rom KYC to fraud detection tools—get a full guide on safely onboarding employees digitally without falling for impersonators.

How Businesses Can Prevent Fraud While Onboarding Employees Digitally

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Imagine hiring a new employee, and a week later, you are discovering that their identity, essential credentials, and other details are totally fabricated. Nowadays, companies usually accelerate the hiring process through different platforms to ensure maximum convenience.

However, this approach also opens the doors for highly sophisticated fraud tactics, ranging from fake documents to stolen identities and many more. Therefore, businesses and their managers should take proactive measures to avoid later frustrations and disappointments.

In this article, we will be discussing some of the most effective ways that can be adapted in this regard. So, let’s get into the details.

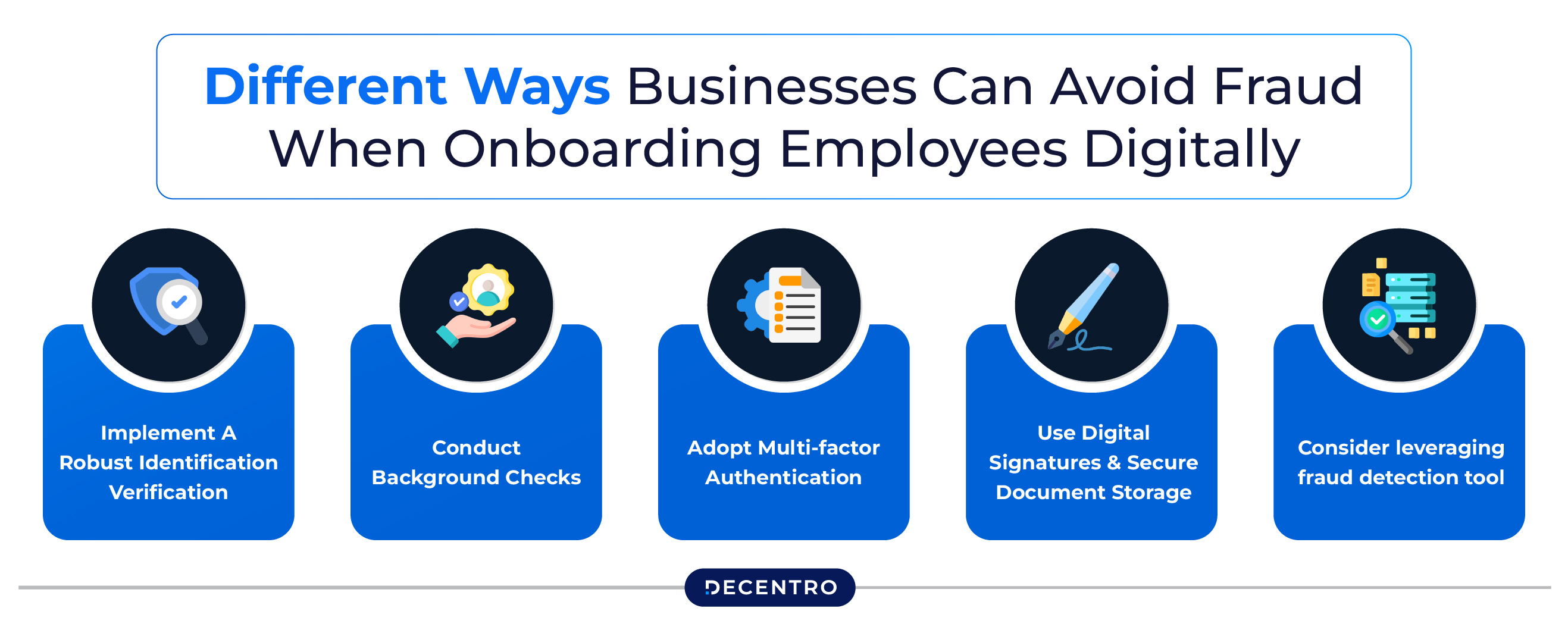

Different Ways Businesses Can Avoid Fraud When Onboarding Employees Digitally

Here are some of the most effective ways that businesses can adapt to avoid fraud when onboarding employees digitally.

- Implement A Robust Identification Verification

This is obvious; to avoid fraud when onboarding a new employee, companies need to implement a strong identification verification mechanism/procedure. This will help verify the authenticity and credibility of the individual from every aspect.

It is important to note that the process includes more than simply collecting copies of government IDs and essential documents. Instead, it is necessary for businesses to opt for real-time validation.

