Embedded Finance is one of those collaboration constructs that is a win-win-win for all the stakeholders in the model. Let’s understand it better today!

What is Embedded Finance? How is it Impacting Fintech?

Heading Product for Decentro, an API banking platform. Built and scaled teams across Product, Data, and Partnerships in the Fintech space.

Table of Contents

Remember the time when you booked a train on Makemytrip and bought insurance for your trip? Travel is no longer something you remember, thanks to COVID? Got it!

How about the time you booked a cab on an app and got an option to opt for a seamless pay-later product? Right. Did you pay for the ride after 15 days? Still don’t remember!

Let’s take a more obvious example. Do you remember Amazon pay asking you for a credit card or Amazon Pay Later? It’s more obvious now, right?

So, what’s common among all the above situations? You are:

- Interacting with an app you use that isn’t primarily isn’t known for financial services

- Being convinced about opting for a financial product on the app with minimal effort

- Someone who loves opting for products that simplify your financial life amidst the chaos.

So, what are we talking about? It’s embedded finance, of course.

When you go through the same experience multiple times, it becomes a habit, an ‘interaction loop’ as product folks like me tend to think of. And it’s a very powerful habit to inculcate in your customers.

The New Shift

You might wonder what was so great about the insurance, pay-later, or even the credit card you’ve got. You have taken insurance, paid later with a credit card, and even taken a loan. What’s the big deal, you say?

It’s the simplicity of customer experience! And we are not talking about the number of clicks or cool UI. Simply delightful customer experiences!

As consumers, we are used to interacting with financial products, right from savings accounts, education loans, investments, credit or debit cards, insurance, auto loan, to home loans – usually in that order among most consumers. We are used to visiting branches or at least the websites or apps (for the millennials!) to avail any of the above.

Let’s move on to the million-dollar question.

What is Embedded Finance?

