Maximize your savings with top 10 financial apps in India 2025. From investment platforms to cashback apps – find your perfect money-saving app.

11 Best Money Saving Apps in India in 2025: Save & Invest

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

A Quick Glance

| App Name | Key Value Proposition |

| Paytm Money | Zero commission mutual fund investments with seamless Paytm ecosystem integration |

| Groww | Completely free demat account with a beginner-friendly interface for investing |

| Zerodha Coin | Direct mutual fund investments from India’s largest discount broker with zero commission |

| ET Money | Comprehensive financial management combining zero-commission investments with expense tracking |

| Bachatt | Automated daily savings starting from ₹51 via UPI into secure mutual funds |

| CashKaro | India’s largest cashback platform offering rewards on purchases from 1,500+ retailers |

| Gullak | Automated micro-savings through UPI autopay with investment in digital gold |

| Money Manager | Detailed offline expense tracking and budgeting with comprehensive analytics |

| PhonePe | UPI payments with integrated cashback opportunities and financial services ecosystem |

| Jupiter | Digital banking experience with lifetime-free credit card and UPI payment rewards |

| CRED | Premium cashback offers up to 100% for users with excellent credit scores (750+) |

In today’s digital-first economy, managing personal finances has become more accessible than ever. With inflation rising and economic uncertainties looming, Indians are increasingly turning to technology to optimize their savings and investments. The Indian fintech ecosystem has evolved dramatically, offering sophisticated money-saving apps that cater to diverse financial needs – from expense tracking to automated savings and investment management.

According to recent industry reports, India’s top fintech companies include Paytm, Razorpay, PhonePe, CRED, Zerodha, PolicyBazaar, Groww, and Pine Labs, reflecting the robust growth in the digital financial services sector. This comprehensive guide examines the top money-saving apps available in India for 2025, enabling you to make informed decisions about your financial management tools.

Paytm Money

Paytm Money is the investment and wealth management arm of One97 Communications, offering a comprehensive platform for mutual funds, stocks, and digital gold investments. Launched as a separate entity to focus on investment services, Paytm Money has established itself as a significant player in India’s investment ecosystem.

The platform leverages Paytm’s extensive user base and technological infrastructure to provide seamless investment experiences, making it a trusted choice for first-time investors looking to diversify beyond traditional savings accounts.

Pros

- Zero commission on direct mutual fund investments

- Seamless integration with Paytm ecosystem

- User-friendly interface with educational content

- Wide range of investment options including stocks, mutual funds, and digital gold

- Strong customer support and regular app updates

Cons

- Limited advanced charting tools for equity trading

- Paytm Money has only 6,62,797 active customers compared to larger competitors

- Higher demand charges compared to some competitors

- Fewer research tools for advanced investors

Top Features

- Direct mutual fund investments with zero commission

- SIP automation and goal-based planning

- Real-time portfolio tracking

- Tax-saving mutual fund options

- Digital gold investment with flexible buying options

Market Share

Paytm Money is rated 4 out of 5 with a customer base of 6,62,797 active users, positioning it as a growing but smaller player compared to established competitors like Zerodha.

Groww

Groww has emerged as one of India’s fastest-growing investment platforms, making investing accessible to millions of Indians through its user-centric approach. Founded in 2016 by former Flipkart executives, the company has simplified the investment process with its intuitive design and comprehensive educational resources.

The platform’s mission to democratize investing has resonated particularly well with millennial and Gen-Z investors who prefer digital-first experiences, successfully bridging the gap between complex financial products and everyday users.

Pros

- Completely free demat account with zero AMC charges

- Excellent user interface designed for beginners

- Strong educational content and investment guidance

- Wide range of mutual funds and stocks

- Quick account opening process

Cons

- Limited advanced trading features for experienced traders

- Fewer research tools compared to traditional brokers

- Customer service can be slow during high-traffic periods

- Limited commodity and currency trading options

Top Features

- Zero brokerage on mutual fund investments

- Free demat account maintenance

- Goal-based investment planning

- SIP calculator and investment tracking

- Educational content for financial literacy

Market Share

Groww is rated 4 out of 5 and offers multiple plans, including monthly options, establishing itself as a significant player in the discount brokerage space.

