Learn how internet banking transformed India’s financial system and what makes NetBanking 2.0 the next step toward smarter digital payments.

Evolution of Internet Banking: From ATMs to NetBanking 2.0

An engineer by culture, but a Marketer by choice. Loves building great products that create a difference. On the lines of being a full-stack marketer.

Table of Contents

Evolution of Internet Banking

When was the last time you pulled out a ₹500 note to make a payment?

Digital banking has transformed how we move money, so seamlessly that even a few minutes of downtime can disrupt billions of transactions and erode customer trust.

From cash withdrawals at ATMs to instant transfers via UPI, IMPS, NEFT, and NetBanking, the evolution of internet banking has been one of relentless innovation and convenience. And now, it’s entering its next big chapter NetBanking 2.0, a unified, interoperable framework designed to make high-value digital payments faster, safer, and more reliable.

But before we explore what makes NetBanking 2.0 a game-changer, let’s trace how internet banking came to be — and the payment rails that shaped its journey.

What is Internet Banking?

Internet banking, also known as e-banking or online banking, is the process of conducting financial transactions through digital channels rather than traditional offline channels. Just like a passbook that you or your parents must have gotten printed, it also allows individuals and businesses to initiate fund transfers, check balances, pay bills, and even apply for loans. All happening instantly and at the ease of your mobile or laptop.

The core idea that the era of digital banking offers is accessibility: anytime, anywhere banking, enabled through secure online platforms.

The Digital Banking Revolution: A Brief History

As such, there is no specific day when digital banking started; however, the pace of digital payments accelerated significantly when Prime Minister Narendra Modi announced Demonetisation.

Demonetisation accelerated digital adoption and nudged businesses and consumers toward digital rails, which ultimately gave rise to various smaller players to onboard users and let them transact instantly.

Going further back, banking in the early 2000s was a manual, branch-driven activity. Customers relied on passbooks, physical cheques, and in-person transactions. And as it’s visible, this model was slow, prone to human error, and offered limited convenience.

Early Digital Era

The introduction of core banking systems in the 1980s and 1990s changed the game. Banks began linking branches through centralised technology. ATMs became widespread, debit and credit cards gained popularity, and NEFT (National Electronic Funds Transfer) was introduced in 2005 by the RBI.

On the global level, the Society for Worldwide Interbank Financial Telecommunication (SWIFT) was founded in 1973 to facilitate secure cross-border financial messaging and officially went live in 1977. It went live with its Indian entity in 2014 to serve Indian users.

Internet Banking Comes Alive

With growing internet penetration in the 2000s, customers could now check balances, make payments, and transfer funds online. By the late 2010s, digital payments had become mainstream, with innovations such as UPI, IMPS, Net Banking, and mobile wallets transforming consumer behaviour.

Traditional Banking vs Internet Banking

| Feature | Traditional Banking | Internet Banking |

| Accessibility | Only via branches, limited hours | 24/7, anywhere |

| Speed | Slow (days) | Instant or near-instant |

| Cost | Higher operational costs | Lower transaction costs |

| Transparency | Manual updates | Real-time tracking |

| User Experience | Paper-driven | Digital-first |

Popular Internet Banking Methods

Looking around us, we can see many payment methods. The common thing is that each can be categorised in either offline or online mode. The bifurcation within online mode can be extensive, with methods such as net banking, wallets, debit cards, credit cards, IMPS, etc.

Let’s look at some of the popular internet banking methods before diving deep into the most interesting one:

Wallets

Digital wallets like Paytm, PhonePe, and Amazon Pay store money virtually and enable quick online transactions for shopping, recharges, or peer-to-peer payments. They became especially popular for microtransactions and cashback-driven consumer adoption.

Net Banking

Net banking allows customers to access their bank accounts online for a wide range of services — from fund transfers (NEFT, RTGS) and bill payments to loan applications. It removes the need to visit branches, but it traditionally required usernames, passwords, and complex authentication flows.

