Capitalize on the Black Friday and Cyber Monday deals this year with a BNPL program. Here’s a quick guide to launch your own BNPL program with Decentro.

Building a Buy Now, Pay Later this Holiday Season

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

It’s beginning to look a lot like Splurge Season, doesn’t it?

It is that time of the year.

When the lights seem brighter on the streets, wallets seem lighter in the bag.

As the season of giving is bestowed upon us, the weight of the same on the consumers leaves them scrambling for the obvious.

OFFERS.

Cue in, the annual Olympics for brands, retailers, merchants, and vendors alike, The BLACK FRIDAY AND CYBER MONDAY BONANZA.

The Cyber Week

To give a little context of how this WHIRLWIND of a week pans out completely,

Cyber Week is a mega retail event that spans five days, covering five major shopping dates: US Thanksgiving Day, Black Friday, Small Business Saturday, Super Sunday, and Cyber Monday.

Of these special days, consumers look forward to Black Friday and Cyber Monday (BFCM) the most.

The Globalisation of BFCM

While originally these dates which revolved around thanksgiving week were centered around the American economy and the spending habits of that geography, there has been a significant shift in its popularity, closer to home in recent times. Additionally, the pandemic accelerated the adoption of digital payments for all types of consumer spending, and holiday shopping became the poster child for experimentation for retailers and marketers alike.

With BFCM, often touted as a barometer to estimate the global trade and retail offerings for the subsequent year, it was obvious that the players closer to home jumped onto the bandwagon. Just to put things into perspective, even amidst the inflation and layoff crisis, the consumers’ black Friday Spend forecast is touted to hit the $158 Billion mark.

Slowly but surely there is visible effort and also impact of these so-called mega sale days, and companies have been integrating marketing efforts, if not full-fledged business models to leverage the same.

The BNPL Blip

As a player looking to leverage the buffet of offers that is Cyber Week, the easiest way to spread the holiday cheer for your consumers, quite literally, is to indulge in the “Buy Now, Pay Later” [BNPL] scheme.

