This guide will help businesses understand the potential of digital lending, the benefits of digital lending vs traditional lending, and how businesses can leverage Decentro’s leading stack to fuel 10X growth.

Digital Lending Guide: A Journey Into Quick, Paperless Loans

Avi is a full-stack marketer on a mission to transform the Indian fintech landscape.

Table of Contents

What is Digital Lending?

Digital lending involves offering loans and credit services through online platforms, utilising digital technologies and data analytics to evaluate a borrower’s creditworthiness. This process enables the swift approval and disbursement of funds. With the rise in digital connectivity, services, and a growing culture of digital finance, this method of credit delivery is rapidly gaining popularity.

Digital lending platforms have made it feasible to obtain loans quickly without the need for traditional procedures such as exhaustive creditworthiness evaluations or extensive paperwork.

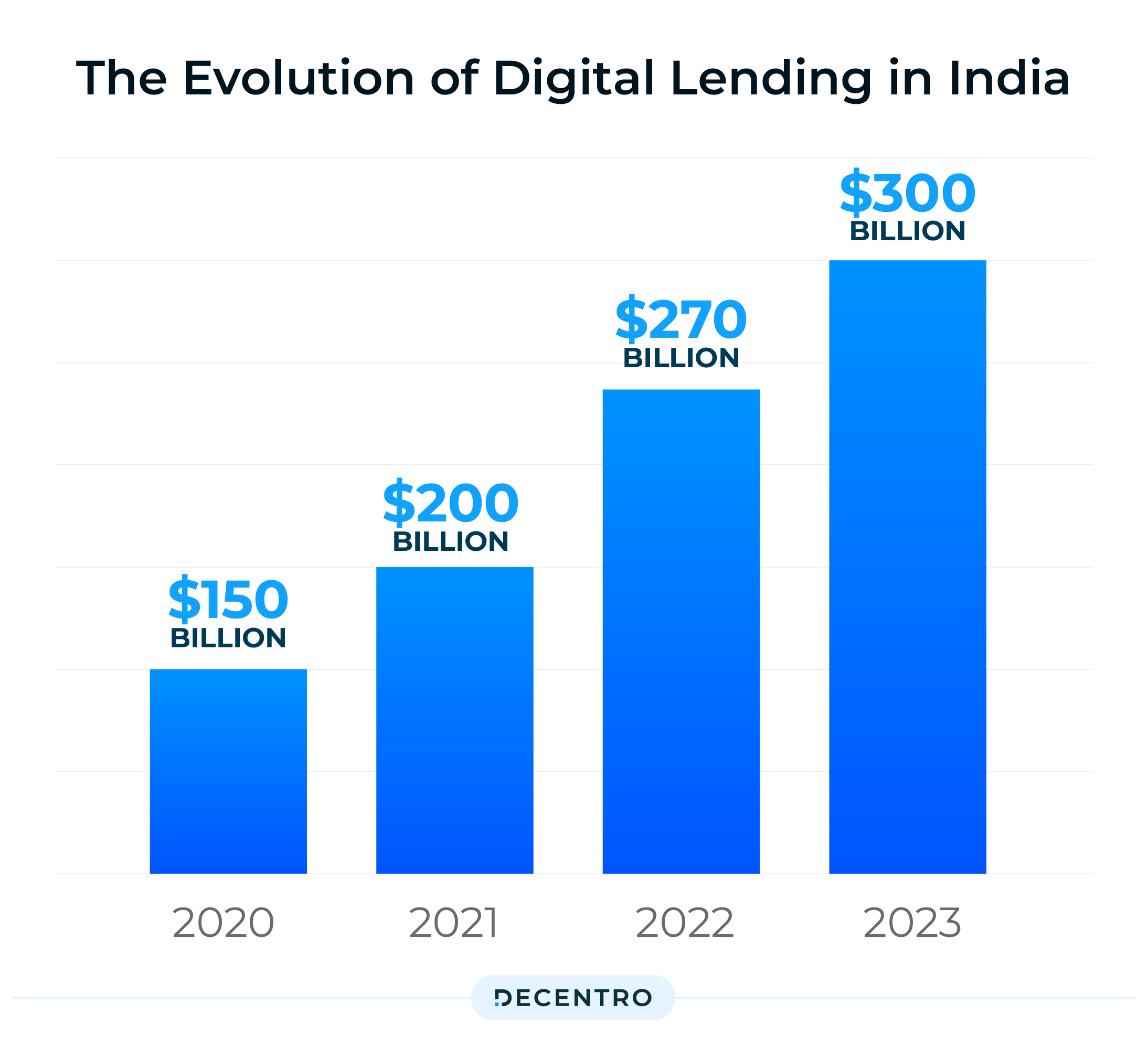

The Evolution of Digital Lending in India

Digitisation has revolutionised India’s traditional lending system, bridging the gap between innovative technologies and financial services. This evolution has led to a completely online lending and borrowing process, making it paperless and more efficient. Fintechs have integrated modern technology with financial services, simplifying the process for lenders and borrowers to transact money.

The recent surge in affordable internet access and a significant increase in smartphone usage in India have set the stage for the growth of digital lending. The total number of internet subscribers in India rose to 881.25 million by the end of March, up from 865.90 million in December 2022, showing a quarterly growth of 1.77%. At the same time, smartphone usage in India has blown up. A Deloitte study indicates that by 2026, the number of smartphone users in the country is expected to reach 1 billion, positioning it as the second-largest smartphone producer within the next five years.

These elements and an increasing demand for fast, small-scale loans have contributed to the emergence of digital lending platforms. India’s digital consumer lending market alone is expected to exceed $720 billion by 2030, accounting for almost 55% of the country’s total digital lending market, estimated to be over $1.3 trillion. Here are some other trends impacting Digital Lending.

