Looking to build a platform for P2P lending in 2025? Check out our list of the top & upcoming P2P Lending Platforms in India and get up to speed.

9 Top and Upcoming P2P Lending Platforms in India in 2025

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

A Quick Glance

| Platform Name | Value Proposition |

| Faircent | India’s first P2P lending platform |

| Finzy | Highly customer-centric with flexible repayment options |

| LenDenClub | India’s largest P2P lending platform |

| Lend Box | Flexible liquidity options allow you to withdraw even before the loan term ends |

| Liquiloans | Capital is distributed across 200+ borrowers, reducing risk to a bare minimum |

| Cash Kumar | Offers flexible tenures and high liquidity |

| i-Lend | A unique borrowing model allows investors and borrowers to decide the loan terms |

| Paisa Dukaan | Attractive rate of interest ranging from 12% to 24% [Now Shut] |

| Rupee Circle | Offers high returns of up to 22.5% per annum |

The online P2P lending market is regulated by the Reserve Bank of India (RBI). Platforms have to abide by several rules, including obtaining a NBFC-P2P certification before commencing lending activities.

There are no stringent eligibility criteria which you must meet to invest via P2P lending sites. You need to register yourself as a lender and start investing. The best part is that lenders can choose whom to invest in. Borrowers are listed on such websites based on their creditworthiness, enabling lenders to invest as per their risk appetite.

Peer-to-peer (P2P) lending websites serve as marketplaces where borrowers and investors can interact with each other without depending on intermediaries like banks, NBFCs, etc. It is a win-win situation for both, as borrowers can get credit with fewer hassles and lower interest rates, while lenders can gain higher returns on their invested capital.

Now, let’s take a look at some of the benefits of P2P lending:

Invest Seamlessly

Nowadays, most top P2P lending platforms are powered by AI. Thus, you can automate several tasks like choosing borrowers or reinvesting your funds as soon as you receive payments, leading to a more seamless investing experience.

Higher Return on Investment

Investing in P2P lending platforms yields higher returns than traditional investment vehicles like FDs. Moreover, the return rate does not fluctuate like the stock market, making P2P lending websites a viable alternative if you are looking for more stable investment options.

Options for Diversification

A significant benefit of investing in P2P lending websites is diversifying risks by investing across multiple borrowers. You can spread your capital among borrowers with different levels of creditworthiness and minimise your losses in case any of them go bankrupt.

