Check out our guide on the booming subscription economy in India and how Decentro enables seamless recurring payments with flexible and secure APIs.

Understanding the Subscription Economy: A Quick Guide

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

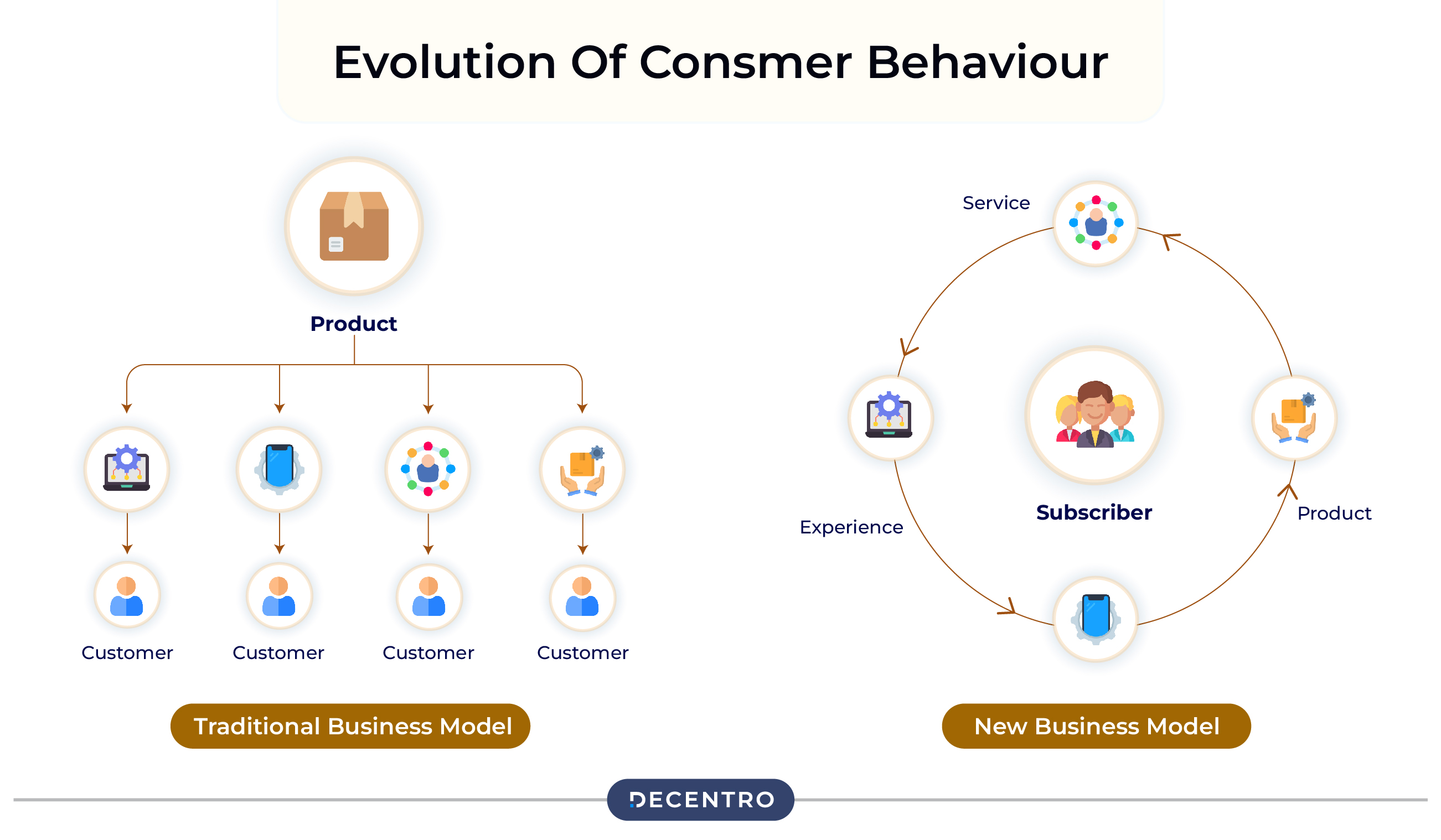

It is the era of access, and the subscription economy has been thriving in this realm.

The economy has skyrocketed to the point that everything is a subscription.