For instance, companies can validate the employee’s ID details through government databases. Here, it would be beneficial for them to rely on Decentro’s KYC & Onboarding Verification platform. It offers validation of employee identities by enabling real-time KYC checks for PAN, voter ID, Aadhaar, and more. This helps authenticate credentials quickly and with precision.

When it comes to academic or other essential documents, i.e., their verification and validation should also be done. Ask the remote employee to submit clear pictures of all the required documents.

Modern universities and other such institutes issue documents with a scannable barcode or even a QR code. Barcodes can be seen at the bottom of most educational certificates, like degrees and diplomas.

Even your passport has a barcode that is scanned by airport authorities to validate your identity instantly. Companies can scan them with an online barcode scanner to determine whether the document is legitimate or fake.

By implementing such an identification procedure, businesses can significantly reduce the risk of fraud when onboarding a new employee digitally.

- Conduct Background Checks

Don’t rely solely on identification verification; also conduct detailed and in-depth background checks. This is the most significant factor contributing to fraud. So, always conduct a thorough background check to confirm that the employee is actually who they claim to be.

Now, the question that arises here is, how can this be done? There are multiple key components involved in a background check; some of the major ones are

- Checking the employee’s criminal record

- Employment history verification

- Reference checks

Useful note: Fraudulent individuals often have fabricated employee records and employ various tactics to conceal their past misconduct.

It is suggested to hire trusted vendors and specialized companies that will help you perform the employee background check. Although this will increase the overall hiring cost, it will definitely be worth the money.

This is because, as a business, you will be getting accurate details about the onboarding employee without spending much time and effort.

- Adopt Multi-factor Authentication

Most of us are already familiar with multi-factor authentication, as we personally use this technique when handling sensitive information. Adapting this technique when onboarding an employee will add an extra layer of security.

The employee will be asked to enter a specific password or OTP or perform biometric (fingerprint/facial recognition) authentication. This way, even if you have hired a fraudster employee, no one will be able to access your accounts, portal, or critical information.

Due to this, it is always considered a wise approach to implement multi-factor authentication during the onboarding process. This special comes really handy in minimizing impersonation and account takeover attempts.

Since you are onboarding an employee digitally, it is essential to keep a close eye on their login attempts. Track the time, location, and IP address to determine whether the attempt was genuine or not.

Note: For any business, its data, such as portals, accounts, and HR systems, is everything. Hiring a fraudulent employee will put all this at risk.

- Use Digital Signatures & Secure Document Storage

We know that paper-based contracts are highly vulnerable to mishandling. It is also true that digital contracts can be compromised if not secured or shared properly. To avoid such issues, you should employ e-signature technology that is backed by encrypted trails.

Make use of specialized tools like Adobe Sign, DocuSign, etc. These solutions offer legally binding options with verifiable timestamps and signer identification. If possible, you even have the option to use a digital certified authentication, which further adds an extra layer of assurance that the signature is actually coming from the real employee.

Remember, this isn’t enough – businesses also need to store the signed essential documents or contracts in secure cloud-based systems with role-based controls and also end-to-end encryption.

By utilizing secure storage and authentic digital signatures, businesses can significantly minimize the risk of fraud.

- Consider leveraging fraud detection tools

This is the final way we will be discussing today for preventing fraud when onboarding employees digitally. Even after taking the aforementioned approach, there is still a chance some subtle forms of fraud can slip through.

This is where fraud detection tools come into play. The internet is filled with a wide range of solutions like the ones offered by Decentro. The platform has sophisticated fraud detection tools that effectively analyze behavioral patterns, metadata, device characteristics, etc., to ultimately detect anomalies during onboarding.

These tools act as a second line of defense by catching red flags in real time with excellent accuracy.

After considering all these methods, we believe you will have a clear understanding of how businesses can effectively prevent fraud during the digital onboarding of new employees.

