Discover India’s top 12 loan origination systems in 2026. Compare features, pricing, and AI capabilities for banks, NBFCs, and microfinance

12 Best Loan Origination Systems in 2026

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

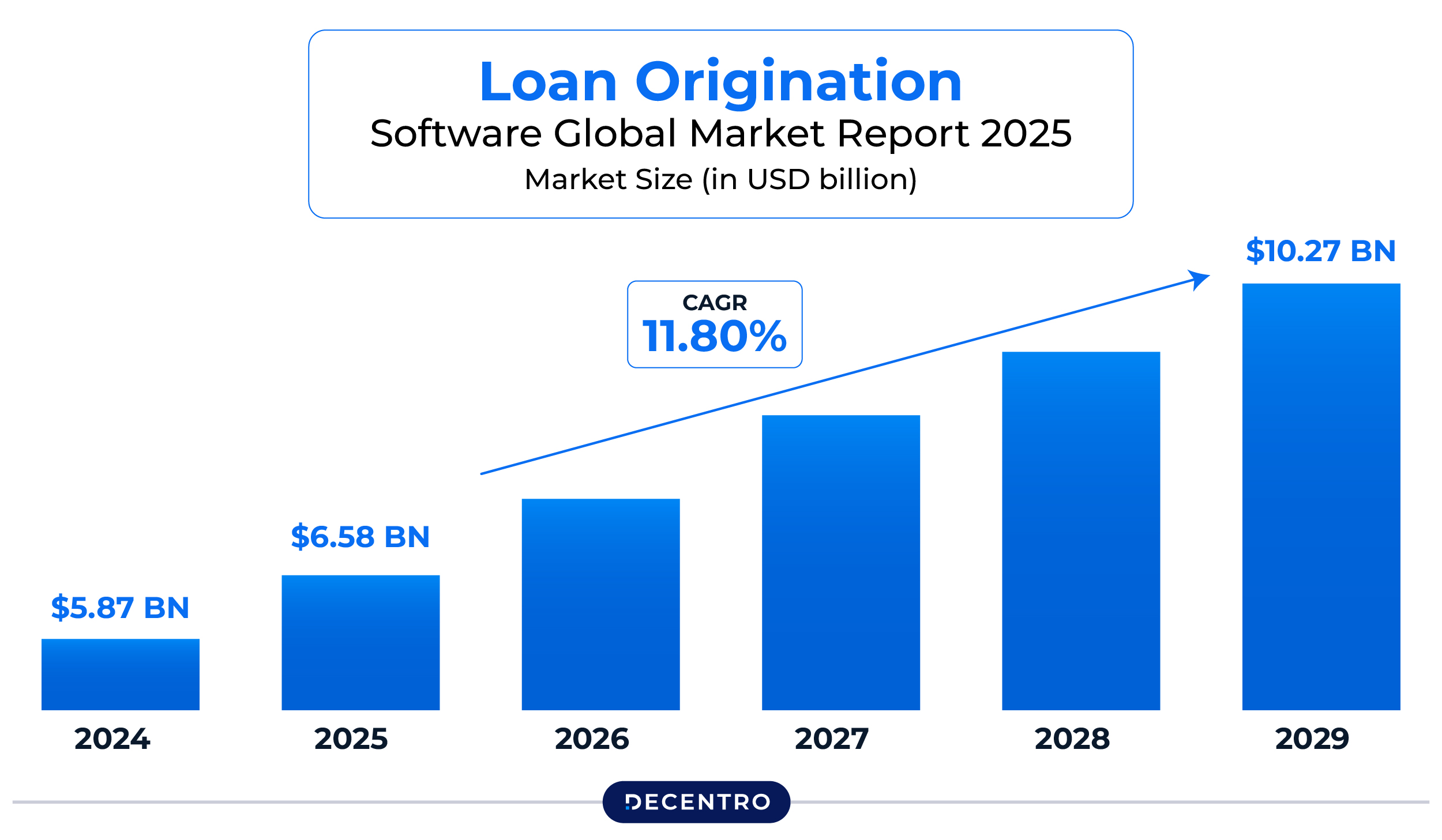

The digital lending landscape in India is experiencing unprecedented growth, with the loan origination software market projected to reach USD 7.157 billion in 2026, advancing at a remarkable compound annual growth rate. As Indian banks and NBFCs face mounting pressure to deliver faster approvals, real-time decision-making, and superior customer experiences while maintaining regulatory compliance, choosing the right loan origination system has become a strategic imperative.

