Find out how Decentro helped Mool Capital automate KYC, reduce onboarding time, and ensure regulatory compliance with seamless API integrations

How Decentro Empowered Mool to Enhance Client Onboarding and Compliance

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

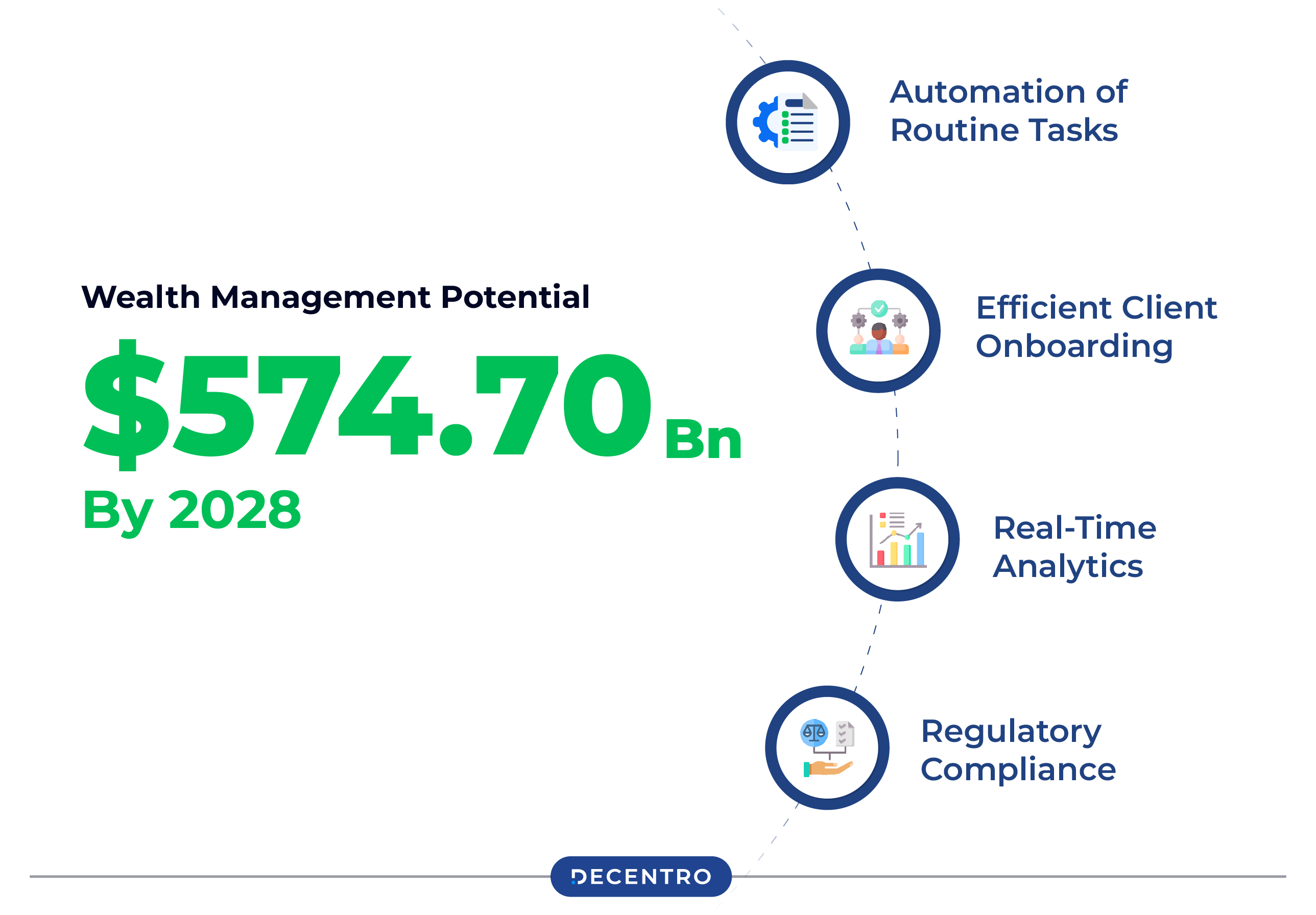

Every organisation in wealth management seeks to enhance operational efficiency. Streamlining critical workflows is essential to eliminate redundancies and bottlenecks, ensuring optimal performance in this rapidly growing sector, projected to reach a market volume of $574.70 billion by 2028.

