Wondering what the essentials of KYC are? Here’s an exhaustive guide to Know Your Customers that you shouldn’t miss.

What is KYC & Why is it Important?

Once a Clueless Engineer, and now a Chuffed Marketer. Learning the trades of Fintech currently and making it great with Decentro.

Table of Contents

Should I? Is it really necessary?

The only two times I ask this question is when:

1. I have to say no to a devilishly delicious chocolate cake(I know, right!)

2. A visit to a bank is upcoming, or there’s a cumbersome procedure awaiting me.

Unlike the cake, some things cannot be bypassed. Nor, ignored.

No, wait, hear me out. You can call me cheesy, but they serve a bigger purpose—just like KYC. I bet you saw that coming from a mile away.

What is KYC? What makes it an integral part of anything remotely related to Banking and finance? And why does it hold its ground firmly even after almost two decades since its inception?

Let’s find out.

What is KYC?

KYC was introduced in the US in 2001 as a part of the Patriot Law in the wake of the 9/11 attacks on an even stronger attempt to thwart terror financing. The following year, in 2002, the Reserve Bank of India(RBI) passed the Know Your Customer guidelines, which all the banks residing in the country must comply with.

KYC or Know Your Customer or Know Your Client refers to the process of collecting, verifying, and confirming the identity of any individual who transacts with a Financial Institution (FI) such as banks or insurance companies.

Know Your Customer consists of procedures to authenticate a person’s identity through important documents such as address proof, photo IDs, and in-person verification.

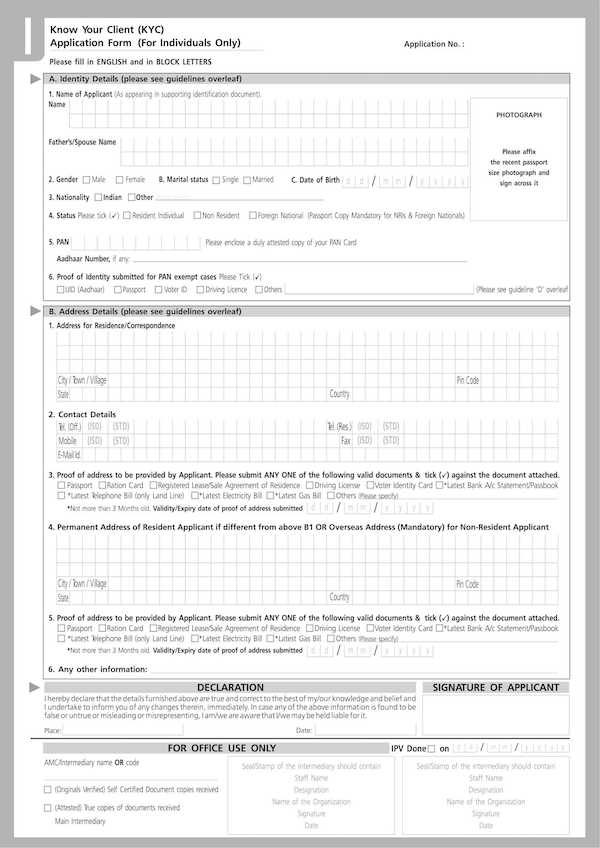

I was wondering what a Know Your Client form looks like.

Sample KYC Form

A printable KYC form that you can get from banks comprises multiple sections that fully disclose your background.

Here’s a glimpse of a form by ICICI Bank for individuals.

The form consists of:

- Identity details: including your personal information

- Address details: including your proof of residence

- And, a declaration about the same.

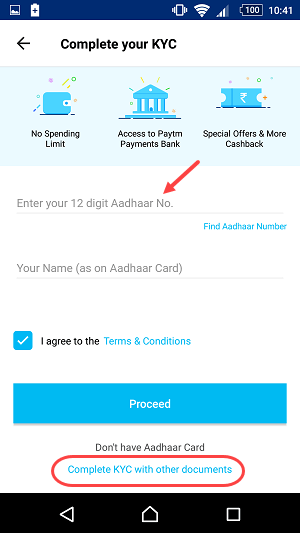

Not just limited to banks or insurance companies, remember the time you set up your PayTm account & wallet?

Minimum KYC verification would help you get started using the e-wallet. However, if you’re talking about big money, you must go through the complete KYC process.

Why is KYC Important?

If the customer is king, then you should know your customer [king!]. The process could be time-consuming and a tad exhaustive. So, the need is to make sure that this KYC process is reliable and effective as it plays a significant role when it comes to dealing with money.