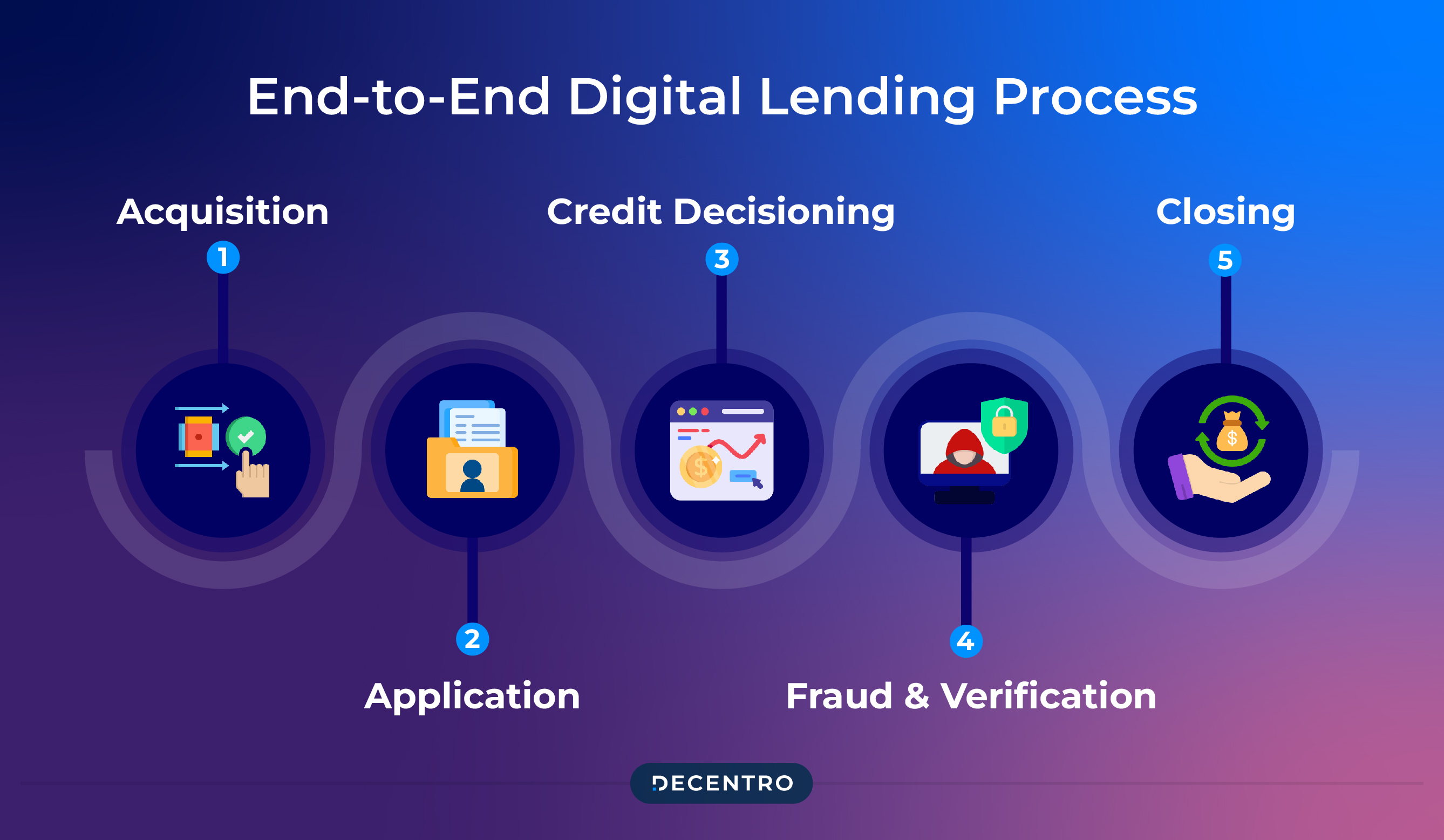

How Does Digital Lending Work?

Traditional lending is typically lengthy and complex, often requiring in-person interactions with financial institutions like banks and NBFCs. This complexity has prevented many people from accessing loans, limiting capital availability.

In contrast, digital lending seeks to make this process more efficient by transitioning it entirely online and automating it. Here’s a breakdown of the key features and elements:

- Online Platforms: Digital lending operates mainly through web-based or mobile applications. These platforms enable borrowers to apply for loans, submit necessary documents, and monitor their application status online.

- Data Analytics: These platforms use advanced data analytics and algorithms to evaluate a borrower’s creditworthiness. They consider various factors, including credit history, income, employment, and social media activity, allowing for more accurate and quicker lending decisions.

- Automation: Most steps in the loan process, from origination to approval and disbursement, are automated in digital lending. This automation dramatically reduces the time required for loan approvals and fund transfers.

- Paperless Transactions: The digital approach eliminates physical paperwork, as all transactions and document submissions are handled electronically. This not only streamlines the process but also minimises errors and fraud risks.

- Personalised Services: Digital lending platforms can tailor loan products and interest rates to individual borrowers based on their unique needs, credit profiles and purchase history. This personalisation can result in more attractive loan offers and an enhanced borrowing experience.

- Accessibility: These platforms are available around the clock, offering the convenience of applying for loans anytime. They cater to many borrowers, including those with limited or no credit history.

- Regulatory Compliance: Despite being digital, these platforms must comply with standard financial regulations, including AML and KYC requirements. Adhering to these regulations ensures the security and privacy of user data and upholds the financial system’s integrity.

