How Decentro & Volopay came together to ensure transparency, control and bank-grade security for users.

How Volopay Achieved 80% Faster Payment Processing with Decentro

An engineer by culture, but a Marketer by choice. Loves building great products that create a difference. On the lines of being a full-stack marketer.

Table of Contents

“A penny saved is a penny earned”, attributed to George Herbert (Published in Outlandish Proverbs, 1640)- the phrase stands true for everyone, be it an individual or an organisation.

Expense management is at the core of financial planning, and every organisation strives to streamline its expenses, reimbursements, and other adjustments to maintain a healthy financial status.

The struggle undergone by finance teams inspired the development of an API-enabled banking system that could control and manage all the money going out of the organization and keep it in sync with their finances.

What is Volopay?

Volopay is a modern business account platform designed to solve the universal challenge of expense management across organisations. Built as a comprehensive financial control centre, Volopay helps businesses save money and streamline operations through:

Core Capabilities:

- Issue and manage employee cards (physical & virtual)

- Enable UPI payments for operational expenses and petty expenses

- Set spending rules and track expenses in real-time

- Facilitate domestic and international money transfers to over 130 countries

- Process vendor payouts and employee reimbursements efficiently

- Automated accounting with fully integrated financial suites

- Procure-to-pay product to simplify and automate procurement workflows for businesses

Volopay’s platform brings transparency to every transaction—when an employee uses a Volopay card, the transaction is immediately visible to the spender, budget owner, and company admin, ensuring complete visibility over organisational spending.