Top P2P Lending Platforms in India in 2025

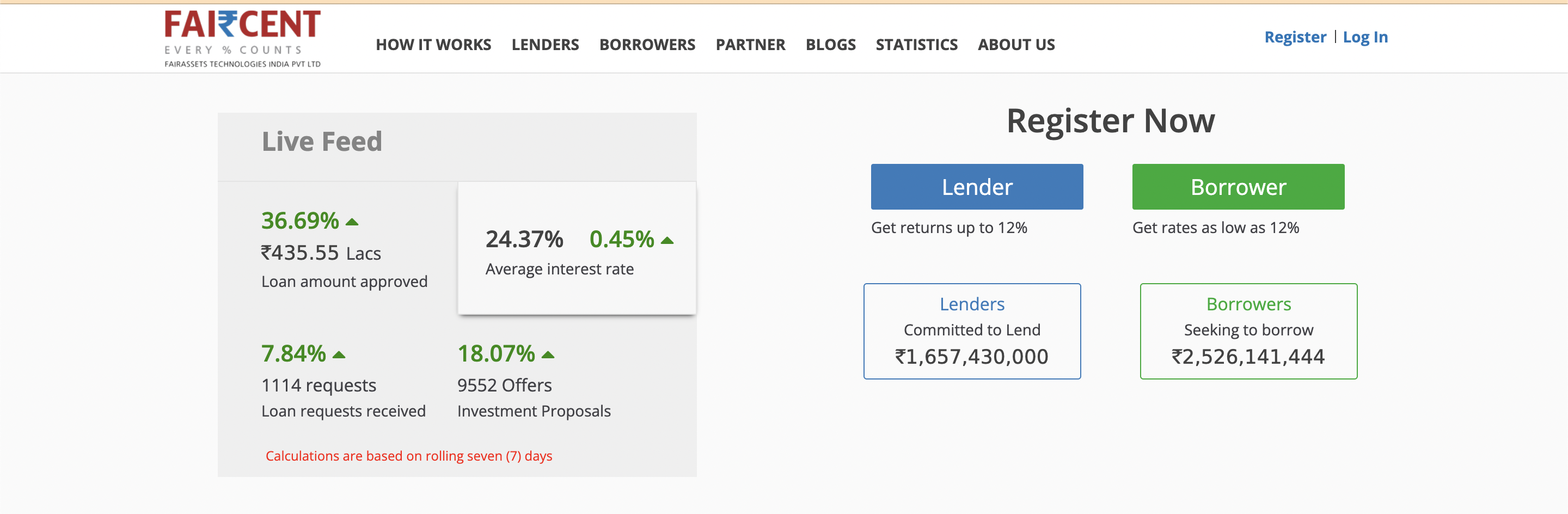

Faircent

Faircent is India’s first P2P lending platform. It has over 35,961 customers across 722 cities and is funded by several companies like Capital M & S Partners Pte. Ltd., J M Financial, 3one4, Aarin Capital, Incofin, Brand Capital, etc.

Here are some of its features:

- A wide array of investment options across multiple tenures.

- Investment amounts range from Rs.50,000 to Rs.50 lakh.

- Interest rates of 8.25% to 12% facilitate high returns.

- Option of choosing monthly payouts or re-investment of your earnings.