Cards

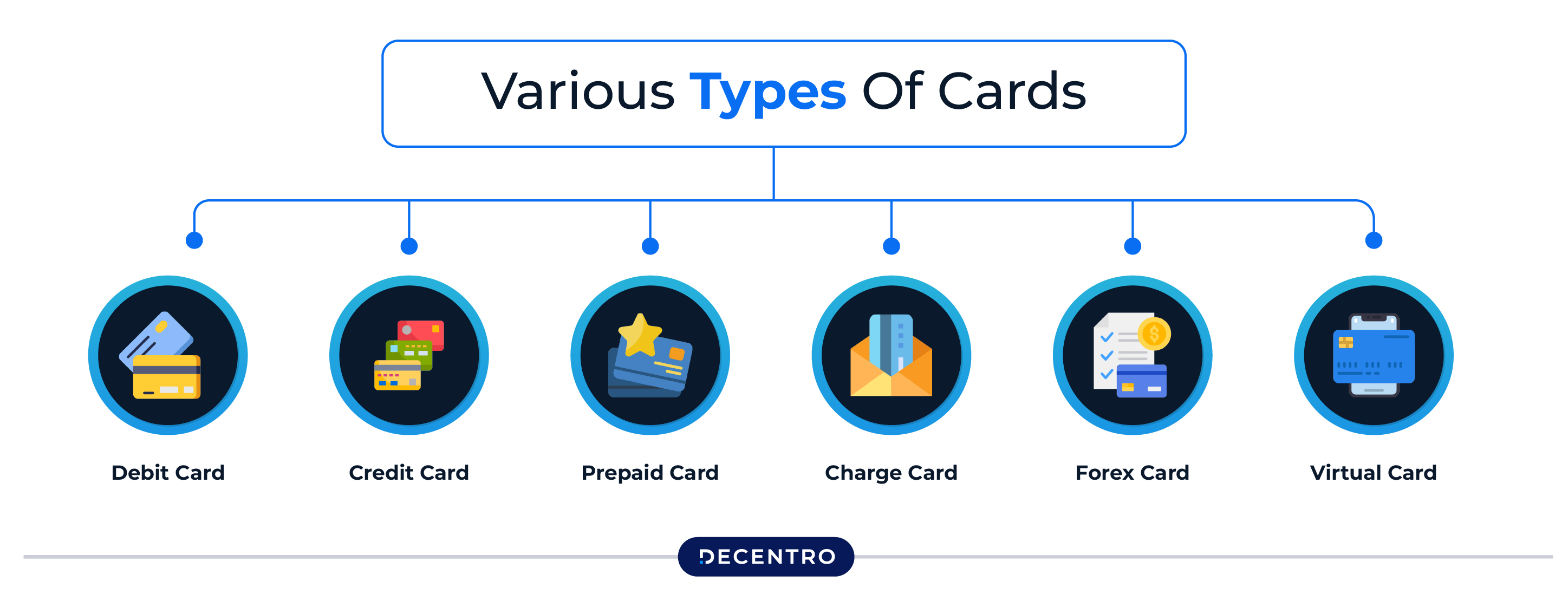

Cards remain one of the most widely used methods of digital payments globally. They enable both online and offline transactions, though they often come with higher merchant fees. There are a few types of cards:

- Debit Cards: Linked directly to a customer’s bank account, debit cards allow instant deduction of funds for purchases or ATM withdrawals. They are widely used for day-to-day transactions due to their simplicity and real-time processing.

- Credit Cards: Credit cards offer short-term credit, allowing users to pay later within a billing cycle, typically 30–45 days. They also offer rewards, cashback, and travel perks, making them popular for both domestic and international transactions.

- Prepaid Cards: Prepaid cards are preloaded with a specific amount and are not linked to a bank account. They are ideal for controlled spending, gifting, or corporate use.

- Charge Cards: Charge cards function like credit cards but require full payment of the balance at the end of each cycle. They are usually offered to premium customers with higher spending limits.

- Forex / Travel Cards: These cards are preloaded with foreign currency for safe and convenient international transactions. They help avoid currency conversion fees and the risks associated with carrying cash abroad.

- Virtual Cards: Virtual cards are digital-only cards generated instantly for online transactions. They reduce fraud risk, as each card can be unique for each merchant or transaction.

While cards, wallets, and IMPS have become familiar tools for consumers, one method that has steadily evolved to handle larger transactions with enhanced security is Netbanking. Let’s take a closer look at what Netbanking is and how it has transformed digital payments.

What is NetBanking?

NetBanking is a digital gateway that lets customers manage their finances from anywhere, at any time. Through a secure internet connection, users can transfer money, pay bills, check balances, and access a range of banking services—all without stepping into a branch.

While often used interchangeably, internet banking is a broader term that encompasses all digital banking activities conducted online, including mobile banking and web-based services. NetBanking, on the other hand, specifically refers to accessing your bank account through a bank’s secure online portal to perform transactions, manage accounts, and authorise payments. Essentially, NetBanking is a core component of internet banking, offering a dedicated platform for direct, real-time financial management.

It goes beyond simple transactions, offering features like recurring payments, instant fund transfers, and account management tools that were once only possible in person. By bridging the gap between customers and banks digitally, net banking has become an essential part of modern financial life, enabling both individuals and businesses to manage their finances faster, safer, and more efficiently.

Market Share

Despite being one of the earliest forms of online banking in India, netbanking contributes only 10–15% of transactions routed through payment aggregators, compared to UPI’s 50%+ dominance.