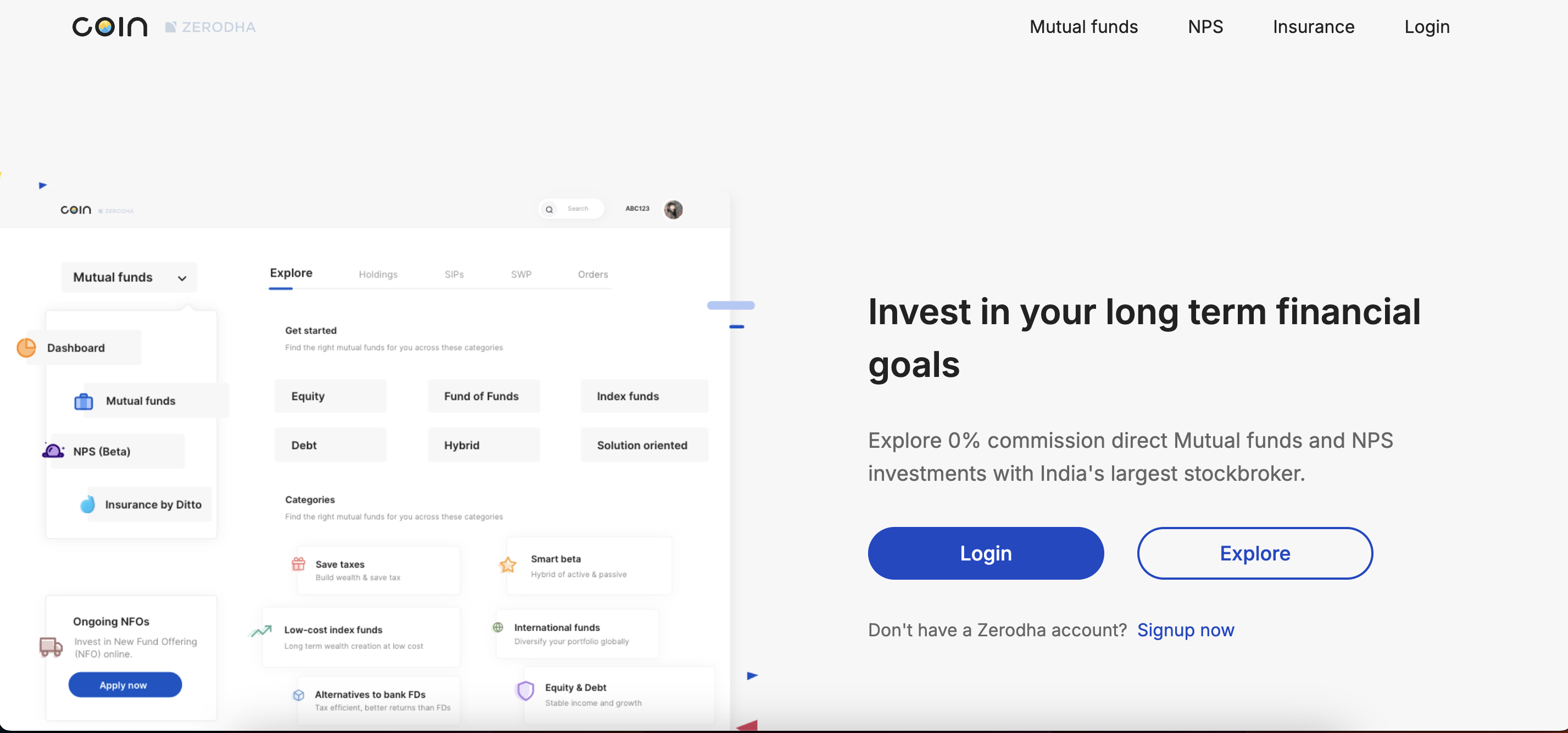

Zerodha Coin

Zerodha Coin is the mutual fund investment platform from Zerodha, India’s largest discount broker, focusing exclusively on direct mutual fund investments to help investors save on commission fees while building long-term wealth. As part of the Zerodha ecosystem, Coin benefits from the company’s decade-long experience in financial services and commitment to investor education.

The platform was designed with a philosophy of keeping costs low and transparency high, representing Zerodha’s focused approach to mutual fund investing with specialized features explicitly tailored for long-term wealth creation.

Pros

- Zero commission on direct mutual fund investments

- Part of India’s largest brokerage ecosystem

- Excellent research and educational resources

- Robust technology infrastructure

- Strong track record and customer trust

Cons

- Annual maintenance charge of ₹300 for a demat account

- No integration with equity trading platform

- Limited to mutual fund investments only

- Separate login required from Zerodha Kite

Top Features

- Direct mutual fund investments with zero commission

- SIP automation and tracking

- Portfolio analysis tools

- Integration with Zerodha ecosystem

- Tax-efficient investment options

Market Share

Zerodha maintains the highest customer base with 79,57,128 active customers and a rating of 4.5 out of 5, making it the market leader in the discount brokerage segment.

ET Money

ET Money, backed by The Economic Times, is a comprehensive financial app offering mutual fund investments, expense tracking, and personalized financial advice. Launched by Bennett Coleman & Co. Ltd (Times Group), the platform leverages decades of financial journalism expertise to provide users with credible market insights.

The platform stands out by offering a holistic approach to personal finance management, integrating investment services with practical money management tools, making it particularly valuable for investors who want to stay informed about market trends while managing their portfolios.

Pros

- Zero commission on mutual fund investments

- Comprehensive expense tracking features

- Personalized financial advice and recommendations

- Strong editorial backing from Economic Times

- All-in-one financial management platform

Cons

- Interface can be overwhelming for beginners

- Limited stock trading options

- Some features require a premium subscription

- Customer support response times can vary

Top Features

- Mutual fund investment with zero commission

- Expense tracking and budgeting tools

- Personalized investment recommendations

- Tax-saving investment options

- Financial news and market insights

Market Share

ET Money is listed among the best personal finance apps in India, though specific market share data is not publicly available.

