An in-depth look into Decentro’s customer Galgal Money, and how they are re-imagining personal finances for Young India via Decentro’s Banking APIs.

How Decentro enabled Galgal’s vision of re-imagining personal finances for Young India

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Can you define your relationship with money?

Is wealth a traditional concept for you or a benchmark that you are looking to achieve?

As personal as this question can get, let’s look for some of these answers from young India’s perspective.

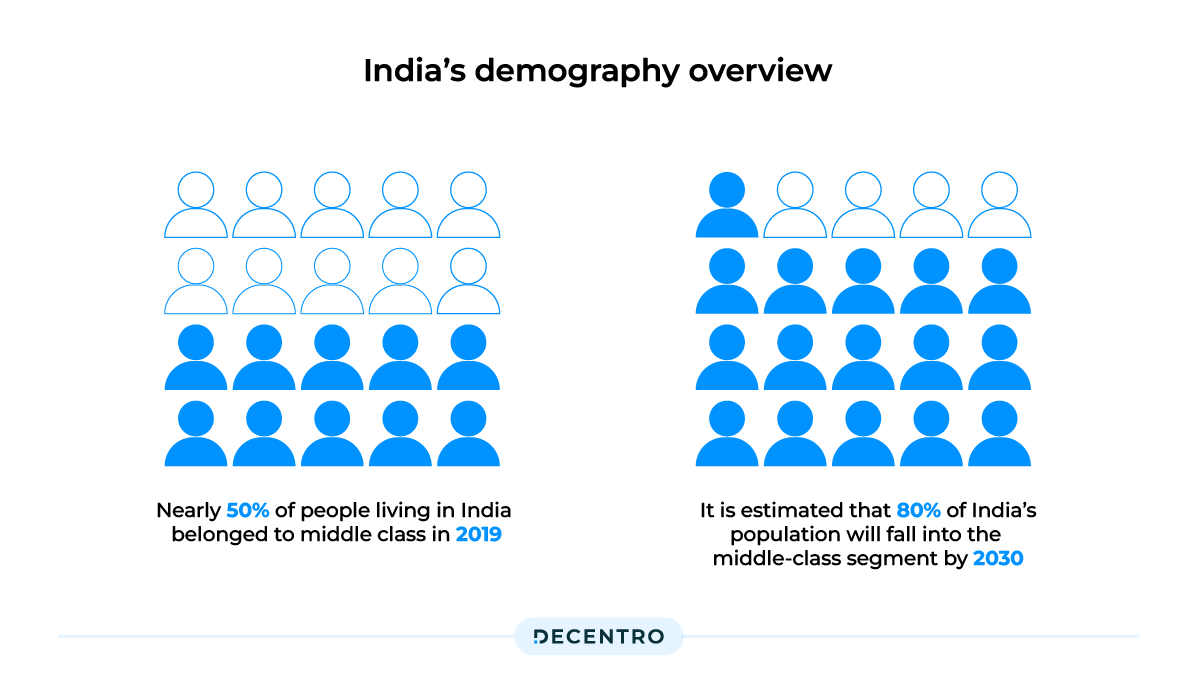

India, the youngest and largest population in the world with one of the highest numbers of middle-income households, is experiencing a shift in its relationship with money. The number of affluent middle-class people is on the rise. The World Economic Forum estimates that 80% of India’s population will fall into the middle-class segment by 2030, up from about 50% in 2019.

A transition from “needs” to “wants” is the transition of Old India investing in physical assets like real estate & gold to New India rapidly moving towards digital financial assets. The increased disposable income of the younger generation has created wealth management needs. Unsurprisingly, India recently witnessed the highest number of financial app installs globally in 2021. India’s fintech majors PhonePe and Paytm, were the most downloaded finance apps in the world in 2022, according to the data.ai’s State of Mobile 2023 report.

There is a rising trend of ‘new-age investors’ consisting of young millennials keen on pursuing asset allocation with the help of the fintech industry. Finance seemed too complicated, at least back when there was little or no transparency, and most investors used to buy things because a broker suggested it. Now, with the disruptive fintech companies, the complexity of finance is being reduced through educational initiatives. This, in turn, helps the end users create wealth for themselves efficiently. In this fast-evolving Indian wealth management ecosystem, a player’s most significant competitive advantage is enabling such users in the most personalised manner.

And this is precisely what our customer, Galgal, has set out to do—an innovative solution that goes beyond money management. Galgal, at its core, has set out to empower individuals to take charge of their personal finances.

Let’s see how.

What is Galgal?

