Discover how AI in banking drives efficiency, reduces costs, enhances compliance, and delivers personalized services to customers globally.

AI in Banking Explained: Benefits, Trends, and Use Cases

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

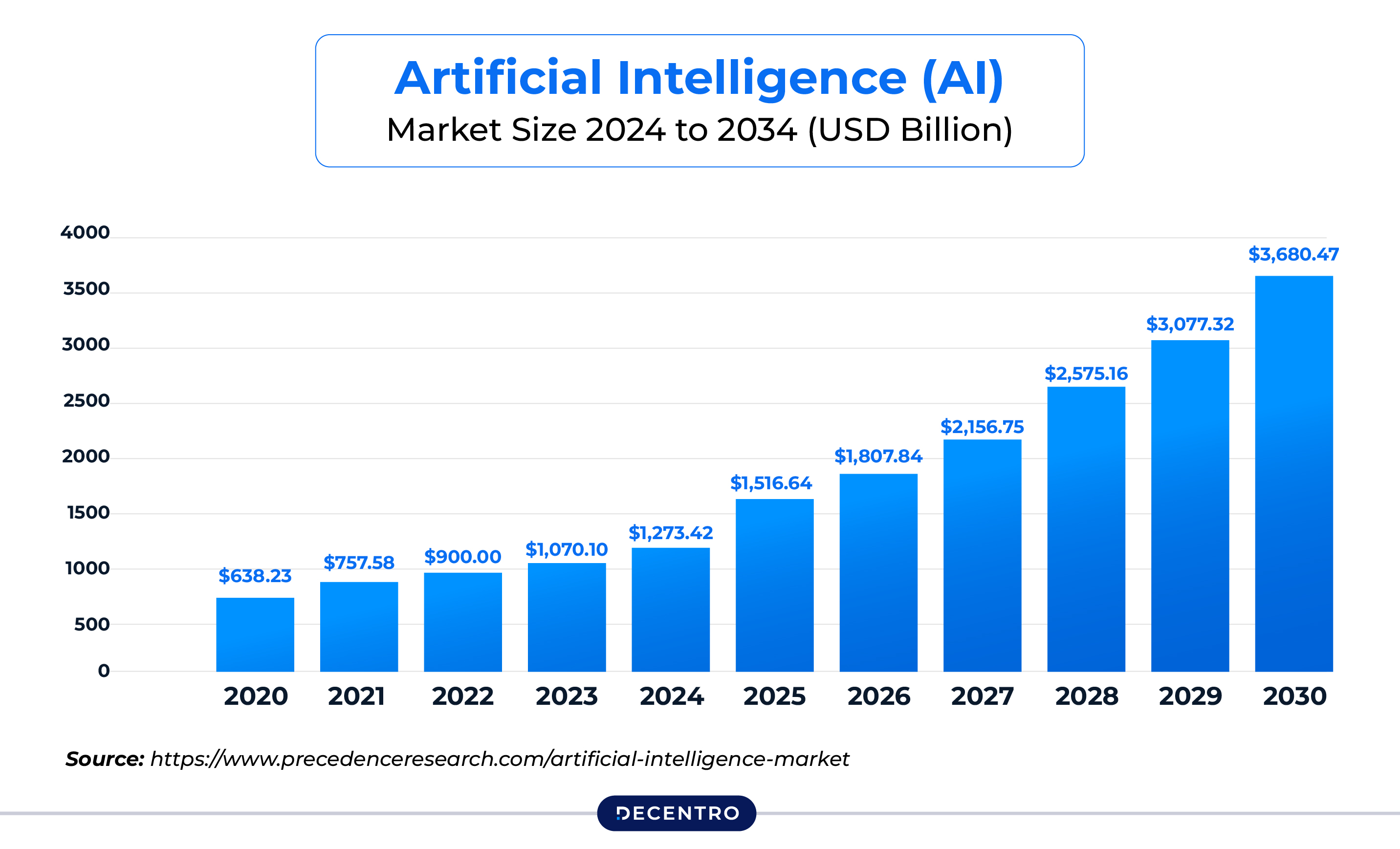

Artificial Intelligence is revolutionising the banking sector, transforming everything from customer service to risk assessment, fraud detection, and regulatory compliance. The global artificial intelligence (AI) market size was USD 638.23 billion in 2024, and is expected to reach around USD 3,680.47 billion by 2034, expanding at a CAGR of 19.20% from 2025 to 2034.

In India, the Reserve Bank of India (RBI) is actively promoting the responsible adoption of AI through its Framework for Responsible and Ethical Enablement of Artificial Intelligence (FREE-AI). The use of AI-related keywords in private sector bank annual reports increased by about sixfold in 2022-23 reports compared to 2015-16 levels, based on a quantitative measure of AI adoption in the Indian banking system using a text-mining approach by RBI staff.

This comprehensive guide examines how AI is transforming banking operations, the regulatory landscape in India, global adoption trends, and practical applications that deliver measurable business value to financial institutions worldwide.

The AI Banking Revolution

Understanding the Shift That’s Reshaping Finance

Imagine walking into a bank today versus ten years ago. The difference isn’t just cosmetic – it’s fundamental. Where tellers once manually processed every transaction and loan officers relied on gut instincts backed by basic credit scores, we now see AI systems that can assess creditworthiness in seconds, detect fraud in real-time, and provide personalized financial advice 24/7.

This isn’t just technological evolution; it’s a complete reimagining of how money moves and decisions are made. The banking industry stands at the precipice of an AI-driven transformation that promises to redefine how financial services are delivered, consumed, and regulated. The numbers tell a compelling story of rapid adoption and unprecedented growth potential.