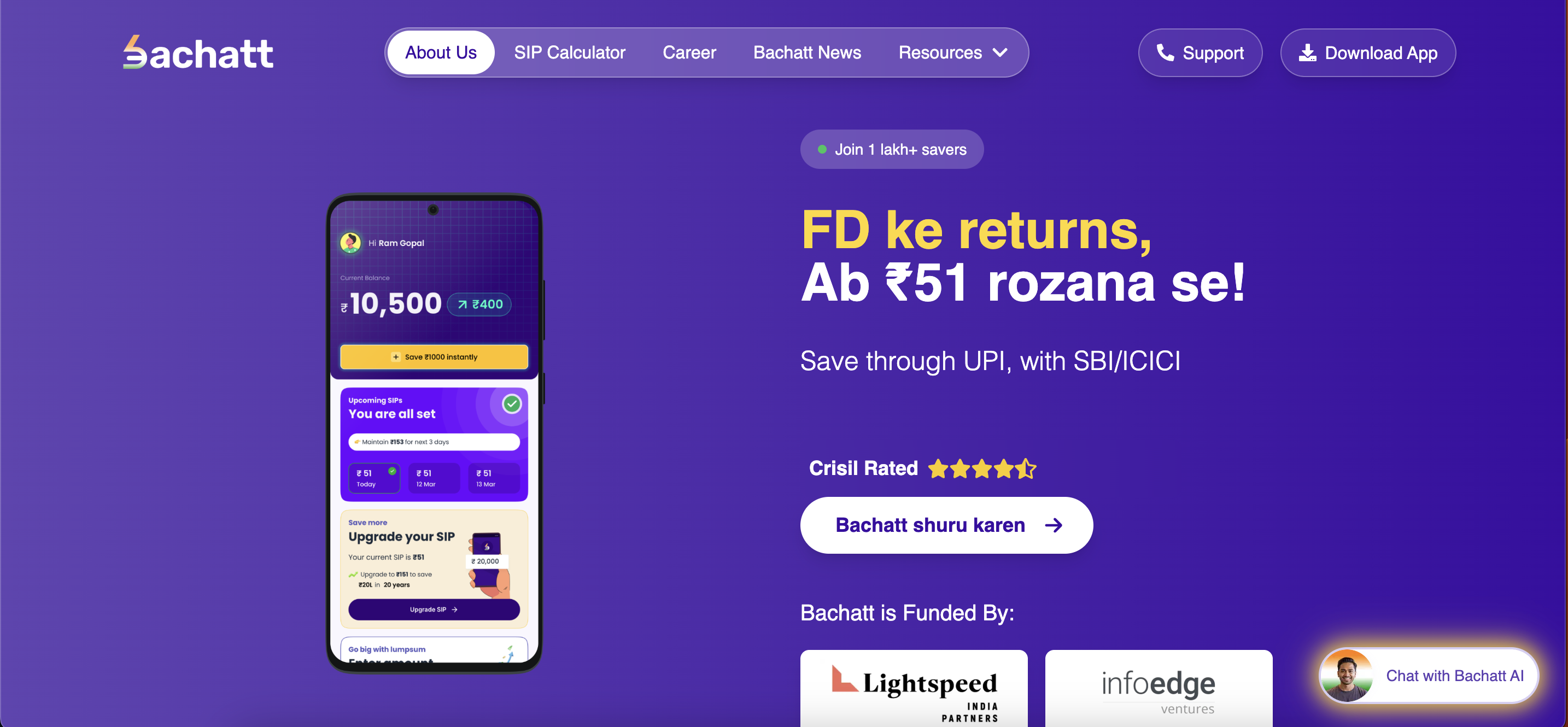

Bachatt

Bachatt is India’s emerging daily savings-led financial services platform, designed specifically to address the financial challenges faced by India’s self-employed population. Founded in November 2024 by Anugrah Jain (ex-Boston Consulting Group partner), Ankur Jhavery (ex-OYO), and Mayank Agarwal (ex-Urban Company), the platform focuses on enabling automated daily savings through UPI for over 30 crore self-employed individuals in India.

The platform operates on an innovative model where users can start saving as little as ₹51 per day through automated UPI transactions into mutual funds managed by SBI and ICICI, helping users build disciplined saving habits while earning Fixed Deposit-like returns without lock-in periods.

Pros

- Automated daily savings starting from just ₹51 via UPI

- No lock-in period with Fixed Deposit-like returns

- Secure investments in stable funds of SBI and ICICI

- Access to loans and credit cards through WhatsApp community

- User-friendly interface designed for financial beginners

- Recently secured $4M seed funding from prominent investors like Lightspeed and Info Edge Ventures

Cons

- Very new platform (launched November 2024) with a limited market track record

- Fixed deposits and loans are currently accessible only through the WhatsApp community, not directly in the app

- Limited to mutual fund investments currently live on the app

- Smaller user base compared to established competitors

- Requires consistent daily saving discipline which may not suit all users

Top Features

- Daily UPI-powered automated savings in mutual funds

- Fixed deposit options through partner network (via WhatsApp)

- Loan and credit card access through the exclusive community

- Investment tracking and portfolio management

- Secure transactions with SBI and ICICI fund partners

- Registered Mutual Fund Distributor (ARN 321640)

Market Share

As a newly launched platform in November 2024, Bachatt is still building its user base. The company has secured $4 million in seed funding and targets India’s massive self-employed segment of 30+ crore individuals who face cash flow challenges due to daily earnings but irregular large expenses. The platform is positioned as a challenger to established players in the savings and investment space.

