Explore various subscription business models, find the right fit for your brand, and learn how to maximise your recurring revenue with Decentro’s APIs.

Subscription Business Models: Everything You Need to Know

Avi is a full-stack marketer on a mission to transform the Indian fintech landscape.

Table of Contents

Nowadays, subscription business models are used across several industries worldwide. These include OTT platforms, SaaS businesses, and consumer services. The biggest benefit of using a subscription business model is its extended buying capability for customers and buyers, helping companies grow their revenues.

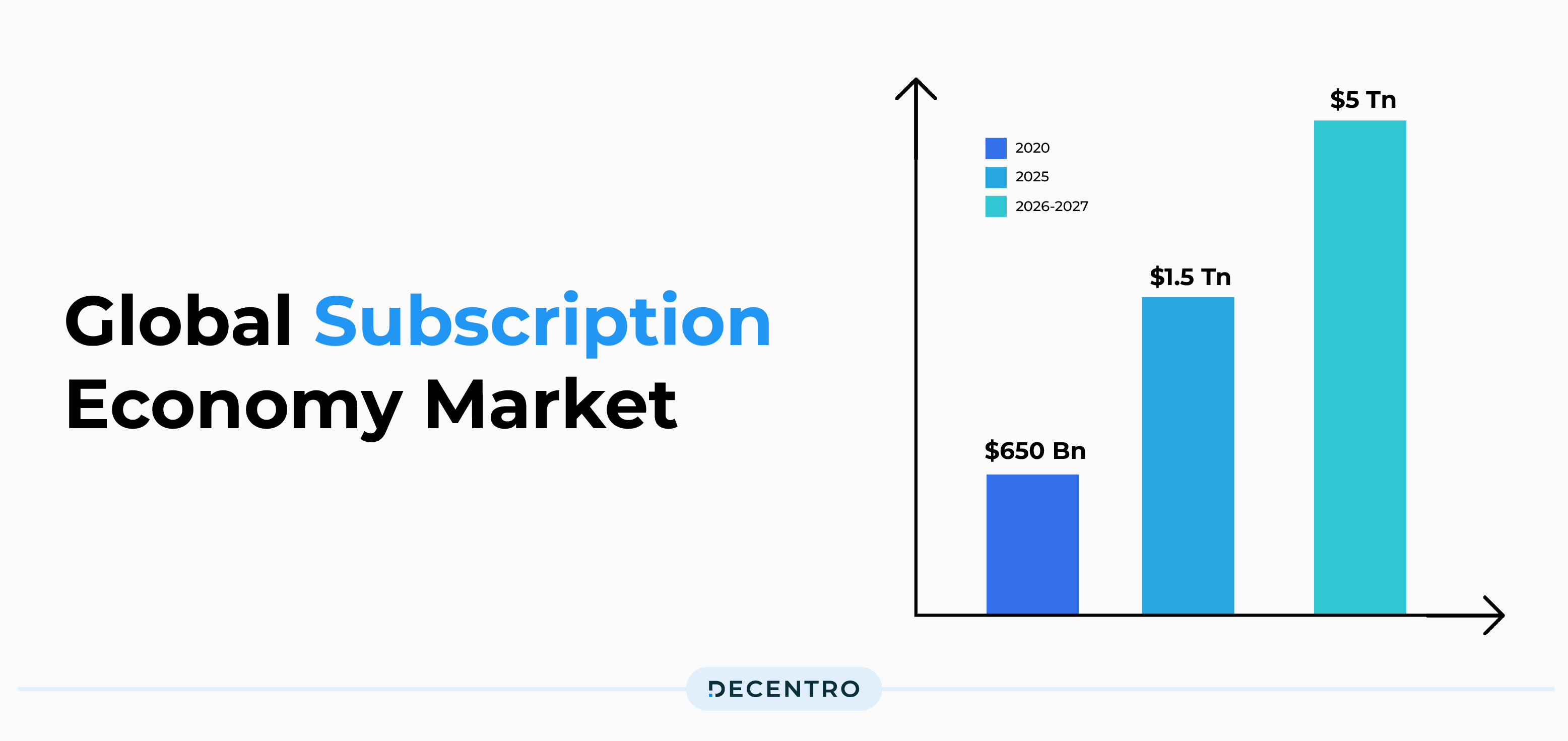

The success of subscription models can be seen in the numbers like OTT video revenue growing to US$4.06B in India by 2024, as per Statista. To give more perspective, the global subscription economy market size is projected to reach $1.5 trillion by 2025, up from $650 billion in 2020. The numbers being seen in India are also backed by the growing Indian economy touted to touch $5Tn by FY 26-27. In this blog, we explore subscription business model types and their workings.