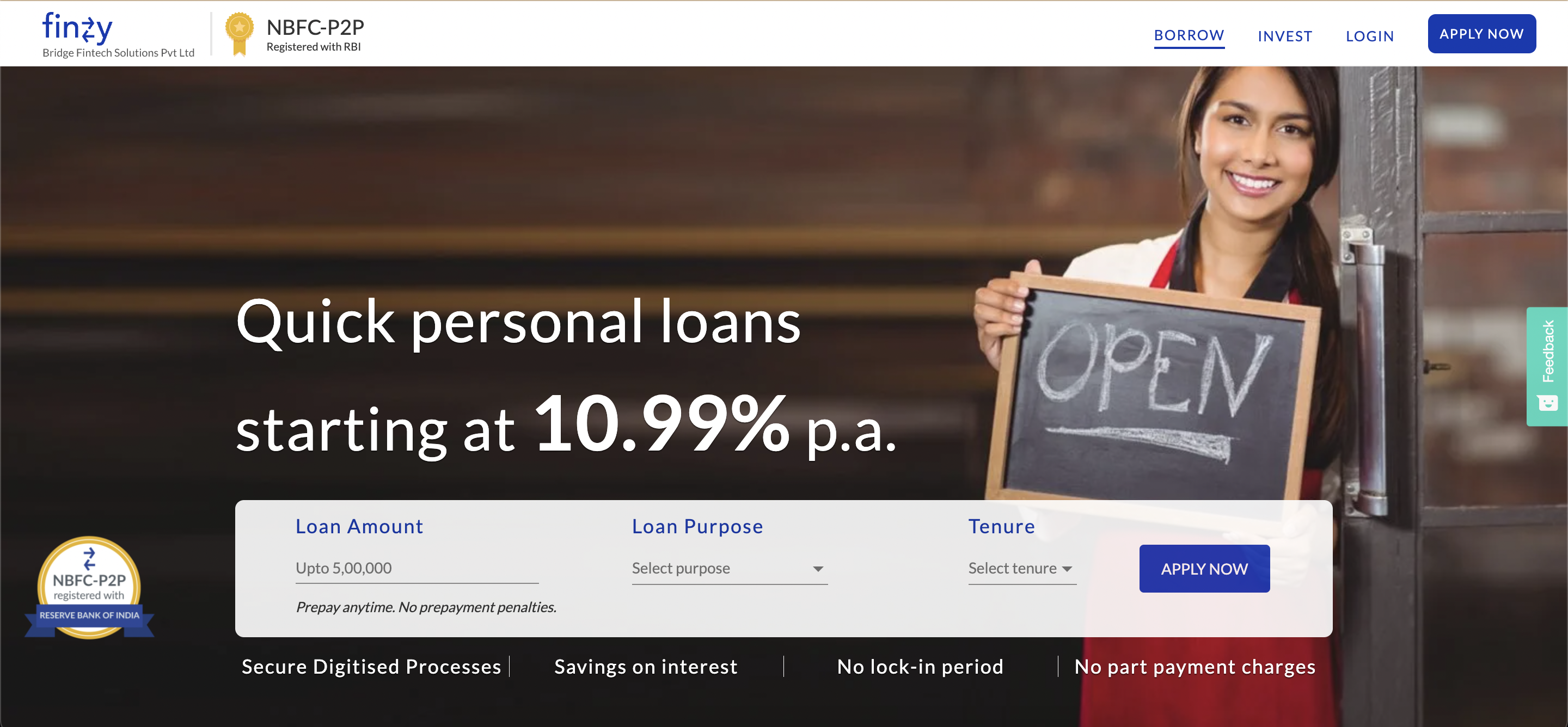

Finzy

Finzy offers a unique mix of flexibility and transparency, making it one of the top P2P lending platforms. It allows only verified investors to fund their customers, and the latter’s personal data is not shared with lenders at any given time. Furthermore, customers are evaluated based on multiple parameters, enabling the platform to cater to a wider borrower segment.

Some of its top features are as follows:

- Interest rates start at 10.99% per annum.

- Visual dashboards to help keep track of all your transactions.

- Online and door-step application process, with loan funding within 48 hours.

- Loan tenures of up to 36 months.

- No prepayment or foreclosure charges.

- Customers with excellent repayment track records can avail of multiple loans even when their current one is ongoing.

