Navigate the debt collection process with our comprehensive guide. Learn how debt collection works and how to maximize recovery with NeoWise.

Mastering the Debt Collection Process: Your Go-To Guide

Avi is a full-stack marketer on a mission to transform the Indian fintech landscape.

Table of Contents

The Indian market, with its vast and diverse borrower base, presents unique challenges and opportunities in debt collection. Recent statistics underscore the burgeoning scale of this issue, with the Reserve Bank of India reporting a noticeable uptick in banks’ gross Non-Performing Assets (NPAs), highlighting the urgency for robust collection solutions.

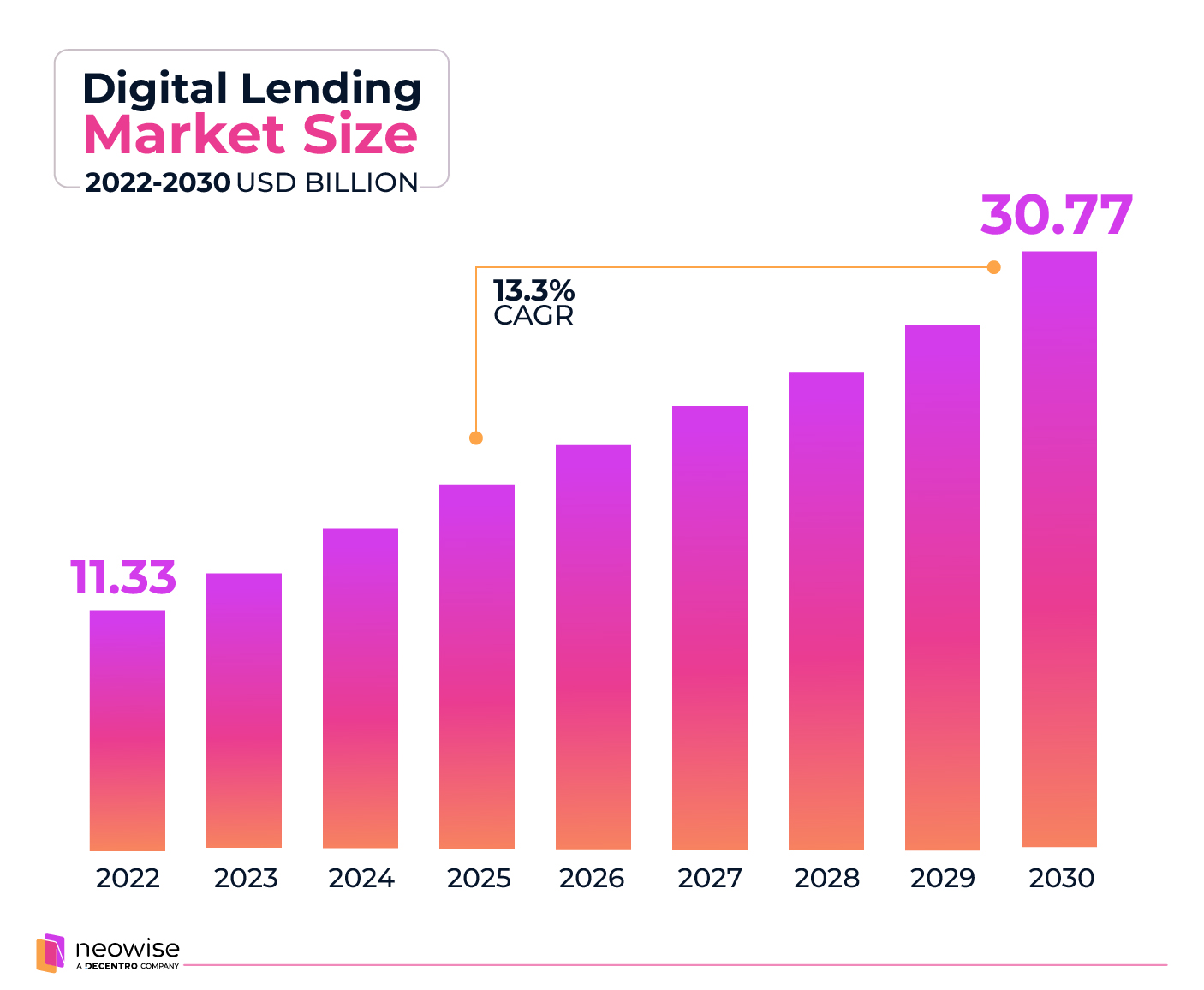

Moreover, the digital lending space, which has seen exponential growth, particularly during the post-pandemic period, has further amplified the need for innovative debt recovery strategies. Industry estimates say the digital lending market is expected to grow to a whopping USD 515 billion by the year 2030, as per a report by IIFL Fintech.