Especially in these two laws:

- AML: Anti-money Laundering Law

- TF: Terrorist Financing

A financial institution requires a method to ensure that the individuals or entities it transacts with don’t deal with black money, are involved with terrorist financing, or aren’t caught up in suspicious financial transactions and fraudulent schemes.

Complying with KYC is the means to combat money laundering schemes and ensure an account holder is genuine and isn’t anonymous or fictitious, i.e., the benami of an individual.

If not?

If a financial institution is involved in a business with a money-laundering or terrorist organization, it can get into serious trouble. Possible fines(huge ones, mind you!), damage to reputation, losses, and sanctions are some of the things that can happen. Phew, rather not!

It turns out that when you’re dealing with money, there’s little room for error. Well, strike that. There’s none!

What is the Difference between KYB & KYCC?

KYB, or Know Your Business, is not drastically different from the fundamentals of KYC. While the latter verifies individual customers’ identities, the former does the same for businesses, corporations, or enterprises.

KYB authenticates a business to ensure it’s not a dummy company or shell corporation involved in anything illegal, such as money laundering, corruption of any kind, tax evasion, or terrorism, making it an integral component of AML compliance.

KYB includes the verification of the following:

- Registration details & credentials

- Location of the company

- UBOs (Ultimate Beneficial Owners)

- Company’s annual turnover statements & accounts

In addition, during the KYB process, the business is run through existing blacklists and greylists and screened to rule out any involvement, interaction, or transaction with anything illegal.

A business must establish a credible identity and ensure that the companies or entities it works with have a clean background, especially those offering professional services.

According to these norms, a business has to authenticate its customers’ identity to ensure their funds are legal and to mitigate the potential risks involved in money laundering.

Taking protection and precaution to the next level is KYCC, i.e., Knowing Your Customer’s Customer. In KYCC, a business looks into the entities with which their customers interact and associate.

The essence is the same. Both are derivatives of KYC, striving to solve the same problems persisting.

When is KYC Verification Required?

Here are some of the instances, but not all, where Know Your Customer becomes mandatory to transact:

- Opening a new bank account, be it deposit or borrow.

- Making investments in fixed or recurring deposits.

- As per IRDAI (Insurance Regulatory and Development Authority India), purchasing life insurance.

- This is for periodic renewal of KYC, as directed by RBI.

- When there’s a change in a company’s UBOs (Ultimate Beneficial Owners).

- When company policy requires customers’ full disclosure.

So yes, you’ll need to go through the KYC process if you’re considering having a new credit card to buy whatever showstopper is on your bucket list.

How is KYC done?

According to the directive by RBI, KYC policy has 4 key elements that pillar it sturdily. These are namely:

- Customer Acceptance Policy

- Risk Management

- Customer Identification Procedures (CIP)

- Monitoring of Financial Transactions

Customer Acceptance Policy

CAP, or customer acceptance policy, directs all financial institutions to accept customers and begin a relationship after verifying their identity through proper diligence.

According to CAP, a customer can open a new account and initiate financial transactions only after proper verification and without discrepancies in the customer’s documents and information.

In addition, note that the account cannot be anonymous or under a fictitious name, e.g., a benami name. Above all, the RBI explicitly mentions that CAP cannot be used to deny financial assistance to any public member, especially the economically disadvantaged.

Risk Management

Risk Management forms an essential element of KYC, which aims to understand customers’ nature before a bank begins and nurtures an account relationship with them. Banks also face rising threats from identity document forgery, which makes strong KYC risk management practices even more critical.

According to this policy, a FI must segment its customers into three categories based on risk assessment: low, medium, and high.

This assessment considers customers’ socio-economic background, financial status, income, the nature of the business, and location.

Customer Identification Procedures (CIP)

Customer Identification Procedures or Customer Identification Programs identify customers and verify their legal status using reliable sources such as national documents like PAN, Aadhaar, Passport, etc. It is only after CIP that a financial institution can:

- Begin an account relationship with the customer.

- Facilitate any international money transfer with someone who isn’t an institution account holder.

If an individual acts on behalf of another(or an entity), the bank would also require due diligence & verification.

Monitoring of Financial Transactions

Financial institutions monitor transactions or ongoing due Diligence to ensure that a customer’s transactions are as per the information they’ve furnished for CIP and have no discrepancies. As a part of this policy, a bank monitors the following types of transactions intently:

- Large transactions that are unusual in nature, high-volume RTGS, or any complex transaction that doesn’t fall within the expected activity spectrum of a customer.

