Choosing the right stock broker is critical for a successful investment journey. Read here to learn about India’s top 20 best stock brokers based on their strengths and weaknesses.

20+ Best Stock Broker Companies in India in 2025

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

A Quick Glance

| Platform Name | Value Proposition |

| Zerodha | The trading platform Kite is one of the best, offering advanced tools, detailed datasets, and an elegant user interface |

| Groww | Offers flat-fee discount brokerage services enabling greater access to stock market investment |

| Rupeezy | Offers a user-friendly platform with advanced trading tools, MTF, automated order placements, stock recommendations and built-in option strategies. |

| Pocketful | Pocketful is built for investors and active traders, offering zero-cost investing, a seamless trading experience, and advanced technical tools. |

| Shoonya by Finvasia | Shoonya is one of the most affordable trading platforms in India, offering a user-friendly trading experience with access to all market segments. |

| Paytm Money | The brokerage from Paytm offers huge benefits for mutual funds, like zero commission on direct funds and no charges for buying or selling MF units |

| Angel One | The web trading platform offers several services, such as multiple order placements, watchlists, and positions |

| Upstox | A two-in-one integrated Demat and trading account |

| HDFC Securities | A unique feature called smart order routing allows investors to compare the price of stocks across different exchanges |

| Motilal Oswal | My Wallet gives a one-view feature regarding your orders and current market positions |

| ICICI Direct (IDirect) | The trend scanner feature allows you to find the trending stocks based on intra-day price movements |

| SBI Securities | Real-time research reports, stock alerts, and market tips |

| Axis Direct | Allows you to link your savings account to a Demat and trading account, ensuring easier fund management |

| Kotak Securities | The Kotak Nest feature allows special features like advanced charts, VWAP statistics, and preset watchlists |

| IIFL Securities | It offers NRI trading in multiple securities like stocks, derivatives, commodities, and currencies |

| Sharekhan | The unique Sharekhan classroom gives detailed insights into basic and advanced stock market features |

| Edelweiss Broking | The special terminal X3 platform allows investors to set investment objectives and track their progress |

| Dhan | Dhan delivers a seamless trading experience with zero commission on delivery trades and advanced tools for both investors and traders. |

| Anand Rathi | One of the old-horse stock brokers offering valuable suggestions on stock market investing |

| India Infoline (IIFL) | Consolidated portfolio view allowing real-time management of your investment basket |

