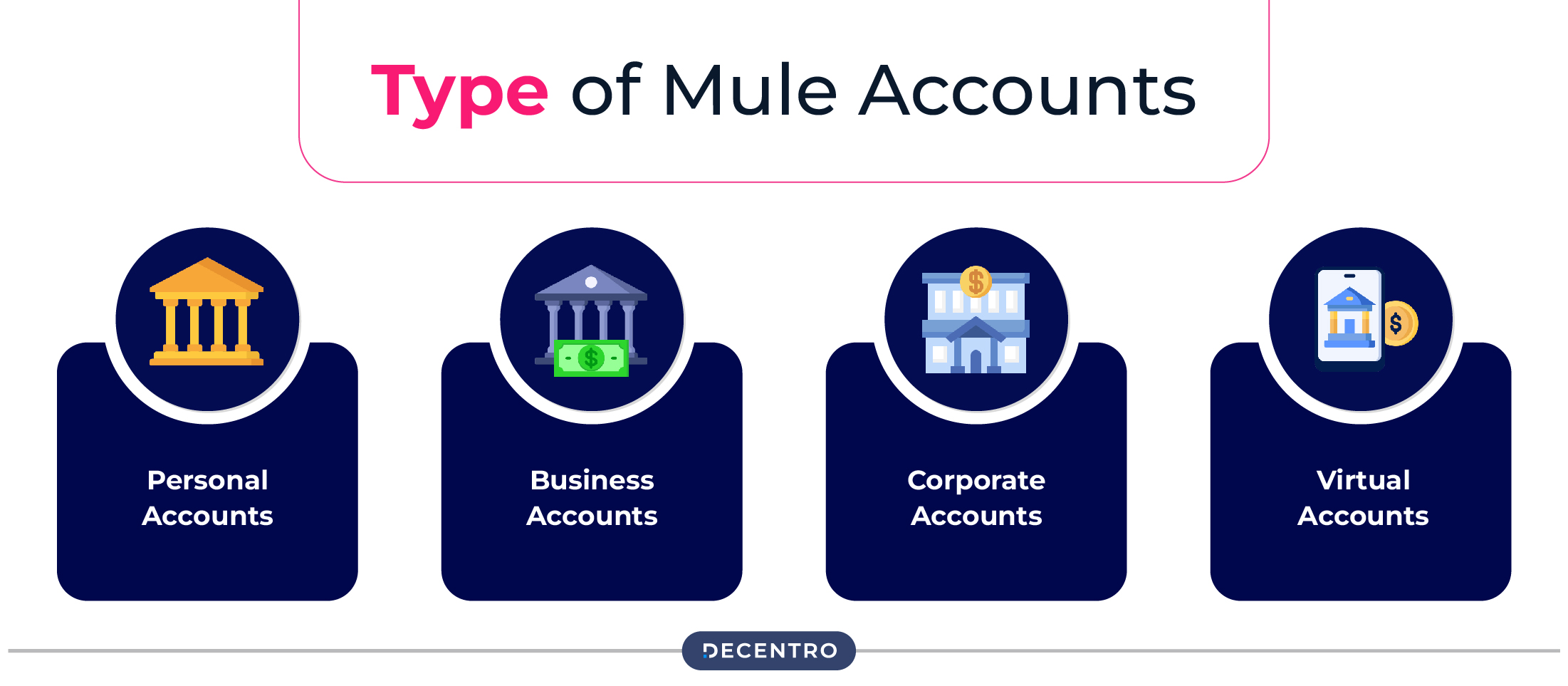

Money mule accounts can be broadly categorised into four types: personal, business, corporate, and virtual accounts. Each serves a unique purpose in facilitating illicit financial activities and has specific advantages and disadvantages.

Personal Accounts

Personal accounts are the most commonly used by money mules. They are easy to open, involve minimal fees, and are widely accessible. Due to their simplicity, these accounts are often exploited to receive and transfer funds. However, they lack the flexibility needed for large transactions, making them less ideal for high-volume activities. Criminals often use personal accounts to launder smaller sums or evade taxes.

Business Accounts

Business accounts offer greater flexibility than personal accounts, allowing for larger transactions. Organisations frequently use them to disguise illicit income as business-related expenses to evade taxes. However, these accounts come with higher fees and stricter scrutiny, increasing the risk of detection.

Corporate Accounts

Corporate accounts are the most versatile, capable of handling significant transaction volumes with the lowest fees. These accounts are typically accessible only to established businesses and organisations, which makes them attractive for large-scale money laundering or fund allocation schemes. Criminals often use these accounts to mask the origins of illicit funds while bypassing government oversight.

