Discover India’s top mutual fund investment apps for 2025. Compare features, pros & cons of Groww, Zerodha Coin, ET Money & more. Start investing today!

Top 10 Mutual Fund Investment Apps in India in 2026

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

The Indian mutual fund industry has experienced unprecedented growth, with assets under management expected to reach USD 0.78 trillion in 2025 and grow at a CAGR of greater than 18% to reach USD 1.78 trillion by 2030. As digital adoption accelerates, choosing the right mutual fund investment app has become crucial for investors seeking seamless, cost-effective investment solutions.

With 23.63 crore (236.3 million) folios as of April 2025, the mutual fund landscape is more competitive than ever. This comprehensive guide explores the top 10 mutual fund investment apps in India for 2025, helping you make informed decisions about your investment journey.

A Quick Glance

| App Name | Key Value Proposition |

| Groww | India’s leading mobile-first platform democratizing investing with zero commission and simplified three-step process for millennials |

| Zerodha Coin | Commission-free mutual fund investing integrated with India’s largest discount broker’s robust trading ecosystem |

| Paytm Money | Seamless transition from digital payments to investments leveraging Paytm’s massive user base and wallet integration |

| ET Money | AI-powered investment recommendations backed by Economic Times’ research credibility and comprehensive financial planning |

| 5paisa | One-stop comprehensive investment platform offering multi-asset options with institutional-grade tools at low cost |

| Angel One | 25+ years of financial services heritage combined with modern technology serving 1.5 crore clients with advanced research |

| Scripbox | Curated mutual fund selection through expert research and automated strategies for busy professionals seeking simplified investing |

| Kuvera | Completely transparent, commission-free investing with advanced portfolio management tools prioritizing investor interests |

| Bajaj Finserv | 90+ year financial services heritage offering comprehensive mutual fund solutions integrated with established brand trust |

| Rupeezy | Modern, simplified investment platform targeting young professionals with clean interface and competitive zero-commission structure |

What Makes a Great Mutual Fund Investment App?

Before diving into our top picks, it’s essential to understand the key features that distinguish exceptional mutual fund apps:

- Zero commission structure for direct mutual fund investments

- User-friendly interface suitable for both beginners and experienced investors

- Comprehensive portfolio tracking and analytics tools

- Seamless KYC process and account opening

- Real-time NAV updates and market insights

- Goal-based investment planning features

- Robust security measures to protect investor data

- Educational resources and research tools

Top 10 Mutual Fund Investment Apps in India 2025

Groww

Groww has emerged as India’s leading investment platform, founded in 2016 by former Flipkart executives. With over 5 crore registered users, the company has democratized investing by eliminating complex jargon and providing a simplified, mobile-first investment experience particularly popular among millennials and first-time investors.

Top Features:

- Zero commission on direct mutual fund investments

- Simple three-step investment process

- Goal-based SIP planning tools

- Comprehensive portfolio analytics

- Educational content and market insights

- Instant KYC completion

- Tax-saving fund recommendations

Pros:

- Intuitive interface with no-commission investment plans

- Excellent customer support and educational resources

- Fast account opening process

- Wide range of mutual fund options

- Real-time portfolio tracking

Cons:

- Limited advanced research tools for professional investors

- Occasional app crashes during market volatility

- Customer service response time can vary

Market Share: Groww has captured a significant portion of the retail mutual fund market, particularly among first-time investors, with millions of active users across India.

Zerodha Coin

Zerodha Coin is the mutual fund platform by India’s largest discount broker, founded in 2010. Known for its technology-first, no-frills approach, Coin offers direct mutual fund investments without commission charges. The platform extends Zerodha’s revolutionary discount broking philosophy to mutual fund investing, making it popular among cost-conscious, self-directed investors.

Top Features:

- Zero extra commission fees on mutual fund investments

- Integration with Zerodha’s trading ecosystem

- Advanced portfolio analysis tools

- Automatic dividend reinvestment

- Tax loss harvesting features

- Detailed transaction history and reports

Pros:

- Completely commission-free investing

- Robust platform with minimal downtime

- Excellent for investors already using Zerodha for trading

- Comprehensive reporting and analytics

- Strong brand trust and reliability

Cons:

- Interface can be overwhelming for beginners

- Limited educational content compared to competitors

- Requires Zerodha demat account for full functionality

Market Share: As part of the Zerodha ecosystem, Coin benefits from the broker’s substantial market presence, serving millions of investors across India.

