Here’s our guide to streamlining payroll processing with payroll automation systems. Dive into the processes, and how you can leverage Decentro to optimize the same.

Guide to Payroll Automation: Benefits, Processes & Solutions

Avi is a full-stack marketer on a mission to transform the Indian fintech landscape.

Table of Contents

This blog delves into the transformative power of payroll automation, offering insights into its benefits, workings, and the best solutions available for payroll automation.

What is payroll automation?

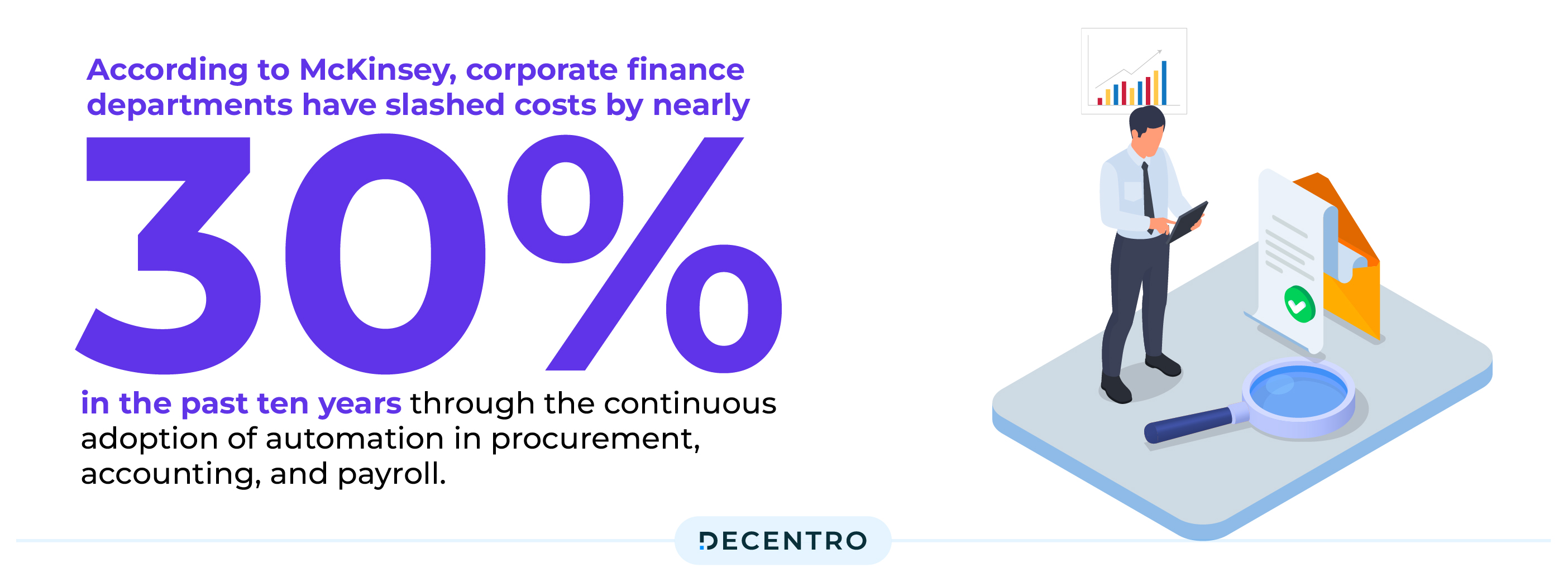

According to McKinsey, corporate finance departments have slashed costs by nearly 30% in the past ten years through the continuous adoption of automation in procurement, accounting, and payroll.

When we talk about payroll, we refer to a crucial function in any business – compensating employees for their work. Payroll automation can help your business streamline and manage the process of paying employees, reducing manual tasks and increasing accuracy in calculations and tax filings.

Payroll management – An overview

70% of small business owners say payroll taxes are a significant or moderate burden. 77% report income taxes create an extra burden. Payroll management is a broader term that covers the administrative aspects of managing a company’s payroll. It’s not just about calculating and distributing pay but also about strategising and overseeing the payroll process. This includes compliance with all relevant laws and regulations, managing payroll data, handling employee queries related to wages, updating policies in response to changes in labour laws, and integrating the payroll system with other business systems (like HR management). Payroll management is about creating an efficient, compliant, and responsive system to both the employees and the company’s needs.