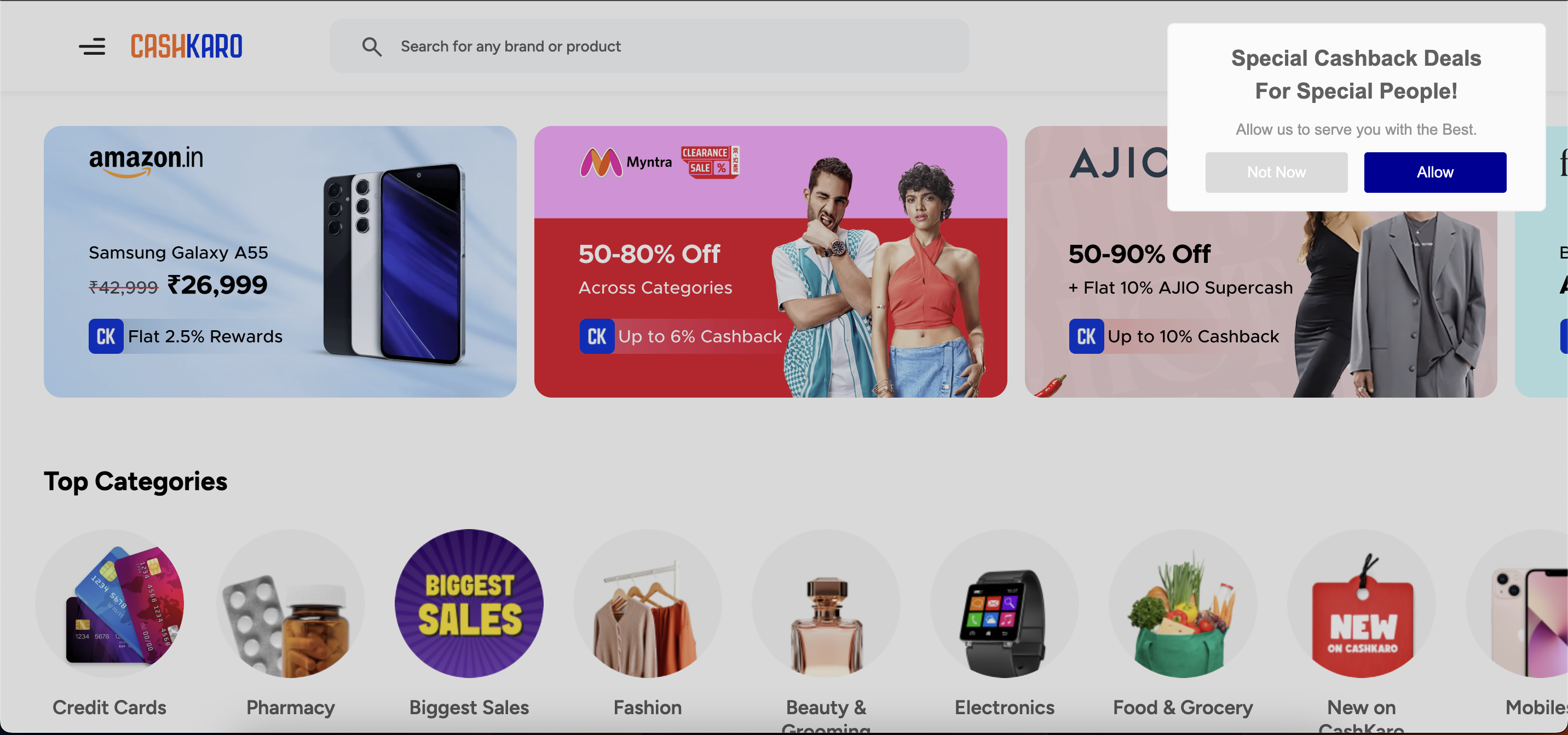

CashKaro

CashKaro is India’s largest cashback and coupon platform, helping users save money on online purchases while earning rewards through partnerships with over 1,500 retailers. Founded in 2013 by Rohan and Swati Bhargava, the platform has revolutionized how Indians approach online shopping by making savings an integral part of the purchase process.

The platform operates on a simple yet effective model where users shop through their app to earn cashback on purchases they would make anyway, effectively reducing overall spending while offering price comparison tools and exclusive deals.

Pros

- CashKaro is the best cashback app in India with the highest cashback rates and a user base of 1 crore+

- Wide network of partner retailers

- Multiple earning opportunities through shopping, referrals, and offers

- User-friendly mobile app and website

- Regular promotional campaigns and bonus offers

Cons

- Cashback processing can take time

- Limited to online shopping savings

- Some offers have minimum purchase requirements

- Cashback rates vary significantly across retailers

Top Features

- Cashback on purchases from 1,500+ retailers

- Price comparison tools

- Coupon codes and promotional offers

- Referral rewards program

- Cashback tracking and payment system

Market Share

CashKaro maintains a regular user base of 1 crore+ users, making it one of the largest cashback platforms in India.

