Multi-currency accounts simplify international transactions, reduce FX fees, and support cross-border growth. Learn how to boost your global business strategy with Decentro.

Multi-Currency Accounts: Your Key to Cross-Border Business Success

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

The world is more interconnected than ever, and with that comes a significant shift: cross-border payments and international trade are booming. However, managing multiple currencies can feel like juggling too many balls for businesses.

From SaaS providers billing customers globally to e-commerce platforms catering to international shoppers, managing multi-currency payments has become critical to maintaining competitive advantage.

Multi-currency accounts come to the rescue here. They allow companies to seamlessly send, receive, and hold foreign currencies without constant conversions. This isn’t just convenient—it helps reduce fees, smoothens cash flow, and makes it easier for businesses to expand globally by effortlessly accepting local payments.

Understanding Multi-Currency Accounts: What They Are

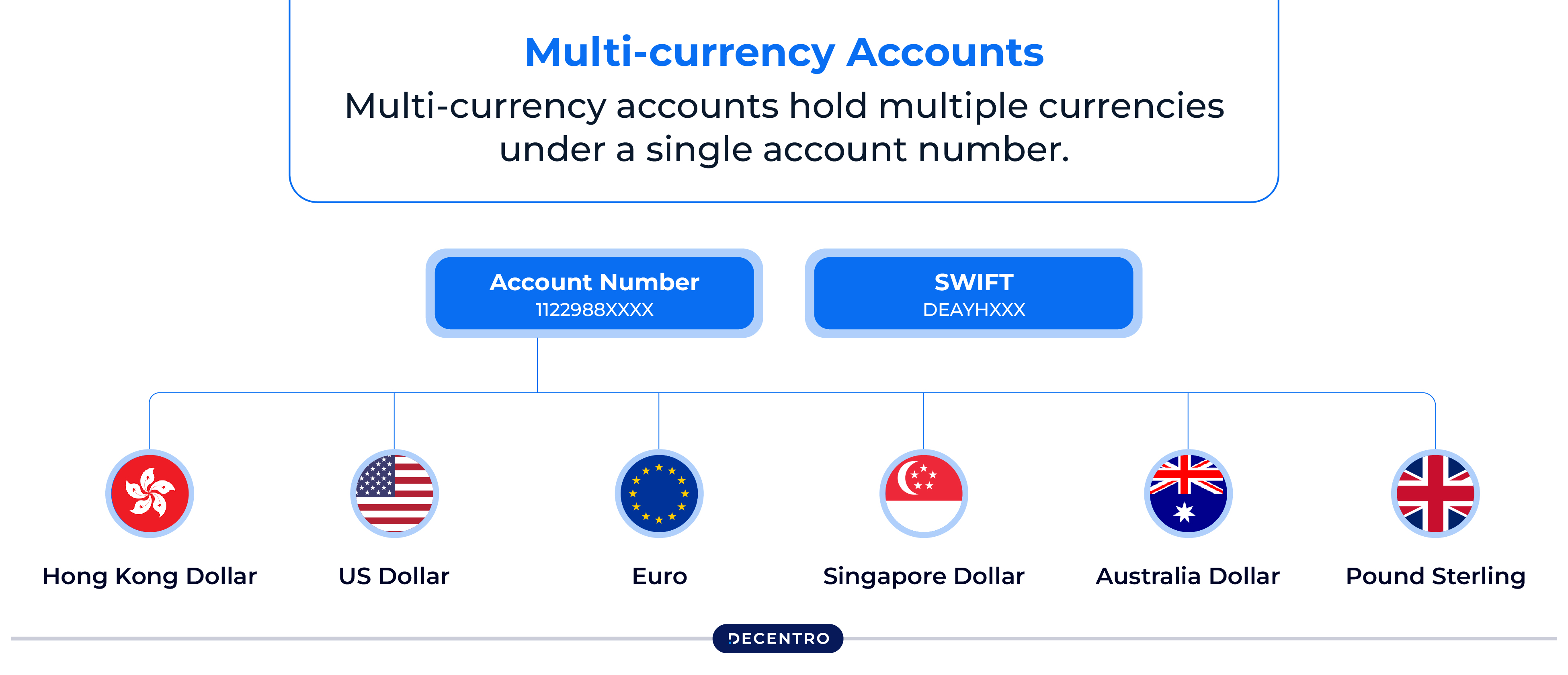

Multi-currency accounts allow businesses to manage and hold multiple currencies within a single, centralised account. This type of account eliminates the need for constant currency conversion, making it easier to manage international transactions, reduce exchange fees, and support global operations.