The Economic Impact of AI in Banking

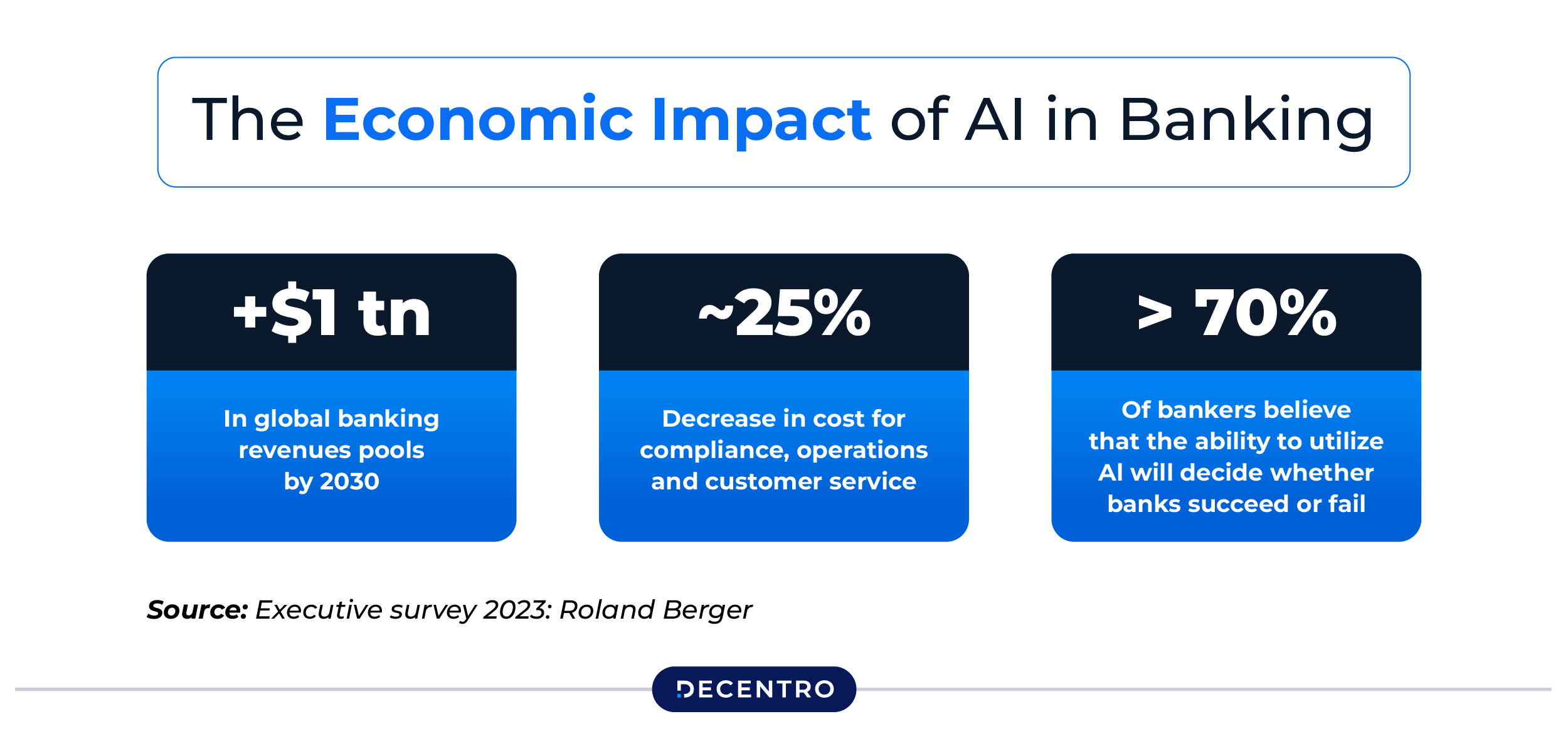

The financial implications of AI adoption in banking continue to exceed expectations. Generative AI could increase operating profits in the U.S. banking sector by an estimated $340 billion, representing a massive opportunity for financial institutions that successfully implement AI strategies.

According to banking leaders polled by Roland Berger, AI capabilities could unlock $1 trillion in global banking revenue pools by 2030 – while decreasing costs associated with compliance, operations and customer service by as much as 25%. AI is set to save the banking industry approximately $1 trillion by 2030, driven by automation of routine tasks, enhanced decision-making capabilities, and improved operational efficiency.

The revenue diversification impact is equally significant. Experts estimate that AI will increase fee-based income for banks from about 30% to 40% of total revenues, allowing them to reduce their dependence on net interest income, which is highly sensitive to central bank policies. This shift toward more stable revenue streams represents a fundamental transformation in banking business models.

India’s AI Banking Landscape: RBI’s Progressive Approach

The FREE-AI Framework: A Blueprint for Responsible Innovation

India’s banking sector is undergoing a remarkable transformation driven by the Reserve Bank of India’s proactive regulatory approach, facilitated by AI. The RBI has constituted a committee to develop a Framework for Responsible and Ethical Enablement of Artificial Intelligence (FREE-AI). This initiative highlights the growing need to strike a balance between AI innovation, risk management, and ethical considerations.

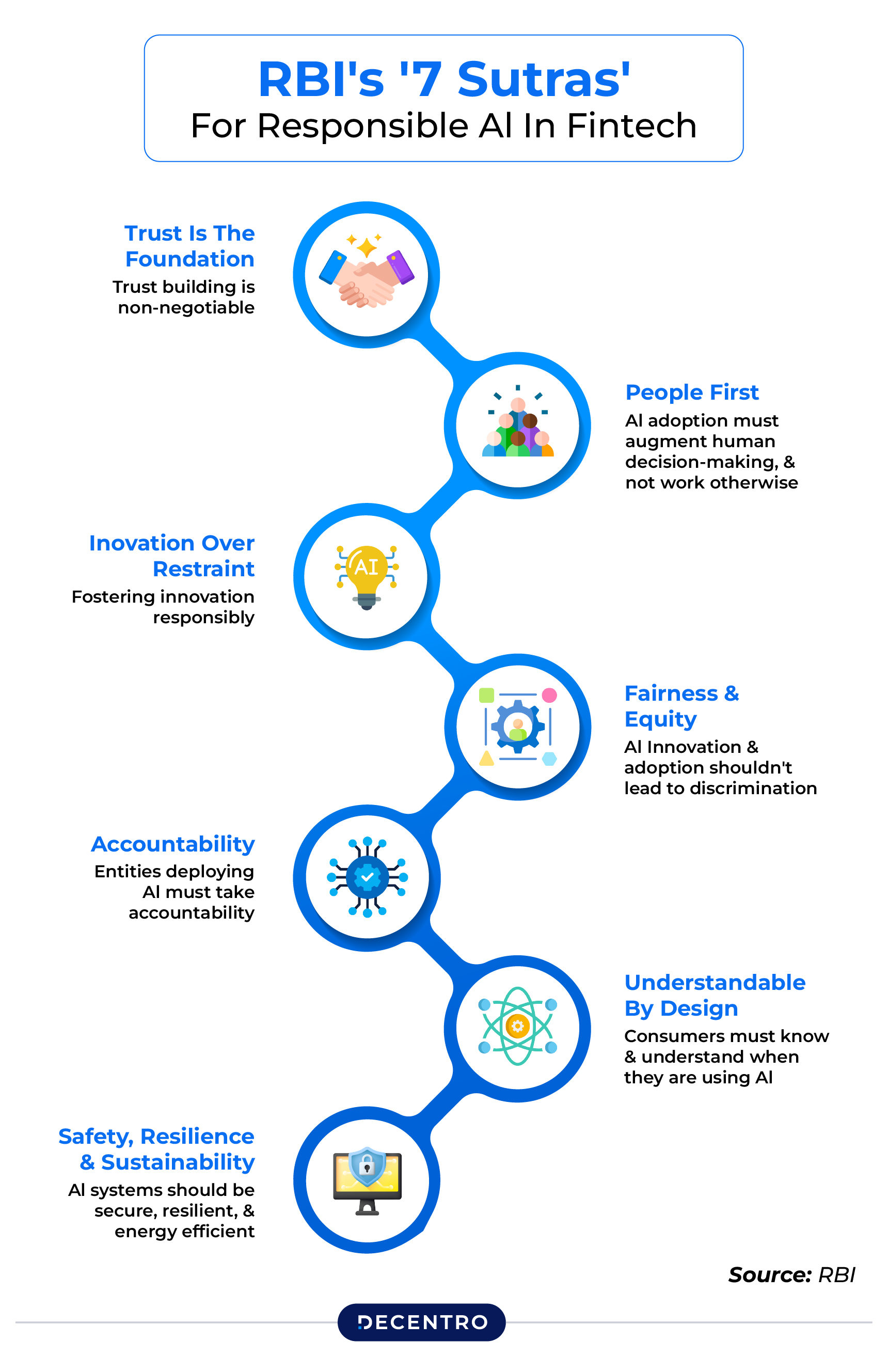

The FREE-AI framework is built on seven guiding principles that form the foundation for responsible AI implementation:

Trust as the Foundation: Trust is the building block, people first, innovation over restraint, fairness and equity, accountability, understandable by design, and safety, resilience and sustainability.