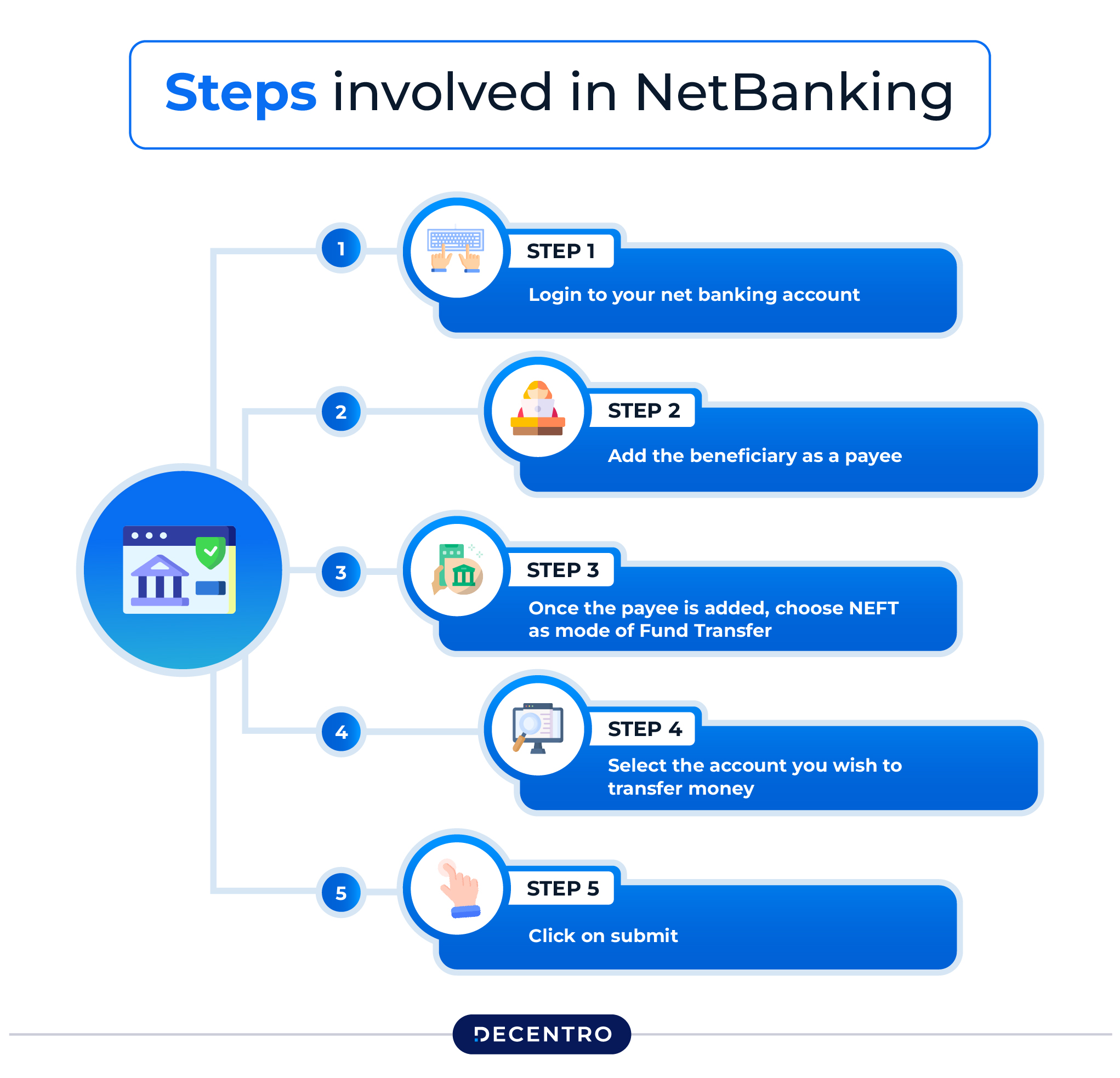

How It Works

- Customers log in with username and password.

- Select transaction type (NEFT, RTGS, IMPS).

- Add/select beneficiary details

- Enter transaction amount.

- Authorise payment with OTP or token.

Advantages

- Safe and regulated by RBI.

- Supports high-value transactions (RTGS, NEFT).

- Widely integrated across e-commerce and utility platforms.

Why Adoption Was Limited

While Net Banking stands as one of the most secure options, its adoption in the market isn’t as widespread as other platforms, such as UPI and cards. The limitations in the current flow are usually:

- Complex login flows with passwords often forgotten.

- Bank-aggregator silos — merchants needed to integrate with each bank separately.

- Slow settlements and reconciliation delays.

- User friction vs UPI’s single-click ease.

Let’s look at it from 2 perspectives, merchants’ and payers’:

Consumer – The biggest challenge was when users often forgot their passwords and had to retry the process multiple times to initiate a ‘forgot password’ query. This led customers to use alternative modes of payment drastically.

Merchants: Currently, merchants must integrate with every bank to provide a seamless customer experience. However, this partnership typically takes 2-3 months or even longer with each bank, resulting in a significant loss of time and increased costs.

Why Does NetBanking Need an Upgrade?

