Dive into the three UPI integration methods for your website, and how they can lower transaction costs while enhancing the customer experience.

UPI Payment Gateway Integration: Complete Guide for 2025

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

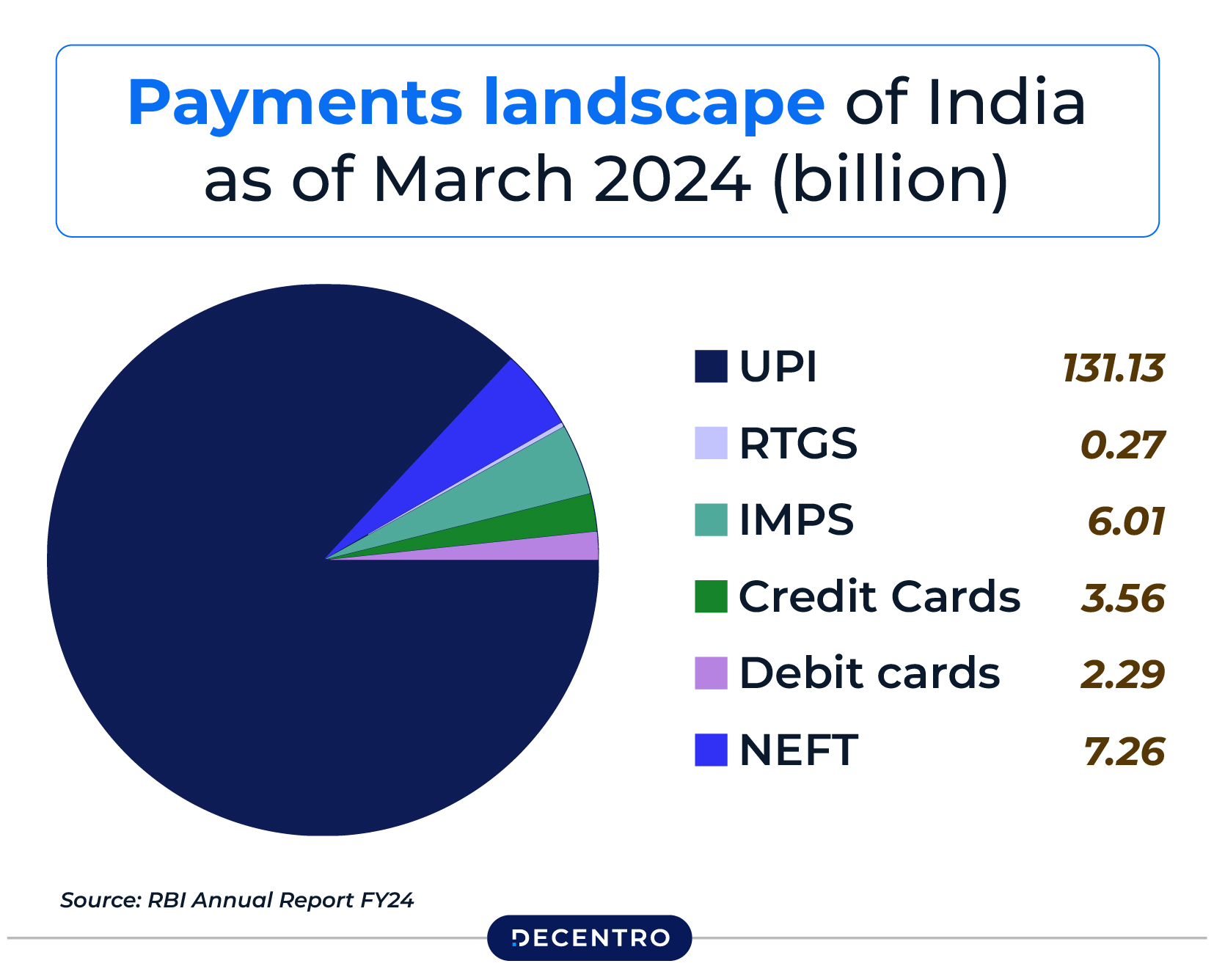

The way India pays has transformed dramatically over the past few years, and at the heart of this transformation is Unified Payments Interface (UPI). In August 2023, UPI transactions crossed the 10 billion mark for the first time, setting a new benchmark for digital payments in the country. With its seamless, secure, and instant nature, UPI has become the preferred payment method for millions, from small businesses to large enterprises.

