Here’s an in-depth guide on UPI Intent Flow and how it enables users to seamlessly transact via UPI. We also go into how you can enable this for your business.

UPI Intent Flow: The next chapter of your UPI journey

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

A Quick Glance

| The total Unified Payments Interface (UPI) transactions saw a significant YoY increase, accounting for almost 86% of India’s GDP in FY22. | UPI’s intent flow emerges as the new climax, providing customers with a smoother payment experience without needing multiple clicks or opening web/browser windows. | Industries like e-commerce and delivery logistics stand to benefit the most from UPI intent flow. Bulk checkouts can streamline high-volume transactions and can reduce payment failures, promising better user experiences. |

| Almost 10 economies are set to witness the potential of seamless P2P transactions, with India being exposed to the most mature model of UPI. | Unlike the conventional UPI collection flow, it allows customers to bypass the need for push notifications, SMS, or VPA validation. | Decentro’s API Suite enables businesses to integrate UPI intent flow seamlessly. |

UNIFIED PAYMENTS INTERFACE.

These three simple words have single-handedly spearheaded India’s digital payments transformation journey.

Here are statistics that reinforce the same sentiment.

In the last month of 2022, the value of UPI transactions stood at INR 12.82 Lakh Cr.

According to data from the National Payments Corporation of India (NPCI), the total number of UPI transactions last year jumped 91.11% YoY, and the value of UPI transactions saw a 74.83% YoY increase in 2022.

Interestingly, the total UPI transaction value accounted for nearly 86% of India’s GDP in FY22.

Naturally, with its growing popularity and nationwide adoption, this payment method is all set to disrupt the economies beyond India. Non-resident account types like NRE/NRO with international mobile numbers will now be allowed to transact with UPI, according to the National Payments Corporation of India (NPCI) notice. Almost 10 economies are set to witness the potential of seamless P2P transactions, with India being exposed to the most mature model of UPI.

The iterations. The regulations. The adoption. The disruption.

We have had the opportunity to witness it all.

Or have we?

It is pertinent to mention that in December 2022, 3.24% of the total person-to-person (P2P) transactions and 14.57% of person-to-merchant (P2M) payments were up to INR 500. The increase in the number of smaller transactions was more evident in P2M transactions, which means more small merchants are using UPI.

To put things into perspective, UPI Enabled 2,348 Transactions Every Second In 2022.

With fast-paced solutions being the need of the hour, a user journey consisting of 4 clicks seems cumbersome.

Therefore, this narrative of UPI being the ultimate powerhouse of digital payments has a new climax.

The protagonist?

Intent flow.

So what is UPI Intent Flow?

With UPI intent flow, you can provide customers with a smoother payment experience through UPI without asking them for any details or opening any web/browser window in between at all.

A little context: Intent Flow offers a native experience and better conversion without the hassle of switching between multiple apps and finding the notification.