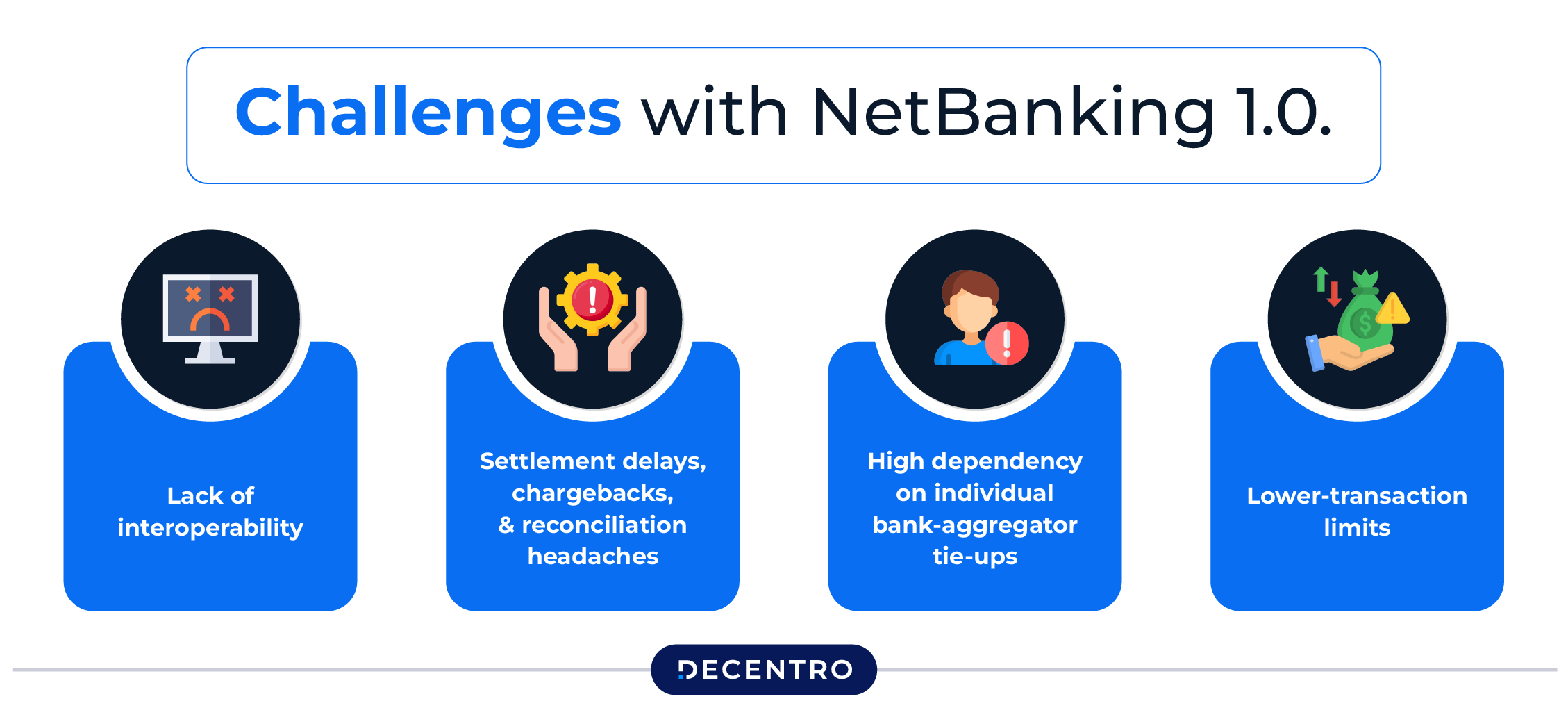

Considering the value NetBanking provides versus the volume of transactions it currently processes, it definitely needs an upgrade that counters the challenges faced by legacy systems:

- Lack of interoperability.

- Settlement delays, chargebacks, and reconciliation headaches.

- High dependency on individual bank-aggregator tie-ups.

Most importantly, with the rise in average order value and changing money habits of users, the demand for Large-Value Transactions is on the rise. MSMEs, corporates, and high-volume businesses need a faster, standardised mechanism for payouts, salaries, and vendor payments — areas where UPI faces transaction size and load constraints.

What is NetBanking 2.0?

NetBanking 2.0, spearheaded by NPCI Bharat BillPay Ltd (NBBL), is an upgraded version of the current NetBanking that replicates UPI’s simplicity while fixing NetBanking’s legacy issues.