Virtual Accounts

Virtual accounts are increasingly popular among criminals because they are anonymous and difficult to trace. These accounts are used to launder money without direct links to the account owner, leveraging the growing digital payment infrastructure. While offering high levels of concealment, they can be flagged by advanced monitoring systems due to unusual patterns or offshore transactions.

Each account type has inherent risks that financial institutions and law enforcement agencies must address through robust monitoring and enforcement measures.

Warning Signs of Money Mule Solicitation

Recognising the warning signs of money mule solicitation is critical to avoiding involvement in illegal activities. Fraudsters often use deceptive tactics to make their requests seem legitimate, but certain red flags can help identify a potential scheme:

- Unsolicited Job Offers – Offers for “easy money” jobs appear out of nowhere, often sent via email, text, or social media. The job description is vague, focusing on tasks like “processing payments” or “managing transactions” with little to no required experience. Promises of high pay for minimal effort are emphasised, with no clear explanation of the company or its operations.

- Requests to Use Your Bank Account – You are asked to receive money into your personal bank account and transfer it elsewhere. The sender may claim they cannot open a bank account due to being overseas or experiencing technical issues. You may be instructed to open a new bank account in your name for “business purposes.”

- Lack of In-Person Interaction – The recruiter or employer has no verifiable physical address or legitimate contact information. All communication happens online or over the phone, with no opportunity for in-person meetings or interviews. The organisation cannot provide authentic documentation or details about its business.

- Emotional Manipulation – In romance scams, fraudsters create a deep emotional connection, using trust and urgency to manipulate you. They may claim to need help transferring money due to a “crisis” or financial emergency. Emotional appeals often include promises of future rewards, such as marriage or financial security.

- Pressure to Act Quickly – You are urged to act immediately, with no time to review or question the request’s legitimacy. Fraudsters use phrases like “time-sensitive,” “urgent,” or “this opportunity won’t last long.” This pressure prevents you from seeking advice or conducting due diligence.

- Involvement in International Transfers – You are asked to transfer funds to or from international accounts, often in countries with lax financial regulations. Fraudsters may claim this is due to logistical challenges or foreign exchange purposes. Engaging in such transactions strongly indicates money laundering or other illicit activities.

- Warnings from Trusted Entities – Bank employees, law enforcement, or friends may raise concerns about your activities. Ignoring these warnings can escalate the risk of being caught in a fraudulent scheme. Legitimate organisations will never ask you to ignore professional advice or conceal activities.

Being vigilant about these warning signs can help protect you from being exploited as a money mule, safeguarding your reputation and legal standing.

Risks and Consequences for Money Mules

Becoming a money mule carries significant risks and severe consequences, whether knowingly or unknowingly. Such activities can have legal, financial, and personal repercussions that can affect individuals for years.

Legal Consequences

- Criminal Charges: Money mules may face charges such as money laundering, wire fraud, or conspiracy, even if they were unaware of their role in illegal activities.

- Fines and Imprisonment: Depending on the severity of the offence and local laws, convictions can result in hefty fines or lengthy prison sentences.

- Permanent Criminal Record: A criminal record can limit future opportunities, such as employment or travel to certain countries.

Financial Risks

- Frozen Accounts: Banks may freeze accounts suspected of being used for fraudulent activities, leaving mules without access to their funds.

- Loss of Earnings: Money mules are often promised compensation but may never receive it, wasting time and compromising their financial stability.

- Liability for Fraudulent Funds: Mules can be held responsible for repaying stolen money transferred through their accounts.

Damage to Reputation

- Professional Impact: A money laundering investigation can tarnish an individual’s professional reputation, making it difficult to find future employment.

- Social Stigma: Being associated with criminal activities can lead to strained relationships with family and friends.

Limited Future Opportunities

- Restricted Banking Access: Involvement in fraud may lead to being blacklisted by financial institutions, making it challenging to open accounts or access credit.

- Travel Restrictions: Some countries may deny entry to individuals with criminal records tied to financial crimes.

Understanding these risks is crucial for avoiding involvement in money mule schemes. By staying vigilant, questioning suspicious offers, and reporting potential scams, individuals can protect themselves from falling prey to such illegal activities and the devastating consequences.

Industries most likely to be impacted by Money Mules and Fraud

Financial Institutions

- Banks and Money Transfer Services: Institutions handling large sums of money, such as banks, credit unions, and remittance services, are prime targets for money muling schemes. Their vast transaction volumes provide opportunities for criminals to mask illicit funds.

- Investment Firms and FinTech Companies: Organisations catering to high-net-worth individuals or dealing with complex financial products face increased risk of exploitation in laundering operations.