These principles ensure that AI adoption in Indian banking serves the interests of customers while maintaining the integrity and stability of the financial system.

Regulatory Evolution and Supervision

The Reserve Bank of India (RBI) plans to extensively utilise advanced analytics, AI, and ML to analyse its vast database and enhance regulatory supervision of banks and NBFCs. This approach demonstrates the central bank’s commitment to leveraging AI not just for industry guidance but also for enhanced regulatory oversight.

The RBI’s approach to AI regulation is characterised by:

- Proactive Framework Development: Rather than reactive regulation, the RBI is establishing comprehensive guidelines before widespread adoption

- Balanced Innovation: Encouraging technological advancement while ensuring consumer protection and systemic stability

- Collaborative Approach: Working with industry stakeholders to develop practical and implementable guidelines

Global AI Banking Trends and Adoption Patterns

Regional Variations in AI Implementation

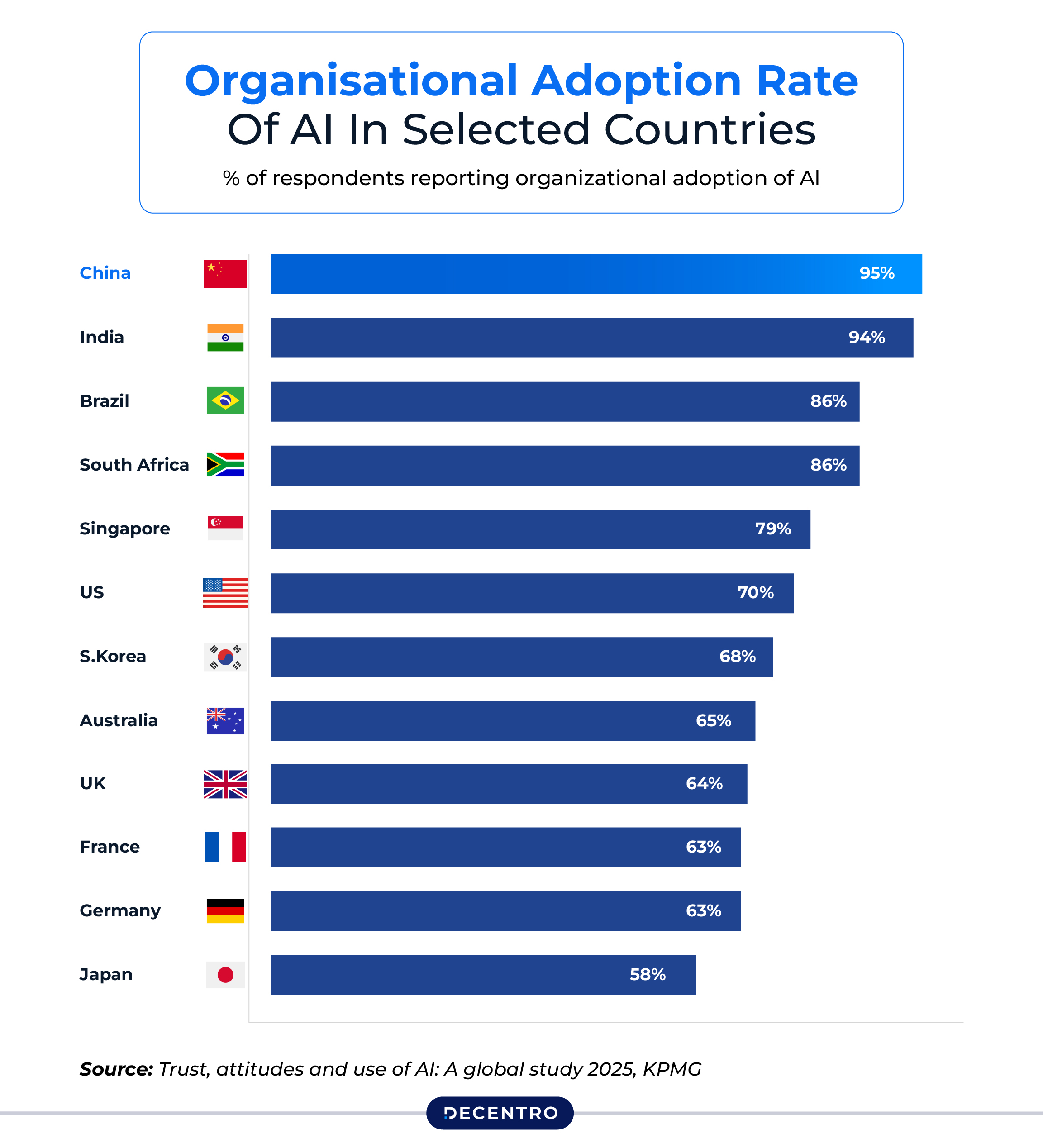

The global banking sector’s AI adoption varies significantly across regions, reflecting different regulatory environments, technological infrastructure, and market maturity levels.

North America: Leading the charge with near-universal adoption across major institutions

Asia-Pacific: Rapid growth driven by countries like India, Singapore, and China

Europe: 86% of banks have integrated AI in at least one operational area, with strong focus on regulatory compliance

Emerging AI Technologies in Banking

Emerging trends include agentic AI for complex tasks, multimodal AI processing multiple data types, and federated learning for privacy-preserving collaboration.

These advanced AI capabilities are enabling banks to:

- Handle complex financial analysis autonomously

- Process diverse data types, including text, images, and voice

- Collaborate on AI models while maintaining data privacy

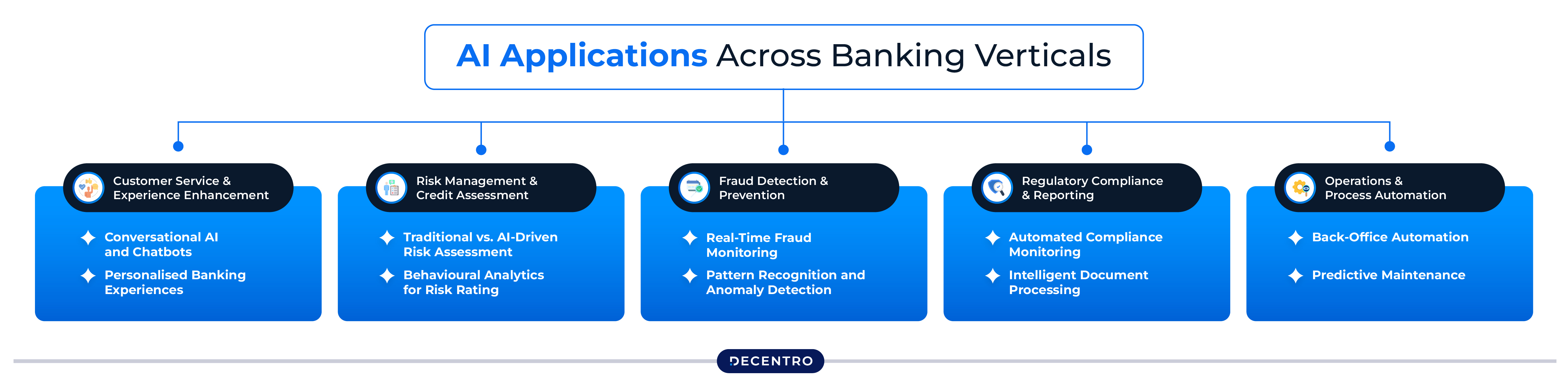

AI Applications Across Banking Verticals

Customer Service and Experience Enhancement

Conversational AI and Chatbots

Modern AI-powered chatbots have evolved far beyond simple rule-based systems. They now provide personalized financial advice, handle complex queries, and can process natural language with remarkable accuracy. By 2025, approximately 30% of customer interactions in banking will be initiated by AI systems rather than by customers themselves, demonstrating the shift toward proactive customer engagement.

Personalised Banking Experiences

AI algorithms analyse customer behaviour patterns, transaction histories, and preferences to deliver highly personalised banking experiences. This includes customised product recommendations, tailored financial planning advice, and personalised user interfaces that adapt to individual customer needs.

Risk Management and Credit Assessment

Traditional vs. AI-Driven Risk Assessment

Traditional credit scoring models rely heavily on historical financial data and credit history. However, AI-powered systems can analyse hundreds of variables, including behavioural patterns, social media activity, spending habits, and even smartphone usage patterns to create more comprehensive risk profiles.

Behavioural Analytics for Risk Rating

Modern AI systems excel at identifying subtle patterns in customer behaviour that may indicate credit risk or potential default. These systems can process:

- Transaction velocity and patterns

- Account management behaviors

- Digital engagement metrics

- Cross-platform financial activities

- Real-time spending analysis

Fraud Detection and Prevention

Real-Time Fraud Monitoring

AI-powered fraud detection systems operate in real-time, analyzing transactions as they occur and flagging suspicious activities within milliseconds. These systems utilise machine learning algorithms that continuously learn from new fraud patterns, thereby becoming increasingly effective over time.

Pattern Recognition and Anomaly Detection

Advanced AI systems can identify subtle anomalies in transaction patterns that would be impossible for human analysts to detect. They consider factors such as:

- Unusual spending patterns

- Geographic inconsistencies

- Device and browser fingerprinting

- Network analysis of related accounts

- Temporal pattern analysis

Regulatory Compliance and Reporting

Automated Compliance Monitoring

AI systems can monitor thousands of transactions simultaneously for regulatory compliance, automatically flagging potential violations of anti-money laundering (AML) and know-your-customer (KYC) requirements.

Intelligent Document Processing

AI-powered document processing systems can extract, validate, and process information from various document types, significantly reducing manual effort in compliance processes while improving accuracy and speed. Alongside these automated pipelines, teams often rely on an accessible AI chat assistant to draft first-pass policy summaries, customer alerts, or training guides in a user-friendly interface.

Operations and Process Automation

Back-Office Automation AI is transforming back-office operations by automating routine tasks such as:

- Account reconciliation

- Report generation

- Data entry and validation

- Loan processing workflows

- Customer onboarding processes

Predictive Maintenance

AI systems help banks maintain their technology infrastructure by predicting system failures, optimising maintenance schedules, and preventing downtime that could disrupt customer services.

The Technology Stack: Building AI-Powered Banking Solutions

| Aspect | AI-Powered Banking | Traditional Banking |

| Decision Making | Machine Learning algorithms analyse vast datasets to make automated, data-driven decisions in real-time | Human-based decision making with manual review processes and rule-based systems |

| Data Processing | Real-time data processing with predictive analytics and pattern recognition across multiple data sources | Batch processing, periodic reports, and historical data analysis with limited real-time capabilities |

| Customer Interaction | Natural Language Processing enables conversational AI, chatbots, and voice assistants for 24/7 support | Human tellers, phone support, and basic online/mobile interfaces with limited hours |

| Document Processing | Computer Vision and NLP automatically extract, verify, and process documents instantly | Manual document review, physical paperwork, and time-intensive verification processes |

| Infrastructure | Cloud-based, scalable architecture with APIs and microservices enabling rapid deployment | Legacy systems, mainframe computers, and monolithic architectures with slower adaptation |

| Fraud Detection | Real-time anomaly detection using behavioural analytics and pattern recognition with 99%+ accuracy | Rule-based systems with manual reviews, higher false positives, and delayed detection |

| Risk Assessment | Continuous risk monitoring with predictive modelling using alternative data sources | Periodic risk assessments based on traditional credit scoring and historical data |

| Customer Service | 24/7 intelligent chatbots, personalised recommendations, and proactive issue resolution | Business hours support, generic responses, and reactive problem-solving |

| Loan Processing | Instant loan approvals with automated underwriting and alternative credit scoring | Days to weeks processing time with extensive paperwork and manual underwriting |

| Personalization | Hyper-personalised products and services based on individual behaviour patterns | One-size-fits-all products with limited customisation options |

| Accessibility | Mobile-first design with voice commands, biometric authentication, and multi-language support | Physical branch dependency with limited digital accessibility options |

| Speed | Instant transactions, real-time insights, and immediate responses to queries | Longer processing times, delayed notifications, and business hours limitations |

| Convenience | Predictive banking, automated savings, and intelligent financial advice are available anytime | Manual account management and scheduled appointments are required |

| Security | Multi-layered biometric authentication, behavioural analysis, and continuous monitoring | Traditional passwords, PINs, and periodic security checks |

| Financial Insights | AI-powered spending analysis, budgeting recommendations, and investment advice | Basic transaction history and generic financial statements |

| Cost Structure | Lower operational costs through automation, reduced manual labour, and efficient resource allocation | Higher operational costs due to physical infrastructure, manual processes, and a larger workforce |

| Scalability | Highly scalable digital infrastructure that can handle millions of customers simultaneously | Limited scalability requiring physical expansion and proportional staff increases |

| Compliance | Automated regulatory reporting, real-time compliance monitoring, and intelligent audit trails | Manual compliance processes, periodic audits, and paper-based documentation |

| Innovation Speed | Rapid deployment of new features through agile development and continuous integration | Slow innovation cycles due to legacy system constraints and regulatory approval processes |

| Data Utilization | Advanced analytics on structured and unstructured data for strategic insights | Limited data analysis capabilities with a focus on basic reporting |

| Credit Risk | Dynamic risk scoring with alternative data sources and real-time portfolio monitoring | Static credit scores based on traditional metrics with periodic reviews |