A recent report from UBS Wealth Management estimates that the subscription economy will reach 1.5 trillion USD by 2025. That’s more than double the addressable market size in 2020.

If we break it down geographically, at the global level, the United States consumes the majority of all digital subscriptions worldwide. The next closest market is Europe, at 21%, followed by China, at 14%.

If we look closer to home, there has been a significant boom in the subscription economy in India, with sectors such as entertainment (OTT platforms), e-commerce (subscription boxes), education (e-learning platforms), health and wellness (gym memberships), and finance (investment plans) witnessing this growth.

The market size for subscription businesses in India was approximately ₹1,200 crore in 2017-2018 and is expected to reach ₹36,000 crore by 2025.

The Boom of the Subscription Economy

This shift, while heavily influenced by the advancement of digital technology and the increasing adoption of smartphones and internet connectivity, is also a by-product of consumers’ desire for convenience, flexibility, and personalised experiences. The added caveat is that the purchasing demographic is heavily moving towards millennials and Gen Z, accounting for 52 per cent of India’s population. They are emerging as the primary consumer segment with higher disposable incomes.

If we have to break down the key factors contributing to India’s subscription economy success, we will see that it stems from a combination of market adaptation and innovative approaches tailored to the unique needs of its diverse population.

- Affordability and Flexibility:

- Tiered Pricing: Subscription services offer multiple pricing plans to accommodate different income levels, making services accessible to people of all socioeconomic strata.

- Flexible Payment Options: Monthly, quarterly, and annual payment plans allow consumers to choose what best fits their budget.

- Digital Infrastructure:

- Increased Internet Penetration: The rapid expansion of Internet access, especially in rural and semi-urban areas, has enabled more people to adopt digital subscription services.

- Smartphone Usage: The proliferation of affordable smartphones has made it easier for consumers to access and manage subscriptions on the go.

- Consumer Behavior Shifts:

- Convenience: The modern consumer’s preference for convenience over ownership has driven the adoption of subscriptions for everything from entertainment to daily essentials.

- Experience over Ownership: Younger generations, particularly Millennials and Gen Z, value experiences and flexibility, which aligns well with the subscription model.

- Localisation and Personalization:

- Localised Content and Services: Subscription services have succeeded by offering localised content and services that cater to regional tastes and preferences.

- Personalised Offerings: Companies leverage data analytics to provide personalised recommendations and experiences, enhancing customer satisfaction and retention.

- Diverse Industry Penetration:

- Entertainment: OTT platforms like Netflix, Amazon Prime, and Disney+ Hotstar lead the way in digital subscriptions.

- Education: E-learning platforms like BYJU and Unacademy offer tailored subscription models for students and professionals.

- E-commerce: Subscription boxes for beauty, groceries, and other essentials are gaining popularity.

- Fintech Support:

- Seamless Transactions: Fintech companies like ours provide the necessary infrastructure for secure and easy recurring payments.

- Credit Options: Innovations like Buy Now, Pay Later (BNPL) make it easier for consumers to afford subscription services.

So what is the Subscription Business Model?