- Transactions that travel across the threshold are subscribed to an account.

- Account turnover is unusually high compared to the balance maintained by the holder.

- Deposits are made by third parties as cheques or drafts, which are immediately followed by a mass withdrawal.

The extent to which a Financial Institution monitors transactions depends on the risk category of an account or customer.

What are the essentials required for KYC?

Once an individual declares their identity, the same has to be verified with reliable documents. Here are some required documents for your KYC process. We can broadly classify them as:

- Proof of Identity

- Address Proof

Identity Proof Documents

The documents required for Proof of Identity would mainly consist of any legal identification document issued by the central or state government, which has the individual’s photo. Some of them include:

- PAN card

- UID(Unique Identification Number) includes your Passport, Aadhaar card, driving license, or voter’s ID.

- ID cards issued by affiliated educational institutions.

- Members-only ID card issued by Bar Council.

- ID cards issued by Professional Bodies such as ICAI, ICSI, ICWAI.

Documents for Address Proof

To produce the Proof of address, you can make use of the following documents:

- Passport

- Voters ID card

- The lease agreement of the residence or registration document.

- Copy of the insurance made for residence.

- Maintenance or utility bills such as telephone(landline), electricity, gas, etc. Do keep in mind that these bills can’t be more than 3 months old.

- Bank statements and passbooks, which, again, aren’t more than 3 months old.

In addition, you can also use proof of residence documents issued by the Government or authority, Multinational Foreign Banks, Scheduled cooperative banks, Gazetted officers, Notaries public, Parliament, or elected members of the Legislative Assembly.

What Are The Different Types of KYC?

KYC has evolved from its paper form and is as tech-savvy as a baby boomer dabbling with the latest smartphone. From the KYC Process to KYC regulations, we have gone through beats of changes to reach a place where you don’t have to visit the bank (or whichever financial institution) each time there’s a need for verification.

Ergo, there are two types of Know your client:

- Online KYC

- Offline KYC

- Video KYC

Online KYC

Online KYC or Aadhaar-based KYC allows you to complete the verification process online using your Aadhaar card number or a national ID like PAN. The type of document accepted may vary depending on the business and the regulator by which it is governed.

NOTE: A credit limit amount might be involved when you carry out online KYC. For instance, deposits in mutual funds cannot be more than Rs. 50,000.

Using your Aadhaar card, there are again two ways to go about it:

1. Aadhaar OTP

2. Aadhaar Biometrics

The aadhaar OTP method is reasonably straightforward and can be done in minutes using your registered phone number. However, this is not categorized as a full KYC, and banks have to adopt offline modes such as Aadhaar Biometrics to complete the process. For non-banks and telcos, the UIDAI recommends Aadhaar Paperless Offline e-KYC.

What are the steps to carry out Aadhaar Paperless Offline e-KYC?

| 1. Visit the UIDAI portal – https://resident.uidai.gov.in/offline-kyc |

| 2. Enter your Aadhaar number along with the Security Code |

| 3. Enter the OTP received on your registered mobile number and set up a numeric password to download the XML file |

| 4. Convert the XML file to a Base 64 String and pass it on to a KYC provider to validate the digital signature |

On the other hand, Aadhaar Biometrics would be completed after a KRA(KYC Registration Agency) executive visits your residence and performs biometric verification.

Offline KYC

While opting for offline KYC, the credit limit gets deleted. However, it may take up to a week for the verification to be completed and approved by KRA.

Here’re the steps to carry out KYC offline:

| 1. Download and fill out the KYC form. You can use NDML, CAMS, NSE, Karvy, or, CVL. |

| 2. Visit a KRA office nearby and submit the location. |

| 3. Be sure to furnish all the supporting documents. |

| 4. Safely store and track your application number to check the verification status. |

Video KYC

Modern problems require even modern solutions. In addition, the verification process is making quite a stir, along with online KYC, which is video KYC. The RBI amended the KYC norms in January 2020 to push customers’ digital onboarding via a video recording.

The below framework covers most of the regulator’s norms & recommendations:

| 1. Customers verify their Aadhaar number using mobile OTP (for banks) or XML download (for non-banks) |

| 2. customers click a live photo of their PAN card in the scheduled video call. The Regulated Entity verifies the PAN card via the underlying government database (NSDL) |

| 3. The Regulated Entity (led by the official) checks the customer’s live location (to ensure they’re in India), matches customers’ face with the respective identity document, and performs their liveliness & identification checks |

| 4. Other regulatory norms include storage and time stamp on the video, security measures, end-to-end encryption, and recommended use of advanced technology, including face match and AI. |

Above all, video KYC will be an important pillar while initiating new account relationships, and it has superior workflows compared to offline Aadhaar verification via a biometric machine.