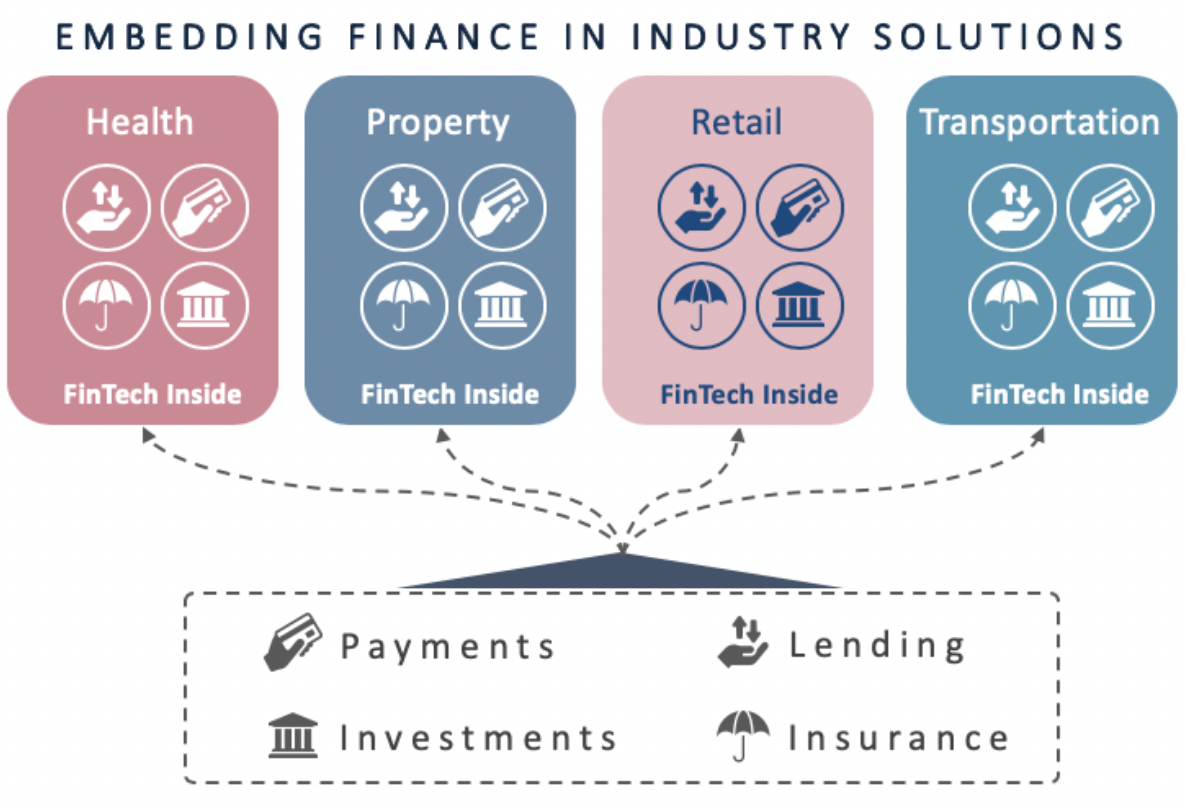

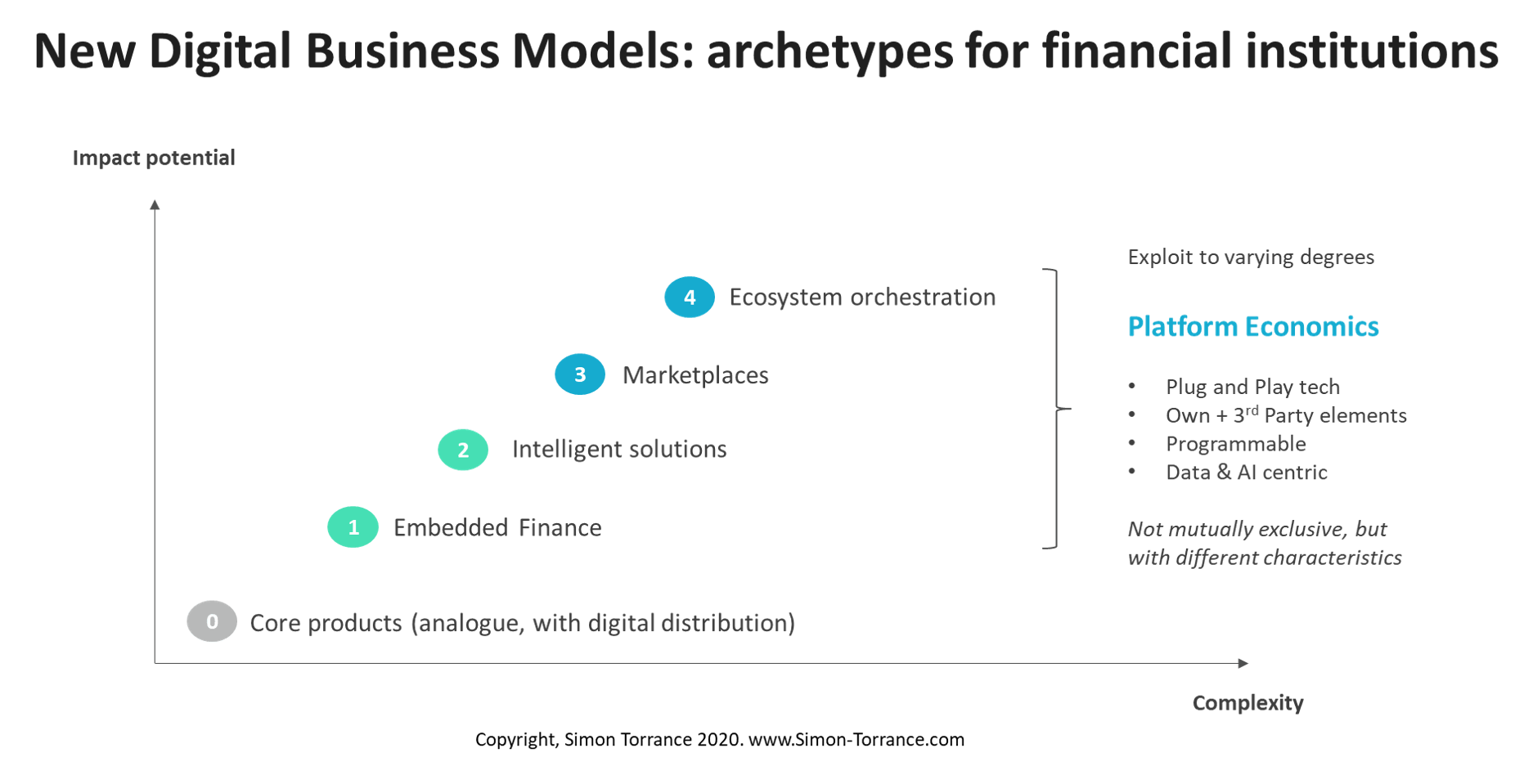

The ecosystems across consumers & businesses have seen immense growth. Embedded finance has evolved from being a financial layer in ecosystems to being an incumbent Fintech offering. Let’s look a bit deeper.

At a basic level, embedded finance is all about offering financial services to captivate customers, individuals, and businesses within an ecosystem and with minimal effort.

This could typically be one of the following scenarios as an example –

- Providing loans to sellers on marketplaces

- Extending pay-later options to consumers (buyers) on marketplaces

- Issuing insurance for shipping and services offered on marketplaces

Embedded Finance is not new. There has been a lot of legacy play from the perspective of embedding financial products where the customers have been transacting with businesses and platforms.

Some legacy examples of embedded finance include:

- Manufacturing & FMCG firms providing credit to their distributors

- Consumer durable loans at offline electronics stores

- Enabling auto loans and insurance by car dealers

Over a while, embedded finance has unfolded to adapt to the digital world –

- Marketplaces have tied up with fintech lenders to facilitate loans to businesses via APIs