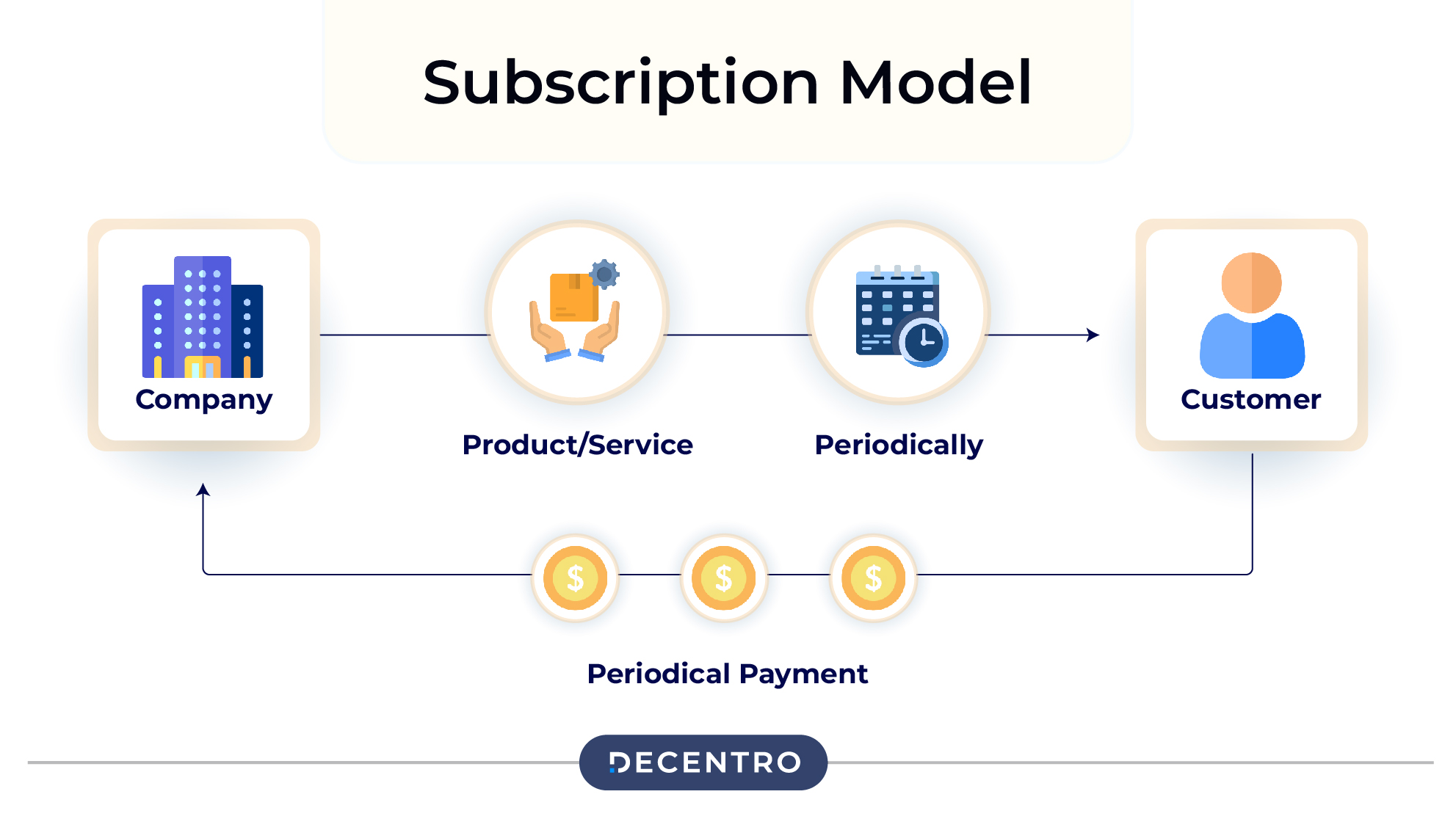

The subscription model is a business strategy where customers pay a recurring fee at regular intervals (monthly, quarterly, annually) to access a product or service. This model is widely used across various industries, including media, software, retail, and more.

The core value proposition of subscription business models is as follows:

Recurring Revenue:

One of the most significant benefits of the subscription model is the predictable and recurring revenue it generates. This steady cash flow allows businesses to plan more effectively, invest in growth opportunities, and manage finances with greater certainty.

Enhanced Customer Loyalty and Retention:

Subscriptions foster long-term relationships with customers. Businesses can build strong customer loyalty and reduce churn rates by continuously delivering value.

Convenience and Flexibility:

Subscriptions offer customers flexibility and convenience. They can choose plans that best suit their needs and budget, and they often receive ongoing value through updates, new features, or exclusive content.

Scalability

Businesses can scale their services to accommodate more subscribers without proportionally increasing costs.

Improved Customer Insights

With recurring interactions, businesses can gather detailed data on customer preferences, behaviours, and usage patterns. This information is invaluable for tailoring offerings, improving products, and creating targeted marketing campaigns.

Cost Efficiency

A subscription model can reduce customer acquisition costs over time. While acquiring a new customer may initially be expensive, the recurring revenue from subscriptions helps spread this cost over the customer’s lifetime value.

Types of Subscription Models and Pricing:

Having established the drivers of this model, let’s deep dive into the types of these models and further break down the pricing tiers that are available in the market now.

