Looking to simplify your customer transactions via QR codes? Check out our list of the Top QR Code Companies in India in 2023 and get up to speed.

Top & Upcoming QR Code Companies In India

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

A Quick Glance

| Name of Application | Value Proposition |

| BharatPe | Multi-source payment acceptance |

| ScanPay | Low transaction fees, making it an affordable option for small and medium-sized businesses |

| Paytm | Integration with the Paytm for Business app |

| Google Pay | In-app offers and discounts for customers |

| DigiPe | Conduct double transactions by establishing a double QR Code |

| Uniqode | Create dynamic, trackable QR Codes |

| Ensygnia | Customizable QR code |

| Yoyo Wallet | Personalized offers and customer recommendations |

QR codes, short for Quick Response codes, were first developed in Japan in 1994 by Denso Wave, a subsidiary of Toyota. Originally, QR codes were used to track parts in vehicle manufacturing. Soon, they found their way into other industries, such as marketing and advertising. They became popular because they provided customers with more information about products or services quickly and easily.

Recently, QR codes have gained widespread adoption in the payment space, particularly in India. They provide a convenient way for customers to make payments using their smartphones. With the increasing penetration of smartphones and digital payment systems in India, QR codes have become popular. Many merchants and vendors have adopted them to offer customers a more convenient payment experience.

Thanks to the growing adoption of QR codes, making payments has become faster, more convenient, and more secure than ever. The total number of Bharat QR (BQR) transactions in September 2021 was 52 lakhs, while the total number of UPI QR transactions was 11.96 crores, with a dramatic rise of 116% and 98%, respectively.

As India continues to embrace digital payments, the importance of QR codes in the fintech space is only set to grow. This blog post will closely examine India’s top and upcoming QR code companies, highlighting the companies driving this exciting trend forward. The following companies enable customers to complete transactions effortlessly when their QR codes are scanned, enhancing the overall payment experience.Whether you’re a merchant or consumer, these issuers will play a crucial role in the future of payments in India.

Note: The QR code companies below are in no order of preference and are arbitrarily placed.

BharatPe

BharatPe is India’s leading QR code issuer, focusing on small and medium-sized merchants. The company was founded in 2018 to simplify digital payments for merchants and customers. One of the key features of BharatPe’s QR code is its multi-source payment acceptance. This allows merchants to accept payments from various sources, such as UPI, credit cards, and debit cards. Here are some more features of BharatPe’s QR code:

- Instant settlements of funds, ensuring that merchants receive their payments within minutes of the transaction.

- Quick and easy refunds for customers.

- Customizable QR codes with customers’ branding to increase brand visibility and recognition.

- Access to working capital loans for merchants to grow their businesses.

- Widely accepted across India, with millions of transactions processed every day. This means merchants can accept payments from a wide range of customers, increasing their customer base and sales.

With its range of value-added services, BharatPe will remain a key player in the Indian fintech space.

ScanPay

ScanPay, a QR code issuer in India, provides merchants a convenient and secure way to accept payments. The company was founded to make digital payments more accessible for businesses of all sizes. One of the key features of ScanPay’s QR code is its ability to accept payments from a wide range of sources. Here are the top features of ScanPay:

- Easy integrated with a merchant’s existing payment systems, making it a seamless addition to their business operations.

- Low transaction fees, making it an affordable option for small and medium-sized businesses.

- Highly secure with advanced encryption technology and fraud detection measures.

- Instant payment settlement, i.e., merchants receive their funds within minutes of the transaction. This helps to improve cash flow and reduce the need for manual reconciliation.

- Access to detailed analytics, giving merchants insights into their sales trends and customer behavior.