Online Businesses

- E-commerce Platforms: With a high volume of transactions, online stores are often exploited to blend money laundering activities into seemingly legitimate purchases.

- Gaming Platforms: Criminals use in-game currencies and microtransactions to transfer and launder illicit funds, often targeting younger, less vigilant users.

- Online Marketplaces: Platforms like eBay or Craigslist are used to sell stolen goods, with the proceeds funnelled through mule accounts to obscure the trail.

Other Vulnerable Sectors

- Real Estate: High-value property transactions and intricate inheritance processes make this sector a favoured choice for laundering large sums of money.

- Forex and Cryptocurrency Brokers: The speed and anonymity offered by foreign exchange and cryptocurrency markets are highly attractive to criminals seeking to move and conceal illicit funds.

- Carsharing and Rental Services: Stolen identities or mule accounts are used to finance vehicle rentals or accommodations, which can then be leveraged for further illegal activities.

While critical to the economy, these sectors remain at risk of criminal exploitation. Strengthening safeguards, monitoring systems, and compliance protocols is essential to combat money-making effectively.

Identifying and Avoiding Money Mule Scams

Money mule scams often appear harmless or even appealing, but they are traps set by criminals to exploit individuals for illegal activities. Recognising the signs and taking preventive steps can save you from serious consequences.

Identifying Money Mule Scams

- Too-Good-To-Be-True Offers – Be wary of unsolicited job offers promising easy money for minimal effort, especially those involving “payment processing” or “money transfers.”

- Unclear or Vague Job Descriptions – Legitimate employers provide detailed job roles and responsibilities. Scams often use vague language to mask illegal activities.

- Requests to Use Your Bank Account—Any offer asking you to use your personal bank account to receive or transfer funds is a red flag.

- Online Romance or Friendship Requests – Scammers posing as romantic partners or friends may ask for financial favours or claim to need help with money transfers.

- Pressure to Act Quickly – Scammers often create urgency, asking you to complete tasks immediately without giving you time to verify their legitimacy.

- Involvement in International Transfers – Being asked to transfer funds to or from foreign accounts, especially without a clear reason, is a strong indicator of fraudulent activity.

Steps to Avoid Money Mule Scams

- Research Job Offers or Requests – Verify the employer, their company, and the role details through independent sources.

- Refuse Suspicious Requests – Do not agree to use your bank account for third-party transactions or open new accounts at someone else’s request.

- Beware of Emotional Manipulation—Stay cautious of anyone, even someone you trust, who asks for financial help with receiving or transferring money.

- Monitor Communication Channels – Scammers often use informal or unprofessional channels, such as social media, messaging apps, or unverified emails.

- Consult Trusted Sources – If something feels off, discuss it with a trusted friend, family member, or legal professional.

- Report Suspected Scams – If you suspect a money mule scam, report it immediately to your bank, local law enforcement, or cybercrime authorities.

Stay Informed, Stay Aware

Being educated about money-mule schemes is the first step in protecting yourself. Update your knowledge about common scams regularly and share this awareness with others to help prevent the spread of these fraudulent activities.

These proactive measures can help you avoid becoming a money mule and safeguard your financial and personal well-being.

Role of Financial Institutions and Law Enforcement

Role of Financial Institutions

- Monitoring and Flagging Suspicious Activity – Financial institutions serve as the first defence against money mule operations. By deploying advanced transaction monitoring systems, they can identify anomalies such as unusual account activity, rapid transfers, or transactions involving high-risk regions. Example: Monitoring accounts with frequent deposits followed by immediate withdrawals, a common indicator of mule activity.

- Enhanced KYC and AML Protocols – Rigorous Know Your Customer (KYC) and Anti-Money Laundering (AML) checks are vital for identifying potential mules during onboarding and throughout account usage. Enhanced due diligence for high-risk customers can help prevent their misuse in illicit schemes.

Digital Tools: Biometric verification, AI-driven risk assessments, and real-time identity checks strengthen these processes.

- Customer Awareness Campaigns – Many money mules are unwitting participants. Financial institutions run education initiatives to inform customers about common scams, red flags, and the consequences of being involved in mule activities.

Channels Used: Email alerts, social media posts, and website resources help spread awareness effectively.

Collaboration with Other Institutions

Through information-sharing frameworks and partnerships, banks and financial institutions can pool insights on emerging trends and mule tactics, creating a united front against fraud.

Role of Law Enforcement

- Investigating Criminal Networks – Law enforcement agencies dismantle the larger networks behind money mule operations by tracing and analysing the flow of illicit funds.

Tech-Driven Analysis: Using forensic tools to follow digital trails, uncover mule hierarchies, and identify the masterminds.

