What is Buy Now Pay Later? How can you set up a BNPL product for your business in a few weeks?

What is BNPL (Buy Now Pay Later) – The Complete Guide

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

If this were 2021, Buy Now Pay Later [BNPL] would be touted as the new buzzword around the retail block, especially for the Indian market.

Picture this, an economy still grappling with the effects of the COVID-19 pandemic had found a bit of a breakthrough in the retail market. Intense economic conditions not only morphed consumer behaviour but also refined the concept of standard practices for every retailer.

The clear establishment of the consumer is the king ethos trickled down to the financial aspect of the user journey.

Convenience took the forefront and paved the way for BNPL to find footing in a market as conservative as India.

As novel as the idea seemed at the time, it was merely a repackaging of the traditional lending methods with a dash of convenience to up the ante.

Loan for some and instalment payment for others, BNPL is a credit tool in a new skin that lets customers flexibly split bills at little or no cost multiplying their convenience.

So let’s break down this favourite segment of embedded banking further.

Let’s see some more numbers, shall we?

What is BNPL?

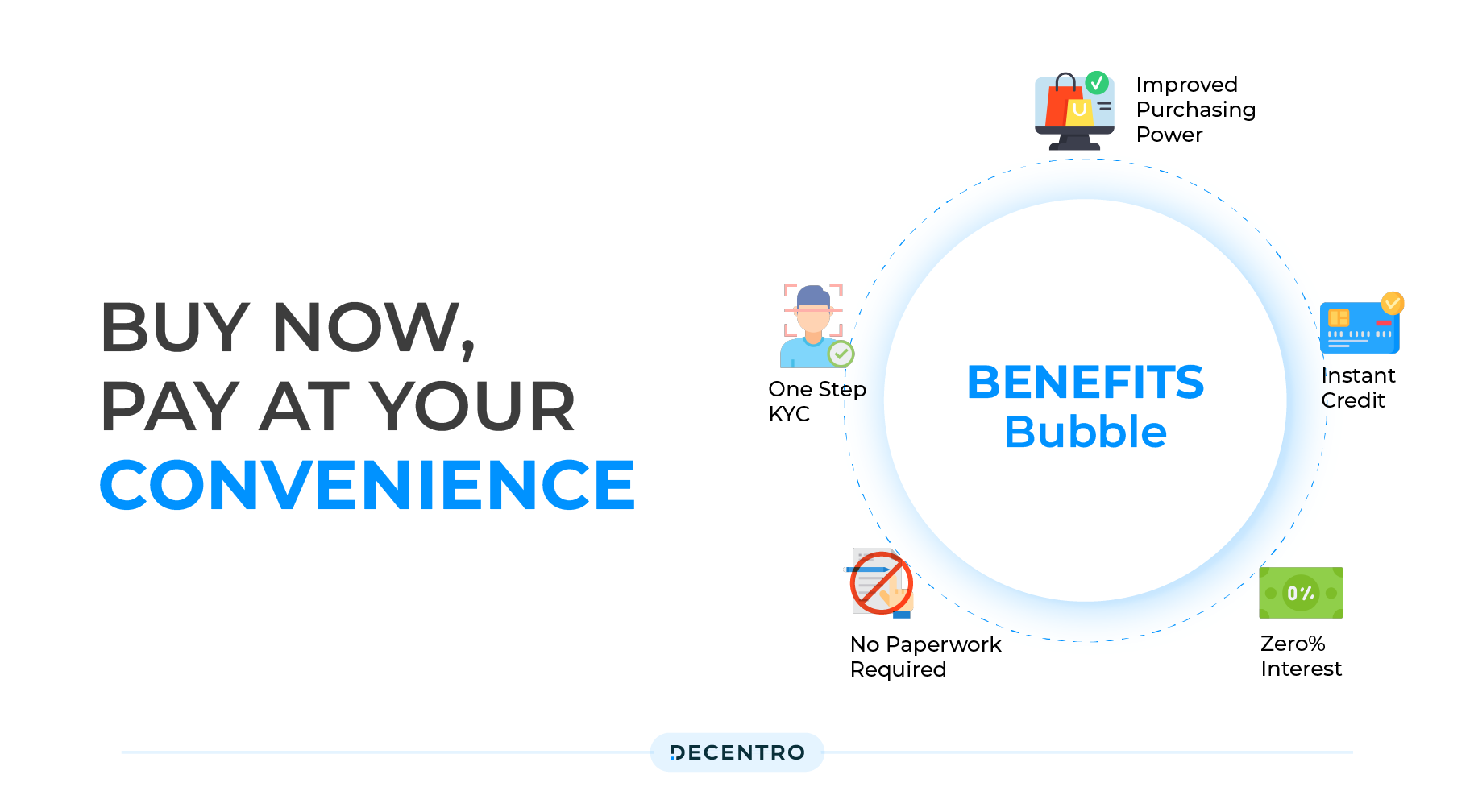

BNPL stands for “Buy Now, Pay Later.” It is a financial service that allows consumers to make purchases immediately and pay for them over time in installments, typically without any interest or fees if paid within a specified period. Tailored to enhance the spending power of consumers across demographics, financing through BNPL is generally low-cost or free, with various repayment options.

How does BNPL work?

One of the value propositions with a BNPL model is the fact that it cannot be standardised, which means each of the BNPL offerings has its own set of terms and conditions built to cater to specific users.

However, we can take a typical example of how the Buy Now, Pay Later system would work if you integrate it with a third-party provider like Decentro.