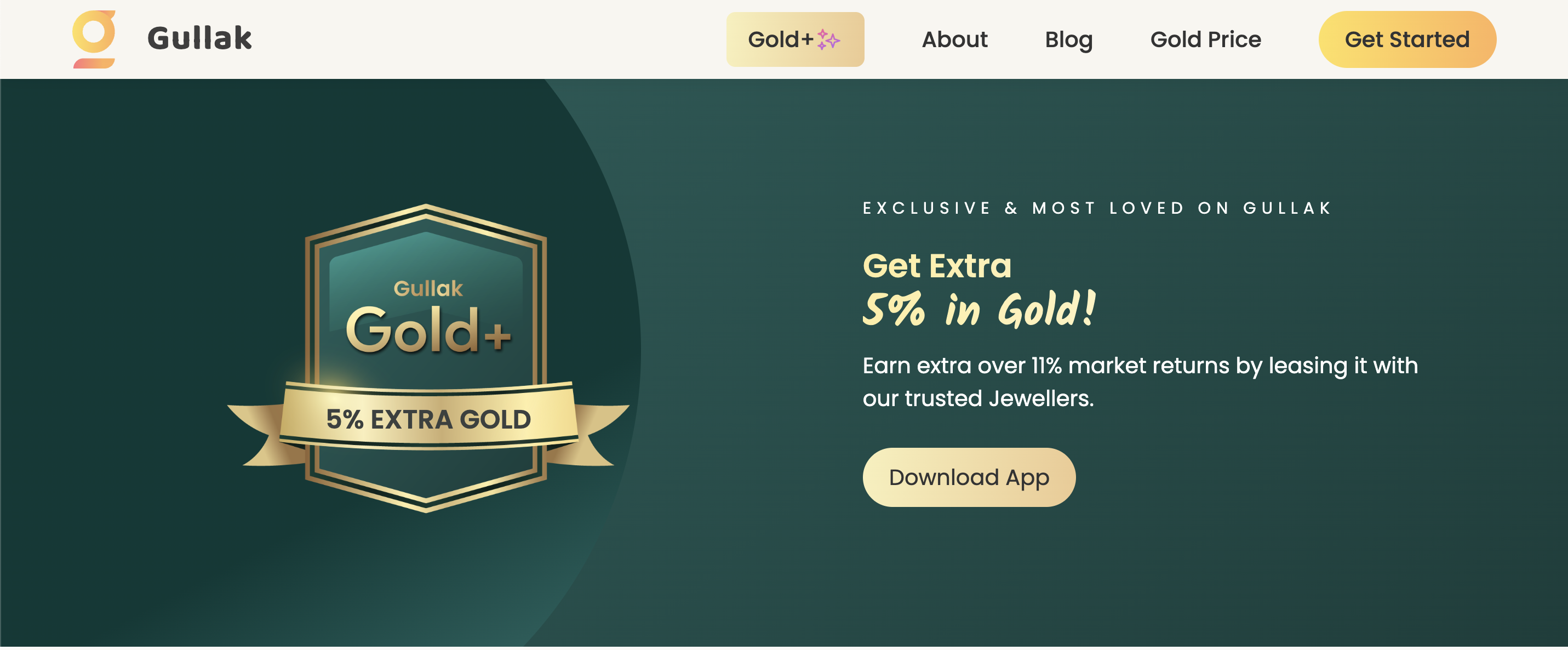

Gullak

Gullak is an innovative savings app that automates the saving process by using UPI autopay to regularly transfer small amounts into wealth-creating investments, starting with digital gold. The platform addresses one of the biggest challenges in personal finance – maintaining consistent saving habits – by automating the entire process.

Gullak’s approach is particularly appealing to young professionals and those new to saving, as it starts with very small amounts and gradually builds wealth without requiring significant lifestyle changes, while providing exposure to precious metals as a hedge against inflation.

Pros

- Automated savings through UPI autopay

- Starts with small amounts, making it accessible

- Invests in digital gold for wealth creation

- Simple and intuitive user interface

- Helps build disciplined saving habits

Cons

- Limited investment options beyond digital gold

- Relatively new platform with smaller user base

- Limited liquidity options for digital gold

- Fewer educational resources compared to larger platforms

Top Features

- Automatic savings via UPI autopay with investment in digital gold

- Wealth creation through precious metal investments

- Flexible saving amounts

- Goal-based saving plans

- Real-time portfolio tracking

Market Share

As a newer entrant, Gullak’s market share is still developing, but it represents the growing trend of automated micro-savings in India.