What is a Subscription Business Model?

A subscription model is a revenue model in which customers pay a recurring fee for using a product or service. The fees can be collected weekly, monthly, or yearly. The customers can renew their subscriptions after a certain period to continue using them. So, why is the subscription business model such a hit with customers and businesses? For customers, it’s all about the convenience and personalisation it brings. For companies, it’s the predictability and long-term sustainability that make it so appealing.

In a traditional business model, revenue moves from marketing to sales and finance. But in subscription businesses, the revenue flow is cyclical. The subscription model allows businesses to build long-term customer relationships, ensuring a steady stream of recurring revenue. Over time, companies can continuously improve their products and services to meet customers’ evolving needs, growing alongside their customers.

Benefits of the Subscription Business Model

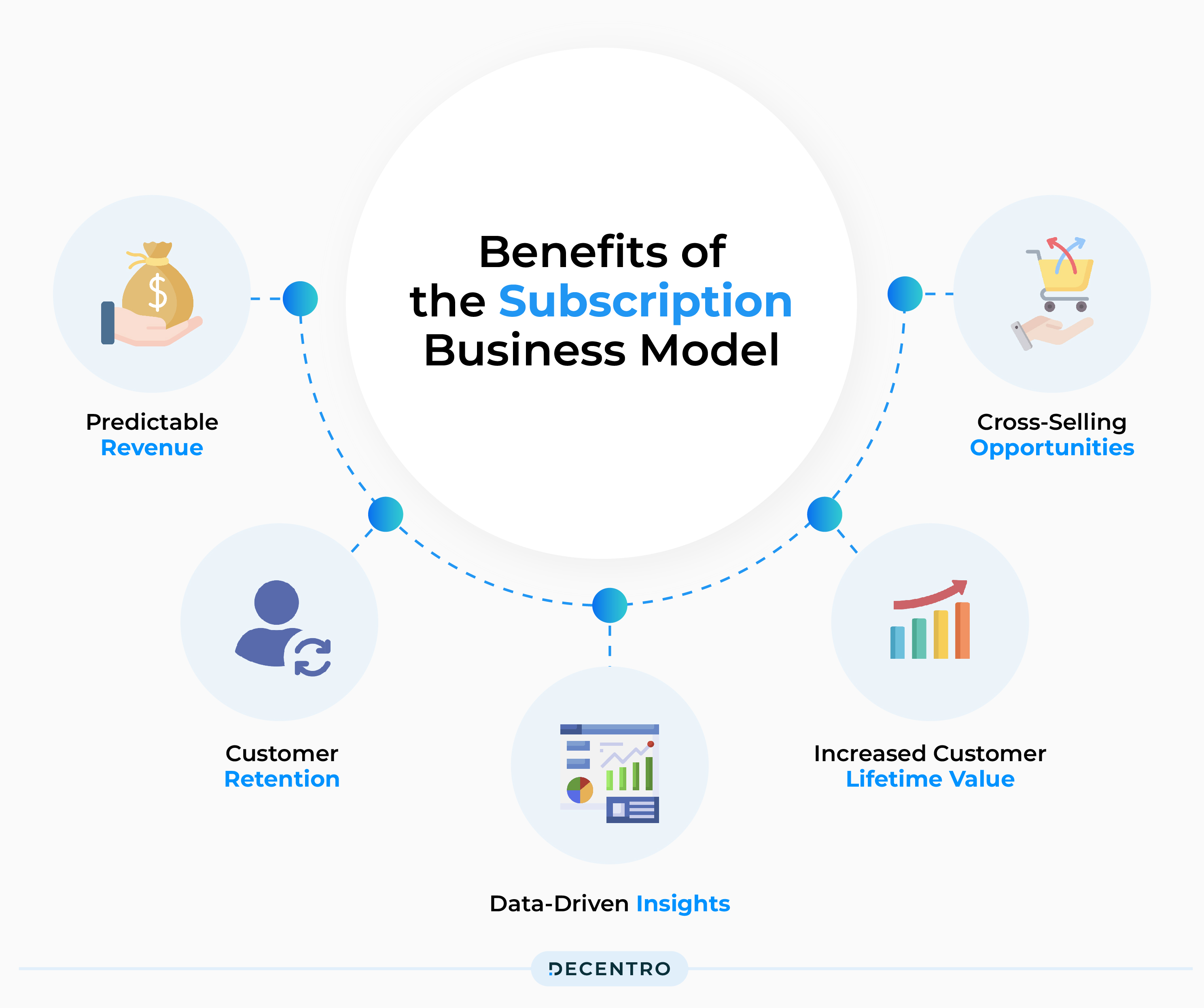

The subscription business model carries some benefits:

- Predictable Revenue: A subscription model creates a steady, reliable recurring revenue stream. This predictability allows businesses to forecast with greater accuracy, leading to more informed decisions around budgeting, growth investments, and resource allocation.

- Customer Retention: Instead of chasing one-time sales, subscription models focus on locking in customers for the long haul. This shift from short-term transactions to building lasting relationships reduces, with tools such as Flipsnack for creating engaging digital content, reduces marketing costs and fosters a stable, loyal customer base.

- Data-Driven Insights: Frequent customer interactions generate valuable data on preferences and behaviours. These insights enable businesses to tailor marketing, refine products, and customise user experiences. In fact, companies leveraging customer data see up to 85% higher sales growth compared to their peers.

- Increased Customer Lifetime Value: The opportunity to sell repeatedly to the same customer means that the lifetime value in a subscription model can far surpass that of one-off transactions.

- Cross-Selling Opportunities: With 71% of customers expecting personalised interactions, subscription models excel at offering targeted promotions and relevant product recommendations. Engaged subscribers are more open to upgrades and add-ons, boosting average revenue per user.