A modern loan origination system streamlines the entire lending lifecycle—from application intake and credit assessment to underwriting, approval, and disbursement. With Indian banks projecting over 12% loan growth in FY 2026, lenders need robust, AI-powered platforms that can handle increased volumes without compromising accuracy or compliance.

This comprehensive guide examines the 12 best loan origination systems available in 2026, prioritising solutions built for the Indian lending ecosystem while including proven global platforms that serve the market.

A Quick Glance

| Company | Main Takeaway |

| Finflux by M2P | Strong M2P ecosystem backing with microfinance expertise |

| Nucleus Software (FinnOne Neo) | Enterprise-grade solution for large institutions |

| Biz2X | AI-powered SME lending expert with proven scale |

| CloudBankIN | Cost-effective all-in-one solution with 10-minute disbursement |

| Newgen Software | Low-code automation platform for all lending types |

| Finezza | AI-driven credit assessment with 360° borrower profiling |

| Credility (goOriginate) | Mobile-first solution with offline capabilities |

| LendingPad | Mortgage-focused platform with strong broker support |

| Nelito Systems | Established Indian provider with deep regulatory knowledge |

| AllCloud LOS | Digital journey specialist with rapid deployment |

| ICE Mortgage Technology | Global mortgage leader with massive scale |

| LoanPro | API-first platform for modern fintech lenders |

Finflux by M2P

Finflux, acquired by M2P Fintech in July 2022 for an estimated $15-20 million, is a cloud-based lending platform founded in 2010 and headquartered in Bengaluru. The platform serves over 1,100 employees and generated ₹391 crore in annual revenue as of March 2024. Finflux serves a diverse range of financial institutions, from microfinance institutions and NBFCs to universal banks and neo-banking entrants.

Pros

- Comprehensive end-to-end solution covering the entire loan lifecycle

- 50+ in-built third-party integrations for seamless connectivity

- Supports 15+ loan products, including personal, auto, education, and gold loans

- Fast implementation with minimal learning curve

- Excellent customer support with responsive 24/7 service

- Cloud-native architecture for scalability

Cons

- UI design could be more modern and intuitive

- Bulk transaction handling can be challenging for large MFIs

- Documentation for configuration and database optimisation needs improvement

- Some features require better localisation for regional markets

Top Features

- Multi-channel lead management system

- Custom form builder with drag-and-drop interface

- No-code Business Rules Engine (BRE) for automated decisioning

- Straight-Through-Processing (STP) workflows

- Document management with OCR capabilities

- Pre-approval flows and offer & pricing engine

- Scorecard generation for credit assessment

- Micro-services architecture for flexibility

- Integration with 30+ third-party API providers

- Mobile app for field officers

- Alternative data-based credit scoring

Nucleus Software (FinnOne Neo)

Nucleus Software Exports Ltd. is a publicly traded software company (BSE: 531209, NSE: NUCLEUS) established in 1986, making it one of India’s pioneering fintech product companies. With over three decades of creating intellectual property on Indian soil, Nucleus powers operations for 200+ financial institutions across 50+ countries, managing over USD 500 billion in loans and facilitating 26+ million daily transactions.