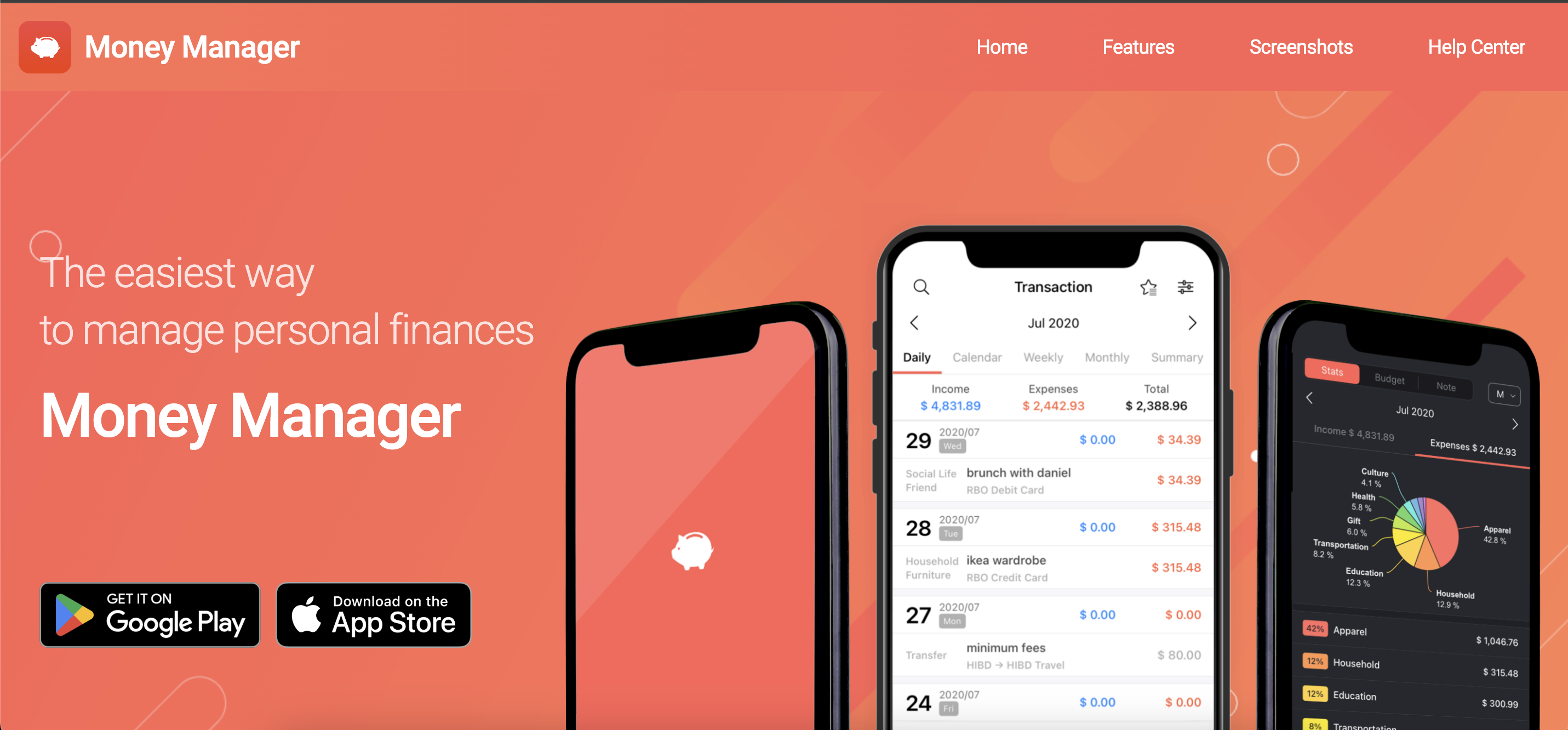

Money Manager (Realbyte)

Money Manager by Realbyte is a comprehensive expense tracking and budgeting app that helps users monitor their spending patterns and achieve financial goals through detailed analytics and reporting. Developed by Realbyte Inc., this app has gained popularity among users who prefer detailed control over their financial tracking.

Unlike many modern apps that focus on automation, Money Manager emphasises user control and customisation, working offline while providing detailed reports that help users identify spending patterns and make informed financial decisions.

Pros

- Detailed expense categorisation and tracking

- Multiple account management

- Graphical representation of spending patterns

- Budget planning and goal-setting features

- Works offline without internet connectivity

Cons

- Steep learning curve for new users

- Interface can feel outdated compared to newer apps

- Limited integration with bank accounts

- Manual data entry required for most transactions

Top Features

- Graphical view of expenditure against budget with asset tracking

- Multi-currency support

- Customizable categories and subcategories

- Recurring transaction management

- Detailed financial reports and analytics

Market Share

Money Manager Expense & Budget by Realbyte is listed among the best personal finance apps in India, though specific user numbers are not publicly disclosed.

PhonePe

While primarily known as a UPI payment platform, PhonePe has expanded into comprehensive financial services, offering savings opportunities through cashback, insurance, and investment products. Owned by Walmart through Flipkart, PhonePe has leveraged its massive user base of over 400 million registered users to create an ecosystem of financial services.

The platform’s strength lies in integrating savings opportunities into everyday transactions, making money-saving a natural part of users’ daily financial activities while ensuring accessibility for users with limited financial knowledge.