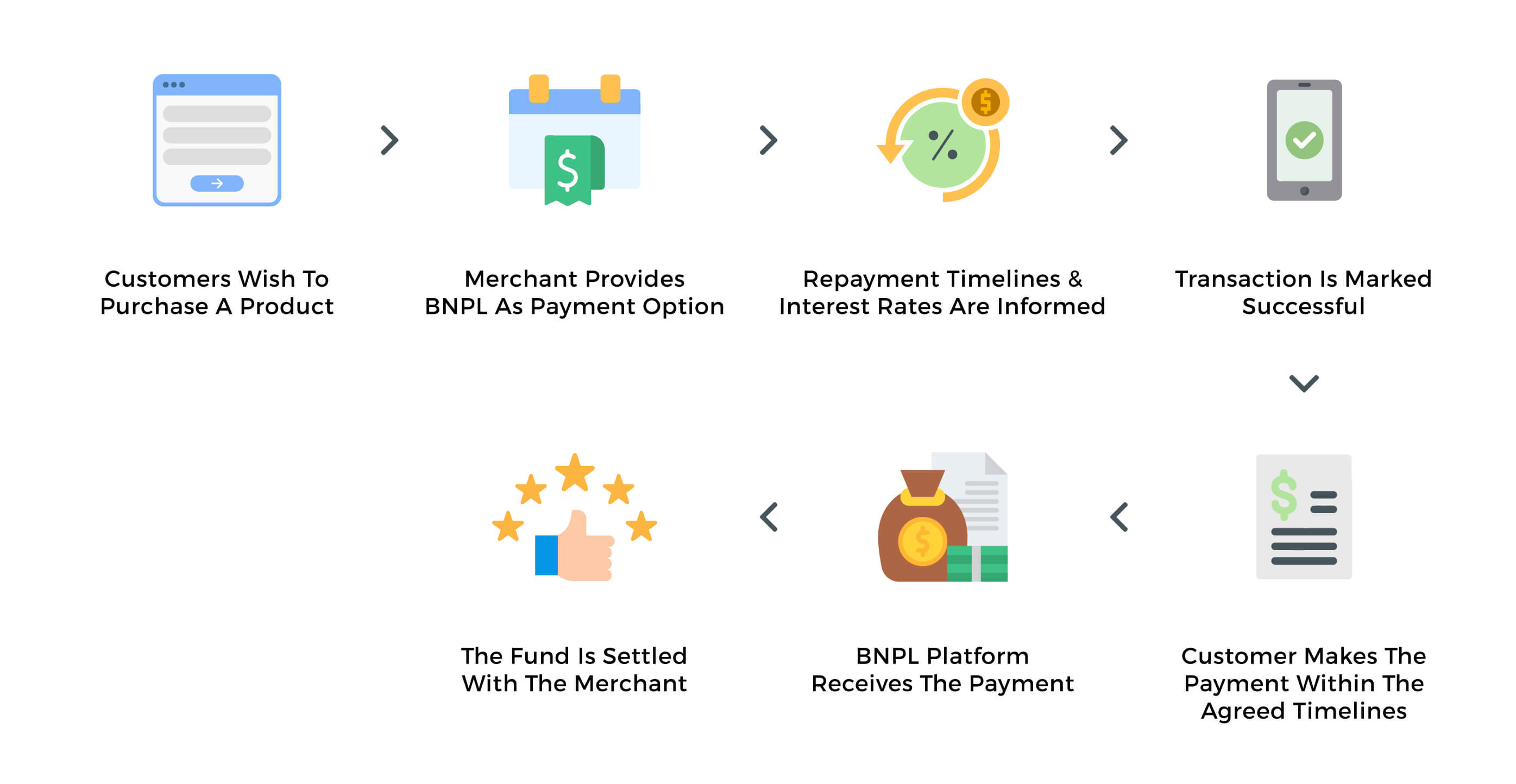

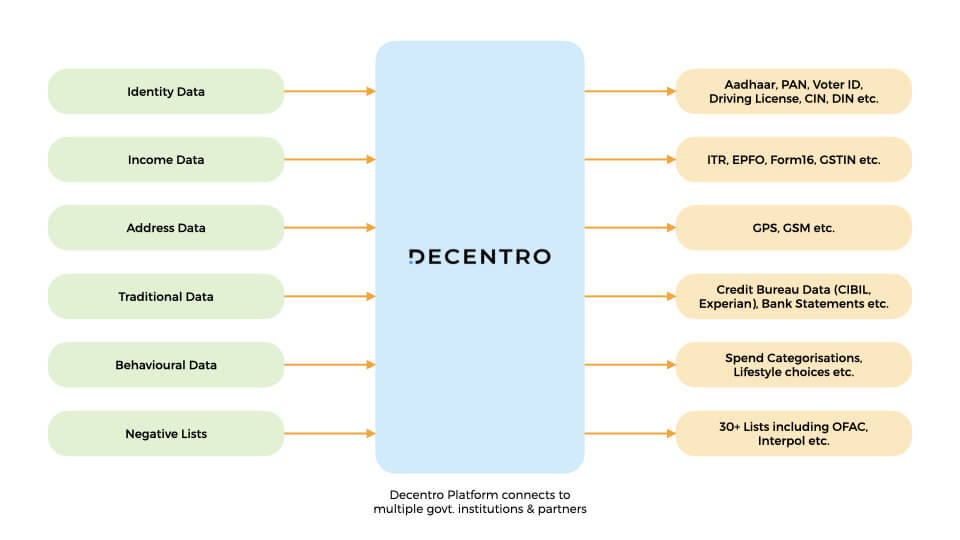

A business owner or merchant integrates with a BNPL provider to offer credit-based payments for their customers. The BNPL entity runs e-KYC checks on the customer and background credit checks before extending the service. In essence, the customer’s creditworthiness is evaluated with income checks, negative lists, and behavioural checks via KYC for the same.

The customer sometimes pays a small amount in advance, and the purchase is successfully completed. In due course, the BNPL provider receives the payment from the customer and later settles the funds with the merchant. The platform earns an interchange commission from the merchant with each transaction.

