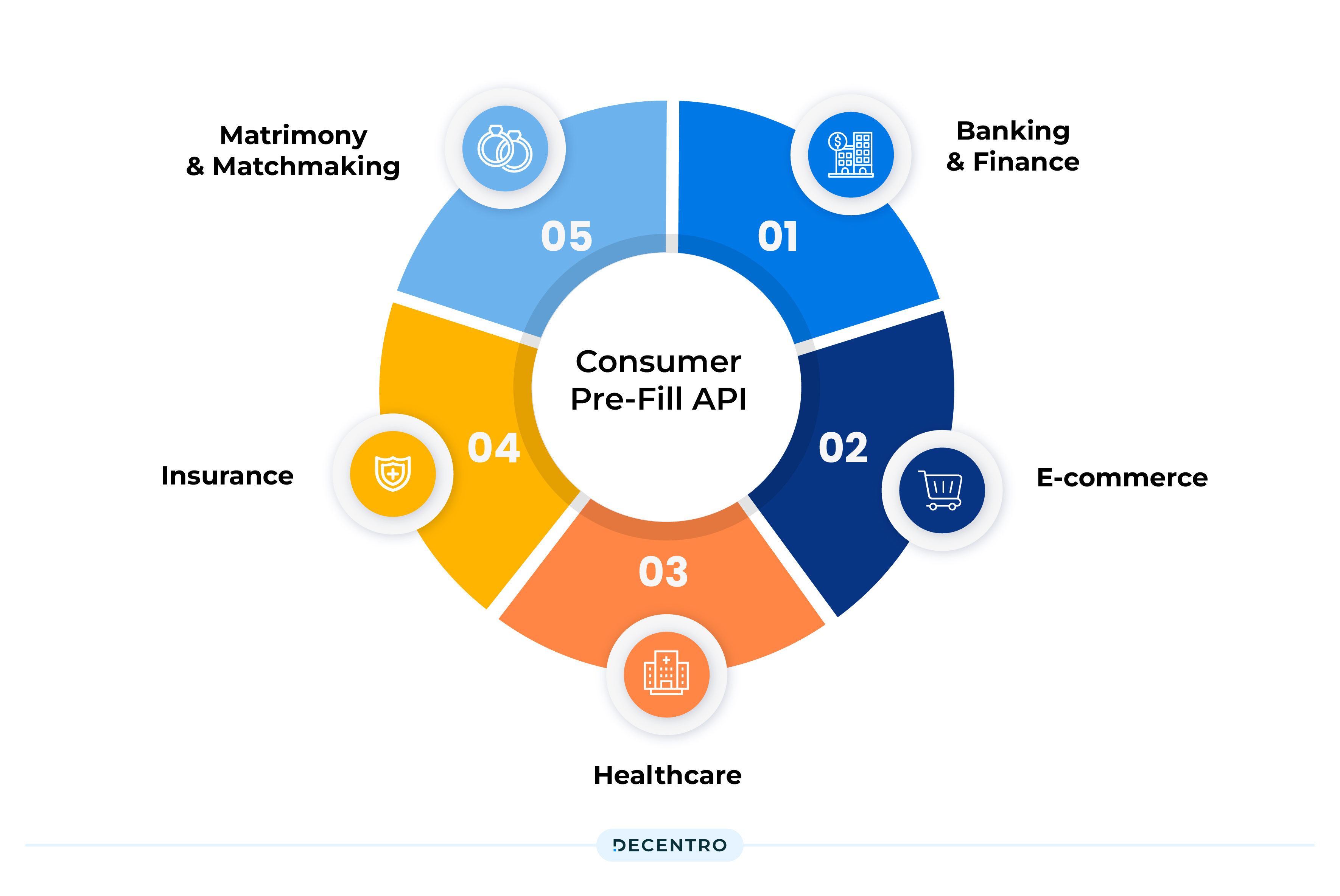

Here’s a deep dive into how Prefill API is transforming onboarding in eCommerce, Finance, Healthcare, Insurance, and Matchmaking.

Revolutionizing Onboarding: 5 Industries Disrupted by Prefill API

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

While the fear of abandoned carts is personal, the fear of abandoned onboarding is very business-centric.

The world is inching towards the minimalist approach, but what about your onboarding process?

The world of consumer onboarding across the industries is pretty maximalist.

8 fields, a check box, and confirmation later, you as a user begin your journey with that particular solution.

In the world of one-tap payments, this seems excessive.

With consumer expectations at an all-time high regarding fast and easy digital experiences, every second and field counts when trying to get new customers to sign up for your services.

Consumers will only abandon application processes if they are not manageable and convenient. Failing consumer engagement and abandonment can seriously threaten organisations and significantly impact their revenues.