- Disbursals: The disbursal process is much more streamlined – unlike traditional lending, where the funds are disbursed only after a few days, digital lending platforms allow instant fund disbursement. The entire process is very efficient, providing borrowers timely access to the funds they need.

- Loan repayment: Repayment of the loan is also entirely online – the payments are typically managed through the digital lending platform. Some may even offer flexible repayment options to accommodate borrowers’ needs.

Using Lending Analysis for Information

Financial institutions have the opportunity to significantly improve their lending process by implementing digital solutions in the realms of analytics and intelligence. This strategic move can help businesses tackle the challenge of inconsistent estimates and assessments, which frequently result in wrong calculations, improper credit decisions, and unreliable reporting.

By seamlessly integrating a digital lending system into their platforms, financial institutions can expedite and enhance the evaluation of their products, check the credit history and do customer verification quickly and at scale.

This digital transformation can also allow lenders to aggregate valuable lending data, which offers valuable insights for evaluating portfolio risk and facilitating strategic decision-making. With the RBI’s emphasis on reducing the portfolio risks for banks and other lending institutions to create a more sustainable lending ecosystem, digital solutions can go a long way in helping these businesses grow better through better risk management and informed decision-making.

Digital Lending Platforms in India

Digital Lending is the future. Here are some of the top digital lending platforms in India.

- CASHe – Headquartered in Mumbai, operates as a digital lending platform catering to the financial needs of young salaried millennials. CASHe specialises in offering immediate short-term personal loans, with amounts ranging from INR 7,000 to INR 300,000 and loan durations extending up to one year. These loans are extended to young working professionals based on an evaluation of their profile, facilitated by the company’s proprietary algorithm-based machine learning platform.