Pros

- Recognized by Aite Group as a top retail loan origination system globally

- Proven track record with 18+ years of partnerships with major Indian lenders

- 360+ APIs for extensive third-party integrations

- 10 special zero-code engines for maximum configurability

- Supports both cloud and on-premise deployments

- Strong domain expertise in consumer and commercial lending

- Comprehensive reporting and analytics capabilities

Cons

- Can be complex to implement for smaller institutions

- Higher upfront costs compared to some cloud-only alternatives

- Customization may require technical expertise despite low-code features

- Implementation timelines can be lengthy for complex requirements

Top Features

- AI-driven intelligent queue-based workflow management

- Dynamic and robust workflow engine with customizable routing

- Supports all loan types: retail, corporate, SME, SBA, and Islamic banking

- Unified customer view across multiple loan products

- ML-enabled analytics for targeted product recommendations

- Real-time compliance checks with audit trails

- Automated underwriting with policy management

- Multi-channel support (branch, online, mobile)

- Advanced credit decisioning with scorecard-based evaluation

- Built-in business activity monitoring

- Exposure calculation across multiple loans

- De-duplication and fraud detection capabilities

Biz2X

Biz2X is an AI-powered loan origination platform trusted by over 250,000 businesses in India, facilitating INR 2.7+ trillion in loan disbursements. The company specializes in providing SaaS-based digital lending solutions specifically designed for banks, NBFCs, and rural lenders across India, with a strong focus on commercial and SME lending.

Pros

- 40% faster decision times through AI-driven automation

- 2X loan portfolio expansion capabilities

- Up to 10% reduction in default rates

- Typically implemented in 90-110 days

- Highly configurable to match diverse institutional needs

- Strong regulatory compliance features aligned with RBI guidelines

- Multilingual rural lending enablement

Cons

- Pricing not publicly available; requires a custom quotation

- Primary focus on commercial lending may require adaptation for retail products

- Smaller market presence compared to global enterprise solutions

- May require integration expertise for legacy system connectivity

Top Features

- AI-powered credit assessment and underwriting

- Automated document verification with OCR

- Real-time integrations with CIBIL, GST systems, and KYC services

- Multi-product support (business loans, term loans, lines of credit, SBA loans)

- Marketplace pricing engine for brokers

- Deal room functionality for price options

- Fully customizable customer journeys

- Low-code configuration for rapid customization

- Business Rules Engine for automated decisioning

- Loan portfolio monitoring and risk analytics

- Collections management system

- CRM integration for lead management

CloudBankIN

CloudBankIN, developed by Habile Technologies, is a comprehensive SaaS-based banking engine designed specifically for mid-tier NBFCs, microfinance institutions, and co-operative banks. The platform has been recognized by G2.com as a Momentum Leader and High Performance provider in Winter 2024, with awards for Best Support and Best Relationship.

Pros

- Rapid loan disbursement within 10 minutes

- Quick implementation (as low as 24 hours for basic setup)

- Highly affordable pricing for smaller institutions

- Excellent customer support and responsiveness

- Low learning curve with intuitive interface

- Integrated accounting features with GST and TDS support

- Strong focus on operational simplicity

Cons

- May lack advanced features needed by large banks

- Smaller ecosystem compared to enterprise platforms

- Limited international presence

- Customization options may be constrained for complex requirements

Top Features

- Instant KYC verification through CKYC integration

- Real-time credit scoring and decision-making

- Bank statement analysis with automated categorization

- Robust credit rule engine for rapid approvals

- Enach integration for seamless e-mandate processing

- OCR-based document extraction

- Digital onboarding (branchless, paperless, contactless)

- API-based architecture for easy integration

- Support for point-of-sale (POS) lending and BNPL

- Automated credit bureau reporting in CIBIL format

- Comprehensive loan product configuration

- Mobile and web application support

- SMS/email notifications and alerts

Newgen Software

Newgen Software is a global leader in low-code digital automation platforms, serving financial institutions worldwide with its AI-powered lending solutions. The company has been recognized as a Representative Vendor in the 2024 Gartner Market Guide for Commercial Loan Origination Solutions and has successfully implemented solutions at some of India’s oldest and largest private sector banks.