With a multi-currency account, businesses can streamline their cash flow across different markets and offer localised payment options to customers, which is especially valuable for e-commerce, cross-border payments, and companies expanding internationally.

How it differs from a foreign currency account

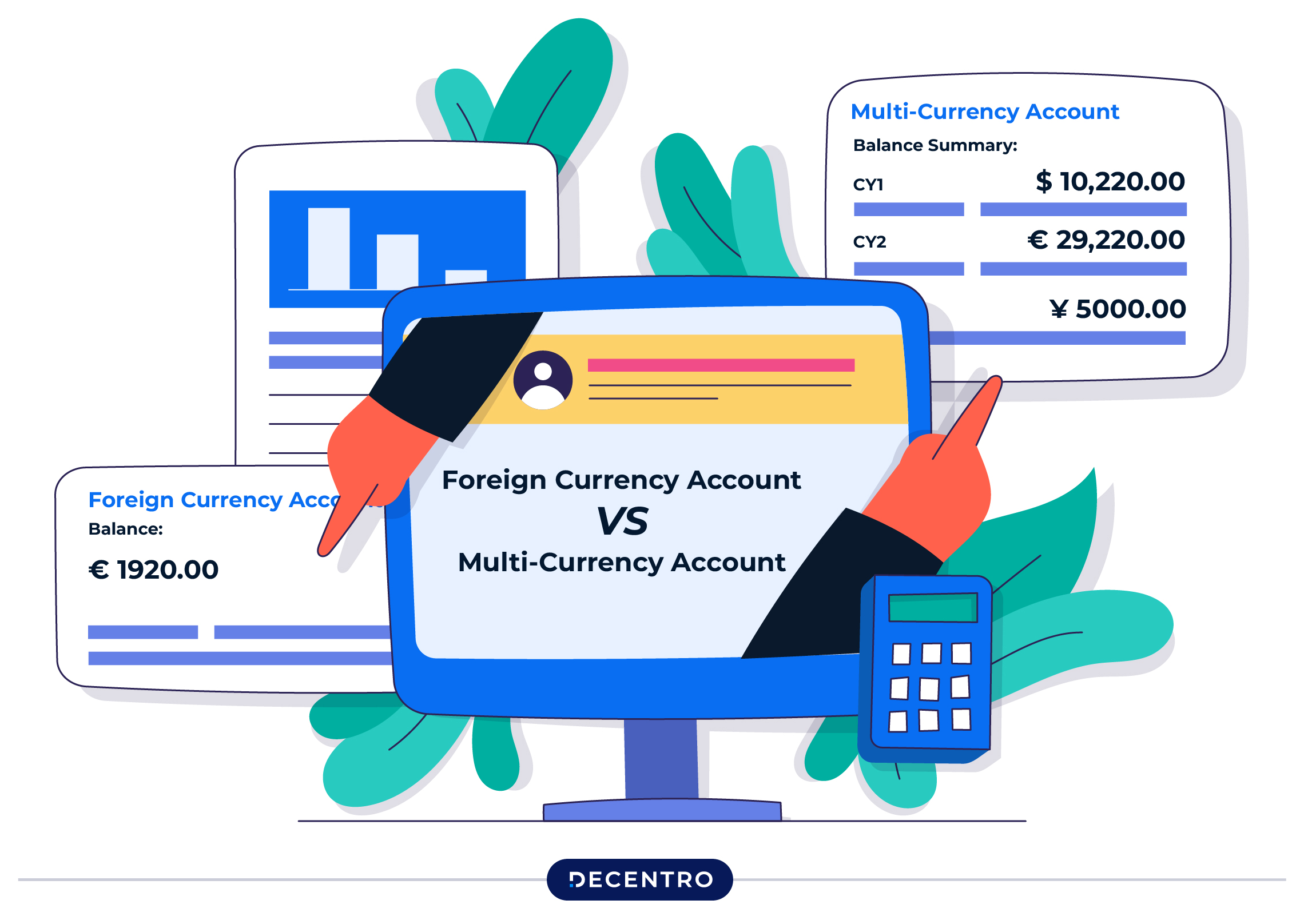

A multi-currency account lets users hold, manage, and transact in several currencies within a single account, making it ideal for global businesses.