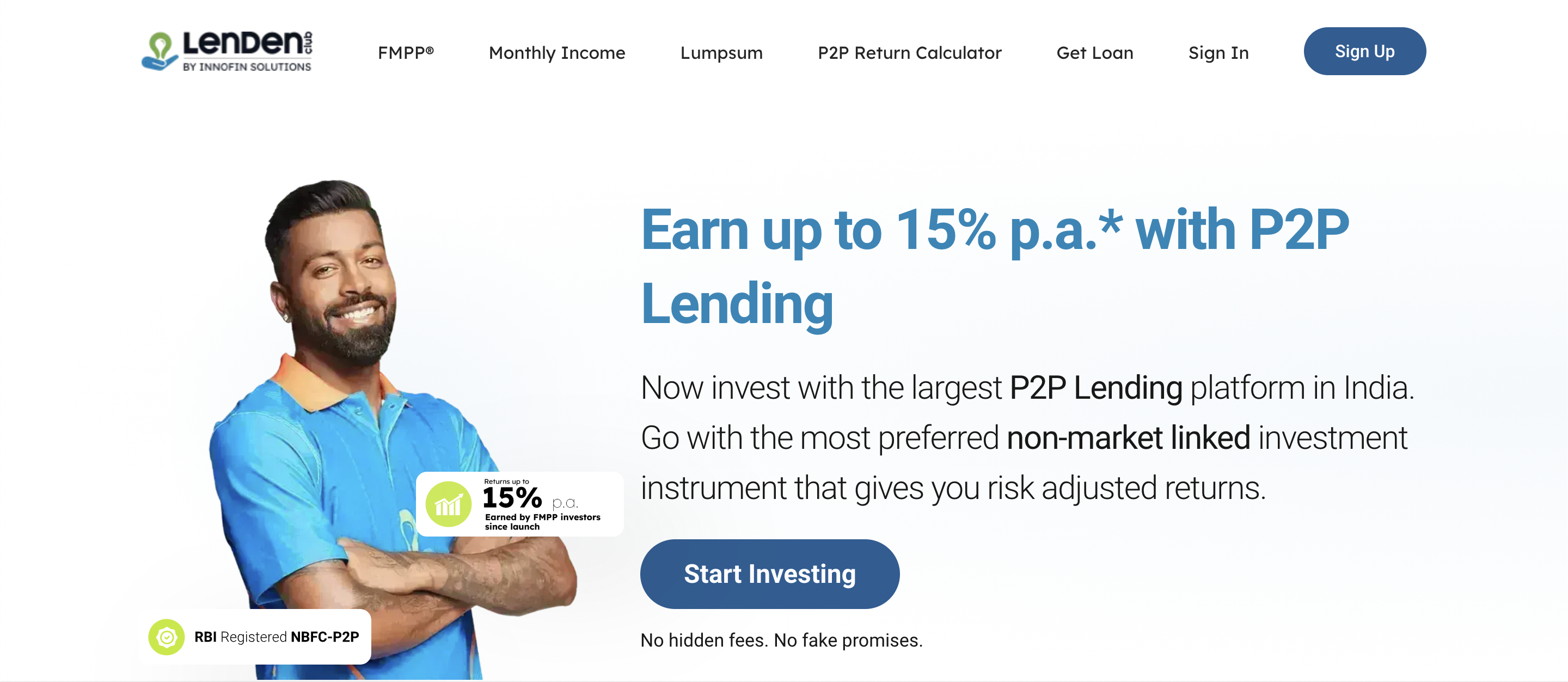

LenDenClub

LenDenClub is India’s largest P2P platform with a 1Cr+ customer base. Since its incorporation in 2015, people have invested around Rs. 13,000 crore through this platform, resulting in 400% annual investment value growth in FY 2022.

Its top features are:

- 100% digital transactions.

- Interest up to 15% per annum.

- Investors can start with as low as Rs.10,000.

- Escrow accounts handle all investors’ funds, adding a layer of security.

- Options for both monthly payouts and auto-reinvestments.

- Zero withdrawal fees with funds credited to your account within 24 hours after your investment matures.