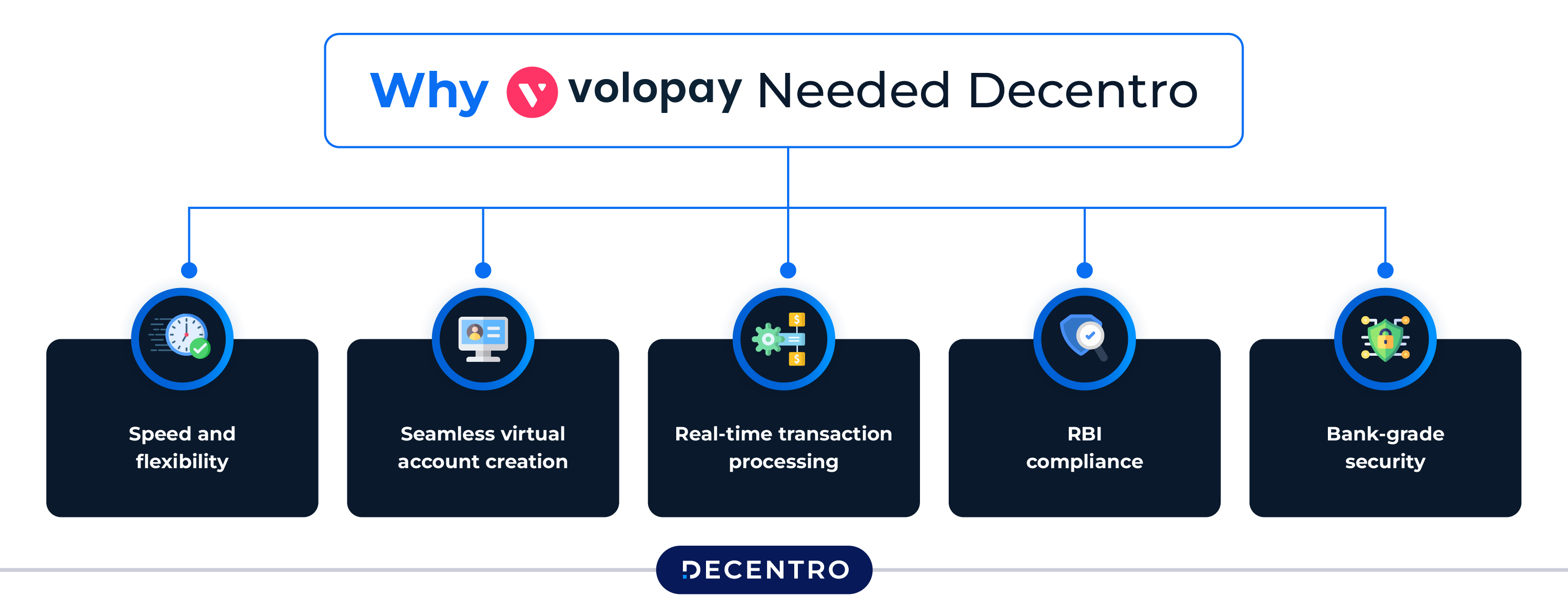

The Challenge: Why Volopay Needed Decentro

Volopay’s ambitious vision required more than traditional banking infrastructure could deliver. Their wide range of services, from VISA/UPI-enabled RuPay Cards and virtual cards to international money transfers, demanded:

- Speed and flexibility that legacy banking systems couldn’t provide

- Seamless virtual account creation at scale

- Real-time transaction processing with industry-best success rates

- RBI compliance without compromising on innovation

- Bank-grade security for customer data and transactions

Traditional banking partners would have meant months-long approval processes and limited scalability, unacceptable for a platform built for the modern business landscape.

The Solution: Decentro’s API Banking Platform

Decentro’s cutting-edge API banking platform provided Volopay with the infrastructure needed to deliver on its promises:

Key Enablers:

