User profile plays a crucial role in preventing cybercrime and fraud. Learn about its role in risk management, components, importance, challenges, and future trends.

User Profiles Demystified: The Foundation of Modern Risk Management

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

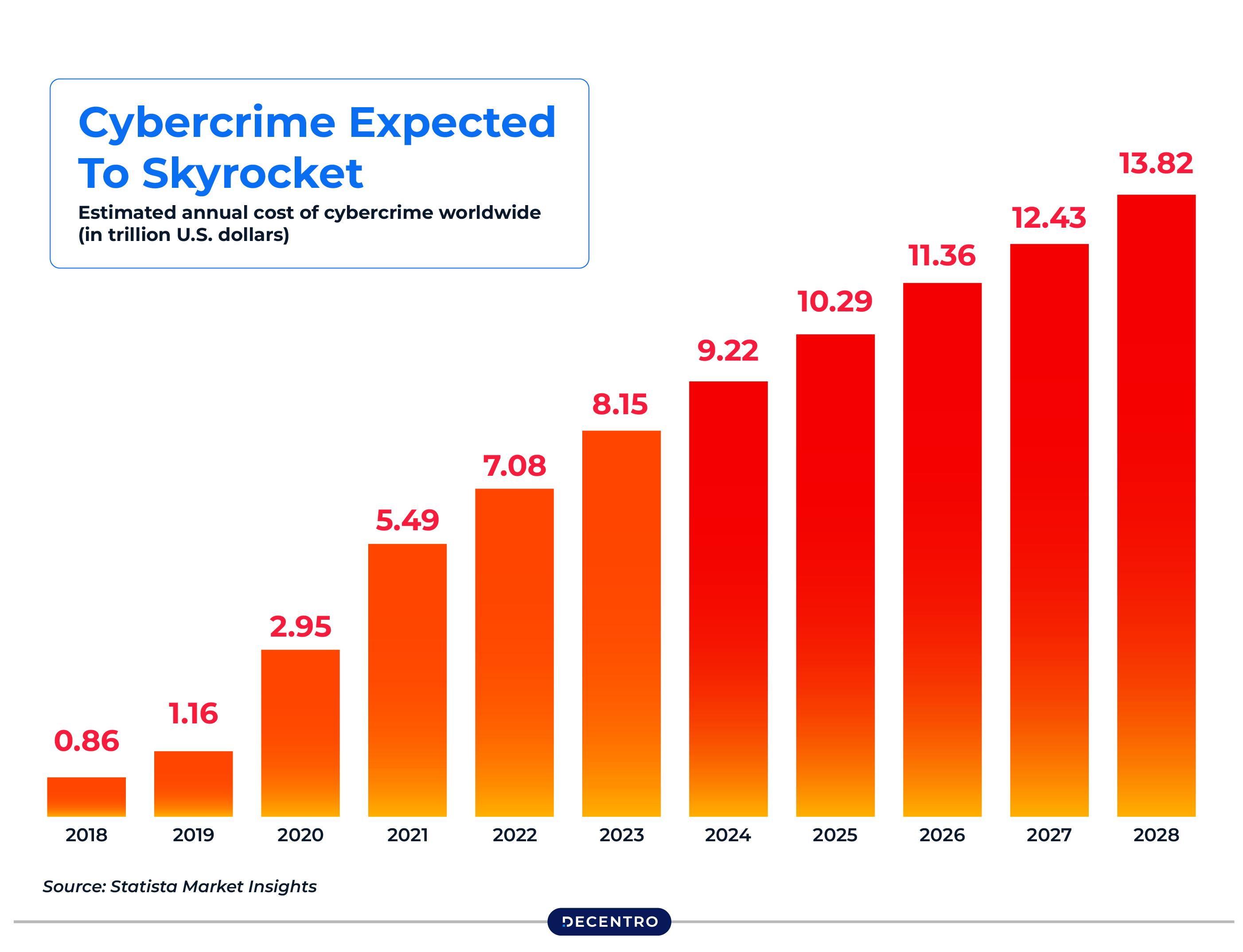

Cyberattacks, frauds, compliance violations, etc., are the major business risks these days. As per recent data, the global cost of cybercrime, which includes identity thefts, frauds, scams, breaches, etc., is expected to reach $10.5 trillion annually by 2025. The annual Identity Fraud Report states that digital document forgery has increased 244% YoY, and a deepfake attempt occurs every 5 minutes globally.