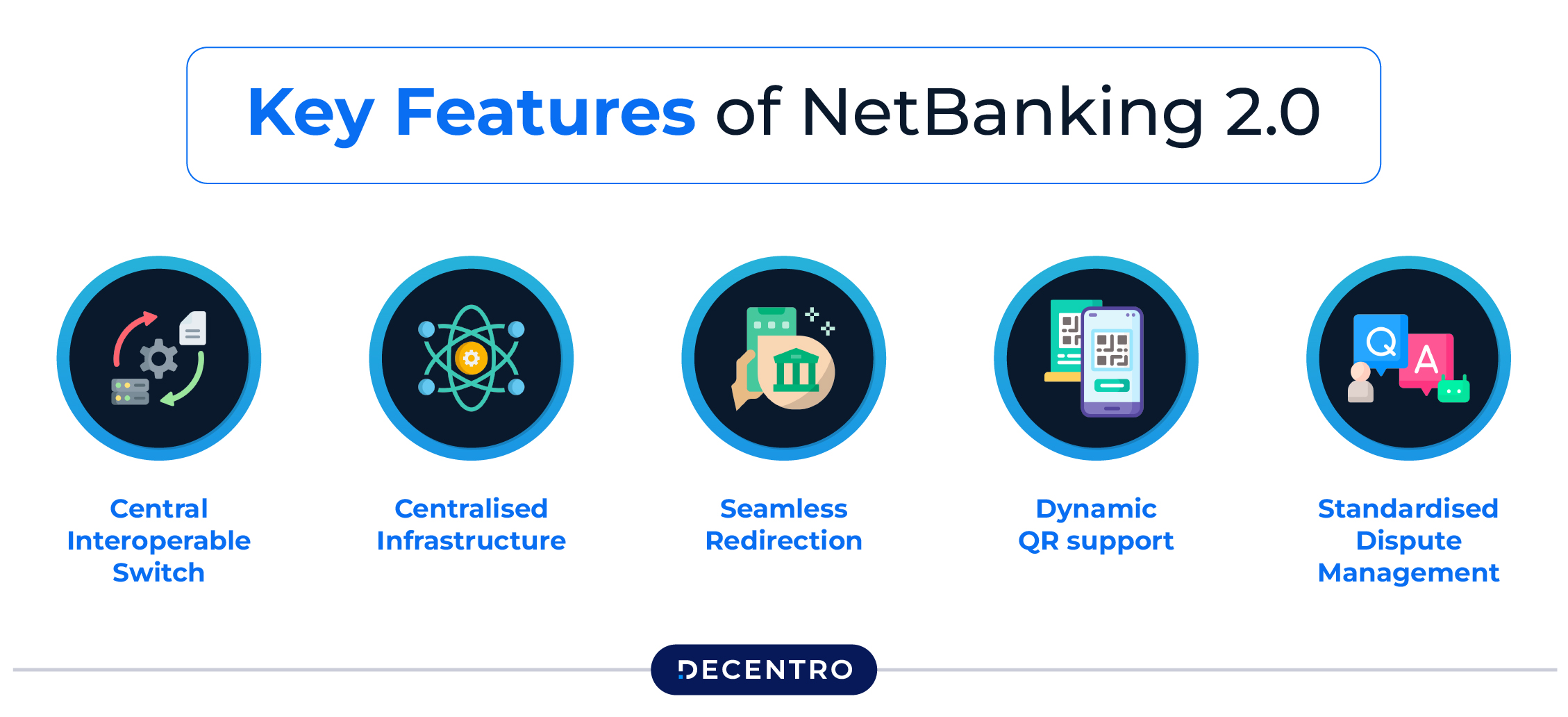

Key Features

- Operates as a central interoperable switch that standardises routing and settlements.

- Centralised infrastructure for banks, aggregators, and merchants.

- Seamless redirection to mobile apps for authorisation.

- Dynamic QR support for desktop-to-mobile flows.

- Standardised dispute management across banks.

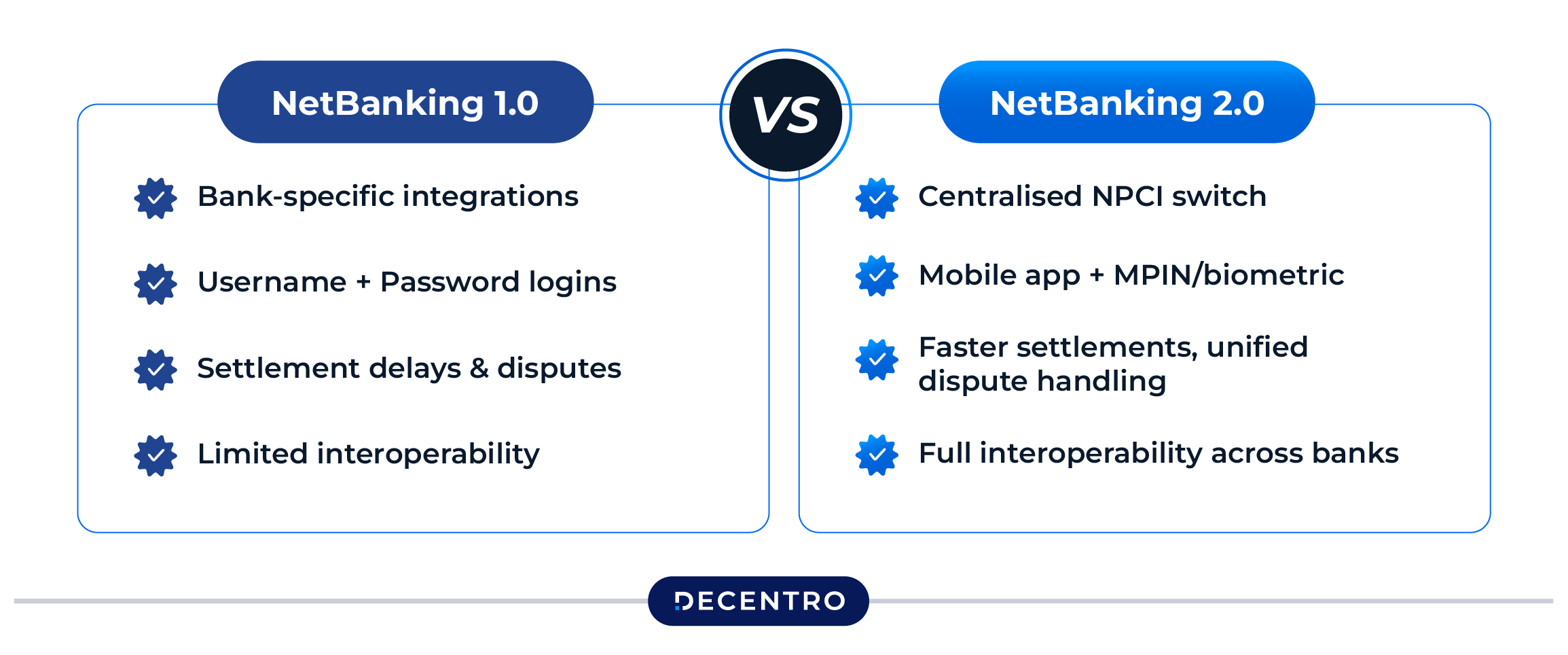

How is it different from NetBanking 1.0?