| Aditya Birla Money | Zero account opening fee |

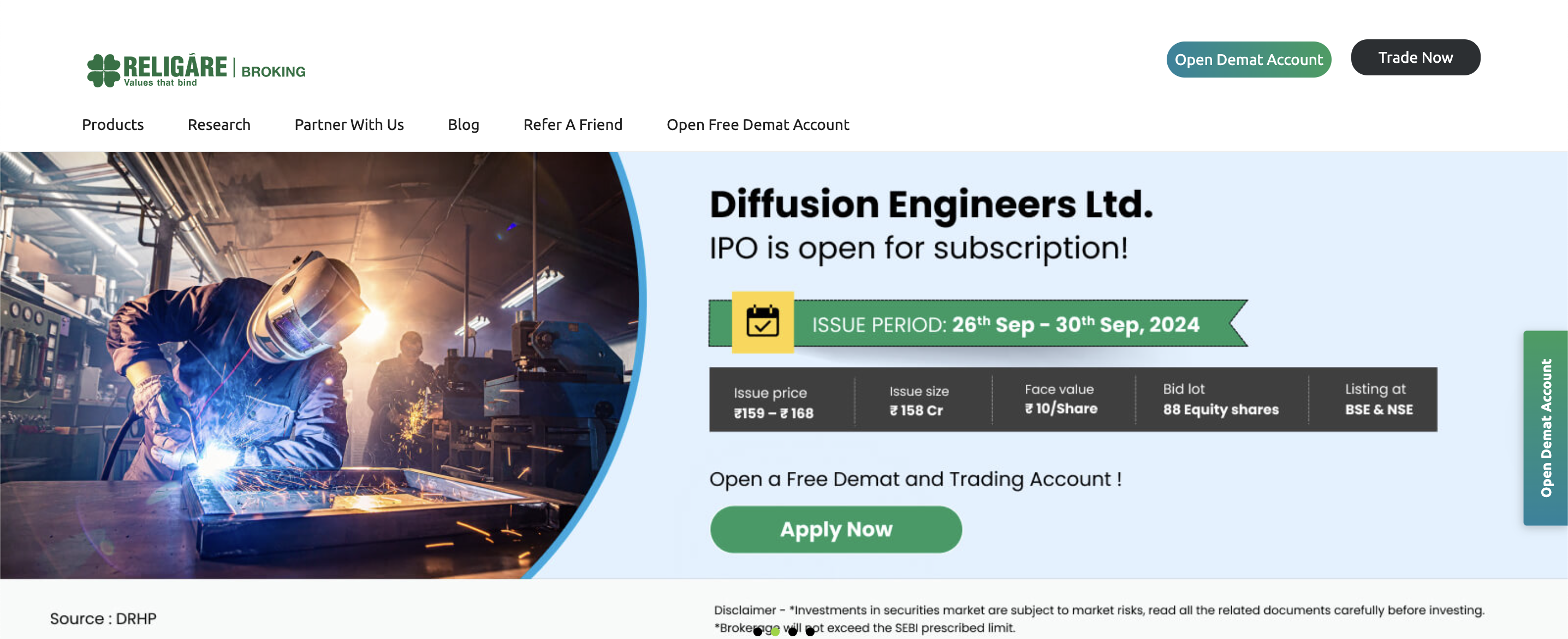

| Religare Broking | Offers algorithm-based trading tips to carry out seamless trading activity |

| Geojit Financial Services | It offers customisable investment solutions based on your goals |