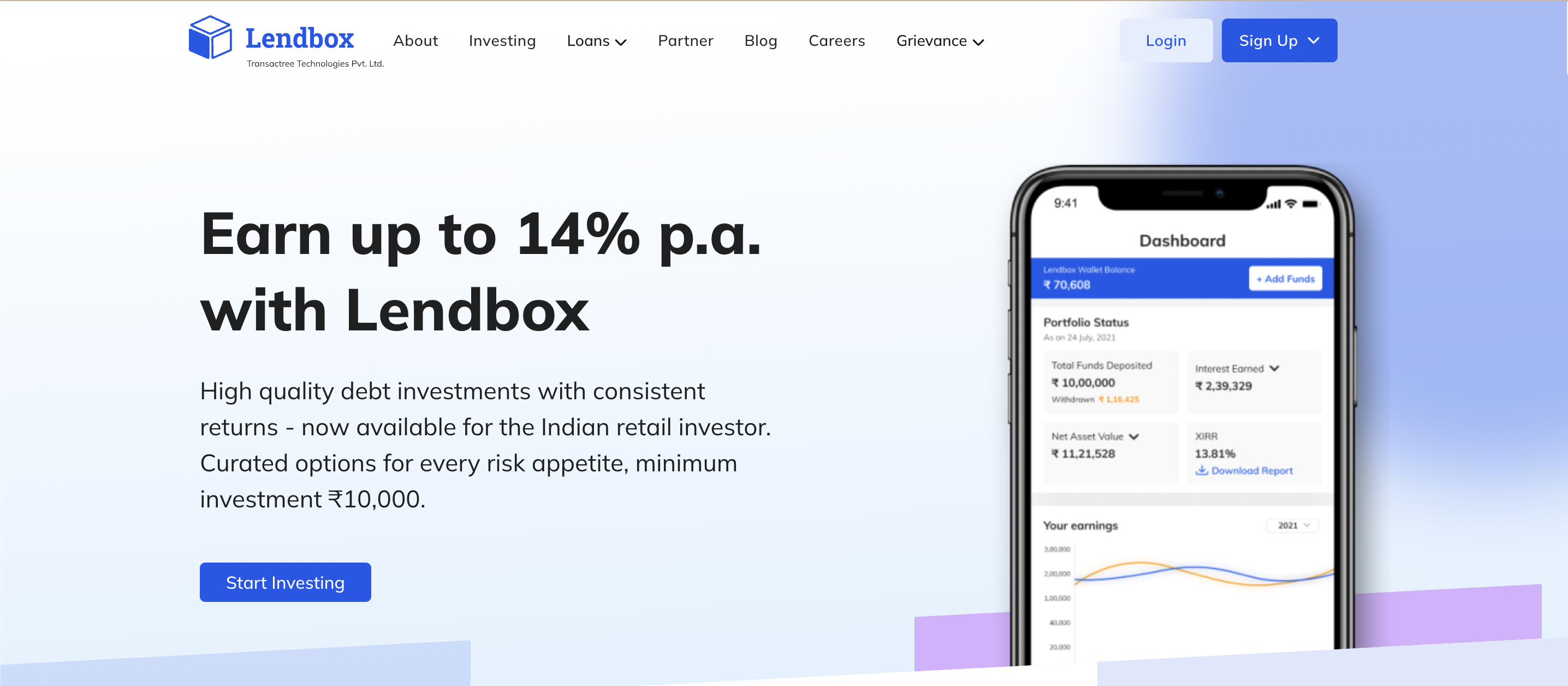

Lendbox

Lend Box is the one for you if you are looking for a P2P lending app with flexible liquidity options. You can withdraw your earnings after maturity, monthly, or even cash out before your investment matures. This platform processes withdrawal requests within 24 hours and is preferred by 3,30,000+ happy customers.

Here are some of its noteworthy features:

- Start with a minimum investment amount of Rs.10,000.

- Earn interest of up to 14% per annum.

- Track the performance of your investments right from the dashboard.

- The platform also provides a dedicated personal relationship manager to help you make better investment decisions.

