How do UPI & Payment Links blow Payment Gateways out of the water? How can you leverage UPI Payment links for your business? Find out with Decentro!

UPI, Payment Links & Payment Gateways

Once a Clueless Engineer, and now a Chuffed Marketer. Learning the trades of Fintech currently and making it great with Decentro.

Table of Contents

A Quick Glance

| The blog explores the evolution of payment methods in the Indian landscape, from the hassle of splitting expenses in cash to the advent of digital payment solutions like UPI, Payment Links, and Payment Gateways. | For B2B platforms with high-volume, high-amount transactions, UPI and Payment Links offer cost-effective solutions and streamline payments. In-store or POS payments are encouraged to use UPI-based QR codes or payment links to avoid MDR charges. |

| The benefits of UPI for consumers include more security, a lesser risk of fraud and sensitive information leakage, access to multiple bank accounts at once, a wide variety of apps to process UPI-based payments, the ability to request payments, and instant money transfers in real time. | Decentro’s Payment APIs are a valuable tool for businesses to set up app-to-app payments, create custom UPI handles, automate recurring payments, and facilitate point-of-sale transactions. |

Time for a flashback. The screen cuts to black & white.

Don’t go so far back; this is still in the millennium. Remember the time when you went out with friends and the task of splitting expenses & settling in cash, fishing for change which no one ever had, rummaging through the wallet to realize it’s near empty?

Or, depositing that cheque to your landlord or waiting for that high-value invoice at the office for days together? Well.

UPI, Payment Links, Payment Gateways, PhonePe, GooglePay, QR Codes…. haven’t they removed all these hurdles from the equation?

Times have changed. So has the Indian landscape.

In this blog, let’s explore UPI, Payment links, and payment gateways in detail and see how they fare against each other.

What is UPI?