Paytm

Paytm is one of India’s largest mobile payments and financial services companies, with over 450 million users. Paytm includes a universal QR code scanner that can be used to make payments with any QR code. Installing the Paytm app is the first purchase step by scanning a QR code, entering the amount, and completing the transaction. Some of the features of Paytm’s QR codes include:

- Quick and seamless payments using QR codes

- Multiple payment options, including UPI, mobile wallets, debit/credit cards, and net banking

- Integration with the Paytm for Business app, which allows merchants to manage their transactions, view transaction history, and more

- Real-time transaction updates and settlement

Google Pay

Google Pay is a popular digital wallet and online payment system developed by Google, with over 7 crore users monthly in India. It offers its customers numerous discounts, rewards, and freebies through cashback, schemes, and coupons. The company has its own QR code-based payment solution, enabling merchants to accept customer payments using QR codes. Some of the features of Google Pay’s QR code solution include the following:

- Quick and easy payments using QR codes

- Integration with the Google Pay app, which allows customers to manage their accounts, view transaction history, and more

- Multiple payment options, including UPI, mobile wallets, and debit/credit cards

- Real-time transaction updates and settlement

- In-app offers and discounts for customers

DigiPe

Touted as India’s fastest-growing Neo-banking service, DigiPe has developed the Double QR, eliminating the phrase “failed transaction” from the consumer’s vocabulary. What sets DigiPe apart from the other players is that none has solved the problem of failed transactions. The platform plans to offer first-of-its-kind services enabling shops and other business ventures to conduct double transactions by establishing a double QR Code in a single stand as a trailblazer. If one QR fails, the other QR will ensure that the consumer is not dissatisfied during the transaction.

- Swift and Easy Verification via paperless procedures

- Two QR code services will be offered in Andhra Pradesh, Odisha, and Telangana

- Real-Time Transaction Updates and Settlements

- Exciting Cashbacks

- Robust Support

Uniqode

Uniqode is a dynamic QR Code generator platform used by top companies like Nestle, Pepsi, Revlon etc. With Uniqode, you can effortlessly create, manage, and track QR Codes for various needs (15+ different types of QR Codes), all while seamlessly aligning with your brand’s identity through logos, colors, and designs. Here are some top features of Uniqode’s QR Code Generator

- Auto-design stunning branded QR Codes by just uploading your logo

- Create dynamic QR Codes. Edit the QR destination whenever you want.

- In-built analytics helps track scan count, scan location etc

- Supports integration with 5000+ other tools

- Bulk create upto 2000 QR Codes at once

- GPPR and SOC Type 2 Compliant

Top Global Players

Ensygnia

Ensygnia is a UK-based company that offers a unique QR code-based payment solution called Onescan. The company was founded in 2012 to revolutionize how people make payments by providing a secure, fast, and convenient way to pay for goods and services. Here are five features of Ensygnia’s Onescan QR code:

- Advanced security features, including multi-factor authentication and biometric verification. This makes it a highly secure option for merchants and customers alike.

- Payments with just one click eliminate the need for manual data entry and speed up the checkout process.

- Loyalty and rewards programs are featuring incentives for using their QR codes.

- Customizable QR code with logo and brand colors for a more personalized look.

- Easy integration with a merchant’s existing payment systems, making it a seamless addition to their business operations.

With its advanced security features, one-click payments, and support for loyalty and rewards programs, Onescan is a great option for businesses looking to simplify their payment processes and enhance their customer experience.

Yoyo Wallet

Yoyo Wallet is a UK-based mobile payment and customer engagement platform that provides a QR code-based payment solution. The company was founded in 2013 and has since become popular for retailers looking to enhance their customer experience through mobile payments and loyalty programs. Here are some of the features of Yoyo Wallet’s QR code:

- Loyalty and rewards programs.

- Customers can order ahead and skip the queue, reducing waiting times and improving their overall experience.

- Easy integration with merchants’ existing business operations.

- Personalized offers and customer recommendations based on their purchase history and preferences enhance customer experience and drive repeat business.