- Multi-Collect Module for seamless virtual account creation

- Enhanced payments stack with industry-best success rates

- 100% RBI compliance built into every API

- Bank-grade security encryption and access protocols

- Plug-and-play integration reduces time-to-market from months to weeks

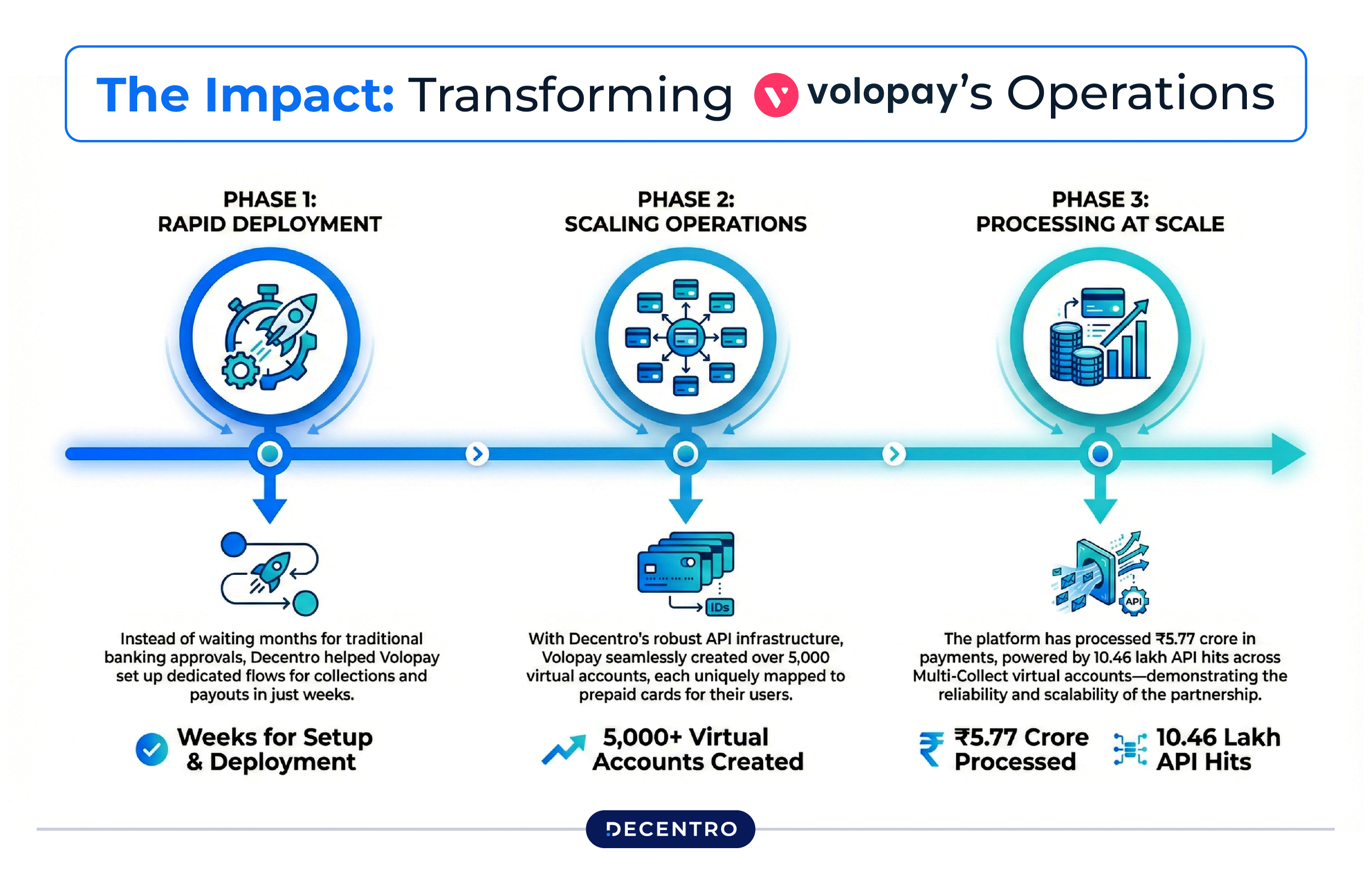

The Impact: Transforming Volopay’s Operations

The Journey

Phase 1: Rapid Deployment Instead of waiting months for traditional banking approvals, Decentro helped Volopay set up dedicated flows for collections and payouts in just weeks.

Phase 2: Scaling Operations With Decentro’s Robust API Infrastructure, Volopay Seamlessly Created Over 5,000 Virtual Accounts, Each Uniquely Mapped to Prepaid Cards for Their Users.

Phase 3: Processing at Scale The platform has processed ₹316 crore annually in payments, powered by 10.46 lakh API hits across Multi-Collect virtual accounts, demonstrating the reliability and scalability of the partnership.

