Looking to build your own UPI app? Check out our list of the Top & Upcoming UPI Apps in 2025 and get up to speed.

10+ Top & Upcoming UPI Apps To Send & Receive Money In 2025

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

A Quick Glance

| Name of Application | Value Proposition |

| PhonePe | 48% of India’s UPI payments are done via PhonePe |

| GooglePay | 34% of India’s UPI payments are done through Google Pay |

| Paytm | 15% of India’s UPI payments are done via Paytm |

| CRED | 4th position in UPI payment transaction volumes. |

| BHIM | Application for IPOs |

| Freo Money | Fast-growing and NPCI-approved UPI platform |

| Amazon Pay | Additional discounts and cashback if you choose Amazon Pay as a payment method |

| Mobikwik | Offers high cashback in the form of super cash and loyalty points |

| Freecharge | Investment products such as FDs, digital gold, etc |

| Airtel Thanks App | Access free subscriptions to OTT platforms like Disney- Hotstar as a premium member |

| iMobile App | Launched by ICICI bank for its customers along with non-ICICI bank account holders |

| Tata Neu | The reward points gained via Neu Coins |

| Jio Pay | The UPI payment option of Jio Pay in the MyJio app |

In the last five years, the volume of digital payments in India has grown at an annual average rate of 50%. This considerable feat owes itself mainly to the Unified Payments Interface(UPI) developed by the National Payments Corporation of India (NPCI). UPI is an immediate instant payment system by which you can transfer funds from one bank account to another.

Presently, around 200 crore UPI transactions are undertaken each month, out of which a sizeable share originated through the Third Party Application Providers (TPAPs). In the financial space, third-party apps are often connected to a banking application to tailor various services for a better and more compliant user experience.

BHIM was the first app that enabled UPI payments between bank accounts. However, 6 years after its launch, many UPI payment apps have come making it daunting to determine which UPI app is best for you. Continue reading to learn about the top UPI apps – their features, pros & cons, to choose among the best.

Note: The listicle has not been drafted with an order of preference. The players chosen for the same have been listed arbitrarily. With that, let’s jump onto the UPI apps.

PhonePe

PhonePe is one of the top UPI apps, owned by Walmart and powered by ICICI Bank. As per the latest NPCI data on Dec 22, it accounts for almost 48% of the total UPI payment transactions in the country. Other than sending money from one bank account to another through UPI, Credit card, and IFSC codes, it:

- Offers other services such as bill payment, online shopping, mobile recharge, food ordering, etc.

- Offers cash backs and reward points on transactions

- It provides an option to set autopay for bills, credit card, and utility payments

- Access to your favorite apps through PhonePe

- It can buy investment products such as mutual funds, insurance, etc.

- Offers the use of other wallets on PhonePe as well

- Allows you to have multiple bank accounts and choose between UPI IDs to make payments

GooglePay

Google Pay is another top UPI app used to make contactless payments. Nearly 34% of India’s UPI payments are done through Google Pay. The app was launched as Android Pay in 2011, which became Tez in 2017, and was finally rebranded to Google Pay in 2018. The features of the app are:

- It allows you to send money from one bank account to another

- Its Scratch’ cards are a unique offering, which are rewards on various transactions. These could contain cashback or discount vouchers on multiple items and brands.

- It recently launched wallet services through Google Wallet

- Allows you to have multiple bank accounts and choose between UPI IDs to make payments

- Offers other services such as bill payment, online shopping, mobile recharge, food ordering, etc.

- It also allows you to split bills among people and settle payments. This is one of the unique features of the app.

Paytm

The app initially started as a prepaid recharge app for mobile and DTH. Eventually, it launched wallet services on the app, which became its primary use. Today it has become a super financial app providing various products and financial services:

- You can send money to other bank accounts through UPI, credit and debit cards into and from Paytm wallets using the app

- It has options to pay utility bills, rent, mobile recharge, and credit card bills

- You can buy tickets to movies, flights, buses, trains, etc., on the app

- You can also purchase investment tools such as equity and mutual funds

- Further, the app offers a facility to avail of instant personal loans

- You get cashback and vouchers on using the app

- The app allows you to access various health services, such as ordering medicines, booking lab tests, etc.

Paytm is the third most commonly used for UPI payments accounting for nearly 15% of total transactions. While it occupies a distant third place in the UPI transaction volumes, it owns a payment bank license, allowing it to accept deposits and offer remittance services.