- KreditBee – KreditBee, a digital lending application, specialises in delivering swift and hassle-free personal loans tailored towards professionals. With the capability to provide loans of up to ₹4 lakhs, KreditBee strongly emphasises leveraging technology for data-driven Know Your Customer (KYC) procedures. KreditBee’s vision is to promote greater financial inclusivity among diverse demographic groups nationwide.

- LendingKart – Established in 2014, LendingKart’s core mission is to provide a diverse range of capital loans to businesses, predominantly catering to the small and medium-sized enterprises (SMEs) sector throughout India. Lendingkart is renowned for its streamlined approach, where the entire capital acquisition process takes place online with menial documentation.

- MoneyTap – Headquartered in Bengaluru, has earned a reputation as a prominent lending company primarily recognised for providing consumers with credit lines in the form of loans. Among its myriad notable features, the standout is undoubtedly its streamlined documentation process for personal loans, making it a standout feature.

- Faircent – Faircent is the first and largest Indian peer-to-peer digital lending platform. It offers a secure marketplace for individuals to extend loans to borrowers. It serves as a conduit for organisations and individuals seeking to provide credit to those in need.

Types Of Lending Models

In finance, lending models have evolved to cater to diverse borrower needs and market dynamics. Here’s a simple breakdown:

- Traditional Bank Lending: This is the most common form of lending. Banks offer loans based on credit scores, financial history, and collateral. Interest rates and terms vary, but the process can be lengthy and requires substantial documentation.

- Peer-to-Peer (P2P) Lending: P2P platforms connect borrowers directly with individual lenders. It bypasses traditional financial institutions, often resulting in lower interest rates. It’s ideal for those who may not qualify for bank loans.

- Microfinance: This model targets small business owners or individuals in developing regions who need small loans. Microfinance institutions focus more on the feasibility of the business idea rather than credit scores.

- Payday Loans: These are short-term, high-interest loans intended to cover borrowers’ expenses until their next payday. While quick and easy to obtain, they can lead to a cycle of debt due to high interest rates.

- Digital Lenders: Similar to traditional banks but operate entirely online, offering quicker application processes and sometimes more flexible lending criteria. They use advanced algorithms for credit decisions.

- Invoice Financing: Businesses use their unpaid invoices to get cash immediately. Lenders advance a percentage of the invoice amount, with the remainder paid upon invoice settlement minus fees.

- Crowdfunding: This involves raising small amounts of money from many people, typically via the Internet. It’s more about funding a project or venture; investors may receive rewards or equity in return.

- Government or SBA Loans: Specifically backed by government agencies, these loans usually have lower interest rates and favourable terms aimed at supporting small businesses.

- Asset-Based Lending: Loans are given based on the value of assets like inventory, equipment, or real estate. It’s useful for companies with significant physical assets.

- Credit Unions: Member-owned financial cooperatives that offer similar services to banks but often with more favourable terms. They are more community-oriented and may have more flexible lending criteria.

Each model serves different market segments and has advantages and challenges.