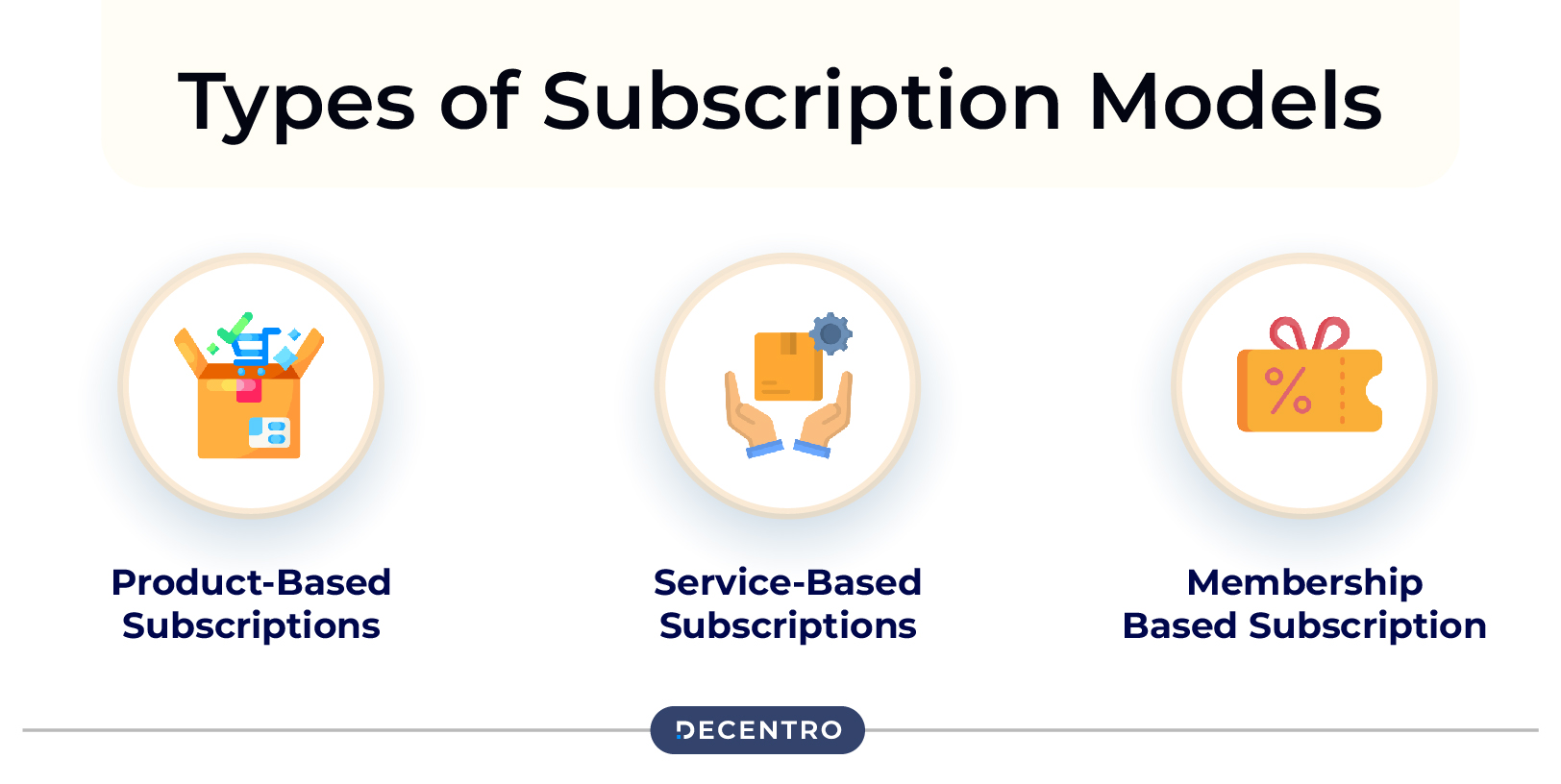

- Product-Based Subscriptions: Customers receive physical products on a recurring basis (e.g., meal kits – Zomato Gold, beauty boxes – Dollar Shave Club).

- Service-Based Subscriptions: Customers gain access to ongoing services (e.g., streaming platforms – Netflix, Prime and more, software as a service – such as Adobe and Microsoft).

- Membership-Based Subscriptions: Subscribers get access to exclusive content, discounts, or community benefits (e.g., fitness clubs – Cult Fit).

Each of these models can deploy a different type of pricing system.

