An in-depth look at how UPI is working with Credit & Debit cards to shape the payments landscape. Find out how UPI is helping and what challenges it faces.

UPI On Credit Explained: How It Works & How to Get Started

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

The payments space has undergone many evolutions. Placifying the cash revolution seems premature, with UPI now leading the way in India.

While UPI catered to the need for accessibility, it fell short of pandering to the credit-hungry demographic that India fosters. This is where the fintech players thrive with their solutions. Yet, the RBI regulates this sandbox more often than not with its guidelines. While the National Payment Corporation Of India (NPCI) does find its way through each development to make the digital payments space more inclusive, the recent launch of UPI on credit cards has already left banks and fintech companies wanting more.

This is purely motivated by the potential of this model to transform India’s payments landscape by expanding financial access to underserved populations and offering seamless, fast credit integration within the familiar UPI platform. This innovation drives the adoption of digital payments, supports MSMEs with easier credit access, and encourages the development of new financial products tailored to diverse needs.

By helping individuals build credit histories, UPI on credit also enhances long-term financial access. Additionally, it stimulates economic growth through increased consumer spending and leverages UPI’s robust security to ensure safe transactions. Backed by the RBI, UPI on credit is poised to make financial services more accessible, efficient, and integral to everyday life in India.

Let’s examine the journey leading to this desire to extend UPI privileges to other credit products.

The Debit and Credit Card Landscape

Let’s backtrack a little and understand how this “plastic cash” has impacted the economy.

It does not seem too long ago that debit and credit cards were being viewed as the “next big thing”, the realm of a cashless economy. It was the initial window into cashless payments and has stood its ground ever since. According to Worldline India’s Annual Digital Payments Report, the total number of debit and credit cards in circulation breached the 1 billion mark, with 1006.7 million cards recorded as of December 2021. Out of the total cards in circulation, credit cards represented 7% of the market share, while debit cards accounted for 93%.

Now, regarding service providers, the card market has been operated by two major players: Visa and Mastercard. Together, the two companies handle 90% of global card payments. In India, the government has promoted the RuPay card as an alternative, but it has low penetration compared to Visa and Mastercard. Yet, the push of national payment systems in countries apart from India has significantly impacted this duopoly.

The UPI intervention

Speaking of national payment schemes, UPI’s advent has been the catalyst in the narrative of the country being an innovator-based payments economy. The execution of powering many bank accounts into a single mobile application (of any participating bank), and merging several banking features, for seamless fund routing & merchant payments, was paramount. In a matter of years, UPI has become the most inclusive mode of payment in India, with over 26 crore unique users, 5 crore merchants onboarded on the UPI platform, and a mammoth 7 Billion mark volume of UPI transactions.

Scan and pay | Enter the number and pay.

It’s as easy as it gets. This ease was the reason behind the proliferation of this mode of payment from the streets to each household.

The ease naturally leads to demands for a more inclusive payment model. A model that goes beyond linking bank accounts.

The UPI+card model

This demand for inclusivity paved the way for probably the most dominant model responsible for the UPI takeover: linking your cards.

The lending narrative is tailor-made for UPI and card networks to coexist. The new fintech players aim to go beyond the idea of a credit line and also ease the consumption or spending of the credit. To facilitate the transaction, a merchant/payment aggregator must be integrated. The mere integration of these aggregators poses a huge challenge in terms of delayed approvals and extended timelines. Therefore, with the universal card networks and UPI, the accessibility of the UPI journey is about different combinations of prepaid cards, payout models, and credit cards.

- Iteration one

The first iteration was when users could link their bank account to their UPI ID using a Debit Card (Aadhar OTP). The catch was that a debit card was the only way to link the bank account, and UPI transactions are bank transactions, not card transactions that involve card networks (Visa, MasterCard, Rupay).

- Iteration Two

To overcome this challenge, iteration two was revealed to the public. The Reserve Bank of India proposed allowing credit card linking to the UPI platform. In a bid to end the need to carry physical credit cards, the circular stated that the credit cards issued on the RuPay Network can be linked with UPI, which adds credit cards to the suite of offerings.