An individual business spends over $4.5 million annually to prevent these fraudulent activities. However, despite such preventive measures, the consumer out-of-pocket losses of each firm are expected to reach more than $1 billion by 2025.

Considering the severity of the situation, an effective digital identity verification setup is needed at this hour to protect businesses from digital fraud. Thus, user profiles have emerged as a cornerstone of modern risk management. By providing a structured representation of individuals or entities based on their data, behaviours, and risk indicators, user profiles empower organisations to mitigate risks while enhancing operational efficiency proactively.

Keep reading to learn the function, application, and advantages of user profiling in effective risk management for businesses!

Understanding User Profiles

User profiling refers to grouping users into different categories based on their specific metrics. It includes a detailed compilation of information about an individual, including personal data, behavioural patterns, risk indicators, etc. Individuals are grouped based on their purchase type, the websites they visit, and several other factors.

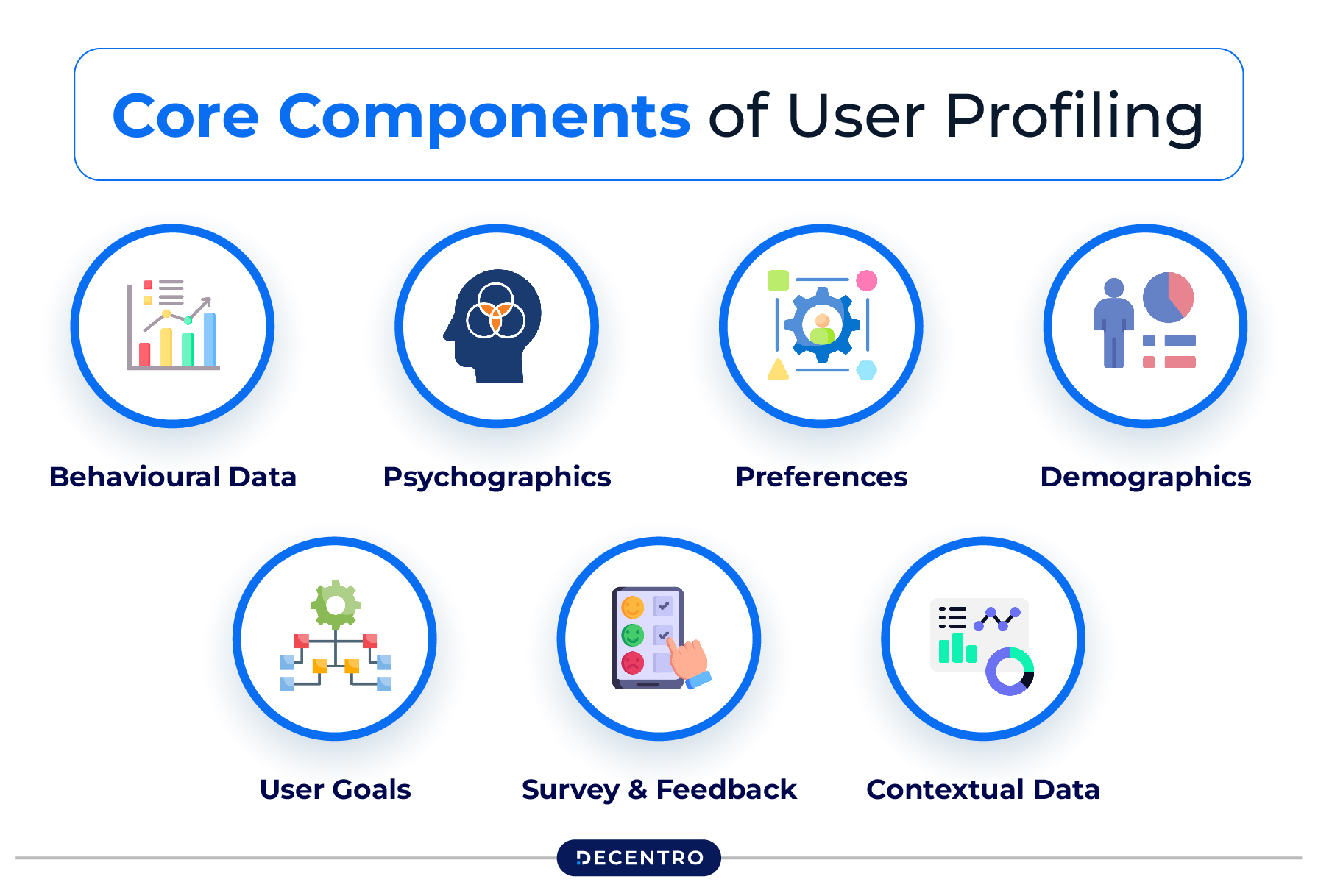

Core Components of User Profiling

The core components of a user profile include the following:

- Behavioural Data

It helps analyse a user’s interaction with an application or website, their browsing history, click patterns, transaction history, etc.

- Psychographics

This analyses the interests, lifestyles, and values of a user. Studying psychographics provides a detailed description of why the user performs any action.

- Preferences

It helps learn about a user’s preferences, such as content categories, products, or any specific features they may prefer to use frequently.

- Demographics

It helps create a basic user profile based on information like the user’s age, location, gender, occupation, etc.

- User Goals

This involves understanding the aim of a user while using any service or product.

- Survey and Feedback

A user’s needs, satisfaction, and pain points can be analysed through the information gathered from their responses to a survey or direct feedback.

- Contextual Data

It provides data about a user’s location when they access a platform, their device, and the time when they are active.

Applications of User Profiling

User profiling helps collect and analyse data regarding the user’s interaction with a service, product, or platform. It provides a detailed understanding of the user’s behaviour, needs, and interests.

Additionally, user profiling can be used in various fields like marketing, e-commerce, personalisation, UX (user experience) design, etc.

Why are User Profiles Essential for Risk Management?

User profiling can help assess risks and manage them efficiently. Here is the importance of user profiling in risk management:

- Risk Assessment

Personalising user profiles helps organisations analyse a user’s behaviour and historical data to identify or assess their risk profile. Thus, any unusual user behaviour helps detect the risks beforehand and assists in mitigating them as per the specific needs of an individual or group.

- Fraud Detection

User profiles allow for real-time user activity monitoring. With this technique, modern behaviour analytic tools can detect fraudulent activities beforehand and prevent financial losses. The user profile system notifies the users and blocks suspicious activities to prevent fraud.

- Compliance

It is essential to maintain compliance with certain regulations like AML (Anti-Money Laundering), GDPR (General Data Protection Regulation), KYC (Know Your Customer), etc. User profiles provide detailed insights into the activities and identities of a user, ensuring the user’s adherence to these regulations. As part of maintaining compliance, it’s crucial for businesses to regularly assess their data protection practices. A GDPR compliance checklist offers a structured approach to evaluate your compliance status, making it easier to stay on top of required actions and avoid costly penalties.

- Improved Decision-Making

Organisations can enhance operational efficiency by focusing on actionable insights derived from a user profile. This allows for informed decision-making processes prioritising high-risk areas while optimising resource allocation.

How to Create User Profiles for Risk Management?

Creating a customer risk profile involves data collection, integration, risk assessment, and due diligence. It is essential to collect data accurately to effectively assess user risks. Professional digital identity verification services perform such tasks to ensure accurate and reliable data collection.

After this, the professionals consider financial behaviour, industry, geographical location, and other factors to analyse data for the user’s risk assessment. Based on these aspects, one can categorise the customer’s risk levels from low to medium to high. Enhanced due diligence, or EDD, is necessary for users with high-risk profiles.

Continuous monitoring and deeper investigation can identify any changes in user behaviour. Thus, it is essential to review the profiles regularly and enable interventions at the right time to ensure profile accuracy. Regularly updated and dynamic profiles help reflect even the minute changes in the user’s circumstances.

Advantages of User Profiles in Risk Management Strategies

User profiles help in strategic risk management in many ways. Here are some of the advantages of user profiling in managing risks:

- Enhanced Fraud Detection

Detection of fraudulent activities becomes more efficient with effective user profiling. It helps detect the behavioural pattern of a user using historical data, demographics, etc. Moreover, it provides real-time data on the behavioural pattern of a user, helping detect any fraudulent activities before they can happen.