You can see a summary of differences between subscription-based business models and one-time payment business models below:

| Feature | Subscription Revenue Model | One-Time Payment Revenue Model |

| Predictable Revenue | Provides steady, reliable recurring revenue. Easier to forecast and plan for the future. | Revenue is less predictable, relying on one-time sales. It is harder to forecast long-term. |

| Customer Retention | Focuses on long-term relationships, reducing customer churn and marketing costs. | Requires continuous efforts to acquire new customers. Retention depends on product quality and customer service. |

| Data-Driven Insights | Generates valuable data from frequent customer interactions, enabling personalised marketing and product improvements. | Limited customer interaction means less data for insights. Difficult to personalise offerings. |

| Customer Lifetime Value | Higher lifetime value due to recurring sales. Opportunity to maximise revenue over time. | Limited to the value of the single transaction, which may not maximise customer potential. |

| Cross-Selling Opportunities | Better suited for targeted promotions and relevant product recommendations, leading to higher average revenue per user. | Cross-selling is more challenging due to limited customer interaction and engagement. |

| Marketing Costs | Lower marketing costs over time as customer acquisition costs are spread across long-term revenue. | Higher marketing costs due to continuous need for new customer acquisition. |

| Scalability | Easier to scale with a growing customer base, as revenue grows consistently. | Scalability depends on sales volume; requires constant marketing and sales efforts. |

| Customer Experience | Provides ongoing value, leading to higher customer satisfaction and loyalty. | Limited to the value delivered at the time of purchase; customer satisfaction may decrease if follow-up is poor. |

| Flexibility in Pricing | Allows for flexible pricing strategies (e.g., tiered plans, upgrades, downgrades). | Less flexibility; typically a one-time price with limited options. |

| Upfront Revenue | Revenue is spread over time, which may be a disadvantage for businesses needing immediate cash flow. | Generates immediate cash flow from single transactions, benefiting businesses that need quick revenue. |

Based on the above factors, India has successfully adopted subscription-based services and, subsequently, subscription-based business models. These have been seen across various categories:

- Entertainment: OTT platforms like Netflix, Prime Video, CrunchyRoll, etc.