To simplify with an analogy: If payroll were a car, payroll management would be the combined efforts of the driver, the mechanic, and the road rules that ensure the vehicle operates smoothly, safely, and legally. Payroll is the actual process of the vehicle running (paying employees), while payroll management involves everything that keeps the vehicle running well (strategic planning, compliance, and problem-solving).

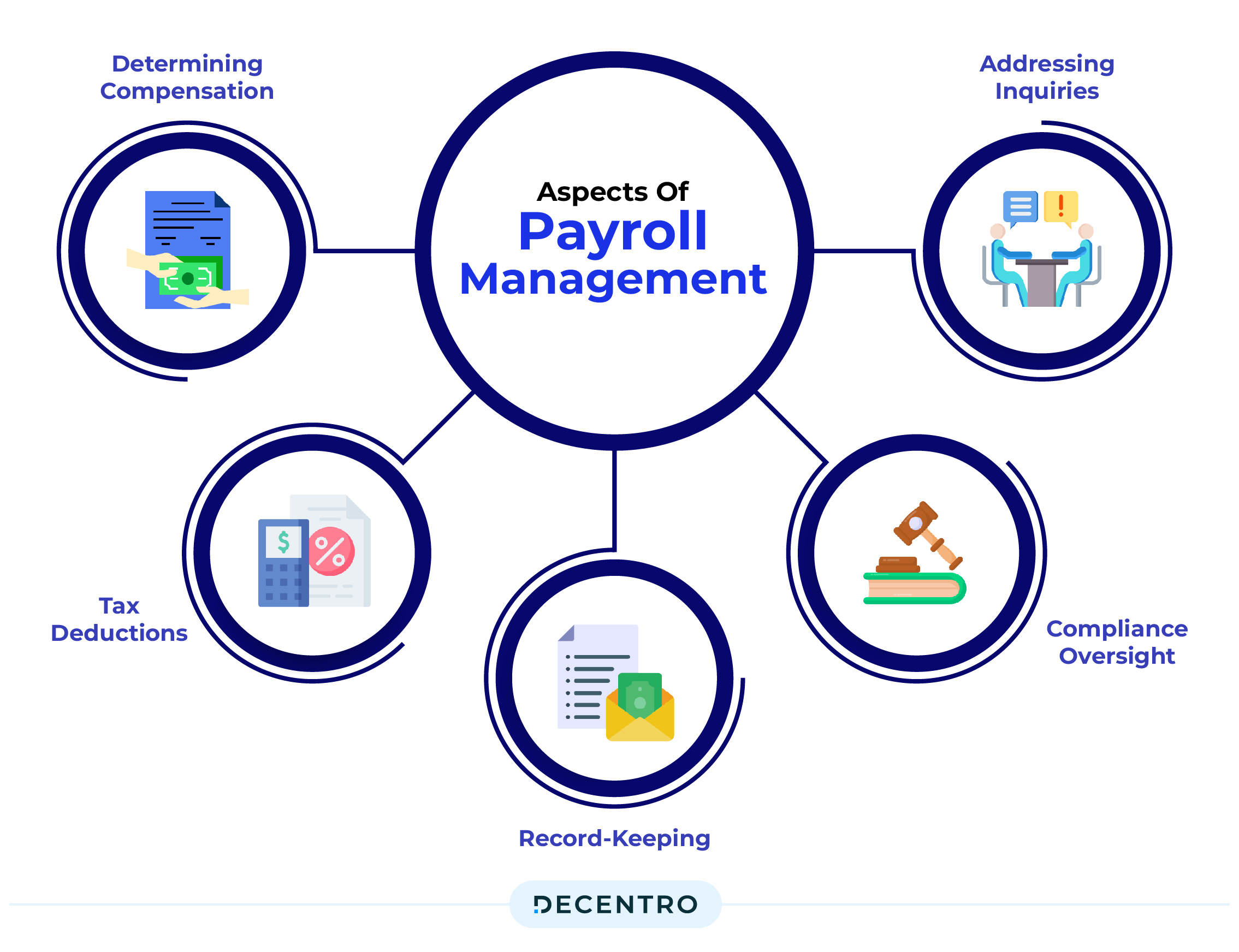

Aspects of payroll management

When discussing payroll functions, we discuss the backbone of employee compensation in any business. Let’s break it down into key points:

1. Determining Compensation: Payroll ensures the accurate disbursement of wages to employees. Subsequently, payroll facilitates the issuance of checks or initiates bank transfers to fulfil salary obligations.