- Platforms have used transaction data to assess loans and insurance via APIs

- Companies have built skin-in-the-game models with financial institutions

Why is Embedded Finance Beneficial to Every Business?

Embedded Finance is all about being where your customers are. So, let’s look at some of its tenets in its new avatar.

- Delivering the value of financial products within the captive ecosystem

- Simplifying the customer interaction with the financial ecosystem

- Enabling financial transactions using customer footprint

- Capturing value for the core business offering

Embedded Finance presents a very compelling value proposition to digital platforms for multiple reasons.

- Greater customer lifetime value by providing credit facilities

- Reduced customer churn, thus providing more significant growth momentum

- Additional revenue streams for the platform from financial services

- Increased customer acquisition due to word-of-mouth and scale

Not just digital platforms, the market potential of this fintech wave turbocharges financial services players as well. How?

- Increased distribution resulting in greater business opportunities

- Diversification of products resulting in lower business risk

- Enhanced operational efficiency since platform undertakes operations

- Heightened focus on core operations, product innovation, and compliance

Embedded finance is one of those collaboration constructs that is a win-win-win for all the 3 stakeholders in the model: The customer, the platform, and the financial service provider.

What if we say that Decentro can simplify the entire integration and go-live process for your embedded finance strategy?

Embedded Finance: Things to Consider

While we have discussed embedded finance and have found it to be a great business driver, implementing it requires careful planning. Luckily, we at Decentro have just the right sauces for you, just like we power numerous such use-cases across platforms.

Getting started with Embedded finance requires clarity on the below areas.

- Customers: Who are your customers, and what are their business needs?

- Needs: What are the most critical financial needs of your customers?

- Experience: What is the customer experience you envisage?

- Business: Which business will benefit from adopting & providing finance?

- Impact: What is the impact of this on your customers?

- Operations: How much effort are you ready to handle?

- Technology: How well does the tech stack sit with core business?

Embedded Finance, in most use cases, requires greater focus from the platform on the below areas.