- Improved Customer Experience

User profiles are crucial in enhancing customer experiences through effective risk management strategies. It prevents downtime, improving data security and operational efficiency. Timely fraud detection and accurate risk analysis facilitate optimum risk management, improving the overall user experience.

- Operational Efficiency

Businesses can address the risk areas through effective user profiling and tackle the problems before they become too severe, just as a enterprise password manager helps prevent data breaches before they happen. This becomes possible due to real-time risk assessment, which helps make decisions based on updated data.

- Predictive Capabilities

User profiling helps anticipate potential risks by assessing a user’s historical patterns. Changes in user behaviour are detected immediately to predict possible risks and mitigate them before they can cause any severe damage.

Common Challenges in User Profiling for Risk Management

Here are some of the challenges faced while using user profiling for risk management:

- Privacy Concerns

Collecting user data is necessary to accurately assess risks. However, maintaining the user’s privacy is equally important. Some areas include strict data protection laws, and it becomes a bit tough to maintain the balance in these fields.

- Algorithmic Bias

Improper calibration of automated systems can lead to human biases and unfair classification of specific user groups as high-risk profiles. Thus, firms should maintain a fair risk profiling method to prevent discrimination against certain regions or demographics.

- Fragmented Data

Risk profiling can get fragmented due to poor data integration and lead to incomplete profiles. This usually happens in case of large institutions where data is kept in siloed systems.

The flexibility to adapt to the evolving methodologies of user profiling or incorporating new data sources may be compromised due to older systems. It can cost both time and money if companies transition away from these advancements.

- Evolving Threats

Hackers and fraudsters keep adopting new techniques, evolving their existing tactics, and finding new ways to hide their activities. Moreover, these fraudulent activities have increased with the innovations of decentralised finance platforms, cryptocurrencies, etc. It is challenging to incorporate these advanced activities into traditional risk profiling techniques.