NetBanking 2.0, still in the building block phase, has already captured the attention of merchants across India. This is simply because it provides a much easier way for merchants to allow NetBanking functionality to their customers, and customers get a seamless way to transfer.

Let’s understand it via the table below:

| NetBanking 1.0 | NetBanking 2.0 |

| Bank-specific integrations | Centralised NPCI switch |

| Username + Password logins | Mobile app + MPIN/biometric |

| Settlement delays & disputes | Faster settlements, unified dispute handling |

| Limited interoperability | Full interoperability across banks |

A Comparative Study – NetBanking 2.0 vs Other Payment Modes

While UPI dominates small-ticket retail payments, cards remain popular for consumer spending, NetBanking 2.0 is designed to handle high-value, large-volume transactions with enhanced interoperability. Unlike legacy net banking or fragmented systems, it offers a unified, NPCI-powered infrastructure designed for businesses, banks, and end-users alike.

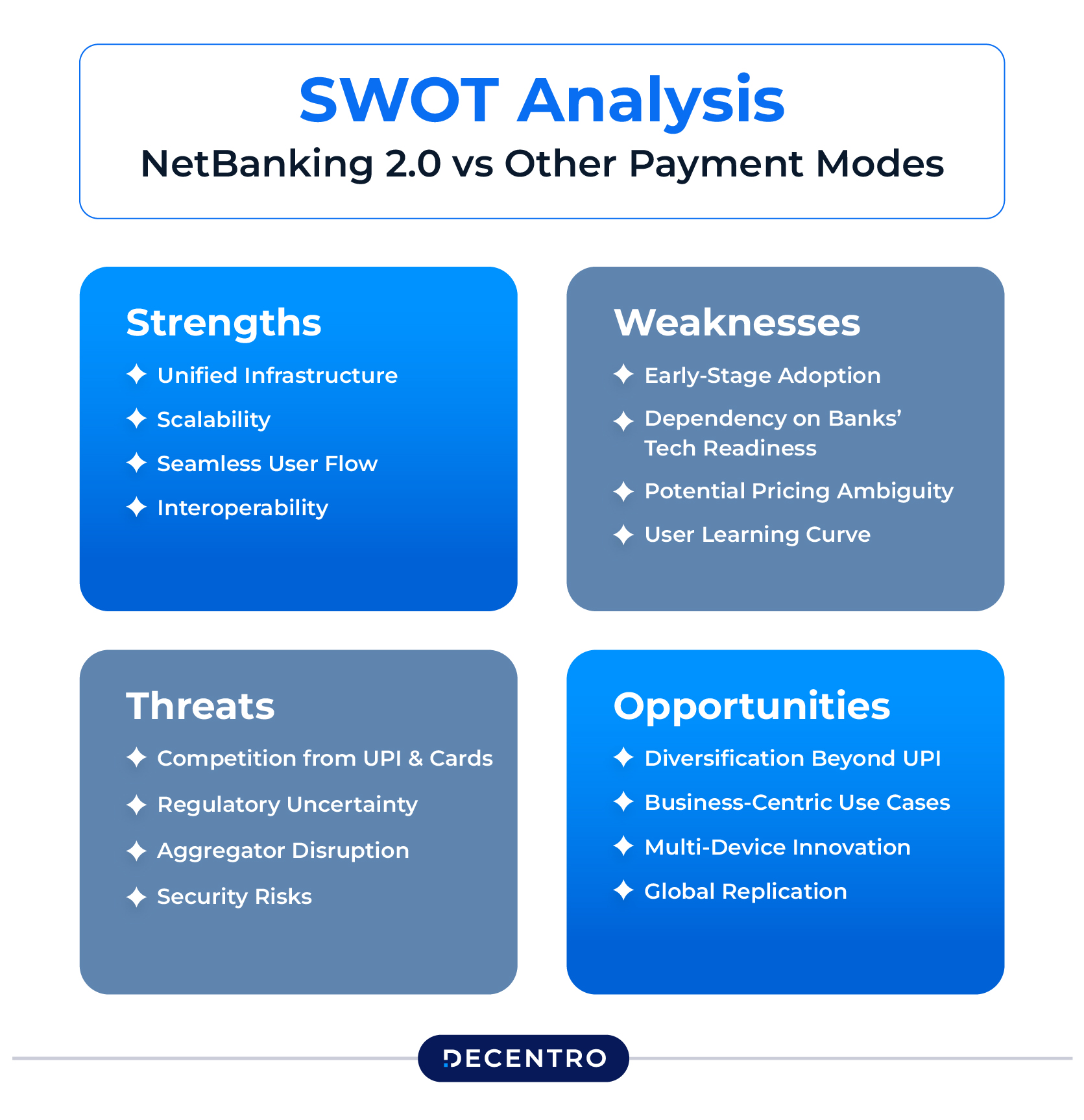

SWOT Analysis: NetBanking 2.0 vs Other Payment Modes

Strengths

- Unified Infrastructure: NPCI-powered central switch removes the need for fragmented bank–aggregator integrations.

- Scalability: Designed for high-value, high-volume B2B transactions like salary payouts, vendor settlements, and MSME flows.