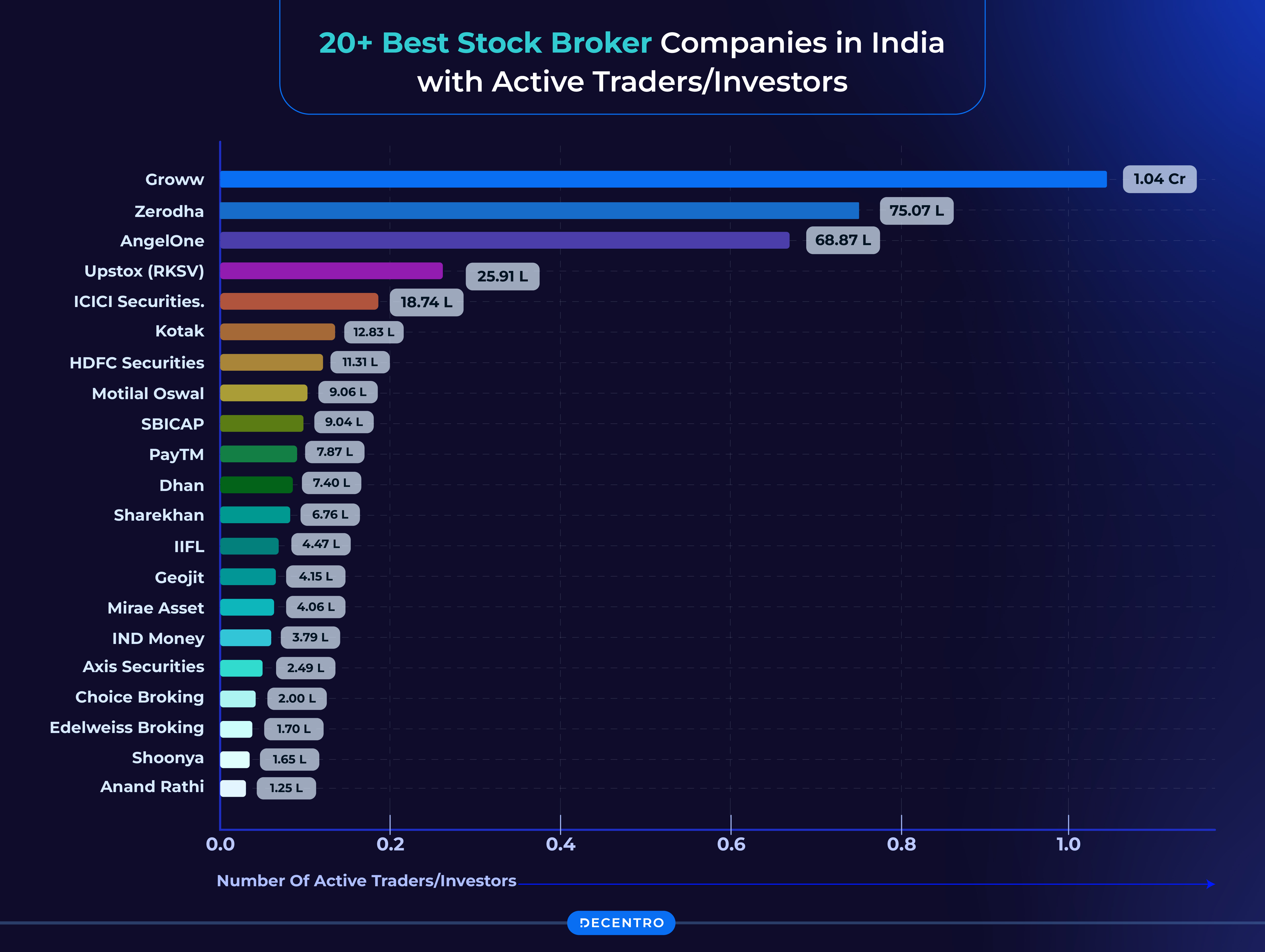

India’s National Stock Exchange (NSE) is the world’s fifth-largest stock exchange, with a total market capitalisation of more than $5.5 trillion.

Post-COVID, there has been a significant surge in market activity, with a large entry of retail investors and a positive outlook of foreign investors towards India’s economy.

To invest in the booming stock markets, you must open a Demat account with a SEBI-registered stock broker. Choosing the right broker is a very important decision. Professional brokerage firms provide various technical analysis research, consultancy advice, and tools for understanding stock market patterns.

These increase your understanding of stock markets and help you make correct decisions. On the other hand, poor choice of stock brokers can lead to high costs, missed opportunities, and bad experiences, eventually resulting in loss.

While choosing the brokerage platform, you must carefully examine the fees levied, as they add to the overall investment costs. Moreover, the broker’s trading platform should be modern and have sophisticated data analysis and research tools. It should allow traders to execute quick trades and take advantage of rapid market fluctuations.

Top 20 Stock Brokers of India

Zerodha

Zerodha is one of the fastest-growing discount brokers, offering modern investment and trading solutions at very low costs. Because of low brokerage fees and efficient, user-friendly services, its client base of 76,62,920 customers is the second largest among all stock brokers in India.

Features

- A flat fee is levied for trading in securities such as stocks, derivatives, commodities, etc.

- The Kite platform is an advanced, sophisticated trading guide that offers modern tools for understanding stock price movements.

Pros

- Low charges make it affordable

- ₹20 is levied on every intra-day and F&O segment

Cons

- Covers only the Indian market

Market Position: 19.9% (as of September 2023) with 76,62,920 active clients

Groww

Launched in 2016, Groww has risen phenomenally to become India’s largest stockbroking company. One of the biggest reasons for its popularity is the company’s approach to simplifying the investment process and providing a straightforward user interface accessible to all kinds of investors. Groww offers various investment services, such as stocks, bonds, mutual funds, commodities, and derivatives.

Features

- Investors can access market data from the past 10 years.

- Special features for traders include expected profit and loss, loss protection, and constant portfolio monitoring.

Pros

- Easy and simple user interface

- Low charges for carrying out trading and investment

Cons

- Lack of stock research and consultancy advice

Market Position: 23.4% (FY24) with 9.5 million active clients

Rupeezy

Rupeezy is a tech-driven stock broking platform designed to offer a seamless trading experience for both beginners and experienced traders. With its user-friendly interface, advanced trading tools, and cost-effective brokerage structure, Rupeezy has become a preferred choice among Indian traders and investors. The platform supports equity, FnO, and commodity, along with access to 1500+ mutual funds.

Features

- Zero Brokerage on Equity Delivery and 5x Margin Trading at competitive rates.

- Advanced Trading Tools such as Strategy Builder and Store, advanced charts and option chain, FnO scanner etc.

Pros

- Low cost trading with ₹0 brokerage in equity delivery, flat ₹20 or 0.03% (whichever is lower) brokerage on equity intraday and ₹20 brokerage on F&O trades.