2. Tax Deductions: Payroll operations include deducting taxes from employees’ earnings. This can be likened to the prudent practice of allocating a portion of one’s income for tax obligations.

3. Record-Keeping: Similar to recording sales and earnings, payroll meticulously maintains comprehensive records of all compensation transactions.

4. Compliance Oversight: Payroll ensures adherence to regulatory requirements and organisational policies, guaranteeing that all procedures are conducted per established standards and legal frameworks.

5. Addressing Inquiries: Lastly, payroll serves as a resource for addressing any inquiries about compensation. Much like being available to field inquiries regarding pricing or promotions during a sale, payroll personnel can provide clarification and assistance regarding remuneration matters.

In essence, payroll management embodies the role of orchestrating a large-scale event, ensuring that the efforts of all stakeholders are duly and punctually acknowledged and compensated.

Challenges in payroll management

Effective payroll processing is a pivotal component of an organisation’s employee retention strategy while mitigating legal risks. Conversely, inaccuracies or delays in employee compensation can detrimentally impact morale and potentially result in non-compliance with tax or labour regulations.

1. Compliance Challenges: Navigating the intricate landscape of employment law and tax regulations poses a significant challenge for payroll professionals. Failure to stay aware of regulatory changes can lead to errors in payroll calculations, potentially resulting in fines or legal actions on your business. Monitoring and adjusting your payroll processes accordingly is crucial to ensure compliance.

2. Confidentiality Concerns: Maintaining the confidentiality of payroll records is paramount in today’s data-sensitive environment. Unauthorised disclosure of employee information can damage your company’s reputation and violate privacy laws. Safeguard payroll documents in secure locations, utilising encryption or password protection to restrict access to authorised personnel only.

3. Data Backup: Protecting payroll data from loss or corruption is essential for business continuity. Implementing robust backup procedures using cloud platforms or external devices to safeguard against data loss due to system failures or disasters is becoming necessary for companies and businesses.

4. Timesheet Management: Managing employee timesheets accurately, especially in complex organisational structures, poses a challenge. Utilising reliable payroll processing software can help you streamline timesheet management, minimise errors, and ensure compliance with labour regulations.

5. Accurate Pay Calculation: Miscalculating employee pay can lead to financial discrepancies and dissatisfaction. Double-checking calculations and utilising automated payroll systems can help your business mitigate the risk of errors, particularly in overtime calculations.

6. Integration of Payroll Inputs: Integrating disparate payroll input sources can present logistical challenges. Ensuring compatibility among payroll management systems, time-tracking tools, and employee record-keeping software is essential for seamless payroll processing and data accuracy.