Paytm Money

Paytm Money, launched in 2017 as part of One97 Communications, leverages Paytm’s massive user base to offer mutual fund investments. The platform capitalizes on India’s digital payments revolution, providing a unified financial services experience that allows users to seamlessly transition from digital payments to investments with trusted brand recognition.

Top Features:

- Integration with Paytm wallet and UPI

- Zero commission on direct mutual fund investments

- Goal-based investment planning

- SIP automation and management

- Tax-saving mutual fund recommendations

- Real-time portfolio tracking

Pros:

- Seamless integration with Paytm ecosystem

- Quick fund transfers through multiple payment methods

- User-friendly interface for beginners

- Strong brand recognition and trust

- Competitive pricing structure

Cons:

- Platform is quite new compared to established players and provides basic trading software

- Limited advanced features for experienced investors

- Customer service can be inconsistent

Market Share: Paytm Money has gained traction by leveraging Paytm’s existing user base, though it faces stiff competition from more established platforms.

ET Money

ET Money, backed by The Economic Times and launched in 2016, offers a comprehensive personal finance platform with strong mutual fund capabilities. The app leverages India’s leading business media house’s credibility to provide research-backed investment solutions, focusing on financial literacy and goal-based planning beyond just mutual fund investments.

Top Features:

- AI-powered investment recommendations

- Comprehensive financial planning tools

- Expert research and market insights

- Tax planning and optimization features

- Goal-based investment strategies

- Expense tracking and budgeting tools

Pros:

- Recommended for beginners alongside Groww for simplicity

- Strong editorial backing with quality research

- Comprehensive financial planning beyond just mutual funds

- Regular market insights and newsletters

- Good customer support

Cons:

- Interface can be cluttered with multiple financial products

- Some premium features require subscription

- Limited customization options for advanced users

Market Share: ET Money has established a solid presence in the personal finance app segment, particularly among users seeking comprehensive financial planning solutions.

5paisa

5paisa, established in 2016, offers a comprehensive investment platform covering mutual funds, stocks, and other financial instruments. Known for its low-cost structure, the platform provides institutional-grade trading and investment tools to retail investors, serving as a one-stop solution for investors looking to diversify beyond just mutual funds.

Top Features:

- One-stop app catering to all investment needs including stock market

- Zero brokerage on mutual fund investments

- Integrated trading and investment platform

- Advanced charting and technical analysis tools

- Multi-asset investment options

- Research reports and market analysis

Pros:

- Comprehensive investment platform beyond mutual funds

- Competitive pricing across all investment products

- Advanced tools for experienced investors

- Good research and analysis capabilities

- Multiple investment options under one roof

Cons:

- Interface can be complex for beginners

- Customer service quality varies

- App performance issues during high-traffic periods

Market Share: 5paisa has carved out a niche among investors seeking a comprehensive investment platform with competitive pricing.

Angel One (Formerly Angel Broking)

Angel One (formerly Angel Broking) is one of India’s leading financial services companies with over 25 years of experience since 1996. The company has successfully transformed from a traditional broking house to a technology-driven digital platform, serving over 1.5 crore clients with comprehensive investment solutions combining legacy trust with modern innovation.

Top Features:

- Seamless SIP and lump sum investment options with flexible withdrawal policy

- Comprehensive portfolio management tools

- Advanced research and advisory services

- Goal-based investment planning

- Tax optimization features

- Integration with trading platform

Pros:

- Strong brand heritage and trust

- Excellent research and advisory services

- Comprehensive investment solutions

- Good customer support

- Advanced portfolio analysis tools

Cons:

- Interface can be overwhelming for new investors

- Some features require premium subscription

- Occasional technical glitches during market hours

Market Share: Angel One maintains a strong position in the Indian financial services market, serving millions of clients across various investment products.