The rise of lending businesses in India and the escalating need for effective debt collection solutions signifies a pivotal moment in the country’s financial services sector. It calls for a balanced approach that safeguards the interests of lenders while ensuring fair treatment and transparency for borrowers. As the industry stands at this crossroads, embracing advanced debt collection technologies and practices will be crucial for sustaining growth and maintaining the health of India’s credit ecosystem.

Debt Collection Processes in India

The regulatory landscape

The debt collection sector navigates a complex landscape of regulations and guidelines to safeguard the balance between creditor rights and debtor protection in India. Here’s a snapshot of the major players and policies shaping this industry:

- Reserve Bank of India (RBI): At the helm, the RBI sets the policies for banks and non-banking financial companies involved in debt collections. Their guidelines promote fair treatment and defend borrower rights.

- The Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002: The SARFAESI Act empowers banks and financial institutions to enforce security interests and manage assets without court intervention, detailing the nitty-gritty of asset sale and control.

- The Recovery of Debts Due to Banks and Financial Institutions (DRT) Act, 1993: Introducing Debt Recovery Tribunals (DRTs) and Appellate Tribunals, this act focuses on smoothing the debt recovery path, ensuring cases related to debt dues are processed efficiently.

- Telecom Regulatory Authority of India (TRAI): In telecom debt scenarios, TRAI regulates collection efforts, ensuring that contact frequencies with borrowers are kept within reasonable bounds.

Together, these bodies and regulations form the backbone of a debt collection system that strives for fairness and efficiency, balancing the interests of all parties involved in the debt recovery equation.

