An in-depth look at Decentro’s customer Leadoff and how they leveraged financial APIs to enable customers to invest in India’s top private companies.

How Precize Leveraged Decentro To Enable Customers To Invest In India’s Private Companies

Let’s go back to the history of private equity – as far back as the 1850s during the industrial revolution in the United States of America.

In the pre-history of investing in private equities, investors have been acquiring businesses and making investments in privately-held entities ever since the dawn of the industrial revolution. However, due to certain restrictions imposed on American banks under the Glass-Steagall act during the 1930s, the private banking industry was unheard-of in the United States; quite atypical for a developed nation. With very few exceptions, investment options in private equity were only accessible to wealthy individuals and families during the first half of the 20th century.

Cut to the 21st century.

And if there’s one company that is aiming to unlock the private equity investment options for millennials, then it’s Precize. To win the game of investment when everyone is rolling their money into the same mutual funds and the stock market, you need more than a good stock to yield higher profits. What about investing in privately-held, yet growing companies? Seems quite untapped. However, given the current state of infrastructure in India – not to forget the job of getting credible info about a private company – the opportunity seems pretty far-fetched.

In this case study, we’d be having an insight into Precize, an investment app offering investment opportunities in private companies by leveraging Decentro’s custom suite of financial API for banking integrations.

Let’s Introduce Precize

That’s where Precize takes the lead! Just as investments in public companies are getting convenient, Precize – built by the former teams at Deloitte, Bain & Company, and Morgan Stanley – is aiming to disrupt the private equity market by easing out the process.

But how exactly Precize is facilitating such service in an industry which is widely scattered? That is with their digital infrastructure, web of connections, and references. From taking the decision to the setup process of owning the shares in companies, the process is simplified into four easy steps:

- Reserve Access

- Login To Portal

- Confirm Demat

- Invest & Diversify

The Challenges Faced By Precize

However, Precize had to face significant challenges in exploring any untapped industry. Since investments are illiquid and owning equities in privately-held companies generally requires a large financial commitment, interested parties often face challenges in understanding the investment partnership, funds, and the terms of obligations. In most cases, it’s recommended to deal with an advisory firm with the requisite knowledge and skills. However, that removes any option for minimum investment where advisory fees simply wouldn’t outweigh the profits.

Decentro’s Banking Integration API To The Rescue

What was still promising is that the team at Precize wasn’t newly introduced to this challenge. Thanks to Y Combinator, Precize connected to Decentro as they continued to discover Decentro’s APIs, proceeded with using Decentro’s services, and have been satisfied with the leverage they got.

How Decentro Is Continuing To Empower Precize

One of the many challenges Precize faced was payment collection and UPI integration. But with Decentro and its partnership with Yes Bank enabling co-branded cards for payment collection and UPI, the process became much more effortless. Here are the two major offerings by Decentro used by Precize:

1. Payment Collection: Thanks to Decentro and its partnership with leading banks to enable co-branded cards, payments can be directly accepted and transferred to virtual cards. What’s unique is that such virtual card accounts identify the source of any incoming money, making reconciliation much easy.

2. UPI Integration: If a brand wants to target a millennial audience – especially for a business model requiring monetary transactions – what better way could be there other than supporting the nationwide payment infrastructure of UPI? Decentro has made it easy for Precize to accept payments and transactions via UPI.

The Results Precize Got With Decentro’s Banking Integration API

Of course, to demonstrate a successful service, the numbers are required to support it! And Precize has plenty to show. The unique offerings by Precize have attracted prominent individuals in the FinTech space, notably Rachana Ranade, Shashank Udupa, and Sharique Samsudheen. Not to forget, Precize now offers investment opportunities in private companies such as Capgemini, Pharmeasy, Fino Paytech, Hero Fincorp Limited, and much more. To get started, all you need is just Rs 10,000 and you benefit from a simple, hassle-free investment experience with just three steps.

