Check out how Decentro’s API suite enabled Craze to scale operations, automate HR processes, and simplify compliance for fast-growing startups

How Decentro Enabled Craze to Enhance Payroll Efficiency and Onboarding

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

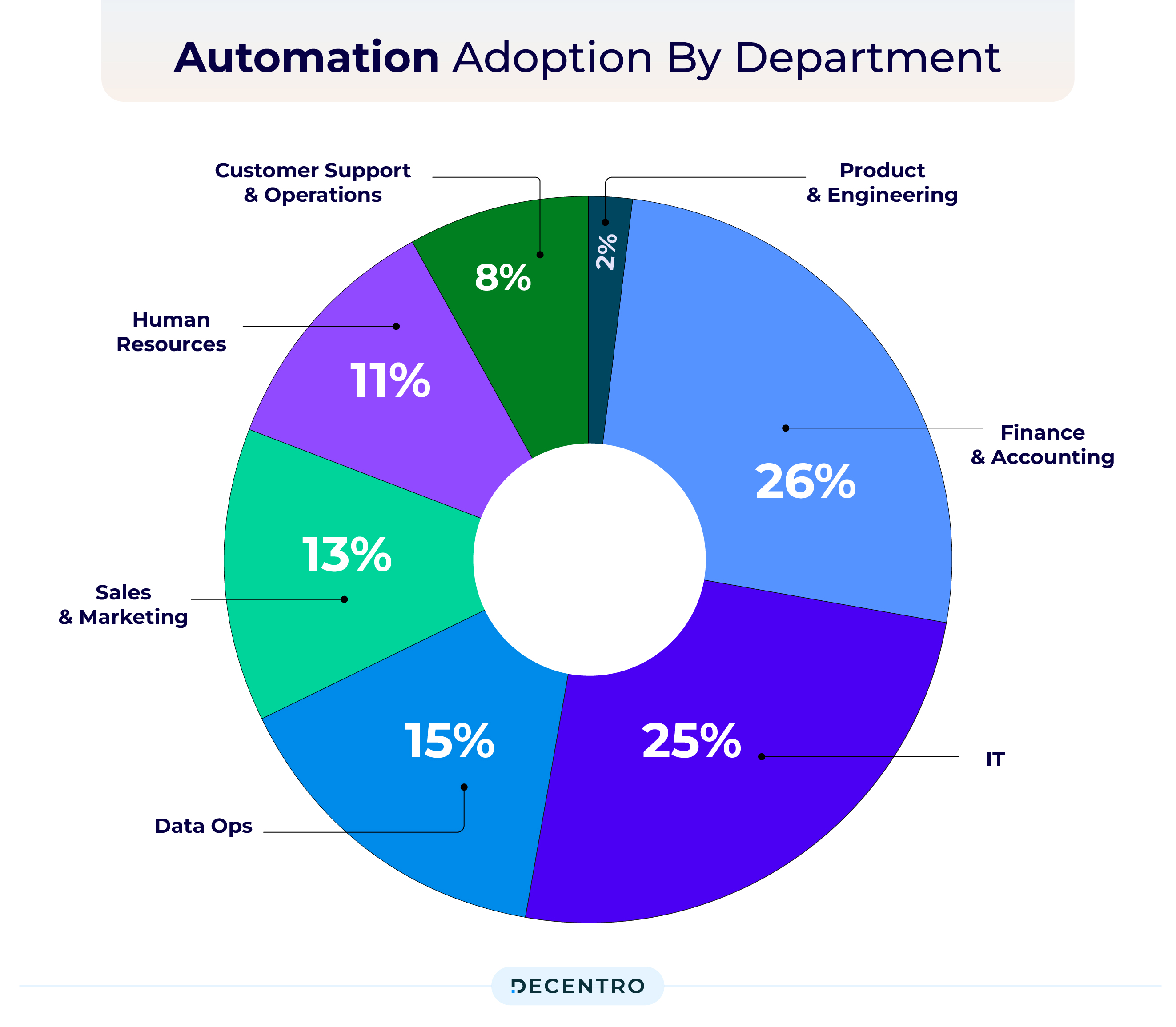

Workflow automation can be the most effective way to eliminate process redundancies and improve process efficiency. For startup founders, these workflow challenges may vary from managing HR and payroll to compliance tasks.

Statistically, 45% of the HR departments focus on intelligent process automation over the next year. Furthermore, automation around direct compensation is the most popular, making up 47% of all payroll and benefits automation. Payroll processing has risen the most in automation adoption, growing by 3,700% YoY.