How can a player in this sector enable its growth?

- Automation of Routine Tasks: Leveraging technology to automate everyday tasks is fundamental. This increases efficiency and allows teams to focus on strategic initiatives.

- Efficient Client Onboarding: A streamlined KYC process reduces delays and enhances the client experience, allowing for swift onboarding.

- Real-Time Analytics: Utilizing real-time analytics for proactive decision-making and personalised advice enhances service delivery, ensuring that client needs are met promptly.

- Regulatory Compliance: Efficiently navigating regulatory standards is crucial. Players must ensure compliance without hindering operations, which often necessitates third-party intervention.

For fintech startups like Mool, compliance, KYC, and user verification challenges can impede growth. A robust onboarding process is vital, mainly when dealing with regulatory frameworks such as Aadhaar and CKYC, while maintaining a secure user experience.

So, What is Mool?

Mool Capital Pvt Ltd offers a cutting-edge, multilingual AI-powered financial advisor called “Mool Chacha,” designed to provide personalised financial advice to underserved populations in India. Secure consent management aggregates users’ financial data from various institutions, such as banks, insurance, and pension funds. By leveraging account aggregator (AA) frameworks, Mool Chacha provides insights based on over 300 data points, offering actionable advice on saving, investing, and financial planning. Its services cater to non-English speaking, peri-urban populations, empowering them to achieve financial security through technology.

Challenges Faced by Mool

Mool encountered several hurdles in its onboarding process, including:

- Time-Consuming Manual KYC: Lengthy verification steps delayed user onboarding.

- Complex Compliance Requirements: Navigating diverse regulations was both labour-intensive and error-prone.

- Security Risks: Ensuring secure data collection while enhancing user experience was crucial.