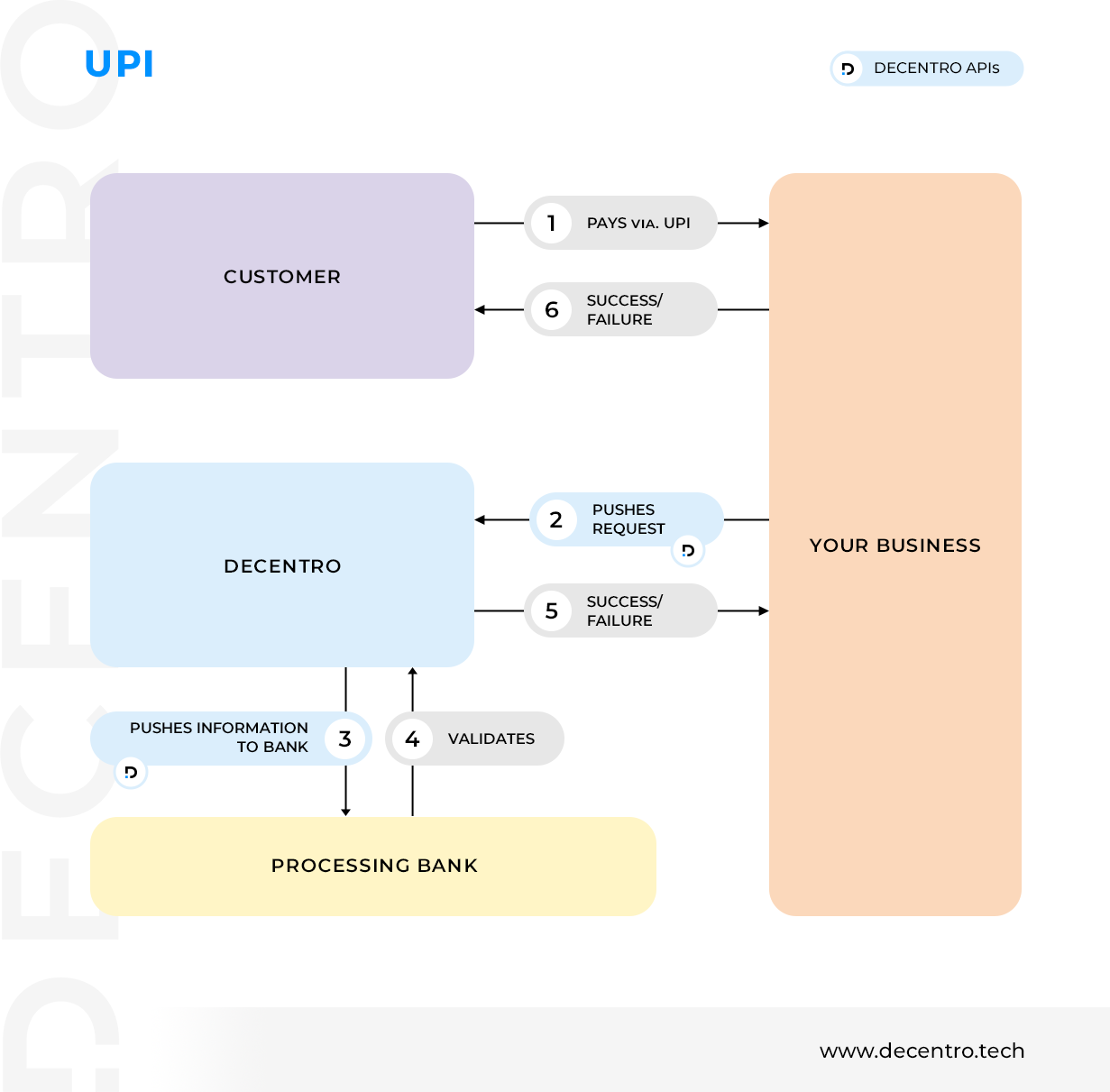

UPI, or Unified Payments Interface, is a real-time, instant payment system regulated by the Reserve Bank of India (RBI). It facilitates peer-to-peer transactions without a customer having to enter bank details every time a payment is made.

UPI Interoperability

We juggle with umpteen UPI IDs every single day for various payments. However, what if there was a single UPI ID you could use across all the apps?

Sounds amazing, isn’t it?

Guess what? NPCI is already on top of it and has rolled out a pilot for UPI interoperability via UPI Number.

UPI Number is an 8-10 numeric code digits a user can create to use across any UPI app. If it’s a 10 digit number, they have to mandatorily use mobile phone numbers.

By 1st December 2021, all the UPI apps(TPAPs & PSPs) must be compliant-ready with UPI Numbers. In addition, they are not allowed to incentivize users for this. The pilot allows apps to run with less than 5 million users for this.

What are Payment Links?