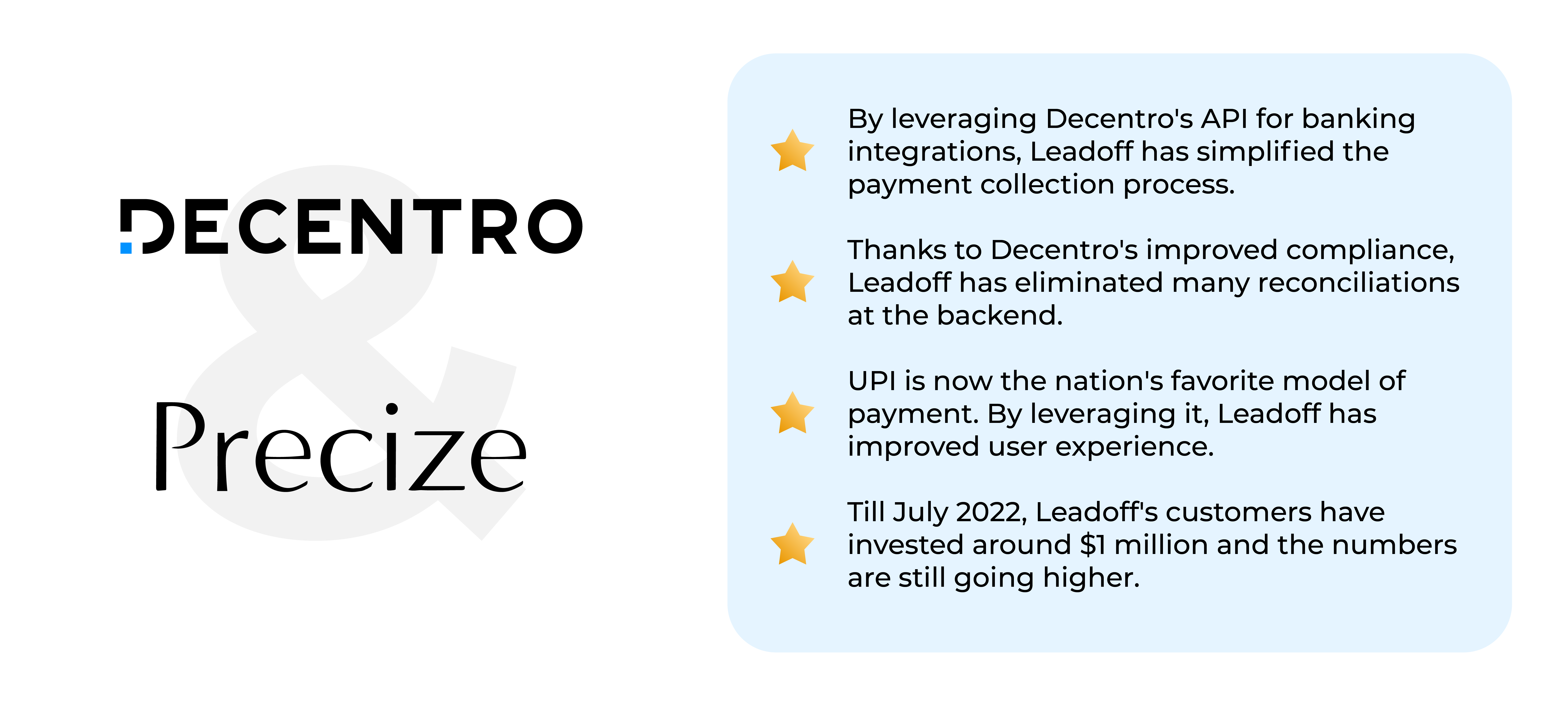

- By leveraging Decentro’s API for banking integrations, Precize has simplified the payment collection process.

- Thanks to Decentro’s improved compliance, Precize has eliminated many reconciliations at the backend.

- UPI is now the nation’s favorite model of payment. By leveraging it, Precize has improved user experience.

- Till July 2022, Precize’s customers have invested around $1 million and the numbers are still going higher.

Decentro’s APIs are constantly powering the payment collection stack at Precize. We are fortunate enough to have Decentro at our end which helps us set up a dedicated flow for simple collection with Virtual Accounts and UPI-based payments along with Automated Reconciliation, all with their simple yet powerful APIs. We’re highly confident with the team and systems at Decentro which makes us believe in looking forward to growing exponentially in the coming years.

This is the future of fintech, cheers team Decentro.

Nikhil Agrawal, Founder at Precize

Can Your Business Benefit From Decentro’s API Too?

And that answer is YES! Not just Precize, but Decentro has enabled major companies – notably Volopay and BusyBox– to facilitate a better user transaction experience with sharper expense tracking, better compliance, and improved reconciliation. Decentro’s API offers a plug-and-play solution to your banking integration needs and covers all compliances. Whether your business requires extended credit with custom Buy Now, Pay Later, or ensuring thorough verifications via CKYC, Decentro has covered you with a suite of banking APIs.

Looking to leverage financial APIs, like Precize did, to power your FinTech app and scale things up? Simply leave us a message at hello@decentro.tech to get started immediately or reach out to us below and let’s talk! Let’s Connect

Drop a Comment