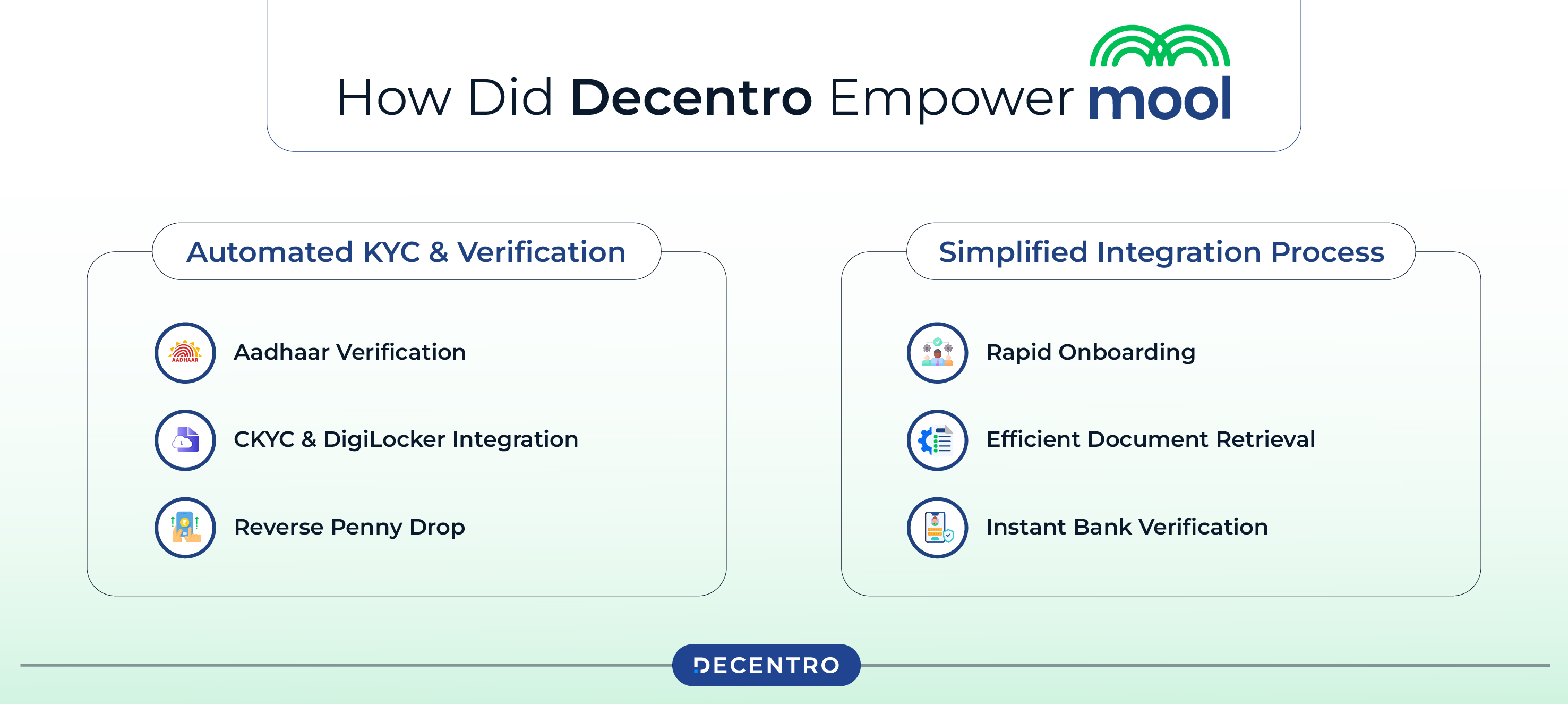

How Did Decentro Empower Mool?

Recognising these challenges, Mool turned to Decentro for a robust solution. By integrating Decentro’s KYC and Verification APIs, Mool aimed to streamline its onboarding and verification processes. Here’s how Decentro facilitated Mool’s transformation:

Automated KYC and Verification

- Aadhaar Verification: Enabled swift user identity checks by cross-referencing with Aadhaar data.

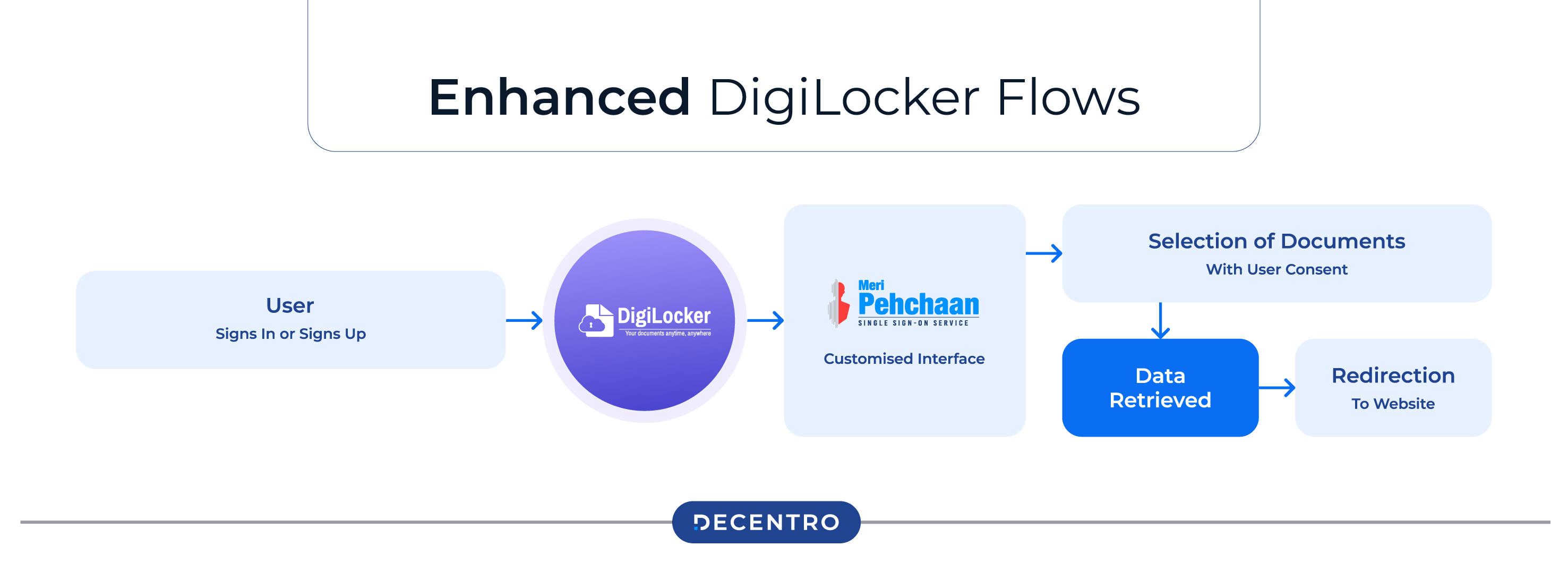

- CKYC and DigiLocker Integration: Provided real-time access to verified documents, reducing manual uploads and speeding up processing times.

