Understand how underwriting insights impact Indian lending, enhance loan approval processes, reduce risks, and foster better lender-borrower relationships.

Credit Underwriting Process: Everything You Need to Know

Product, GTM & Partnerships

Table of Contents

Dramatic fall in India’s savings

India has traditionally been a nation of savers. People stash away a significant portion of their earnings for future security, often at the expense of current consumption.

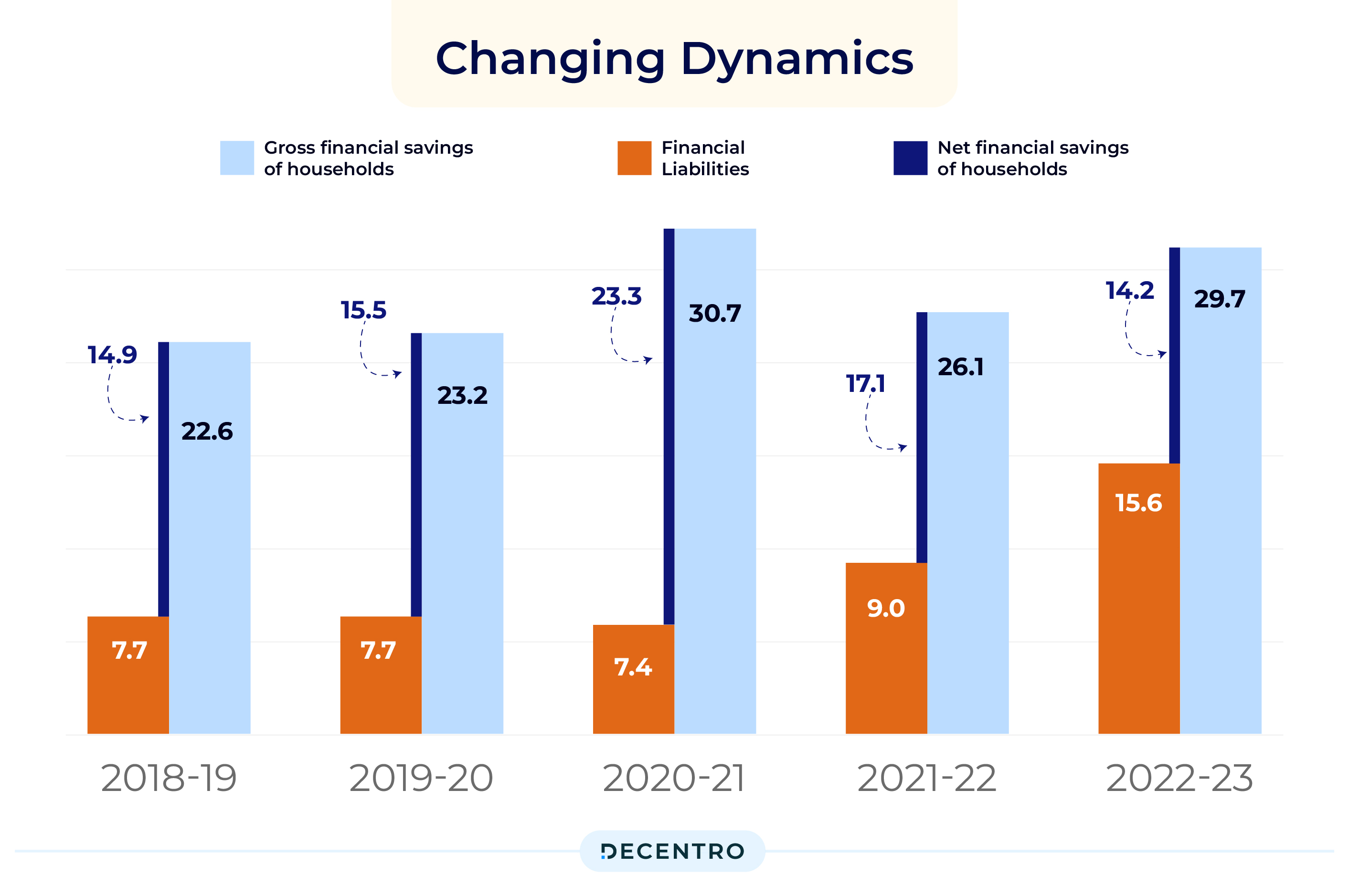

However, recent data from the RBI says India’s net household savings stood at a 47-year-old low. Household net savings are the total money and investments families have, like deposits & stocks, minus any money they owe, like loans and debt. Savings shrank to 5.3% of the gross domestic product (GDP) in the financial year 2023, down from 7.3% in 2022.

In another report released by the Ministry of Statistics and Program Implementation, there has been a significant fall in net financial savings of households by over 9 lakh crore between 2021-22 and 2022-23. Net financial savings of households were down to a five-year low of Rs 14.2 lakh crore in 2022-23 from 17.1 lakh crore in 2021-22.