- Combined ledger enables seamless trading across NSE, BSE, and MCX.

Cons

- Lack of bonds and international stocks limits Rupeezy’s options.

Market Position: 300,000+ customers as of January 2025 with a 4.4+ star rating on iOS and Android.

Pocketful

Pocketful is a rising stock broking platform and a subsidiary of Pace Stock Broking Services. Developed by industry experts with over 27 years of experience, Pocketful offers zero brokerage on equity delivery and no account opening fees—making it an ideal choice for both investors and traders.

Features

- Advanced Charting Tools: Equipped with robust features for in-depth technical analysis.

- Zero Charges: No account opening fees and zero annual maintenance charges.

- Thematic Investing with Pockets: Invest easily in pre-curated, theme-based portfolios.

- User-Friendly Interface: Designed to support both beginners and experienced traders in one integrated platform.

Pros

- Advanced Option Chain: Simplifies the process of trading options.

- Innovative Features: Includes Pockets, Superstar Portfolios, and daily and weekly Paper to track stock market events.

- Free Trading APIs: Code and automate your custom trading strategies at no additional cost.

Cons

- Lacks offline presence

Market Position: Pocketful has earned a 4+ rating on the Play Store and a perfect 5 rating on the App Store, reflecting its exceptional user experience and reliability across platforms.

Shoonya by Finvasia

Shoonya by Finvasia is an easy-to-use stock trading platform in India. It seamlessly combines advanced technology with simplicity, making it an ideal trading platform for beginners such as students, working professionals, etc. The USPs of this trading platform include the user-friendly trading app available on the App Store and Google Store, a transparent pricing policy and sophisticated APIs for automated trading.

Features

- Zero Brokerage on bonds, mutual funds, IPOs, and ETF (delivery trades).

- A free demat account with zero AMC- annual maintenance charges and zero platform charges.

- Zero API charges and call & trade charges.

Pros

- You can invest in all the market segments on the best trading platform in India – stocks, bonds, mutual funds, IPOs, ETFs, Futures, options, currencies and commodities.

- No Brokerage Charges on delivery trades.

- There are zero hidden charges.

Cons

- Limited offline branch support.

Market Position: Shoonya trading platform has earned a strong 4-star rating on the Play Store/ App Store and has 165,164 active clients as of December 2024.

Paytm Money

Paytm Money is one of the newest brokerage firms that has made significant inroads in a very short span of time. As a discount brokerage firm, it leverages technology to provide affordable investment and trading solutions for new-gen retail investors. The linkage with the Paytm ecosystem offers users a seamless integration of financial services.

Features

- Paytm Money uses technology to develop innovative trading models and solutions.

- Investors can start trading by just completing their digital KYC.

Pros

- No commission on direct mutual funds

- Paperless account opening and other formalities

Cons

- Lack of offline support centres

Market Position: ₹38,000 crore (as of December 2023) with 7.7 million active clients

Angel One

Formerly known as Angel Broking Limited, Angel One is a household name in stock broking. It offers a unique combination of traditional and discount brokerage services and has a strong customer base of 6.7 million. Its strong in-house team of experts gives consistent and productive advice using various tools and solutions.

Features

- Angel One has a desktop app, website, and mobile app catering to investors’ diverse needs.

- A dedicated relationship manager is assigned to every client.

Pros

- Angel One app is one of the most advanced and efficient trading platforms that executes fast and efficient trade

- Full-service brokerage facilities are available at low costs

Cons

- No option for direct integration of the bank account with the Demat and trading account

Market Position: 14.9% market share as of March 2024 and 6.7 million active users

Upstox

Backed by VCs like Kalari Capital and Tiger Global, with early investment from Ratan Tata, Upstox has a growing user base of 2.6 million. The platform offers free third-party premium subscriptions at registration and has attracted tech-savvy young investors who value ease and convenience. Upstox is known for its strong marketing and accessibility.

Features

- The Chaintool facility lets traders determine the spot price, stop loss, vertical comparison rates, etc.

- Traders can opt for a margin against their shares, reducing the transaction risk.