Integrating UPI payments is no longer an option for businesses—it’s a necessity. Whether you run an e-commerce store, a subscription-based service, or a fintech platform, having a UPI payment gateway on your website ensures a smooth payment experience, reduces transaction failures, and improves customer satisfaction.

But how does UPI integration actually work? What options are available? And most importantly, how can your business benefit from it? Let’s break it down step by step.

How does UPI Payment Gateway Integration help

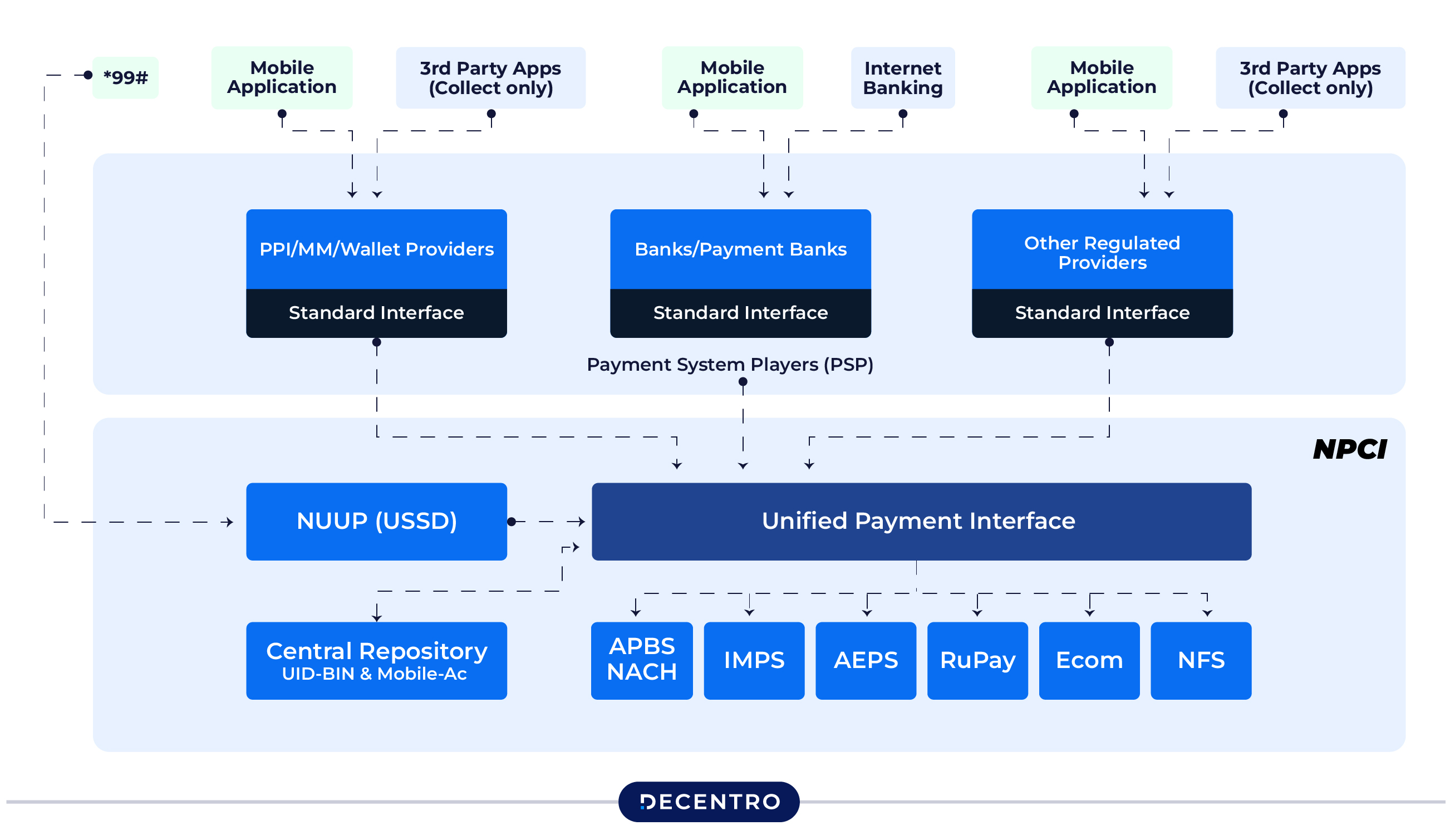

A UPI payment gateway allows businesses to accept payments directly through UPI on their website or mobile app. Unlike traditional card payments that require entering card details, CVVs, and OTPs, UPI payments are completed in a few taps, making transactions faster and reducing friction for customers.

The most significant advantage of UPI is its interoperability—customers can pay using any UPI-enabled app, such as Google Pay, PhonePe, Paytm, or BHIM, without needing to sign up for a specific service. This ease of use has made UPI the backbone of India’s digital economy, with over 160 banks now supporting UPI transactions.

With UPI, businesses can accept payments through various methods, including UPI ID, QR codes, and intent-based transactions. This gives customers multiple ways to pay while ensuring high success rates.