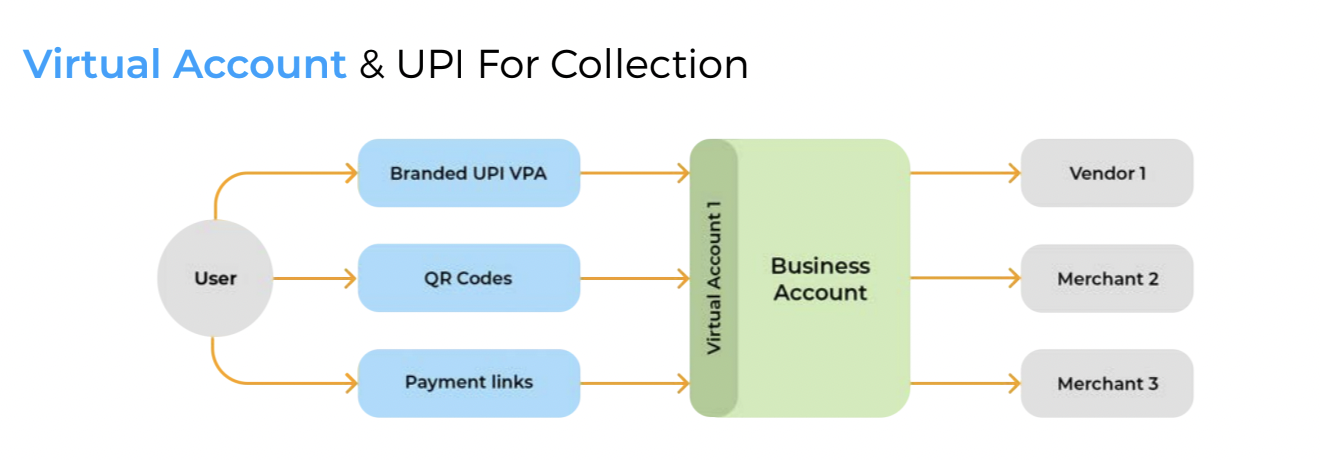

A payment link is a method to pay online that uses a URL unique for a customer and sends them to a secure payments page to proceed with the transaction. Users can complete the payment through their desired UPI app or any available NEFT/IMPS/RTGS options to the displayed virtual account.

What is a Payment Gateway?

A payment gateway is a service provider that securely transfers funds between a customer and a merchant/entity using any payment method. Payment gateways are like a middleman between the two entities and offer a secure environment to prevent the leakage of customers’ sensitive information, such as card details or frauds of any kind.

Some of the prominent payment gateways in India include Razorpay and Stripe.

Is UPI a Payment Gateway?

Unified Payment Interface is a simple bank-to-bank transfer network. A user can easily send or receive money to/from anyone instantly and without having to enter bank details as required by IMPS. On the other hand, a payment gateway, a subset of payment service providers(PSP), is a more complex instrument with multiple underlying processes and steps to facilitate a fund transfer between a customer and a merchant/business. Even though the end goal of both is to facilitate payment transfers, UPI is the simpler and hassle-free option of the two.