Banks and financial institutions will save huge costs, as an official will only spend a fraction of the time verifying the authenticity of the video recorded.

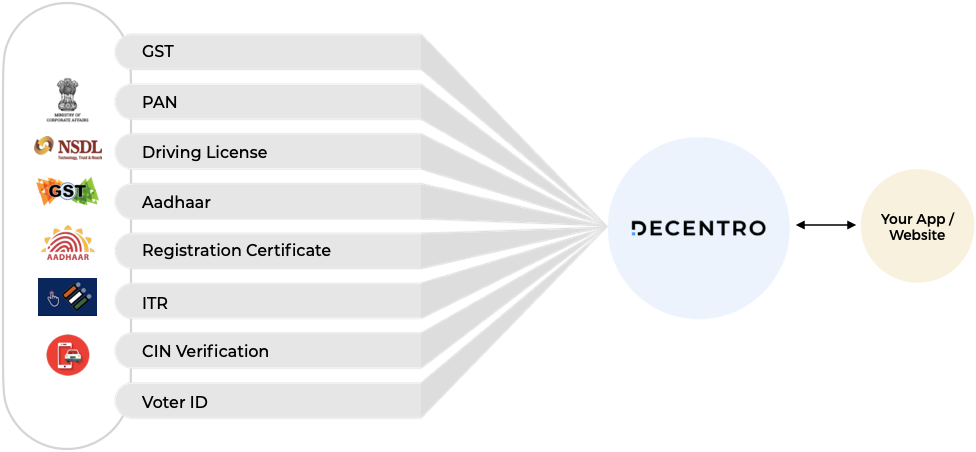

How can Decentro Help your Business?

There is a long queue of customers who value time and a competitive market that can swoop in and snatch your customers away if you falter even a bit.

Need we say more?

We’ve seen the struggle of customers stuck with legacy KYC technologies. Some of the key problems they faced were:

- Slow onboarding processes that are highly fragmented and cumbersome

- Little to no room for customization

- Lengthy documentation that never seems to end and lacklustre tech updates

- Black Swan Events that could halt operations and drown things in the darkness

- The sheer struggle of adhering to compliance & data security, the right way

If you’re facing any of these, maybe it’s time you explored better solutions. Hey, you’re here!

Would you like your KYC API integration done in 2 days instead of an average of 40-60 days, and would you like a fully automated real-time onboarding?

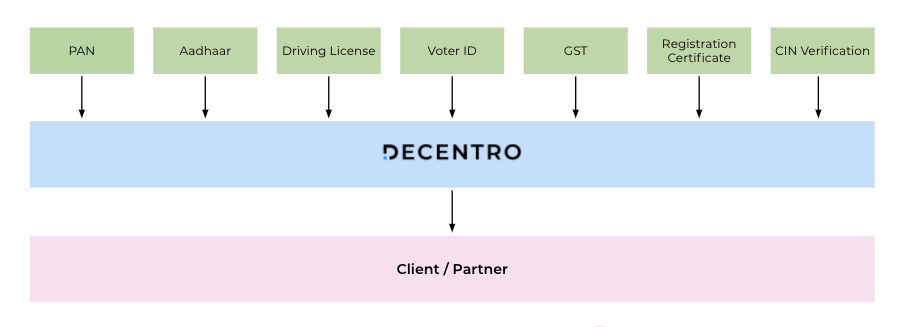

Our single API endpoint eliminates any complexities tied to KYC and customer onboarding and lays out a scalable frictionless and automated system in real time as your business grows.

In just two years, our KYC stack has been churning solid numbers.

With over 400+ Identity validations, 250+ Image recognitions, and 300+ Repository fetches happening via Decentro’s KYC stack per hour, we’re more than equipped to enable your verification and validation journey right from the customer onboarding to even a check-out.

Save a ton of time, reduce a bunch of humdrum, and leave the effort-intensive bit to us. Oh, and don’t worry about compliance and adherence—we’ve got you covered there, too.

If you have any questions, don’t hesitate to message us.

Let’s talk, troubleshoot, and solve. Together! 🙂

Cheers!

P.S. If you wish to participate in this revolution, we’re hiring! Please apply on AngelList to find your next challenge.

References:

Thales Group

Max Life Insurance

Trulioo

Paisa Bazaar