Scripbox

Scripbox, founded in 2012, focuses exclusively on mutual fund investments through curated recommendations and automated strategies. The platform offers a highly curated selection of mutual funds based on extensive research, making it popular among busy professionals seeking expert curation over self-selection for goal-based wealth creation.

Top Features:

- Curated mutual fund recommendations

- Automated investment strategies

- Goal-based financial planning

- Simple portfolio rebalancing

- Tax-efficient investment options

- Personalized investment advice

Pros:

- Listed among top picks for safe and convenient mutual fund investing

- Simplified investment approach for beginners

- Strong focus on long-term wealth creation

- Excellent customer education resources

- Transparent fee structure

Cons:

- Limited mutual fund options compared to competitors

- Fewer advanced features for experienced investors

- Higher fees on some advisory services

Market Share: Scripbox has built a loyal customer base among investors seeking simplified, goal-oriented mutual fund investing.

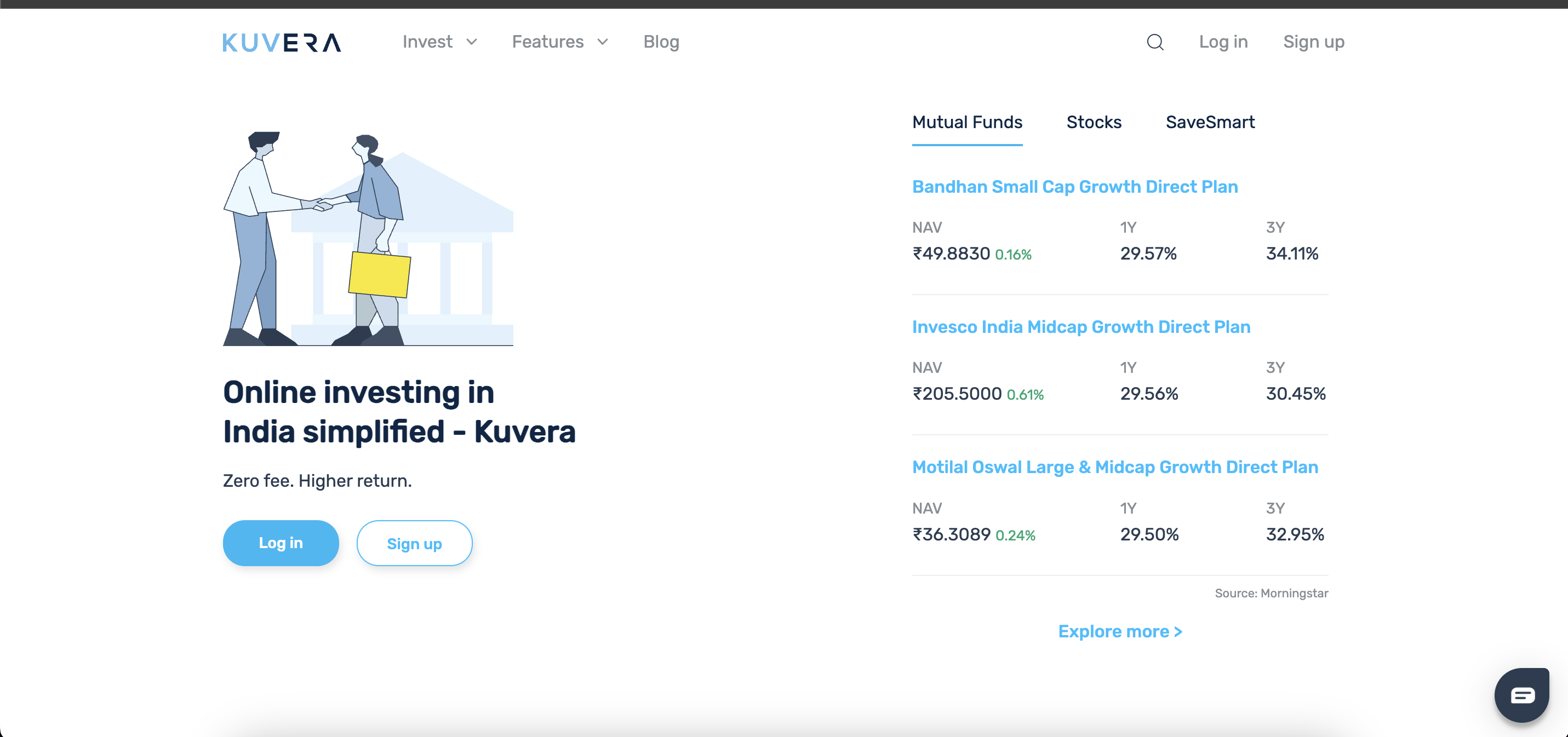

Kuvera

Kuvera, founded in 2016, offers commission-free mutual fund investments with complete transparency and a direct-pay model. The platform operates on putting investor interests first, becoming popular among cost-conscious and analytically-minded investors who value comprehensive portfolio management tools and transparent fee structures.

Top Features:

- Zero commission on all mutual fund investments

- Advanced portfolio analysis and optimization

- Goal-based investment planning

- Tax loss harvesting automation

- Family portfolio management

- Comprehensive reporting tools

Pros:

- Completely free mutual fund investing

- Advanced portfolio management features

- Excellent educational resources

- Strong focus on investor interests

- Transparent operations

Cons:

- Limited brand recognition compared to larger players

- Fewer payment options

- Customer service can be slow

Market Share: Kuvera has gained recognition among informed investors seeking transparent, commission-free mutual fund investing.

Bajaj Finserv

Bajaj Finserv leverages its 90+ year financial services heritage as part of the renowned Bajaj Group to offer comprehensive mutual fund investment solutions. The platform combines the trust and reliability of an established financial institution with modern technology, serving millions of customers across various integrated financial products.

Top Features:

- Seamless onboarding, comprehensive portfolio tracking, and secure investment transactions

- Goal setting and advisory services

- Comprehensive financial product integration

- Strong security measures

- Personalized investment recommendations

- Tax planning features

Pros:

- Strong brand trust and heritage

- Comprehensive financial services integration

- Good customer support infrastructure

- Secure and reliable platform