Surge in Credit Use Across Households

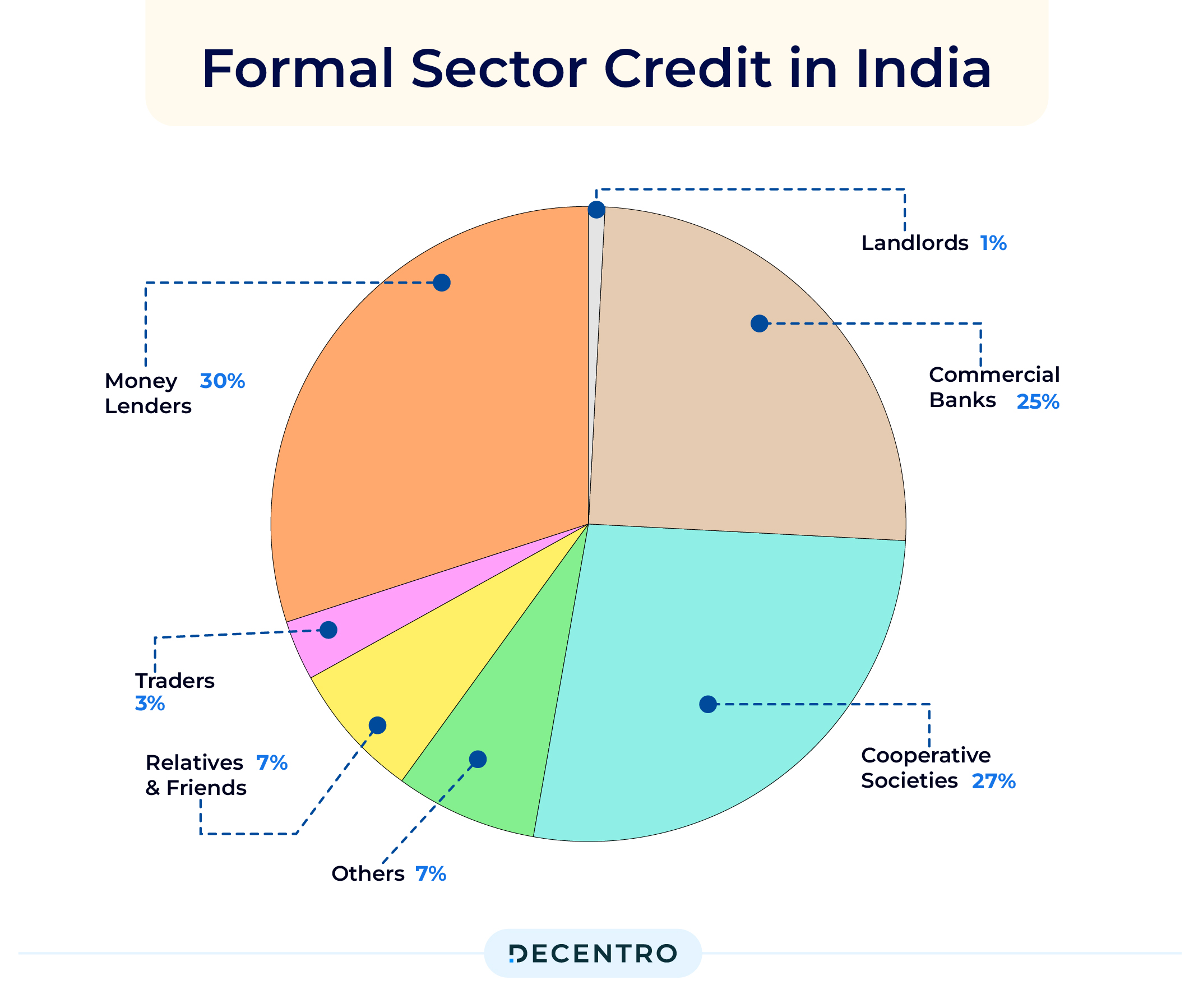

Annual borrowings stood at 5.8% of GDP: the second-highest level after the 1970s.

Households are increasingly relying on debt to fuel consumption. This has led to fast growth in borrowing for categories like credit cards, consumer durables, weddings, health emergencies, etc.

Changing Financial Habits in India

What does this trend of low savings and high debt indicate about India’s credit consumption? On the one hand, there is an increase in consumer confidence, and there are many who hope income growth will be strong enough in the future. On the other hand, it could be a change in the mindset about spending more, in the moment.

At a macro level, it becomes difficult to validate any of these hypotheses due to a lack of granular data. E.g., what kind of jobs do borrowers do? How many people have taken how many loans? What are they using the loans for? What is their repayment history? However, at a micro level, it’s becoming easier for lenders to try and address such questions.

Challenges in Building Loyal Borrowers

The lending business involves a two-pronged approach: distribution and underwriting. Every lender strives to identify a cohort of target users, determine how to acquire them cost-effectively, develop tailored credit products, and implement an underwriting model that balances risk and returns. When executed successfully, this strategy enables lenders to achieve scale and profitability.

One approach lenders typically take is to focus on the acquisition of more users/borrowers. This has led to credit widening, ie, an increase in the number of overall borrowers. However, this leads to a potential long-term problem of building a high-quality retention cohort. While having more people borrowing is preferable to having each borrower take out larger loans, an ideal retention cohort would be one that does not turn delinquent and continues to come back for loans to service different needs. That is credit deepening (higher / frequent loans per the right borrower).