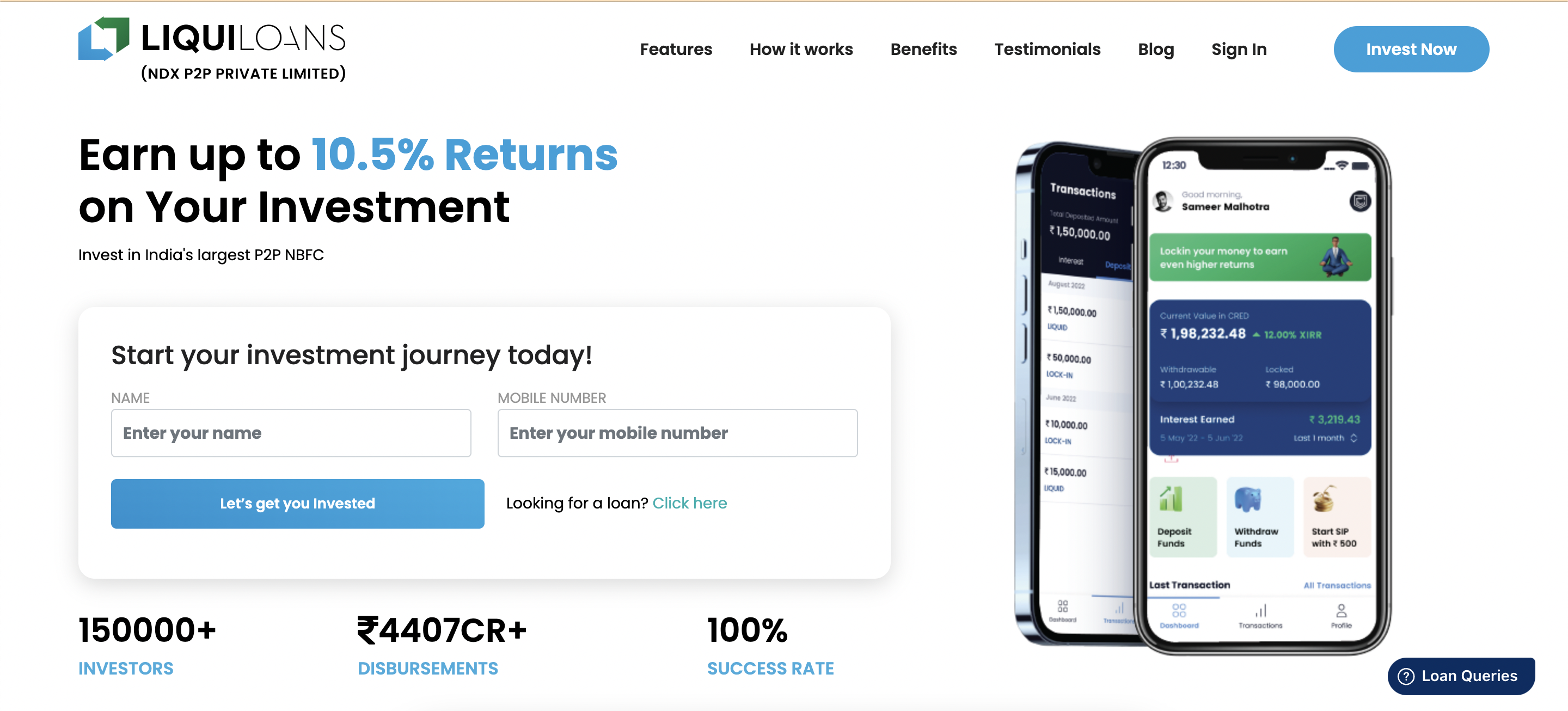

Liquiloans

Liquiloans is another top-ranking P2P lending website with 1,50,000+ investors and a 100% success rate. Borrowers with credit scores above 700 can only register on this platform, making it safe for investors to allocate capital and gain sustainable returns. Additionally, the platform handles all investments via IDBI Bank & Trustee.

Mentioned below are some of its top features:

- Investors’ capital is spread across 200+ borrowers, reducing portfolio exposure per borrower to 0.5%.

- A stringent borrower verification via credit scores, income proofs, and KYCs ensures guaranteed returns to investors.

- Start investing at just Rs.10,000 and earn interest up to 10.5% annually.