CRED

CRED is an Indian Fintech company founded in 2018 by Kunal Shah. The app’s primary use was to manage credit card and utility payments. However, the app is embedded as a payment option in most e-commerce platforms. This, along with offering high cashback, has occupied the 4th position in UPI payment transaction volumes. The features of the app are:

- It allows you to add your credit cards to your account and make payments using them

- There are alerts and notifications for paying credit card bills

- You can also use Cred to make UPI payments to vendors

- The app provides ‘Cred’ points, cashback, and vouchers on payments

- The app is known for its quirky marketing campaigns capturing recent trends

BHIM

The National Payment Corporation of India(NPCI) has developed the BHIM app. Fund transfers can be done through UPI, bank account number, or IFSC code. The app is known to be slower than other UPI payment apps. While it doesn’t provide add-on financial services, it is well-equipped to provide all essential basic payment services, such as:

- Utility bill payments

- Auto payments of EMIs, bills, OTT subscriptions, mutual fund SIPs, and insurance premiums

- Application for IPOs

Due to cashback provided by other UPI apps, BHIM has been unable to maintain its share of the transaction volumes. However, the government recently approved Rs. 2600 crore incentives for digital payments to encourage person-to-merchant transactions via BHIM. Such a massive infusion of cash could change which UPI app is best for many in India.

Freo Money

Freo Money is a dynamic Indian fintech platform offering smart financial solutions, including instant credit lines, digital gold, fixed deposits, and a user-friendly UPI service designed to simplify everyday payments.

Freo’s UPI service allows users to make instant payments, transfer money, and manage transactions effortlessly with just a mobile number or UPI ID. Integrated with top banks, Freo UPI ensures a secure and reliable payment experience, enabling seamless bill payments, merchant transactions, and peer-to-peer transfers—all with zero transaction fees.

Key Highlights of Freo UPI

- Instant Transfers: Send and receive money instantly using UPI ID, mobile number, or QR codes.

- Seamless Payments: Pay bills, recharge mobiles, and make online/offline purchases with ease.

- Bank Integration: Works with multiple banks for secure and direct transactions.

- Zero Transaction Fees: Enjoy cost-free money transfers with no hidden charges.

- 24/7 Availability: Make transactions anytime, anywhere, even on holidays.

- Robust Security: Advanced encryption and multi-layer authentication ensure safe transactions.

Benefits for Users

- Convenience: No need to enter bank details—just use your UPI ID or phone number.

- Time-Saving: Quick and hassle-free payments without waiting for OTPs or approvals.

- Universal Acceptance: Accepted by millions of merchants, apps, and service providers.

- Track Expenses: Get instant notifications and transaction history for easy budget management.

- Reliable & Secure: Powered by UPI’s advanced payment infrastructure, ensuring smooth and secure transactions.

Amazon Pay

Amazon Pay started a prepayment wallet, which soon became Amazon Pay – a payment service integrated with UPI payments. It is owned by Amazon and is well-integrated with most shopping and payment gateways. Amazon offers additional discounts and cashback if you choose Amazon Pay as a payment method. It offers various other services, such as:

- Ticket Booking services

- Utility payments

- Buying investment instruments such as Mutual funds, FDs, Gold, and Insurance

- Wallet-loading services through a co-branded bank credit card such as ICICI bank

Mobikwik

It was founded in 2009 as a mobile recharge app; Mobikwik has grown into a digital wallet and payment services app. It can send and receive money via UPI, credit cards, and cash pickup and deposit. It offers high cashback in the form of super cash and loyalty points. It also provides financial services such as:

- Buying Insurance

- Purchase of investment instruments such as Mutual Funds

- Small loans to users

- Credit card bill payment

- Merchant loan offerings

- EMI products

- Options to Buy Now and Pay Later (BNPL) through ‘ZIP’

The company turned profitable in 2022 and wants to venture more deeply into financial services products.

Freecharge

A Gurugram-based platform that provides easy payment options through UPI, credit cards, and its wallet. Using the app, you can make all kinds of recharges and utility and credit card bill payments. The app is owned by Axis bank and geared towards providing all digital banking services, such as purchasing insurance and investment products such as FDs, digital gold, etc.

It also provides credit facilities in the form of personal loans and Buys Now Pay Later options based on your CIBIL score.

It allows small businesses to send gift vouchers to their customers. It also allows them to send messages in case of pending or overdue payments.

It also provides services like financial goal management and financial scores to gauge how financially stable and healthy you are continually. Its ownership by a bank gears it better toward lending-related products in the future.

Airtel Thanks App

The Airtel thanks app combines your airtel connections management with various payments and financial services. Through the app, you can:

- Send and receive money, both in your e-wallet as well through UPI, credit cards, etc., by linking your bank account

- Access content through Airtel TV and Wynk music

- Link it to your mobile number. Airtel Money is a part of Airtel payments Bank, which you can use to send money even without an internet connection

- Access free subscriptions to OTT platforms like Disney- Hotstar as a premium member

- Make various recharges and bill payments

iMobile App

While the app was launched by ICICI bank for its customers, it was recently made open to all, including non-ICICI bank account holders. The app allows you to add bank accounts and send and receive money through IMPS, RTGS, and UPI. The app also provides ICICI bank’s net banking services, such as submitting an online loan application and applying for a checkbook or a forex card.