As per The Remarketing Report by SalesCycle, the average abandonment rate of carts and user journeys across industries was close to 77%.

However, being a devil’s advocate, we also recognise that companies must protect their “front doors” against account opening fraud and other onboarding scams.

So, where is the sweet spot of simultaneously solving application abandonment and security issues associated with consumer applications?

A Pre-Fill API.

What is a Prefill API?

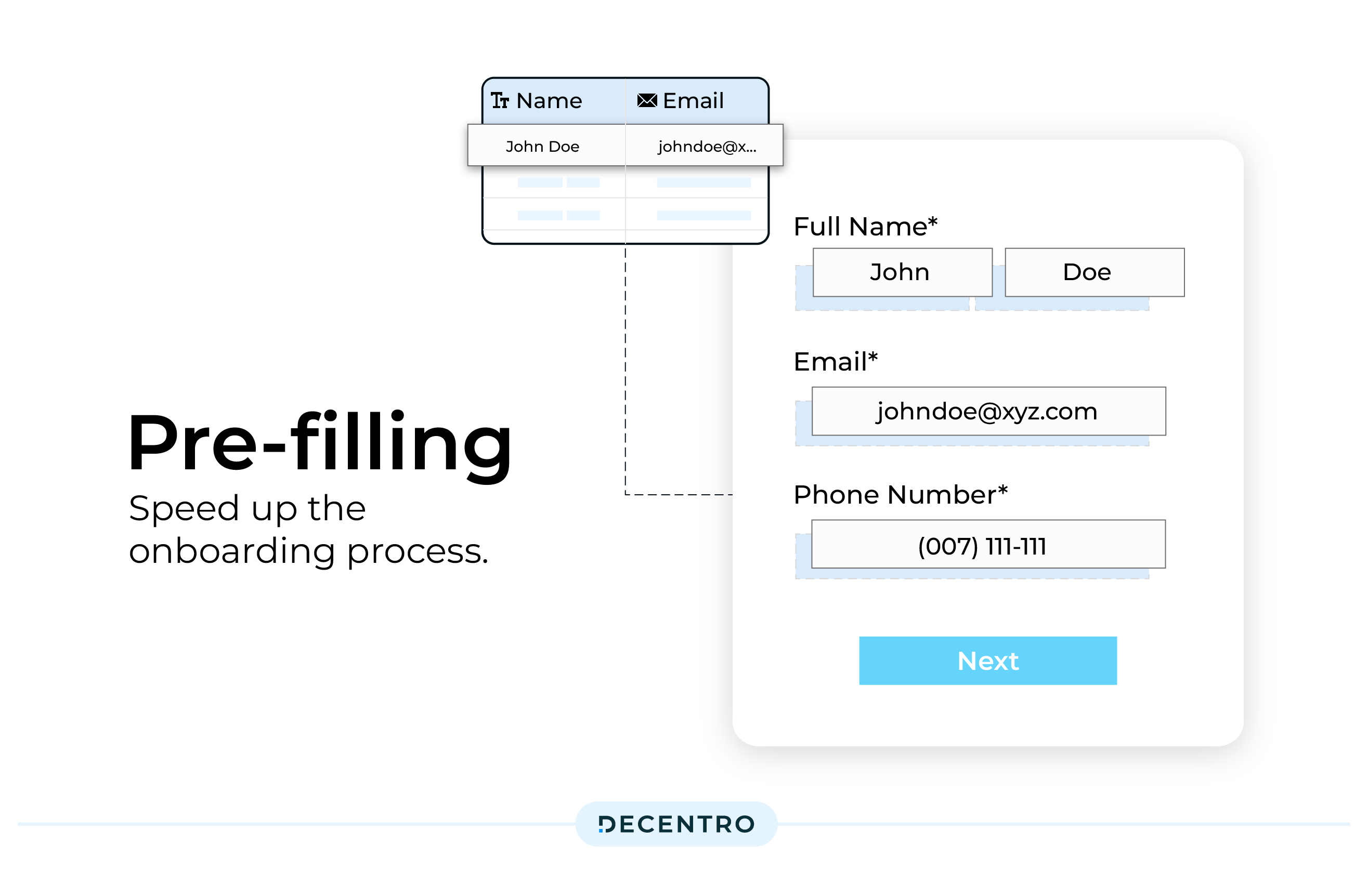

Prefill API is a technology that automatically populates forms and data fields with authenticated and verified data. In addition to reducing the friction in the form-filling process, it mitigates identity fraud and minimises the need for costly manual reviews.