The process remains the same,

- Link your bank account and one-time authentication for PIN setup with a debit/ credit card. Then, a one-time password is sent to your registered mobile number.

- Scan a QR code and choose the added debit/ Credit card as the payment method.

- Authenticate your payment via the One time password sent to the registered mobile phone number.

- Complete the payment

From linking bank accounts, UPI now supports online, offline, and voice-based along with recurring payments.

As a result of UPI’s monumental success, the Reserve Bank of India has expanded the scope of UPI by enabling the operation of pre-sanctioned credit lines from banks within the UPI ecosystem. This initiative aims to lower transaction costs and encourage the development of innovative financial products tailored for the Indian market.

Let’s delve a little deeper into this model,

The Credit on the UPI model

The Credit on UPI (Unified Payments Interface) model is designed to integrate credit facilities seamlessly into the UPI ecosystem, allowing users to access and utilise credit directly through their UPI-enabled apps. Given the growing appetite for credit among Indian consumers, for instance, at the end of FY23, personal loans by banks stood at INR 40 lakhs, a jump of 20% from FY22, this initiative is expected to extend the reach of credit to a broader consumer base including the underbanked segment and significantly expand the credit market.

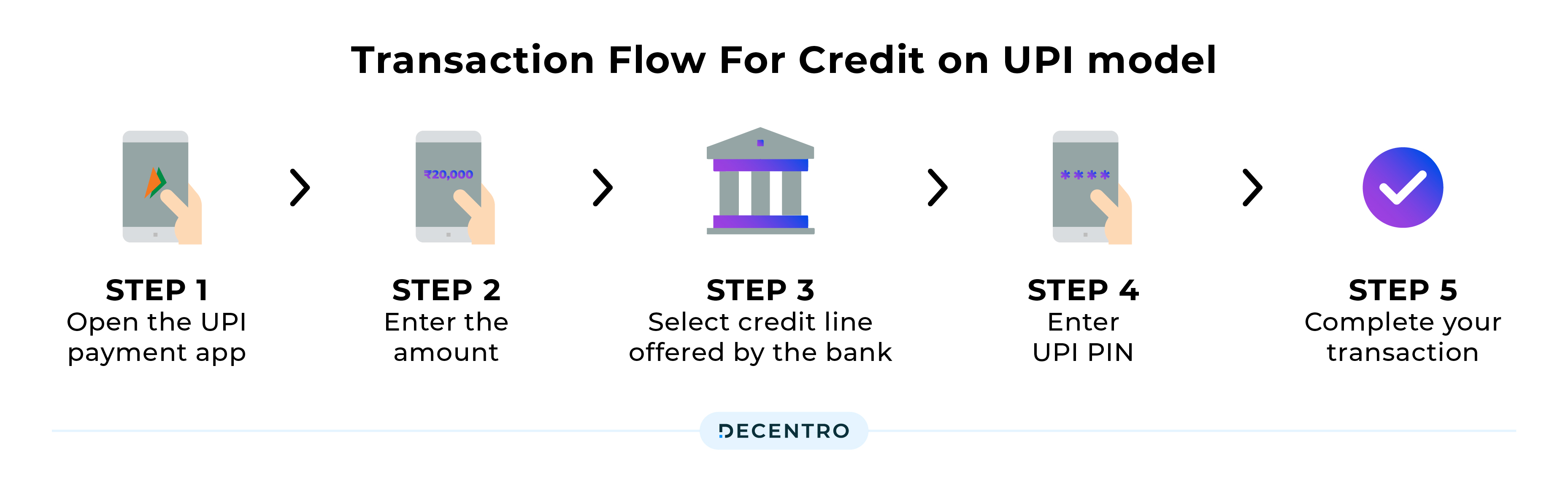

Here’s a breakdown of how the model works:

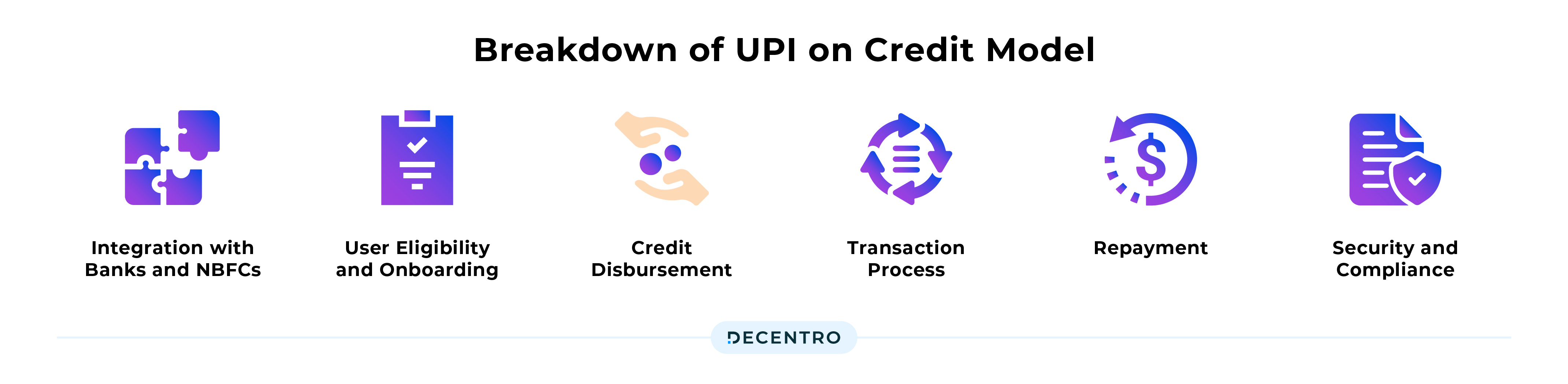

1. Integration with Banks and NBFCs

- Partnerships: Fintech companies collaborate with banks and Non-Banking Financial Companies (NBFCs) to offer credit products.

- APIs and SDKs: Integration is achieved through APIs and SDKs, enabling real-time credit availability on UPI platforms.

2. User Eligibility and Onboarding

- Credit Assessment: Users undergo a credit assessment based on their transaction history, credit score, and other relevant data.

- Instant Approval: Eligible users receive instant credit approval, with the credit limit determined by the lending partner.

3. Credit Disbursement

- Linking to UPI ID: Once approved, the credit amount is linked to the user’s UPI ID, making it accessible for transactions.

- Seamless Access: Users can use their UPI app to make payments directly from their credit line, similar to how they would use their bank account.

4. Transaction Process

- QR Code Payments: Users can scan QR codes at merchants or online platforms to make payments using their credit line.

- P2P Transfers: Peer-to-peer transfers are also possible, allowing users to send money to friends and family using their UPI credit.

5. Repayment

- Flexible Repayment Options: Users are provided with various repayment options, such as EMIs (Equated Monthly Installments) or a lump-sum payment.

- Auto-Debit: Repayments can be set up for auto-debit from the user’s bank account on the due date, ensuring timely payments and convenience.

6. Security and Compliance

- Robust Security: UPI’s secure infrastructure protects all credit transactions against fraud and unauthorised access.

- Regulatory Compliance: The model adheres to regulatory guidelines set by the Reserve Bank of India (RBI) and other relevant authorities.

UPI credit lines are increasingly used across various sectors in India:

- BNPL Services: Platforms like Lazypay and Simpl integrate with UPI, enabling consumers to purchase now and pay later, improving convenience and cash flow.

- Small Business Financing: Fintechs like KreditBee and Slice offer UPI-linked credit lines to help small businesses manage cash flow, pay suppliers and cover operational costs efficiently.

- Instant Personal Loans: Services like Paytm Postpaid and Amazon Pay Later provide instant UPI credit for personal expenses, offering quick, flexible access to funds.

- Education and Healthcare: UPI credit lines are used to pay tuition fees and medical bills in instalments, easing financial strain for families and patients.

- Everyday Expenses: Platforms like Freecharge and Mobikwik allow consumers to cover daily expenses like groceries and utilities through UPI credit, offering greater financial flexibility.

