Capitalize on the Black Friday and Cyber Monday deals this year with a BNPL program. Here’s a quick guide to launch your own BNPL program with Decentro.

Building a Buy Now, Pay Later this Holiday Season

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

It’s beginning to look a lot like Splurge Season, doesn’t it?

It is that time of the year.

When the lights seem brighter on the streets, wallets seem lighter in the bag.

As the season of giving is bestowed upon us, the weight of the same on the consumers leaves them scrambling for the obvious.

OFFERS.

Cue in, the annual Olympics for brands, retailers, merchants, and vendors alike, The BLACK FRIDAY AND CYBER MONDAY BONANZA.

The Cyber Week

To give a little context of how this WHIRLWIND of a week pans out completely,

Cyber Week is a mega retail event that spans five days, covering five major shopping dates: US Thanksgiving Day, Black Friday, Small Business Saturday, Super Sunday, and Cyber Monday.

Of these special days, consumers look forward to Black Friday and Cyber Monday (BFCM) the most.

The Globalisation of BFCM

While originally these dates, which revolved around Thanksgiving week, were centred around the American economy and the spending habits of that geography, there has been a significant shift in its popularity, closer to home, in recent times. Additionally, the pandemic accelerated the adoption of digital payments for all types of consumer spending, and holiday shopping became the poster child for experimentation for retailers and marketers alike.

With BFCM, often touted as a barometer of global trade and retail offerings for the subsequent year, it is evident that players closer to home jumped onto the bandwagon. Just to put things into perspective, in 2024, Black Friday online sales in the United States reached a record $10.8 billion, up 10.2% from the previous year. Looking ahead, projections indicate that U.S. Black Friday spending in 2025 will reach approximately $11.7 billion.

Slowly but surely, there is a visible effort and impact from these so-called mega sale days, and companies have been integrating marketing efforts, if not full-fledged business models, to leverage them.

Slowly but surely, there is a visible effort and also an impact of these so-called mega sale days, and companies have been integrating marketing efforts, if not full-fledged business models, to leverage the same.

The BNPL Blip

As a player looking to leverage the buffet of offers that is Cyber Week, the easiest way to spread the holiday cheer for your consumers, quite literally, is to indulge in the “Buy Now, Pay Later” [BNPL] scheme.

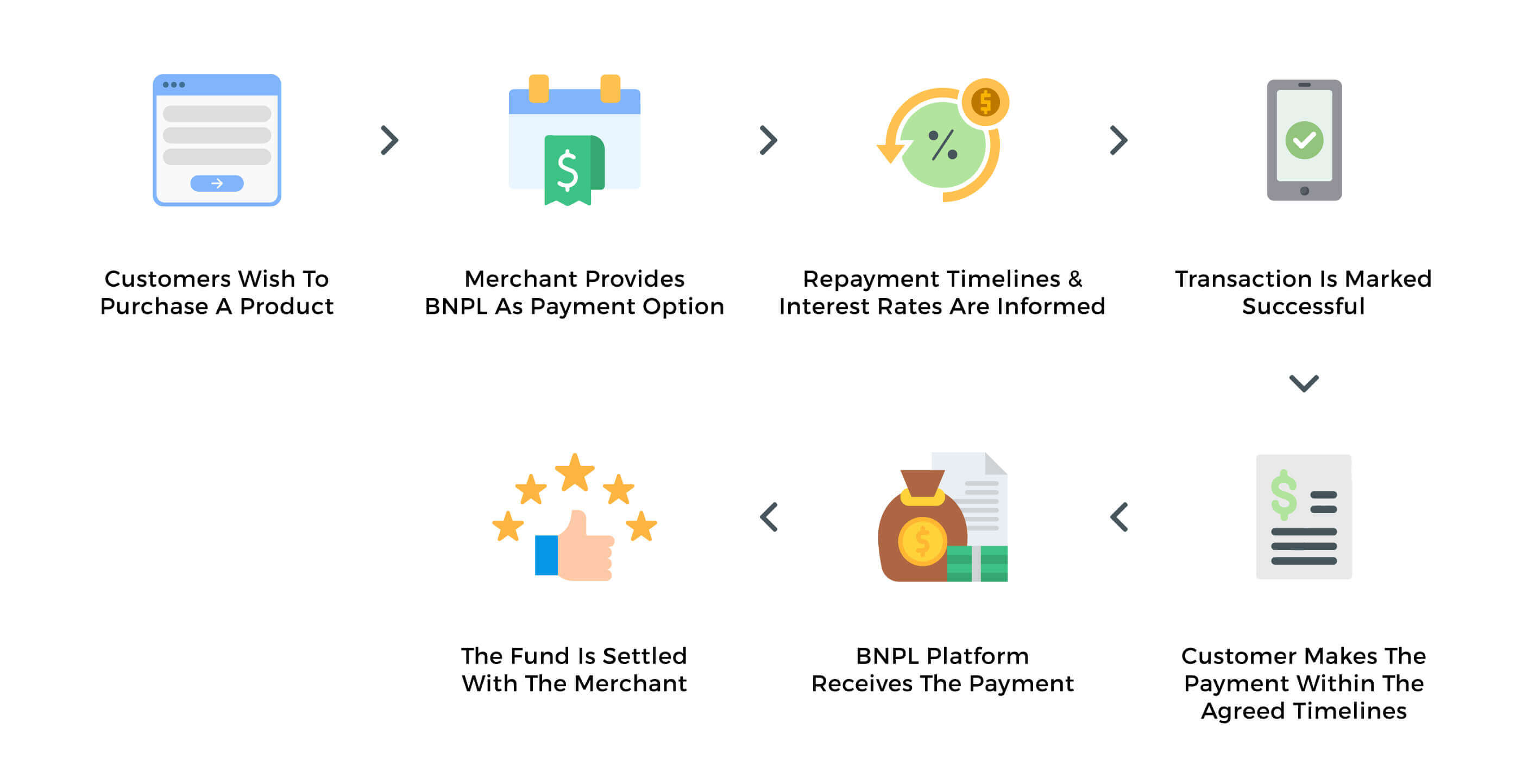

As the name suggests, BNPL is a financial arrangement that brings friction-free options to pay off the bills over a few months. It is strikingly similar to a credit system. However, easier to integrate and execute.