Buy Now Pay Later vs. Credit Cards

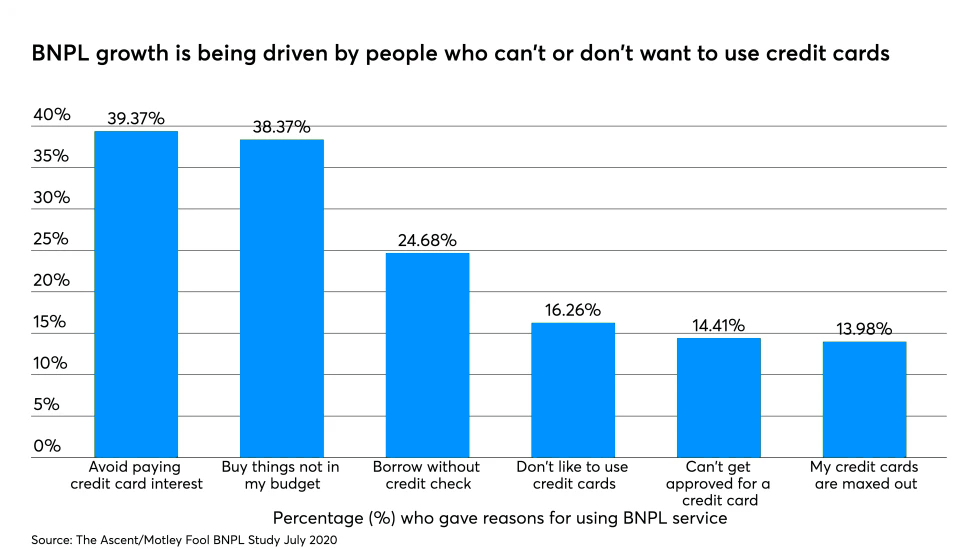

A survey by The Ascent showed that about 62% of users think BNPL will rule over credit cards and replace them in the future.

How is this model different from a card if it’s about credit?

At first glance, BNPL looks like a credit card. However, there are some differences between the two.

- Interest Fees

BNPL arrangements often don’t charge an interest fee on the amount and come with a fixed repayment period- this could be weeks or months. Furthermore, in most cases, the payment is the same as the purchase amount.

On the contrary, when you use a credit card, you can only make the minimum payment due on the repayment cycle. The interest adds up until the payment is complete for the pending amount unless your card has a 0% introductory APR.

- Access/ Eligibility

Credit card eligibility is based on customers’ annual income and credit score. On the other hand, BNPLs are small-ticket loans with relatively flexible eligibility criteria determined by the BNPl, provider and can be obtained very quickly.

- Acceptance

Credit cards are universally accepted, while BNPL is currently limited to fewer partnering merchants. However, the number of BNPL partners is increasing at a breakneck pace.

What is its hold in the Indian Market?