Banks that Offer UPI Credit Lines

- State Bank of India (SBI)

- HDFC Bank

- ICICI Bank

- Axis Bank

- Yes Bank

- Kotak Mahindra Bank

- IndusInd Bank

- Federal Bank

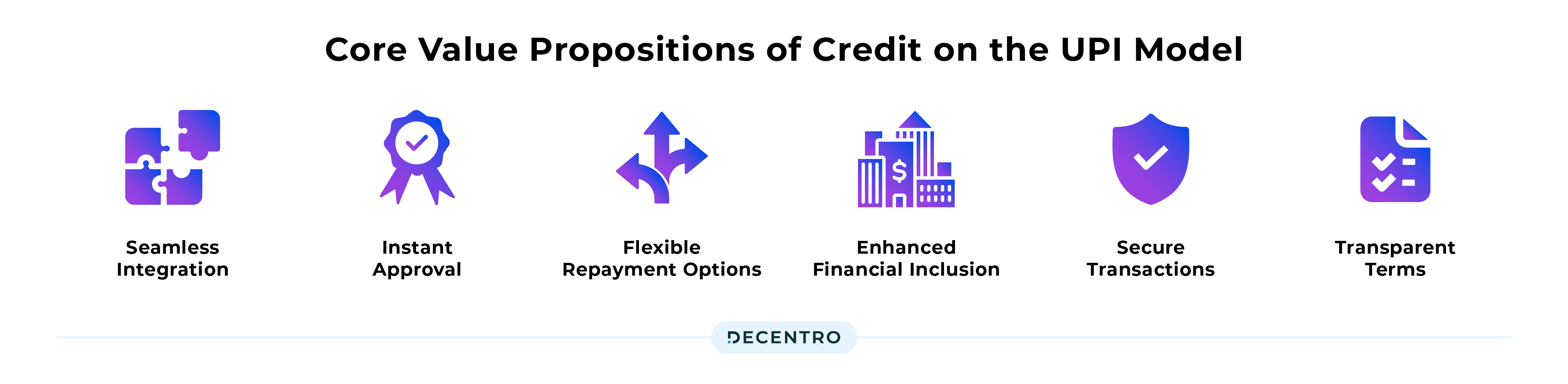

Core Value Propositions of Credit on the UPI Model

Linking your credit card to UPI simplifies your payments and lets you completely control your financial transactions, with real-time notifications for every transaction. Following are the benefits of credit lines in UPI

- Seamless Integration: Easily access credit right from your UPI app, blending convenience with financial flexibility.

- Instant Approval: Get quick, hassle-free credit approvals, giving you immediate access to funds when needed.

- Flexible Repayment Options: Customise your repayment schedule to fit your financial situation, with multiple options for your convenience.

- Enhanced Financial Inclusion: More people can access credit, boosting personal and business growth across all sectors.

- Secure Transactions: Enjoy the robust security of UPI, ensuring your credit transactions are safe and reliable.

- Transparent Terms: Benefit from clear, straightforward terms and conditions with no hidden fees, fostering trust and financial clarity.