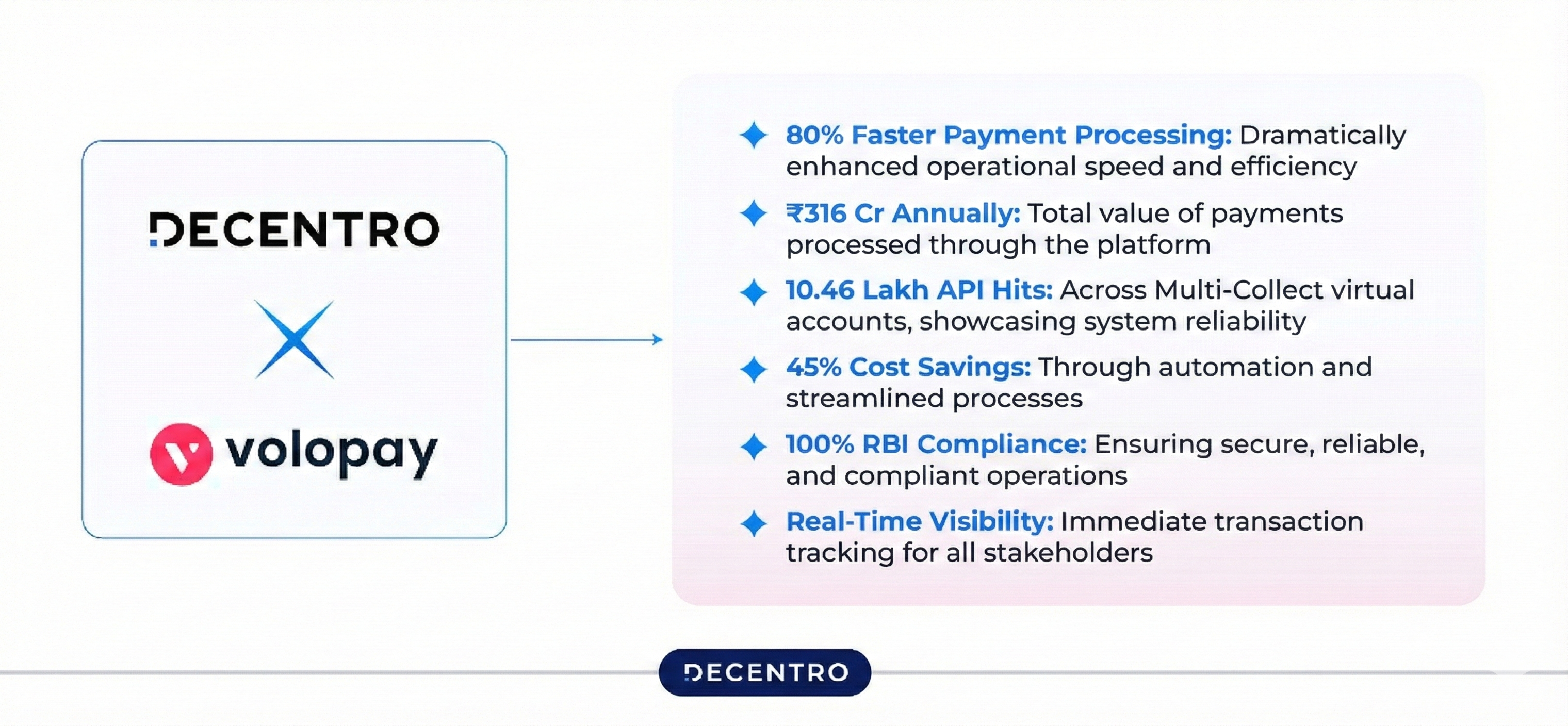

Key Metrics Achieved

- 80% Faster Payment Processing: Dramatically enhanced operational speed and efficiency

- ₹316 Crore Annually: Total value of payments processed through the platform

- 10.46 Lakh API Hits: Across Multi-Collect virtual accounts, showcasing system reliability

- 45% Cost Savings: Through automation and streamlined processes

- 100% RBI Compliance: Ensuring secure, reliable, and compliant operations

- Real-Time Visibility: Immediate transaction tracking for all stakeholders

What Volopay’s Leadership Says

“Automating payout flows requires a platform that complies with all the RBI regulations. Instead of waiting for months-long approvals with banks, Decentro helped us set up a dedicated flow for simple collection and reliable payouts in weeks with their simple yet powerful APIs. We’re highly confident in the team and systems at Decentro, which makes us believe in looking forward to growing 100X in the coming year, along with Decentro. More power to the team at Decentro.”

Rajith Shaji, Founder & CEO at Volopay:

The Decentro Difference

Decentro’s API banking platform isn’t just about processing transactions—it’s about enabling businesses to focus on what they do best while we handle the complex financial infrastructure:

- Compliance-First Approach: Fully aligned with RBI guidelines

- Speed to Market: Go live in weeks, not months

- Scalability: Infrastructure that grows with your business

- Reliability: Industry-best success rates for payment collections

- Security: Bank-grade encryption and access protocols

True financial freedom is about frictionless money flow, enabled by a robust infrastructure that minimises costs and supports your scale. Decentro’s plug-and-play API solutions enable businesses like Volopay to stay compliant while focusing on their core competencies.

Whether you’re building a neobank, fintech lending platform, gig economy marketplace, or NBFC, Decentro empowers you with:

- Custom collections and payout solutions

- Split payments & recurring payments management

- Thorough CKYC verifications for credit underwriting

- And much more

Ready to Transform Your Financial Operations?