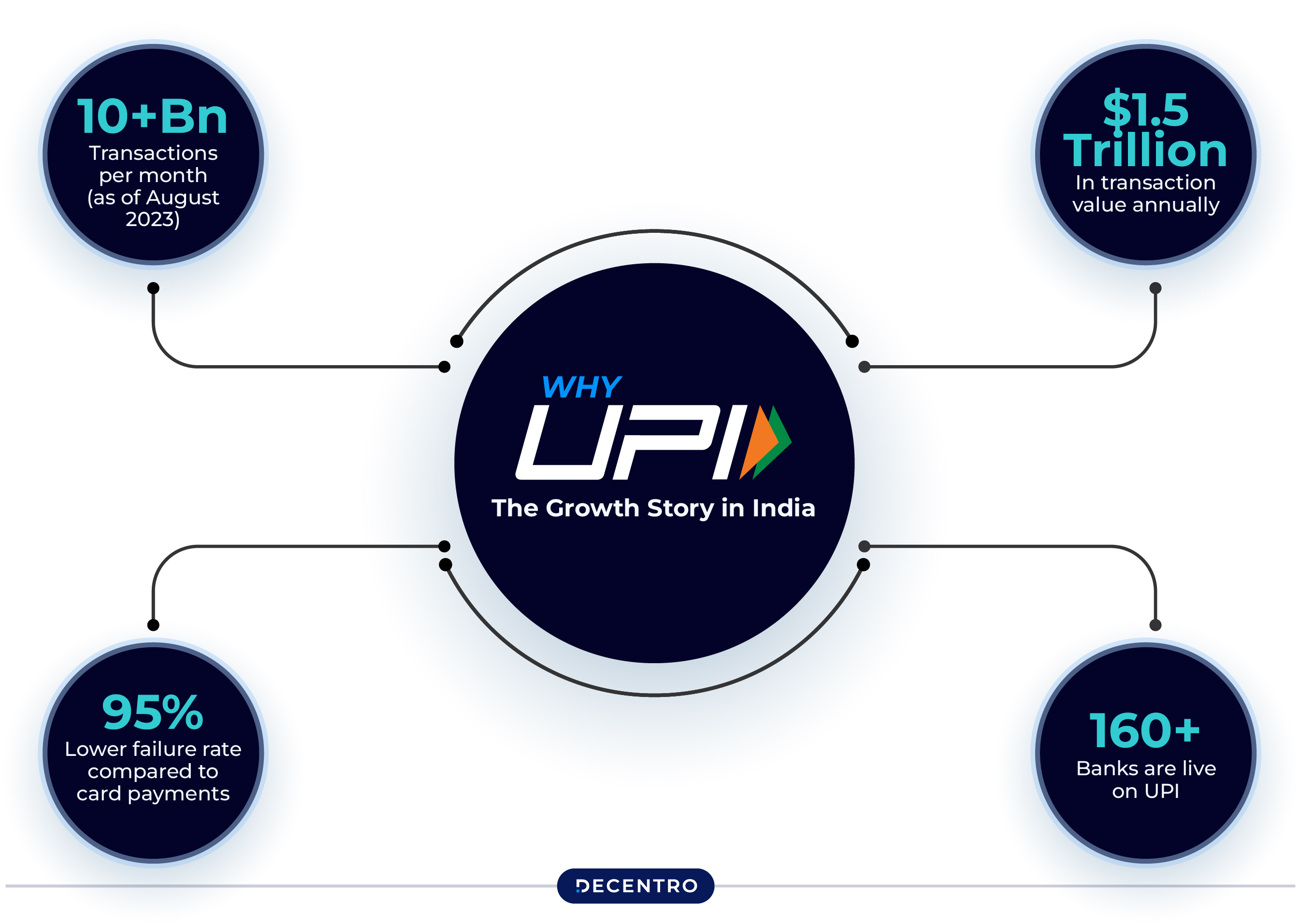

Why UPI? The Growth Story in India

UPI is not just a payment method—it’s a revolution. Its widespread adoption has made it a must-have for businesses looking to scale. Here’s why:

- 10+ billion transactions per month (as of August 2023).

- Over $1.5 trillion in transaction value annually.

- 95% lower failure rate compared to card payments.

- 160+ banks are live on UPI.

For businesses, this means higher conversion rates, reduced payment failures, and an improved checkout experience—all of which contribute to revenue growth.

How to Integrate UPI Payments on Your Website

Businesses have three primary options when integrating a UPI payment gateway into their website. Each method offers a slightly different experience, and the best choice depends on the business model, customer behaviour, and platform.

1. Web Collect Flow – A Seamless Payment Option

This method lets customers enter their UPI ID (e.g., abc@okhdfcbank) directly on the checkout page. Once the UPI ID is submitted, a payment request is sent to the customer’s UPI-linked app, from where the customer approves the transaction.

Web Collect is an excellent option for businesses that want to keep customers on the same payment page without redirection. It provides a smooth checkout experience for e-commerce stores, SaaS platforms, and other online businesses that prioritise speed and simplicity.

2. Intent Flow – Ideal for Mobile App Payments

Intent-based UPI payments leverage the pre-installed UPI apps on a customer’s smartphone. When users choose UPI as the payment method, they are redirected to their preferred UPI app, such as Google Pay or PhonePe, to complete the transaction. After authorisation, the user is automatically redirected back to the business’s website or app.

This method is particularly useful for businesses with a strong mobile presence. It eliminates the need for customers to manually enter their UPI ID, reducing customer effortfriction and increasing conversion rates.

3. QR Code-Based Payments – Perfect for Omnichannel Businesses

QR codes offer a quick and secure payment method for online and offline businesses. A dynamic QR code is generated for every order, allowing customers to scan and pay using their UPI app. Alternatively, businesses can use a static QR code, which links to their UPI payment ID, making it ideal for recurring payments or retail transactions.

QR code payments are widely adopted in physical stores, restaurants, and even large enterprises looking for a frictionless way to accept payments. With instant confirmation and no dependency on POS machines, QR codes are a cost-effective and reliable solution.