Stages in Debt Collection

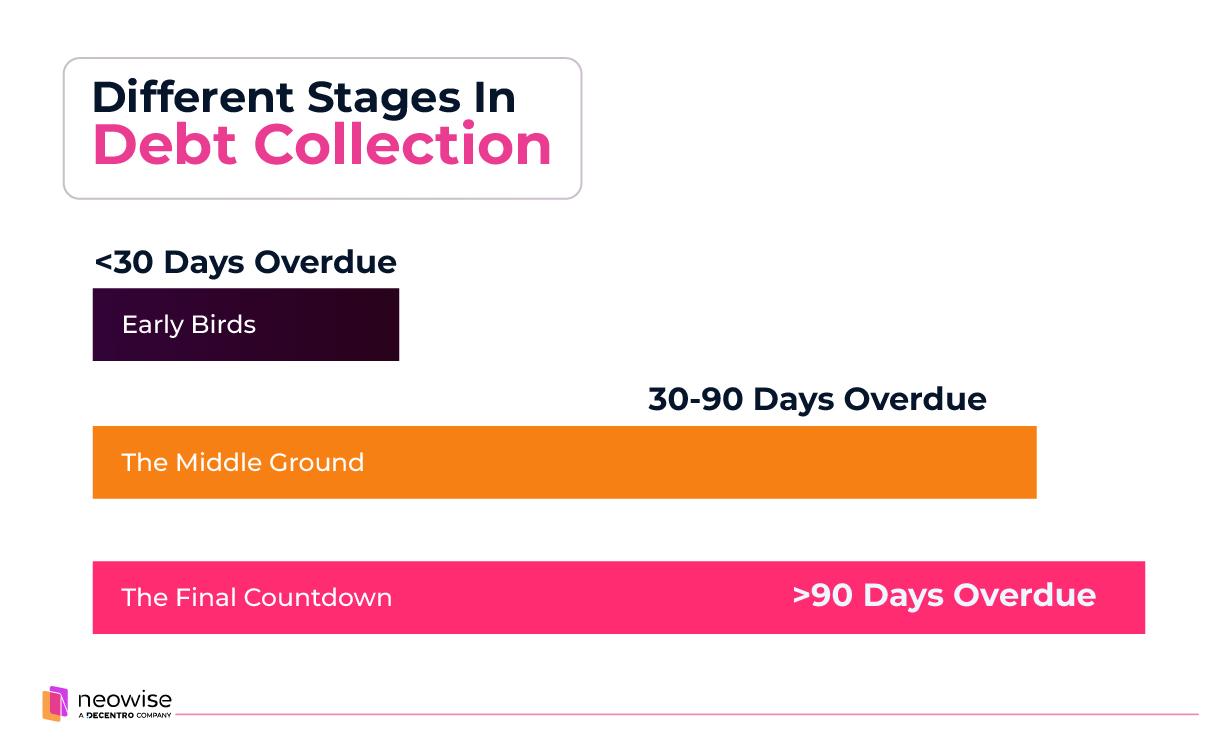

When a payment misses its due date, it kicks off a series of time-sensitive actions known as the stages of collection. Different companies might have unique ways of slicing these stages, marking different periods as milestones. This is how lenders keep track of overdue payments and decide how to approach each stage accordingly.

Let’s see the different stages in debt collection:

Stage 1 – The Early Birds ( Approx. less than 30 Days overdue)

Companies engage with customers with gentle nudges in the early days after the due date. Your business might reach out with a friendly reminder via letters, phone calls, emails, or texts. Sometimes, customers lose track of time or might need leeway to catch up.

Stage 2 – The Middle Ground (Approx. 30-90 Days overdue)

In this stage, companies categorise their customers by risk and decide on their next move. Is it time for a payment plan? Companies may also consider a payment plan for the customers considering their financial state.

Stage 3 – The Final Countdown ( >90 Days Overdue)

Once a defaulter hits the 90-day mark, the strategy shifts towards more intensified efforts to reconnect and resolve. Understanding the different stages in which your customers are can help your business segment the risk categories and guide your approach towards debt recovery accordingly.

Throughout these stages, there’s more happening than just debt collection. Showing support and flexibility can turn a late payer into a loyal customer. After all, a thoughtful collection strategy can be the key to securing repayments and retaining customers.

Traditional Debt Collection Processes Used in India

As lending practices in India become more widespread and diversified, the mechanisms for debt recovery need to adapt to a rapidly changing environment. The current landscape of debt collection in India is a complex tapestry woven with traditional methods that have long defined the practice yet are increasingly punctuated by the need for innovation and efficiency. As we peel back the layers, a picture emerges of a sector at the cusp of transformation, driven by the urgent need for more effective, ethical, and technologically advanced debt recovery solutions.

For a very long time, lenders in India have used one or more of the following methods for debt collection:

- Phone calls and letters: Debt collection in India typically commences with debt collectors employing traditional methods such as making phone calls and dispatching reminder letters to the debtor. This initial approach aims to prompt repayment before escalating the matter further.

- Field visits: Should these preliminary efforts prove unsuccessful, collectors might escalate their tactics to include field visits to the debtor’s home or workplace. These visits are intended to serve as a direct reminder of the debtor’s repayment obligations, though they can sometimes cross the boundaries of politeness. In more pressing circumstances, debt collectors have been known to exert family and social pressure, involving the debtor’s close contacts to encourage repayment. This tactic, however, has been met with significant controversy due to its invasive nature.

- Legal action: Legal notices represent a further step in the debt collection process, issued as a final ultimatum when previous attempts have failed. These notices caution the debtor about impending legal actions, which could lead to severe consequences such as property seizure or wage garnishment.

- Mediation: For substantial debts, mediation and negotiation may be introduced, bringing in a neutral third party to help broker a fair repayment plan between the creditor and the debtor.

- Loan collaterals: In secured loans, lenders can seize collateral if the debtor defaults, offering a tangible recourse for loan recovery.

- Credit Bureaus: Another strategy is to report delinquent accounts to credit bureaus, potentially damaging the debtor’s credit score and hindering their future borrowing capabilities.

The varied tactics employed by debt collectors have raised numerous issues, prompting a closer examination of the legality and ethics surrounding debt collection practices. This evolving landscape underscores the need for a balanced approach that considers creditors’ rights and debtors’ dignity.

Challenges faced by lenders and collection agencies

Lenders and collection agencies face numerous challenges in today’s complex landscape, especially as consumer rights and collection ethics become more prominent.