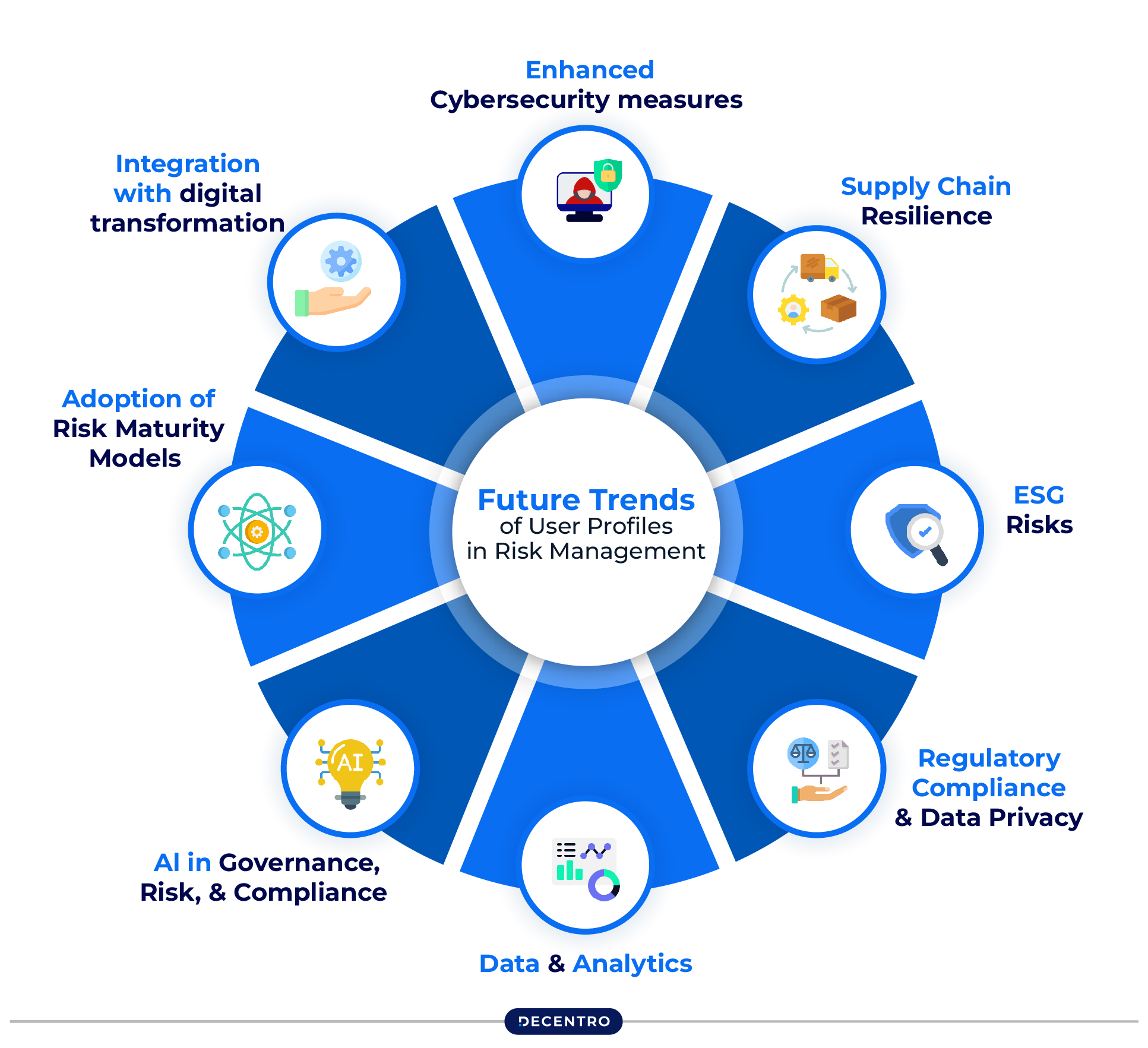

Future Trends of User Profiles in Risk Management

Introducing artificial intelligence (AI) in user profiles for risk management can transform the way in which a business can analyse, predict, and mitigate risk factors. AI can ensure accurate and efficient risk management strategies to enhance the user experience. As per studies, the market value of AI trust, risk, and security management is expected to grow to $7.4 billion by 2032 at a CAGR of 16.2%. Thus, businesses using AI to predict risks and mitigate them effectively can gain a significant advantage in the future.

Another technology that shows great promise in the risk management field is machine learning (ML). It can help in CRR (customer risk rating), which is a band, or score, given to users based on their risks of perceived financial crime. This can be derived from the user’s income source, residence, income level, business type, etc.

Use Cases of User Profiles in Risk Management

Here’s how user profiles in various sectors help in effective risk management:

Banking & Finance

Fraud prevention is crucial in bank profiles to prevent money laundering or theft. However, the strategies to avoid fraudulent activities rely heavily on profiling techniques. Credit risk scoring models use historical financial behaviour to assess lending risks. AML compliance requires robust customer identification processes supported by detailed profiles.

E-Commerce

Personalisation engines in e-commerce customise offers based on the consumer’s preferences. However, in case of any anomalies in customer behaviour, the suspicious transaction detection system will use behavioural data from the user’s profile to detect fraud.

Cybersecurity

User profiles help identify and mitigate insider threats in cybersecurity. It can monitor any deviation from the user’s normal behaviour to flag cybercrime.

Insurance

Fraudulent claims detection algorithms analyse inconsistencies in claim histories. Besides, user profiles help in dynamic policy pricing when it comes to adjusting premiums based on individual risk assessments derived from customer profiles.

Generating User Profiles for Risk Management: Ethical and Legal Considerations

Here are some of the ethical and legal considerations of generating a user profile for risk management:

- Transparency

It is essential to maintain transparency while generating user profiles. It includes informing users about data collection practices to enhance trust and ensure compliance with legal standards regarding personal data usage.

- User Consent

Users must have control over their data usage. It is essential to seek their consent while using their information for user profiling. Moreover, they should clearly know how their data is used within the user profiling frameworks.

- Accountability

As per ethical profiling practices, organisations are accountable for fair treatment throughout the profiling process. It also helps promote trust among stakeholders.

Streamlining User Profile for Risk Management with Decentro’s APIs

With Decentro’s Scanner API suite, businesses can build a customer risk profile while onboarding clients. It is designed to simplify creating and managing a user profile for effective risk management strategies. It facilitates seamless integration across platforms while ensuring compliance with privacy regulations.

Scanner uses computer vision and machine learning to enhance fraud detection and data verification. From KYC onboarding to document management, fraud prevention, and data validation, this API suite can perform everything accurately and seamlessly.

Thus, businesses looking for enhanced security and robust compliance with legal requirements can implement it in their system for the best results.

Interested to learn more about our product?