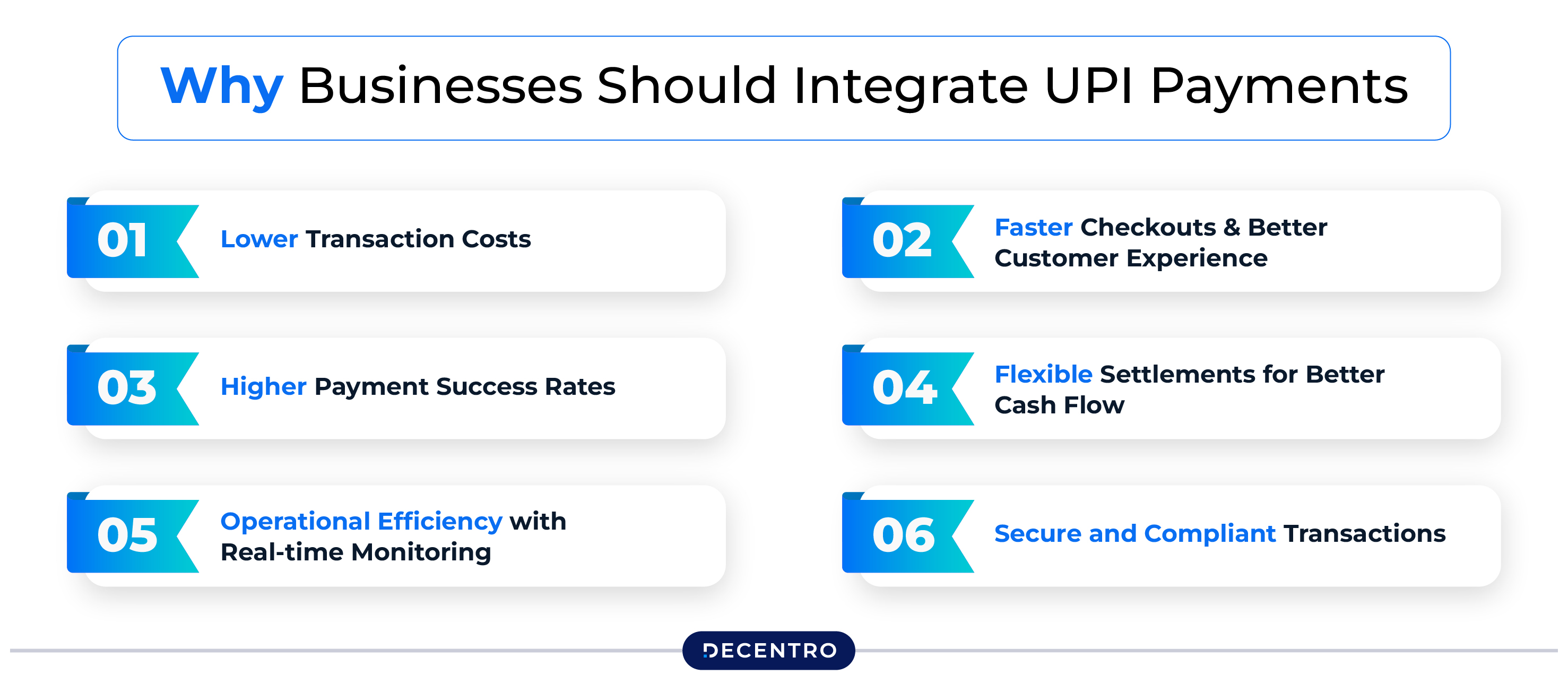

Why Businesses Should Integrate UPI Payments

The impact of UPI integration goes beyond just offering another payment option—it enhances the customer experience, reduces costs, and improves operational efficiency. Businesses that enable UPI payments can expect multiple benefits, including:

Lower Transaction Costs

Compared to traditional card payments, which often have 2-3% transaction fees, UPI payments have minimal to zero processing charges. This makes them a highly cost-effective option for businesses, allowing them to maximise their profit margins.

Faster Checkouts and Better Customer Experience

UPI payments eliminate the need to enter long card details or wait for OTPs. Customers simply enter their UPI ID, scan a QR code, or use their preferred UPI app, completing the transaction in seconds. This speed and simplicity reduce cart abandonment rates and improve overall checkout efficiency.

Higher Payment Success Rates

One of the biggest challenges businesses face with online payments is transaction failures. UPI has a 95% success rate, significantly higher than credit or debit card payments. This reliability ensures customers are not frustrated due to failed transactions, leading to higher sales and better customer retention.