- Food delivery: Swiggy One and Zomato Gold deliver food to customers’ doorsteps.

- E-commerce: Amazon Prime offers perks like free shipping, same-day grocery delivery, and unlimited digital content.

- Fitness: Cure.fit and Cult.fit offer fitness services.

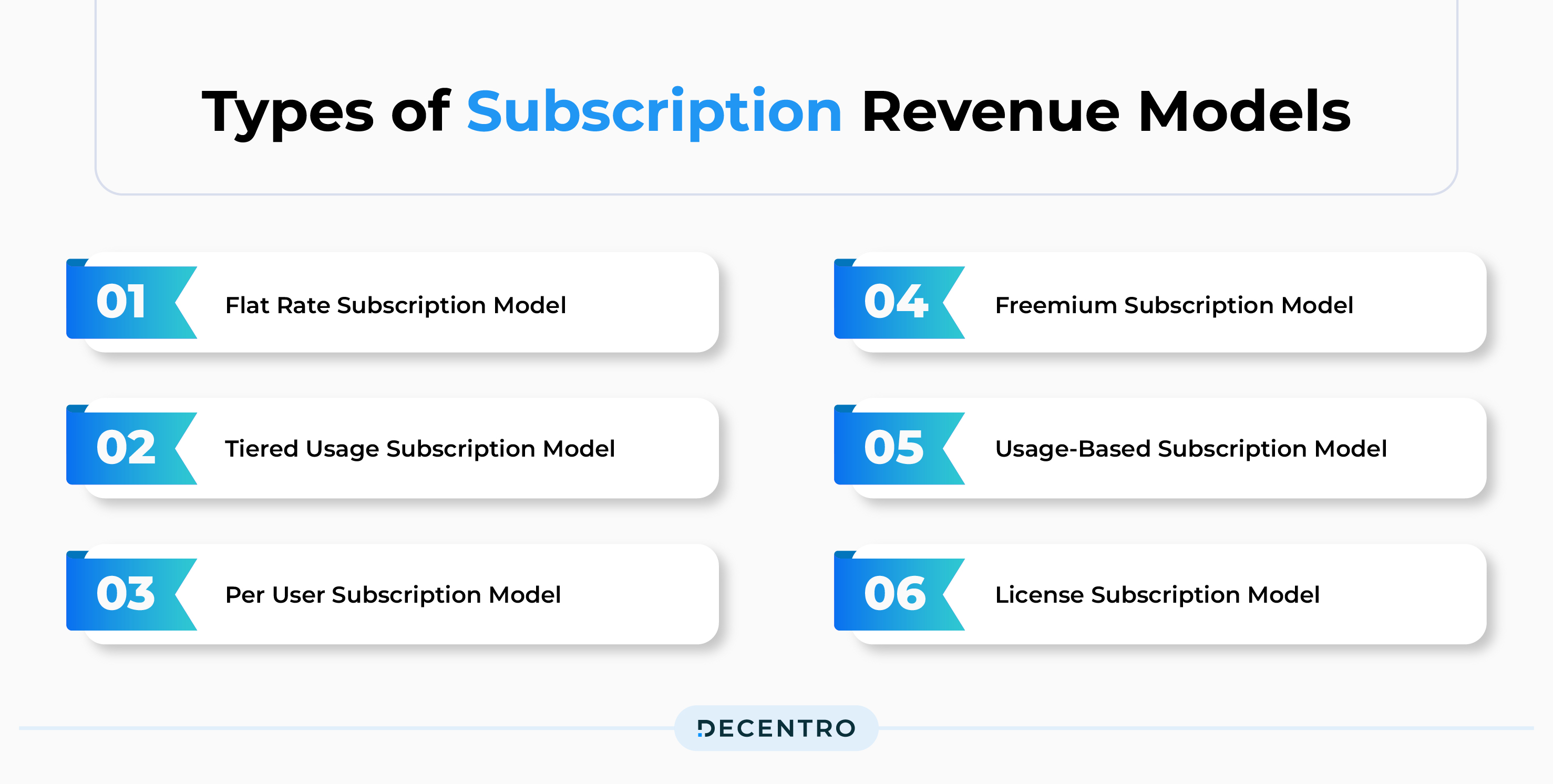

Types of Subscription Revenue Models

Subscription business models are incredibly popular because they provide consistent revenue streams and often enhance customer loyalty. However, not all subscription models are created equal—different types cater to various needs, making it crucial for businesses to choose the right one. Let’s explore some of the most common subscription models and see how they work.

