Discover how Olyv scaled DigiLocker adoption by 200% and simplified onboarding for 3 Cr+ users with Decentro’s KYC and verification APIs.

How Olyv Boosted DigiLocker Adoption by 200% with Decentro’s Fabric

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

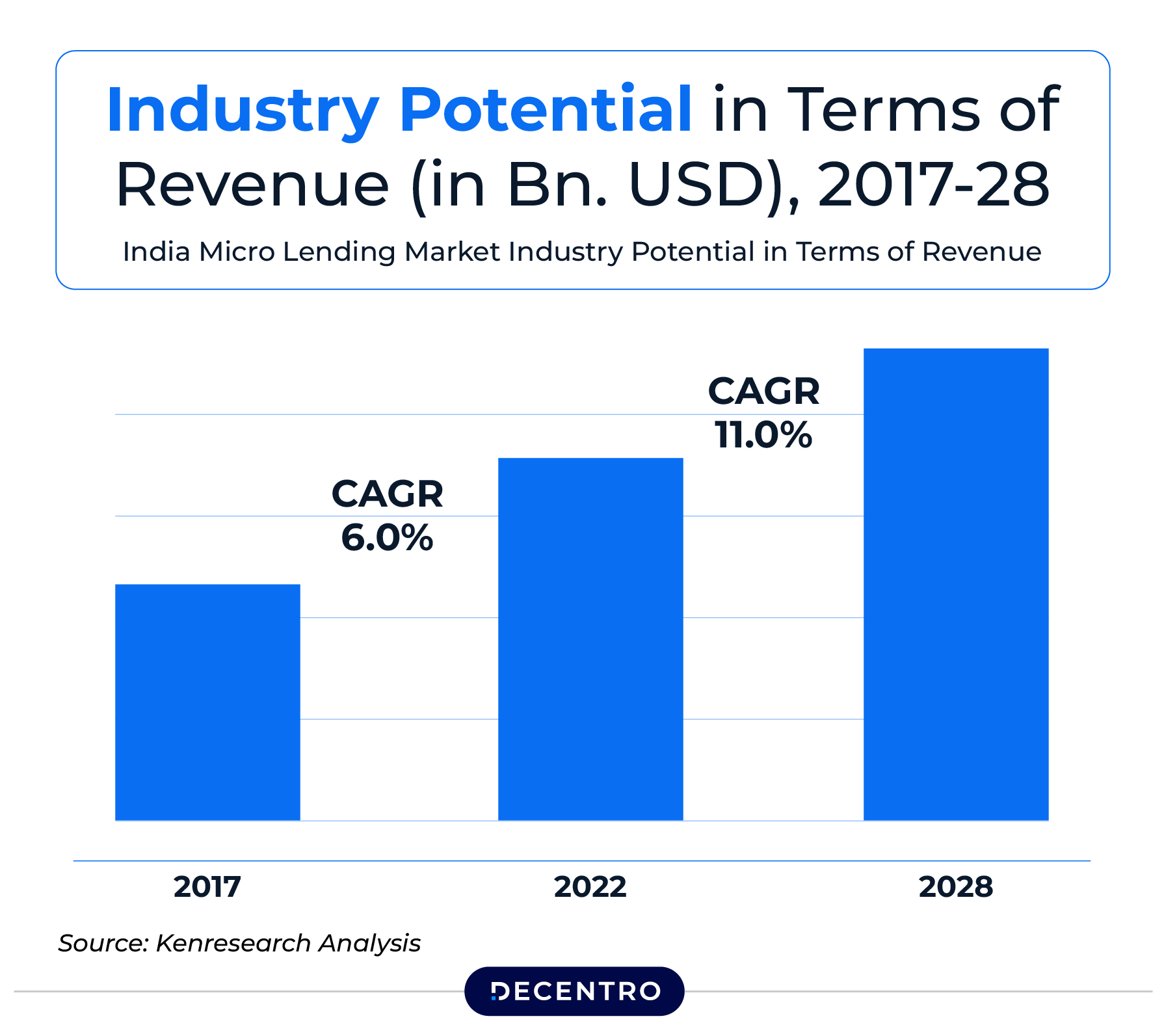

The financial inclusion landscape in India has witnessed remarkable growth in recent years. With the government’s push for Digital India and increased smartphone penetration, financial services are reaching previously underserved segments of the population like never before.

In India, the microfinance and digital lending market has expanded significantly, with an estimated 190 million underbanked individuals seeking access to formal financial services. However, this growth comes with challenges, particularly in ensuring robust KYC compliance while maintaining a frictionless user experience.

In this evolving landscape, we have a player who has remained compliant while pioneering financial inclusion with innovative offerings. Olyv (formerly SmartCoin) has enabled millions of underserved Indians to access micro-loans, digital gold savings, and credit health services. By simplifying financial access with technology-driven solutions, Olyv caters to micro-entrepreneurs, small retailers, blue-grey collared workers, and salaried employees across sectors.