Flexible Settlements for Better Cash Flow

UPI transactions follow a T+2 settlement cycle, meaning businesses receive their funds within two business days. Some payment providers offer instant settlements for businesses that require faster liquidity, ensuring better cash flow management.

Operational Efficiency with Real-time Monitoring

With a UPI-enabled payment gateway, businesses can access real-time dashboards to track transactions, refunds, and settlements. This level of transparency and control helps businesses streamline financial operations and detect discrepancies instantly.

Secure and Compliant Transactions

Security is a top priority in digital payments, and UPI is backed by NPCI and RBI regulations, ensuring every transaction is encrypted and protected against fraud. Features like two-factor authentication, device binding, and dynamic QR codes make UPI one of the safest payment methods.

How Businesses Are Leveraging UPI Payments

UPI integration isn’t just limited to e-commerce or retail. Many businesses use UPI payment gateways to streamline transactions, reduce costs, and enhance customer convenience.

For subscription-based businesses, UPI AutoPay enables recurring payments without requiring customers to manually authorise each transaction. Streaming platforms, SaaS companies, and insurance providers are increasingly adopting this model to reduce involuntary churn caused by failed card payments.

Lenders and financial institutions are using UPI to disburse and collect loan repayments seamlessly. With UPI-based payment links, customers can repay EMIs with a single tap, avoiding delays and improving collection efficiency.

Even offline businesses and restaurants are moving away from traditional card machines, opting for QR code-based payments. This eliminates the need for expensive POS devices, making transactions faster, safer, and more cost-effective.