Types of Subscription Pricing Models

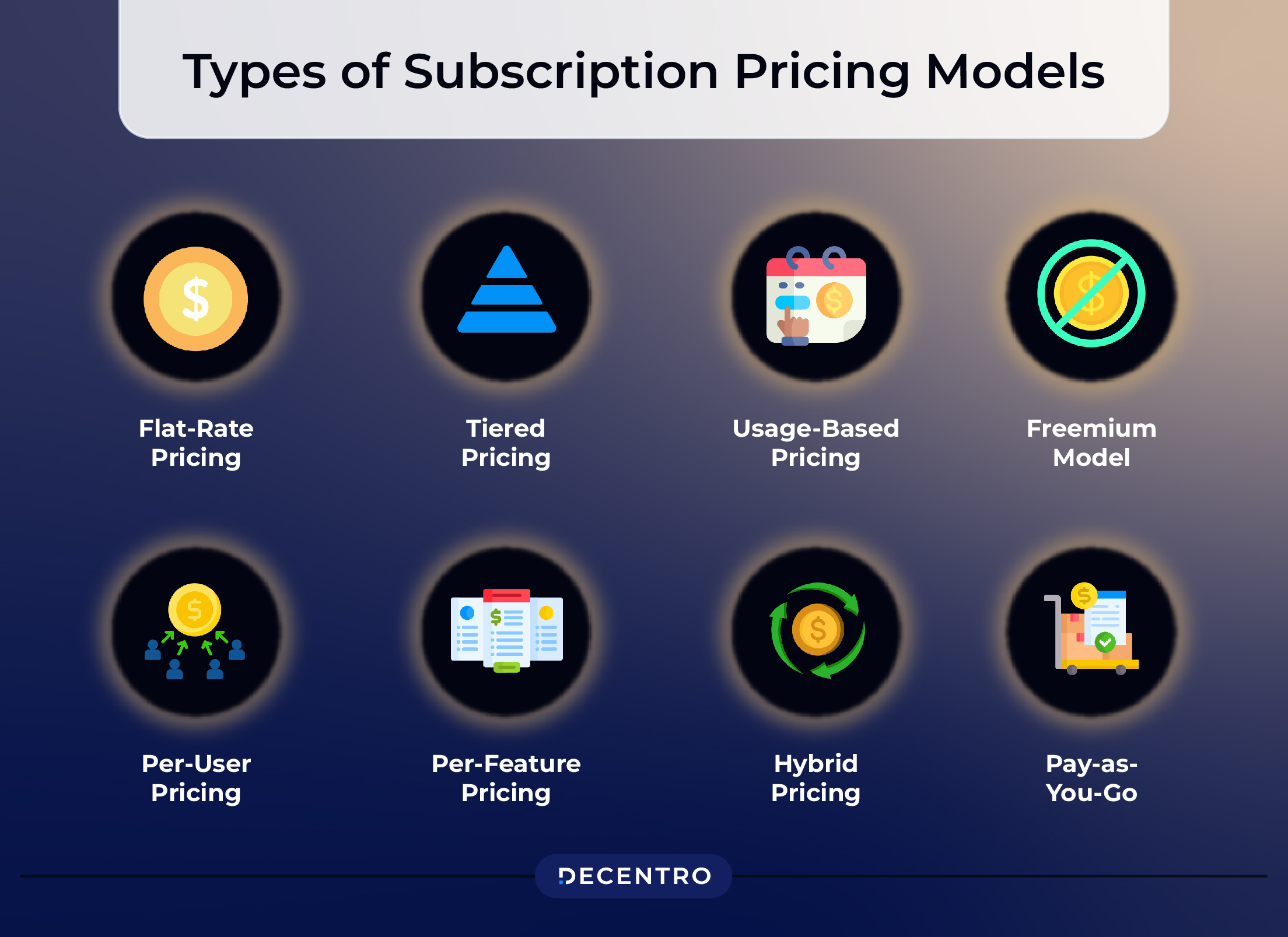

- Flat-Rate Pricing: A single fixed price for access to all features or products, such as streaming services like Netflix.

- Tiered Pricing: This involves multiple levels of service at different price points, offering varying degrees of access or features. Examples include Spotify’s free, premium, and family plans.