So, let’s delve deeper into the case study and use case of Olyv.

What is Olyv?

Olyv is on a mission to create India’s largest fully automated digital platform for financial inclusion. Recognised as one of the Top 10 Google Launchpad-backed AI/ML Tech startups and awarded as an Economic Times Best BFSI Brand in March 2023, Olyv provides diverse financial services including micro-loans, digital gold savings, and credit health solutions to the vast underserved middle/lower-income segment.

With a vision “to be the foremost financial wellness partner for aspiring Indians, delivering unparalleled hassle-free financial products and empowering millions,” Olyv has already served over 3 crore+ users across more than 19,000 pin codes in India.

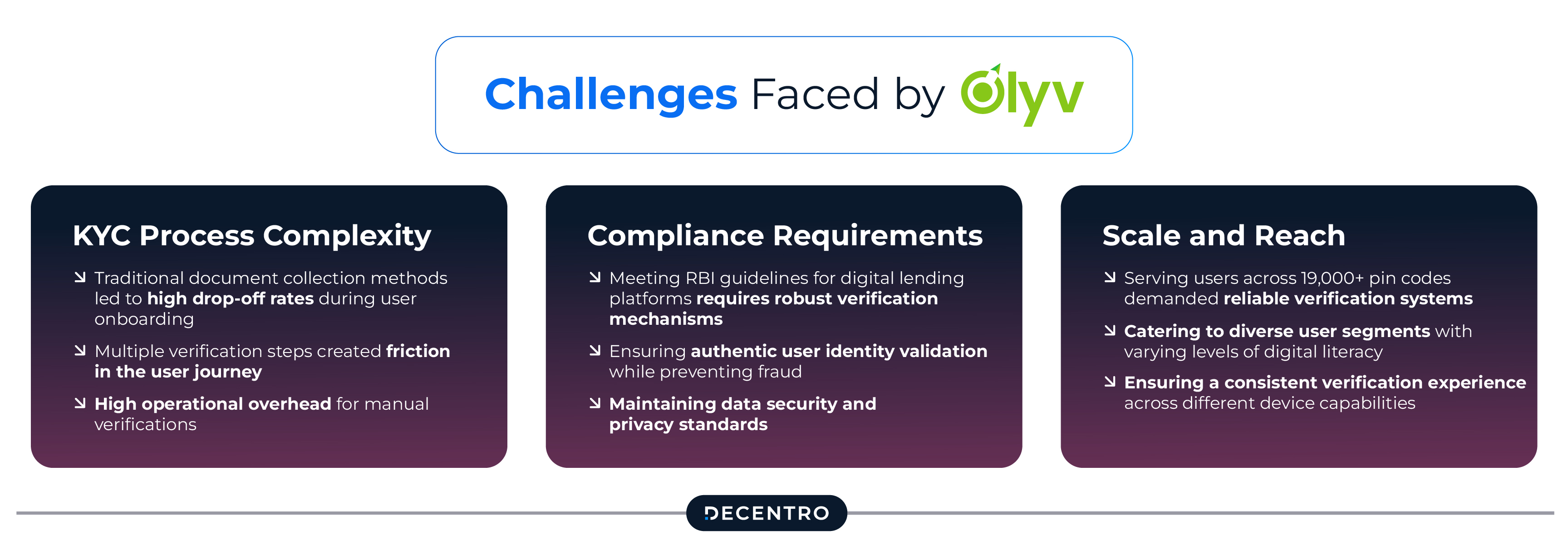

Challenges Faced by Olyv

As a rapidly growing fintech platform focused on financial inclusion, Olyv encountered several hurdles in maintaining compliance while delivering a seamless user experience:

KYC Process Complexity:

- Traditional document collection methods led to high drop-off rates during user onboarding

- Multiple verification steps created friction in the user journey

- High operational overhead for manual verifications

Compliance Requirements:

- Meeting RBI guidelines for digital lending platforms requires robust verification mechanisms

- Ensuring authentic user identity validation while preventing fraud

- Maintaining data security and privacy standards

Scale and Reach:

- Serving users across 19,000+ pin codes demanded reliable verification systems

- Catering to diverse user segments with varying levels of digital literacy

- Ensuring a consistent verification experience across different device capabilities