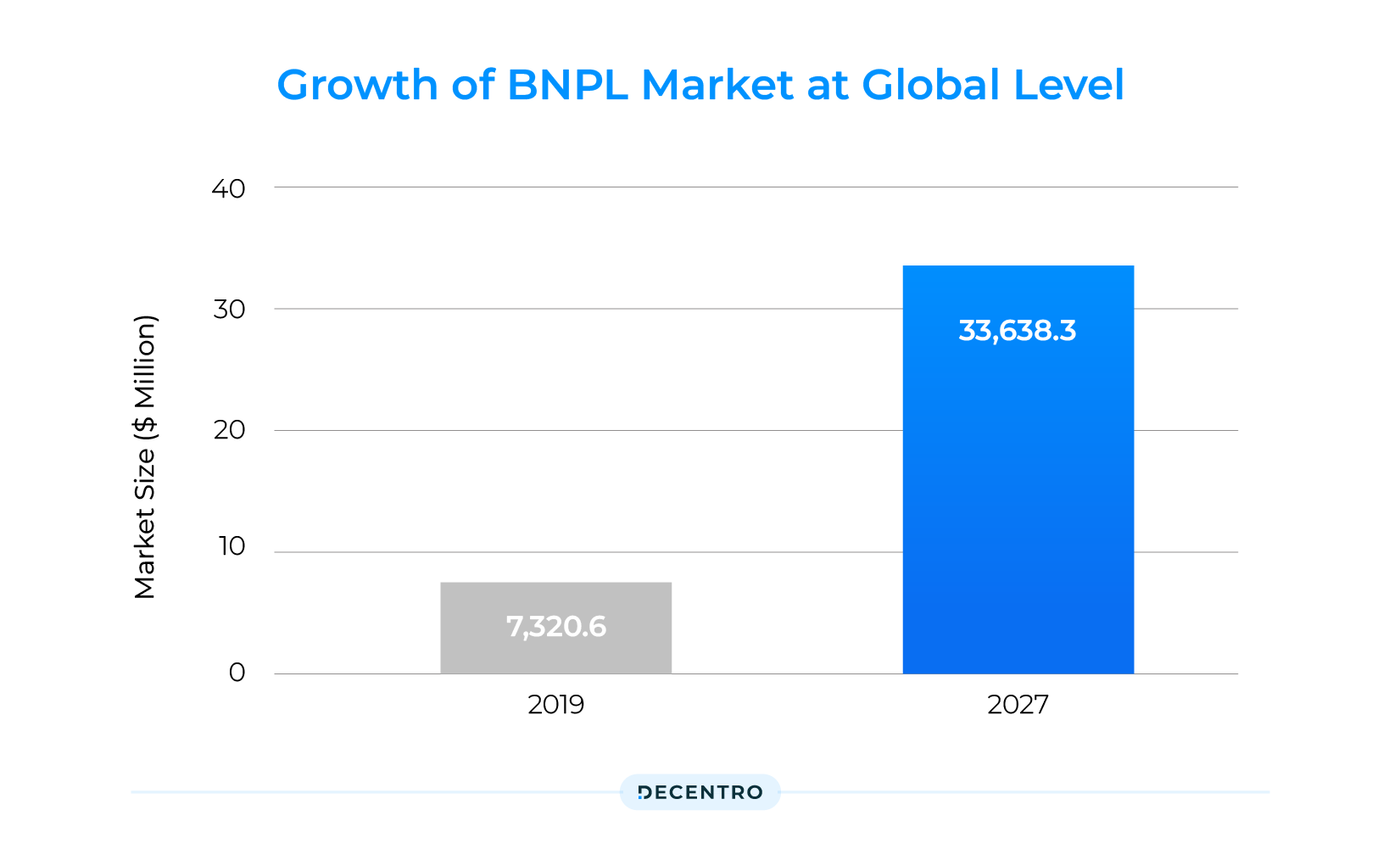

At a global level, the BNPL market is expected to grow from $7,320.6 million in 2019 to $33,638.3 million by 2027, i.e., at a CAGR of 21.2 per cent.