- Flat Rate Subscription Model: Customers pay a fixed amount at regular intervals, such as monthly or yearly, to access a product or service. Streaming services like Netflix often use this simple and predictable model.

- Tiered Usage Subscription Model: This model offers different levels or packages with varying features and pricing. Customers can choose a package that best suits their needs, such as basic, premium, or enterprise plans.

- Per User Subscription Model: Common among SaaS companies, this model charges customers based on the number of users accessing the service. It’s ideal for businesses that scale up or down based on user count.

- Freemium Subscription Model: A basic version of the service or product is offered for free, with the option to upgrade to a paid version for additional features. This approach helps attract a large user base quickly.

- Usage-Based Subscription Model: Also known as the pay-as-you-go model, customers are charged based on how much they use a service. This model is often used for utilities like cloud storage and mobile data, providing flexibility for customers.

- License Subscription Model: This model is typically used for software and digital products. Customers pay for a licence to use the product for a specific period. It ensures ongoing revenue and software compliance.

Each subscription model offers unique benefits, making it easier for businesses to find the right fit for their products and target customers.

Implementing a Subscription Model in Your Business

Components of a Subscription Business Model

When implementing a subscription business model, several key components must be considered. First, clearly define your product or service offering. Understanding what value you provide to your customers is crucial. For example, if you’re offering a music streaming service, the product’s value might be the extensive library of songs and the convenience of listening anywhere. Similarly, a software-as-a-service (SaaS) company may provide tools that streamline business processes, saving time and improving productivity. The clarity of the offering helps to set customer expectations and positions the product effectively in the market.

Pricing and subscription tiers

Alongside the product offering, determining the pricing and subscription tiers is essential. Pricing should be competitive and offer perceived value to the customer. Flat-rate pricing models, like those used by Netflix or Spotify, offer simplicity, where customers pay a set fee for unlimited access. Tiered pricing, often seen with services like Dropbox, offers different levels of service—basic, premium, and business plans, each with escalating features and costs. Usage-based pricing, like Amazon Web Services (AWS), charges customers based on the actual use of services, providing flexibility and scalability.

Billing and Payments

Another critical aspect is the billing and payment process. This should be seamless and user-friendly, as a complicated payment process can deter potential subscribers. Companies like Adobe, with its Creative Cloud subscription, ensure that customers can easily sign up, make payments, and manage their subscriptions through an intuitive online portal. Multiple payment options, such as credit cards, PayPal, and direct bank transfers, can cater to customer preferences, enhancing the user experience.

Efficient subscription management is also crucial. This involves tracking customer subscriptions, handling renewals, processing cancellations, and securely managing customer data. For instance, subscription management software like Chargebee or Recurly helps automate these processes, reducing administrative burdens and minimising errors. Proper subscription management ensures customers have a smooth experience from sign-up to renewal, contributing to higher satisfaction and retention rates.

Subscription Renewal and Churn Management

Focusing on subscription renewal and churn management is vital for maintaining a stable subscriber base. Encouraging renewals through loyalty discounts, personalised reminders, or even auto-renewal options can be effective. For example, Amazon Prime automatically renews yearly unless cancelled, keeping subscribers engaged and preventing churn. Understanding why customers leave and addressing those issues proactively can also reduce churn. For instance, feedback surveys and customer support interactions can provide valuable insights into customer dissatisfaction, enabling companies to improve.

