How Decentro enables Vedfin’s Flexi Debt Program, bridging working capital gaps with revenue-based financing.

How Decentro is Enabling Vedfin’s Flexi Debt Program For Budding Brands

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Working capital crunch hugely hinders the growth of online-first, asset-light businesses. This is primarily due to the fact that the existing financial instruments do not offer practical solutions.

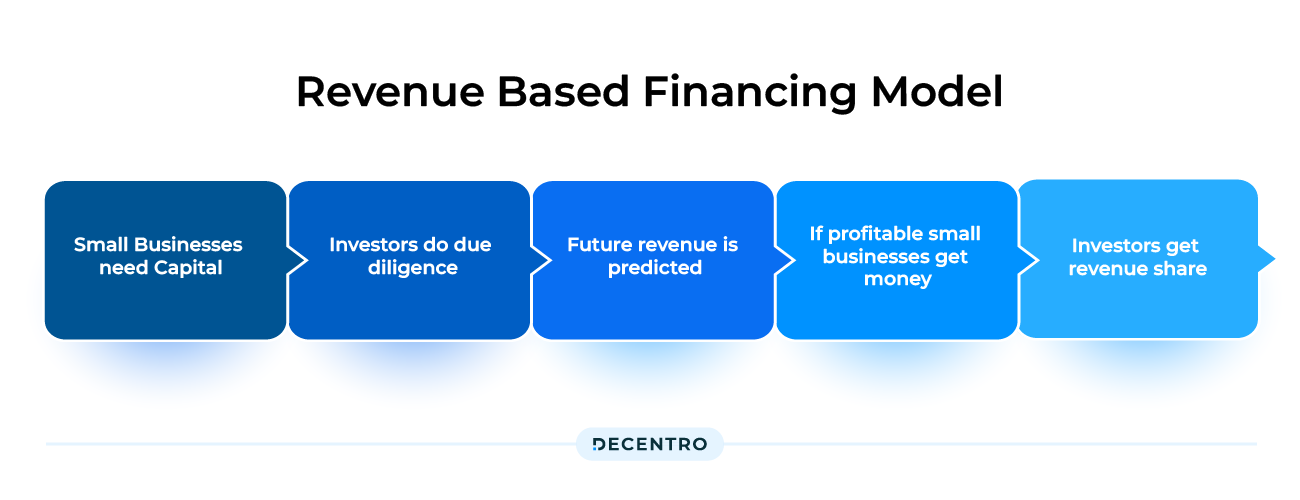

When the traditional systems fail to address the first generation of budding brands, a solution like Revenue Based Financing comes to the rescue.

What is Revenue Based Financing (RBF)?

Revenue-based financing fills the credit gap for online businesses without requiring collateral or dilution, offering flexibility in funding.

The concept of RBF first emerged in the 1990s when US-based venture capitalist Arthur Fox set up the first RBF fund to showcase this alternative fundraising method.

Traditional lending mechanisms rely on limited metrics such as asset size, traction, profitability, availability of collateral, and personal/business credit score. In contrast, revenue-based financiers consider online sales, marketing efforts, and the company’s reputation. This broader perspective allows them to form a more comprehensive and holistic understanding of the company’s creditworthiness.