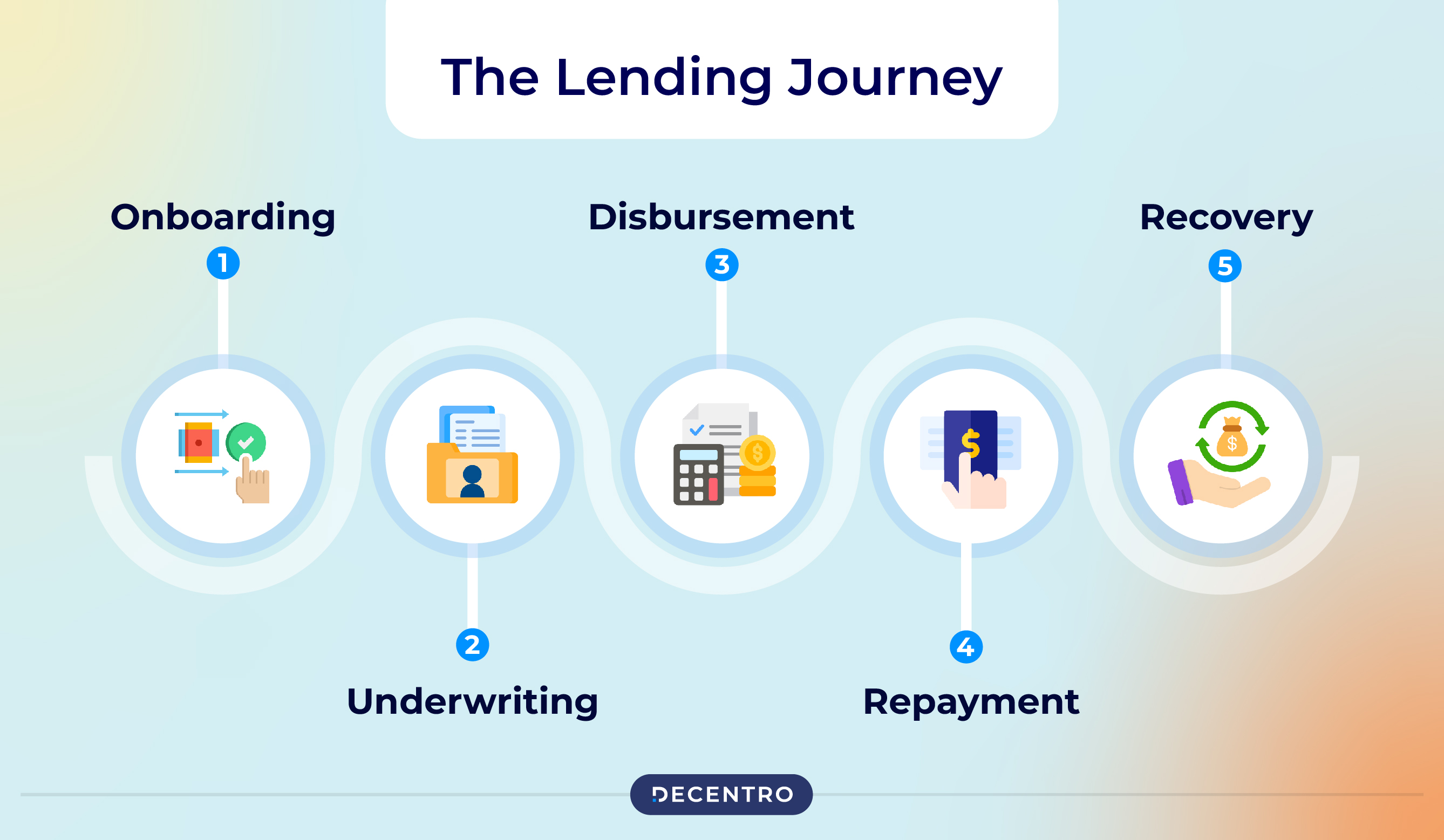

Steps in the Credit Underwriting Process

A typical lending journey involves several steps from onboarding to disbursement and post-disbursement. Onboarding and underwriting usually require a specific set of data points, which can result in the approval or rejection of an application. Some steps may overlap, depending on factors like ticket size and target segment. Underwriting is where the lender decides the loan amount to be approved for the borrower. This step can result in the applicant being rejected, approved, or receiving an in-principle approval subject to further verification. If approved, the borrower moves to the disbursement step, where the approved loan is transferred to their bank account.