Galgal Money is a new-age fintech start-up that focuses on bringing efficient banking solutions to the youth, simplifying money management, and making savings as stress-free as possible. As a team, they share a vision of putting mindful finance habits into young Indians. Applying fierce monetary knowledge while creating a fun space for those who fear or feel stressed out by the word “savings,” the organisations hope to deliver a behavioural revolution in how this segment handles their money.

How does Galgal work?

Galgal is a comprehensive platform designed for individuals earning smaller salaries, addressing their unique needs and challenges. With intuitive features and a user-friendly interface, they empower users to take control of their finances, one wise decision at a time.

The organisation provides personalised budgeting tools that help users understand spending patterns, set realistic goals, and track progress. By visualising their financial journey, users gain clarity and make informed choices that align with their long-term aspirations.

The app also offers insights tailored to smaller budgets, attractive offers, educational resources, tips, and tricks to help users optimise their savings and make informed investment decisions.

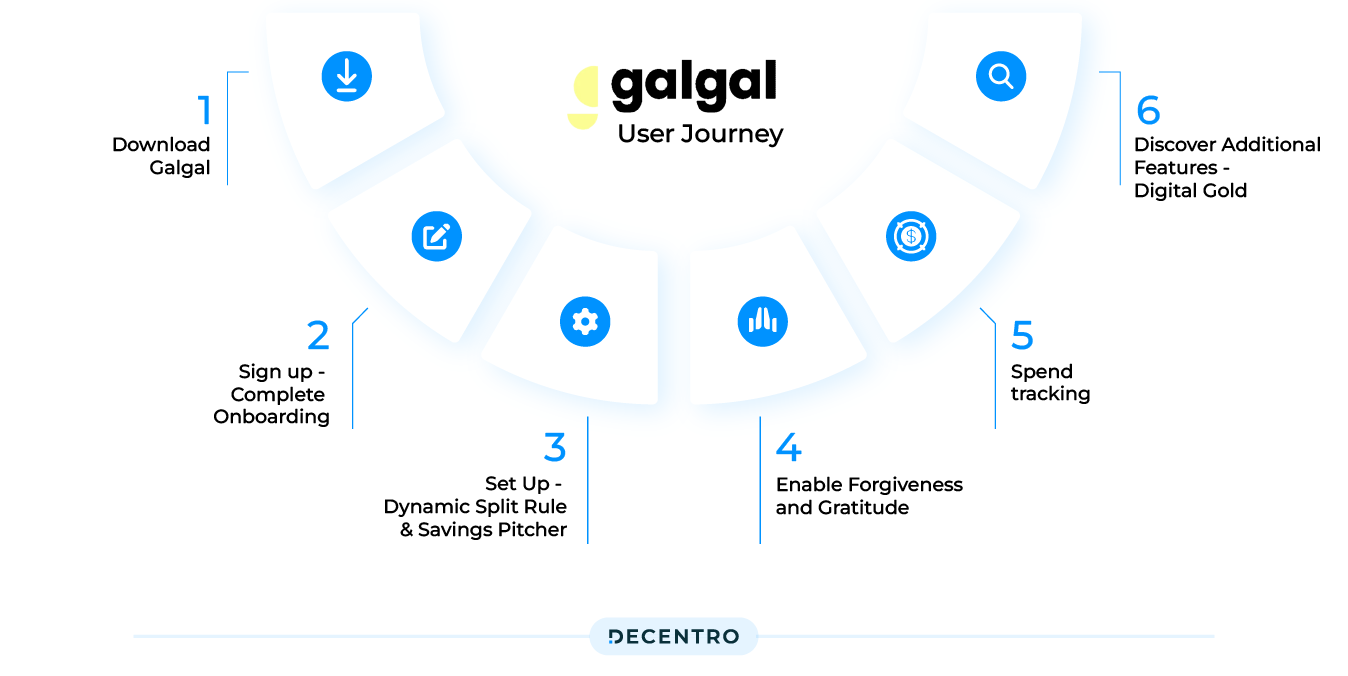

A user journey with Galgal would look like this,

- Discover the Galgal app and download it.

- Sign up and complete the onboarding process.

- Set up Dynamic Budget Split Rule to allocate income.

- Create custom savings goals using Savings Pitcher.

- Enable Forgiveness and Gratitude Rules for automated savings.

- Track expenses with Spend Tracking.

- Stay motivated with milestone celebrations.

- Discover additional features like a digital gold investment.

- Achieve financial empowerment and success.

How did Decentro empower Galgal?

Navigating the complex, heavily regulated finance sector and gaining quick access to the market were crucial challenges faced by Galgal. Managing these services with legacy players would have been next to impossible.