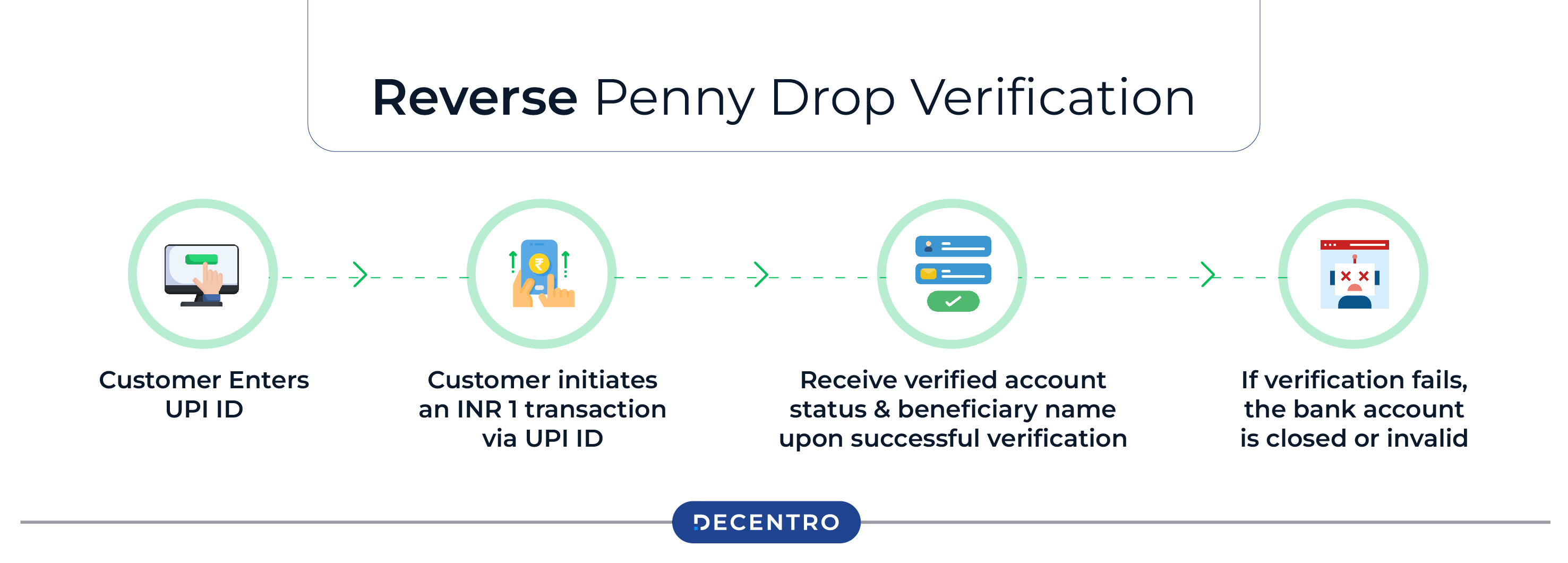

- Reverse Penny Drop: Allowed for instant bank account verification by depositing a nominal amount, ensuring authenticity without manual checks.

Simplified Integration Process

- Rapid Onboarding: Decentro’s plug-and-play API structure reduced development time and costs.

- Efficient Document Retrieval: The integration with DigiLocker and CKYC simplified the fetching of verified documents.

- Instant Bank Verification: The reverse penny drop service ensured quick and efficient account validation.