- Ownership: Embedded finance requires the platform to own the customer and, thus, heavy-lift the product discovery phase. Consequently, a business can easily discover the right product offering for its customers.

- Process: Embedded finance requires the platform to drive and facilitate most of interacting with the service provider, preferably in a tech-driven manner to minimize human efforts.

- Risks: Embedded finance might require the platform to own up to a certain amount of risk in lending or insurance to facilitate the product to a cohort of customers. This results in a scattered positive impact on revenue.

- Experience: It’s not about building jazzy technology. It’s all about providing a superior customer experience, even if it’s offline or assisted. The platform needs to understand how its users interact with its product.

- Education: Your business might require to educate the users on the benefits and any downsides of the product, including educating the benefits of availing from the platform.

What are Modern Use Cases of Embedded Finance?

Some of the best use cases for embedded financing enhance the critical business drivers the platform is trying to achieve.

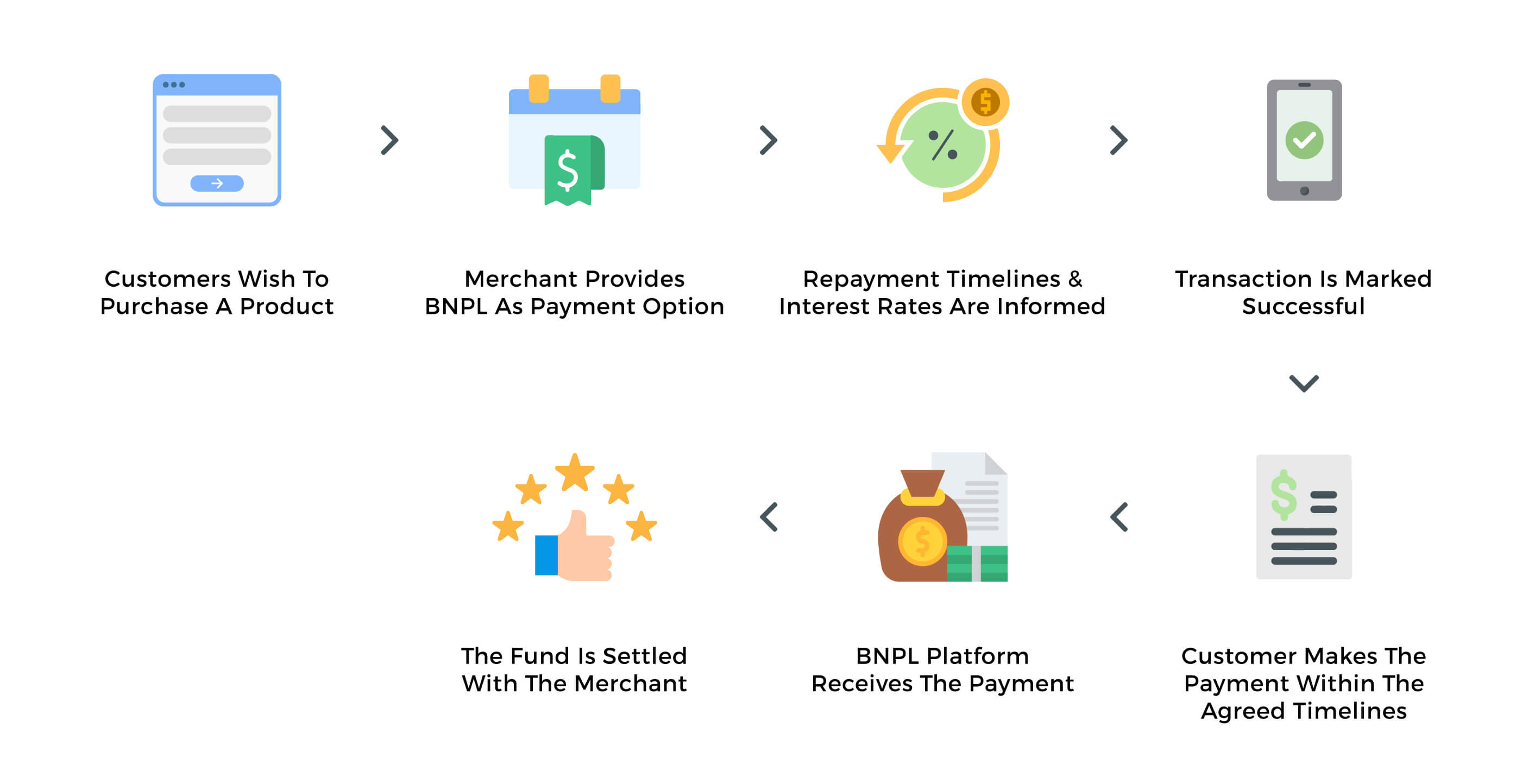

Buy Now Pay Later

BNPL is a tailored offering where a platform offers a specific credit limit by partnering with a lender based on the transaction history to its buyers, usually consumers. Buy Now Pay Later helps a user to avail credit by bypassing the long-drawn processes of loans.

Example: Amazon Pay Later.

Seller Financing

A custom offering where a marketplace offers loans to its sellers against receivables. It partners with a fintech lender or NBFC and does so based on the transaction history of the user.

Example: Amazon or Flipkart Seller Financing program.

Invoice Financing

Here, a marketplace gets the seller of a product to be paid upfront through a credit line from a lender, bearing some amount of interest.

Example: Cloudtail program

Travel Insurance

An oversimplified version of general insurance where the platform provides insurance for a traveler for a specific trip.

Example: IRCTC insuring travelers.

Credit Line

A tailored offering where a marketplace offers a credit line to its SME buyers through a credit card, prepaid payment instrument, or credit line basis their loyalty.

Example: Amazon B2B financing.

Payments Infrastructure

This is something that a lot of ERPs and SaaS providers are plugging into their systems by providing a seamless payment experience to customers.

Example: Clear, Zoho, SAP.