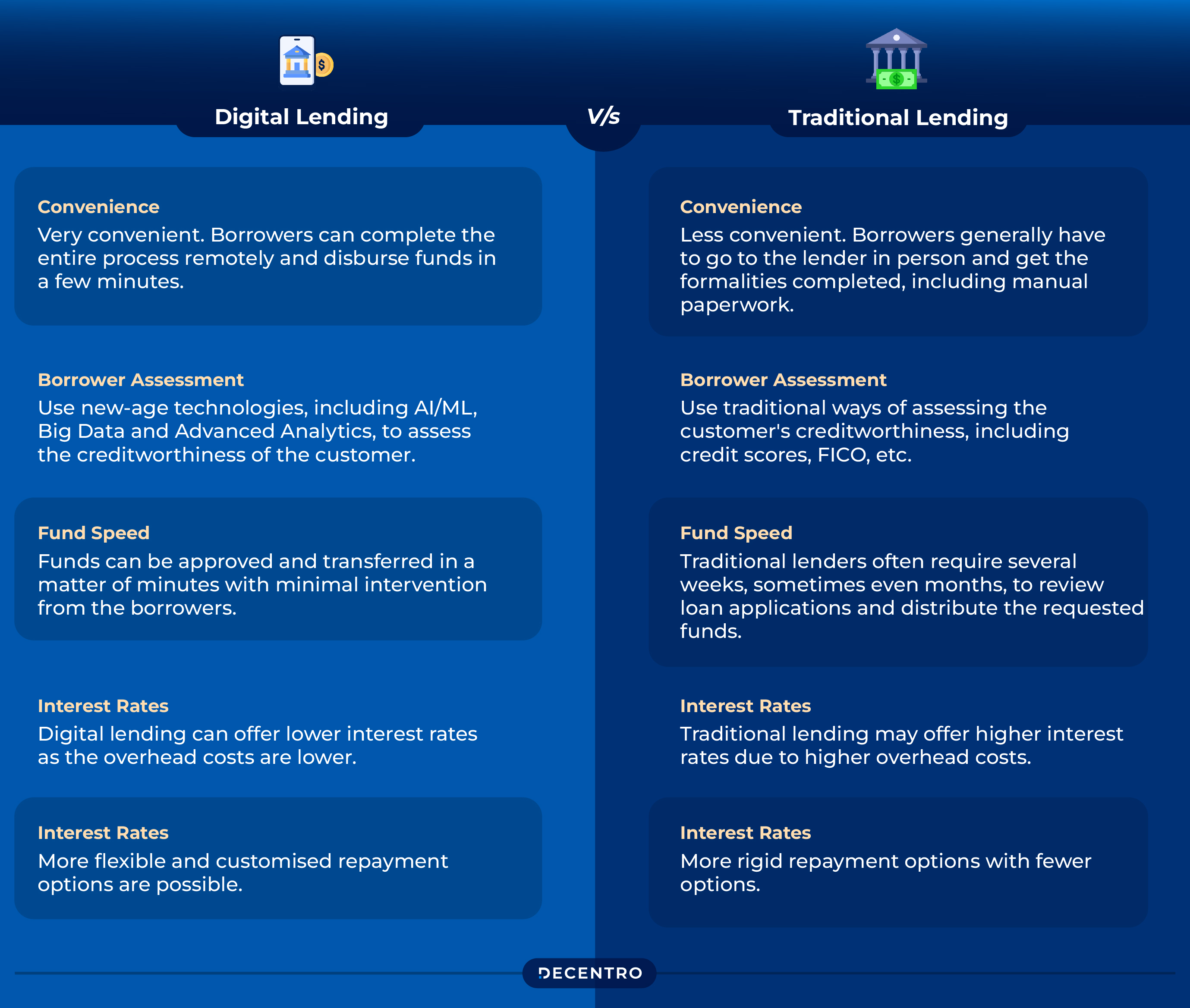

Digital Lending vs Traditional Lending

How is digital lending compared to traditional lending? What specific advantages does it offer compared to traditional lending? Let’s see a comparison between digital and traditional lending.

| Digital Lending | Traditional Lending | |

| Convenience | Very convenient. Borrowers can complete the entire process remotely and disburse funds in a few minutes. | Less convenient. Borrowers generally have to go to the lender in person and get the formalities completed, including manual paperwork. |

| Borrower Assessment | Use new-age technologies, including AI/ML, Big Data and Advanced Analytics, to assess the creditworthiness of the customer. | Use traditional ways of assessing the customer’s creditworthiness, including credit scores, FICO, etc. |

| Fund Speed | Funds can be approved and transferred in a matter of minutes with minimal intervention from the borrowers. | Traditional lenders often require several weeks, sometimes even months, to review loan applications and distribute the requested funds. |

| Interest Rates | Digital lending can offer lower interest rates as the overhead costs are lower. | Traditional lending may offer higher interest rates due to higher overhead costs. |

| Repayment Terms | More flexible and customised repayment options are possible. | More rigid repayment options with fewer options. |

What Are The Benefits Of Digital Lending?

1. Speed and Efficiency: Digital lending platforms streamline the loan application and approval process, offering borrowers rapid access to funds. This accelerated timeline, often reduced to hours or minutes, is especially advantageous for individuals and businesses with urgent financial needs.

2. Enhanced Accuracy and Personalisation: Digital lending leverages advanced algorithms and data analytics to assess credit risk more precisely. This results in personalised loan offerings tailored to each borrower’s unique financial situation, increasing the likelihood of approval and favourable terms.