- Prosecuting Offenders – Agencies enforce legal action against individuals and networks involved in money laundering, knowingly or unwittingly.

Impact: Prosecution serves as both a deterrent and a message that such crimes carry severe consequences.

- Cross-Border Coordination – Money mule operations often involve multiple jurisdictions. Law enforcement agencies collaborate through international task forces and agreements, such as Interpol or regional anti-money laundering bodies, to combat global networks.

- Educating the Public and Businesses— Law enforcement campaigns raise awareness about scams and educate individuals and businesses on how to report suspicious activity.

Workshops and Seminars: Target vulnerable communities, such as students and job seekers, to prevent them from becoming unwitting mules.

The success of combating money mule schemes lies in the synergy between financial institutions and law enforcement. Sharing data, leveraging technology, and fostering open communication channels can amplify the impact of preventive and corrective measures. Example: Joint task forces between banks and law enforcement have led to the early detection of mule accounts and the recovery of stolen funds.

Financial institutions and law enforcement can create robust defences against the growing threat of money mule schemes by combining technological advancements, public education, and inter-agency coordination. This collaboration protects the financial ecosystem and reinforces trust among customers and stakeholders.

What to Do If You Suspect Money Muling

Acting quickly and responsibly is essential if you suspect that you or someone you know is involved in money-making. Taking the right steps can help prevent legal troubles and disrupt fraudulent schemes.

Stop All Involvement

- Immediately cease any activity related to transferring or handling funds.

- Do not accept further payments, open new accounts, or follow instructions from the recruiter.

Notify Your Bank

- Inform your bank about your concerns, especially if your account has been used to receive or send suspicious funds.

- Cooperate with the bank’s investigation and provide any necessary information.

Report to Authorities

- Contact local law enforcement or cybercrime agencies to report the suspected money muling activity.

- In some countries, dedicated financial crime units or helplines can assist in handling such cases.

Keep Evidence

- Save any communications, emails, or messages from the person or organisation that solicited you.

- Document transaction details, including account numbers and amounts, to support investigations.

Seek Legal Advice

- If you believe you have unknowingly participated in money muling, consult a lawyer to understand your rights and responsibilities.

- Legal professionals can guide you on how to mitigate potential consequences.

Spread Awareness

- Educate others about the experience to help them avoid falling into similar traps.

- Share your story anonymously if needed, to raise awareness about how money mule schemes operate.

Taking these steps promptly can protect you from further involvement, help authorities track down perpetrators, and prevent others from being exploited.

Preventive Measures for Businesses

Businesses play a critical role in identifying and preventing money mule activities. By implementing robust controls and fostering a culture of compliance, companies can protect themselves and their stakeholders from fraud and financial crime.

Strengthen KYC and AML Protocols

- Conduct thorough Know Your Customer (KYC) checks during onboarding to verify customer identities.

- Use advanced Anti-Money Laundering (AML) tools to monitor transactions for suspicious patterns, such as unusual fund transfers or account activity.

Implement Transaction Monitoring

- Set up real-time transaction monitoring systems to detect red flags, such as high-risk geographic locations or rapid movement of large sums.

- Flag and investigate activities that deviate from typical customer behaviour profiles.

Educate Employees

- Train employees to recognise and respond to signs of money mule activity, such as customers avoiding verification processes or making unusual requests.

- Conduct regular workshops to reinforce compliance with KYC and AML procedures.

Risk-Based Customer Segmentation

- Identify and categorise customers based on their risk level during onboarding and ongoing relationships.

- Apply stricter controls, such as enhanced due diligence, for high-risk customers or transactions.

Collaborate with Law Enforcement

- Establish a strong relationship with local and international law enforcement agencies.

- Share information and respond promptly to requests for assistance in investigating suspicious activities.

Regular Audits and Reviews

- Perform regular audits of customer accounts, transactions, and internal processes to identify gaps in compliance.

- Update policies and technologies in response to emerging fraud trends.

Customer Awareness Campaigns

- Inform customers about the risks of being exploited as money mules through educational materials, email alerts, and website resources.

- Encourage them to report suspicious solicitations or requests involving their accounts.

By integrating these preventive measures, businesses can safeguard their operations, reduce the risk of being exploited by criminals, and contribute to a safer financial ecosystem.

As the fight against money mule schemes intensifies, the need for advanced, proactive solutions has never been more critical. What if there was a way to detect mule accounts in real-time, before they could compromise the financial ecosystem? At Decentro, we’re working on something groundbreaking—a solution to uncover the invisible. Stay tuned as we unveil the future of fraud prevention.