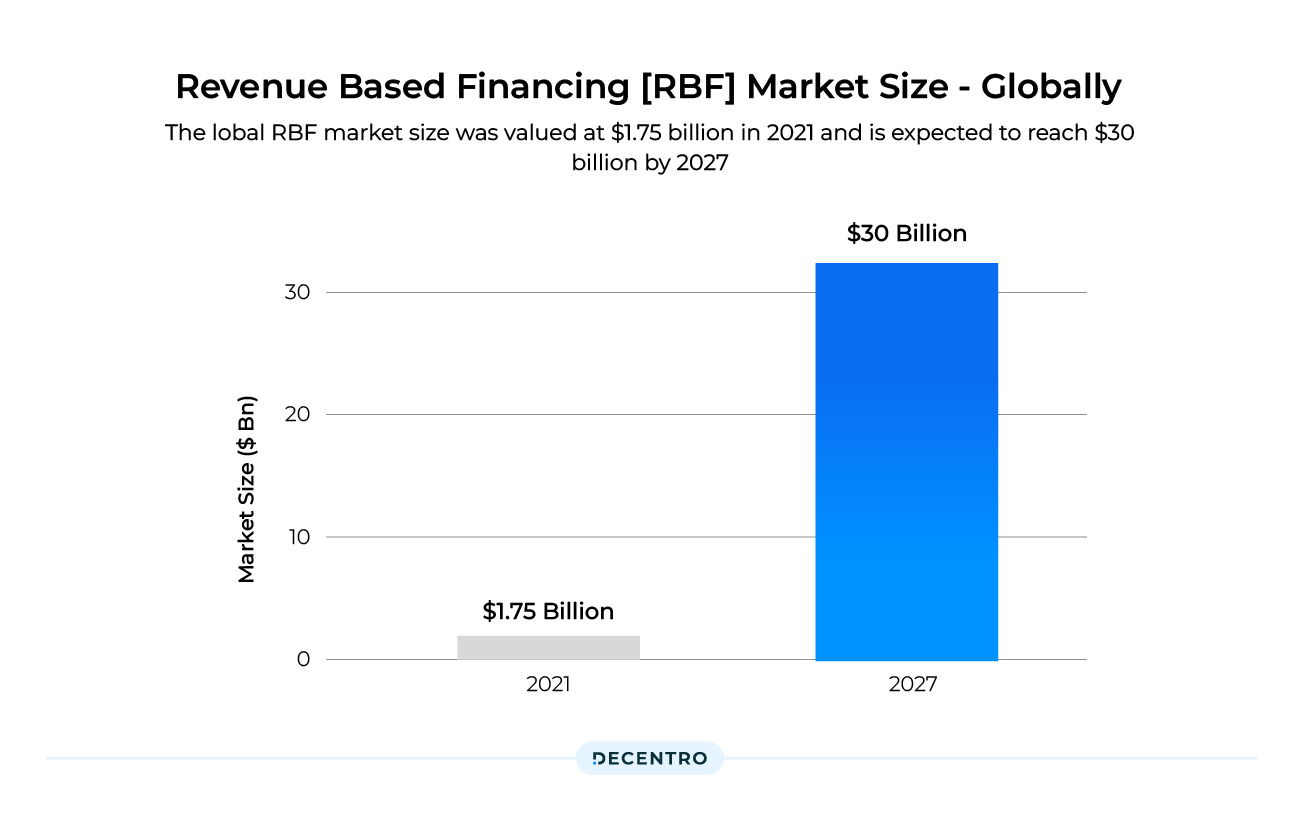

As per the Revenue-Based Financing Market Research Report (2022-2027), the global RBF market size was valued at $1.75 billion in 2021 and is expected to reach $30 billion by 2027.

So, where do we stand in the Indian Context?

In the past two years, the Indian e-commerce industry has proven to be a massive disruptor. The market is estimated to reach $400 Bn by 2030 and has opened up many opportunities for aspiring entrepreneurs and new-age brands; it has also cluttered the market with options. This gives birth to concerns such as acquiring and retaining users and gaining the capital required to grow & scale sustainably.

A recent analysis revealed that out of more than 75K independent e-commerce stores hosted on enablers such as WooCommerce and Shopify, less than 0.5% are equity-funded.

Today, revenue-based financing is a convenient option to bridge working capital gaps that spur business growth. The fundamentals of RBF — zero-collateral and dilution — are primarily used by companies to scale up operations and enter a higher revenue bracket. Moreover, businesses with healthy margins can gain access to additional cash flows that can be utilized to spur exponential growth further.

Keeping in mind the above ethos, along with providing a holistic financial ecosystem for the “GAP” clientele, which do not fit the definition of an ideal “borrower” in the traditional banking system, we have Vedfin – India’s one-of-a-kind credit lending organization, for those who dare to dream.

What is Vedfin?

Many businesses have creative ideas but must compromise with control over the business to fulfil their dreams because they need funding.

Vedfin aims to facilitate revenue-based financing services for such sellers and companies. Comprising a team of specialized financial, business, and technical analysts, they have massive experience in nurture-based lending. The company understands the unique requirements of direct-to-customer/locally grown brands and intends to help them with vital loans (big or small) at the growing/traction stage.

They have also designed a unique AI-based credit profiling software, which can review the digital data, match it with industry benchmarks, and generate a credit profile of the potential borrower within minutes. These reports are accessible to the borrower for review purposes.