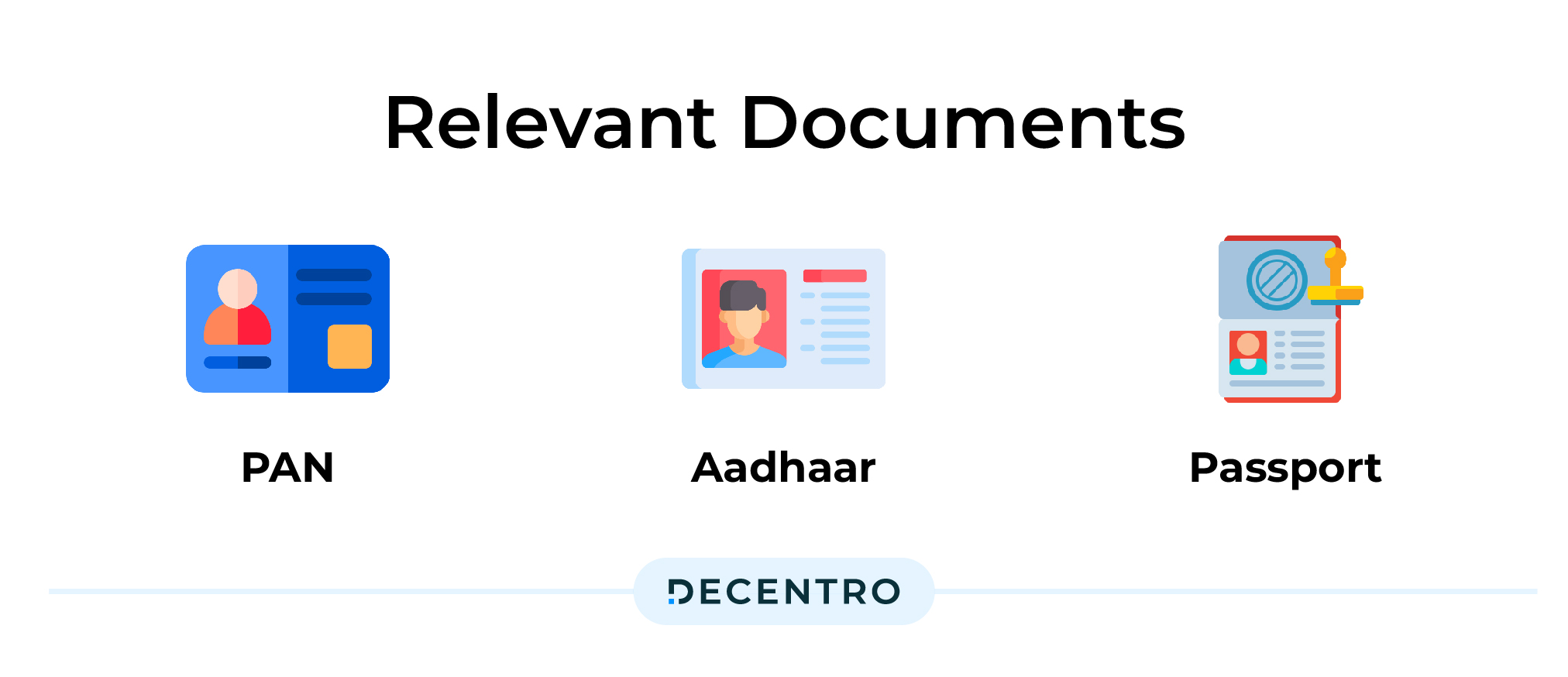

The efficacy of pre-fill hinges on the accuracy of the data being filled. This effective method of validating identity fetches the relevant details such as DOB, Age, ID numbers such as PAN, Aadhaar, Passport, etc., and the address of a user by just using their name and mobile number.

Pre-filled identities can be sourced and verified using Phone-Centric Identity information linked with other data sources strong enough to meet KYC requirements for financial institutions and regulatory requirements for different industries. The result is prefilled data that is highly accurate and privacy-focused, as the consumer is in complete control of prefilling vs. not prefilling.

While efficient onboarding is a sector-agnostic ask, we have created an industry-specific analysis of how this API can impact different industries.

Banking and Finance

If e-commerce is the crowd favourite, banking and finance as an industry is a no-brainer, ripe to be disrupted by a prefill API.

When it comes to financial transactions, inevitably, security becomes an added layer in all transactions. However, in addition to protection from identity takeover, consumers demand a frictionless application service that operates seamlessly and in real-time. Consumers who go through lengthy and cumbersome application-filling tend to abandon the application altogether.

