An in-depth look into Decentro’s customer ALT DRX, and how they built a smooth user onboarding & fund collection processes via banking APIs.

How Decentro is Helping Alt DRX Democratize Real Estate

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Fractional Ownership is the new bandwagon that the real estate players are jumping onto.

In the world of trials, fractional ownership is what real estate as an industry offers for investors. Its model is custom-made for people more open to trying other low-risk and optimal options.

So, what is Fractional Ownership?

As the name suggests, Fractional Ownership is partial Ownership in big-ticket properties jointly operated by a group of investors and pooled investment. These large commercial properties do not otherwise fall under the investment potential of retail investors. The real estate management company invites retail investors to invest a certain amount and benefit from the appreciation of the rates.

The ethos stays rooted in the idea of democratizing the real estate sector.

Commercial real estate has been a playground for large corporate entities and wealthy investors. However, with the arrival of the Fractional Ownership trend in India, retail investors are also participating in these high-potential markets and reaping the benefits.

According to an analysis by the JLL, Despite the Covid-19 pandemic, fractional investment deals worth 350 Million were in their advanced stages in India.

But can the scale get bigger?

The answer is always yes.

Experts believe that in the next 7 to 10 years, the Tokenisation of Real Estate would pave the way for huge real estate exchanges to emerge worldwide, which in size, scale, and credibility would compete against the likes of NASDAQ or SGX, or NSE.

And this time around, this innovation will be India-led in the form of our customer Alt DRX.

What is Alt DRX?

Alt DRX is World’s First Digital Real Estate marketplace which allows Indians to invest in dematerialized real estate, one square foot at a time. This aims to solve the liquidity problem in mid-size real estate assets and allow capital to move into rent-yielding assets like rental housing, hostels, care homes, holiday homes, schools, industrial warehousing, high-street retail, hotels, and managed offices.

How does Alt DRX work?

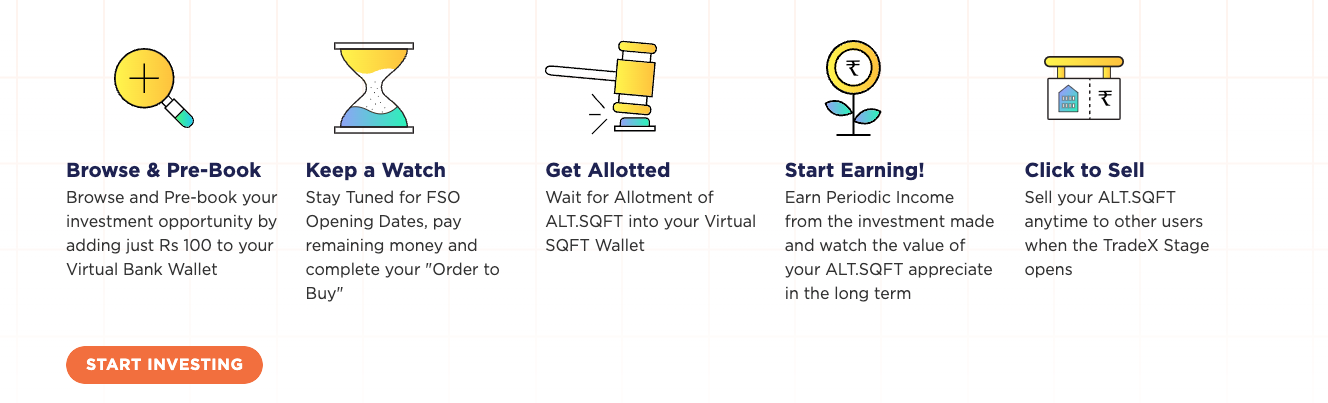

Through its ALT.SQFT, a tradable digital asset, Alt DRX allows you to Invest in a Limited Liability Partnership firm that buys real estate. There is also the added benefit of owning Partnership Rights & a proportionate share of ALT.SQFT. These tradable digital assets represent a proportionate financial value of 1 SQFT of real estate.

The investment model allows users to earn income from Partnership Rights and ALT.SQFT, with the flexibility to Buy and sell ALT.SQFT anytime.

For a detailed breakdown of the process, click on the link below.

How does Alt DRX leverage Banking APIs?

At this disruptive stage of Alt DRX, the ask from Decentro’s API suite was to enable smooth user onboarding and eliminate any fund reconciliation hassle.

Seamless user journey via our KYC Stack

With access to various data points such as PAN, Aadhaar, and Alt DRX, Alt DRX onboards users in real time and automates the KYC process once and for all. When users enter their details during the process, Decentro’s APIs run checks in the backend and render all relevant information for Alt DRX to access with negligible drop-offs. Alt DRX users finish their account registrations and KYC in a minute.

Efficient tracking and bookkeeping of transactions via Virtual Accounts

The challenge of enabling funds collection, bookkeeping, reconciliation, and payouts were solved by Alt DRX by issuing Virtual Bank Wallets for their investors using Virtual Accounts API.

Alt DRX eliminated the time, effort, and capital required to manage fund collections and payments, leveraging the efficiency of VAs for each investor without hassle.

‘Alt DRX is a Fin Tech Platform enabling retail investors to Invest in Real Estate 1 SQFT At A Time. Our investors are spread across different age groups and have experience using different investment platforms daily. Decentro enabled us to deliver a seamless fintech platform onboarding experience with their KYC APIs for new user registrations. Our platform framework significantly emphasizes the compliance and safety of funds. The challenges around safe collections and reconciliations of funds on our platform were made very simple and easy using Decentro’s VA APIs.

We wish Decentro more power and success ahead.’

Sachin Joshi, Co-Founder and CTO of Alt DRX

In Conclusion

Our aim to empower fintech players has found fruition through our partners. Their promise of enabling innovation and disruption via their offerings takes our association with Alt DRX a step further.

That’s precisely what our simplified banking APIs are here for! It’s not just the reconciliation, management, and settlement of payments alone. Our host of products has solved pertinent use cases for customers across the industry. Right from bank accounts, payments, and KYC helps your business simplify financial integration and run workflows smoothly.

Along with Alt DRX, we’ve enabled many partners, such as FamPay, Money Tap, and KUWY, to thoroughly verify their customers’ backgrounds before bringing them on board.

P.S. Our CKYC APIs can help your company fetch the latest signed and attested KYC documents stored at the central repository with the government by banks and financial institutions.

In just two years, our KYC stack has been churning solid numbers.

With over 400+ Identity validations, 250+ Image recognitions, and 300+ Repository fetches happening via Decentro’s KYC stack per hour, we’re more than equipped to enable your verification and validation journey.

Are you a fintech platform struggling with a focused use case or looking to align your financial wellness? We would love to help you figure this out. Together.