Results and Impact

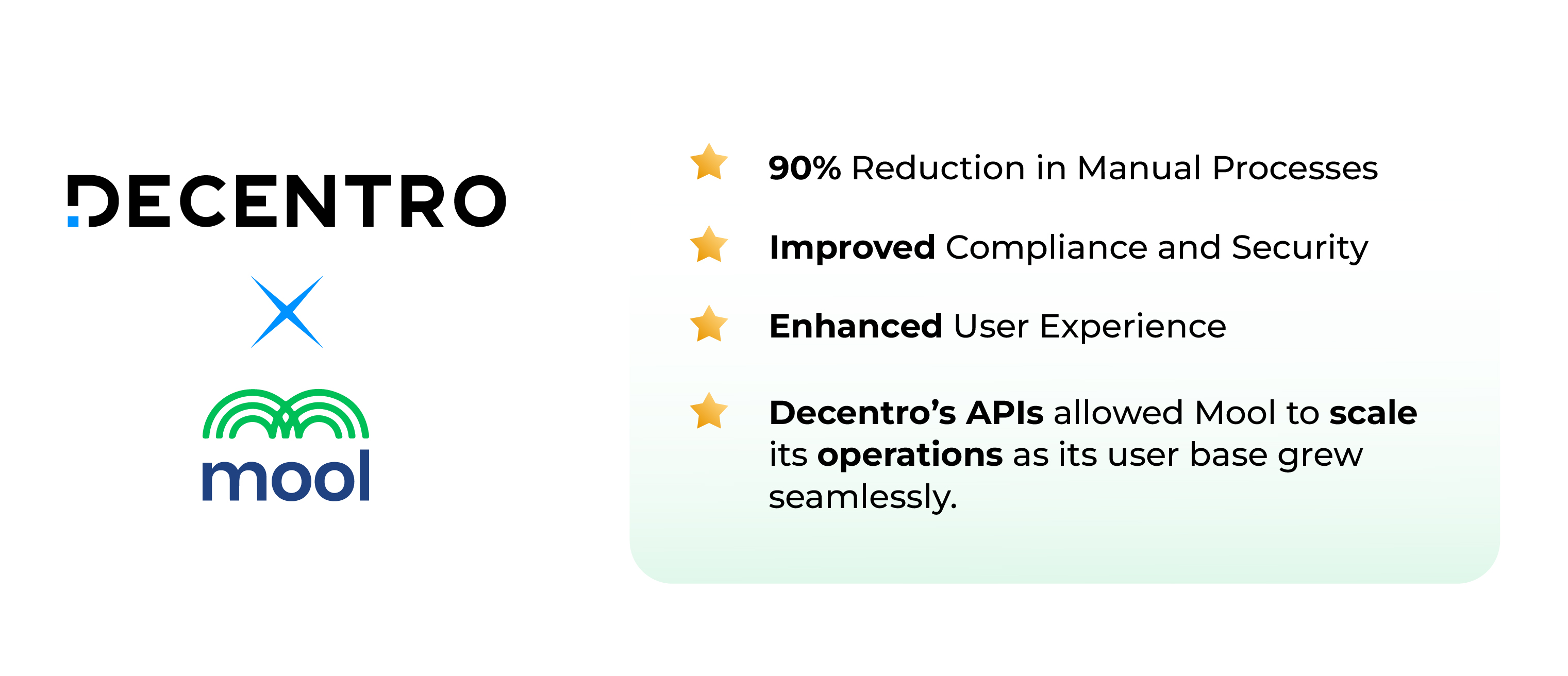

The implementation of Decentro’s solutions led to significant improvements in Mool’s operations:

- 90% Reduction in Manual Processes: Automation drastically reduces manual checks, speeding up onboarding.

- Improved Compliance and Security: Enhanced adherence to regulatory requirements increased user trust in Mool’s platform.

- Enhanced User Experience: Quicker onboarding and secure verification methods elevated customer satisfaction.

- Scalability: Decentro’s APIs allowed Mool to scale its operations as its user base grew seamlessly.

Hear directly from Abhinav Nayar, Founder, Mool about this association.

Conclusion

Decentro’s KYC and verification solutions were pivotal in transforming Mool’s onboarding processes and operational efficiency. By automating essential tasks, Mool enhanced its customer experience, ensured compliance, and reduced the time to market for its financial products.

Decentro’s offerings demonstrate the power of automation in driving efficiencies. If your organisation aims to tackle similar challenges in the fintech space, consider leveraging Decentro’s API solutions for a seamless KYC and verification experience.

Ready to transform your business like Mool? Reach out to discover how Decentro can streamline your financial workflows!