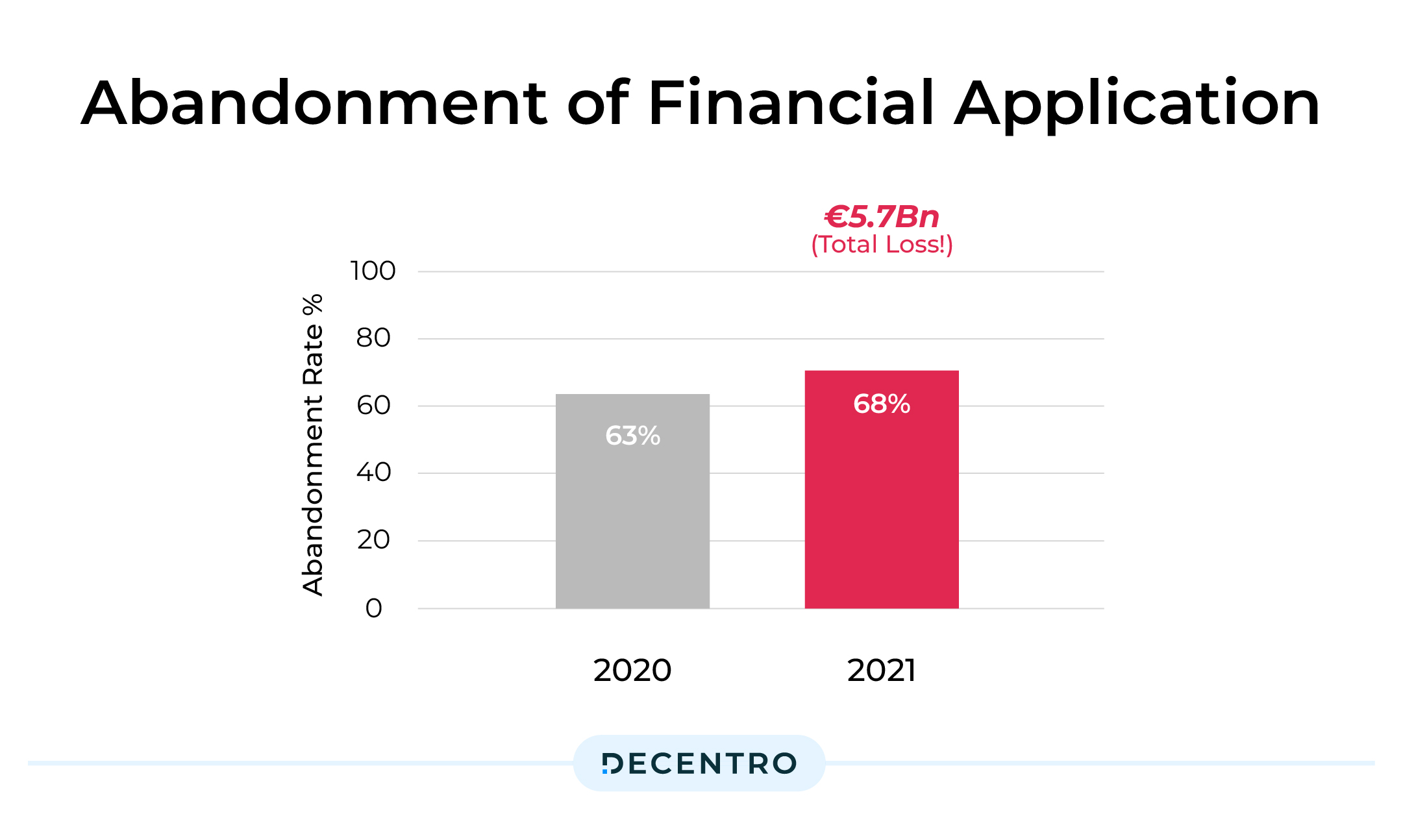

More than half of consumers (68%) abandoned a financial application during the onboarding process in 2021, up from 63% in 2020, research from Signicat claims.

This directly means financial service providers lost an estimated €5.7Bn (!) during onboarding without deploying a simple prefill.

Prefill can redefine customer onboarding and enhance transactional processes in the financial realm. Financial institutions can expedite loan applications, credit assessments, and account openings by seamlessly pulling data from official sources. This accelerates customer journeys and ensures data accuracy and compliance with regulatory requirements.

eCommerce

The crowd favourite of all things bulk and convenience, eCommerce as an industry sits at the top of the list of sectors that can be revolutionised via a prefill API.

Because of cart abandonment, E-commerce stores lose $18 billion in sales revenue annually. An efficient prefill API has the potential to simplify the checkout process by automatically populating shipping and payment details, reducing cart abandonment rates and boosting customer retention.

Prefill also targets a significant subsector of the e-commerce industry – Mobile commerce. With this sub-sector rising, prefill can pose a game-changer for mobile shoppers. Typing on small screens can be cumbersome, but prefill technology transforms the experience by allowing customers to complete transactions, boosting mobile conversion rates swiftly, and, in turn, significantly contributing to the existing revenue model.