A foreign currency account, on the other hand, typically holds only one specific foreign currency. It’s commonly used by individuals or companies that need to manage funds in that particular currency for transactions or investments. Unlike a multi-currency account, a foreign currency account doesn’t support holding multiple currencies simultaneously.

Understanding Multi-Currency Accounts: How They Work

Multi-currency accounts are often built on virtual accounts and unique sub-ledger accounts linked to a primary bank account. Virtual accounts allow financial institutions to manage different currency balances under one umbrella by creating “virtual” sub-accounts for each currency.

Here’s how it works:

- Simplified Currency Management: Each virtual account can hold a different currency, allowing easy tracking of balances and transactions.

- Real-Time FX Capabilities: Virtual accounts enable instant currency exchanges within the main account, avoiding delays and high fees.

- Streamlined Payments and Reconciliation: Businesses can send and receive money in multiple currencies without opening separate bank accounts, simplifying reconciliation.

- Localised Customer Experience: With currency-specific virtual accounts, companies can pay and get paid in local currencies, enhancing the customer experience in foreign markets.

Significance of Multi-Currency Accounts

To drive the narrative home of the growing need for multi-currency accounts, let’s take a closer look at some significant numbers reflecting global cross-border and multi-currency trends:

- E-commerce Growth: Cross-border e-commerce sales are growing at about 25% annually, fueled by demand for foreign goods and digital services. Multi-currency accounts reduce friction, improve conversion rates, and lower FX fees, providing a competitive edge.

- Rising FX Costs: Currency conversion fees average 1-3% per transaction for cross-border payments. Businesses managing high volumes can result in significant overheads, making multi-currency accounts crucial for reducing FX expenses.

- Corporate FX Exposure: Nearly 70% of businesses report foreign exchange exposure, and companies lose an estimated $10 billion annually due to FX-related costs. Using multi-currency accounts, businesses can manage this risk effectively by holding balances in local currencies.

- Digital Payments Adoption: As digital payments become increasingly standard, cross-border transactions are expected to rise, with Asia-Pacific and the U.S. leading the way. Multi-currency accounts streamline this growth by consolidating transactions and optimising FX management.

In today’s global landscape, multi-currency accounts are essential because of increased cross-border transactions and to address the diverse needs of international businesses. Here’s why:

- Market Growth and Demand

Globalization has brought increased demand for cross-border commerce. Cross-border payments are projected to grow by over 5% annually, with the transaction value nearing $250 trillion by 2027. This rapid growth underlines the importance of efficient currency management for businesses to stay competitive. - Digital Transformation and Real-Time Payments

Digital transformation has accelerated payment capabilities. Real-time payment solutions supporting seamless FX transactions across countries are becoming a standard in B2B and B2C transactions, creating the need for multi-currency options that facilitate instant settlement and reduce friction. - Currency Risk Management

Fluctuations in currency values pose risks for companies with international transactions. By holding balances in local currencies and transacting without immediate conversions, businesses can mitigate FX risk and choose favourable exchange rates, effectively managing their foreign exchange exposure. - Cost Savings and Convenience

Multi-currency accounts also save on conversion costs. With optimised FX rates and fewer intermediary steps, businesses can reduce transactional expenses while simplifying operations using a single account for multiple currencies.

These trends underscore why businesses should consider adopting multi-currency accounts to enhance transaction efficiency, cost control, and competitiveness in the global market.