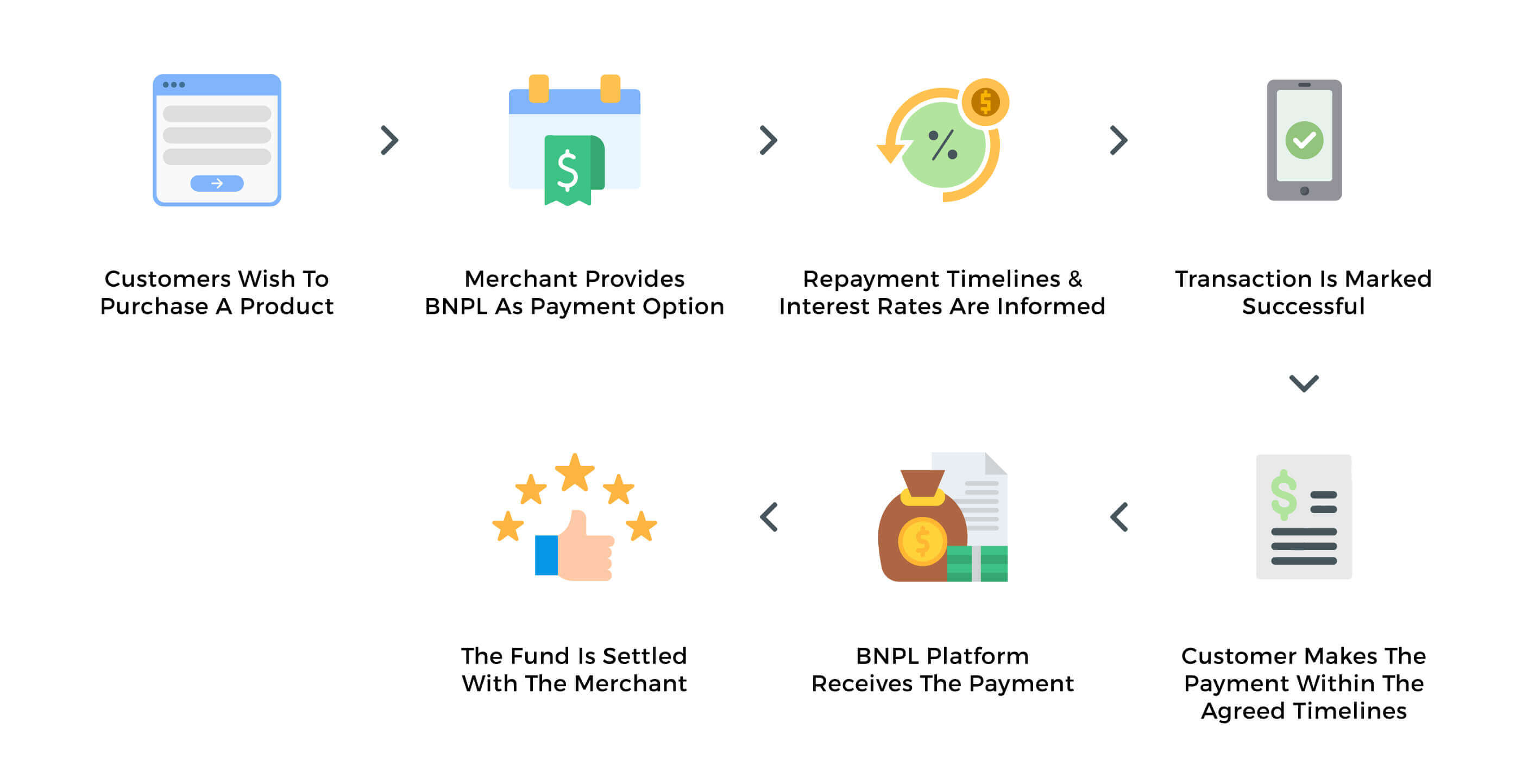

As the name suggests, BNPL is a financial arrangement that brings friction-free options to pay off the bills over a few months. It is strikingly similar to a credit system. However, easier to integrate and execute.

Are you interested to know more? Read our exhaustive article on the nuances of BNPL products and how it fares in the Indian market, all while elucidating its key benefits.

While from the consumer’s perspective, the BNPL model offers purchasing power, the business side of launching your BNPL product during this window makes for an interesting use case.

Just to put things in perspective,

Last year, 3.7 percent of Black Friday shoppers used BNPL to pay for their purchases, which is projected to increase again this year.

There was a 51% increase in the use of BNPL payment methods in Europe during Black Friday, Cyber Week, and Cyber Monday compared to the previous year, according to data from Mollie.

When it comes to data and traffic, there are insights as detailed as the time slot of the highest transaction volumes on Black Friday.

For Germany, the key period was 11:00 – 12:00.

In France, we had 19:00 – 20:00.

The Netherlands witnessed traffic between 13:00 and 14:00 in Belgium between 16:00 and 17:00.

Where there is a wealth of information and insight, there should be a marketeer or, even better, a product manager.

You know the famous saying,

Where there is data, there is an analyst.

And if you put your analyst to good use, you too can launch your own BNPL scheme.

Let us show you how.

Launch your BNPL

The idea is to set your goal from the BNPL model right from the get-go. Following are the practices merchants or businesses can employ to help ensure optimal outcomes from their implementation of a BNPL solution:

- Clarity of thought: Split Payments or Installment Loans

As a BNPL provider, depending on your consumer base, you must deploy one of the two payment methods. Customize and finalize the payment methods best suitable for your consumer.

For example, for big-ticket transactions, split payments may not be the most ideal route, however, installment loans are the perfect fit in such cases.

If your solution is flexible enough to offer both, make sure that there is an effective tool that pre-selects the optimal route based on the ticket size of that session.

- Knowledge is Power

As cliche as it sounds, make sure that you inform consumers early in the purchase journey. This can be done with the help of banner ads or even an intuitive product journey. The earlier in the purchase journey, consumers become aware of BNPL payment options, the more likely they will use it.

- Omnichannel Presence

Never underestimate the power of all offerings coming under the same roof. Make sure your BNPL covers the width of the user authentication and account management to even the extension of payments or rescheduling.

- The Post Purchase Checklist

Ensure that your BNPL model checks the post-purchase checklist provided below

- Initial contact creation (customer agrees to terms)

- Requesting and protecting payment information

- Tracking the payment schedule

- Handling accounts payable and collections

- The Power of Giving Back

Rewards and referrals are the X-factor when it comes to BNPL service. This low-cost yet effective strategy focuses on retaining existing users with reward points and cashback for every unique referral. If implemented effectively, it opens up acquisition channels with little capital input.

Across the arguments of why there should be a BNPL offering for your business to how you can go about doing the same, one thing is pretty evident. The time to launch your BNPL product is now.

What if we tell you that your business can launch your buy now, pay later product in a matter of weeks without depending on any service providers?

Why wait to integrate when you can find your efficient way around via us?