- Usage-Based Pricing: Charges are based on the amount of service used, often seen in cloud services (e.g., AWS, Azure).

- Freemium Model: Basic services are free, with premium features available at a cost. Example: LinkedIn.

- Per-User Pricing: Charges are based on the number of users accessing the service, which is common in SaaS (e.g., Slack, Zoom).

- Per-Feature Pricing: Customers pay for specific features they need, allowing customisation. Example: Many CRM software platforms.

- Hybrid Pricing: This model combines elements of the above models to create a custom pricing structure that meets various needs. For example, Adobe Creative Cloud offers both flat-rate and per-user options.

- Pay-as-You-Go: Similar to usage-based pricing, this often involves prepaid credits that customers use as needed. Prepaid mobile plans are an example.

Subscription Model Consumption Patterns

Having established the basics of the subscription model, let’s examine what’s been driving consumption patterns in India’s subscription economy.

Demographically

The younger generation of customers is becoming more frugal with their purchasing because of the current state of economic instability. Let’s look at how India is responding to the subscription economy demographically.

- Millennials and Gen Z: These tech-savvy demographics are leading the adoption of subscriptions. They are attracted to the flexibility and convenience offered by this model. Popular subscriptions include digital content (Netflix, Spotify), fitness programs (Cult.Fit), meal kits, and online gaming services.

- Working Professionals: This group opts for subscriptions that enhance productivity and convenience. Cloud storage services (Google Drive, Dropbox), professional development courses (LinkedIn Learning, Coursera), and premium news services (The Hindu, Times of India) are in high demand.

- Families: Families tend to prefer subscriptions that cater to household needs. This includes educational subscriptions for children (BYJU’s, Unacademy), family entertainment (Amazon Prime Video, Disney+ Hotstar), and essential goods delivery (BigBasket, Amazon Pantry).

Geographically

Blume Ventures recently released a very insightful report called Indus Valley Report 2024. It estimates India’s “consuming class” to be ~30M households or ~120M people. It further breaks this down to India 1A, 1B, and 1C.

Here is a breakdown of how India is responding to the subscription economy across tiers.

- Tier 1 Cities: Cities like Mumbai, Delhi, and Bangalore have the highest adoption rates due to higher disposable incomes and greater digital literacy. Residents extensively use subscriptions for various needs, from entertainment to daily essentials.

- Tier 2 Cities: Cities like Pune, Jaipur, and Lucknow are experiencing rapid growth in subscription adoption, driven by increasing internet penetration and digital payment usage. Popular subscriptions in these areas include e-learning platforms, OTT services, and utility services.

- Tier 3 Cities and Beyond Although slower to adopt, these emerging markets hold significant potential. There is growing interest in affordable subscriptions for essential services such as healthcare and education, facilitated by improving internet infrastructure and financial inclusion initiatives.