| Market Risk | Predictive modelling for market volatility with automated hedging strategies | Historical analysis and manual risk assessment with limited predictive capabilities |

| Operational Risk | Continuous monitoring with predictive maintenance and automated incident response | Reactive approach to operational issues with manual monitoring systems |

| Regulatory Risk | AI-powered compliance monitoring with automatic regulatory updates | Manual compliance tracking with a higher risk of regulatory oversights |

| Adaptability | Highly adaptable to changing market conditions and customer preferences through machine learning | Slow adaptation requires significant infrastructure and process changes |

| Technology Integration | Seamless integration with emerging technologies like blockchain, IoT, and quantum computing | Challenges in integrating new technologies with legacy systems |

| Competitive Advantage | Continuous learning and improvement create sustainable competitive advantages | Diminishing competitive advantages as digital transformation becomes essential |

| Customer Expectations | Meets evolving digital-native customer expectations for instant, intelligent services | Struggles to meet modern customer expectations for digital-first experiences |

| Initial Investment | High upfront costs for AI infrastructure, talent acquisition, and system integration | Lower initial costs but higher long-term operational expenses |

| Talent Requirements | Need for specialised AI/ML talent, data scientists, and digital transformation experts | Traditional banking expertise with a gradual need for digital skills |

| Regulatory Compliance | Complex AI governance requirements and explainability standards | Established regulatory frameworks with clear compliance paths |

| Customer Trust | Building trust in AI-driven decisions and data privacy concerns | Established trust relationships but potential loss to more innovative competitors |

Core AI Technologies in Banking

Machine Learning and Deep Learning: These technologies form the backbone of most AI applications in banking, enabling systems to learn from data and improve their performance over time without explicit programming.

Natural Language Processing (NLP): NLP enables banks to analyze customer communications, process unstructured documents, and provide conversational interfaces that feel natural and intuitive.

Computer Vision: Used for document verification, biometric authentication, and analyzing visual data for fraud detection and compliance purposes.

Predictive Analytics: Helps banks forecast customer behavior, market trends, and potential risks, enabling proactive decision-making and strategic planning.

Data Infrastructure and Management

Data Quality and Governance

Successful AI implementation requires high-quality, well-governed data. Banks are investing heavily in data infrastructure to ensure their AI systems have access to clean, relevant, and timely data.

Real-Time Data Processing

Modern banking AI systems require real-time data processing capabilities to provide instant insights and responses, particularly for fraud detection and customer service applications.

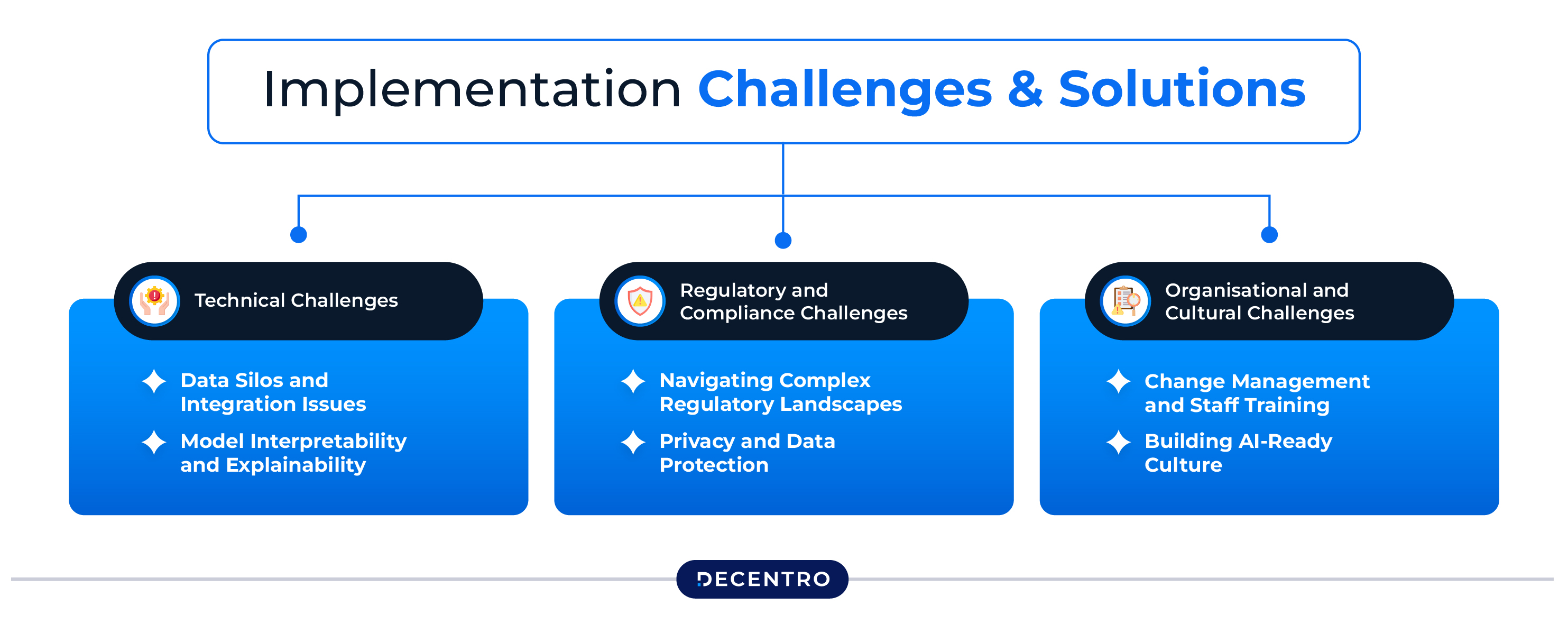

Implementation Challenges and Solutions

Technical Challenges

Data Silos and Integration Issues: Many banks struggle with legacy systems and data silos that prevent effective AI implementation. The solution involves gradual system modernisation and the development of data integration platforms that can connect disparate systems.

Model Interpretability and Explainability: Regulatory requirements and customer trust demand that AI systems provide clear explanations for their decisions, particularly in credit assessment and fraud detection applications.

Regulatory and Compliance Challenges

Navigating Complex Regulatory Landscapes: Banks must ensure their AI systems comply with various regulations while maintaining innovation momentum. This requires close collaboration with regulators and the development of governance frameworks that can adapt to evolving requirements.

Privacy and Data Protection: AI systems must process customer data responsibly, ensuring compliance with data protection regulations while providing valuable insights and services.

Organisational and Cultural Challenges

Change Management and Staff Training: Successful AI implementation requires significant organisational change, including staff retraining and the development of new workflows that effectively integrate AI capabilities.

Building AI-Ready Culture: Organisations must foster a culture that embraces AI as a tool for enhancement rather than replacement, encouraging collaboration between human employees and AI systems.

Best Practices for AI Implementation in Banking

Strategic Planning and Roadmap Development

Phased Implementation Approach: Successful AI adoption typically follows a phased approach, starting with low-risk applications and gradually expanding to more critical functions as experience and confidence grow.