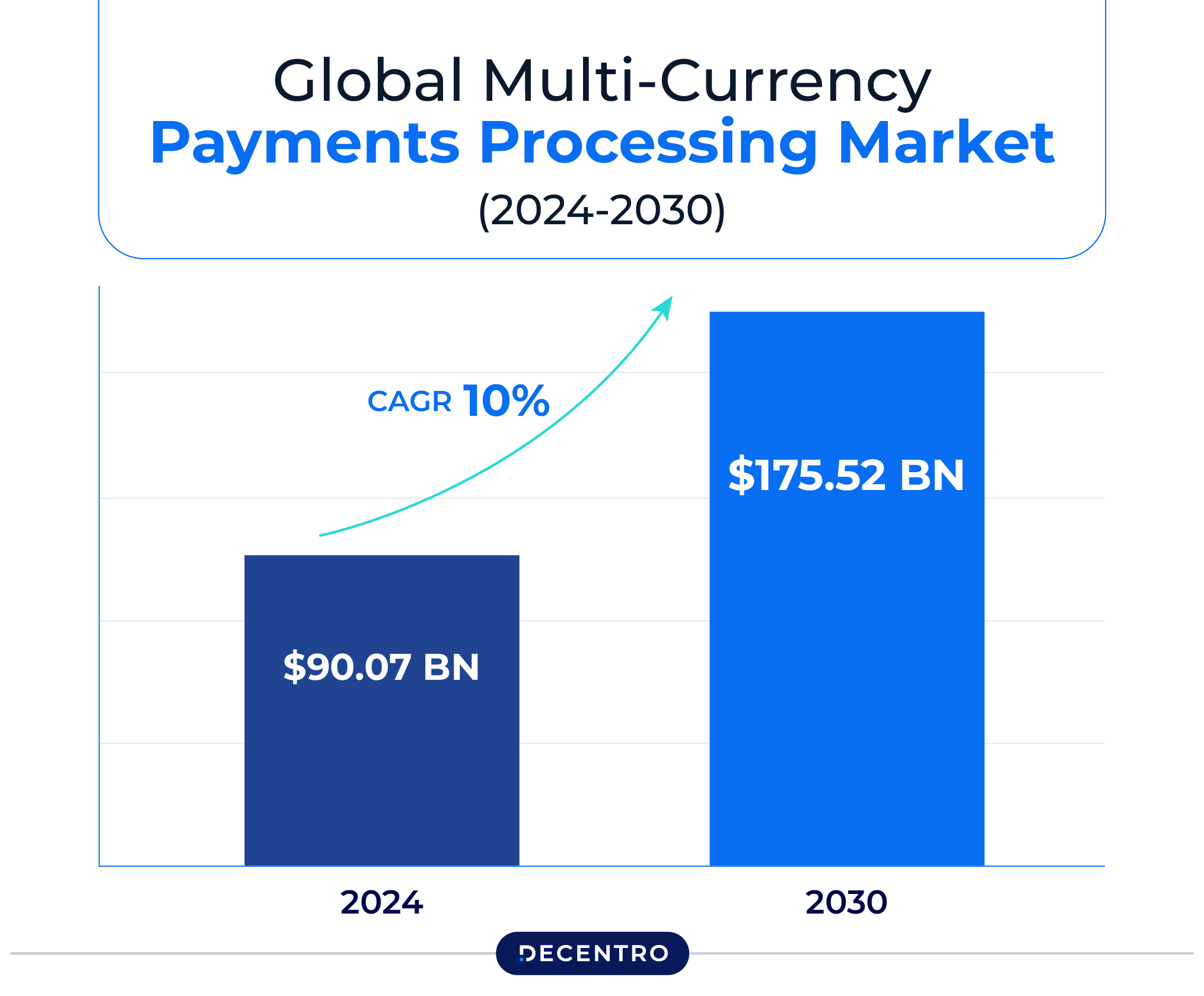

Current Market Trends

Apart from the apparent business need to deploy a multi-currency account for their use case, there are market trends that consistently reiterate the need to have the same. We have,

- Dominance of Fintech in Cross-Border Transactions

Fintech platforms like Stripe, PayPal, and others dominate the multi-currency space, focusing on offering seamless user experiences, lower fees, and high-speed transactions. In this competitive market, businesses demand solutions that balance ease and cost-effectiveness. - Focus on Regional Currencies

Beyond major currencies (USD, EUR, GBP), there’s a rising trend in supporting emerging market currencies like INR, BRL, and CNY. This shift responds to growing economies and the expansion of companies into diverse regions, necessitating access to local currency options. - Local Settlement Cycles and Compliance

Many businesses now prioritise local settlement and compliance to reduce delays and ensure alignment with local regulatory frameworks. This trend is increasingly popular among companies targeting fast-moving markets in Asia, Latin America, and Africa.