Setting up an automated payroll management system

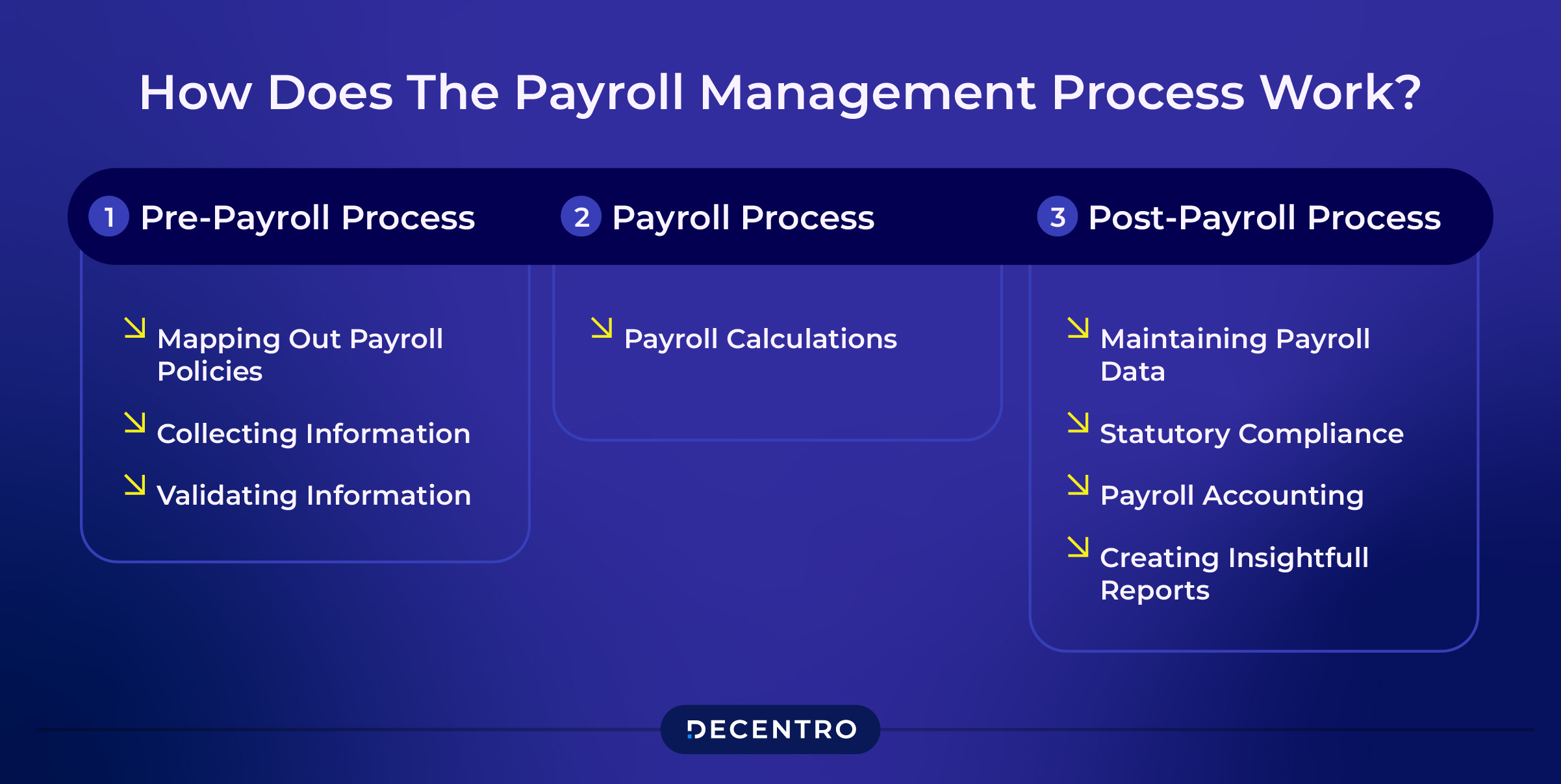

Navigating the complexities of payroll management is essential for businesses to ensure timely and accurate employee compensation while maintaining compliance with legal requirements. From onboarding new hires to disbursing salaries and managing statutory deductions, each step in the payroll process demands meticulous attention to detail. Let’s see the various stages of setting up an automated payroll management system to streamline your operations and mitigate potential errors and compliance risks for your business.

- Employee Onboarding: Introducing new hires and gathering necessary documents is crucial for payroll setup. As your business grows, keeping track of this process can become increasingly complex. That’s where automated employee onboarding shines, making it easier to collect data through user-friendly features like employee self-service portals, thereby streamlining the onboarding journey.

- Defining Payroll Policies: Setting clear policies regarding pay structure, benefits, leave, and attendance. Automated solutions streamline this process, automatically dividing salary components based on inputs.

- Gathering Inputs: Collect employee data, including PAN, bank details, leave records, and tax declarations. Innovative payroll automation solutions facilitate this process and support old and new tax regimes.