There is also the inherent promise of Cross-Device Consistency, where customers interact with e-commerce platforms across multiple devices. Prefill provides a consistent experience by syncing customer data seamlessly, allowing users to start a transaction on one device and finish it on another.

As minute as these details might seem, the cumulative result of the entire piece lands directly in the realm of consumer convenience, making it a solid enough case to be a top priority to your product teams.

Healthcare

According to Internet and Mobile Association of India and Praxis Global Alliance research, India’s health tech sector was valued at US$1.9 billion in 2020. This is set to grow at a CAGR of 39% to touch US$5 billion by 2023 and a staggering US$50 billion by 2033, according to RBSA Advisors.

If we talk about impact, the healthcare industry can benefit on both the administrative and the patient front by an effective prefill API. Patient onboarding is a critical step in healthcare delivery, yet it often involves cumbersome paperwork and redundant data entry. By allowing patients to populate forms with their existing data from secure sources, such as electronic health records and Digilocker, there is a significant reduction of errors caused by manual data entry.

With each patient a healthcare facility treats, a new data set evolves. Managing all this data becomes quite tricky. What’s more difficult is the accessibility of the correct data at the right time. Getting quick access to accurate and updated patient information while making sure that there are no chances of a data breach is something that healthcare centres face every day. From an administrative standpoint, prefill can be a game-changer for the healthcare sector by simplifying patient registration, medical history input, and insurance claim submissions. This accelerates administrative processes, allowing healthcare providers to focus more on patient care.

Insurance

The insurance market has become competitive and more robust over the last few years with the rise of online P2P insurers, technology, and InsurTech players. With automation being the name of the game, the most obvious but often overlooked aspect of automation efficiency can be achieved by deploying a prefill API.