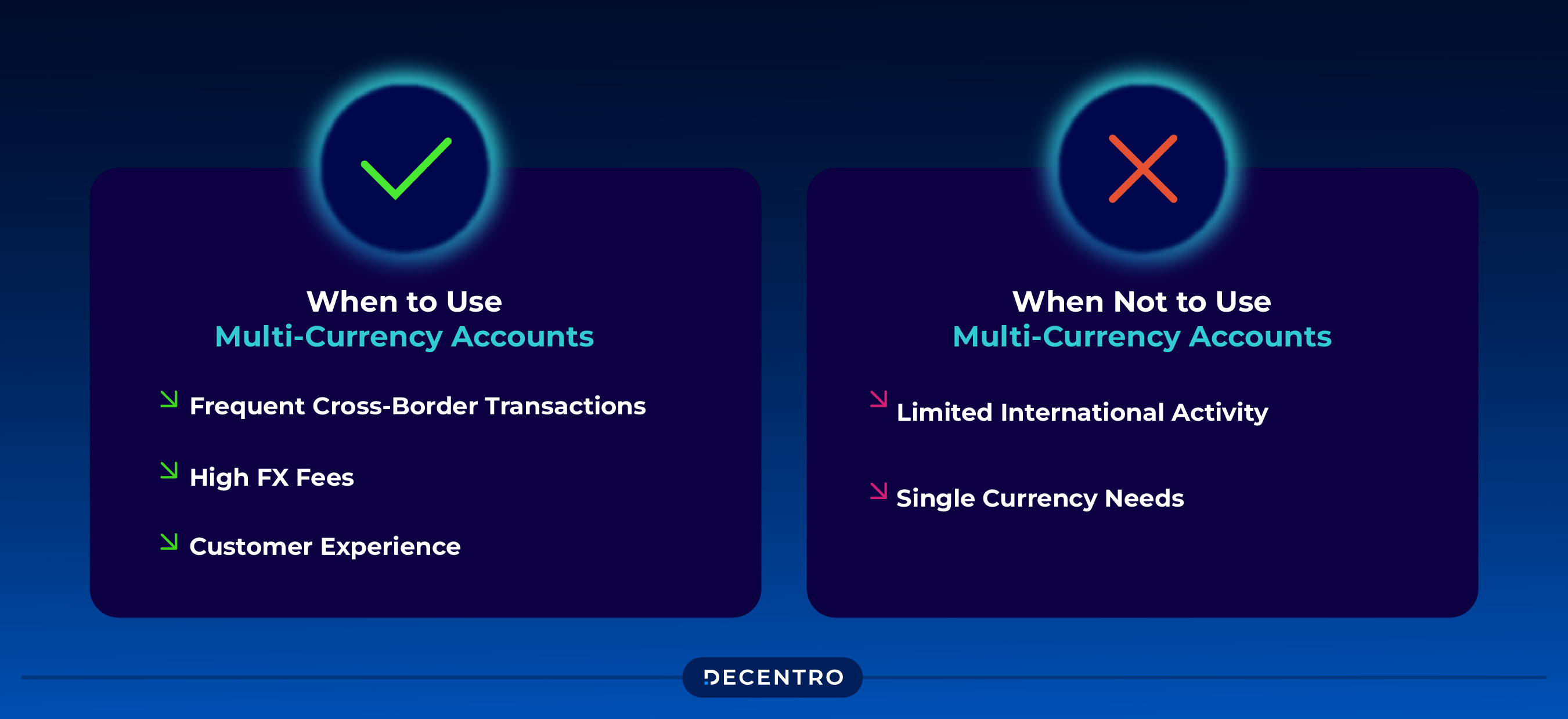

When to Use Multi-Currency Accounts

Multi-currency accounts are particularly beneficial for industries like SaaS, e-commerce, and professional services, where businesses have frequent cross-border transactions and a broad international customer base. These accounts enable them to accept and hold payments in various currencies, reducing FX fees and offering a seamless customer experience. To break it down, if you as a business cater to the following needs, you should deploy Multi-Currency Accounts,

- Frequent Cross-Border Transactions: This is ideal for businesses with regular international transactions, such as SaaS providers, e-commerce platforms, and service providers.