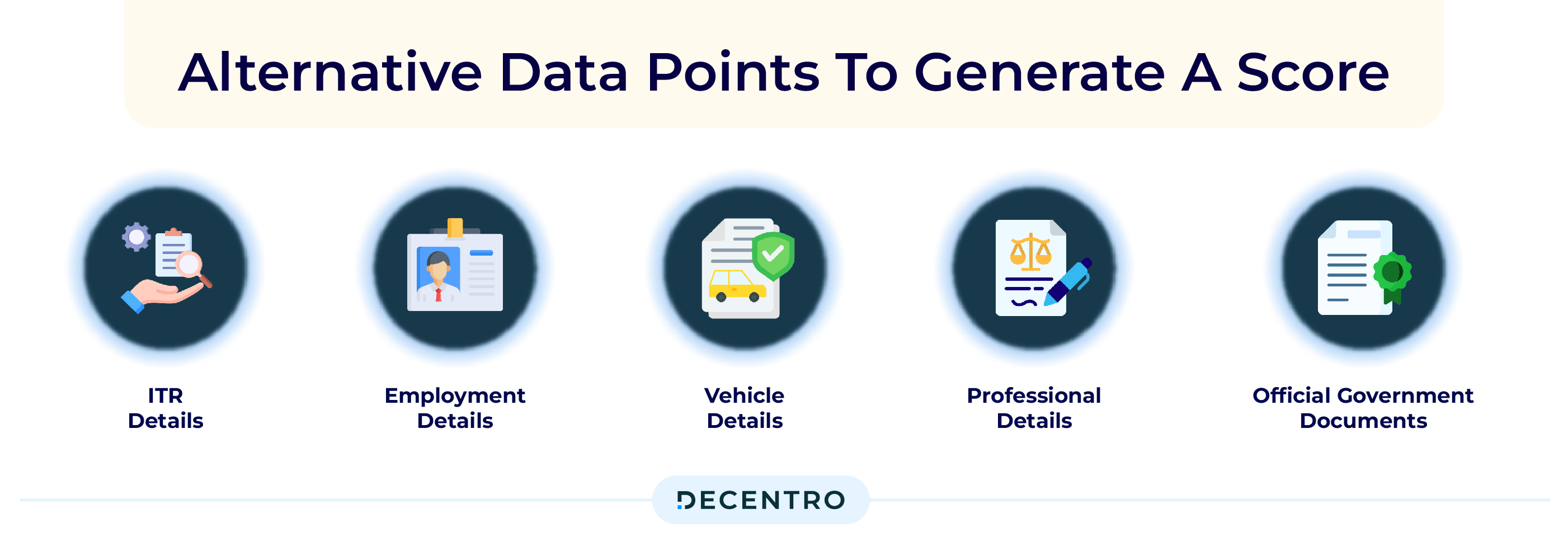

Data Sources Needed for the Credit Underwriting

Beyond standard credit bureau scores, lenders consider multiple alternative data points to generate a score or decision on the applicable loan amount. These data sources include:

- ITR details: Tax filing status, return details, etc.

- Employment details: Employment email, EPFO, etc.

- Vehicle details: RC, challan, etc.

- Professional details: For practising professionals like CAs, CSs, doctors, etc.

- Official government documents: Such as PAN and Aadhaar for individuals, and GST and Udyam for businesses.