While the need for automation is apparent, the solutions catering to this are cluttered by the minute. Recognising this need, Craze (YC S22) now offers a comprehensive admin solution designed to automate these tasks and simplify the entire process, from onboarding to offboarding.

By integrating core HR, payroll, and compliance features into a single platform, Craze empowers startups to streamline their administrative operations easily.

Before we delve into what Craze HQ does, let’s examine the broad challenges the ecosystem faces regarding administrative tasks in general.

Challenges Faced by Startups

Managing administrative tasks such as HR, payroll, and compliance can overwhelm startups. Many face the following challenges:

- Time-Consuming Processes: Manually handling payroll, tax deductions, compliance filings, and employee management consumes valuable time and resources.

- Error-Prone Compliance Management: Ensuring accurate and timely compliance with statutory requirements like TDS, PF, PT, and ESIC is critical yet prone to errors.

- Complex Onboarding and Offboarding: Managing the entire employee lifecycle, including onboarding, leave management, and offboarding, can lead to inefficiencies and administrative burdens.

- Fragmented Systems: Many startups rely on multiple systems to manage different aspects of HR and payroll, causing data silos and complicating workflows.

So, what does Craze HQ do?

Craze HQ addresses these challenges with an all-in-one admin platform that automates HR, payroll, and compliance tasks, enabling startups to focus on growth.

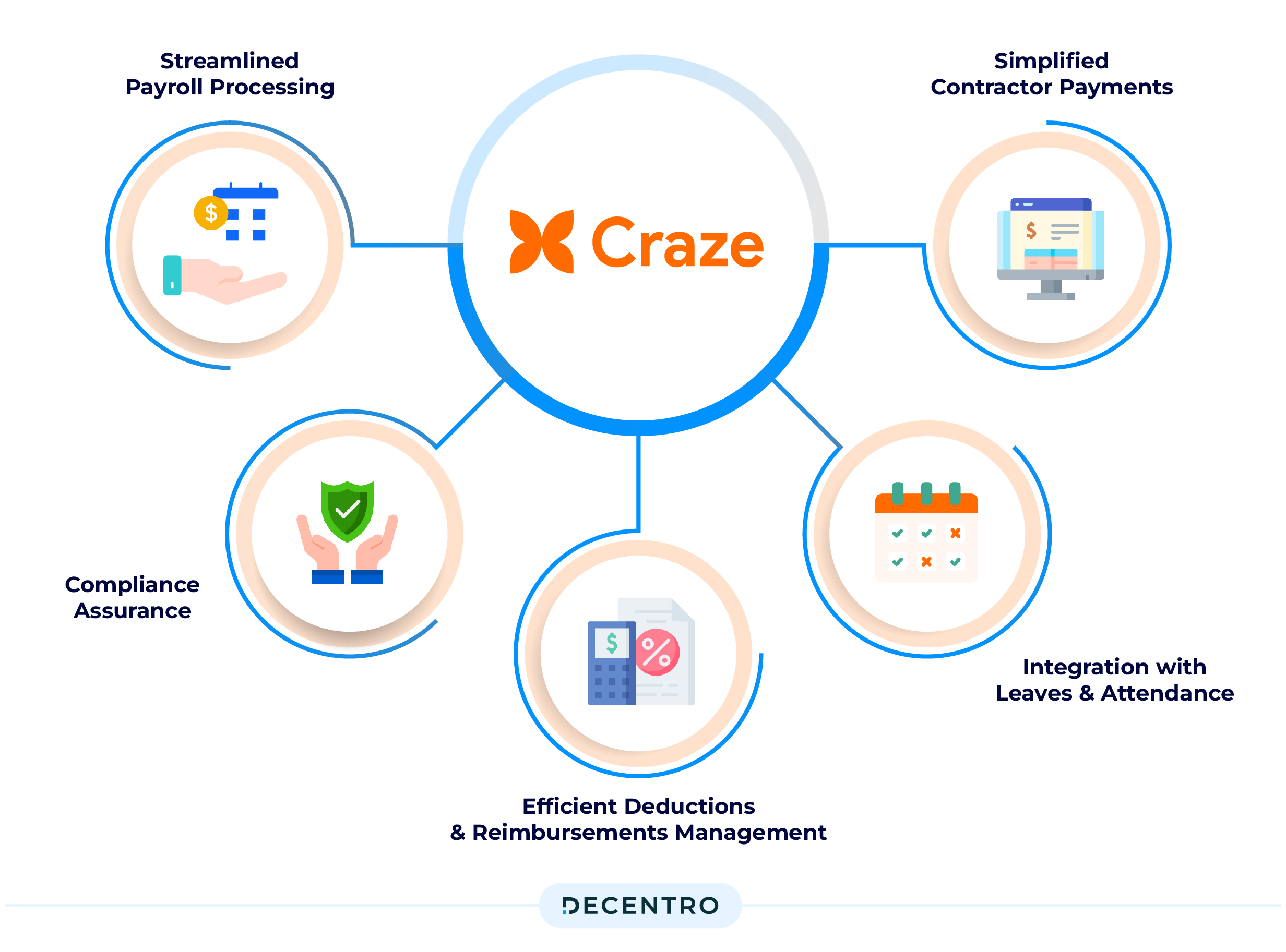

Key features include:

- Streamlined Payroll Processing: With just one click, craze automates payroll tasks, from calculating tax deductions to processing reimbursements and bonuses. Startups can disburse salaries seamlessly without manual bank transactions, reducing back-and-forth with HR and Finance teams.

- Compliance Assurance: Craze ensures statutory compliance by accurately applying deductions for TDS, PF, PT, and ESIC. It also generates Form 16 for employees and provides detailed summaries of EPF, ESIC, and TDS taxes, simplifying legal obligations.

- Efficient Deductions and Reimbursements Management: The platform’s user-friendly dashboard makes it intuitive for HR and employees to handle bonuses, deductions, and expense approvals.

- Integration with Leaves and Attendance: Craze integrates leave and attendance management directly with payroll, allowing companies to synchronise leave policies, manage loss of pay, and disburse salaries efficiently.

- Simplified Contractor Payments: Craze supports payments to interns or contractors, enabling startups to manage payouts based on TDS or GST slabs effortlessly and process multiple payments simultaneously or selectively.

What were Craze HQ’s key challenges?

The end-to-end enablement of businesses’ administrative activities can be challenging due to high-value disbursals and collections, mainly catering to companies and individuals. With high volumes, the need for an efficient disbursal and a practical verification module comes to the forefront.

From a payout perspective,

To enable the prepaid leg of the disbursal experience, Craze needed a banking and infrastructure partner who understood the complexities of the heavily regulated finance sector and helped streamline its collection services, ensuring transparency and control while maintaining transaction speed.

From a verification point of view,

The business automation business can be challenging due to high-volume disbursals and collections and the need for identity verification methods. At this disruptive stage of Craze HQ, to connect with various financial institutions such as CERSAI, NSDL, UIDAI, and more, the company was looking for a partner who could absorb the complexity of these integrations and offer a simple API with faster response times.

How did Decentro empower Craze HQ?

To provide an enhanced and seamless payroll experience, Craze integrated Decentro’s Payouts and Verification solutions into its platform. Here’s how Decentro supported Craze in elevating its offering:

- One-Click Salary Disbursement: Decentro’s API product suite, centred around UPI payouts, enabled Craze to offer a smooth payment flow and eliminate any reconciliation hassle.

Using Decentro’s Payouts solution, Craze enabled startups to disburse salaries instantly with a single click without needing a new bank account. This significantly simplifies the payroll process for users.

- User Verification and Onboarding: Decentro could stand out and differentiate itself from other players with its KYC module, which helps to collect and validate multiple IDs from the databases of various governmental authorities.

With Decentro’s bank account and document validation APIs, Craze streamlined the onboarding process. Startups can quickly validate PAN, Aadhaar, and bank details, ensuring faster and more reliable user verification.

Results and Impact

Decentro’s robust APIs have allowed Craze to drive the following results:

- 35% Higher Payment Success Rates: Multiple payment modes with higher reliability across UPI and bank transfers.

- 80% Lower Drop-Offs: Improved customer retention and satisfaction.

- Scalability and Efficiency: Achieved a 97% success rate in payouts and reduced collection costs, allowing for scalable operations.

- Over ₹10 Cr processed to date

- 10X faster integration timelines

- Decentro’s multi-channel customer support for any problem resolution

Conclusion

Our aim to empower fintech players has found fruition through our partners. That’s precisely what our simplified banking APIs are here for! Not just Craze but Decentro has enabled major companies—notably SalarySe, Omnicard, MoneyTap, and others—to facilitate a better user transaction experience with sharper admin tracking, better compliance, and improved reconciliation.

Decentro’s API offers a plug-and-play solution to your banking integration needs and covers all compliances. With over 400+ Identity validations, 250+ Image recognitions, and 300+ Repository fetches happening via Decentro’s KYC stack per hour, we’re more than equipped to enable your verification and validation journey.

Ready to Empower the Future of Transactions with Decentro?

With efficiency being our promise, feel free to reach out if your business wants to solve a use case involving anything linked to banking. We’re all ears!