- High FX Fees: This is useful for companies wanting to minimise foreign exchange fees by holding funds in local currencies, reducing the need for constant conversions.

- Customer Experience: Enhances local customer payment options, increasing satisfaction and driving international growth.

When Not to Use Multi-Currency Accounts

On the contrary, businesses with minimal cross-border activity or limited currency needs may not need a multi-currency account. So, if you cater to both or one of the following needs, you can skip deploying these accounts,

- Limited International Activity: Companies with occasional cross-border transactions may avoid a multi-currency account’s extra cost and complexity.

- Single Currency Needs: Businesses dealing in only one foreign currency might find single foreign currency accounts more straightforward and economical.

Challenges of Multi-Currency Accounts

In today’s interconnected global economy, businesses increasingly rely on multi-currency accounts to facilitate cross-border transactions. However, despite their benefits, multi-currency accounts come with challenges that companies must navigate to ensure smooth operations and avoid pitfalls. We have,

- Currency Conversion Costs: Multi-currency accounts often require frequent exchanges, and conversion fees can add up depending on the market. These costs may be higher if the exchange rates are unfavourable or the conversion is done outside peak times.

- Regulatory Complexity: Each country has different tax regulations, reporting requirements, and compliance laws that apply to foreign exchange. Keeping up with these varying regulations can take time and effort, particularly for businesses expanding into multiple regions.

- Exchange Rate Volatility: Currency exchange rates are unpredictable, exposing businesses to losses. A small change in exchange rates could significantly impact international transactions, especially in markets with unstable currencies.

- Operational Complexity: Managing funds across multiple currencies requires efficient tracking and reporting. A centralised system can facilitate reconciling transactions and maintaining a clear overview of global finances.

- Tax Implications: Holding funds in various currencies can create unforeseen tax obligations, requiring businesses to understand each country’s tax laws to avoid penalties.

- Technical Integration: Multi-currency accounts must integrate seamlessly with a business’s existing financial systems and software, which can be complex and require custom-built solutions.

- Security Risks: International transactions increase the risk of fraud and cyber threats, as regulations and security standards differ from country to country. Ensuring that data and funds are secure can be an ongoing challenge.

Decentro’s Multi-Currency Settlement Account (MCSA) Solution

Having established the need for MCSAs, we must help you understand why our offering stands out. With Decentro MCSAs you have,

Seamless Integration and Localized Accounts

Decentro’s MCSA allows businesses to manage transactions in multiple currencies within a single platform. With integration options for cross-border e-commerce, SaaS, and service providers, Decentro offers named accounts in Singapore, the USA, and several other geographies. This helps companies streamline collections and manage funds in local currencies without excessive fees.

FX Management and Cost Efficiency

Decentro’s competitive FX rates allow companies to save significantly, especially for high-volume users:

- Monthly Volume of $10 Million: Fees drop to 25-35 basis points.

- Monthly Volume Above $30 Million: Discounts improve to 10-12 basis points.

- Case in Point: Businesses transacting $15 million monthly can save up to $30,000 in bank-to-bank transfers alone.

