An in-depth analysis of how Decentro is enabling Omnicard to redefine business payment experiences with its Banking APIs.

How Decentro Is Helping Omnicard Re-invent Spend Management

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

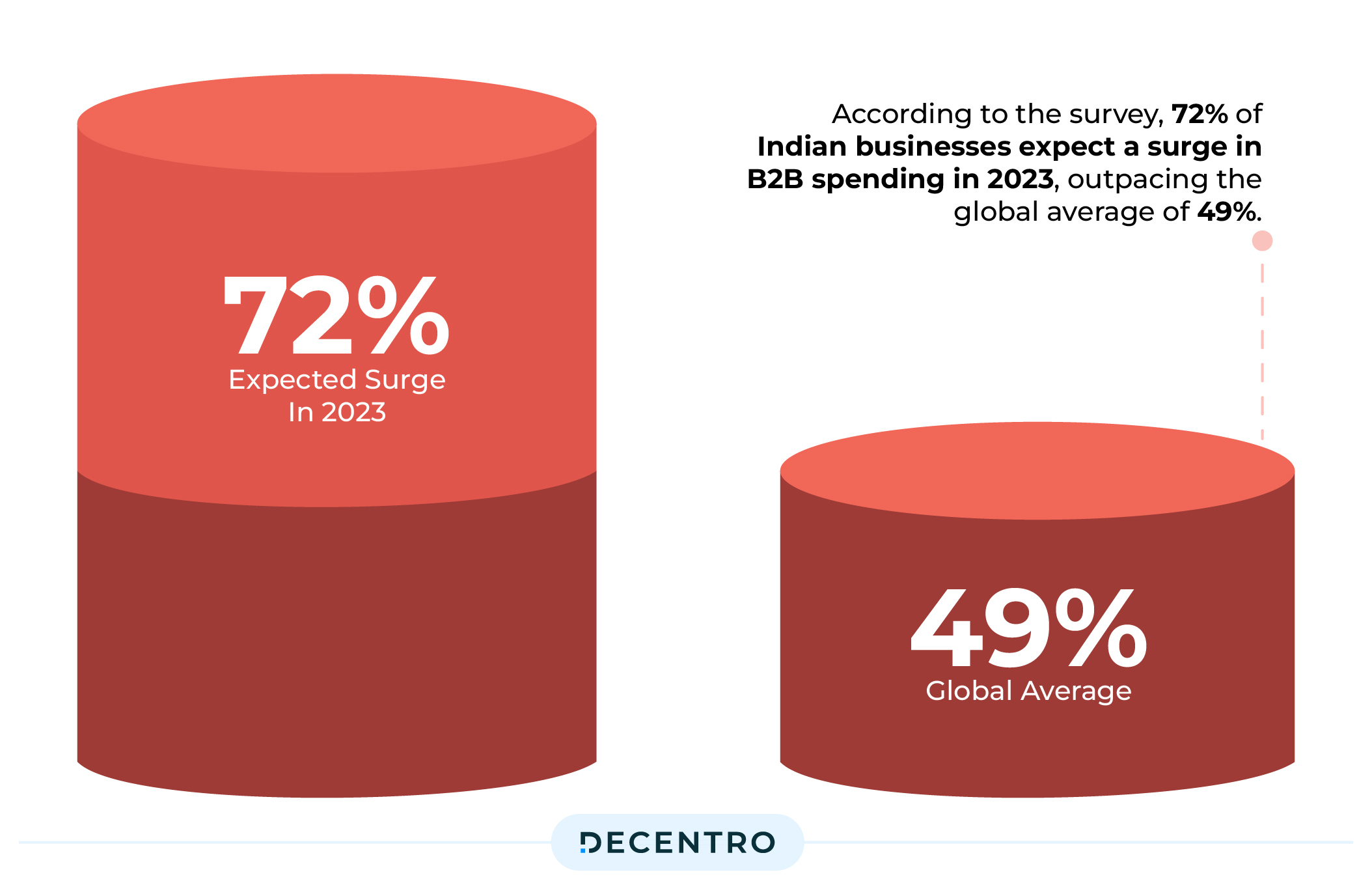

According to Kearney, a global management consulting firm, India’s business spending market is valued at $6 to $7 trillion and could reach $15 trillion by the end of this decade.