Pros

- No account opening charges

- Users can track multiple market indicators from one platform

Cons

- A high brokerage fee for stock deliveries

Market Positions: 9% as of FY23 with 2.6 million active clients

HDFC Securities

It is a subsidiary of HDFC Bank, and its linkage with it allows customers to manage their finances and portfolios seamlessly. A comprehensive and sensitive customer support team and a strong focus on research are some of HDFC Securities‘ major USPs. Among the wave of new-age discount brokerage firms, HDFC Securities is the leader of traditional value-added brokerage companies.

Features

- Users can avail of an in-depth portfolio tracking system.

- Smart order routing features allow you to compare share prices across different exchanges, helping you get a good deal.

Pros

- 24/7 customer assistance service

- Easy user interface helps beginners and those from a non-finance background.

Cons

- Does not have the facility of commodity trading

Market Position: 3% as of January 2024 with a 1.1 million active customer base

Motilal Oswal

Motilal Oswal is another full-service stock brokerage platform that employs modern technology to maintain its customer base. Key features include portfolio management services, regular stock recommendations, and consultancy based on extensive research. With over 900,000 active clients, the company’s service charges are somewhat higher, which may affect its expansion.

Features

- It has the facility to go for bulk orders at one go.

- Extensive stock alerts, research reports and expert buy/sell recommendations.

Pros

- Motilal Oswal offers free day trading for a lifetime

- Allows 4 times margin on certain stocks to help maximise your capital

Cons

- Lacks the facility of savings account integration with Demat and trading accounts

Market Position: 2.18% as of FY 24 with more than 9 lakh active subscribers

ICICI Direct (IDirect)

Highly popular among retail investors, IDirect’s business model combines quality service at affordable prices with a user-friendly interface. The ICICI Direct Market is its flagship platform for trading and investment, and it offers a 3-in-1 integrated account that allows customers to invest and manage their portfolios simultaneously.

Features

- State-of-the-art modern technical charts to assist traders.

- Allows investment in multiple stocks, ETFs, and mutual funds.

Pros

- Seamless integration of your existing bank account with the Demat and trading account

- The VTC feature allows clients to place their buy/sell orders with a validity of 45 days

Cons

- Very high brokerage charges and commissions

Market Position: 4.67% as of FY 24 with 1.8 million active users

SBI Securities

SBI Securities is a public sector undertaking from India’s largest bank that provides brokerage services. Established in 2006, it offers investment opportunities in stocks, bonds, commodities, F&O, and mutual funds, targeting Tier 2 and 3 city populations. Although its research and recommendations are credible, technology improvements are still needed.

Features

- Investors can create multiple watchlists and track them on a real-time basis.

- The SBI securities app has a specific section covering major market news and quotes/opinions from trusted experts.

Pros

- It offers brokerage services as well as a host of other financial services, such as PMS and forex transactions.

- Invest in IPOs, debt markets, derivatives, and equities.

Market Position: 2.14% as of FY24 with more than 9 lakh active clients.

Axis Direct

Another full-service broker, Axis Direct, offers investment and consultancy services. Its platform is known for comprehensive research reports and customised investment solutions. With a strong focus on accessibility, it has over 300,000 active clients. However, its high service charges and poor customer support are significant drawbacks.

Features

- Allows investment in all types of instruments like stocks, bonds, derivatives, and currencies.

- The Axis Direct Lite app is a low bandwdith application suitable for investors living in slow connectivity areas.

Pros

- Integrated access to savings, demat, and trading account

- Regular webinars, seminars, and Q&A sessions with some of the renowned names in stock industry

Cons

- Very expensive

Market Position: 0.89% as of FY24 with 3 Lakh+ active client base

Kotak Securities

Founded in 1994, Kotak Securities is one of India’s oldest stock broking platforms. Its integration with Kotak Mahindra Bank allows it to offer trading, demat, and banking services on a single platform. Customers can access the US markets directly. However, the platform’s complexity can make navigation difficult.

Features

- Offers a variety of plans for different categories of traders and investors.

- The dealer-assisted brokerage plan offers critical guidance support, but it is expensive.

Pros

- Low-cost brokerage services for small investors

- Seamless linkage with Kotak Bank’s financial service department

Cons

- Very high equity delivery brokerage fee

Market Position: 2.95% as of FY24 with 1.3 million active clients

IIFL Securities

It offers comprehensive research reports and technical analysis that aid in crucial trading and investment decisions. As a tech-savvy platform, it is ideal for new investors looking to enter the stock market. IIFL Securities is transitioning from a full-service brokerage to a discount brokerage to increase its market share.