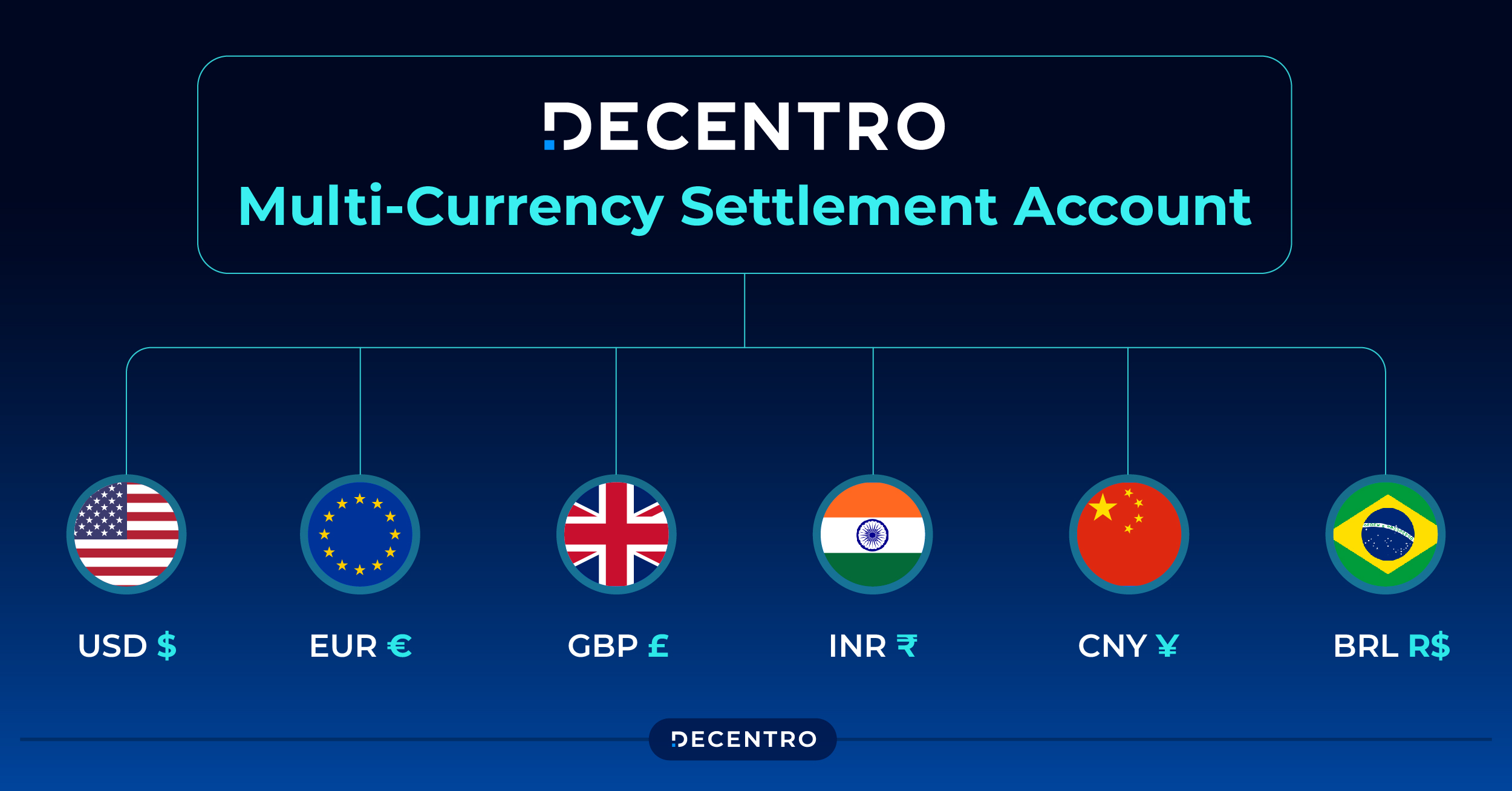

Treasury Feature for Regional Currency Support

Decentro supports various currencies, including SGD, USD, IDR, AUD, GBP, etc. This treasury feature enables businesses to collect, hold, and make payouts in various currencies, all managed through Decentro’s user-friendly platform.

Real-World Use Cases

- Cross-Border E-Commerce: Platforms can accept payments from customers globally in local currencies, reducing cart abandonment and boosting conversions.

- Global Payroll: Companies with international employees can process payroll in their local currencies, reducing administrative burdens and increasing satisfaction.

- SaaS Companies: For SaaS businesses with global clients, recurring payments in local currencies enhance customer experience and lower FX overheads.

- Service Providers: Consulting firms can invoice clients in their currency of choice, simplifying revenue recognition and ensuring clarity in billing.