Pros

- Low-code platform for easy customization and rapid deployment

- Comprehensive coverage of all loan types (retail, commercial, trade finance)

- Strong AI and automation capabilities

- Proven implementation track record in India

- 50% reduction in FTE costs for trade finance

- 70% improvement in first-time-right accuracy

- Robust integration ecosystem

Cons

- An enterprise-grade solution may be cost-prohibitive for smaller lenders

- Requires significant change management for full implementation

- Complexity may overwhelm institutions with simpler needs

- Implementation and customisation require skilled resources

Top Features

- AI-driven workflow automation with intelligent queuing

- Low-code BPM framework for rapid configuration

- Straight-through processing (STP) for faster approvals

- Omnichannel journey support (branch, online, dealership)

- Model battery and rule battery for credit assessment

- Automated KYC, AML checks, and compliance tracking

- Integration with major credit bureaus and verification services

- Document verification with OCR and AI

- Real-time reporting and analytics dashboards

- Scenario analysis with “what-if” modelling

- Queue-based task management with role-based access

- Customizable approval matrix and lender tree

- Support for 70+ service requests in loan servicing

Finezza

Finezza is a Bangalore-based fintech company founded by tech and product veterans with deep domain knowledge in lending. The platform provides end-to-end lending solutions specifically designed for NBFCs, housing finance companies, and fintechs, with a focus on AI-driven credit assessment and analytics.

Pros

- Unified platform combining origination, management, and collections

- Strong credit assessment capabilities with alternative data analysis

- 50+ third-party integrations pre-configured

- Account Aggregator framework integration

- Comprehensive mobile app ecosystem

- 360-degree customer profile assessment

- No-code configuration for rapid customization

Cons

- Relatively newer player compared to established enterprise solutions

- Market presence primarily in India; limited global footprint

- May require additional modules for specialised lending products

- Documentation and the knowledge base could be more comprehensive

Top Features

- OCR-based automatic document identification

- AI-powered credit underwriting

- Bank statement analyser supporting 250+ banks and 600+ formats

- Integration with all four major credit bureaus (CIBIL, CRIF, Experian, Equifax)

- GST and ITR verification framework

- Real-time fraud detection checks

- Digital footprint tracking for borrower assessment

- Loan Eligibility Estimator with scenario building

- DPD (Days Past Due) analysis across products

- Predictive analytics for default detection

- Self-service borrower portals

- API-enabled ecosystem for seamless integration

- Delinquency management and collections suite

Credility (goOriginate)

Credility is an Indian company specialising in digital loan processing solutions, offering goOriginate as its flagship mobile app-based loan origination platform. The platform is specifically configured for NBFCs, housing finance companies, and specialised lending sectors, including Loan Against Property (LAP), business loans, and auto loan origination.

Pros

- Mobile-first approach with offline capability

- Complete app-based solution for field operations

- Supports 20-30% customization based on business requirements

- Integration with 10+ third-party APIs (PAN, Aadhaar, CIBIL, etc.)

- Strong focus on Indian lending market requirements

- User tracking and analytics capabilities

- Available for both Android and iOS

Cons

- Primarily focused on mobile interface; web capabilities may be limited

- Smaller market presence compared to enterprise platforms

- May require additional modules for complex commercial lending

- Limited information on scalability for very large institutions

Top Features

- Comprehensive lead management app for sales agents

- Real-time digital loan application generation

- eKYC and digital document gathering

- Credit underwriting software with expert review capability

- Tele-PD and Field-PD app with geo-tagging

- Technical and legal evaluation templates

- Digital CAM (Credit Appraisal Memorandum) generation

- Multi-lingual KFS and sanction letter generation

- Integration with payment gateways (Razorpay, CCAvenue, Billdesk)

- API integrations (Karza, NSDL, Signzy, Paynimo, Equifax, Experian)

- Mobile POS support (Ezetap, Mswipe)

- Offline mode for field operations

- Configurable workflow templates

LendingPad

LendingPad is a cloud-based mortgage loan origination system created by mortgage banking professionals, specifically designed for brokers, lenders, banks, and credit unions. While primarily focused on the residential mortgage market, LendingPad has gained recognition with endorsements from NAMB, AIME, and MBA membership, plus winning the 2019 HW’s Tech100 award.