Enabling Credit Widening

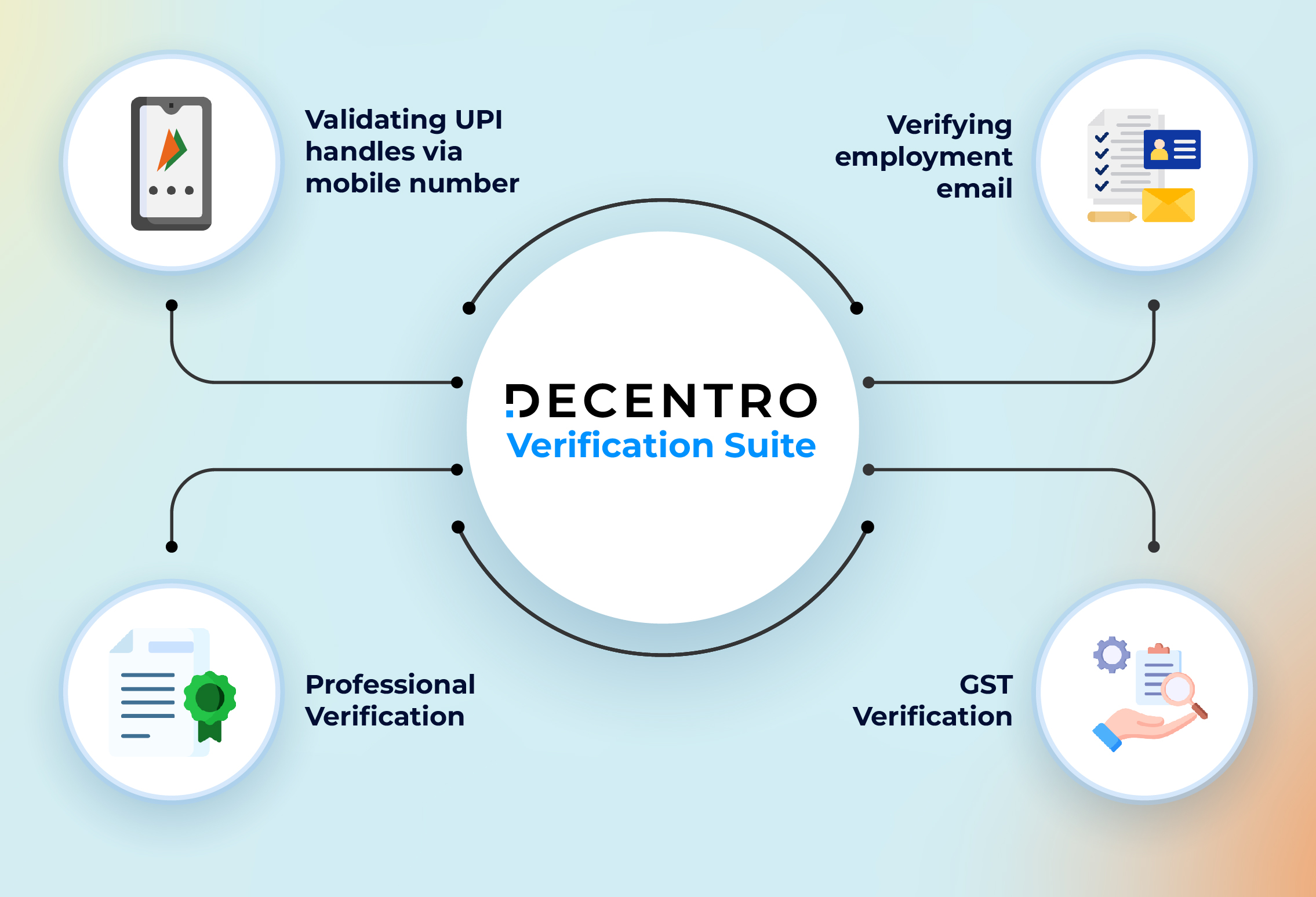

In order to acquire more digital users and build a wider borrower base, it’s not just the quality & speed of data, but the seamless journey that is important. Apart from the standard credit score from credit bureaus, Decentro has increased significant coverage by adding verification APIs for various alternate data types. Examples –

- Validating UPI handles via mobile number: Helps verify name & autofill VPA handles for payments/collections

- Verifying employment email: Reduce fraud at the initial steps of onboarding

- Professional verification: Identify genuine practising professionals

- GST Verification: Verify data of SMEs/businesses to underwrite faster

All of these are available not just as simple APIs but also as plug-and-play UIStreams and HyperStreams that can be integrated in hours and not weeks. This helps lenders in not just minimising costs and risks on the front, but also reducing time to market and driving better success rates. E.g., Lenders have observed an uptick in the success rates of their onboarding journey by using Decentro’s Digilocker services, thereby being able to issue loans faster.

Enhancing Loan Book Quality through Better Insights

At Decentro, we are on a mission to help lenders by onboarding seamlessly, reducing fraud, and gaining insights into their customers. We have already made multiple strides by solving the acquisition/onboarding part of the lending journey.

We are now focused on helping lenders build a quality loan book via better underwriting. That is, we are aggregating richer data sets to help lenders understand their customers better and, in turn, underwrite better. These insights will be powered via simple-to-consume APIs and dashboards. We continue to provide lenders with the flexibility to tweak their business rule engine by using these data points as part of their underwriting process.

If you are interested in becoming an early customer for our upcoming insights APIs, please contact us.