Further through the app, you can also:

- Purchase various tickets such as for movies, travel, etc

- Recharge your mobile, DTH, etc

- Make credit card, utility bills, and rental payments

- Investing in multiple products such as Mutual funds, gold, and equity

Other Upcoming Apps

Other than the above list of UPI apps that see the maximum volume and amount of transactions, some late entrants into this TPAPs space have the potential to make an impact. Some of these are:

Tata Neu

Launched by the Tata group, this app is a one-stop solution to all the consumer’s needs. You can shop, make payments, and access all financial services via the app. The reward points gained through transactions on the app are called Neu Coins. The app is a window to the plethora of goods and services the conglomerate giant Tata group offers. In a true sense, this app is nifty and could change the UPI payments landscape in the country if taken off.

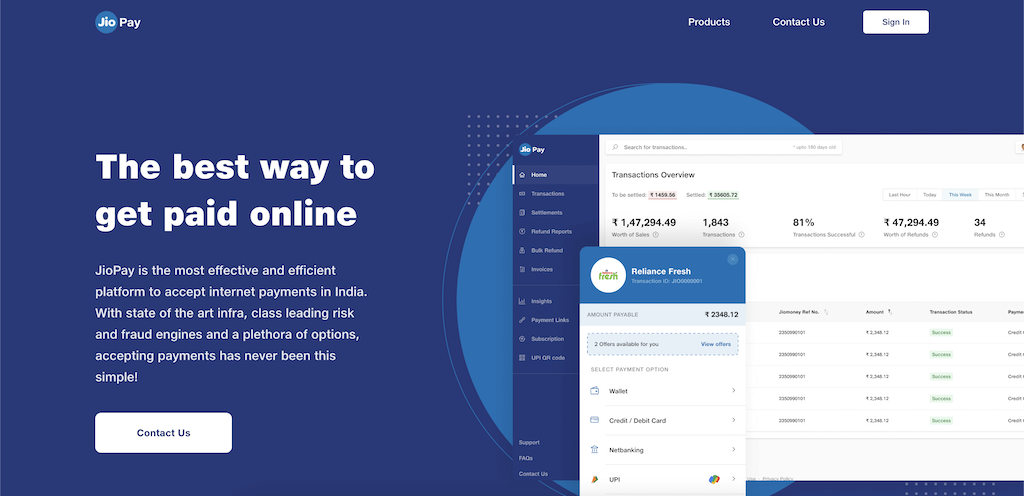

Jio Pay

The UPI payment option of Jio Pay appears in the MyJio app. It lets you send and receive payments through UPI, credit cards, and IFSC codes. It also enables the payment of bills and for completion of online recharge.

Apart from the above, various banks have launched their own UPI payment apps to recognize digital banking as the future of banking in India. Deciding which UPI app is best will now be a personal decision, as it would depend on your payment preferences, bank accounts, and consumption pattern.

Future of UPI Payments App

While the UPI payment apps have revolutionized digital payments in India, more than 95% of the transactions are done through three major apps – Phone pe, Google pay, and PayTm. Two of these major players are owned by foreign companies. To protect the payment landscape from heavy dependence on them, NPCI introduced market cap guidelines restricting the market share of a single company to 30% by 31st Dec 2024. Today, the players in the Indian context are serving a digital payments infrastructure that has evolved to such an extent that instant funds transfer is more of a hygiene factor than a unique selling point. There is also room for players beyond the big 3 to tailor-make solutions with a customer-centric approach, and we at Decentro are here to enable that UPI payment journey, collect, or intent flow. We have it all.

The Decentro API stack integrates with your existing process, allowing you to customize your payment journey. We are already helping neobanking platforms, NBFCs, wealth managers, fintech lenders, gig economy players, and more to set up a secure & seamless payments ecosystem for their business.

What’s even more interesting is that Decentro is also venturing into the world of SDKs. But more on that later. Drop us a line at hello@decentro.tech, and let us help you figure out your next move.

Frequently Asked Questions

If you’ve created a UPI ID (VPA) on another payment app, your VPA handle is specific to that payment app. Similarly, on an app, a handle (@ybl/@ibl/@axl) will be automatically assigned when you create the bank account-specific VPA.

You can add up to four UPI IDs to your bank account. You can have multiple UPI IDs for the same bank account. This lessens payment delays or failure and is secured by the different apps.

The maximum number of UPI transactions is usually limited to 20. Although the transaction limit per UPI transaction is ₹1 lakh, the upper limit depends on bank-to-bank. Therefore, the upper limit could be between ₹10,000- ₹1 lakh. The transaction limit per day for UPI transactions is ₹1 Lakh.

Each VPA can be linked to all the bank accounts or individually to each account, depending on the app’s functionality. Therefore, mobile no is the center of the universe. If you have multiple mobile no’s linked to various bank accounts, you need multiple UPI apps, i.e., precisely one app for each mobile no.