1. Incomplete Customer Data: Effective debt collection begins with accurate customer segmentation, utilising call centre solutions tailored for collection agencies. However, a significant hurdle is often the incomplete transfer of crucial data like payment histories or credit scores, hindering the success of personalised collection strategies despite advanced software.

2. Inefficient Collection Processes: For optimal EMI recovery, it’s essential to have a structured approach, categorising customers into distinct groups based on specific criteria. However, several collection agencies need help with a clearly defined process, leading to ineffective reminder campaigns that fail to yield desired outcomes.

3. Disconnected Collection Systems: Seamless integration between NBFCs and collection agency systems is crucial for successful collection efforts. Disparities like unlinked CRM and collection software can cause operational inefficiencies, underscoring the need for cohesive system synchronisation.

4. Lack of Advanced Tools: Specialised collection campaigns require sophisticated tools that can go beyond standard call centre software. With these advanced solutions, collection agencies can operate effectively, facing operational challenges that impede debt recovery.

5. Inappropriate Call Frequency: Excessive or insufficient calling can lead to customers ignoring calls, marking them as spam, or neglecting less frequent reminders. Balancing call frequency is critical to ensure effective communication without diminishing the chances of EMI recovery.

6. Insufficient Agent Training: Skilled agents, proficient in utilising specific collection software and tools, are essential for successful collection campaigns. However, many agencies need to pay more attention to the importance of comprehensive training, resulting in inconsistent operations and challenges.

7. Targeting Incorrect Individuals: Accuracy in targeting customers for payment reminders is crucial. Mistakenly contacting those who have already paid or are regular with their EMIs wastes resources and risks customer dissatisfaction, exacerbating operational challenges.

The Shift Towards Digital Debt Collection

India’s digital lending is booming, set to hit $720 billion by 2030, fueled by government digitisation initiatives and innovative FinTechs. This growth is driven by banks, NBFCs, and FinTechs offering digital credit solutions, making capital more accessible and introducing models like BNPL and P2P lending.

With digital lending expanding, balancing loan accessibility and avoiding debt traps is vital. Digital debt collection, leveraging AI and intelligent tech, is streamlining this process, ensuring fairness in lending and collection practices.

Benefits of Digital Debt Collection:

Smart Data Use: Leveraging algorithms and diverse data sources, lenders can predict repayment risks and tailor their approach, enhancing risk management and future preparedness.

Effective Communication: Digital tools enable personalised borrower communication, improving engagement and empathy in collections.

Advanced Insights: Data analytics provide a comprehensive view of customer behaviour, aiding in risk avoidance and financial forecasting.

Strategic Recovery: Understanding customer needs allows for a multi-channel, personalised contact strategy, improving recovery efficiency and customer satisfaction.

Enabling Efficiency in Debt Collection Processes

Sharpen your debt recovery strategy with these key best practices, blending efficiency and ethics to maintain strong customer relationships:

1. AI-Powered Omnichannel Communication

In the digital era, embracing an AI-enhanced omnichannel approach ensures your message reaches customers wherever they are with intelligent personalization. This strategy integrates various channels—email, social media, AI chatbots, intelligent calls, and face-to-face interactions—to create a consistent and seamless customer experience.

AI-Driven Personalization: Tailoring communication based on customer demographics, behavioral patterns, and preferences using advanced AI and predictive analytics can significantly boost engagement and satisfaction. AI-powered bots can adapt conversations in real-time, ensuring multilingual campaigns that understand cultural nuances and maximize debt recovery potential.

Proven Results: AI-enhanced communication strategies deliver ~5% improvement in recovery rates and 20% increase in customer engagement across multiple products.

2. Flexible Payment Plans with Smart Automation

Ease the debt collection process by offering AI-optimised payment plans that automatically adapt to customer financial profiles, allowing customers to settle their dues over time. This intelligent approach supports those facing financial hardships while using predictive analytics to enhance the likelihood of full recovery. AI-powered systems can automatically generate personalised payment terms and associated fee structures, ensuring optimal mutual understanding and compliance.

3. Predictive Credit Reporting & Early Warning Systems

Leverage AI-enhanced credit reporting as a multi-purpose tool that not only protects your business from future losses but also provides early warning signals to detect borrower distress before it escalates. This intelligent approach motivates timely payments, enhances cash flow, and reduces portfolio delinquencies by giving your team the upper hand in preventing defaults.