- Competitive pricing structure

Cons:

- Interface can be complex with multiple product offerings

- Limited customization options

- Focus on multiple products may dilute mutual fund experience

Market Share: Bajaj Finserv benefits from the parent company’s strong brand presence in the Indian financial services sector.

Rupeezy

Rupeezy is a newer entrant focusing on simplified investment solutions with modern technology and competitive features. The platform targets young professionals and first-time investors with its clean interface, educational content, and contemporary design principles to make investing accessible to every Indian.

Top Features:

- Zero commission mutual fund investments

- Simplified investment process

- Goal-based SIP planning

- Portfolio tracking and analysis

- Educational resources for beginners

- Competitive fee structure

Pros:

- Listed among India’s 10 best apps for mutual funds

- Simple and intuitive interface

- Competitive pricing

- Focus on customer education

- Quick account opening process

Cons:

- Limited track record as a newer platform

- Fewer advanced features

- Smaller customer base and community

Market Share: As a newer platform, Rupeezy is working to establish its presence in the competitive mutual fund app market.

Key Considerations When Choosing a Mutual Fund App

Security and Regulation

Ensure your chosen app is regulated by SEBI (Securities and Exchange Board of India) and implements robust security measures to protect your investments and personal information.

Cost Structure

Zero transaction fees have become a key feature in 2025, but evaluate the complete cost structure including any hidden fees or charges.

User Experience

The app should offer intuitive navigation, easy account opening, and seamless transaction processing to enhance your investment experience.

Investment Options

Look for platforms offering a wide range of mutual fund schemes across different categories, risk profiles, and fund houses.

Research and Analytics

Quality research, market insights, and portfolio analysis tools can significantly enhance your investment decision-making process.

The Future of Mutual Fund Apps in India

The Indian mutual fund app landscape continues to evolve rapidly, driven by technological advancement and changing investor preferences. Key trends shaping the future include:

- AI-powered investment advisory services becoming mainstream

- Integration with digital payment ecosystems for seamless transactions

- Enhanced personalization through data analytics and machine learning

- Sustainable and ESG investing options gaining prominence

- Voice-enabled investment capabilities for improved accessibility

Making Your Choice: Final Recommendations

Based on our comprehensive analysis, here are our recommendations for different investor profiles:

For Beginners: Groww and ET Money are recommended for simplicity, offering user-friendly interfaces and comprehensive educational resources.