How Businesses Can Thrive in the Subscription Economy

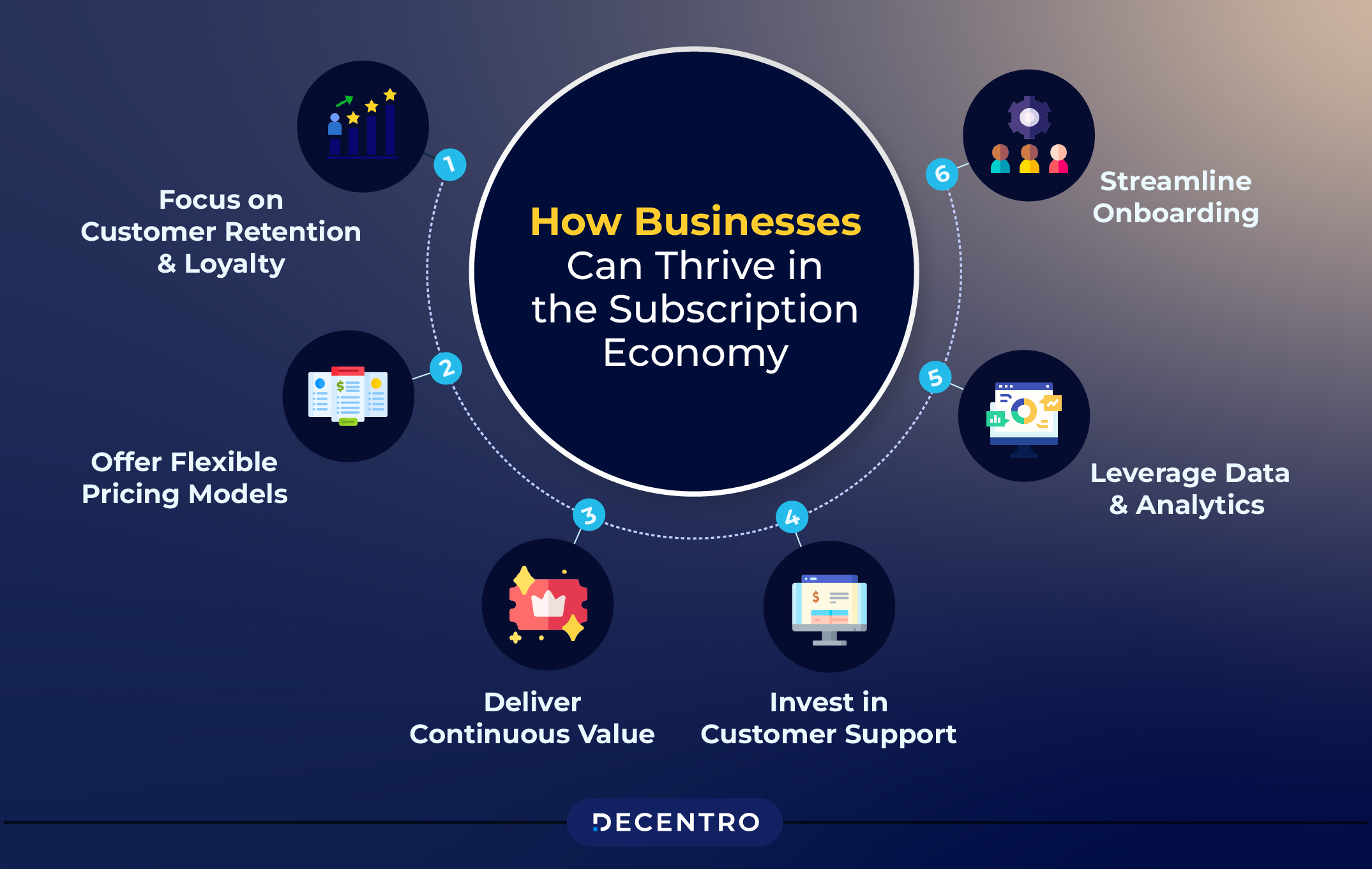

The subscription economy is rapidly transforming how businesses operate across various industries. Companies must adopt strategic approaches focusing on customer retention, value delivery, and continuous innovation to thrive in this competitive landscape. Here are key strategies for businesses to succeed in the subscription economy:

Focus on Customer Retention and Loyalty

Retaining existing customers is often more cost-effective than acquiring new ones. Businesses should prioritise customer satisfaction and loyalty by delivering consistent value and maintaining high-quality service.

- Personalisation: Use data analytics to understand customer preferences and tailor services accordingly.

- Engagement: Regularly engage with subscribers through personalised communication, updates, and exclusive offers.

Offer Flexible Pricing Models

Providing flexible pricing options can attract a broader customer base and cater to varying needs and budgets.

- Tiered Plans: Offer multiple subscription tiers with different levels of access and features.

- Freemium Model: Provide a basic free tier with the option to upgrade to premium features.

Deliver Continuous Value

Subscribers need to feel that they are getting continuous value from their subscriptions. This can be achieved through regular updates, new features, and exclusive content.

- Content Refresh: Regularly update content or features to keep the service fresh and engaging, and ensure you’re consistently offering SEO optimized content that performs well in search results.

- Exclusive Access: Offer exclusive content or early access to new features for subscribers.

Invest in Customer Support

High-quality customer support can significantly enhance the subscriber experience and reduce churn rates. Ensure that support is easily accessible and responsive.

- Multichannel Support: Provide customer support across various channels such as email, chat, and phone.

- Proactive Assistance: Offer proactive support to address potential issues before they escalate.

Leverage Data and Analytics

Data and analytics are crucial for understanding customer behaviour, optimising pricing strategies, and improving service offerings.

- Behaviour Analysis: Use analytics to track customer behaviour and identify patterns.