4. AI-Centralised Data Management & Advanced Analytics

Centralising customer data into a single AI-powered platform revolutionises the debt collection process. This approach combines traditional data management with machine learning capabilities to cut operational costs, reduce manual data retrieval time, and minimize disputes from inaccurate data.

Intelligent Insights: Advanced AI algorithms predict customer behavior patterns, identify optimal engagement strategies, and automatically prioritize cases based on recovery probability. Real-time analytics provide actionable insights that optimize collection strategies for better efficiency and outcomes.

Behavioral Analysis: AI-powered systems can detect conversational cues, borrower tendencies, and engagement patterns to tailor personalized strategies that increase recovery rates while maintaining compliance standards.

Combining these AI-enhanced techniques into a cohesive strategy maximises return on investment and elevates service delivery, ensuring businesses stay ahead in the competitive landscape.

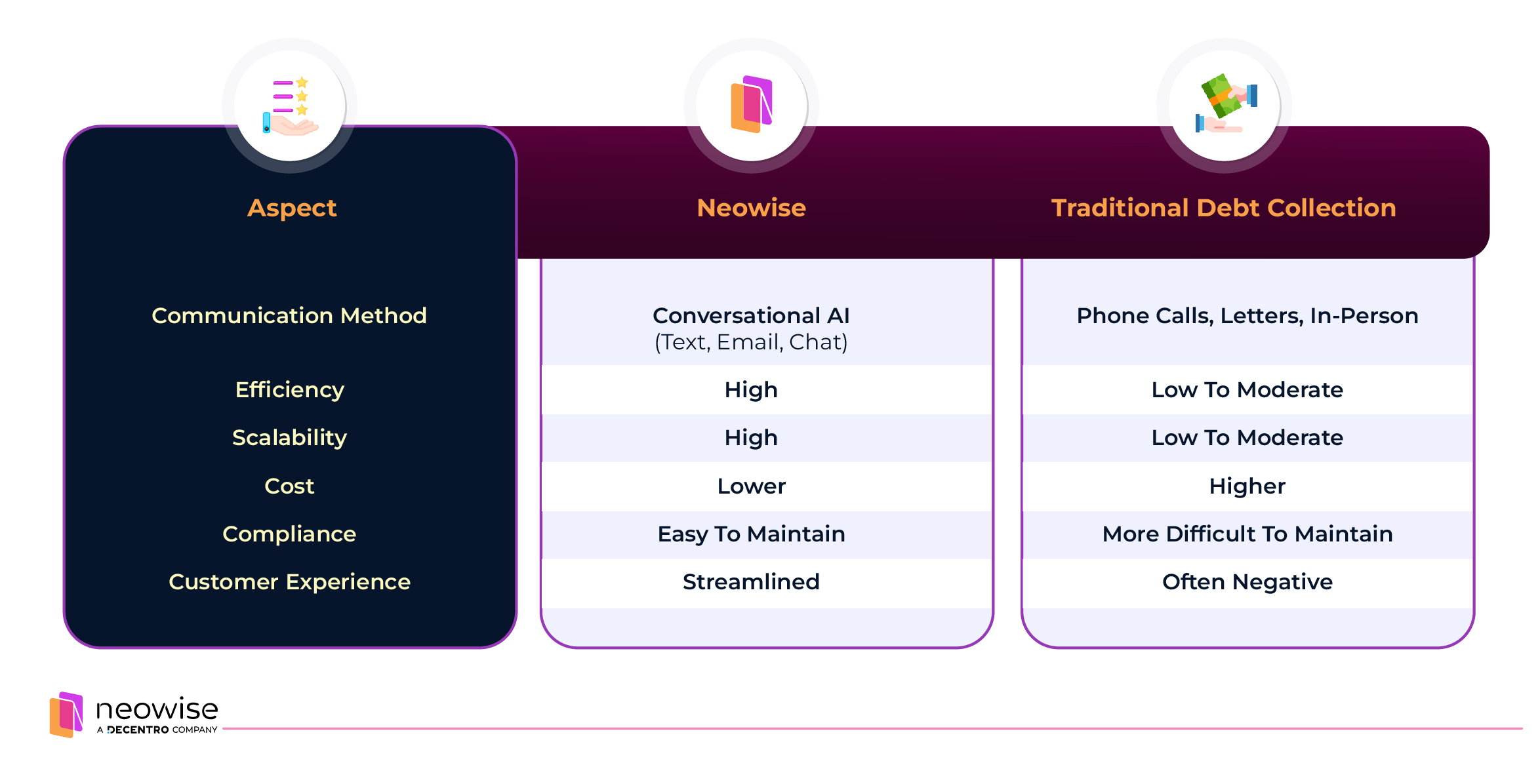

Neowise – A revolutionary debt-collection platform

We have seen how traditional debt collection methods lack many benefits offered by digital debt collection methods in terms of efficiency, scalability, borrower experience, and compliance risks. Neowise is an end-to-end debt collection platform that automates lenders’ recovery and collection pipelines to streamline and manage the loan recovery process, empowering your debt collection process to have exponential benefits compared to traditional methods.

Neowise Empowers Your Debt Collection Process Through:

AI-Driven Communication with NeoBot (AI Calling Bot)

- Intelligent Borrower Engagement: Automate and personalise outreach with AI-powered conversations that adapt to each customer’s needs and communication preferences

- Multi-Channel AI Deployment: Seamlessly integrate SMS, WhatsApp Business API, Email, IVRS, and AI bots to reach borrowers in their preferred language and channel

- Early Warning Intelligence: Detect borrower distress signals before escalation, enabling proactive intervention strategies

- Predictive Engagement: AI algorithms determine optimal timing, messaging, and channel selection for maximum engagement effectiveness

Advanced Call Analytics with NeoSight (AI Calling Analytics)

- Real-Time Call Monitoring & Quality Control: Leverage AI to oversee live collection calls, ensuring compliance, accuracy, and efficiency while identifying improvement areas instantly

- Call Outcome Optimization: AI-powered evaluation of call effectiveness with actionable feedback to improve borrower engagement and successful resolutions