Upselling and Cross-Selling

Upselling and cross-selling are effective ways to increase revenue and enhance customer value. By offering additional features, higher-tier packages, or complementary products, businesses can maximise the lifetime value of their subscribers. For example, a video streaming service might offer a higher-tier package with more channels or exclusive content. Similarly, a SaaS company might cross-sell additional tools or integrations that complement the existing subscription. Implementing targeted marketing campaigns and personalised offers, like those seen on platforms like LinkedIn Premium or HubSpot, can significantly boost upselling and cross-selling efforts.

Potential drawbacks and challenges of implementing a subscription model

Despite its advantages, a subscription model comes with its challenges. One potential drawback is managing customer expectations and ensuring service consistently delivers value. For instance, a drop in service quality or failure to introduce new features could lead to dissatisfaction and cancellations. Additionally, businesses may need more cash flow, as subscription revenue is spread over time rather than received upfront. Companies must carefully plan their finances to manage this steady but gradual income stream. Another challenge is maintaining a low churn rate, which requires ongoing customer engagement and satisfaction efforts. Finally, implementing robust security measures to protect customer data is essential in building trust and compliance with data protection regulations. Companies handling sensitive information, like financial data or personal details, must have strong cybersecurity protocols to avoid breaches and protect customer privacy.

By carefully considering these factors and planning accordingly, businesses can effectively implement a subscription model, leveraging its benefits for sustainable growth and long-term customer relationships.

Subscription Business Model Metrics and Performance

Understanding and tracking key metrics is essential for any subscription-based business. Here’s a simplified look at some of the most important metrics and how they impact SaaS businesses:

- Monthly Recurring Revenue (MRR): MRR is the total predictable revenue that a business expects to receive every month from its subscription customers. Imagine you run a gym, and you have 100 members who each pay $30 per month for their membership. Your MRR would be calculated as 100 members x $30, which equals $3,000. This means you can earn $3,000 monthly if those members continue their subscriptions.

- Annual Recurring Revenue (ARR): ARR is similar to MRR but calculated yearly. It shows the predictable revenue a business expects yearly from its subscription customers. If your gym has an MRR of $3,000, your ARR would be $3,000 x 12 months, which equals $36,000. You can expect $36,000 in revenue over a year from your subscriptions.

- Average Revenue Per User (ARPU): ARPU is the average revenue generated per user or subscriber over a specific period, usually a month. Let’s say your gym has 200 members and your total MRR is $4,000. To calculate the ARPU, you would divide the total MRR by the number of members: $4,000 ÷ 200 members = $20. This means, on average, each member contributes $20 to your monthly revenue.

- Customer Lifetime Value (CLTV): CLTV is the total revenue a business can expect to earn from a customer over the entire duration of their relationship with the company. If a typical gym member pays $30 per month and stays a member for an average of 12 months, the CLTV would be $30 x 12 months, which equals $360. This means each customer, on average, brings in $360 over their lifetime with your business.

- Customer Acquisition Cost (CAC): CAC is the total cost of acquiring a new customer, including marketing and sales expenses. Suppose you spend $1,000 on marketing and sales monthly, gaining 10 new members. To calculate the CAC, divide the total marketing spend by the number of new members: $1,000 ÷ 10 members = $100. This means it costs you $100 to acquire each new gym member.

- Churn Rate: Churn rate is the percentage of customers who cancel or stop their subscriptions during a specific period. If your gym started the month with 200 members and 10 members cancelled their memberships by the end of the month, the churn rate would be calculated as (10 cancelled members ÷ 200 total members) x 100 = 5%. This means that 5% of your members cancelled their subscriptions that month.

- Net Dollar Retention (NDR): NDR measures the percentage of recurring revenue retained from existing customers over a specific period, factoring in upgrades, downgrades, and churn. A high NDR indicates strong customer satisfaction and effective upselling strategies, suggesting that the subscription model is successfully retaining and growing its customer base. It provides a clear view of revenue growth potential without relying solely on new customer acquisition.

- Net Promoter Score (NPS): NPS gauges customer loyalty and satisfaction by asking customers how likely they are to recommend the product or service to others on a scale from 0 to 10. A high NPS reflects positive customer experiences and strong brand advocacy, which can lead to organic growth through referrals. It serves as a key indicator of customer sentiment and long-term retention within the subscription model, helping businesses proactively address issues before they lead to churn.