Pros

- PhonePe UPI app gives more cashback on money transfers

- Integrated financial services ecosystem

- Wide merchant acceptance network

- Regular cashback offers and promotions

- Strong security features and customer trust

Cons

- Primary focus on payments rather than savings

- Limited advanced investment options

- Cashback offers are often time-limited

- Requires active usage to maximize benefits

Top Features

- UPI payments with cashback opportunities

- Mutual fund investments

- Insurance products

- Bill payments with rewards

- Merchant payment solutions

Market Share

PhonePe is ranked among the top fintech companies in India, with significant market presence in the UPI payment segment.

Jupiter

Jupiter Money is India’s most-loved financial wellness app, trusted by more than 2.8 million Indians, offering a comprehensive digital banking experience with rewards on UPI payments and a lifetime-free credit card. The platform enables users to pay, track, save, and invest from a single app, offering instant cash of up to Rs. 5,00,000. Built as a neobank, Jupiter focuses on delivering a financial experience that keeps pace with modern users’ needs.

Jupiter helps users cut through financial jargons, offers smart insights based on spending patterns, and provides new-age features to make sense of personal finances. The platform’s Edge CSB Bank RuPay Credit Card, available exclusively on Jupiter, comes with no joining or annual fees, making it an attractive option for users looking to maximize rewards while minimizing costs.

Pros

- Lifetime-free credit card with no joining or annual fees

- Rewards on UPI payments and transactions

- Comprehensive digital banking experience

- Smart spending insights and financial tracking

- Instant cash facility up to Rs. 5,00,000

- User-friendly interface designed for financial wellness

Cons

- Relatively newer platform compared to established banks

- Limited physical banking infrastructure

- Dependent on partner bank for core banking services

- Customer service may be slower during peak times

Top Features

- Edge CSB Bank RuPay Credit Card with lifetime free benefits

- UPI payments with cashback rewards

- Smart spending categorisation and insights

- Instant cash facility and overdraft options

- Savings account with competitive interest rates

Market Share

Jupiter is trusted by more than 2.8 million Indians and is positioned as one of the leading neobanking platforms in the country.

CRED

CRED offers up to 100% cashback offers and curated shopping experiences for users while providing enhanced security measures to protect user data. Initially launched as a credit card bill payment platform, CRED has evolved into a comprehensive financial ecosystem targeting affluent users with excellent credit scores. CRED has rolled out new features including CRED Money that helps customers manage and gain deeper insights into their cash flow and bank transactions.

The platform operates on an exclusive membership model, requiring users to have a credit score of 750+ to access its services. This selective approach has created a premium user base that enjoys exclusive deals, cashback offers, and curated experiences across various categories including travel, dining, and shopping.

Pros

- High cashback rates up to 100% on select offers

- Exclusive membership model with premium benefits

- Curated shopping and lifestyle experiences

- Advanced security features and data protection

- Free credit score check feature not offered by many other UPI apps

- Premium customer service experience

Cons

- Exclusive to users with credit score 750+

- Limited accessibility for users with lower credit scores

- Focus primarily on credit card users

- Offers may have complex terms and conditions

Top Features

- Credit card bill payments with rewards

- Up to 100% cashback on curated offers

- Free credit score monitoring

- CRED Money for cash flow management and transaction insights

- Exclusive access to premium deals and experiences

Market Share

While specific user numbers aren’t publicly disclosed, CRED maintains a premium position in the Indian fintech space, focusing on quality over quantity with its high-income user base.

Key Trends in Money-Saving Apps for 2025

The Indian money-saving app landscape is evolving rapidly, with several key trends shaping the market:

Automation and AI Integration: Apps are increasingly using artificial intelligence to automate savings and provide personalized financial advice. This trend makes financial management more accessible to users who may not have extensive financial knowledge.

Micro-Savings and Round-Up Features: Many apps now offer features that save small amounts automatically, such as rounding up purchases to the nearest rupee and saving the difference.

Integrated Financial Ecosystems: Companies are moving beyond single-purpose apps to create comprehensive financial platforms that combine payments, savings, investments, and insurance.

Focus on Financial Literacy: There’s an increased emphasis on educating users about financial planning, with apps providing educational content alongside their core services.

Regulatory Compliance and Security: With increasing regulatory scrutiny, apps are investing heavily in compliance and security features to maintain user trust.