According to the survey, 72% of Indian businesses expect a surge in B2B spending in 2023, outpacing the global average of 49 percent.

The survey highlighted that 92 percent of Indian businesses said that enhancing payment security is their top priority, indicating a greater understanding of the significance of safe financial transactions.

India is also poised to become the third-largest consumer market behind only the US and China, with consumer spending expected to surge from US$1.5 trillion to nearly US$6 trillion by 2030, a World Economic Forum report has said.

Such consumption-driven growth is unsurprising given India’s large, young, and rising share of the upper middle-income population, many of whom have a high propensity to spend. Among India’s fast-growing (and spending) population, Generation Z (aged 18-26 in 2023) represents a significant brand opportunity. India has an estimated 116 million Gen-Z consumers, with two out of five urban Indian consumers aged between 15 and 55 being Gen-Z.

The need is for mindful spending.

The want is for an efficient and easy process to track and facilitate the same.

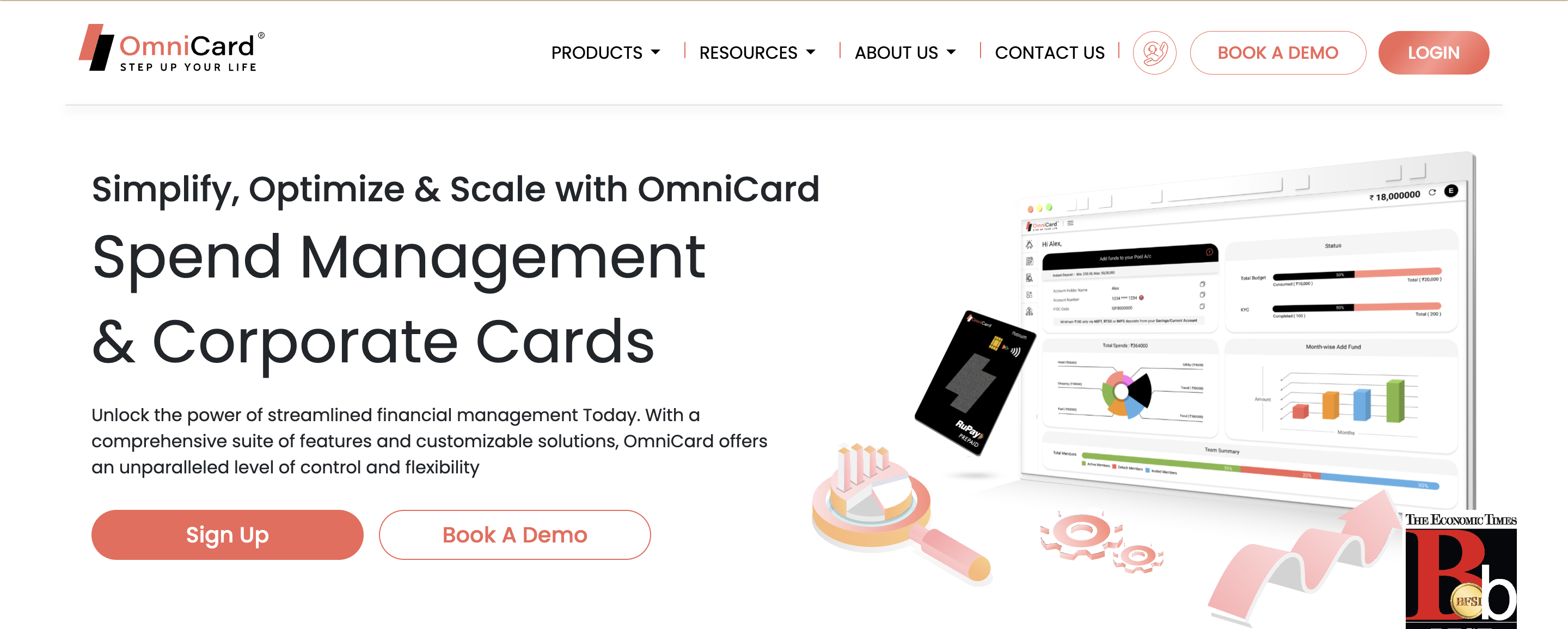

Today, let’s delve into how Omnicard, India’s 1st Omnichannel Payment Platform for end-to-end Spending Solutions, is navigating this landscape of bridging the gap between mindful spending and efficient tracking of the same via the capabilities of Decentro’s APIs

What is Omnicard?