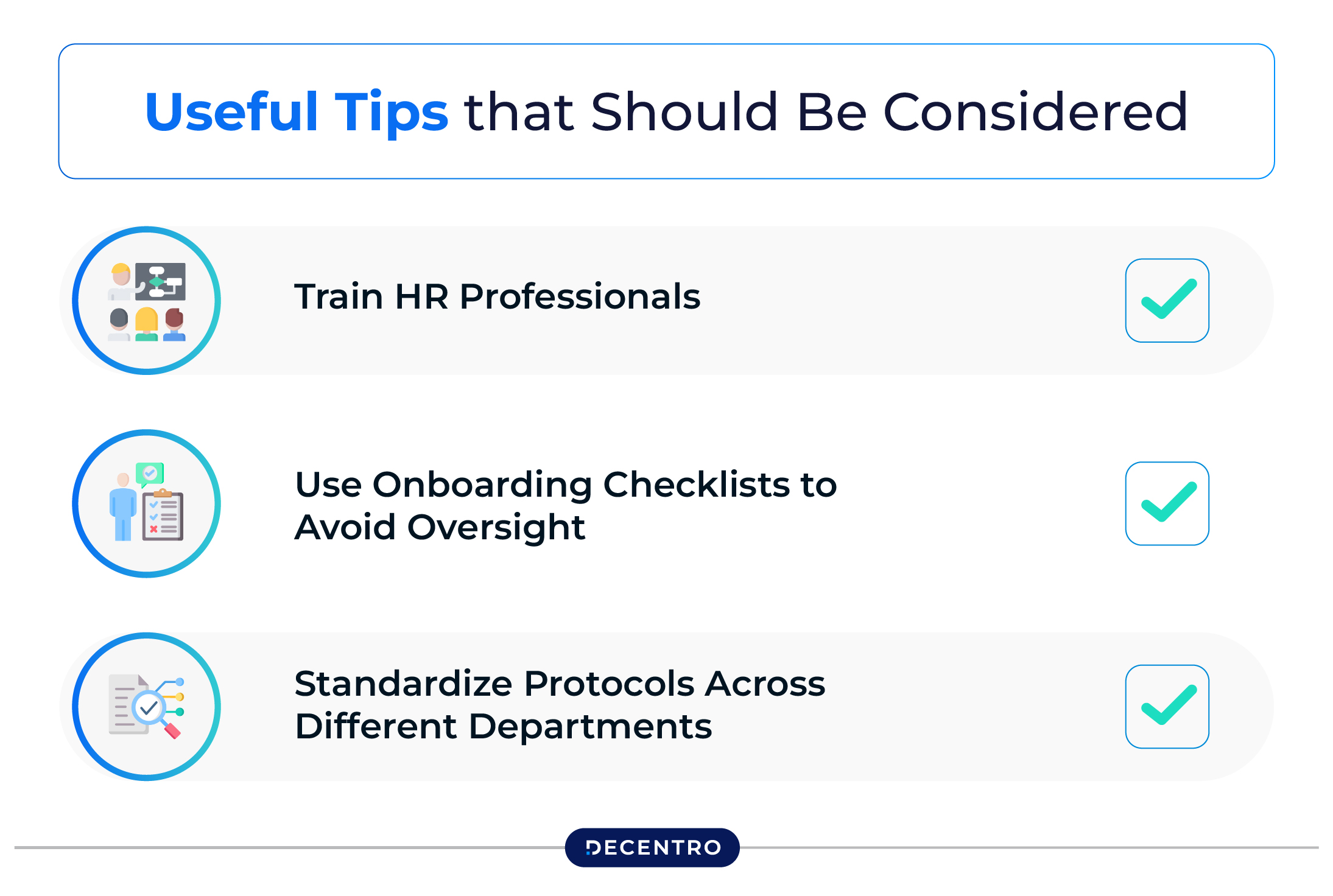

Useful Tips that Should Be Considered

There are a few useful tips that businesses and managers should keep in mind when onboarding employees digitally.

- Train HR Professionals

Businesses need to guide and train their HR professionals regarding the onboarding of remote employees. This is useful for several reasons, including ensuring compliance, identifying potential red flags, and many more.

Hold regular sessions and workshops to guide HR managers about the use of different detection tools. The more effectively the systems and tools are utilized, the fewer the chances of fraudulent activities during the onboarding process.

- Use Onboarding Checklists to Avoid Oversight

After all, we are all humans…right? And it’s our nature to make mistakes, no matter how carefully we perform a task. That’s why it’s considered an essential tip to create a checklist of various onboarding steps.

By doing so, managers can ensure that every step or requirement is fulfilled without missing any important details, ultimately reducing the chances of a fraudulent employee infiltrating your workflow.

- Standardize Protocols Across Different Departments

Last but not least, businesses should also consider standardizing all the onboarding protocols across different requirements. This is essential because if a team accepts a document via email and the other department uses a secure portal for updating that document, then this inconsistency could turn into a vulnerability.

Final Words

So, finally, we have reached the end – since our world has become a global village, businesses now opt to hire skilled employees from all over the globe. However, digital hiring often increases the likelihood of being deceived by fraudulent employees, resulting in the loss of time, effort, and resources.

This blog post discusses some of the most effective ways businesses can adapt to prevent fraud when onboarding new employees digitally.

Incase you are looking to streamline your onbaording process, drop us a line and we will get in touch.