3. Convenience and Accessibility: Digital lending eliminates the need for extensive paperwork and in-person visits to traditional banks. Borrowers can conveniently apply for loans online, making the process accessible 24/7 from the comfort of their homes or offices.

4. Financial Inclusion: Digital lending platforms broaden access to credit, particularly for underserved populations and those with limited access to traditional banking services. This fosters financial inclusion and economic opportunities for a wider range of individuals and businesses.

5. Environmental Sustainability: By reducing the reliance on paper-based processes and physical branches, digital lending contributes to a more environmentally friendly and sustainable approach to lending, aligning with global efforts to reduce paper waste and carbon footprint.

Challenges For Digital Lending

Despite its numerous advantages over traditional lending, digital lending encounters several noteworthy challenges. Here are some of the primary challenges digital lending platforms must contend with:

- Fraud and Cybersecurity: Digital lending platforms are susceptible to fraudulent activities and cyberattacks. Lenders must invest significantly in robust security measures to safeguard customer data and thwart fraudulent loan applications.

- Customer Education: Many borrowers are unfamiliar with digital lending platforms and their functioning. Lenders must be responsible for educating borrowers about the lending process and the associated risks before they apply for a loan.

- Regulatory Compliance: The digital lending sector is still relatively young and evolving rapidly. Consequently, certain jurisdictions lack clear and comprehensive regulations. Lenders must stay abreast of the latest regulatory developments and ensure their operations remain compliant.

- Risk Assessment: Sources such as social media and other modern credit reports may prove less reliable than traditional credit reports. Lenders need to develop intricate risk assessment models to mitigate the risk of loan defaults.

In addition to these challenges, digital lenders face stiff competition from traditional lending institutions since traditional lenders still dominate the mass markets. To thrive in this competitive landscape, digital lenders must offer a unique product or service to scale up successfully.

The Potential of Digital Lending in India

Digital lending has tremendous potential in India, with strong macroeconomic indicators and a sizable capital-hungry population. With digital lending, a public-private partnership approach can bring in the next round of growth for the economy.

For Financial Inclusion

Bringing financial services to those who don’t have them is a big step towards growing India’s economy in a way that includes everyone. Making it easy to get loans when needed is a significant part of this. The Government of India is focused on this and is pushing for digital lending. This is to help people who usually don’t have easy access to these services, especially in rural areas.

FinTech companies are at the forefront of this change, especially in the countryside. They combine technology with government support to reach these untapped markets and help more people get financial services.

For example, financing electric vehicles (EVs) and installing solar panels on houses. These two areas alone could lead to a vast business opportunity worth INR 1 lakh crore over the next four years. And a lot of this can be handled through digital loans. This shows just how big the impact of digital lending can be.

For MSMEs/ SMEs

Small and medium-sized businesses are important for many countries’ growth, including India. They add much to the economy, bring new ideas, and create jobs. They’ve been crucial in ensuring development happens evenly across different regions and reducing inequality in India.

Since the COVID-19 pandemic hit, digital lending has become a big hit with these businesses. They love the flexibility it offers, like choosing how long to borrow for, not needing much paperwork, getting low-interest rates, simple identity checks, and really quick loan payments.

Using digital lending with UPI (Unified Payments Interface) makes getting funds easier and more cost-effective. It’s quick, there’s a lot of data available, it handles more transactions, and is efficient to sign up for. It’s beneficial for groups that usually don’t get much attention from traditional lenders.

Decentro’s Enablement of Digital Lending Ecosystem

With Decentro’s product suite, you can access multiple APIs and SDKs that can manage repayments and KYC verification while ensuring full adherence to the RBI’s digital lending guidelines (Reserve Bank of India). With our APIs, you can:

AI-Powered Debt Collection –

With NPAs becoming a major challenge for banks and lenders, Neowise, a Decentro company, delivers a revolutionary AI-enhanced solution that transforms lenders’ debt recovery and collection pipeline through intelligent automation and predictive analytics, allowing lenders to streamline and manage their loan recovery workflow with unprecedented efficiency.