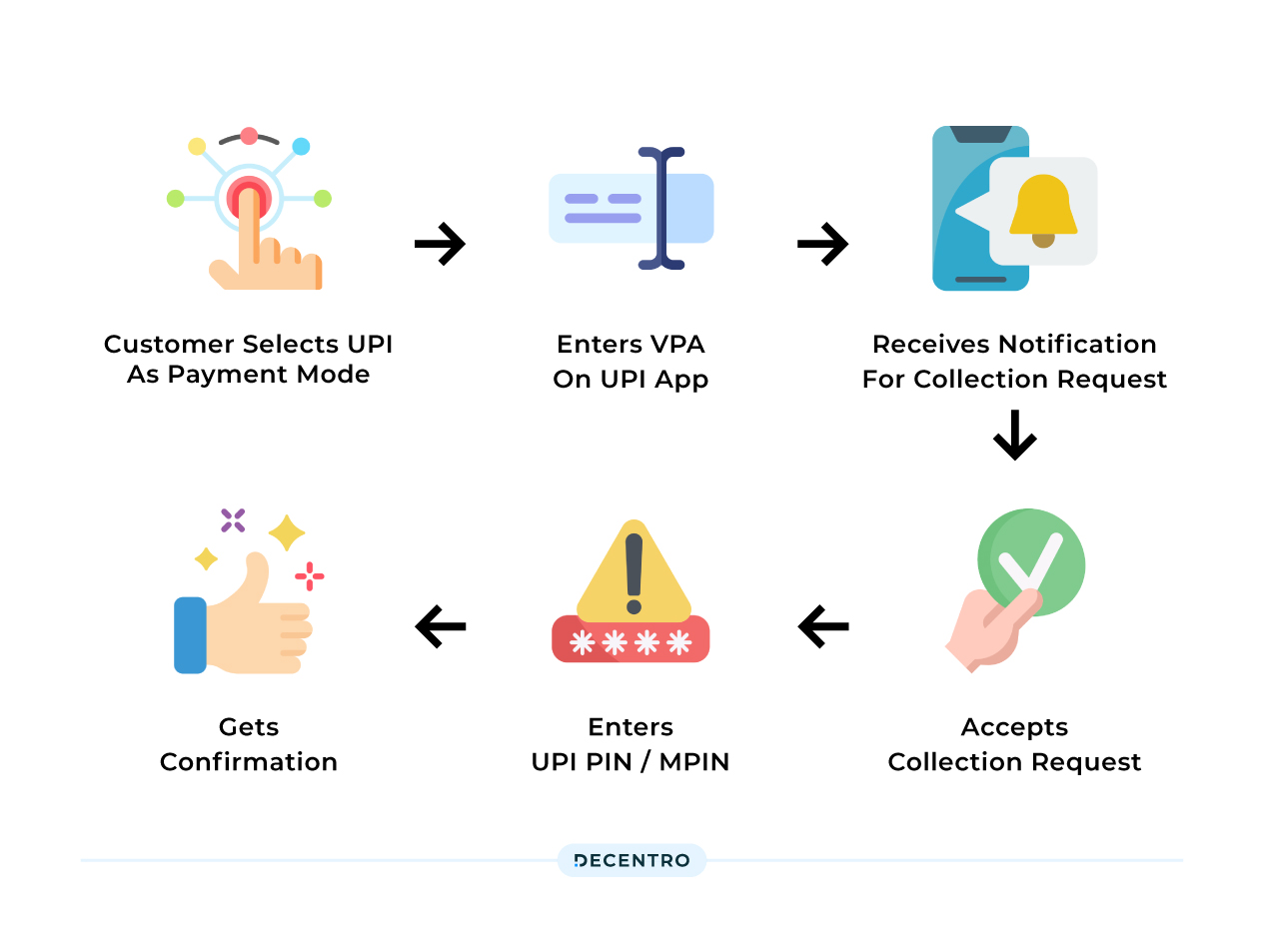

Let’s take a look at how the conventional UPI collection flow works,

- The customer selects UPI as the payment mode in the merchant app/website

- The customer enters the VPA (Virtual Payment Address) on the UPI application

- The customer receives a push notification and SMS for the collection request

- The customer accepts the collection request

- The customer enters the UPI PIN / MPIN

- The customer gets confirmation that the payment is thriving on the app/website.

In a UPI collect flow, when a transaction request is sent to the VPA id linked mobile number and UPI app; the customer needs to move out for the current page and click on the link shared in the SMS or tap on the app notification, which breaks the payments journey.

Post authorization of the UPI collect flow, the screen gets stuck at the UPI app, and the customer has to use the OS screen switch feature to get back to the merchant’s app, breaking the payments flow.

Beyond the payment flow breaks, the following points also act as a roadblock for the UPI collection request-based method –

- The conventional collection flow is lengthy. It can trickle into delayed delivery for high-speed transactions or offline deliveries.

- Even the need to validate a VPA can lead to spelling mistakes or incorrect VPA input delays.

- High Latency: The dependence on bank gateways also increases the latency, as bank APIs take up to 30 seconds to respond.

As swift and convenient UPI has been for payment in the Indian context, there is room to do more, and the Intent Flow model has filled that void.