OmniCard is a fintech company with a vision to redefine business payment experiences. They seek to address the needs of underserved groups by providing secure and convenient spending solutions through innovative technologies. With a user base of over 1.6+ million, over 10+ lakh cards created, and transactions worth ₹14.4 billion processed annually, OmniCard brings UPI payments, transit service, cards, and cash together without a bank account.

With an open API-driven integration that can help businesses and individuals build a custom spending infrastructure, Omnicard aims to unlock the true power of streamlined financial management for businesses across India.

How does Omnicard work?

OmniCard simplifies the user payment experience with its seamless functionality and user-friendly features. At the core of OmniCard is an intuitive mobile app that simplifies the payment process, making transactions swift and hassle-free.

The app supports various payment methods, including UPI (Unified Payments Interface), NCMC (National Common Mobility Card), Mobile/DTH Recharge and offline and online card payments, ensuring versatility in payment options. The user onboarding journey is designed to be easy, ensuring users can quickly navigate and set up their accounts with minimal effort.

What were Omnicard’s key challenges?

The end-to-end enablement businesses can be challenging due to high-value disbursals and collections, mainly catering to businesses and individuals. With high volumes, the need for an efficient yet effective verification module came to the forefront. Additionally, with a push towards putting a one-stop KYC maintenance system for its users, a Permanent Account Number is required, leaving room for Omnicard to pivot towards one solution that would address all these concerns simultaneously.

How did Decentro empower Omnicard?

While dealing with businesses and individuals, user background checks are crucial for any platform.

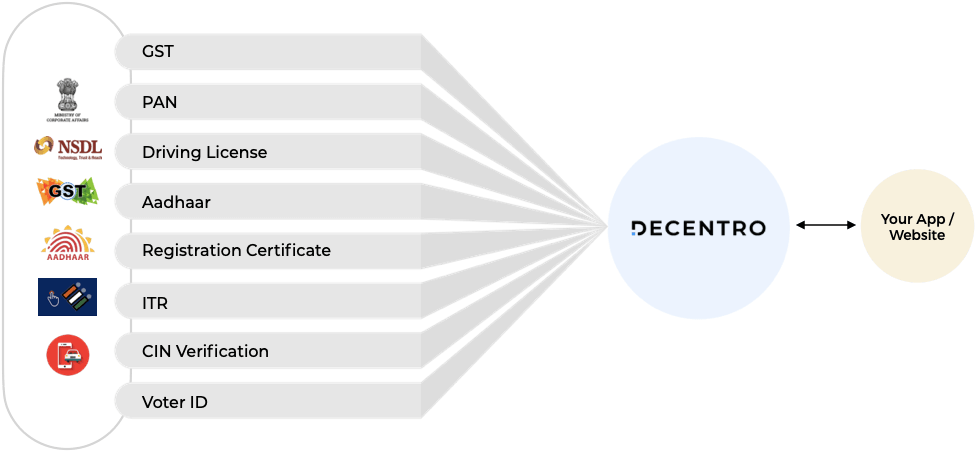

With Decentro’s single end-point for KYC APIs, Omnicard set seamless onboarding flows to offer smooth and secure user onboarding. With single-point access to various data points such as PAN, Aadhaar, Driving License, Voter ID, and more, Omnicard onboards users in real-time and automates the KYC process end to end.

In this manner, when users enter their details, Decentro’s APIs check in the background and provide Omnicard with all necessary information for evaluation.

What were the key outcomes for Omnicard?