Features

- Flat brokerage charges for all kinds of derivative trading.

- Advanced trading tools to target new-gen traders.

Pros

- Offers the facility of pre-apply IPO for both mainline and SME IPOs

- No brokerage charge for mutual fund investment

Cons

- Lack of liquidity as it does not offer 3-in-1 account opening services

Market Position: 1.09% as of FY 24 with 4.5 lakh active clients

Sharekhan

Founded in 2000, Sharekhan is a leading full-service stock broker with a research team of professionals and experts who regularly provide valuable insights to customers. However, the platform’s complicated user interface can make it challenging for new investors to navigate the complexities of stock market investment.

Features

- Registered with both BSE and NSE and offers trading in various instruments.

- Free financial advisory based on your activity and investment goals.

Pros

- Customised trading platforms to cater to the diverse needs of clients

- One can use FD as collateral for F&O trading

Cons

- Requires a separate registration and activation for commodity trading

Market Position: 1.66% as of FY24 with 6.7 lakhs active customers.

Edelweiss Broking

Edelweiss is a traditional full-service stock broking firm that prioritizes quality and accessibility. It offers a wide range of investments and trading in stocks, F&O, bonds, mutual funds, ETFs, commodities, and MCX. Recently, the firm has shifted its focus towards digitisation, adopting new technologies and trends.

Features

- There is a complete digital account opening facility for users.

- Also offers add-on services like PMS, forex management, etc.

Pros

- Regular stock recommendations and trading tips at no cost

- A significant number of offline branches is quite helpful for digitally challenged investors

Cons

- Additional charges for call and trade facility.

Market Position: 0.44% as of FY24 with 1.7 lakh active clients.

Dhan

Dhan is a modern stock broking platform that caters to retail investors and traders in India. Launched to provide a seamless trading experience, it offers investments across stocks, ETFs, derivatives, and commodities. Dhan also supports options trading with a user-friendly interface that appeals to both beginners and experienced traders.

Features

- The platform boasts a clean and intuitive design, providing easy access to real-time market data and analytics tools.

- Integrated with advanced charting tools and educational resources to support informed trading decisions.

- Offers “Trader’s Web” for a more focused trading experience with features like basket orders, options strategies, and faster execution speeds.

Pros

- Zero commission on delivery trades.

- Instant account opening with digital KYC.

- User-friendly app and web platforms tailored for seamless trading.

Cons

- Limited branch presence for customers who prefer physical locations for support.

- Advanced features may require users to upgrade to a premium plan for full access.

Market Position: As of August 2024, Dhan has about 7.4 lakh active clients, making it one of the top stockbroking apps in the country.

We at Decentro have had the opportunity to enable Dhan’s business use case, with our robust APIs and this is what the team has to say about the collaboration,

“Implementing Decentro’s KYC & Onboarding solutions has transformed our customer onboarding experience. Their innovative APIs allow us to efficiently verify critical user information, significantly reducing the friction typically encountered during the KYC process. This has not only streamlined our operations but also enhanced the speed and accuracy of our user validations, giving us a distinct competitive advantage.”

Dhan’s Spokesperson

Anand Rathi

One of the largest traditional stock brokerage firms, Anand Rathi is known for its strong brand image and consistent performance. Like other full-service brokers, it offers extensive stock recommendations to assist clients in decision-making. Its customised investment advisory services are highly popular, and market participants closely follow its recommendations.

Features

- There are personalised investment solutions and portfolio management services.

- It offers loans against margin trading facility.

Pros

- Huge offline presence across the country

- Free of-cost financial advisory and stock tips

Cons

- There is an annual maintenance charge for the Demat account

Market Position: 0.31% as of FY 24 with 1.25 lakh active clients.

India Infoline (IIFL)

The company provides a wide range of investment options in stocks, derivatives, commodities, currency, mutual funds, and various debt market instruments. IIFL offers tools and analytics to help traders and investors analyse stock and derivative patterns. Its strong, responsive customer service team ensures a seamless investment and trading experience.

Features

- You will find tailor-made financial advisory services.

- It offers modern financial tools that you can use to earn high returns.