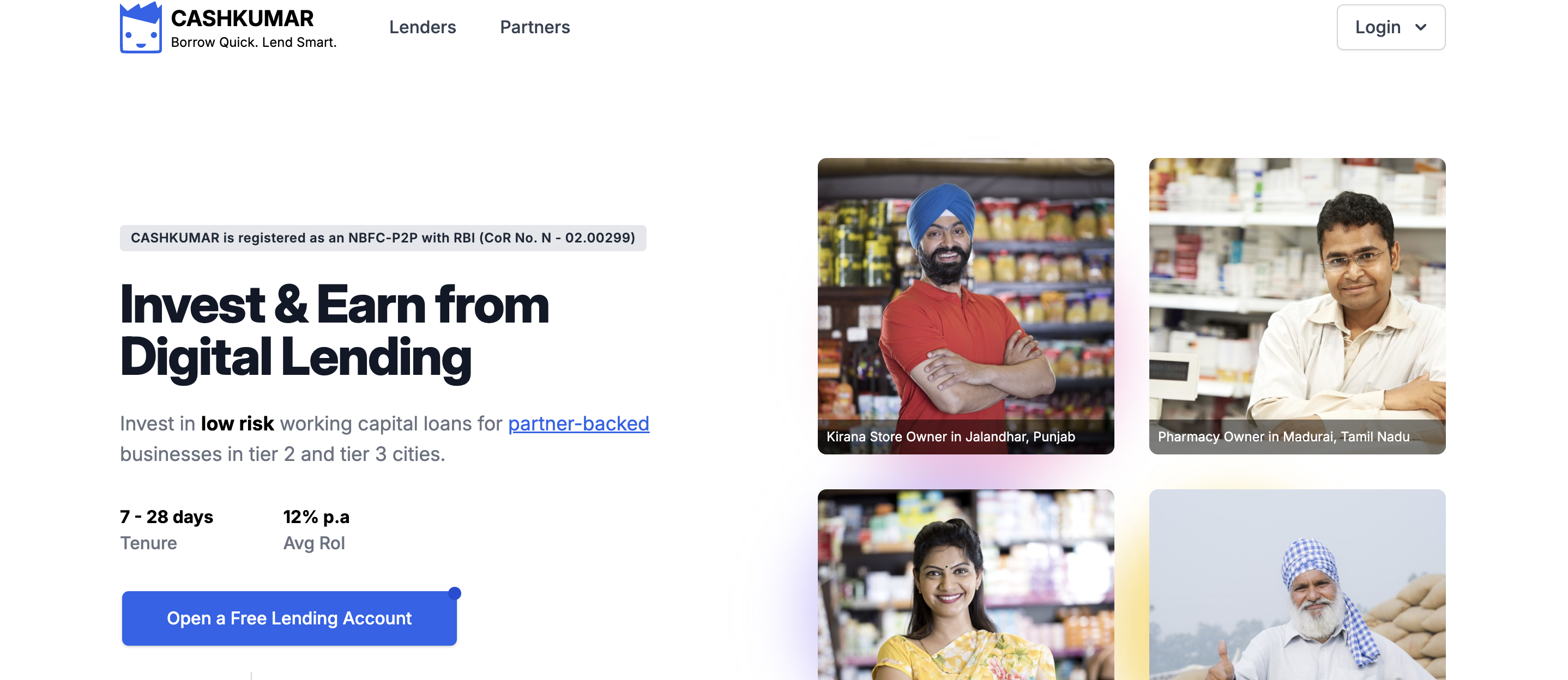

Cash Kumar

Cash Kumar is a unique P2P lending platform that allows you to invest in the working capital loans of the company’s partner-backed businesses in Tier 2 and Tier 3 cities. This platform only lends to businesses dependent on its partners to minimise default risks.

Here are some of its features:

- Short investment tenures ranging from 7 to 28 days provide high liquidity.

- An average ROI of 12% per annum.

- Investors’ capital is spread across borrowers, thus reducing risks and maximising returns.

i-Lend

i-Lend aims to revolutionise India’s credit market. Here, both parties can decide on the loan terms like principal amount, tenure, interest rate, etc., and strike a deal which benefits them both.

Here are some of its features:

- Interest rates start from 15% per annum.

- Loans ranging from Rs.25,000 to Rs.5 lakh.

- Flexible loan tenures range from 6 to 36 months.

Paisa Dukaan [Now Shut]

Established in 2017, Paisa Dukan is a P2P lending platform which aims to curb the number of financially excluded people in India via its flexible loan policies. Owned by BigWin Infotech, this platform aims to provide credit to a wide number of borrowers to fulfil their financial needs.

Mentioned below are its top features:

- Interest rates of 12% to 24% per annum facilitate high returns.

- Flexible repayment tenures of 3 months to 3 years.

- Loan amounts range from Rs.5,000 to Rs.10 lakh.

PS: Paisa Dukaan has shut its operations as of October 2023.

Rupee Circle

Rupee Circle is one of India’s fastest-growing P2P lending platforms. It aims to make a bank-less world so borrowers can get easy credit and investors can get higher returns.

The top features of this platform are as follows:

- Personal loans ranging from Rs.25,000 to Rs.5 lakh (in multiples of Rs.5,000).

- Flexible repayment tenures ranging from 3 months to 24 months.

- Interest rates ranging from 12% to 30%, facilitating excellent returns.

- Options for both monthly payouts and auto investment.

- Easy exit option for times when you need to withdraw your funds immediately.