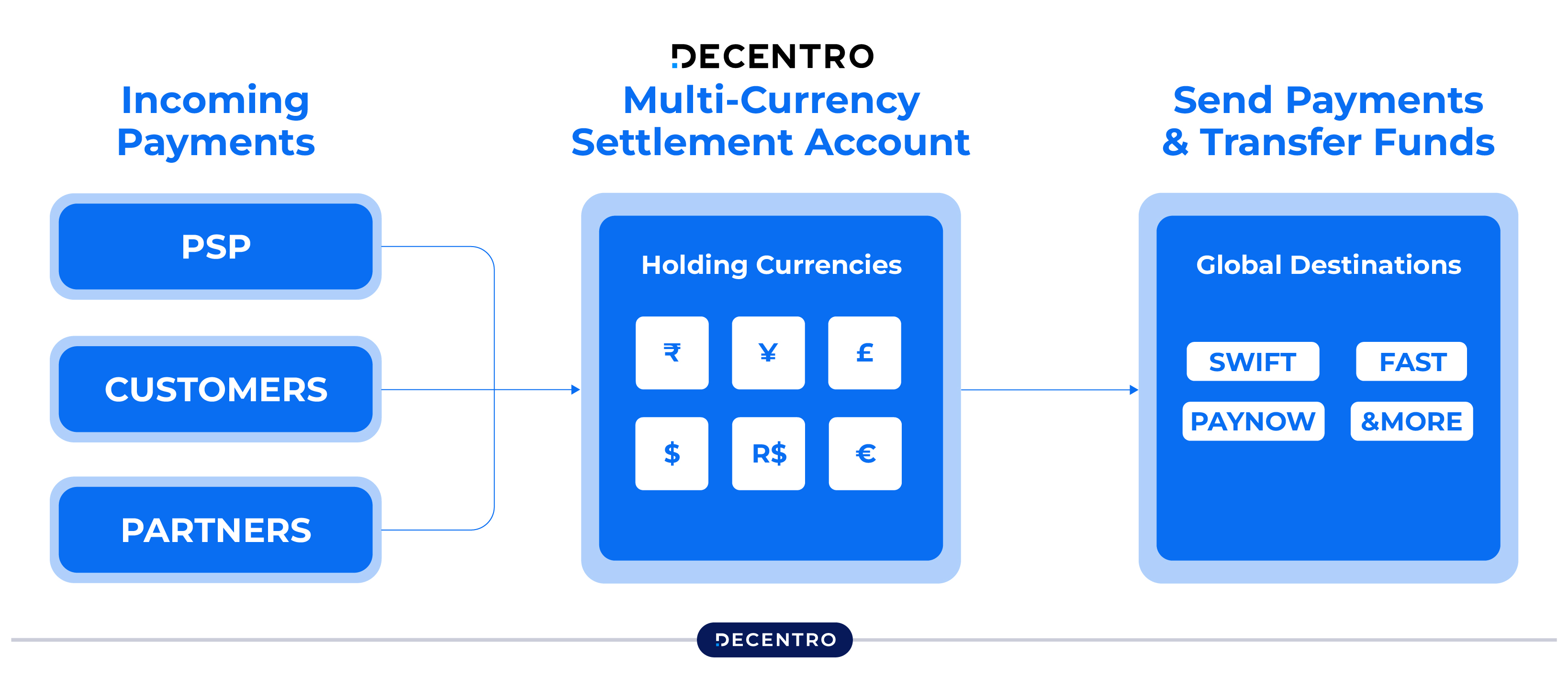

How Decentro’s Solution Works

The following are the key offerings of our MCSA

- Holding and Managing Balances

Businesses can hold funds in multiple foreign currencies without needing separate accounts. Funds are easily accessible for both local payments and conversions. - Real-Time FX Conversions

With live FX rates, Decentro enables businesses to automate currency conversions at favourable rates, ensuring transparent, cost-effective transactions. - Single-Platform Reconciliation

Decentro’s unified platform provides detailed reporting, allowing businesses to reconcile multi-currency transactions efficiently. - Optimized Local Settlements

Local settlements in various currencies occur in real-time, in line with regional settlement cycles. This reduces FX risk and speeds up access to funds.

Supported currencies range from major ones like USD, EUR, and GBP to emerging currencies like INR, CNY, and BRL, providing flexibility for growth across regions.

Decentro provides flexible options for companies to expand across multiple regions with tailored multi-currency solutions that offer high scalability and low FX costs.

Multi-currency accounts are indispensable for businesses operating in today’s interconnected world. With the exponential rise of global commerce, companies must leverage tools like Decentro’s Multi-Currency Settlement Account to remain competitive, minimise costs, and optimise their currency management processes.

To explore how Decentro can transform your global transactions, feel free to reach out to us.