How did Zoozle overcome the hurdles of settlements, bank integrations, and background checks?

How Zoozle Simplified Collections & Payouts

Fintech Serial Entrepreneur. Love solving hard problems. Currently making fintech great again at Decentro!

Table of Contents

“A Symbiotic Community For Businesses”

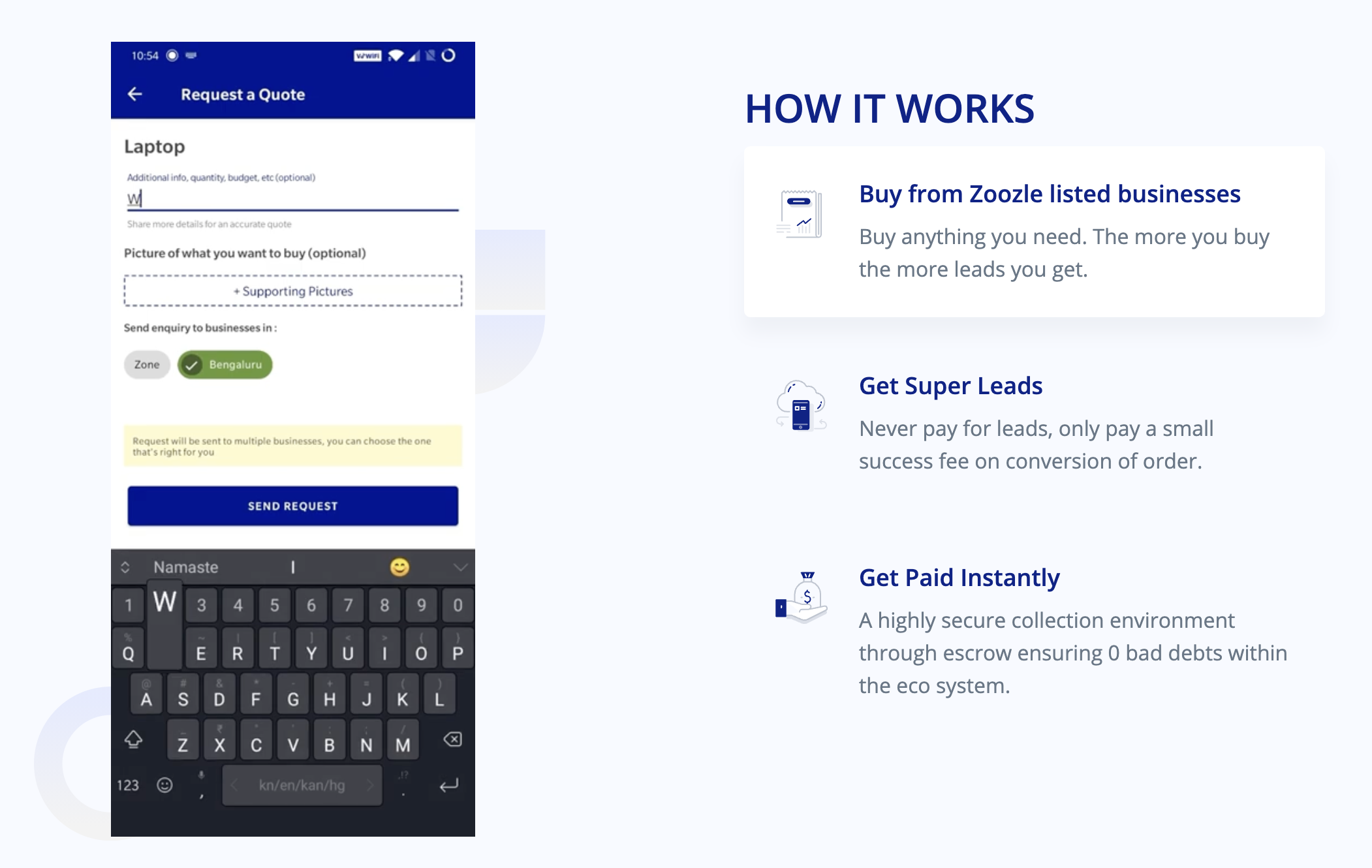

An online platform for companies to find leads & make purchases from verified businesses, Zoozle helps a business to gather leads from everyday purchases. Be it anything- a laptop or executive chair.

When your business makes a purchase, it goes as a lead for another company, and when you buy something on Zoozle, you get their lead. This is the symbiotic relationship Zoozle is setting up for the business community.

Driven by AI, Zoozle helps businesses with lead generation, logistics, supplier credit & financing, and payment management, to name a few.