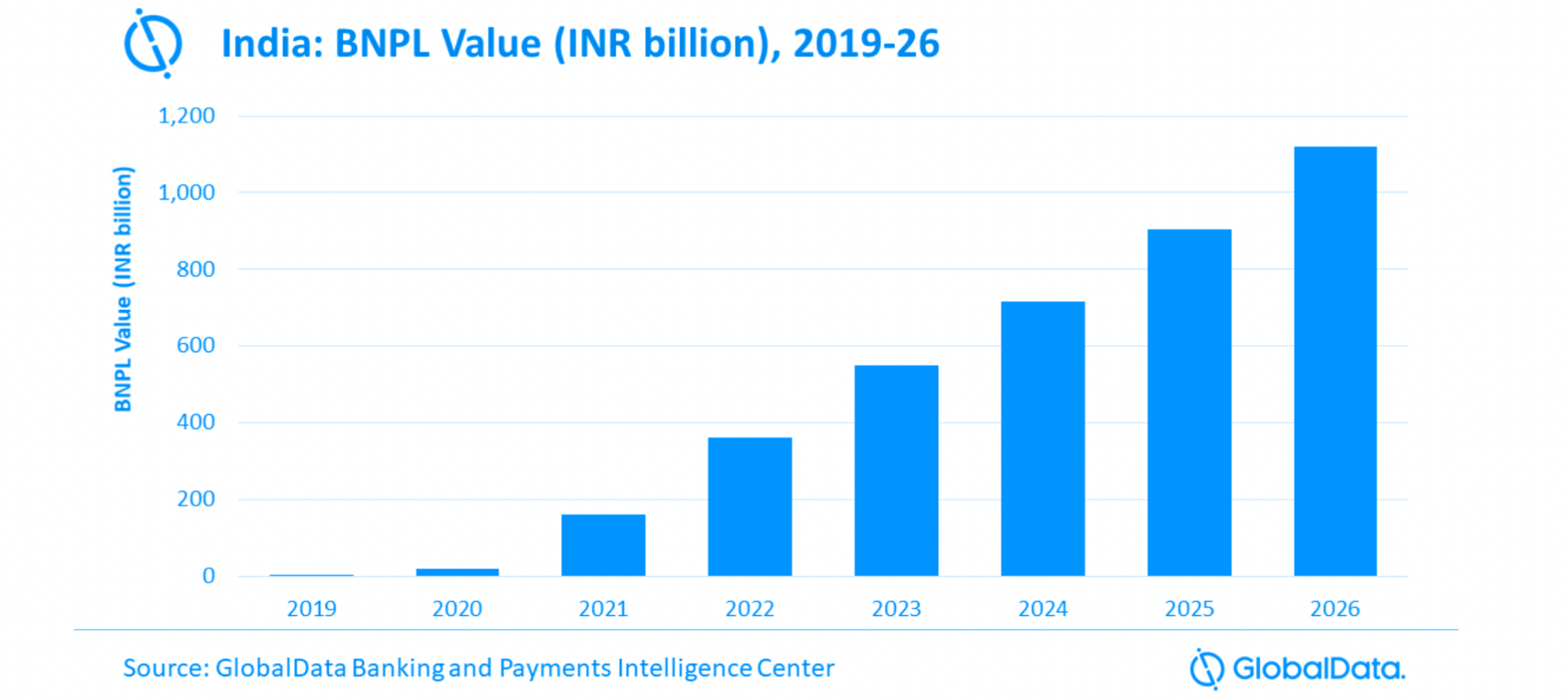

Closer to home, the success of the India stack and digitally savvy Indians paved the way for broader and deeper adoption of digital financial services. There is also a massive demand for credit in tier-2, tier-3, and beyond. Most consumers in these markets are mostly ‘new to credit’ (NTC) or those with smaller credit scores and often look for small-ticket credit for specific needs. But with many not being eligible for a credit card, they have few sources to turn to for safe, transparent, hassle-free, and low-cost credit.

Naturally, the potential that this market holds is paramount. Redseer estimates that India’s BNPL market will rocket to $45–50 billion by 2026 from $3–3.5 billion. The research firm also forecasts that the number of BNPL users in the country may rise to 80–100 million customers by then, from 10–15 million in 2021.

So now that we have established BNPL’s promising future in the country, let’s strengthen this particular case a bit, shall we?

What are the Benefits of BNPL?

Let’s examine the advantages of buy now, pay later from two different perspectives: one from a customer’s point of view and another from that of a business owner.

Buy Now Pay Later For Customers

- From the POV of a customer, BNPL offers the ability to make instant purchases, even if they lack funds.

- The ability to make payments in instalments over time or pay the total amount by the end of a stipulated period.

- The system is entirely free for users who pay on time. Credit cards allow you the option to pay a minimum value and charge interest on the rest. On the other hand, BNPL only charges for late payments.

- It is much easier to get credit via BNPL than traditional lending methods.

- Contrary to credit cards, BNPL gives customers instant access to funds without waiting for months, together with quick approvals.

Buy Now Pay Later For Businesses

- Enables a merchant to increase customer conversion rates and reduce cart abandonment.

- Boost sales with diverse payment options and increase the average order value or AOV.

- In addition, business owners can also open an additional revenue stream using the loan interest.

- Merchants pay an interchange fee to BNPL companies, around 2-7%. However, this is significantly less than credit card providers’ fees.

The Category Breakdown of BNPL

The BNPL model’s core is the idea of credit for all. With access being the primary driver, the category that encompasses this model is vast. So, let’s break this down one by one.