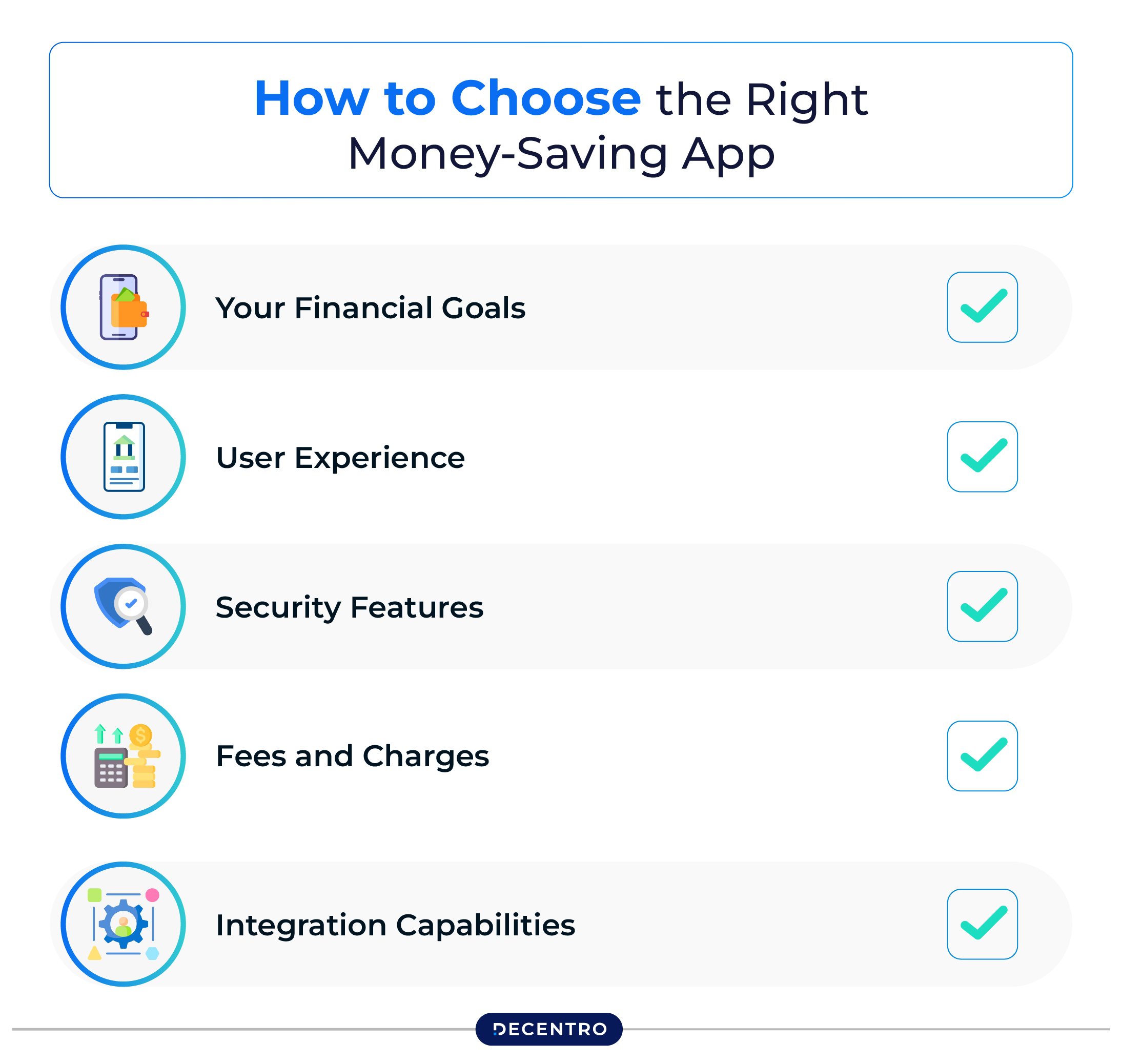

How to Choose the Right Money-Saving App

When selecting a money-saving app, consider these factors:

Your Financial Goals: Different apps cater to different needs – whether you want to track expenses, invest in mutual funds, or earn cashback on purchases.

User Experience: Look for apps with intuitive interfaces and strong customer support.

Security Features: Ensure the app uses robust security measures and is regulated by appropriate financial authorities.

Fees and Charges: Compare fee structures, especially for investment-related services.

Integration Capabilities: Consider how well the app integrates with your existing financial accounts and services.

The Future of Money-Saving Apps in India

The money-saving app ecosystem in India is poised for continued growth, driven by increasing smartphone penetration, digital literacy, and changing consumer behavior. As more Indians embrace digital financial services, we can expect to see further innovation in areas such as:

- Advanced AI-powered financial planning

- Integration with emerging technologies like blockchain

- Enhanced security features using biometric authentication

- Greater focus on sustainable and ESG investing options

- Improved interoperability between different financial platforms

Powering the Future of Financial Technology

As the Indian fintech ecosystem continues to evolve, the infrastructure supporting these innovative money-saving apps becomes increasingly critical. Modern financial applications require robust, scalable, and secure backend systems to handle millions of transactions while ensuring seamless user experiences.

This is where infrastructure providers like Decentro play a crucial role in the fintech ecosystem. By offering comprehensive APIs and financial infrastructure solutions, Decentro enables fintech companies to focus on their core product offerings while ensuring reliable, secure, and compliant financial operations.

For businesses looking to enter the money-saving app space or enhance their existing financial services, partnering with established infrastructure providers can significantly accelerate development timelines and ensure regulatory compliance. Whether you’re building expense tracking features, implementing automated savings, or creating investment platforms, having reliable financial infrastructure is essential for success in today’s competitive market.

As we look toward the future of financial technology in India, the combination of innovative user-facing applications and robust underlying infrastructure will continue to drive the democratization of financial services, making smart money management accessible to every Indian.