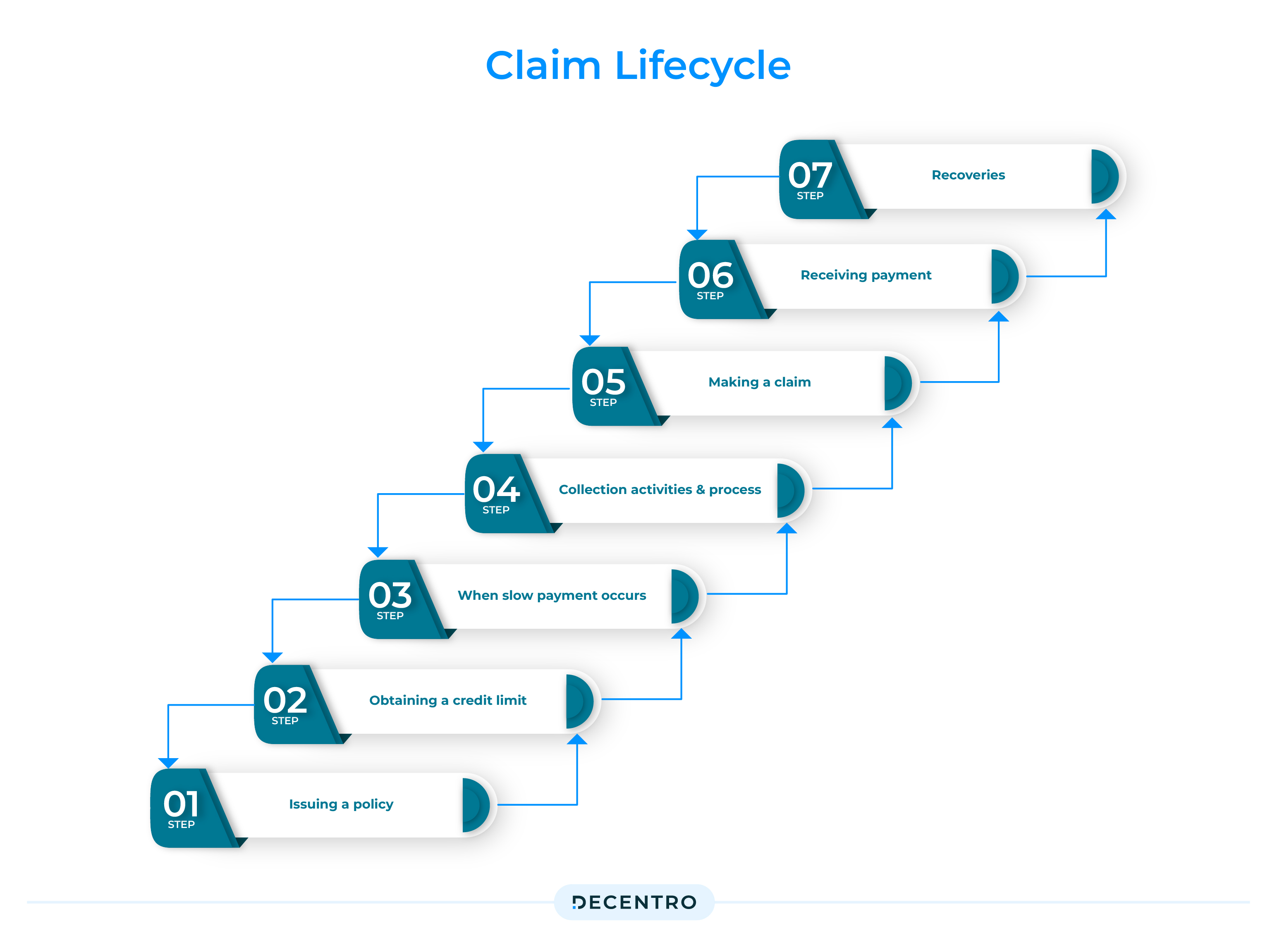

Right from the start, when it comes to the data entry process during policy applications to expediting claims processing, each touch point of the insurance lifecycle can be enabled by prefill API, with data accuracy being the driver for underwriting and claims processing.

Pre-fill ensures that the customer’s information is accurately entered into the system. This reduces the risk of errors arising from manual data entry, such as typographical mistakes or discrepancies in personal details.

Prefill can swiftly populate claims forms with relevant customer information during the claims process. This expedites the claims submission process and reduces the administrative burden on the customer and the insurance provider. Quick and accurate claims processing enhances customer satisfaction, which ultimately has been the overarching theme for any product /business model across the industries.

Matrimony and Matchmaking

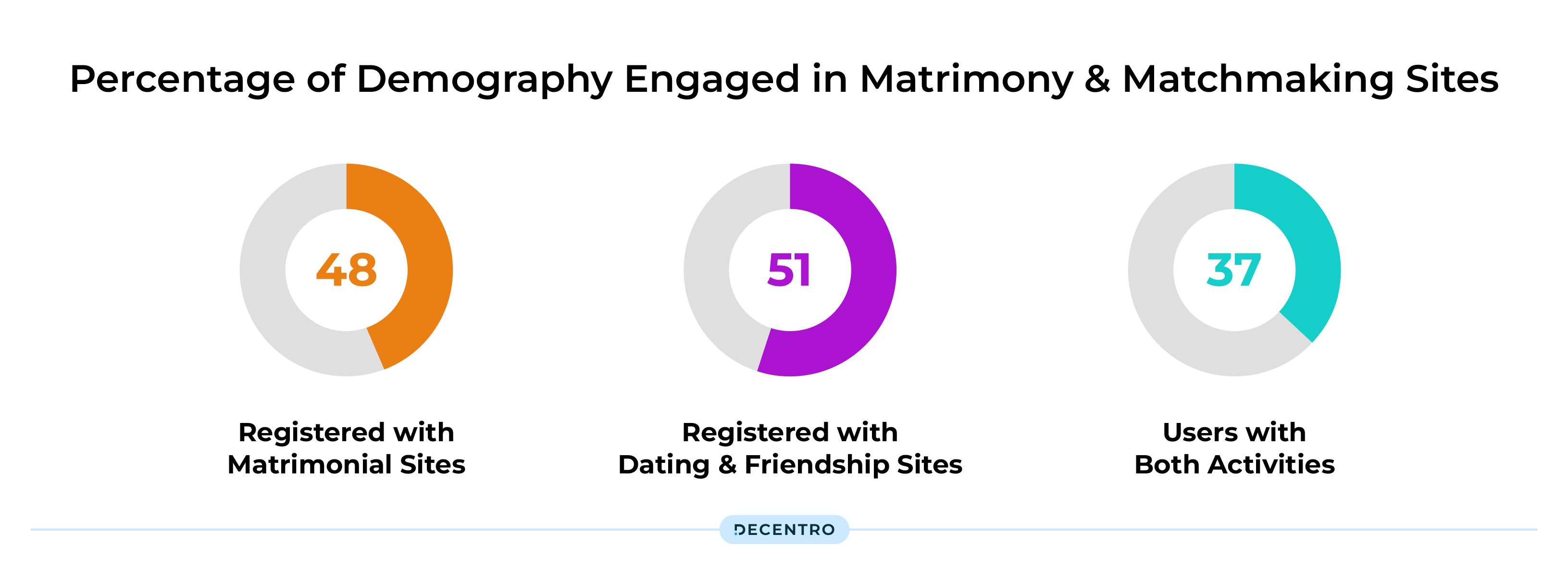

India has some 38.5 million Internet users, and nearly 60 per cent are below 25. Of them, 48 per cent are registered with matrimonial sites, 51 per cent with dating and friendship sites, and 37 per cent of Internet users are into both activities.