Business Case Development: Each AI initiative should have a clear business case with measurable outcomes, including cost savings, revenue enhancements, risk reduction, or improvements in customer experience.

Technology and Infrastructure Considerations

Cloud-First Architecture: Modern AI systems benefit from cloud-based infrastructure that provides the scalability, flexibility, and computational power required for advanced analytics and machine learning.

API-First Design: Building AI systems with API-first architectures enables better integration with existing systems and easier scaling as needs evolve.

Governance and Risk Management

AI Governance Framework: Banks should establish comprehensive AI governance frameworks that address model validation, risk management, compliance monitoring, and ethical considerations.

Continuous Monitoring and Validation: AI systems require ongoing monitoring to ensure they continue to perform as expected and adapt to changing conditions and requirements.

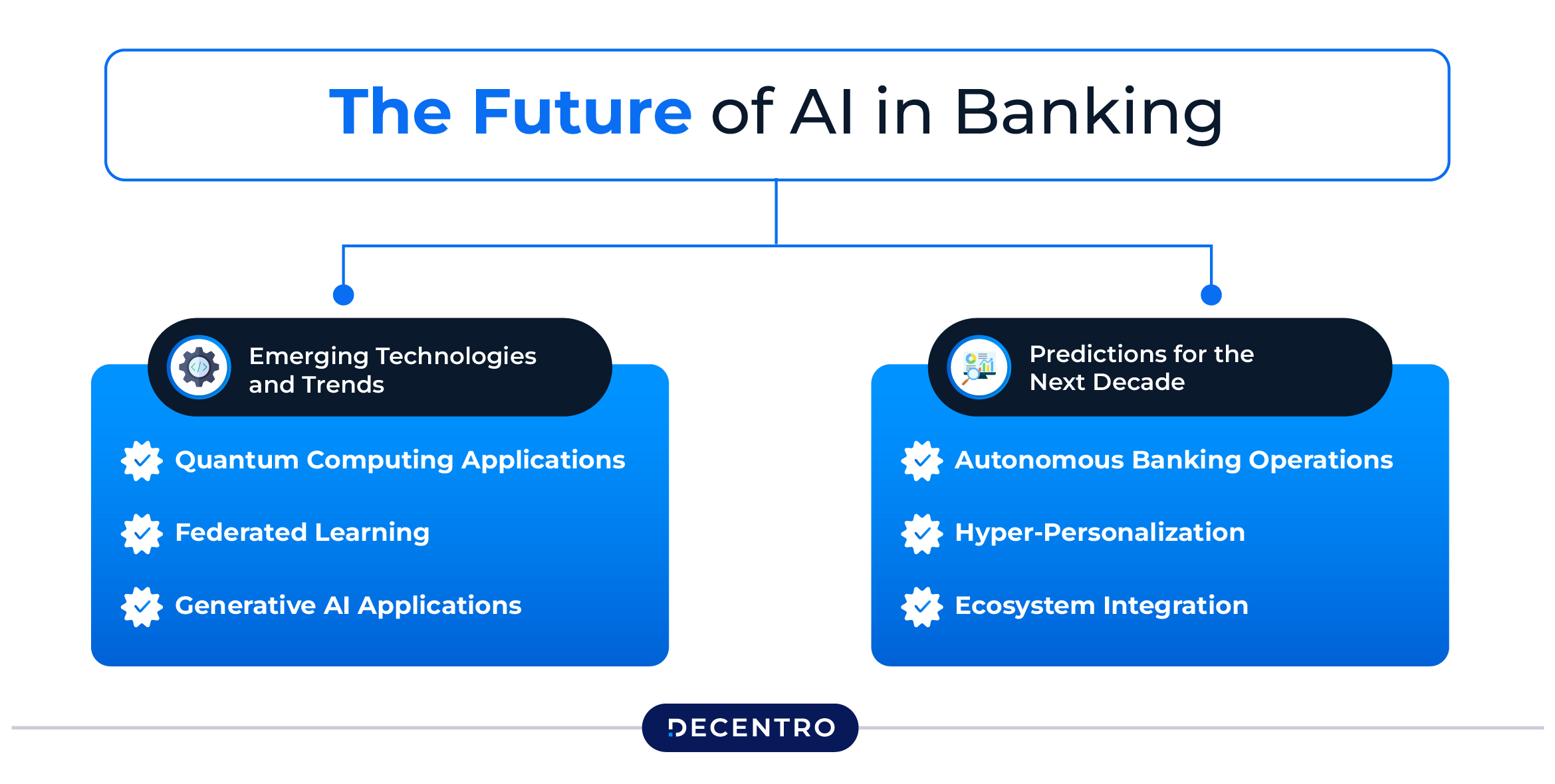

The Future of AI in Banking

Emerging Technologies and Trends

Quantum Computing Applications

As quantum computing matures, it promises to revolutionise banking AI by enabling complex calculations that are currently impossible, particularly in areas like risk modelling and cryptography.

Federated Learning

This approach enables banks to collaborate on AI model development while maintaining their data privacy, resulting in improved models that do not compromise customer privacy or competitive advantages.

Generative AI Applications

In a Bloomberg survey of banks published last month, 70 per cent indicated that generative AI would be widely used or critical to their business within the next two years, compared with 24 per cent currently.

Predictions for the Next Decade

Autonomous Banking Operations

We’re moving toward a future where many banking operations will be fully autonomous, with AI systems handling everything from customer service to complex financial analysis and decision-making.

Hyper-Personalization

AI will enable banks to provide hyper-personalised services that adapt in real-time to customer needs, preferences, and life changes.

Ecosystem Integration

AI will facilitate seamless integration between banking services and broader financial ecosystems, creating more comprehensive and convenient customer experiences.

Risk Assessment Revolution: Beyond Traditional Methods

The Limitations of Traditional Risk Assessment

Traditional risk assessment methods in banking have long relied on static data points such as credit scores, employment history, and collateral value. While these factors provide valuable insights, they paint an incomplete picture of a borrower’s true creditworthiness and risk profile.

Traditional methods often fall short because they:

- Rely on historical data that may not reflect current circumstances

- Fail to capture behavioural patterns and trends

- Cannot process the vast amounts of unstructured data available today

- Are limited in their ability to adapt to changing market conditions

- May inadvertently perpetuate bias in lending decisions

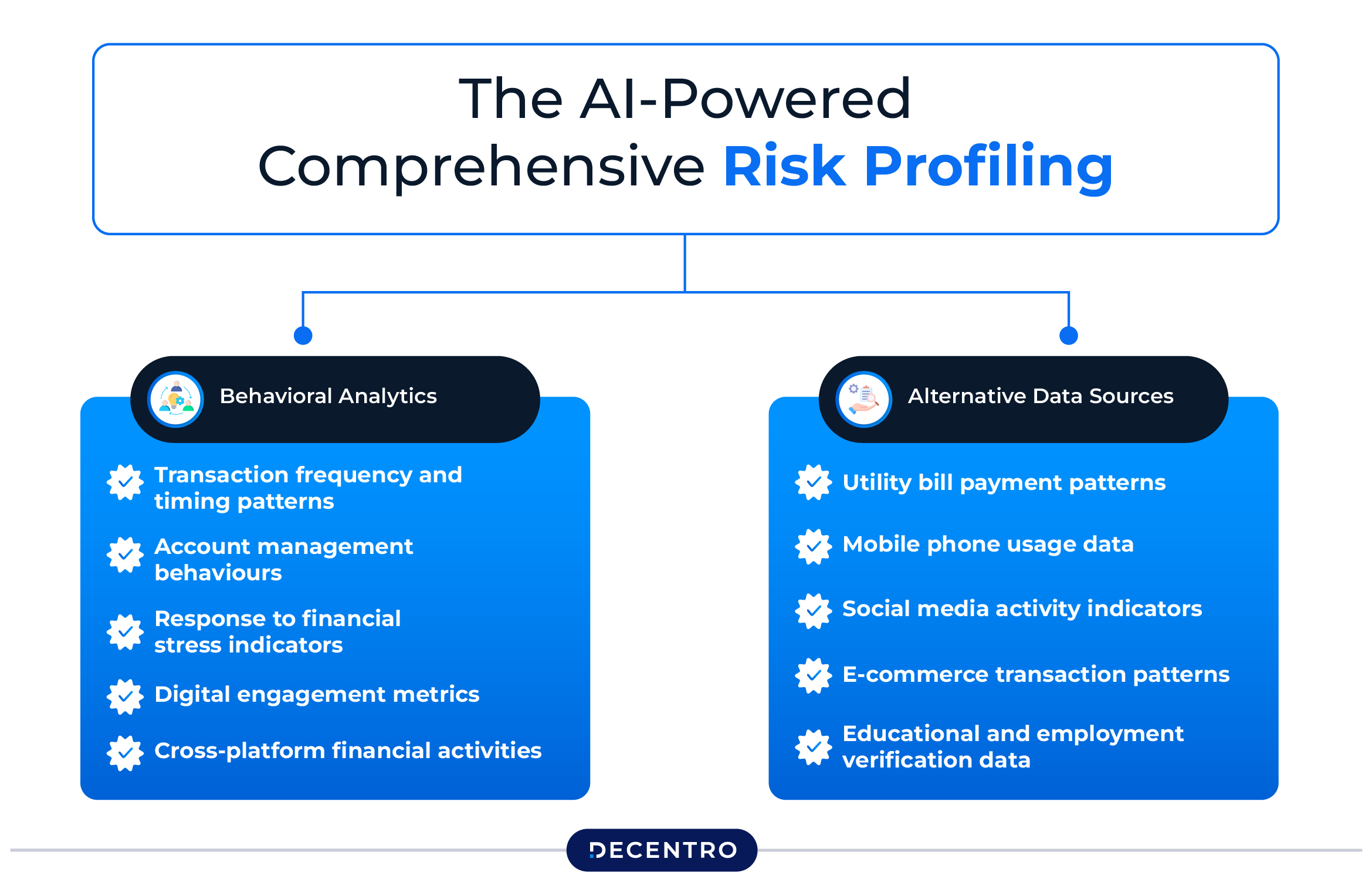

The AI-Powered Alternative: Comprehensive Risk Profiling

Modern AI-driven risk assessment solutions leverage advanced analytics and machine learning to create more accurate, dynamic, and comprehensive risk profiles. These systems can analyse hundreds of variables in real-time, providing lenders with unprecedented insights into borrower behaviour and creditworthiness.

Key Components of AI-Driven Risk Assessment:

Behavioral Analytics

AI systems can analyse patterns in how customers interact with their financial accounts, including:

- Transaction frequency and timing patterns

- Account management behaviours

- Response to financial stress indicators

- Digital engagement metrics

- Cross-platform financial activities

Alternative Data Sources

Beyond traditional financial data, AI systems can incorporate:

- Utility bill payment patterns

- Mobile phone usage data

- Social media activity indicators

- E-commerce transaction patterns

- Educational and employment verification data

Real-Time Risk Monitoring

Unlike static traditional assessments, AI-powered systems provide continuous risk monitoring, updating risk scores as new information becomes available and market conditions change.

Transforming Credit Decisions with Behavioural Insights

Behavioural insights represent one of the most powerful applications of AI in banking risk assessment. By understanding how customers behave in various financial situations, banks can make more informed lending decisions and better predict future payment behavior.

Spending Pattern Analysis AI systems analyse spending patterns to identify:

- Seasonal variations in income and expenses

- Financial discipline indicators

- Emergency fund management behaviours

- Discretionary spending patterns that may indicate financial stress

Account Management Behaviour: The way customers manage their accounts provides valuable insights into their financial responsibility:

- Frequency of account monitoring

- Response time to account alerts

- Balance maintenance patterns

- Payment timing consistency

Digital Engagement Metrics: How customers interact with digital banking platforms can indicate their level of financial engagement and responsibility:

- Login frequency and duration

- Feature utilisation patterns

- Customer service interaction patterns

- Financial education content engagement

Beyond Traditional Credit Assessment: The Smart Solution Stack – Scanner

Picture this: A small business owner walks into a bank for a loan. Under the old system, they’d wait weeks while clerks manually verified dozens of documents, cross-referenced data across multiple systems, and relied on outdated credit scores that told only part of their financial story. Today, AI is completely changing this narrative.

The modern approach to credit assessment combines intelligent document processing with behavioural analytics to create a comprehensive view of creditworthiness. Think of it as upgrading from a black-and-white photograph to a high-definition video – you’re not just seeing more details, you’re understanding the full story.

Intelligent Document Processing: From Paper Chase to Digital Intelligence

Traditional document verification resembles a detective’s evidence room – papers scattered everywhere, hours spent cross-referencing details, and human error lurking at every step. The Scanner module transforms this chaos into a streamlined digital process that works like having a team of expert analysts working around the clock.

This AI-powered system instantly processes everything from bank statements and identity documents to property papers and tax returns. But it goes beyond simple data extraction. The technology acts like a financial forensics expert, analysing document authenticity markers, checking consistency across multiple documents, and flagging unusual patterns that might indicate fraud. What once took days now happens in minutes, with accuracy that surpasses human capability.

Comprehensive Risk Intelligence: The OmniScore Advantage

While traditional credit scores provide a snapshot of financial information, OmniScore creates a living, breathing financial profile. It’s the difference between judging a movie by a single frame versus watching the entire story unfold.

OmniScore analyses traditional credit factors alongside behavioral indicators, alternative data sources, and real-time market conditions. It considers how customers manage their accounts, their digital engagement patterns, utility payment histories, and employment stability. Unlike static scores that update monthly, OmniScore provides dynamic assessments that evolve as new information becomes available.

The system also offers explainable AI features, meaning lenders can understand precisely why a particular score was assigned. This transparency fosters trust and enables more informed decision-making – a crucial aspect in today’s regulatory environment.