UPI Payment Links Vs Payment Gateways

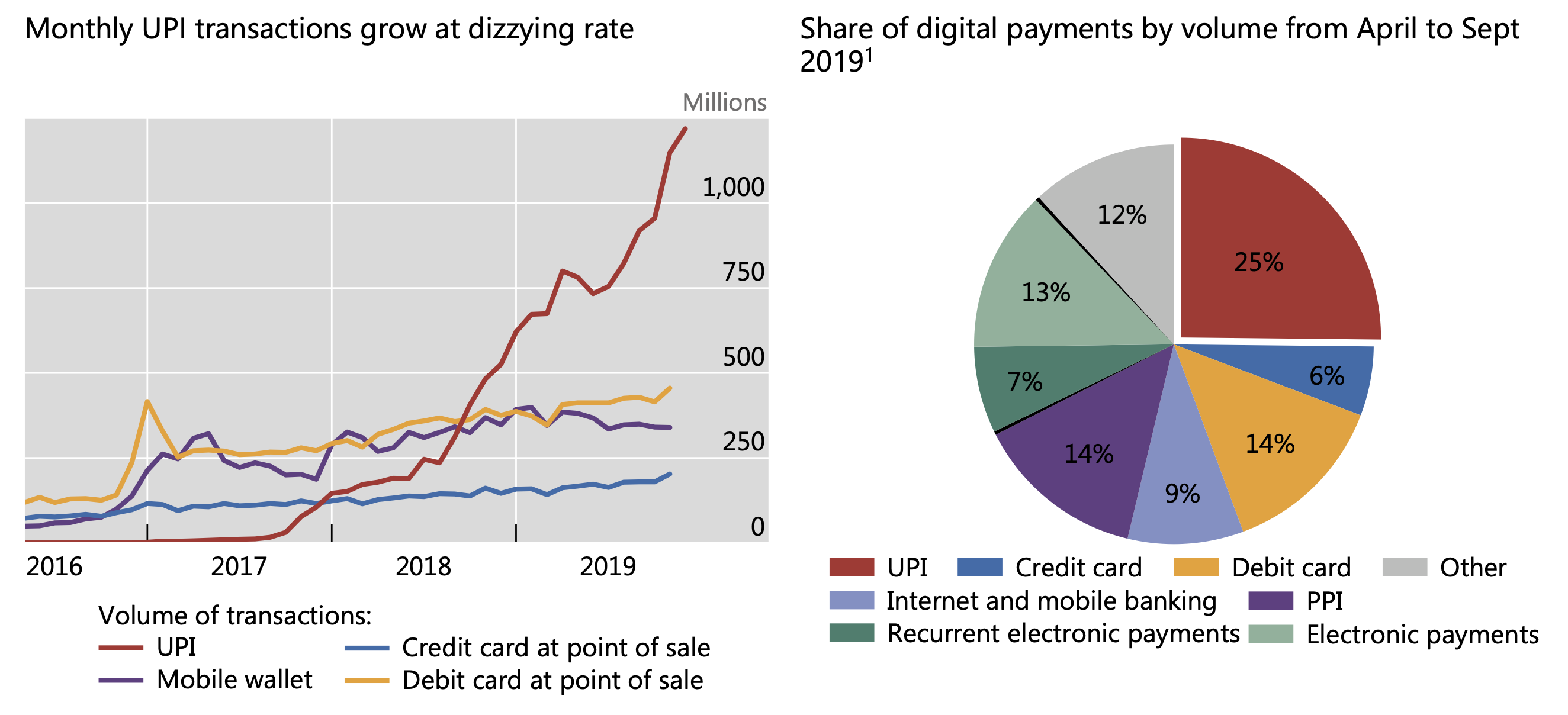

Launched in April 2016, UPI has been a roaring success and is the 5th largest payment network in the world, volume-wise, following Visa, WeChat Pay, Alipay, and MasterCard.

In 2019, Google penned a letter to the Federal Reserve about the execution & runaway success of UPI built by India’s NPCI for digital payments with a scalable architecture. The tech giant strongly vouched on how the same can be replicated in the US after their product Google Pay(formerly Google Tez) tripled growth within a year and landed an impressive 67 million users.

India’s UPI has been turning heads globally, not just in the US. NPCI is working to land UPI in UAE and Singapore and, soon enough, in the rest of South Asia.

So, why have people unanimously embraced UPI? Making it one of the most popular payment modes in the country(and possibly in the world, too, in the near future)?

- More secure and with a lesser risk of fraud and sensitive information getting leaked.

- Ability to access multiple bank accounts at once, using a single point.

- Wide variety of apps to choose from to process UPI-based payments.(Google Pay, PhonePe, BharatPe)

- The ability to request payments

- Instant money transfer and in real-time

While these are some of the many advantages for a consumer who opts for UPI, what about businesses?

We could go on a limb here and even say that quite a big chunk of businesses are still parked in the cash-based or net-banking payment zones. However, why should they move to the fast track of UPIs? Let’s find out.

Transaction Fees

Imagine every time you make a payment, a good chunk of it goes as a service/transaction fee? Don’t believe us? Ask a freelancer who transacts with clients, especially overseas.

A payment gateway makes payments uncomplicated. However, a ~2.0% transaction fee for each payment is a definite loss for the merchant and the customer. This issue further snowballs if the subject in question is an SMB with heavy transactions going in & out daily. A payment gateway’s cost definitely eats into the company’s commission structure.

On the other hand, businesses can significantly lower transaction costs by adopting UPI or payment links for simple bank transfers. The lower UPI costs can be attributed to the zero Merchant Discount Rate (MDR) mandated by the government. MDR is the merchants’ cost to banks and payment service providers (PSPs) for enabling the UPI infrastructure.

Fund Settlement Times

When a customer pays through the payment gateway, it could take 1-3 days (or even more) to be transferred to the company’s account. Unlike businesses having their own UPI/banking infrastructure, where the fund transfers are close to instantaneous. To overcome this, we’ve helped one of our customers, Workflexi, who had to wait for around 5-6 days for payment settlements on their platform.

Open Infrastructure

UPI is ‘open’ – this means that a technology company can build applications that help its users directly manage transfers in & out of their bank accounts.

Float or Interest

While businesses transact using a payment gateway, the funds stay in the gateway’s escrow account for a few days and then are settled to the merchant. During this interval, the PG could earn a float or interest on the fund balance before transferring it to the business’s account. The longer the funds stay at the account, the more interest the gateway could make.

Which are some of the Industries to Benefit from UPI & Payment Links?

TLDR, we could say that in any industry that could switch to cash-free or card-free payment mode, it can utilize UPI or payment links to improve its financial & payment workflows.