The Future of QR Code Payments

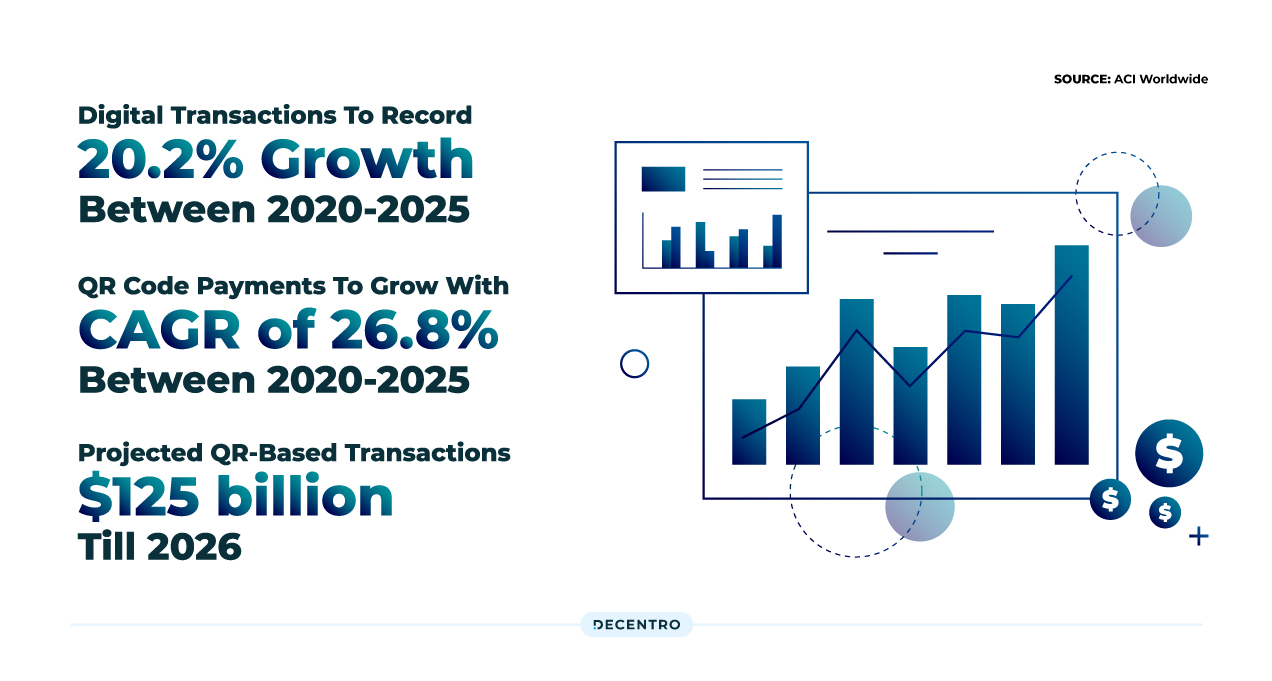

As per a report by ACI Worldwide, India is poised to become a global leader in mobile payments, with a growth rate of 20.2% in digital transactions between 2020-2025. This report also reveals that QR code payments are expected to grow significantly over the next few years, with a CAGR of 26.8% from 2020-2025. Speaking strictly of QR-based transactions, a projected figure of $125 billion in 2026 has been quoted for the Indian sub-continent.

These numbers testify to the fact that the adoption of QR based has gained momentum and how. Also, the fact that it is the go-to payment option for merchants across Tier 1, 2, and 3 cities in India cement its versatility across demographics. The emergence of new QR code companies and the innovative features they offer, such as dynamic QR codes, in-app payments, and loyalty programs, will only further boost the adoption of QR code payments.

Finally, integrating digital payments into all forms of commerce will hold key to the consistent growth of embedded payments and the embedded finance lateral, revolutionizing how we transact and interact with our money.

We at Decentro, with our Payments APIs, also help you create static or dynamic QR codes based on your business needs. Be it neobanks, fintech lenders, gig economy platforms, or NBFCs, Decentro’s payment stack supports multiple modes of transfers, including bank transfers, UPI, and QR code payments.

If you think now’s the time you want to get the best of QR code payments and make your customer transactions simple and secure, scan the QR code below.

Frequently Asked Questions

What are QR codes?

A QR code payment is an alternative to a contactless payment at the point of sale, where an electronic funds transfer is performed through a mobile app by scanning a QR code.

How to set up QR code payments?

To set up QR code payments for your business, simply:

1. Generate the QR code on your mobile device

2. Have your customers scan the QR code with their smartphone

3. Within moments, a payment screen will appear on their device so they can finish the payment process

What are the QR Payment Modes?

There are two different payment modes:

1. Customer-presented mode means customers display codes on their devices, and merchants scan them for payment.

2. Merchant-presented mode means the merchant displays QR codes the customer scans to pay. The merchant can use a payment app to create payment QR codes.

What are the different types of QR Codes?

At present, two types of QR code systems are being used by Indian merchants to accept and disburse payments – Static and Dynamic QR codes.