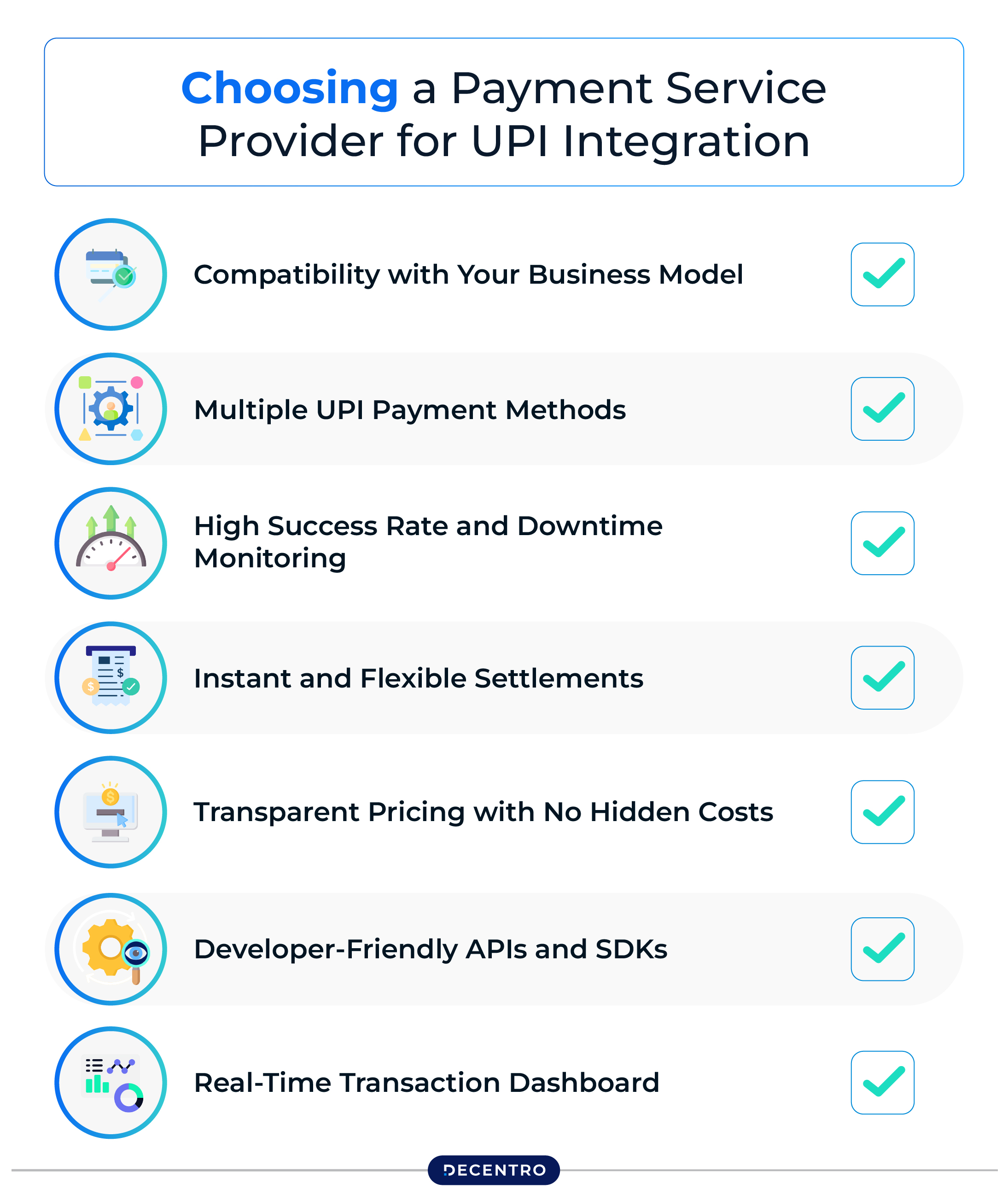

Choosing a Payment Service Provider for UPI Integration

While UPI payments are seamless for customers, businesses need a reliable Payment Service Provider (PSP) to integrate and manage transactions efficiently. Here’s what to look for when choosing a PSP for UPI integration:

1. Compatibility with Your Business Model

Some PSPs specialize in e-commerce payments, while others focus on subscription businesses, lending platforms, or offline merchants. Ensure the provider supports your specific business model and industry.

2. Multiple UPI Payment Methods

A good PSP should offer multiple ways to accept UPI payments, including:

- UPI ID-based payments (Web Collect)

- UPI Intent flow (redirecting to pre-installed UPI apps)

- QR code-based payments (static & dynamic QR codes)

- UPI AutoPay (for recurring payments)

3. High Success Rate and Downtime Monitoring

Since UPI transactions rely on banking networks, occasional downtimes are inevitable. A reliable PSP should provide multi-bank routing, failover mechanisms, and real-time downtime monitoring to ensure maximum uptime and transaction success rates.

4. Instant and Flexible Settlements

Faster settlements mean better cash flow. Some PSPs offer instant or T+0 settlements, while others follow a T+2 cycle. Choose a provider that aligns with your financial needs.

5. Transparent Pricing with No Hidden Costs

Look for PSPs that offer explicit pricing models with minimal setup fees, transaction charges, and hidden costs. Many PSPs also offer customised pricing based on transaction volumes.

6. Developer-Friendly APIs and SDKs

The easier the integration, the faster you can start accepting payments. Opt for a PSP with well-documented APIs, SDKs, and sandbox environments to facilitate seamless integration.

7. Real-Time Transaction Dashboard

A good PSP should provide detailed transaction analytics, allowing businesses to monitor successful payments, failed transactions, refunds, and settlements in real time.