Pros

- User-friendly interface with simple navigation

- Excellent customer support via live chat

- Real-time collaboration capabilities

- Cloud-based for anytime, anywhere access

- Unlimited users and branches for brokers

- Strong document management features

- Fast implementation compared to legacy systems

Cons

- Primarily designed for mortgage lending; limited applicability for other loan types

- Can be glitchy with occasional data saving issues

- Document request functionality needs improvement

- Online application process receives mixed reviews from borrowers

- More tailored to US market than Indian lending requirements

Top Features

- Built-in CRM tool for lead and campaign management

- Compliance check automation

- Document archiving and management

- Real-time loan updates and tracking

- Custom workflow configuration

- Multi-user same-file editing

- Integration with credit and AUS tools

- Third-party processing network support

- Service level agreement tracking

- Warehousing activities management

- Post-closing audit capabilities

- Borrower collaboration portal

Nelito Loan Origination Solutions

Nelito Systems is an established Indian IT solutions provider with deep expertise in banking and financial services. The company offers comprehensive loan origination solutions tailored for Indian banks and NBFCs, with a strong focus on regulatory compliance and integration with Indian financial infrastructure.

Pros

- Deep understanding of Indian banking regulations

- Strong track record with Indian financial institutions

- Customizable to specific institutional requirements

- Comprehensive product suite beyond LOS

- Local support and implementation teams

- Cost-effective for Indian market

Cons

- Limited public information on recent product features

- May lag behind newer cloud-native platforms in innovation

- Market presence primarily in India

- Less emphasis on AI/ML capabilities compared to newer platforms

Top Features

- End-to-end loan origination workflow

- Multi-channel application capture

- Credit assessment and scoring

- Integration with Indian payment systems

- Compliance management for RBI regulations

- Document management and verification

- Automated approval workflows

- Portfolio management capabilities

AllCloud LOS

AllCloud offers a comprehensive loan origination system focused on streamlining end-to-end onboarding from lead capture to loan sanction. The platform is designed for progressive financial institutions embracing digital transformation, with particular strength in enabling digital KYC, bureau pulls, and customizable approval workflows.

Pros

- Supports multiple journey types (walk-ins, DSA, API-based)

- Digital KYC with automated bureau pulls (CIBIL, CRIF)

- Bank statement analysis integrated

- Income verification checks

- Customizable approval workflows

- Quick implementation

- Support for various customer onboarding channels

Cons

- Relatively newer entrant with limited market track record

- Less comprehensive than full-suite enterprise platforms

- Limited information on advanced features

- May require additional modules for complete lending lifecycle

Top Features

- Lead management with automated routing

- Digital KYC and eKYC integration

- Credit bureau integration (CIBIL, CRIF)

- Bank statement analysis

- Income verification framework

- Customizable approval workflows

- Support for DSA and API-based journeys

- Task management and notifications

- Email/SMS marketing automation capabilities

ICE Mortgage Technology (formerly Ellie Mae)

ICE Mortgage Technology, a division of Intercontinental Exchange Inc., is the leading cloud-based loan origination platform provider for the mortgage industry globally. The company processes approximately 35% of US mortgage applications and has an established presence in select international markets. Formerly known as Ellie Mae, the platform represents decades of mortgage technology innovation.

Pros

- Industry-leading platform with massive scale

- Comprehensive mortgage-focused features

- Strong compliance and regulatory capabilities

- Extensive integration ecosystem

- Proven reliability and uptime

- Continuous innovation and updates

Cons

- Primarily US-focused; limited Indian market adaptation

- High cost structure for international implementation

- Mortgage-specific features may not translate to other loan types

- Requires significant training and change management

- May be over-engineered for simpler lending operations

Top Features

- Encompass loan origination system

- URLA (Uniform Residential Loan Application) support

- Loan product and pricing engine

- Automated loan closing documents

- eClosing capabilities

- Digital mortgage workflows

- Cybersecurity features

- AI-powered automation

- Compliance management tools

- Loan tracking and pipeline management

- Integration with major service providers

LoanPro

LoanPro is a cutting-edge, API-first lending and credit platform designed to streamline origination, servicing, collections, and payments for all types of loans and credit accounts. The platform empowers financial institutions to innovate quickly and scale efficiently without compromising security or regulatory requirements, with strong adoption among modern fintech lenders.