The more a business purchase via Zoozle, the more leads it can gather. The platform also creates a secure payments collection environment to ensure zero bad debts via escrow.

What were Zoozle’s Key Challenges?

Being the auto-pilot for businesses meant there were many aspects for Zoozle to take care of. Some of the challenges Zoozle wished to iron out were:

Cashflow Management & Instant Settlements

Increased trade among businesses meant increased fund flows. Traditional payment gateways could prove inept to handle SMEs’ essence- quick settlements at affordable rates. This is a myth in the SME landscape and is a crucial challenge that most businesses struggle with.

Besides, Zoozle knew that for the platform to deliver the promised symbiotic community, it was necessary to manage the flow of funds between businesses.

Company Identity Verification

When two companies come together to make purchasing decisions, it’s vital to verify each one’s identity to ensure they are trustworthy & real. Lack of KYC-compliance meant serious trouble & hefty fines. Zoozle wanted a solution that helped them onboard businesses and perform KYC(know your customer) checks.

Bank Integrations

To manage cash flows and, most importantly, to ensure that settlements between the SMEs were instant, Zoozle must integrate with banks to have control over the payments. The integration process is long-drawn and would’ve cost them a lot of money and time.

How Decentro Helped Zoozle with Collections & Payouts

Decentro’s product suite helped Zoozle streamline its collection processes and payouts and verify the identities of registered businesses.