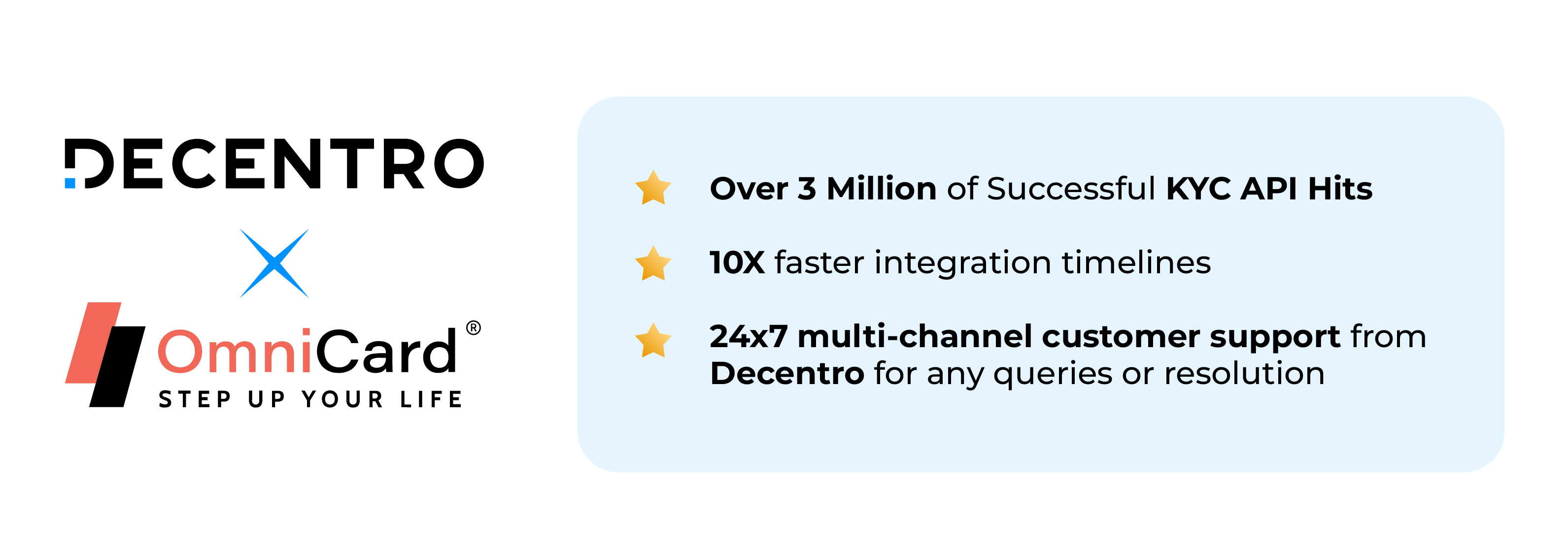

Decentro’s robust APIs have allowed Omnicard to drive the following results:

- Over 3 million successful KYC API Hits

- 10X faster integration timelines

- 24×7 multi-channel customer support from Decentro for any queries or resolution

“With the demand for an elevated user experience being a prerequisite for any organisation, we were looking for a technology partner who would understand this space and efficiently enable the same. Integrating Decentro’s KYC APIs has been a game-changer for our user onboarding journey. It’s not just about technology; it’s about empowering our users from the very first interaction.”

Abhinav Saxena, the CTO, COO, & Co-founder of OmniCard

In Conclusion

Thriving in India’s banking and infrastructure ecosystem requires fair collaboration between players. This is where Decentro’s partnership with Omnicard comes into play. This partnership serves the bigger purpose of not only enabling fintech players within the Indian ecosystem but also doing our respective bit to democratise fintech for all.

Along with Omnicard, we’ve enabled many customers, such as Baya and Dvara, among others, to verify their customers’ backgrounds thoroughly before bringing them on board. With over 400+ Identity validations, 250+ Image recognitions, and 300+ Repository fetches happening via Decentro’s KYC stack per hour, we’re more than equipped to enable your verification and validation journey.

Our host of products has also solved pertinent use cases for customers across the industry. The need to solve for a complete user journey was the obvious next step that paved the way for the bifurcation and launch of full-stack payments and banking modules, namely, Fabric and Flow.

Curious to know more? With compliance and efficiency being our promise, feel free to reach out if your business wants to solve a use case involving anything linked to banking.

Drop a Comment