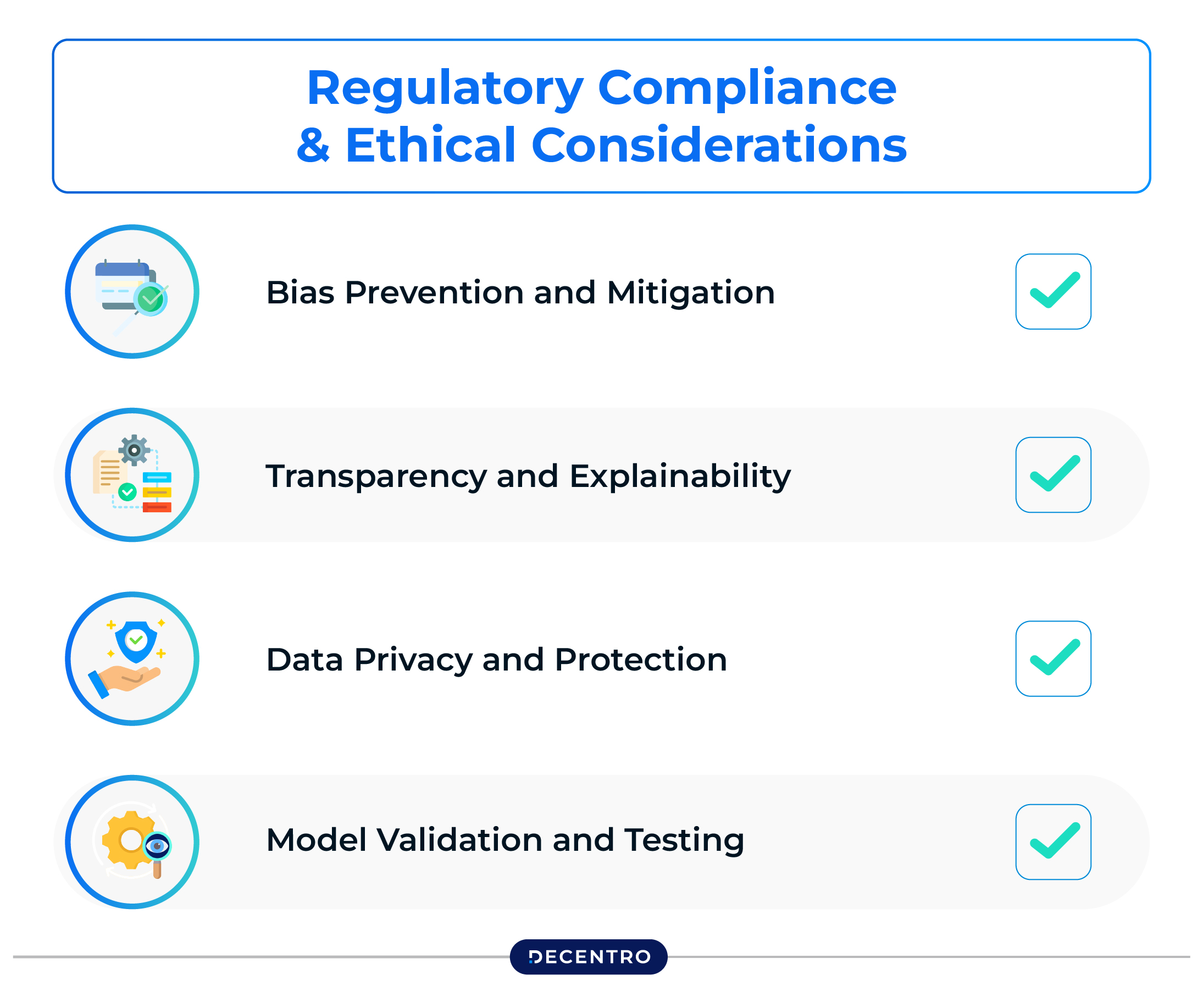

Regulatory Compliance and Ethical Considerations

As AI becomes more prevalent in banking risk assessment, ensuring responsible implementation becomes crucial. This involves:

Bias Prevention and Mitigation: AI systems must be designed and monitored to prevent discriminatory outcomes and ensure fair treatment of all applicants regardless of protected characteristics.

Transparency and Explainability: Regulatory requirements and customer trust demand that AI-driven risk assessments provide clear explanations for decisions, particularly in credit denial situations.

Data Privacy and Protection: AI systems must process customer data responsibly, ensuring compliance with data protection regulations while providing valuable insights.

Model Validation and Testing: Continuous validation and testing of AI models ensure they perform as expected and adapt appropriately to changing conditions.

Measuring Success: KPIs and Metrics for AI-Driven Banking

Financial Impact Indicators

- Banks implementing AI solutions report cost reduction through automation, operational cost savings, reduced manual processing time, decreased error rates, and lower fraud losses. Revenue enhancement comes through increased loan approval rates, improved pricing accuracy, enhanced cross-selling success, and faster time-to-market for new products.

Risk Management Improvements

- AI delivers improved prediction accuracy for default probability, reduced false positive and false negative rates, better portfolio performance and risk distribution, and enhanced effectiveness of the early warning system. Compliance benefits include automated monitoring coverage, reduced regulatory violations, improved audit trail completeness, and enhanced reporting quality.

Conclusion: Embracing the AI-Powered Banking Future

The transformation of banking through artificial intelligence represents one of the most significant technological shifts in the history of the financial services industry. With AI capabilities expected to unlock $1 trillion in global banking revenue pools by 2030 while decreasing operational costs by up to 25%, the question is not whether AI will transform banking, but how quickly institutions can adapt. India’s FREE-AI framework offers a blueprint for responsible innovation, strengthening the financial sector while safeguarding customer interests. The institutions that will thrive are those that embrace AI not as a replacement for human judgment, but as a powerful tool that enhances human capabilities, improves customer experiences, and creates more inclusive and efficient financial services.

Curious about our stack or the general implementation of riding the AI wave in banking?

Frequently Asked Questions

What is AI banking?

AI banking leverages artificial intelligence to enhance financial services, utilising machine learning, natural language processing, and predictive analytics to automate processes, inform decision-making, and enhance customer experiences through intelligent systems.

How is AI used in banking?

- Fraud Detection: Real-time transaction monitoring and anomaly detection

- Customer Service: AI chatbots for 24/7 support

- Credit Scoring: Alternative data analysis for instant loan approvals

- Risk Management: Predictive modelling for various risks

- Personalisation: Tailored product recommendations

- Automation: Document verification and compliance

What are the benefits of AI in banking?

For Banks: 30% cost reduction, 99%+ fraud detection accuracy, faster processing, automated compliance

For Customers: 24/7 service, personalised experiences, instant loan approvals, better financial insights, enhanced security

What is the future of AI banking?

2025-2027: Hyper-personalisation, conversational AI for financial planning, predictive banking, behavioural biometrics

2028-2030: Autonomous banking systems, quantum computing integration, blockchain transparency, open banking ecosystems

How does RBI regulate AI in banking?

Key Frameworks:

- Digital Lending Guidelines (2022): Human oversight mandatory

- IT Framework (2021): Board approval required

- Data localization within India

- Algorithmic accountability and explainability

Requirements: Risk management frameworks, regular model validation, customer grievance mechanisms, audit trails, stress testing, and human intervention capabilities for critical decisions.