How Decentro Empowered Olyv

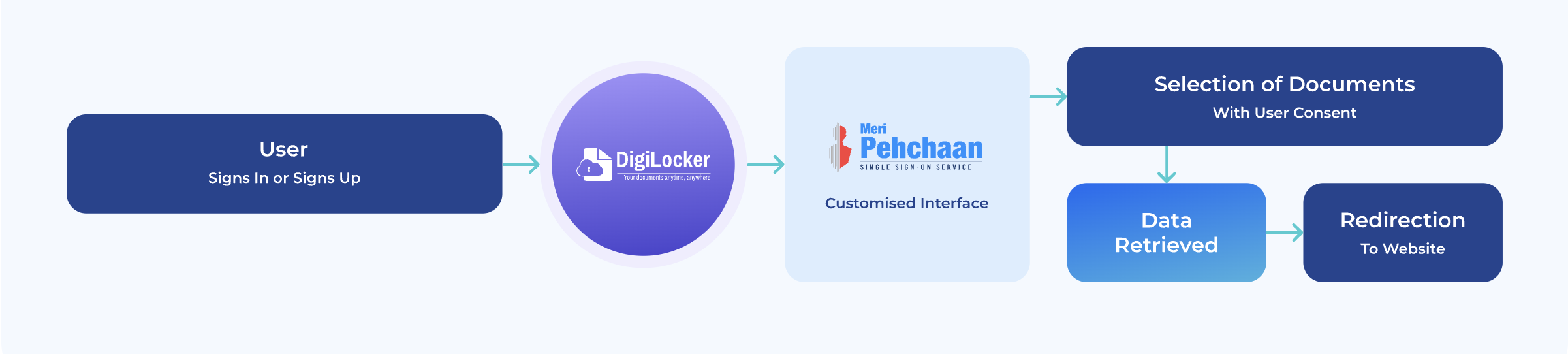

Olyv integrated Decentro’s KYC Verification APIs to overcome these challenges, particularly focusing on DigiLocker integration and Bank Account Validation solutions.

Automated KYC and Verification

DigiLocker Integration:

- Simplified Workflows: Optimized for seamless user journeys

- Pinless Sign-In: Eliminated extra authentication steps, reducing friction

- Secure Document Access: Direct fetching of verified government documents

Bank Account Validation (Penny Drop):

- Pre-disbursement checks: Validating accounts before loan disbursement

- Risk mitigation: Ensuring funds reach only verified beneficiaries

- Real-time verification: Instant validation without offline processes

Streamlined Integration

Plug-and-Play APIs:

- Quick implementation with minimal development resources

- Consistent experience across web and mobile platforms

- Unified verification process regardless of user device capabilities

Comprehensive Security:

- End-to-end encryption of sensitive user data

- Compliance with regulatory frameworks

- Fraud prevention through multi-layered verification

Results and Impact

The implementation of Decentro’s solutions delivered measurable improvements to Olyv’s operations:

200% Growth in DigiLocker Adoption:

- DigiLocker user base increased from 20% to 60% of total users

- Higher trust in the platform due to government-verified documents

- Reduced document forgery risks

Enhanced Conversion Metrics:

- Overall KYC completion rates improved by 0.5 – 1.5%

- Funnel growth by 1.5- 3.5 % from verification initiation to completion

Operational Efficiency:

- Reduced manual verification requirements

- Faster loan processing and disbursement

- Lower operational costs for verification processes

Expanded Reach:

- Better servicing of users in remote locations

- Enhanced capability to onboard users across the digital literacy spectrum

- More inclusive financial services delivery

Voice of the Customer

“At Olyv, our mission is to provide technology-driven financial products that empower the next billion hard-working and underserved Indians. Decentro’s DigiLocker and Bank Account Validation APIs have been transformative in helping us streamline our verification processes while maintaining the highest compliance standards. The significant growth in DigiLocker adoption has allowed us to process applications faster and more securely, directly impacting our ability to serve more customers. With improved onboarding funnels and verification success rates, we’ve created a more accessible experience for users across India, increasing both reach and satisfaction. We’re excited to continue this journey with Decentro to further our mission of financial inclusion.”

Vinay Kumar Singh, Co-founder and Head of Product, Olyv

Conclusion

By leveraging Decentro’s KYC and verification solutions, Olyv transformed its onboarding process to meet regulatory requirements, enhance user trust, and deliver a superior customer experience. The partnership highlights how Decentro’s cutting-edge technology empowers fintech platforms to navigate the regulatory landscape with ease and scale rapidly, especially when serving underbanked populations.

Our aim to empower fintech players has found fruition through such partners. Not just Olyv, but Decentro has enabled major companies—notably SalarySe, Dhan, MoneyTap (Freo), OnMeta, and others—to facilitate better user transaction experiences with enhanced security and compliance.

With our robust verification infrastructure processing hundreds of thousands of validations daily, Decentro is well-equipped to enable your verification and validation journey, regardless of scale.

Ready to Streamline Your Onboarding?

If your organization wants to overcome KYC and compliance challenges while enhancing operational efficiency, Decentro’s API solutions can help you achieve your goals.