- Seamless User Flow: MPIN-based authentication and mobile app redirection, mirroring UPI’s simplicity.

- Interoperability: One integration covers multiple banks, reducing complexity for merchants and businesses.

- Weaknesses

- Early-Stage Adoption: Still in pilot/testing phase, with limited market penetration.

- Dependency on Banks’ Tech Readiness: Success depends on how quickly banks adapt and integrate.

- Potential Pricing Ambiguity: Risk of facing “zero MDR” issues like UPI, impacting ecosystem sustainability.

- User Learning Curve: Customers accustomed to legacy netbanking may take time to adjust.

Opportunities

- Diversification Beyond UPI: Relieves pressure on UPI rails, especially for large-value transactions.

- Business-Centric Use Cases: Salary disbursals, vendor payouts, tourism, healthcare, B2B marketplaces, etc.

- Multi-Device Innovation: Dynamic QR codes bridging desktop-to-mobile flows.

- Global Replication: Framework can potentially be exported as a model for other markets seeking standardised netbanking.

Threats

- Competition from UPI & Cards: These methods already dominate consumer payments.

- Regulatory Uncertainty: Policy direction on MDR/pricing will shape long-term viability.

- Aggregator Disruption: Traditional aggregators may see disintermediation and resist adoption.

- Security Risks: Any breach or failure at scale could impact user trust during early adoption.

How Can You Leverage NetBanking 2.0?

Decentro makes it effortless for businesses to harness the full power of NetBanking 2.0. With plug-and-play APIs, integrate once and gain instant access to all banks connected via NPCI, eliminating repetitive integrations and reducing go-live time.

Our unified dashboard for collections and payouts enables you to manage high-volume transactions — from salary disbursements to vendor settlements — in real-time, with complete visibility over every transfer.

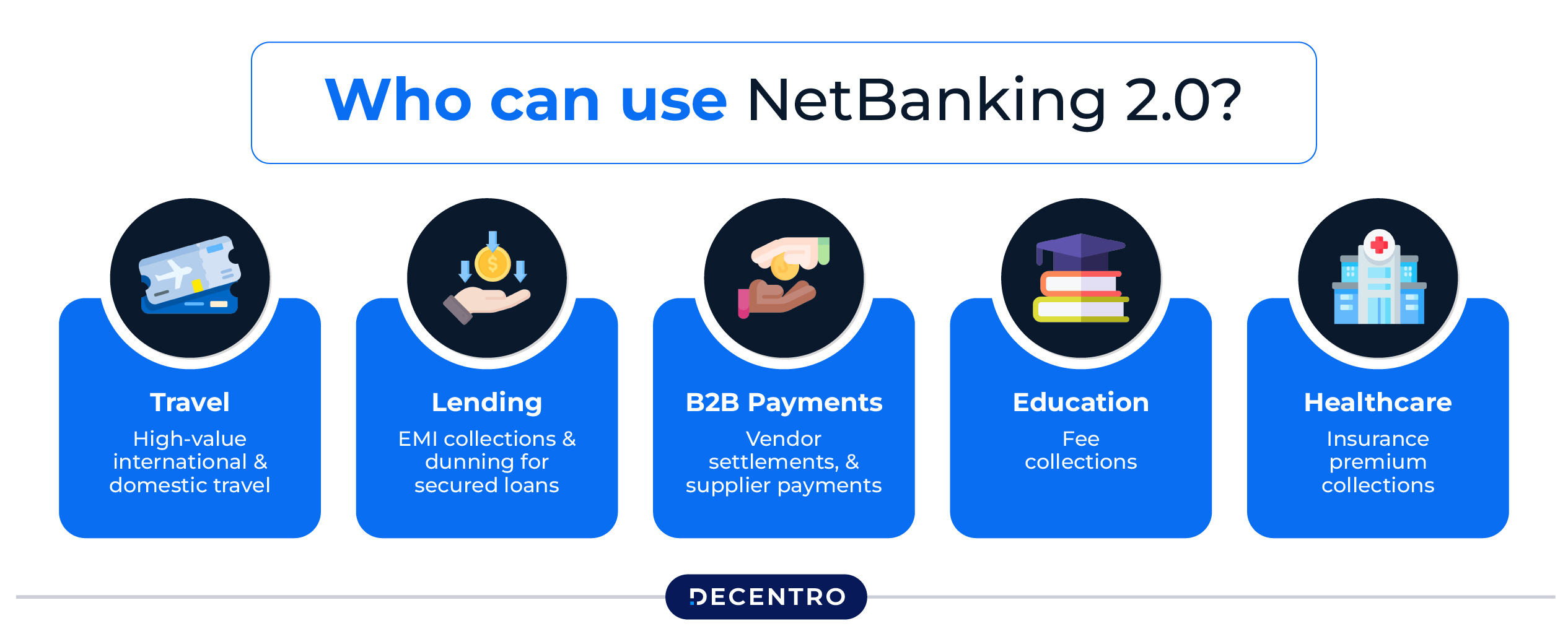

Industry-specific applications include:

Travel & Tourism:

From large corporate bookings to high-value international travel packages, the travel industry frequently handles substantial ticket sizes and complex multi-party settlements, including those involving airlines, hotels, and travel agents. With NetBanking 2.0, businesses can process these transactions securely and instantly, while automating refunds and reconciliations through a centralised NPCI-powered infrastructure.