Additionally, Online matrimony platform Bharat Matrimony has released its annual ‘online matrimony trends report’ for 2022. Based on the user’s activity on the platform, the report reveals that a staggering 280 million members logged in during 2022 from India and abroad.

In the ever-evolving landscape of matchmaking and matrimonial services, prefill technology has the potential to emerge as a transformative force, reshaping how individuals find their life partners. Pre-fill profoundly disrupts the matrimony industry by seamlessly blending technology with the timeless pursuit of love – from enabling efficient profile creation to mitigating profile fatigue.

Combating the ever-challenging aspect of creating multiple profiles, Pre-fill simplifies this process by automatically populating basic details like name, age, education, and occupation. This encourages more individuals to actively engage and participate, creating a larger and more vibrant pool of profiles. Interestingly, prefill also lays the foundation of solid connections by ensuring the information presented is accurate and up-to-date, reducing the chances of misunderstandings or misrepresentations. This sets a strong foundation for genuine connections.

5 behemoths of industries,

A simple efficiency-driven plug-in API.

Pre-fill holds the potential to be everywhere. If we had to condense the top three takeaways that should drive industries to deploy this for their onboarding journey, it would look like

Improved Customer Experience

Studies show that up to 86% of users will leave a page immediately when required to complete a form. Simply put, online forms are tedious, and users don’t want to spend copious amounts of time filling out forms. Pre-fill saves users time and tempers. Happier users lead to increased quoting completion and conversion.

Increased Quote Completion and Conversions

Essentially, prefill asks users to do less and utilise prefill to increase an onboarding form’s completion and conversion rate significantly. Research by Hubspot found that 3 fields are the optimal number on a form to drive completion and conversion. If you have two fields already prefilled in that scenario, it almost guarantees a successful submission for your use case.

Operational Efficiency

The efficiency gains of prefilled data extend beyond customer-facing processes. With less time spent on manual data entry, teams can reallocate their efforts towards strategic initiatives and high-value tasks, thus optimising resource allocation.

The Decentro Offering – Pre-Fill APIs and Hyperstreams

Efficiency is the season’s demand; we at Decentro understand this better than anyone else.