- Validating Inputs: Ensuring all data aligns with your company policy and active employees are included. Payroll errors can have significant repercussions, from incorrect payments to legal issues.

- Calculating Payroll: Ensuring accurate calculation of net pay and deductions is critical. Manual methods are prone to errors, emphasising the need for automated payroll solutions.

- Disbursing Salaries: Transferring salaries to employee accounts, ensuring sufficient funds are available. Payroll solutions can help you simplify this process with just a few clicks.

- Paying Statutory Compliance: Calculating and filing statutory deductions such as TDS, PF, and ESI to avoid legal penalties. Consider all deductions, including income tax, based on employee declarations and tax regimes.

- Distributing Payslips: Sharing payslips with employees is a legal requirement in India. Automated solutions can offer convenience by allowing your employees to access payslips anytime via self-service portals.

Automated payroll management systems and their benefits

Automated payroll systems have revolutionised how businesses manage their payroll processes, offering myriad benefits that enhance efficiency, accuracy, and compliance. These systems utilise advanced technology to streamline payroll operations, eliminating the need for manual calculations and reducing the risk of errors. With automated payroll software, payroll calculations, tax deductions, and employee data management can be executed seamlessly, saving valuable time and resources for businesses.

Benefits of having an automated payroll system:

- Better Accuracy – One of the primary advantages of automated payroll systems is their ability to improve accuracy and minimise errors. By automating calculations and data entry, these systems significantly reduce the likelihood of mistakes that can occur with manual processing. This ensures that your employees are paid accurately and on time, enhancing overall satisfaction and morale.

- Better Compliance – Automated payroll systems are equipped with features that help businesses stay compliant with tax regulations and labour laws. These systems are updated regularly to reflect changes in tax rates, deductions, and compliance requirements, ensuring that payroll processes remain by legal standards. This reduces the risk of non-compliance penalties and provides businesses with peace of mind knowing that their payroll operations are aligned with regulatory guidelines.

- Better Flexibility – Automated payroll systems’ scalability and flexibility are another key benefit. Whether a business is small or large, these systems can adapt to accommodate varying payroll needs and complexities. As companies grow and employee numbers increase, automated payroll software can easily handle the additional workload without compromising efficiency or accuracy.

- Better Reporting – Additionally, automated payroll systems offer enhanced reporting capabilities, providing businesses with valuable insights into payroll expenses, employee costs, and tax liabilities. By generating detailed reports and analytics, companies can make informed decisions regarding budgeting, resource allocation, and strategic planning.

In conclusion, automated payroll systems offer numerous benefits that streamline payroll processes, improve accuracy, ensure compliance, and enhance overall efficiency for businesses of all sizes. By investing in automated payroll software, you can optimise payroll operations and invest your time on driving growth and success in your core business areas.

Payroll Automation Software

Several businesses in India have started using payroll automation softwares to automate their payroll processes. The perfect software combines ease of use with comprehensive features, including e-filing, smooth integrations, employee portals, accurate calculations, and time management tools.

Here are some payroll automation software solutions that businesses can start using to get started with automating their payroll processes:

- greytHR—Since its founding in 2019, greytHR has emerged as a leading payroll software in India. It provides effective HR and payroll management tools. It features an employee self-service portal, enhancing employee engagement and saving time for small and medium enterprises.

- Zoho Payroll – Zoho provides payroll solutions that assist businesses in managing and processing their payroll and expenses efficiently, ensuring accurate and timely employee payments.

- Keka – Keka stands out as India’s leading, user-friendly, and employee-centric payroll software, offering remote data access and simplifying use for widespread adoption. Unique in enabling non-finance roles like HR to partake in salary operations, Keka also supports digital and SMS payslip distribution.

Features of an intelligent automated payroll management system

Managing payroll can be daunting, but with the right automated payroll management software, many challenges can be effectively addressed. Here are some features that an ideal software solution can help businesses with:

1. Comprehensive Processing: Efficient handling of all aspects of payroll, from calculating employee pay to filing taxes, with one comprehensive software solution.

2. Accuracy and Compliance: Up-to-date information on employment laws and tax regulations, ensuring accuracy and compliance in every payroll cycle.