Lending & Financial Services:

For NBFCs, digital lenders, and fintech platforms, NetBanking 2.0 streamlines recurring EMI collections and dunning for secured loans. Its seamless authorisation flow reduces failed payments, eliminates dependency on individual bank integrations, and supports faster settlements — ensuring improved liquidity and better customer experience.

B2B Payments & Marketplaces:

Large-scale enterprises and B2B platforms often struggle with fragmented vendor settlements and delayed supplier payouts. NetBanking 2.0 enables automated, high-volume disbursements from a single dashboard, providing finance teams with complete visibility across multiple banks — ideal for sectors such as manufacturing, logistics, and SaaS platforms with recurring vendor engagements.

Education:

Educational institutions and edtech platforms can leverage NetBanking 2.0 for effortless collection of tuition fees, course enrollments, and hostel payments. By integrating once through Decentro’s APIs, institutions can offer parents and students a standardised, bank-agnostic payment experience — complete with real-time tracking and reconciliation.

Healthcare & Insurance:

Hospitals, diagnostic networks, and insurers can benefit from simplified high-value transactions like insurance claim settlements, premium collections, and hospital billing. NetBanking 2.0 ensures faster authorisations, lower transaction failures, and a smoother experience for both healthcare providers and patients.

With Decentro’s multi-bank architecture and centralised NetBanking 2.0 platform, businesses can scale effortlessly, handle transaction spikes, and provide a seamless, secure experience to end users — all while saving time and operational effort.

Risks and Challenges of Internet Banking

While internet banking has transformed how individuals and businesses interact with money, it’s not without its share of risks and challenges. The same digital efficiency that enables real-time transactions also exposes the system to evolving threats — from cyberattacks and phishing attempts to large-scale data breaches.

Security and Trust:

Cybersecurity remains the foremost concern. As customers transact across devices and platforms, ensuring end-to-end encryption, authentication, and compliance with data privacy norms becomes non-negotiable. Even a single security lapse can erode customer trust — a crucial currency in the digital economy.

Operational Complexity:

For businesses managing thousands of transactions daily, legacy integrations and fragmented systems can cause reconciliation errors, settlement delays, and customer disputes. These issues not only add operational overhead but also limit scalability, especially as payment volumes continue to rise.

Regulatory and Compliance Pressure:

The rapid evolution of payment technologies often means that regulations lag behind innovation. Banks and fintechs must constantly update systems to align with changing RBI and NPCI directives, while maintaining transparency and auditability.

Digital Divide and Customer Experience:

Despite India’s progress, a segment of users still faces connectivity issues or lacks familiarity with online banking tools. Simplifying digital access without compromising security is key to ensuring widespread adoption.

This is precisely where the next generation of digital banking frameworks — like NetBanking 2.0 — step in. By standardising integrations, streamlining settlements, and introducing unified dispute management, it aims to minimise systemic risk while enhancing reliability.

As India continues to digitise its financial backbone, the goal is not just faster payments, but smarter, safer, and more inclusive banking — setting the stage for a future where every transaction, big or small, happens with confidence.

The Road Ahead for NetBanking 2.0

Internet banking in India is on the brink of another transformation. What began as a simple extension of branch services has now evolved into a multi-layered digital ecosystem, one where UPI powers real-time microtransactions, cards continue to drive consumer spending, and netbanking supports larger, account-to-account payments.

As technology deepens and regulations evolve, banks will be compelled to modernise their internet banking infrastructure, offering faster settlements, greater interoperability, and more consistent user experiences. This shift will not only redefine how customers interact with their banks but also how businesses handle high-volume digital transactions with speed and reliability.

At the heart of this next phase lies NetBanking 2.0, a standardised, interoperable framework led by NPCI. Positioned as India’s large-value, enterprise-grade payment rail, it addresses long-standing pain points like fragmented integrations, delayed settlements, and reconciliation inefficiencies. With its dynamic, UPI-like flow and secure multi-device authentication, NetBanking 2.0 bridges the gap between convenience and scale.

Globally, as countries explore models to balance real-time retail systems with robust enterprise settlement layers, India’s experience with NetBanking 2.0 could become a blueprint for digital infrastructure exports, much like UPI’s international partnerships today.

For forward-looking businesses, Decentro’s plug-and-play APIs make it seamless to adopt this next-generation framework, ensuring they remain agile, compliant, and future-ready as India’s internet banking landscape continues to evolve.

Ready to power your payouts and collections with NetBanking 2.0?

Frequently Asked Questions

1. Is NetBanking 2.0 the same as UPI?

No. It mirrors UPI’s simplicity but is designed for larger-value, B2B, and interoperable netbanking transactions.

2. Who operates NetBanking 2.0?

NPCI Bharat BillPay Ltd (NBBL), a subsidiary of NPCI.

3. Can small businesses use NetBanking 2.0?

Yes, MSMEs stand to benefit from faster vendor payouts, salary disbursals, and simplified integrations.

4. How is Decentro involved?

Decentro enables businesses to integrate NetBanking 2.0 via plug-and-play APIs and a unified dashboard, eliminating the need to build multiple bank integrations.