Are you interested in knowing more? Read our exhaustive article on the nuances of BNPL products and how it fares in the Indian market, all while elucidating its key benefits.

From the consumer’s perspective, the BNPL model offers purchasing power, but the business side of launching your BNPL product during this window makes for an interesting use case.

Just to put things in perspective,

In 2024, consumers used buy now, pay later for $686.3 million on Black Friday alone, growing 8.8% year-over-year. Even more impressive, the entire 2024 holiday season saw total Buy Now, Pay Later spending reach a new high of $18.2 billion, up 9.6% from 2023. And Cyber Monday set a new single-day BNPL record, with sales hitting $991.2 million.

The geographic spread is equally compelling. In Europe, the use of BNPL services more than doubled on Black Friday compared to the previous year, with the average value of BNPL transactions 25 per cent higher than other payment methods.

When it comes to data and traffic, there are insights as detailed as the time slot of the highest transaction volumes on Black Friday.

For Germany, the key period was 11:00 – 12:00.

In France, we had 19:00 – 20:00.

The Netherlands witnessed traffic between 13:00 and 14:00, and Belgium between 16:00 and 17:00.

Where there is a wealth of information and insight, there should be a marketeer or, even better, a product manager.

You know the famous saying,

Where there is data, there is an analyst.

And if you put your analyst to good use, you can launch your own BNPL scheme too.

Let us show you how.

Launch your BNPL

The idea is to set your goal from the BNPL model right from the get-go. Following are the practices merchants or businesses can employ to help ensure optimal outcomes from their implementation of a BNPL solution:

- Clarity of thought: Split Payments or Instalment Loans

As a BNPL provider, depending on your consumer base, you must deploy one of the two payment methods. Customise and finalise the payment methods best suited for your consumer.

For example, for big-ticket transactions, split payments may not be the most ideal route; however, instalment loans are the perfect fit in such cases.

If your solution is flexible enough to offer both, make sure there is an effective tool that pre-selects the optimal route based on the session ticket size.

- Knowledge is Power

As cliché as it sounds, make sure that you inform consumers early in the purchase journey. This can be done through banner ads or an intuitive product journey. The earlier in the purchase journey, consumers become aware of BNPL payment options, the more likely they are to use it.

- Omnichannel Presence

Never underestimate the power of all offerings under one roof. Make sure your BNPL covers the width of the user authentication and account management, to even the extension of payments or rescheduling.

- Smart Risk Management with KYC Omniscore

Here’s where things get interesting. Launching a BNPL product isn’t just about offering flexible payments, it’s about doing so responsibly while minimising risk. This is where robust identity verification becomes your secret weapon.

Enter solutions like Decentro’s Omniscore, a real-time behavioural intelligence platform that redefines how you assess customer trust. What makes it special? It generates unified risk scores between 100 and 1,000 in less than 300 milliseconds, combining digital identity, device intelligence, behavioural indicators, and financial activity patterns.

Think about it: when someone’s checking out with a BNPL option during that Black Friday frenzy, you need to make instant decisions. Is this a legitimate customer or a potential fraud risk? Should you offer them the full credit limit or start more conservatively?

With behavioural intelligence, you’re not just doing basic KYC checks; you’re understanding the complete digital footprint. This means you can:

- Onboard customers faster: No lengthy approval processes that kill conversion during peak shopping times

- Reduce fraud: Identify suspicious patterns before they become losses

- Personalise credit limits: Offer appropriate limits based on real-time trust scores

- Improve customer experience: Genuine customers sail through, while risky ones get additional verification

The beauty of integrating smart risk assessment into your BNPL workflow is that it becomes invisible to good customers while acting as a powerful shield against bad actors. And during Cyber Week, when transaction volumes spike and fraudsters are out in force, this kind of intelligence isn’t just nice to have—it’s essential.

- The Post Purchase Checklist

Ensure that your BNPL model checks the post-purchase checklist provided below:

- Initial contact creation (customer agrees to terms)

- Requesting and protecting payment information

- Tracking the payment schedule

- Handling accounts payable and collections

- The Power of Giving Back

Rewards and referrals are the X-factor in BNPL services. This low-cost yet effective strategy focuses on retaining existing users by offering reward points and cashback for each unique referral. If implemented effectively, it opens up acquisition channels with little capital input.

Across the arguments for why your business should offer BNPL to how you can do the same, one thing is pretty evident. The time to launch your BNPL product is now.

Why wait to integrate when you can find your efficient way around via modern fintech infrastructure platforms? With the right technology partners offering everything from payment processing to risk assessment to KYC verification, you can go from concept to launch faster than ever before.

Why wait to integrate when you can find an efficient way around with us?