Demography

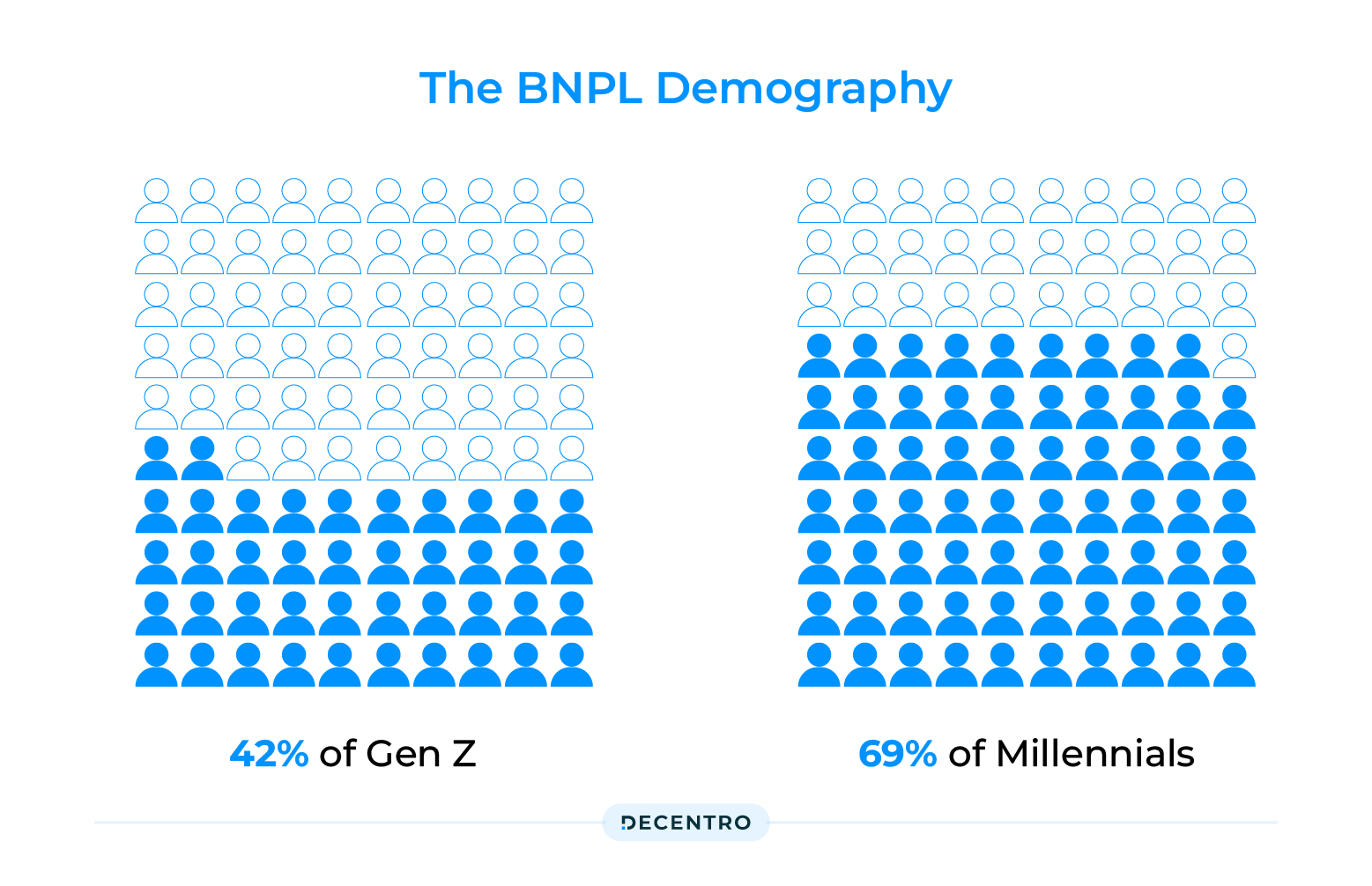

BNPL is made for digitally native GenZ and millennials looking to expand their budget. It is a solution catered to extending that credit line to young India. While the other demographics adapt to this model, a GenZ consumer, a young millennial, or a first-time credit borrower adopts this.

Interestingly, a study by Forbes also found that 42 percent of Gen Z and 69 percent of Millennial customers would be keen to avail themselves of BNPL services if offered. Even for a global player like Afterpay, almost half of its 11.2 million users are Millennials, reinforcing the young narrative for BNPL.

Industries

Access to credit as a use case has many takers, but in the context of BNPL, we have the following prominent BNPL players.