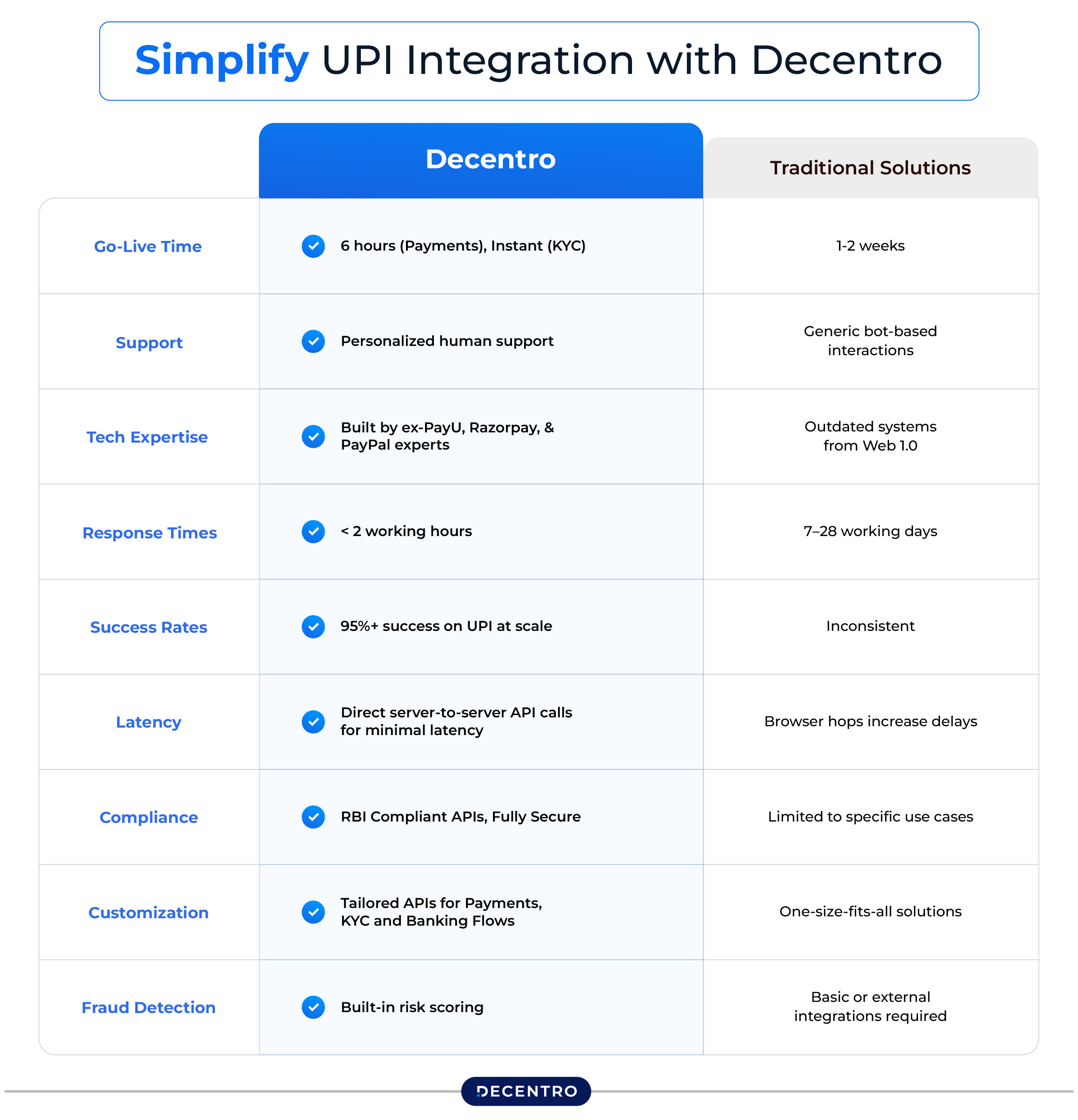

Simplify UPI Integration with Decentro

At Decentro, we make UPI integration seamless for businesses of all sizes. Whether you’re an e-commerce giant, a fintech startup, or an offline merchant, our plug-and-play UPI APIs enable you to start accepting UPI payments in just a few hours.

With over 1200+ businesses already onboarded, Decentro’s UPI payment solutions offer:

- Instant API integration with a developer-friendly setup.

- Multi-PSP support for Google Pay, PhonePe, Paytm, and more.

- Real-time transaction dashboards for complete visibility.

- RBI & PCI DSS compliance for secure transactions.

The future of payments is fast, seamless, and mobile-first, and UPI is leading the way. Integrating UPI payments is a step toward smoother and smarter financial transactions, whether you want to improve your checkout experience, reduce costs, or increase conversions.

Ready to get started? Contact Decentro today and take your business to the next level with UPI payments.