They then provide tailor-made debt solutions to local brands in the growth and expansion stage.

How does Vedfin work?

To empower businesses with sufficient financial liquidity so that the organisation’s focus is on their products, marketing, revenues, and creating a loyal customer base, Vedfin has deployed a straightforward procedure:

Step 1

Fill out the application form (simple 5-10 minute process)

Step 2

The Data analytic and AI-enabled software processes the e-application and auto-generates a unique loan offer specially designed for the brand, keeping in mind the business cycle, trends, and repayment capacity.

Step 3

The business pays only a fixed % of monthly net sales as repayment.

Step 4

Even after the repayment, the business can avail of new loans, as the Data analytics and AI-enabled software will record the growth in real time.

Step 5

These credit analysis and growth reports will be documentary proof of the loan and equity viability to other funding institutions.

How does Vedfin leverage Banking APIs?

At this disruptive stage of Vedfin, Decentro’s API suite enabled an efficient collection and payment system to eliminate any fund reconciliation hassle.

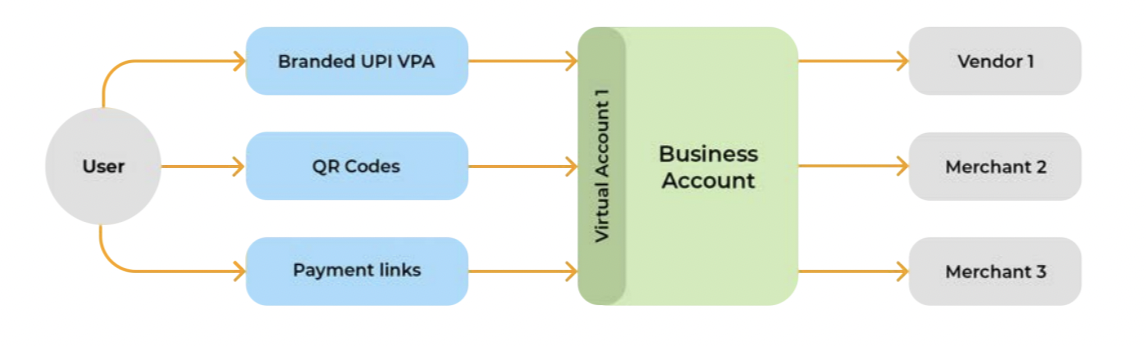

Efficient tracking and bookkeeping of transactions via Virtual Accounts

In the world of credit, the entire process of tracking & reconciling the source of each transaction can get quite tricky when there are umpteen vendors, distributors, retailers, marketplace platforms, and more in the ecosystem.

The challenge of enabling fund collection, bookkeeping, and reconciliation was solved by Vedfin by leveraging the Virtual Accounts API.

Being fully compliant with the RBI’s guidelines, Decentro’s API suites directed Vedfin users to seamlessly create virtual accounts.

Eliminating the expending time, effort, and capital for managing fund collections and payments, Vedfin leveraged the efficiency of VAs for streamlining collections without hassle.

In a world where funding trends are changing, access to equity growth capital is reducing for smaller ventures, and the focus on profitability is forcing smaller ventures and founders to be dependent on personal finances. Funding platforms like Vedfin can provide these ventures with new access to capital and help fintechs with risk management, repayments, and data analytics through the presence of streamlined VA processes and Banking APIs via players like Decentro.

Kartik Lilani, Founder and CEO, Vedfin

What were the Key Outcomes for Vedfin?

Banking APIs and Repayment through VAs have allowed Vedfin to streamline the processes at their end by working with Decentro APIs and creating an automated repayment collection mechanism.

This process allows Vedfin to manage risk and liquidity.

Further, the Banking APIs also allow Vedfin to keep a real-time track of customer performance and banking credits to realize and enable any risk mitigation processes at their end.

In Conclusion,

Our partnership with Vedfin serves the bigger purpose of not only enabling fintech players within the Indian ecosystem but also doing our bit to democratise fintech for all.

Just like Vedfin, we’ve enabled many NBFCs, fintech lenders, neobanks, and businesses to overcome the challenges posed by legacy financial institutions. Our host of products have solved pertinent use cases for customers across the industry. From payouts to collections and KYC, help your business simplify financial integration and run workflows smoothly.

Are you a fintech platform struggling with a focused use case or looking to align your financial wellness? We would love to help you figure this out. Together.