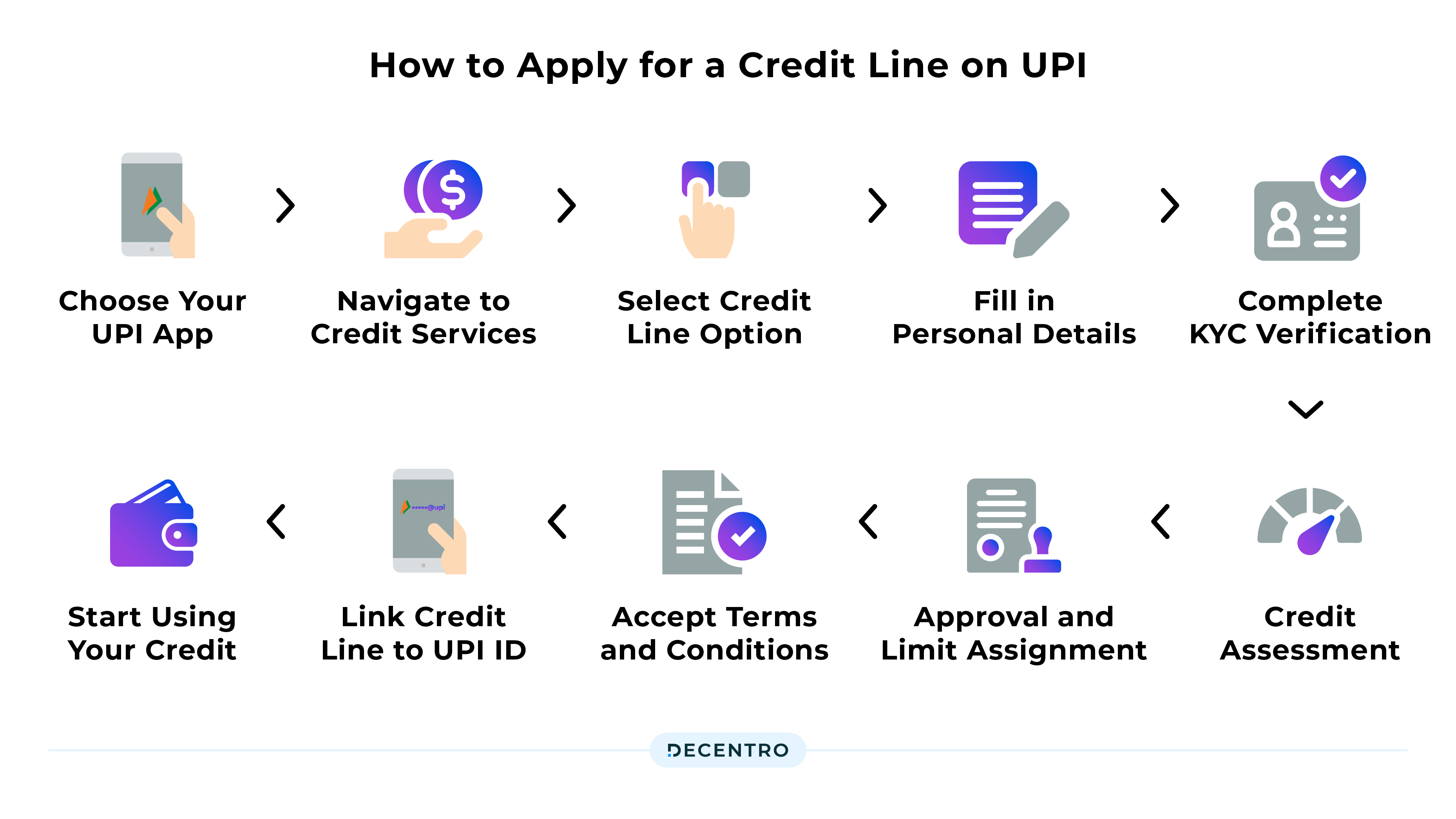

How to Apply for a Credit Line on UPI

Let us examine the steps required to activate the credit line on your UPI application.

- Choose Your UPI App:

- Open your preferred UPI app (e.g., Google Pay, PhonePe, Paytm).

- Navigate to Credit Services:

- Look for the “Credit” or “Loan” section in the app. This is usually found in the main menu or under financial services.

- Select Credit Line Option:

- Click on the option to apply for a credit line. You may see terms like “UPI Credit,” “Instant Loan,” or “Credit Line.”

- Fill in Personal Details:

- Provide the necessary personal and financial information. This might include your name, address, income details, and employment information.

- Complete KYC Verification:

- If you haven’t already, complete the KYC (Know Your Customer) process. This might require uploading documents like your PAN card, Aadhaar card, and recent photographs.

- Credit Assessment:

- The app will conduct a credit assessment based on your credit score and financial history.

- Approval and Limit Assignment:

- You will be notified of your credit limit and terms, usually within a few minutes if approved.

- Accept Terms and Conditions:

- Read and accept the terms and conditions provided by the lender.