Pros

- Get exclusive access to the IIFL Securities ecosystem which includes Trendlyne, Refinitiv Research, MoneyVarsity, GoldenPi, etc.

- Offers the feature of customisable action alerts

Cons

- Does not offer 3-in-1 account services

Market Position: 0.97% as of FY24 with 4.97 lakh subscribers.

Aditya Birla Money

Aditya Birla Money focuses on both trading and investments, offering services such as portfolio management, E-insurance, and investments in stocks, bonds, F&O, commodities, currency, and mutual funds. Its stock recommendations and research reports are frequent, reflecting market changes.

Features

- Part of the Aditya Birla Group, thereby, has high credibility.

- You can access a real-time portfolio tracker.

Pros

- Allows you to transfer funds from more than 11 partner banks

- Good coverage of Tier 2 and Tier 3 cities

Cons

- Does not offer an IPO investment option

Market Position: 0.2% as of FY24 with 80000+ active users.

Religare Broking

Religare Broking platform offers a modernised trading platform with quick order execution, enabling traders to secure profits efficiently. It combines traditional methods with new-age technologies to serve its growing customer base. However, its major drawbacks are inefficient customer service and high service charges across investment categories.

Features

- It has the facility of offering insightful research and quality financial advisory services.

- Religare Broking is a member of the NSE, BSE, MCX, and NCDEX, which allows it complete access to all trading and investment services.

Pros

- Lifetime free AMC account with a small upfront payment

- Advanced research and analysis tools for intraday and margin traders

Cons

- High charges for a call trade

Market Position: 0.36% as of FY24 with 1.43 lakh active users.

Geojit Financial Services

It is one of India’s oldest stock brokerage firms, having started operations in 1987. It has an active subscriber base of 2.5 lakh customers and is one of the biggest firms in the southern part of India. Geojit offers portfolio management services and investment opportunities in stocks, bonds, MFs, ETFs, commodities, and derivatives.

Features

- Its flagship platform Flip has an easy and convenient UI offering real-time market data and analysis.

- It has an extensive presence in the Middle East.

Pros

- No account opening charges

- 4X exposure through the Margin Trading Facility

Cons

- High brokerage compared to other full-service brokers

Market Position: 0.61% as of FY24 with 2.43 lakh active clients.

Future Trends in Stock Broking in India

The stock broking business has come a long way from being manual-intensive and paper-oriented to a tech-oriented paperless industry. With increased participation in stock markets among domestic and foreign investors, the stockbroking landscape is set for a major overhaul. Some of the key future trends of stock broking in India are as follows:

- Greater Digitisation: Post-COVID-19, the number of digital and tech-oriented stockbroking platforms has risen massively. With 5G in place, the world is moving towards the 6G network, and with the increased importance of AI and other technologies, the future will be dominated by tech-heavy stock brokerage firms.

- Diversification: Companies will have to add new services to their offerings, such as PMS, ETFs, mutual fund investments, and investment in international exchanges. This will attract HNIs and new investors looking for alternative modes of investment. Diversification will also help companies better deal with shock in specific segments.

- Mergers and Consolidation: To maintain a competitive edge, the sector could witness massive consolidation, with several small players acquired by big companies. This would help the behemoths gain a greater market share and achieve economies of scale.

- Regulations: SEBI has made many changes in how stock brokerage companies do business. As more people participate in stock markets, the compliance and regulatory structure will undergo frequent changes, and brokerages must be aware of these changes to avoid a crisis.

As these trends reshape the stock broking industry, staying ahead of the curve will be crucial. That’s where Decentro comes in. Our APIs are designed to help businesses navigate this evolving landscape with ease.

From facilitating seamless fund collections and setting up recurring payments to enabling instant payouts and comprehensive transaction recording, Decentro equips companies with the tools they need to thrive in a tech-driven market.

Frequently Asked Questions

No, you can invest in equities and trade derivatives with the same broker. However, you need to open a Demat account for equity investment and a trading account for derivative trading.

Brokerage charges usually range from 0.01% to 0.5% of the total transaction value. However, many brokerages charge a flat fee ranging from Rs. 10 to Rs. 100 per trade. The charges vary from one broker to another and one investor category to another.

GST is 18% on all investment and trading services offered by full-service and discount brokers. Other taxes include securities transaction tax and stamp duty.