3. User-Friendly Interface: The interface’s ease of use for administrators and employees makes payroll management easy for everyone involved.

4. Enhanced Security: Sensitive employee data is protected with robust security features, safeguarding against unauthorised access and misuse.

5. Scalability: Adaptable to businesses’ growth effortlessly as the software scales to meet the evolving needs of companies of all sizes.

6. Affordability: Businesses of any size can access powerful payroll management tools at a price point that fits their budget.

In addition to these essential features, there are additional functionalities that may benefit specific business needs, such as:

- Integration with HR Systems: Streamlining of HR processes by integrating payroll software with other HR systems like performance management and time tracking tools.

- Self-Service Capabilities: Empower employees to access and manage their payroll information online, enhancing efficiency and convenience.

- Advanced Reporting and Analytics: Gain valuable insights into payroll trends and metrics, enabling informed decision-making and strategic planning.

How can Decentro help streamline your payroll management process 10X faster?

Decentro offers a comprehensive suite of tools designed to optimise your payroll management process, making it easier and more efficient than ever before. With the combined strength of our payouts and escrow features, businesses can streamline their payroll operations while ensuring security and compliance at the same time.

Decentro’s payout solutions enable businesses to seamlessly disburse employee salaries and benefits, regardless of their preferred payment method. Whether NEFT, RTGS, IMPS, UPI, direct deposits, or bank accounts, our platform supports various payout options to suit your employees’ needs. By automating the payout process, businesses can eliminate manual errors and delays, ensuring timely and accurate payments every time.

Decentro’s escrow accounts provide a secure and transparent way to manage funds for various business transactions, including payroll processing. Whether it’s holding funds for employee bonuses, compliance deposits, or contingent payments, our escrow services offer peace of mind and assurance for both employers and employees. With built-in security features and customisable workflows, businesses can trust Decentro to handle their escrow needs professionally and reliably.

Benefits:

– Timely Disbursement: Ensure that your employees receive their salaries and benefits on time, enhancing satisfaction and morale.

– Flexibility: Accommodate diverse payment preferences with multiple payout options, including Netbanking, Bank Account Transfer or UPI, while executing bulk payouts instantly with real-time transaction status from our unified dashboard or your platforms.

– Multi-bank Support: Enable funds transfer to various banks from a single dashboard backed by multiple partner banks or through your bank account.

– Efficiency: Streamline your payroll operations with automated payout processes, reducing administrative overhead and freeing up resources for other tasks.

– Security: Protect funds and mitigate risks associated with payroll transactions by leveraging Decentro’s secure escrow services.

– Transparency: Gain visibility into fund disbursement and ensure compliance with regulatory requirements, enhancing trust and accountability.

– Customisation: Tailor escrow workflows to meet your specific payroll management needs, ensuring flexibility and scalability as your business grows.

In conclusion, Decentro’s payout and escrow solutions offer a powerful combination of convenience, security, and efficiency, helping businesses optimise their payroll management processes and drive success in the digital age. Experience the difference with Decentro and revolutionise your payroll operations today!

In conclusion

In conclusion, payroll management is a cornerstone in any business operation, ensuring timely and accurate employee compensation and adherence to legal and regulatory requirements. As highlighted throughout this guide, the complexities of payroll processing can be efficiently navigated through automation, leveraging technology to streamline operations and mitigate potential errors and compliance risks. With the transformative power of automated payroll systems, businesses can experience many benefits, from improved accuracy and compliance to enhanced efficiency and flexibility.

At Decentro, we understand payroll’s vital role in driving organisational success and have enabled players like Workflexi to solve the same pain points. Our comprehensive suite of tools, including our payout and escrow solutions, is meticulously designed to optimise your payroll management process, making it easier and more efficient than ever before. With timely disbursement, multi-bank support, and customizable workflows, Decentro empowers businesses of all sizes to streamline payroll operations while ensuring security, transparency, and compliance.

Experience the difference with Decentro and unlock the full potential of your payroll management process today. Take the first step towards payroll efficiency and revolutionise your business operations with Decentro’s innovative solutions.