Understanding these metrics can help businesses monitor performance, make data-driven decisions, and optimise better for growth.

Subscription Business Model Tools

Navigating the subscription economy can be challenging, but managing and growing your subscription base becomes much easier with the right tools. Various subscription management tools are designed to help businesses handle everything from billing and invoicing to customer relationships and compliance.

Here are some of the best subscription management tools available in 2024.

Selecting the right subscription management tool can significantly impact the efficiency and success of your subscription-based business. Each tool offers unique features tailored to different business needs. By carefully considering factors like scalability, flexibility, billing options, and security, you can choose a tool that best fits your business model, ensuring smooth operations and long-term growth.

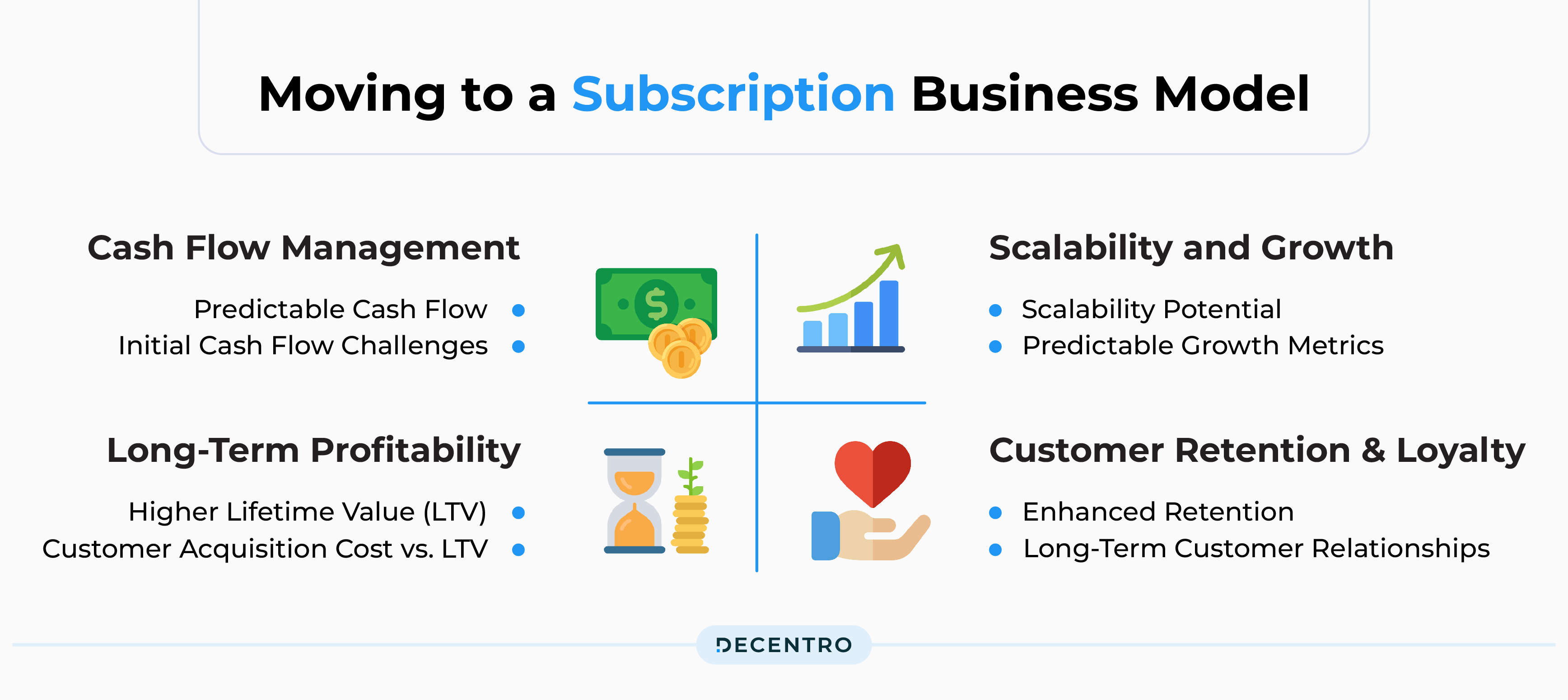

Moving to a Subscription Business Model

Transitioning to a subscription-based business model can significantly impact a company’s financial landscape, particularly regarding cash flow management and long-term profitability compared to traditional sales models. Here are some key financial considerations:

Cash Flow Management:

- Predictable Cash Flow: One of the most notable benefits of a subscription model is the creation of predictable and recurring revenue streams. Unlike traditional sales models, where cash flow can be highly variable and dependent on one-time purchases, subscriptions provide regular, predictable cash inflows. This predictability aids in more accurate budgeting and financial planning.

- Initial Cash Flow Challenges: Companies might experience short-term cash flow challenges during the transition. Traditional sales typically generate a large upfront payment, whereas subscription models distribute revenue over time. Businesses may need to adjust their cash flow management strategies to accommodate this shift, potentially requiring external financing to cover operational costs in the short term.

Long-Term Profitability

- Higher Lifetime Value (LTV): Subscription models often lead to higher customer lifetime value (LTV) as they generate ongoing customer revenue over extended periods. By focusing on customer retention and continuous value delivery, businesses can maximise the revenue generated per customer, significantly enhancing long-term profitability.

- Customer Acquisition Cost (CAC) vs. LTV: The initial customer acquisition cost may be higher in a subscription model due to the need for ongoing engagement and support. However, when successfully implemented, the recurring nature of subscriptions ensures that the LTV outweighs the CAC over time, leading to sustainable profit margins.

Scalability and Growth

- Scalability Potential: Subscription models allow businesses to scale more effectively. As customer numbers grow, the recurring revenue stream grows accordingly, leading to exponential revenue increases without proportionally increasing costs. This scalability is a crucial factor in achieving long-term growth and profitability.

- Predictable Growth Metrics: With metrics like Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR), businesses can track growth more predictably. These metrics provide insights into future revenue potential, enabling companies to make informed strategic decisions about expansion, investment, and resource allocation.

Customer Retention and Loyalty

- Enhanced Retention: A subscription model naturally encourages higher customer retention due to the ongoing relationship between the business and the customer. By focusing on continuous value delivery and leveraging data to personalise customer interactions, companies can reduce churn rates and build a loyal customer base, leading to stable and growing revenue.

- Long-Term Customer Relationships: The shift from transactional sales to subscription models means businesses can develop deeper customer relationships. These relationships are crucial for upselling and cross-selling opportunities, which can further enhance profitability over time.

Transitioning to a subscription-based revenue model can transform a company’s financial health by providing predictable, scalable, and sustainable revenue. While there may be short-term cash flow adjustments, the long-term profitability benefits, driven by higher customer lifetime value and enhanced customer retention, make this model attractive for many businesses seeking sustainable growth. Implementing effective customer engagement strategies and leveraging data to provide continuous value will be critical to maximising these financial benefits.

In Conclusion

The subscription business model is more than just a trend; it’s a fundamental shift in how companies engage with their customers and generate revenue. As we’ve explored in this blog, the subscription model offers many benefits, including predictable revenue streams, increased customer retention, and valuable insights from customer data. By building long-term relationships and delivering continuous value, businesses can foster customer loyalty and drive sustainable growth. Whether through flat-rate subscriptions, tiered plans, or usage-based models, choosing the right approach and effectively managing subscriptions can significantly enhance business performance.

Implementing a successful subscription business model requires the right tools and strategies to efficiently handle billing, payment, customer management, and analytics. With Decentro’s UPI AutoPay and eNACH stack, you can achieve seamless, automated payment collection that enhances customer experience and minimises churn. These solutions provide a robust and compliant infrastructure for managing recurring payments, ensuring high success rates and reliable cash flow.

As the subscription economy grows, leveraging Decentro’s high-performance payment solutions will be essential for staying competitive and meeting customer expectations. Ready to streamline your subscription management and maximise your business growth? Contact Decentro today to see how our UPI AutoPay and eNACH solutions can transform your subscription business into a success story. Let’s simplify your payment collections and set your business on the path to sustained growth and profitability!