- Link Credit Line to UPI ID:

- Once approved, your credit line will be linked to your UPI ID, making it ready for use.

- Start Using Your Credit:

- You can now make payments using your UPI credit line. Choose the credit option during UPI transactions.

Applying for a credit line on UPI is quick and convenient, bringing financial flexibility to your fingertips. However, where ease paves the way for demands, iterations pave the way for unanswered questions.

The ambiguity of the UPI on the Credit Model

The RBI’s Payments Vision 2025 focuses on enhancing financial inclusion through innovative product designs and robust underwriting models. The introduction of pre-approved credit lines via UPI is set to connect more consumers to formal banking and unlock new lending opportunities for banks and NBFCs. As UPI evolves, banks and fintech companies are expected to develop new credit products, leveraging UPI data for better credit assessments and more efficient lending processes. If we have to break down the impact across the consumer and lender segments, we have,

- For Consumers: UPI credit lines offer instant, flexible credit access through a widely used platform, simplifying borrowing and repayment. This enhances purchasing power and convenience without needing a traditional credit card.

- For Lenders: UPI credit lines opens up a broader customer base with lower acquisition costs. Due to its real-time nature and comprehensive data analytics, integrating UPI’s established network potentially reduces defaults.

While the credit on UPI concept doesn’t gain brownie points for novelty, it does open the floodgates for even more widespread adoption of quick and easy payments for minor transactions without needing a PoS machine. This inclusive idyllic scenario also gives rise to the following questions:

- MDR[Merchant discount rate]: UPI’s biggest power play for small and medium-sized businesses was its ability to eliminate merchant fees. The feasibility of the zero-fee model seems low in the credit line, with the risk capital being higher.

- Issuance: The country still faces the roadblock of the issuance of credit cards being a long-winded route from the bank’s side

- Peer-to-Peer: UPI transactions are divided into person-to-merchant (P2M) and peer-to-peer (P2P). So far, credit card payments are used only for payments to merchants, not inter-bank money transfers between two people.

- Debt trap: Consumers must be wary of over-leveraging themselves over credit cards and buy now pay later schemes.

- Revenue Model: Currently, the UPI + debit card game has no network interchangeability fees. The need for clarity about what the model will look like for non-domestic players raises many red flags.

The Next Pivot

The digital payments landscape is where the solutions operating will focus on the following parameters.

- Minimised Product Differentiation

- Robust Risk management

- Minimizing margins when it comes to transactions

The operative words for the next generation of solutions would be Custom Experiences and Detailed Insights. The value of a solution will now be determined by why a customer needs or wants to make a payment, the incentives behind it, and how personal that payment journey is for the customer.

Players ranging from Fintech lenders, gig economy, marketplaces, wealth managers, and payment providers require simple plug-and-play APIs to look after their elevated experience when it comes to financial solutions. A solution that, even after integrating, takes care of all upcoming fixes & iterations without any breakage on the workflows.

Decentro’s APIs for UPI Payments

With Decentro, you can now build a robust payment infrastructure for your business to facilitate collections, enable instant payments, authenticate VPAs, provide QR payments, and more. Decentro’s UPI Collections brings you several features that can add a lot of value to your existing payment stack:

Enable quick digital payments: Generate custom UPI IDs for your customers, merchants, and partners and kickstart hassle-free payouts nationwide without any pesky settlement delays or waiting periods for the recipients.

Set up UPI intent flows: Set up the UPI intent flow on your platform to give your customers a super-smooth payment experience. Let them choose their favourite UPI app, pre-fill payment info, and wrap up the transaction in one shot. Alternatively, share static or dynamic QR codes linked to UPI IDs for hassle-free offline collections.

Set up recurring payments: Let your customers set up autopay for their subscriptions in a snap, whether it’s from their accounts or wallets. And hey, if you’re running a retail or e-commerce gig, you can also use Split Payments APIs to effortlessly split and settle funds from one customer to several vendors or sellers simultaneously. No more fuss!

Feel free to access our documentation: API Documentation

Is it an investment you are ready to make for your business?