Pros

- API-first architecture for maximum flexibility

- Modern technology stack

- Highly configurable for various loan products

- Strong automation capabilities reducing manual collection efforts

- Excellent for fintech and digital-first lenders

- Scalable architecture

Cons

- May require technical expertise to leverage full capabilities

- Relatively higher learning curve for non-technical users

- Pricing structure can be complex

- More suited for tech-savvy organizations

Top Features

- API-first platform design

- Comprehensive loan servicing capabilities

- Automated collections workflows

- Payment processing and reconciliation

- Custom loan product configuration

- Webhooks for real-time notifications

- Robust reporting and analytics

- Multi-currency support

- White-label capabilities

- RESTful APIs for integration

- Loan modification and restructuring tools

- Advanced calculation engine

Understanding the Loan Origination System Market

The global loan origination software market reached USD 4.5 billion in 2024 and is projected to reach USD 9.2 billion by 2033, exhibiting a CAGR of 8.5%. In India specifically, the market dynamics are particularly compelling, with 78% of financial institutions having already implemented or planning to implement AI-driven solutions.

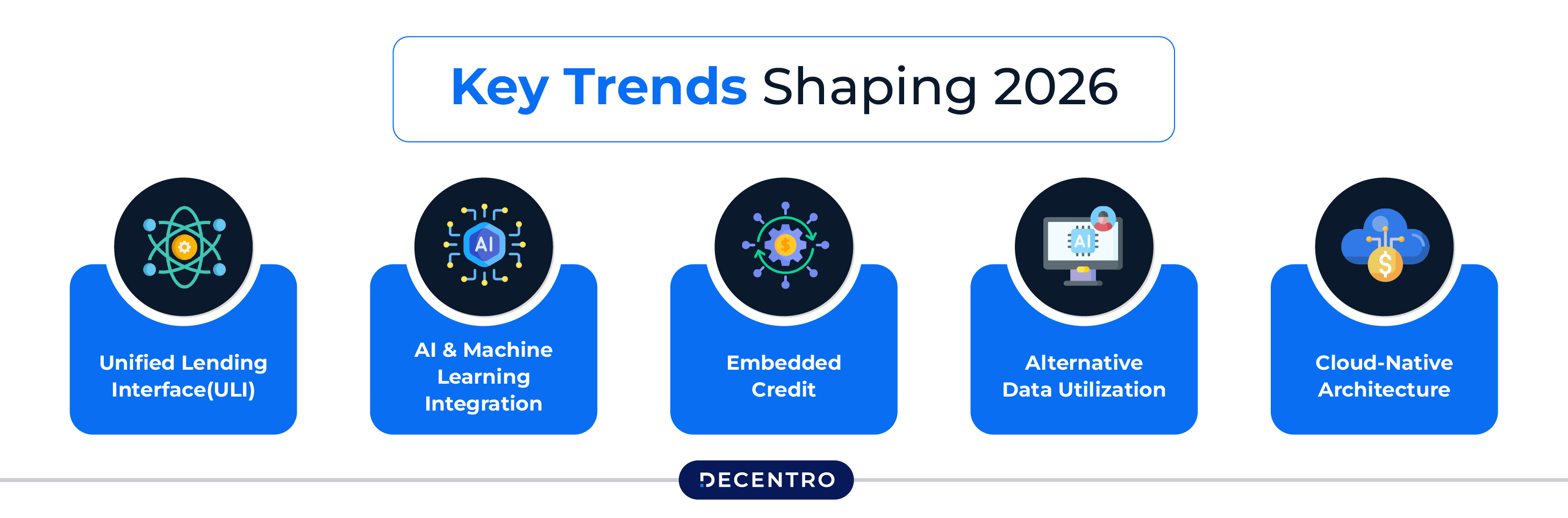

Key Trends Shaping 2026

1. Unified Lending Interface (ULI): The RBI is piloting a UPI-like framework for lending, enabling lenders to pull borrower information from multiple sources via APIs, promising near-instant eligibility checks.