For Advanced Investors: FundsIndia or Zerodha Coin provide advanced tools and expert guidance for sophisticated investment strategies.

For Cost-Conscious Investors: Zerodha Coin and Kuvera offer completely commission-free investing with transparent fee structures.

For Comprehensive Financial Planning: ET Money and Angel One provide broader financial services beyond just mutual fund investments.

Conclusion

The mutual fund investment app landscape in India offers exceptional opportunities for wealth creation through digital platforms. With the best apps in 2025 offering user-friendly features, zero transaction fees, and comprehensive tools, investors have access to professional-grade investment capabilities at their fingertips.

Choose an app that aligns with your investment goals, risk tolerance, and experience level. Remember that successful investing requires consistency, patience, and continuous learning, regardless of the platform you choose.

As the Indian mutual fund industry continues its remarkable growth trajectory, these digital platforms will play an increasingly crucial role in democratizing investment access and empowering millions of Indians to build long-term wealth through systematic investment strategies.

Start your investment journey today with any of these top-rated platforms, and take the first step toward achieving your financial goals through the power of mutual fund investing.

The Technology Behind Seamless Mutual Fund Investing

As the mutual fund app ecosystem continues to evolve, the underlying technology infrastructure becomes increasingly critical for success. Modern mutual fund platforms require robust payment processing, automated recurring transactions, and seamless fund collection mechanisms to deliver the smooth user experience that today’s investors expect.

The key technological requirements for mutual fund apps include:

Automated SIP Collections: Reliable recurring payment systems that can handle millions of monthly SIP transactions without failure, ensuring investors never miss their scheduled investments.

Instant Fund Transfers: Real-time payment processing for lump sum investments and quick fund additions, reducing the time between investment decision and execution.

Seamless KYC Integration: Digital onboarding processes that can verify investor identities quickly while maintaining regulatory compliance.

Multi-channel Payment Support: Integration with UPI, net banking, cards, and digital wallets to provide maximum convenience for fund transfers.

Comprehensive Transaction Recording: Detailed transaction logs and reporting capabilities for regulatory compliance and investor transparency.

As these technological demands reshape the mutual fund industry, having the right infrastructure partner becomes crucial for platform success.

From facilitating seamless fund collections and setting up automated recurring SIP payments to enabling instant payouts for redemptions and comprehensive transaction recording, Decentro equips mutual fund platforms with the robust financial infrastructure they need to thrive in today’s competitive market.

Whether you’re building the next breakthrough mutual fund app or scaling an existing platform, Decentro’s proven APIs can help you deliver the seamless, reliable experience that modern investors demand.

Frequently Asked Questions (FAQs)

1. What are the main features to look for in a top mutual fund app?

Look for zero commission or direct investment options, intuitive and user-friendly interfaces, comprehensive portfolio tracking, fast KYC and onboarding, educational content, robust security, and detailed analytics. Also, evaluate the range of fund choices, including equity, debt, and ELSS, as well as tools for SIP and goal-based planning.

2. Are mutual fund apps in India safe to use for investing?

Yes, the leading mutual fund apps are typically registered with regulators like SEBI and AMFI, use secure encryption, require KYC verification, and have strong privacy protections in place to safeguard investor data and transactions.

3. Which mutual fund apps are best for beginners in India?

Apps like Groww and ET Money are considered beginner-friendly due to their easy navigation, step-by-step guides, excellent support resources, and commission-free direct plans. These platforms simplify the investment process and offer substantial educational materials to help first-time investors.

4. What is the minimum amount required to invest in mutual funds using these apps?

Most top mutual fund apps allow users to start investing with as little as ₹100-₹500 through SIPs or lump sum, making it accessible for new investors to begin their investment journey without a high upfront commitment.

5. How do mutual fund apps help with portfolio management and tracking performance?

These apps provide real-time updates on investments, portfolio analytics, regular performance summaries, and tools for rebalancing, helping investors monitor returns, risk, and diversification with ease. Some even offer tax optimization recommendations and personalized investment insights.