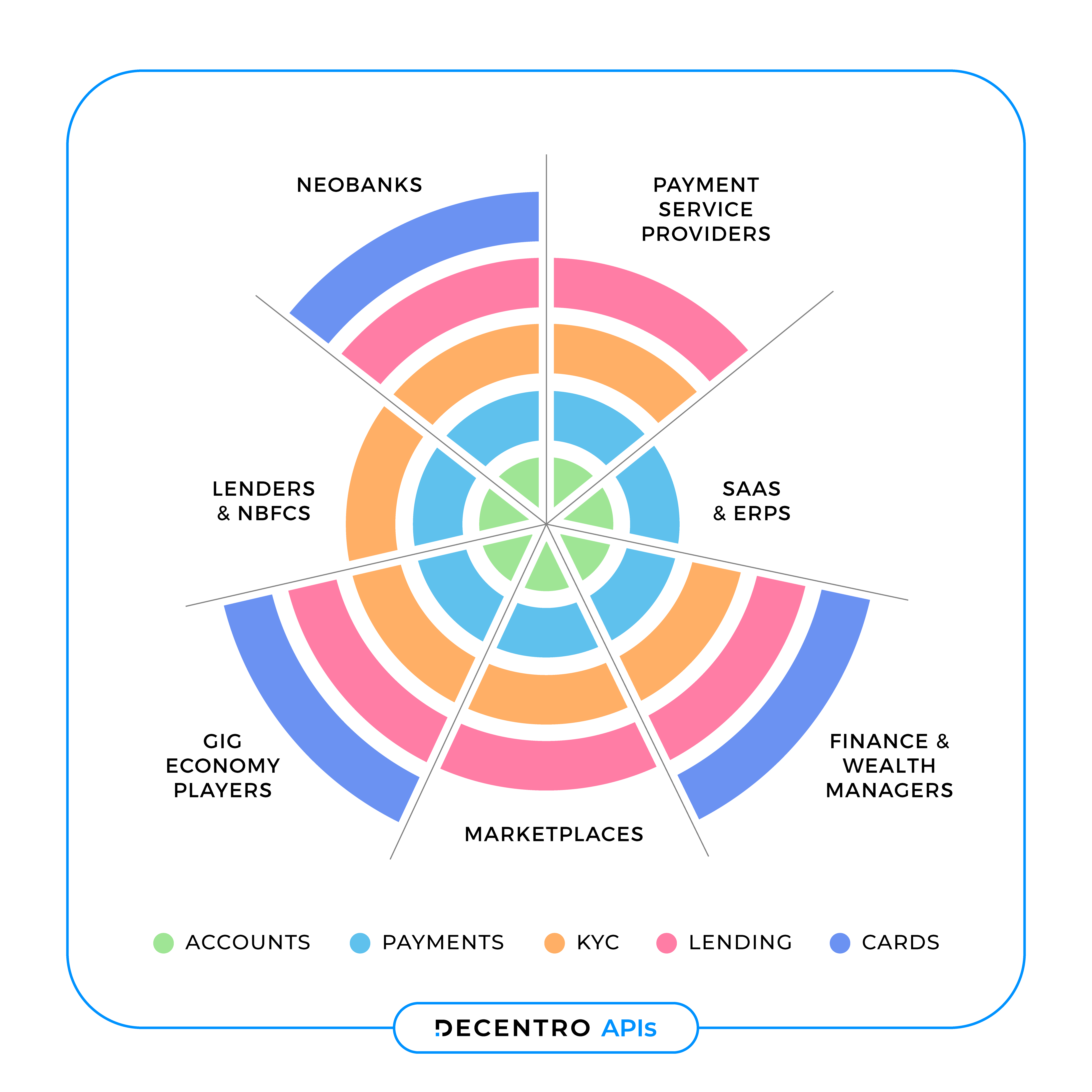

How Decentro Can Power-up Your Business

Kick-starting your embedded financing is really not as uphill as many ‘thought leaders’ make it out to be. Rather, it requires discipline and focus, not always massive funding!

Let us introduce you to some of the modules you can embed into your ecosystem.

KYC

As they say, if you need to get started with anything in financial services, customer onboarding is the first place. Know Your Customer checks helps platforms capture customer information, be it lending, insurance, or payments.

Bureau

Understanding customer creditworthiness is a crucial element of any product offering, be it lending or insurance. A consumer Bureau pull helps the platform understand a customer’s credit history and take risks accordingly.

Payments

No matter which product you are building, payments are integral to your business. Investing in a good payment infrastructure, including recurring payments, helps deliver an excellent customer experience.

Accounts

If you are looking to build out the entire ecosystem of financial offerings, opening up current bank accounts or savings accounts is the easiest way to scale your financial infrastructure.

Data

Gaining a deep understanding of customers is very critical. This is over and above the transaction data on platforms like banking, GST, financial, location, etc. This allows you to make intelligent decisions.

On a Concluding Note

With the rise of the consumer internet, there’s been a phenomenal increase in the consumption of products & services, around an estimated 975 million by 2025!

With it has come a new wave of platforms that deliver almost every desired good and service to consumers’ doorsteps. Naturally, financial services become the next bastion for such platforms as consumers seek to purchase financial products with minimal friction.

And that’s where embedded finance comes into play.

We, at Decentro, empower businesses from different verticals to adopt embedded finance to their products and go live within weeks, i.e., 10X faster, and with lower overhead expenditure by 80%!

If your business is looking to surf this wave, we can help! Our modules come with simple plug-n-play banking APIs that will simplify your most complex financial operations. Be it virtual accounts for reconciliation, white-labeled UPI links for instant fund settlements, or virtual cards for businesses to spend, track, & manage the spend!

Feel free to take a look around while you’re here. We’re always available at hello@decentro.tech.

Until we see you next time with yet another exciting topic!