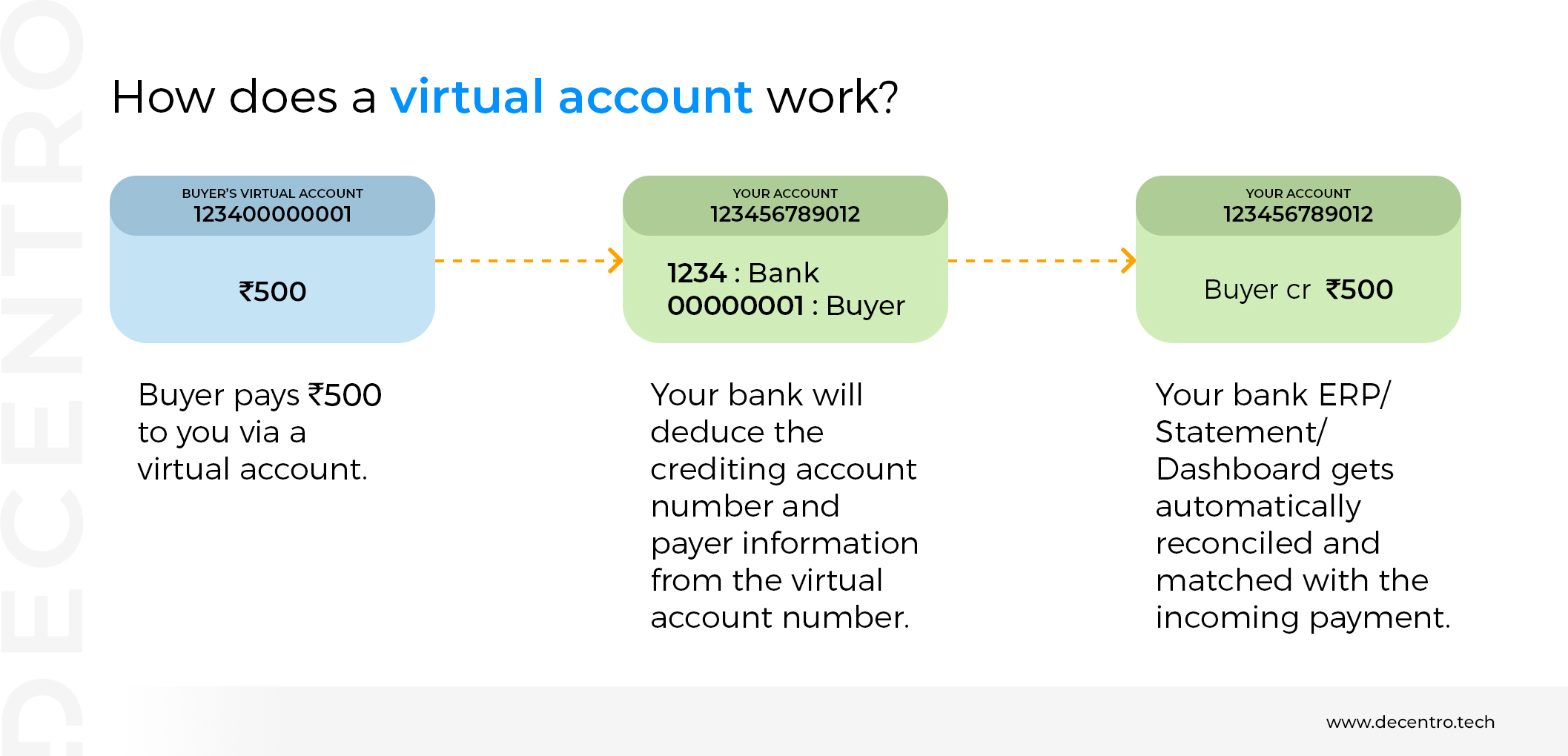

Virtual Accounts

With virtual banking infrastructure, Zoozle was able to launch payment capabilities on its platform within a week.

Each buyer had a virtual account created into which they loaded money using UPI or bank transfers. These virtual accounts were set up on top of Zoozle’s business account. Any ledger entry or transaction was updated on Zoozle’s dashboard & Accounting ERP, making it effortless to reconcile payments. In addition, Zoozle was able to reconcile payments in real-time and automate the same.

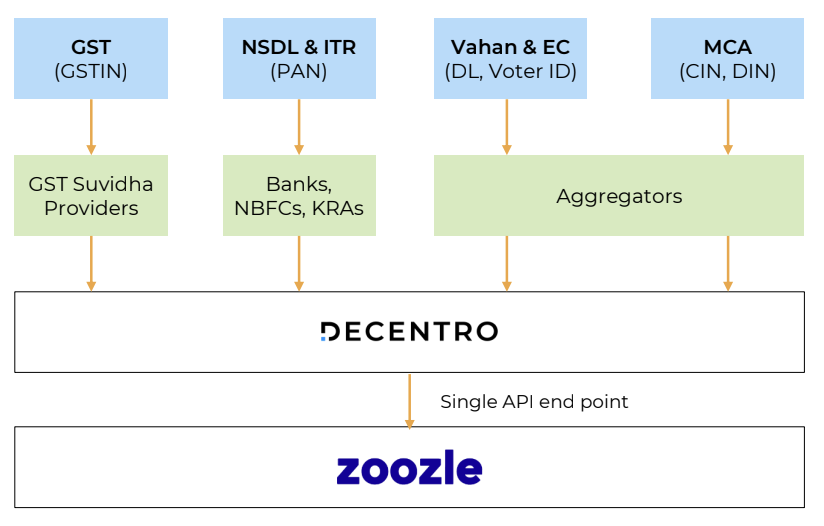

KYC Suite

Decentro’s KYC suite enabled Zoozle to run comprehensive identification checks on sellers using multiple Government-issued IDs such as PAN, GSTIN, Voter ID, Driver’s License, and Aadhar. Instant KYC means faster seller onboarding and lesser hassle of record keeping.

Business Banking

Zoozle is now looking to offer banking to the companies registered on the platform. By linking business accounts to the platform, businesses can perform a variety of banking functions such as:

- Fetching bank statements

- Adding beneficiaries without any cooling periods

- Initiate payments within the platform

- Enable virtual accounts for payment reconciliation

What were the Outcomes?

- Currently, Zoozle is able to onboard more than 1000+ retailers a month using Decentro’s multiple KYC stacks like GST, PAN, etc.

- Proprietors of various businesses are seamlessly onboarded using e-aadhaar via Decentro’s Digilocker APIs.

- Zoozle’s go-to-market timelines were reduced by 50%.

- They were able to facilitate the transfer of funds with a click of a button.

- Instant settlements were made possible at half the costs for sellers.

- Real-time and automated payment reconciliation removed additional headaches from the equation.

- Anytime cash withdrawal from the virtual account to the seller’s bank account gave the sellers absolute control over their funds.

We started evaluating Decentro to power our banking stack. After interacting with the team, I found them very knowledgeable and agile. The product is an excellent fit for us and solves a central pain point. All factors together made me want to invest with them, and that’s how I’m a customer and an investor.

Rajesh Dembla, Founder, Zoozle

If your business is trying to solve a financial challenge and overcome it as Zoozle did, feel free to email us at hello@decentro.tech. Our product suite, comprising payments, KYC, and debt recollection modules, is at your fingertips. To put things into perspective, in just two years, our KYC stack has been churning solid numbers.

With over 400+ Identity validations, 250+ Image recognitions, and 300+ Repository fetches happening via Decentro’s KYC stack per hour, we’re more than equipped to enable your verification and validation journey.

It’s not that hard. We’ll help you make it easy.

As easy as it should be.

Cheers!

Comments are closed.