- Feedback Loop: Collect and analyse customer feedback to make data-driven improvements.

Streamline Onboarding

A smooth onboarding process can significantly impact customer satisfaction and retention. Make it easy for customers to sign up and start using the service.

- Simplified Sign-Up: Ensure the sign-up process is quick and user-friendly.

- Guided Onboarding: Provide tutorials or onboarding guides to help new subscribers get started.

The Fintech Connect

Fintech holds the potential to penetrate each of the touch points of the subscription model journey, from enabling the collection of revenue and tracking expenses to enabling the journey for businesses and consumers alike. We have,

- Payment Solutions: Fintechs provide hassle-free recurring payments through UPI, digital wallets, and auto-debit features, making it easier for consumers to manage their subscriptions.

- Credit Facilities: Micro-credit and BNPL (Buy Now, Pay Later) options make subscriptions accessible to a broader audience, allowing consumers to enjoy services even with limited upfront funds.

- Data Analytics: Fintechs leverage big data to provide personalised subscription recommendations and manage customer retention, enhancing the overall customer experience.

- Regulatory Compliance: Ensuring adherence to financial regulations, fintechs build consumer trust in digital transactions, further driving subscription adoption.

The Decentro Connect

When it comes to enabling businesses in a subscription economy, the one-size-fits-all narrative goes for a toss. The future of any business lies in hyper-personalisation, so naturally, players like us enable those businesses to cater to the same audience.

As a business operating in the subscription economy, with Decentro, you have the opportunity to deploy the mandate stack, which broadly encompasses the capabilities below.

- ENACH is the electronic version of the recurring payments stack built on the NACH platform. ENACH allows platforms to set up mandates of higher amounts with multiple modes, such as Net Banking, debit cards, Aadhaar-based e-sign, etc.

- UPI Auto-pay: This is the recurring payments stack built on the UPI stack. UPI Auto-pay or UPI 2.0, as it is known, allows platforms to set up mandates seamlessly using the collect or intent flow on an app or website for smaller amounts.

Decentro powers both capabilities on its own RBI-approved PA Escrow account and directly on the platform’s bank account as a technology partner.

Decentro’s mandates stack powers the use cases below for platforms to leverage.

- EMI repayments: This allows lenders like LSPs, NBFCs, SFBs, and even banks to leverage the stack to collect EMIs from borrowers through the NACH or UPI mandates stack.

- Insurance premiums: This allows platforms like insurtechs, life insurance, and general insurers to use tools like insurance CRM software to leverage the stack to collect premiums from borrowers through the NACH or UPI mandates stack.

- Investment use cases: This allows investment platforms like Fintechs, RIAs, and even AMCs to leverage the stack to collect EMIs from borrowers through the NACH or UPI mandates stack.

- Subscription use cases: This allows platforms, like consumer internet platforms, ECOMs, and even offline platforms, to leverage the stack to collect EMIs from borrowers through the NACH or UPI mandates stack.

Future of the Subscription Economy in India

The subscription economy in India is on a robust growth path, driven by changing consumer preferences, increasing digital adoption, and a strong fintech ecosystem. The future of the same looks promising, with several trends expected to shape its trajectory:

- Increased Customization: As competition grows, companies will offer more personalised subscription options to cater to individual preferences and needs, enhancing customer satisfaction and loyalty.

- Adapting to Evolving Customer Relationships: The future of the subscription economy hinges on the ability to adapt to evolving customer relationships. Businesses can thrive in this dynamic landscape by focusing on personalisation, flexibility, value, trust, engagement, technology, global reach, and sustainability.

- Expansion into New Sectors: The subscription model will continue to penetrate new industries, including automotive (vehicle subscriptions), real estate (co-living spaces), and agriculture (farm-to-table services).

- Technology Integration: Advancements in AI and machine learning will enable better prediction of consumer behaviour, optimising subscription offerings and improving customer retention.

- Sustainability Focus: With a growing emphasis on sustainability, subscription services that promote eco-friendly products and practices will gain popularity.

- Regulatory Evolution: As the subscription economy expands, regulatory frameworks will evolve to ensure consumer protection and fair practices, further building trust in the system.

As a business, if you are looking to venture into this economy and need assistance with recurring collections, drop us a line at hello@decentro.tech, and we will get in touch.