2. AI and Machine Learning Integration: Modern loan origination systems now leverage AI for document parsing, credit assessment, fraud detection, and predictive analytics, reducing processing times by up to 90%.

3. Embedded Credit: Consumers increasingly encounter instant credit offers embedded within ecosystems—e-commerce checkouts, supplier portals, and utility apps—requiring sophisticated point-of-sale lending capabilities.

4. Alternative Data Utilisation: Beyond traditional credit scores, lenders now analyse cash flow patterns, digital footprints, GST data, and transaction behaviours to assess creditworthiness more holistically.

5. Cloud-Native Architecture: With cloud spending in banking expected to reach $83 billion by 2026, cloud-based loan origination systems offer superior scalability, faster updates, and lower infrastructure costs.

How to Choose the Right Loan Origination System

Selecting the optimal loan origination system for your institution requires careful consideration of several factors:

1. Loan Product Mix

Different platforms excel at different loan types. Mortgage-focused systems like ICE Mortgage Technology may not suit MSME or microfinance operations, while platforms like Finflux and CloudBankIN are specifically designed for diverse Indian lending scenarios.

2. Scale and Volume

Your institution’s size and loan volumes should guide your choice. Enterprise platforms like Nucleus FinnOne Neo and Newgen offer comprehensive capabilities for large banks, while CloudBankIN and Credility provide excellent value for mid-tier NBFCs and MFIs.

3. Integration Requirements

Evaluate how well the system integrates with your existing core banking platform, CRM, payment gateways, and Indian-specific services like CIBIL, CKYC, Aadhaar, and GST systems. Platforms with 50+ pre-built integrations significantly reduce implementation time.

4. Regulatory Compliance

Indian lenders must ensure the system supports RBI guidelines, KYC norms, digital lending regulations, and provide audit-ready compliance trails. All platforms reviewed here offer compliance features, but dthe epth varies.

5. Customisation and Flexibility

Low-code/no-code platforms like Newgen and Nucleus offer extensive customisation without heavy IT involvement, while API-first solutions like LoanPro provide maximum flexibility for tech-savvy organizations.

6. Total Cost of Ownership

Beyond licensing costs, consider implementation time, training requirements, ongoing support, and integration expenses. Cloud-based solutions typically offer better TCO for smaller institutions.

Why Decentro is Your Ideal Banking Infrastructure Partner

While choosing the right loan origination system is crucial, modern lenders need more than just an LOS to succeed. They require a comprehensive banking infrastructure that seamlessly integrates with their lending operations.

Decentro provides the critical banking infrastructure layer that powers digital lending at scale. As India’s leading banking API platform, Decentro offers:

Seamless Payment Integration

Connect your loan origination system with instant payment capabilities—UPI, NEFT, RTGS, and IMPS—enabling real-time loan disbursements and automated EMI collections without building payment infrastructure from scratch

Banking Services APIs

Access essential banking services including penny drop verification, bank account validation, and virtual account creation—all through simple API calls that integrate with any loan origination system.

KYC and Verification Services

Streamline your onboarding with instant Aadhaar verification, PAN validation, bank statement analysis, and CIBIL checks through unified APIs, reducing your loan approval time from days to minutes.

Automated Collections

Integrate e-NACH and recurring payment capabilities directly into your lending workflow, ensuring timely EMI collections and reducing delinquency management costs.

Developer-First Platform

Decentro’s developer-friendly APIs, comprehensive documentation, and sandbox environment ensure your technical team can integrate banking services quickly, whether you’re using Finflux, Nucleus, or any other loan origination system.

The winning combination for modern lenders in 2026 is clear: a robust loan origination system for workflow automation paired with Decentro’s banking infrastructure for payment orchestration, verification services, and regulatory compliance. This integrated approach enables you to offer seamless digital lending experiences while maintaining operational efficiency and regulatory compliance.

Ready to supercharge your lending operations?