When most companies do not have the luxury, bandwidth, or deep connections to build a full-stack lending platform, what’s the way ahead?

Improving Access to Lending Using Technology and OCEN

Chai & Fintech Addict at Decentro. Venture Capitalist in my previous life. Namesake Engineer before that.

I come from a traditional middle-class family & was averse to the idea of lending for a long time. Like a typical millennial, the younger me did not like the idea of owing something to someone. Someone close to my life struggled with loan repayments & my younger self made an immature decision to never take a loan. For every credit card in the country, there are 14 debit cards, and I relied on debit for a long time with this notion.

The economy doesn’t work well without the lubrication of credit and trust

Warren Buffett

I saw this through a different lens when one of my mentors told me that credit can be a net good to businesses and society.

A business can grow faster with access to debt – the current profits might not be adequate to fuel the company’s ambitions. Students can avail themselves of the facilities of a top college due to education loans & set themselves up for a promising future.

If we extrapolate this, it’s evident that lending is one of the building blocks of the economy. The United States, the biggest economy of the world, runs on credit & every American citizen has an avg. 3.2 credit cards vs 0.03 for India.

Hence, we need to make sure that a ‘healthy’ line of credit is easily accessible to the masses, the key word being ‘healthy’ here as the economies have discovered in recent times.

The banks haven’t been able to service all the loan requirements in the country. As a result, the last few decades saw the emergence of many NBFCs & Loan Service Providers who distributed innovative loan products to both consumers as well as SMEs.

These companies have different partners for KYC, disbursements, repayments and some of them have done the arduous task of integrating with Banks and Non-Banking Financial Companies themselves over a span of few years.

Most of the new companies and fast-growing ventures do not have the luxury, bandwidth, or deep connections to build a full-stack lending platform in the same way.

What’s the Way Ahead?

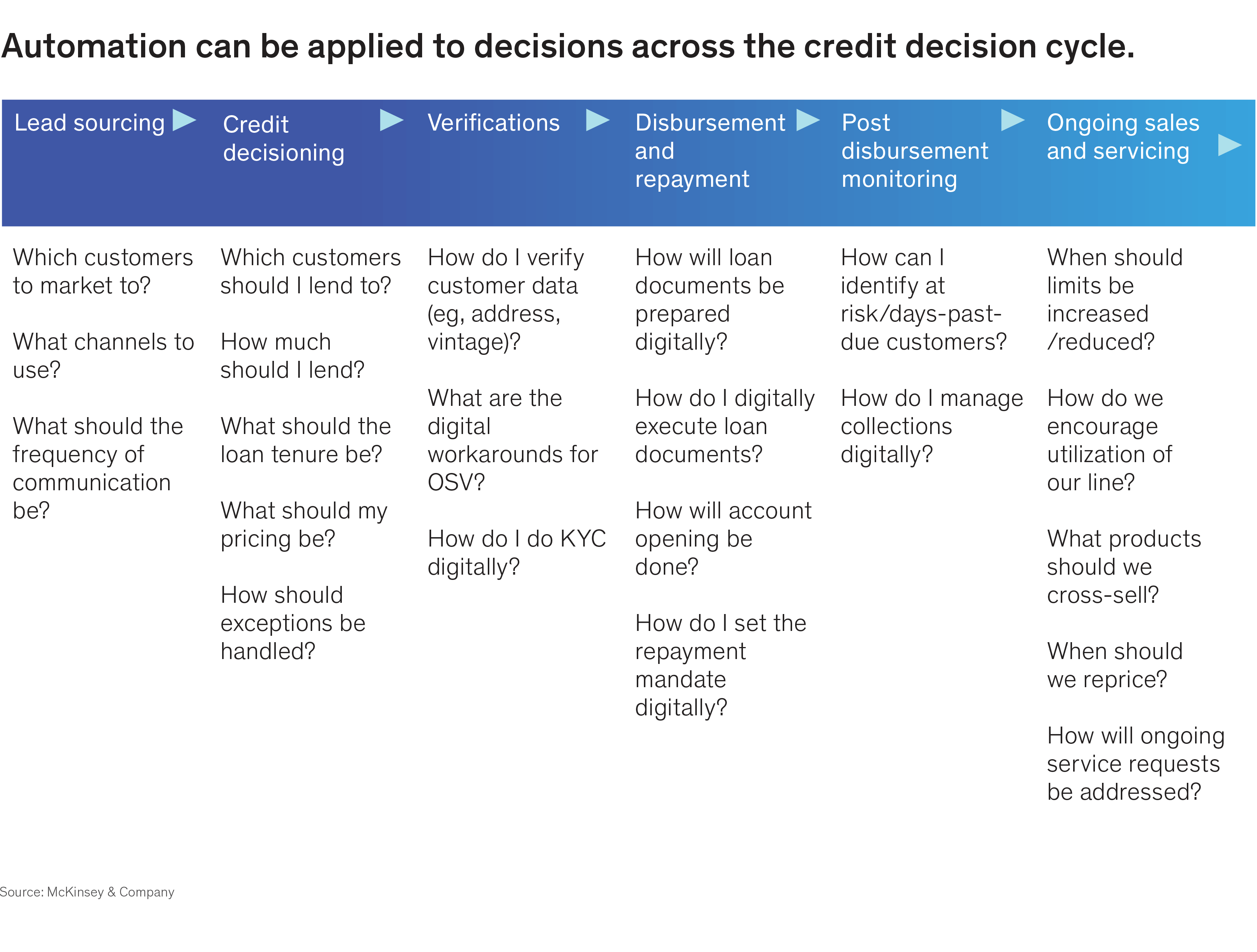

The fragmented financial systems and the slow processes of legacy players have limited the outreach of lending and thereby the proliferation of companies offering lending as a service. India desperately needs a completely new infrastructure with a fresh perspective for long and healthy cycles of credit going forward.

This infrastructure will not only help smaller businesses navigate their working capital requirements and grow faster, but also help consumers fulfill their ambitions across education, travel, and more.

The much-anticipated launch of the Open Credit Enablement Network (OCEN) or the ‘UPI for lending’ will enable the sources of capital (or lenders) to come onboard a common framework and we will play our role in helping you build innovative lending products on top of our APIs based on this framework.

Imagine your local kirana shop getting a low-interest working capital loan within a day and being able to repay that loan in 7 days. Or your favorite apparel manufacturer can then have access to short-term credit due to his/her strong track record of repayments while navigating the seasonality of the business.

Today, a food delivery platform relies on a mesh of providers to offer loans to its restaurants on its platform or delivery heroes.

One of my friend’s restaurants took a loan from one of their NBFC partners & repayments were adjusted against the sales on the online platform. Although this restaurant benefited from the loan, it was not sustainable in the long run and eventually this restaurant shut down.

This is one of the many examples that indicate that the current intelligence/underwriting mechanisms & processes may not be accurately predicting future cash flows.

In the next post, we’ll dig a little deeper into how Decentro is solving the lending infrastructure problem. Our goals are in line with Ispirt’s fundamental vision – enable credit access to the deeper section of society using technology. If you’re a company, platform, NBFC, or Fintech Lender that could benefit from offering loans to your customers, we’d love to speak to you and help create the perfect product with the right banking alliances in the backend.

Onwards and upwards!

P.S. If you wish to be a part of this revolution, we’re hiring! Please apply on AngelList to find your next challenge.

References:

OCEN