Comprehensive AI-Driven Collection Ecosystem:

- Single Intelligent Platform: Harness one unified platform powered by AI to manage all collection touchpoints, send personalized communications, access smart diallers, manage legal workflows, and enable high-performing field teams

- Neobot (AI Calling Bot): Automate and personalize borrower engagement with intelligent conversations that adapt to each customer’s needs across SMS, WhatsApp, Email, IVRS, and AI bots, delivering ~5% improvement in recovery rates

- Neosight (AI Calling Analytics): Real-time call monitoring, quality control, and outcome optimization with behavioral pattern detection and multilingual quality assurance

- Predictive Intelligence: Early warning systems detect borrower distress before escalation, while AI algorithms prioritize cases based on recovery probability

Enhanced Capabilities:

- 40% boost in collection efficiency through advanced AI automation

- 20% increase in customer engagement across multiple products

- Omnichannel AI Communication with multilingual support and cultural adaptability

- Smart Legal Workflows with automated notice dispatch and compliance monitoring

- AI-Enhanced Field Operations with real-time insights and geo-tracking

- Managed Services including 24/7 AI-powered monitoring and dedicated support

Proven Results: Measurable improvements in recovery rates, operational cost reduction, and borrower satisfaction while maintaining full regulatory compliance and ethical collection practices.

Verify customers with our KYC APIs

Before granting loans, ensure the verification and validation of customer identities. Conduct thorough checks, including identity verification through KYC and real-time government data verifications such as GSTIN and facial recognition.

Reconciliation and Settlements

Set up any number of virtual accounts to reconcile all your settlements in real time via Decentro APIs.

The Future of Digital Lending

The future of digital lending in India is poised for significant growth and innovation. With the rapid adoption of technology and a strong push towards digitalization, the Indian financial landscape is evolving quickly. The integration of advanced technologies like artificial intelligence, machine learning, and blockchain is set to revolutionise lending, offering faster, more secure, and more personalised loan products.

Additionally, the Indian government’s supportive policies and initiatives aimed at financial inclusion further propel this sector. We will likely see a surge in digital lending platforms catering to the underserved segments, including small businesses and rural populations. The convenience of quick loan approvals, minimal documentation, and mobile-first approaches will continue to attract a larger customer base. Moreover, the synergy between traditional banks and Fintech companies is expected to strengthen, bridging the gap between conventional and digital finance. Overall, digital lending in India is not just a trend but a foundational shift towards a more inclusive and technologically advanced financial ecosystem.

Whether you’re a business looking to embrace digital lending or a borrower seeking accessible financial solutions, understanding the intricacies of this ecosystem is crucial. This guide’s information empowers you to make informed decisions and confidently navigate the digital lending landscape.

We hope you’ve found this guide enlightening and valuable as you embark on your journey into the world of digital lending. Should you have any further questions or require assistance, do not hesitate to explore the resources and services offered by Decentro’s Digital Lending Stack that can help you harness the full potential of digital lending to fuel your growth and financial aspirations.

Launch Your Business Journey Today

Frequently Asked Questions

Digital lending services can be convenient for individuals with a consistent income and a favourable credit score seeking loans. Using valid identification proof as a prerequisite for loan applications, they can start with the loan application process and get funds directly into their bank accounts.

When delving into digital lending options, borrowers must assess critical factors, including interest rates, repayment timelines, processing fees, and available repayment alternatives. Furthermore, a meticulous review of the loan agreement’s terms and conditions is necessary for protecting the consumer’s interests.

In case of an early repayment, borrowers should be on the lookout for any unstated fees or penalties that might be applied. Therefore, a meticulous review of the loan agreement’s terms and conditions becomes crucial. Borrowers should also ask lenders for clarification if any agreement terms are unclear.

Several fintechs are offering loans to people with low credit scores at higher interest rates. Borrowers can also pay a lower amount to get their loans approved by lenders. Improving their credit scores is another way for borrowers to get loans at better rates.

Decentro’s Digital Lending Stack provides a comprehensive solution for managing loan disbursements, repayments, and KYC verification while adhering to RBI guidelines. It simplifies loan collections and disbursements, verifies customer identities through KYC APIs, enables instant loan disbursals, and offers reconciliation and settlement solutions, all through plug-and-play APIs and a user-friendly dashboard.

Absolutely. Digital lending is revolutionising India’s financial landscape, bridging the gap between technology and financial services. With increasing internet access and smartphone usage, coupled with the demand for quick, small-scale loans, the digital lending market in India is set for substantial growth. It offers convenience, accessibility, and efficiency, making it a dominant force in the financial industry’s future.