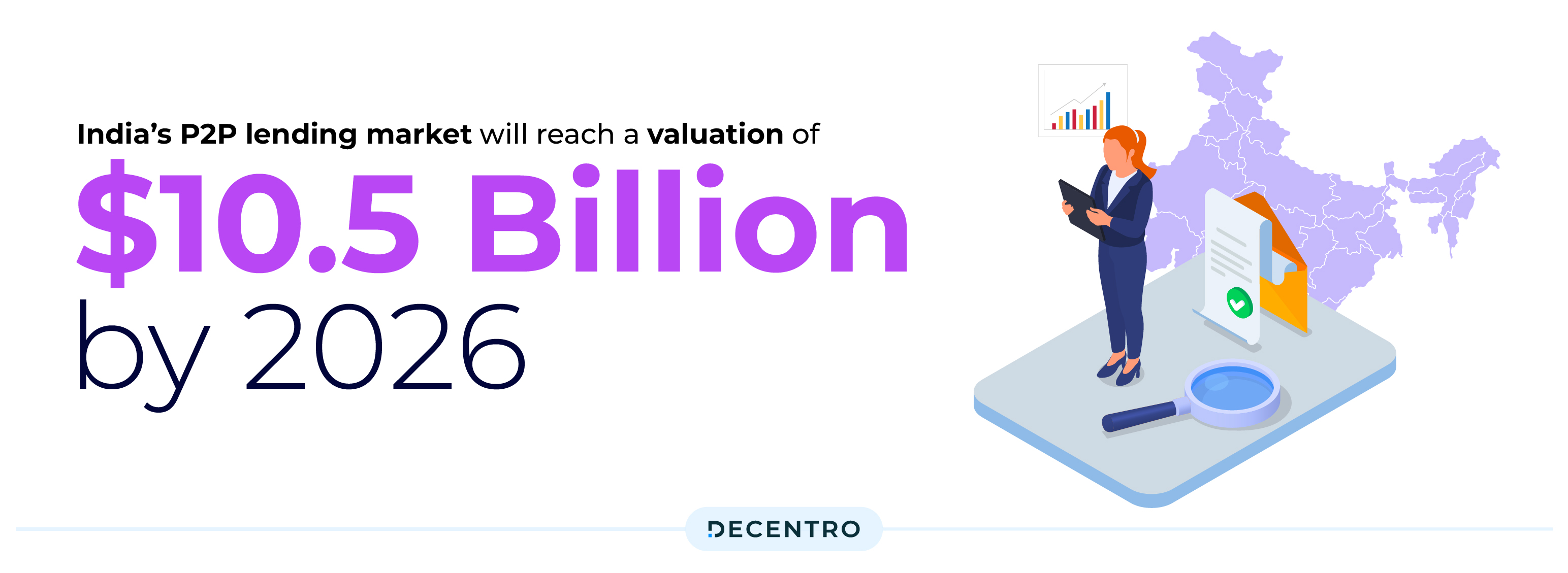

The Future of P2P Lending

Studies suggest that by 2026, India’s P2P lending market will reach a valuation of $10.5 billion. The primary reason behind this segment’s growth is that P2P lending platforms cut out the middleman and make it easier for borrowers to gain credit. At the same time, investors get a higher return on investment.

What’s more, this financial system is RBI-regulated. The Central Bank is actively making new rules and regulations like implementing strict creditworthiness and know-your-customer (KYC) checks. This will help increase transparency and mitigate fraudulent activities in this segment, making it a viable alternate investment avenue for numerous investors.

So, to take advantage of this sunrise sector, several new businesses will develop platforms to facilitate peer-to-peer lending among interested parties. However, to be one of India’s top P2P lending platforms, companies need an integrated payment solution to handle their transactions.

Decentro provides payment APIs with features like instant payouts, multi-collect, recurring payments, and UPI collections. Our Restful APIs allow you to set up digital escrow accounts in seconds, making handling P2P transactions a breeze. What’s more, all transactions are automatically reconciled, helping you keep track of all your dealings.

Additionally, our CKYC APIs make KYC checks seamless, lowering customer acquisition costs by 80%.

Do you want to know more about what we have to offer?

Frequently Asked Questions

As per regulations, P2P lenders can invest up to Rs. 50 lakh across all P2P platforms. Additionally, if an investor lends above Rs. 10 lakh, that individual must be certified as having a net worth of Rs.50 lakh by a practising Chartered Accountant.

Borrower defaults are the biggest risk of P2P lending. Lending platforms are not legally obligated to guarantee returns to lenders in case borrowers go bankrupt. Additionally, liquidity in P2P lending is lower than in stocks and bonds due to the long investment horizons.

Obtaining a Certificate of Registration from the RBI, a Rs.2 crore minimum capital requirement, a 15% minimum capital adequacy ratio level, and disclosing all information regarding interest rates, fees, and other charges to both investors and lenders are some of the compliance requirements for P2P platforms in India.

Yes, all P2P lending platforms must adhere to the Anti-Money Laundering (AML) standards and Know Your Customer (KYC) guidelines set by the Reserve Bank of India. It helps mitigate fraudulent transactions like money laundering, terrorist financing, etc.

P2P lending platforms are not legally responsible for guaranteeing returns to lenders. However, they are responsible for helping investors recover loans taken via their platform. Thus, implementing a thorough borrower screening process is necessary to mitigate the chances of loan repayment defaults.