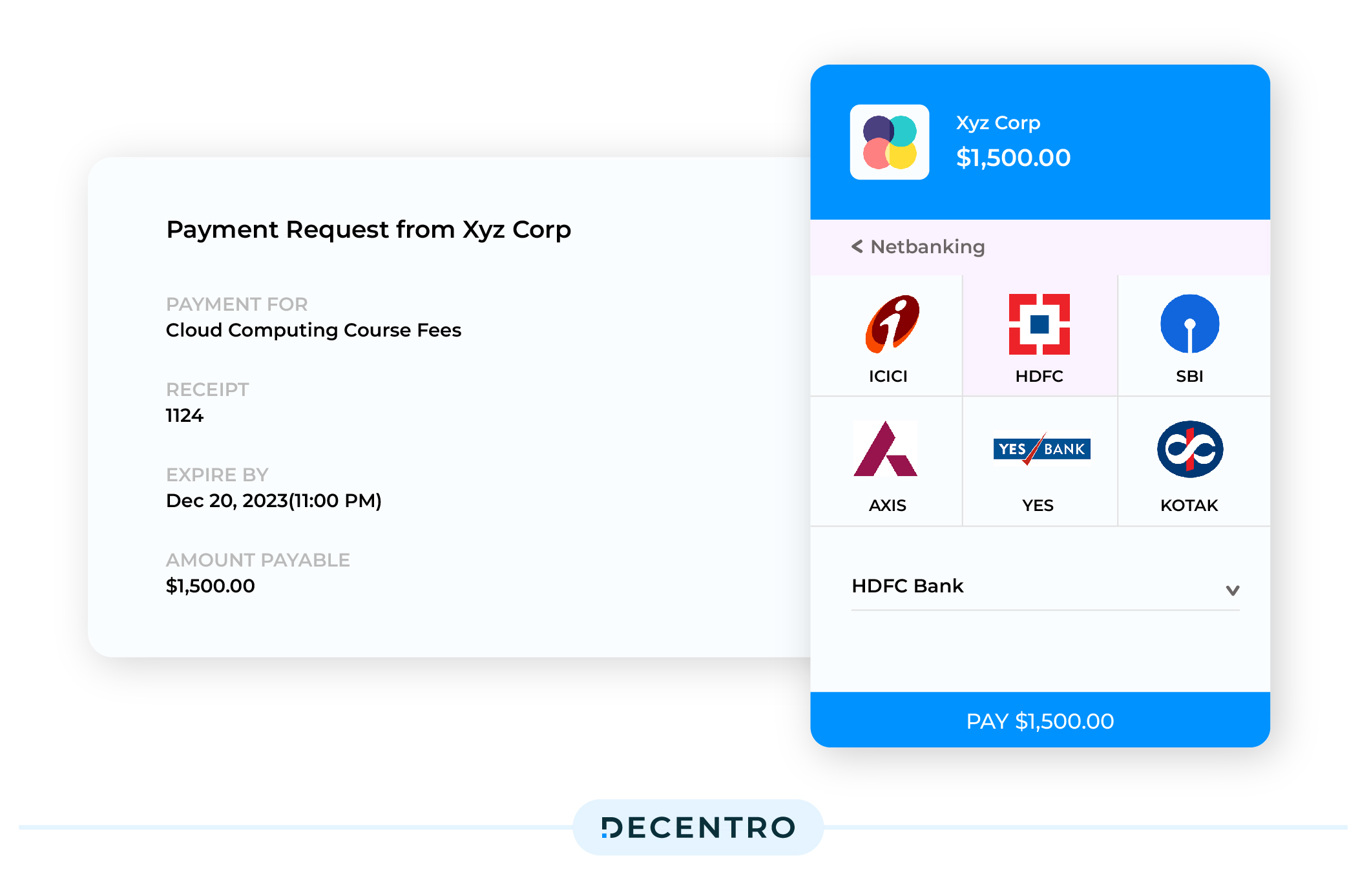

All it takes is our convenient, easy-to-deploy Pre-fill APIs.

Our ask from you?

Your name and phone number.

Do away with the hassle of locating and inputting personal information manually.

Fetch relevant details such as DOB, Age, ID numbers such as PAN, Aadhaar, Passport, etc., and the address of a user by just using their name and mobile number.

This prefill simplifies your user experience by automatically populating fields with accurate and relevant data.

Result? An elevated user experience is driven by a solution that promises:

- Simplifying onboarding by 10X

- Reducing customer acquisition costs by at least 10X

That’s not all.

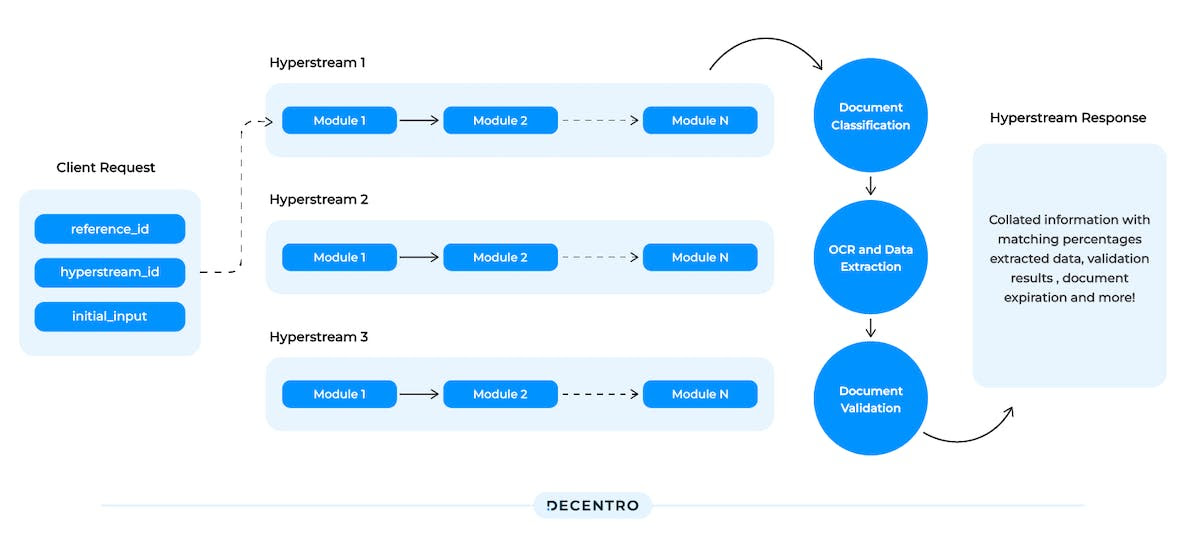

We have also introduced HYPERSTREAMS for CKYC Pre-fill.

The CKYC Pre-fill Hyperstream takes the minimum possible input from the user, i.e., the name and phone number. Following this, the Hyperstream fetches all the documents of the user present in the CKYC Registry.

Curious to know more?