Decentro’s API-enabled banking platform helped Galgal streamline its services, ensuring transparency and control while maintaining the speed of transactions.

Virtual Accounts for Collections and Payout

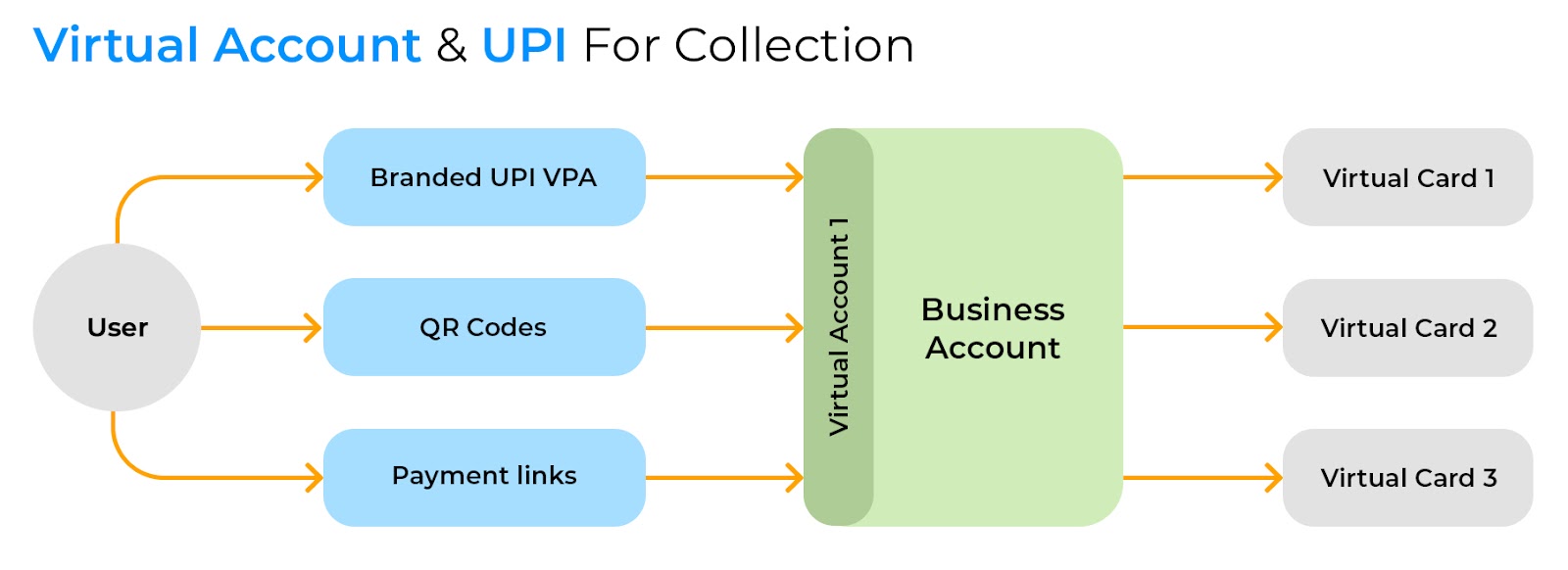

Being fully compliant with RBI’s guidelines, Decentro’s API suites directed Galgal users to create virtual accounts seamlessly. Each user had a virtual account onto which they loaded money using UPI or bank transfers. These virtual accounts were set up on Galgal’s business account, making payouts and collections effortless.

Additionally, using Decentro’s Virtual Accounts API, the challenge of tracking the source of transactions and bookkeeping them for the Galgal team was also solved. Since each virtual account is associated with a UPI ID, the virtual accounts can be customised & white-labelled, tying in perfectly to the hyper-personal finance engine Galgal is aiming to build for its users.

To understand the exact journey that Decentro and Galgal have had until now, access our latest episode of Decentro Talkies, where we conversed with Arun Iyer, CPO, and Co-Founder, Galgal, to understand the company’s business use case and future.

What were the critical outcomes for Galgal?

Decentro’s robust APIs have allowed Galgal to drive the following results:

- 40,000+ Successful API Hits

- 10X faster integration timelines

- Decentro’s multi-channel customer support for any problem resolution

In Conclusion,

The aim to empower fintech players has found its fruition through our partners. That’s precisely what our simplified banking APIs are here for! Along with Galgal, we’ve enabled many customers to empower their users to break free from the limitations imposed by financial circumstances.

Our host of features under the Flow module allows our customers to execute end-to-end payment journeys via robust APIs and SDKs. With compliance and efficiency being our promise, feel free to reach out if your business wants to solve a use case involving anything linked to banking. We’re all ears!

Comments are closed.