B2B Platforms

UPI has positively impacted industries across all domains B2B, C2C, B2C. However, B2B that tends to have high-volume, high-amount transactions, would particularly benefit a lot from UPI and payment links. With low-cost money transfers, a B2B business can save a lot of capital and channelize the saved commission for more effective growth purposes. However, each UPI transaction has a limit of ₹1 lakh (at the time of writing), and businesses could use bank transfer methods for higher ticket transactions.

B2B payments can be made smoothly & instantaneously by embedding a QR code or payment link within the invoice. The payee entity can scan the QR code for payments, visit the link, and wrap up the transaction.

Logistics & Trade

One of the behemoths in the high-volume transactions industries, Logistics & Trade, requires payment tracking, spending monitoring, and easy reconciliations. Since the transaction amounts are enormous, neither the fees nor the intermediary account’s cooling period does any good for the operators. What’s the next best solution? UPI and payment links, of course! A great example is our delivery heroes, who collect Cash-on-Delivery orders using UPI QR codes or payment links.

In-Store or POS Payments

Here, you have POS machines that have simplified the process of accepting payments at the point of sale at a particular location. A merchant is charged MDR or Merchant Discount Rate whenever a customer swipes a card. MDR is a processing fee covering credit/debit card transactions and protection against fraud.

This fee varies for credit & debit cards but could be anywhere from 1% to 3%. As a result, more and more merchants and shop owners are encouraging customers to use UPI-based QR codes or directly send them payment requests or links to avoid this fee. Fintech apps such as PhonePe, GooglePay, and BharatPe are helping merchants to make this happen. (The majority of the shops you visit would now have a QR code to make payments, right? Phew!)

How Can Decentro Help Your Business?

Decentro’s Payment APIs will help you quickly launch your business vertical or new product.

Our Payments module will help you:

Set-up App To App Payments

Deep links are a type of URL using which you can send a customer directly to an application instead of a website. While supporting various kinds of UPI payment apps, you can use deep links to send payment requests to the specific API app of your customer’s choice to collect payments.

Create your own UPI Handle Over your Business Account.

Instead of the Payment Gateway’s nodal account, your customer can transfer money directly to your business account, which will have a customizable UPI handle. Also, settlements are instantaneous.

Enable Social Payments

Thanks to the many social media platforms, it’s much easier to reach customers today. In such a case, as a business, considering their convenience can help you amp up your customer experience effortlessly. With Decentro APIs, you can easily generate a payment link and then share it with your customers over any social channels such as WhatsApp, Email, SMS, and more via conversational banking.

Automate Recurring Payments

Automate any recurring subscriptions or payments for your business via UPI & ENACH using our system. Configure once and forget, save time, and don’t expend on manual efforts.

Facilitate Point Of Sale Transactions

Got the point of sales at your business? Set up QR codes to accept payments from your customers easily. You can create static QR codes (with an open-ended amount to enter for payment) or dynamic codes (with a predefined amount) to facilitate payments.

As of October FY21, 2.07 billion transactions were via UPI out of 3.39 billion retail transactions, the trend only seems to be going upward from there. Needless to say, UPI, open banking, Banking as a Service(BaaS), embedded finance are the front runners when it comes to realizing the dream of financial inclusion in India.

It’s no easy feat to blend the convenience of making payments with fraud protection. Nor is it to bring your multiple bank accounts under a single umbrella to make transactions smooth. All this without paying a hefty amount as a transaction fee. Any business, especially the ones starting, can tremendously benefit from this. Therefore, it’d be only wise to have UPI up & about in your payment systems.

If your business wants to incorporate UPI into your payments system, we’d happily walk you through the best possible ways. Or, if any questions have crossed your mind, don’t hesitate to email us at hello@decentro.tech.

We’re helping neobanking platforms, NBFCs, wealth managers, fintech lenders, gig economy players, and more to set up a secure & seamless payments ecosystem for their business. Let’s listen to your business’s use case and solve it together!

Next time we’ll see you with something big in the banking API space.

Until then, it’s a wrap!

Cheers!

Comments are closed.