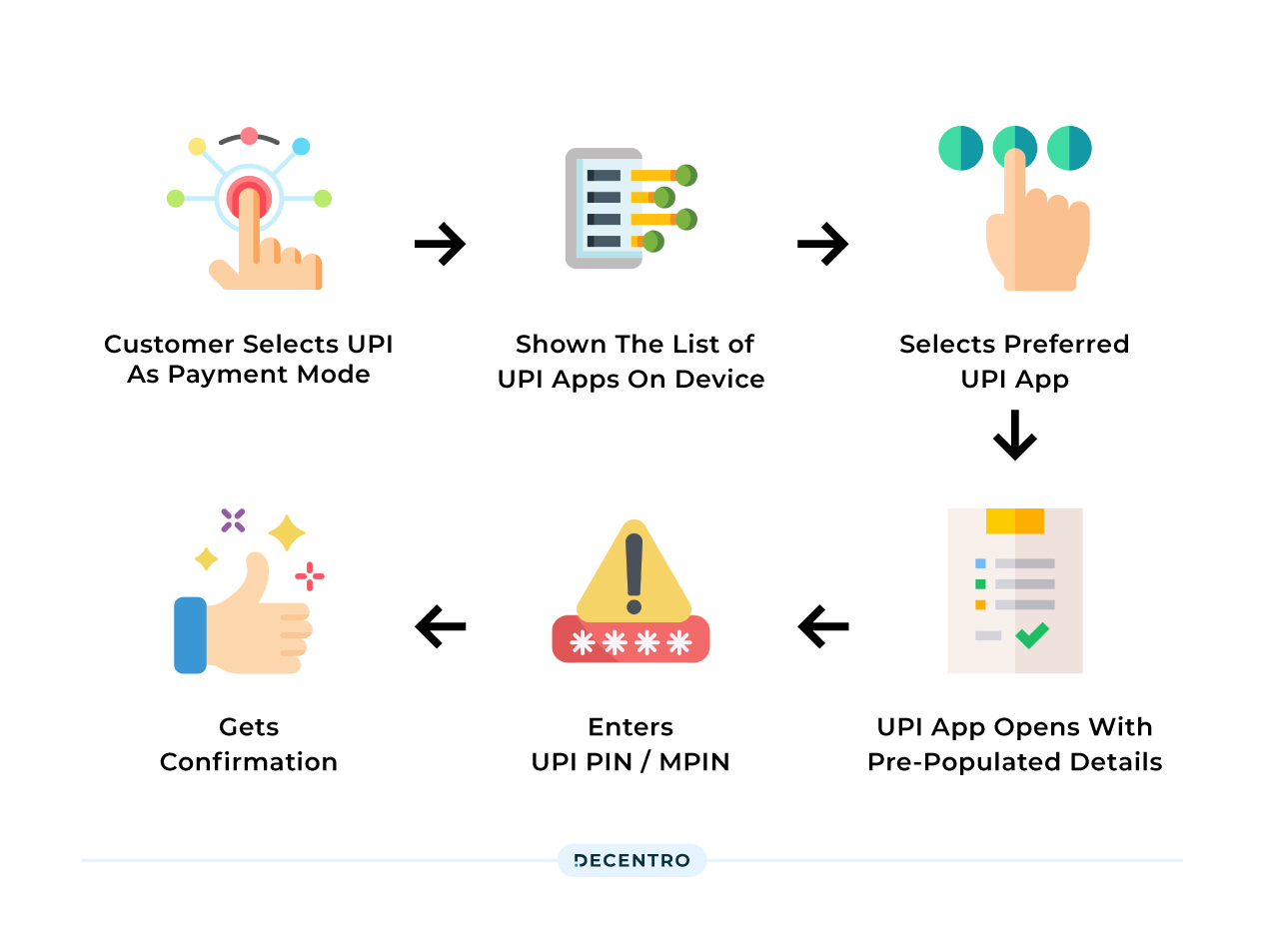

In a UPI intent call, an app switch tray is displayed with all the installed UPI apps on the mobile device, and the customer must select the preferred UPI app to complete the transaction. After completing the transaction on the UPI app, the customer is redirected to the merchant’s app to the transaction summary page.

Here is a look at how it works

- The customer selects UPI as the payment mode in the merchant app/website

- The customer is shown the list of UPI apps installed on their phone that supports intent flow

- Customer selects their preferred UPI application

- UPI App opens with pre-populated payment details

- The customer enters the UPI PIN / MPIN to complete the transaction

- The customer gets confirmation that the payment is successful

The things that we bypass in terms of clicks are as follows,

- No need to handle push or SMS notifications

- No need to invoke or call a browser window to complete a payment

- No need for customers to remember or enter their UPI VPA

These three simple benefits snowball into higher conversion rates, decreased abandoned carts, and decreased payment time.

Which are some of the Industries to Benefit from UPI Intent Flow?

A little speed never hurts anyone, but for some industries, it is just more beneficial than others. For example:

E-Commerce

The high-volume, high-amount transactions nature of bulk checkouts can benefit significantly from UPI Intent flow. With the pre-populated amount feature and one-click transaction clearance, UPI payments are easier for customers by enabling UPI Intent on the website or application checkout.

Delivery and Logistics

Regarding large-volume transactions, e-commerce delivery and last-mile logistics are the front runners that can benefit from the intent flow. With a reduced probability of payment failures which ultimately leads to a higher conversion rate, there is a promise of a better user experience.

How can Decentro Help?

With an API Suite that already caters to players like GoSwift and Pickrr in their product journey regarding checkouts, here is how Decentro’s UPI intent flow will help you launch your business vertical or new product in no time.

- Create UPI intent flow on your platform and provide a seamless payment experience for your customers.

- Enable your customers to opt for their preferred UPI app

- Pre-populate payment details, and

- Complete the transaction on the go in seconds.

With user experience being the trend that will shape the future of Fintech and Banking [do check out the blog listing the same], solutions must pivot their UPI payment flow in this direction. This is where the Decentro API stack integrates with your existing process, allowing you to customize your payment journey.

We are already helping neobanking platforms, NBFCs, wealth managers, fintech lenders, gig economy players, and many others to set up a secure & seamless payments ecosystem for their business.

What’s even more interesting is that Decentro is also venturing into the world of SDKs because flexibility in our offerings has been our priority from day zero. Curious to know more?

Comments are closed.