E-commerce

BNPL is a by-product of the meteoric rise of the e-commerce sector in India during the pandemic—close to 73 per cent of the segment uses BNPL for online shopping. The growth of e-commerce has played a substantial role in driving the popularity and adoption of BNPL. At the same time, BNPL services have contributed to the expansion of the e-commerce sector. From the checkout experience to the point of sale, the entire end-to-end lifecycle of the e-commerce industry is enabled by the BNPL offering. Digestible and lucrative offers, with one click check out, this symbiotic relationship peaks during the festive season, when the adoption of BNPL is seen to be on the higher side. We have done an elaborate piece on how you can time your BNPL launch this holiday season. Feel free to indulge.

Travel Industry

Indian travellers are spoilt for choice nowadays when putting off paying for their travel plans. Travel Now, Pay Later (TNPL) has a buzzing fad in the holiday season. The scheme, which replicates ‘buy now, pay later’ for the travel industry, attracts a host of users who avail of the travel packages immediately and make the payment afterwards, sometimes using the monthly instalment facilities. Most loans have a no-cost EMI option if paid within the specified time frame. However, if you miss a payment, the lender will charge you interest on the principal amount. Interestingly, this scheme is touted to contribute significantly to the travel industry.

Healthcare

Currently, BNPL offers have been mainly confined to financing online purchases of impulse-based categories like apparel, cosmetics, gadgets, food etc. Still, fintech start-ups have been developing a unique offline BNPL product for funding need-based healthcare expenses at physical points of care called ‘Care Now Pay Later’ (CNPL). CNPL aims to facilitate quality care with enhanced affordability, enabling individual healthcare providers from several segments to offer instant, point-of-care flexible payment solutions, thereby building an integrated healthcare finance ecosystem. This new way of consuming BNPL is set to revolutionize the healthcare sector and address the acute pain point of patient financing. We at Decentro are proud to have enabled a player, Eve Healthcare, to operate in this sector. Not only this, our ethos of enabling the ecosystem from within has found its fruition in the form of our customers, whose detailed case studies can be accessed here.

Launch Your BNPL Product With Decentro

E-commerce giants such as Amazon & Flipkart have their native BNPL products offered to customers.

What if we told you that your business can launch its own buy-now-pay-later product in a matter of weeks without depending on any service providers?

With Decentro’s plug-and-play banking APIs build and launch multiple functionalities of your BNPL product within weeks.

Let’s look at how you can set up a buy now, pay later workflow for your business.

Provide Credit to Customers After KYC

With our all-in-one KYC APIs, you can run comprehensive background checks on your customers before deeming them eligible for credit. These checks include identity verification via Aadhaar, PAN, CIN, DIN, income data, behavioural data, negative lists, etc.

In addition, with our CKYC APIs, you can prefill the onboarding information for customers in the future, save time, and reduce instances of fraud drastically.

In just a matter of two years, our KYC stack has been churning solid numbers.

With over 400+ Identity validations, 250+ Image recognitions, and 300+ Repository fetches happening via Decentro’s KYC stack per hour, we’re more than equipped to enable your verification and validation journey.

Set BNPL Repayment Terms

Set the optimum credit limits and assign repayment terms to your customers. Using Decentro, you can seamlessly integrate with credit bureaus to assess the customer’s creditworthiness and decide the criteria.

Simplify Payment Collections

If you think collecting payments from customers after the stipulated period is a headache, we can help. We can simplify collections by using diverse channels to reach out to your customers. For instance, UPI Payments are fully equipped with deep linking from your app.

Save 5x collection costs and get real-time updates of transaction details on a dedicated dashboard. With your customer’s consent, you can also enable autopay debit. Consequently, set the amount(variable or fixed) and frequency and ensure seamless payments. In addition, you can pause and revoke the mandate at any time. Furthermore, you can shed all worries about payment reconciliations—our virtual accounts will take care of that bit in real-time.

The Lending ecosystem in India will only expand in the years to come. With more players opting for the buy now, pay later options, the importance of lending in the economy is evident.

Thus, the possibilities with credit are endless, and we want to help you realise your true potential without spending any interchange commission or waiting months together. Sign up, choose your APIs, test in the sandbox, and go live!