An in-depth look into Decentro’s customer Dvara Money, and how they were able to enable neobank communities and help create financial wellness via banking APIs.

How Decentro helped Dvara Money to Enable Financial Wellness?

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

A recent survey that asked people to define financial freedom showed that it was about meeting life goals for most of them.

While 59 percent of respondents said financial freedom was about achieving life goals, 55 percent said it was about leading a comfortable life. Moreover, while 37 percent felt having no debt was true freedom, 35 percent thought retiring early was absolute financial freedom.

While the demographic that took on the survey were between 18-35 years, the true essence of wellness transpires when the conversation goes beyond demographics and into economic strata.

True financial freedom finds its core in financial inclusion. The aim is to include everybody in society, giving essential financial services regardless of income. It focuses on providing financial solutions to the economically underprivileged. With advances in financial technology and digital transactions, more startups are making financial inclusion simpler to achieve.

This is where Dvara Money thrives—enabling communities with limited access to financial wellness advisory services.

What is Dvara Money?

Dvara Money is a community neobank that offers financial products to the financially excluded by leveraging technology and deep customer insights. It provides personalized nudges created based on data-driven behavioral science pushed to the customers at the correct time to help customers. Using ‘Spark Money’, a mobile platform, the company weaves together a customized bouquet of financial products across savings, loans, insurance, investments, and tax, helping chart a path toward financial wellness for customers in a user-friendly manner.

Dvara Money is a portfolio company of Dvara Holdings (formerly Dvara Trust) and part of the Dvara Venture Studio cohort that supports entrepreneurs working towards large-scale systemic change in financial inclusion. Dvara Holdings has been pioneering initiatives that have impacted the financial lives of millions of low-income households in India through policy research and investing in/supporting commercial efforts where there is a significant market gap.

How does Dvara Money work?

At Dvara Money, the aim is to be the trusted partner for financial wellness in urban low-income households. In working towards the vision, they have created Spark Money which aims to be a way of life for the 300 million gig economy workforce. The offering is an all-in-one Spark Account that provides a simple, secure, and trusted platform that leverages data science, behavioral science, and technologies to deliver a tailored financial offering for Urban Bharat.

With “Spark Account” customers have instant access to a zero-balance prepaid account, a Spark Card, and UPI. The account holder can save in gold or mutual funds, manage their insurance, apply for low-interest credit, or file their ITR return, among other services that the one account enables. This allows customers to manage their earnings, savings, and expenses in a single account.

What were Dvara money’s key challenges?

With the key focus groups being low-income households, there were some challenges that Dvara Money faced.

Collections & Reconciliation

With this focus group expanding to the length & breadth of the country, collections & reconciliation were tough. Most importantly, facilitating accessible collections was necessary for an excellent experience for customers. In addition, the platform will need to dedicate valuable hours and resources to keep track of these transactions.

How did Decentro empower Dvara Money?

Decentro’s API product suite, centered around UPI payouts, enabled Dvara money to offer a smooth payment flow and extinguish any reconciliation hassle.

Un-interrupted UPI capabilities

By leveraging the UPI payout suite, consumers who open a “Spark Account” as part of the Spark Money platform offered by Dvara Money will get instant access to UPI capabilities which they can use to make/receive payments instantly. With access to UPI, Spark Account holders will now have Spark Card, micro-savings in Gold, UPI, and IMPS all bundled into the account.

This provides the flexibility of managing their earnings, savings, and expenses in a single account. The partnership will accelerate financial access for the unserved and underserved segment of various communities in the urban gig economy.

80%+ Cost Reduction & Instant Settlements

Direct bank transfers ensured an 80%+ reduction in cost compared to traditional payment gateways. In addition, Dvara Money removed delayed settlements from the equation entirely by controlling their money flow directly and having visibility in real-time on the status.

What were the critical outcomes for Dvara Money?

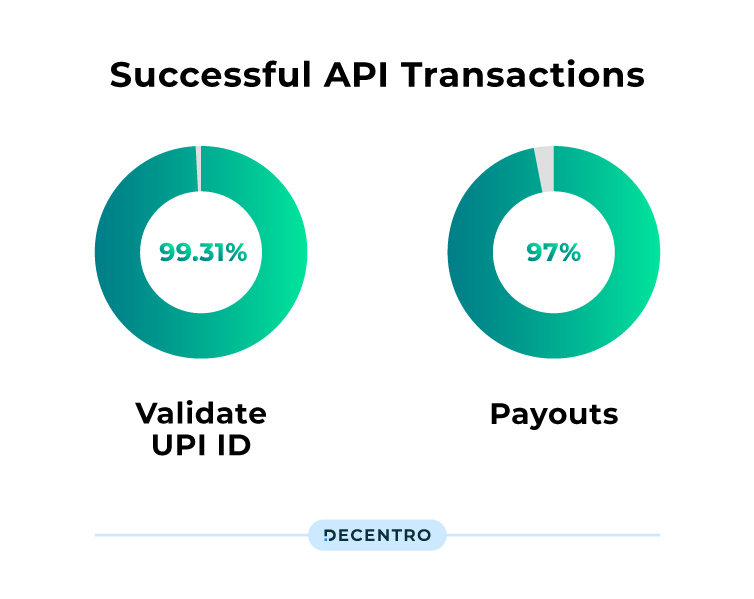

The banking APIs provided by Decentro have propelled Dvara Money down the scalability curve. Let’s look at the month-on-month numbers that Dvara’s consumers are furnishing post this partnership.

- Successful API transactions

- Validate UPI ID – 99.31%

- Payouts – 97%

- Real-time payment reconciliation that saves time, effort, and capital for the platform

- 5X reduction in collection costs while extending credit facilities

- 10X faster integration timelines.

- Availed Decentro’s multi-channel customer support for any queries or resolution

- Employed full payments & collection APIs with >99.9% uptime and response times of a few hundred milliseconds.

“Dvara Money operates in communities with limited access to financial wellness advisory and services. Our partnership with Decentro will empower and encourage our customers to use digital payment methods for day-to-day financial transactions in a safe and secure environment. Using simplicity in design, we plan on bringing more and more of these communities from cash to digital transactions. UPI access as part of Spark Account, provides our customers’ convenience, transparency, and flexibility to transact digitally.”

Pramod Ghorpade, MD, CEO of Dvara Money.

In Conclusion

Educating the masses about financial wellness is key to unlocking India’s immense potential as a digital economy. The future of banking is simplification, personalization, and delivering a superior experience leveraging mobile and emerging technologies, including artificial intelligence. This is where players like Dvara Money can establish, expand, educate, and provide FinTech solutions.

With Decentro’s easy-to-integrate and plug-and-play banking and payments infrastructure, we are committed to enabling Dvara’s vision of financial access for all. The resolve to help FinTech players like Dvara Money through our solution suite has led us to reach over 10 million API transactions across our customers monthly. It’s not just the reconciliation, management, and settlement of payments alone. Our host of products has solved pertinent use cases for customers across the industry. From bank accounts, payments, and KYC helps your business simplify financial integration and run workflows smoothly.

To put things into perspective, our KYC stack has been churning out solid numbers in just two years.

With over 400+ Identity validations, 250+ Image recognitions, and 300+ Repository fetches happening via Decentro’s KYC stack per hour, we’re more than equipped to enable your verification and validation journey.

Are you a fintech platform struggling with a focused use case or looking to align your financial wellness? We would love to help you figure this out. Together.