- Behavioral Pattern Detection: Identify borrower tendencies and conversational cues during calls to tailor strategies that increase recovery rates and minimize defaults

- Multilingual Quality Assurance: Conduct seamless quality assessments across multiple languages, ensuring high standards regardless of region

Unified Customer Intelligence Platform

Manage all collection touchpoints across omnichannel communications, AI-enhanced tele-calling, field operations, and legal workflows under a unified, intelligent view. Upload customer data 100% securely using Excel, SFTP, and API integrations with AI-powered data validation and enrichment.

Smart Omnichannel Communication

Communicate across channels—email, SMS, WhatsApp, IVR, Cloud Calling, AI Voicebots, intelligent Chatbots, and Speed Post—with AI-powered communication analytics that automatically evaluate which channels and messaging strategies work best for different customer segments.

AI-Optimized Legal Workflows

Streamline litigation tracking and outcomes with AI-enhanced end-to-end visibility and compliance monitoring. Intelligent timing algorithms trigger physical and digital notices through empaneled lawyers, while predictive analytics optimize legal strategy effectiveness.

Empowered AI-Enhanced Tele-calling Teams

- Automated Smart Scheduling: AI algorithms prioritize contactable cases and optimize call timing for higher conversion rates

- Intelligent Dialer Interface: Seamless interface that focuses agents on highest-value resolutions with real-time AI insights

- Performance Optimization: AI-driven coaching and feedback systems that continuously improve agent effectiveness

Superior Field-Agent Performance with AI Insights

Real-time AI-powered data insights combined with advanced task management capabilities, comprehensive reporting, geo-tracking functionality, and predictive analytics that guide field agents to the most promising collection opportunities.

Accelerate Your Collections Today

Wrapping up

As India strides towards an increasingly digital economy, the debt collection landscape is poised for a transformative shift. With technological advancements and the proliferation of fintech companies, the methods and strategies of debt collection are expected to undergo significant evolution in the coming years.

India’s traditional debt collection approach is set for a significant overhaul. Predictions suggest a move towards more personalised and efficient collection strategies, leveraging data analytics and behavioural insights. As understanding of borrowers’ financial habits and preferences improves, collection agencies will adopt more targeted approaches that respect the borrower’s situation while optimising recovery rates.

Artificial Intelligence (AI) and automation are at the forefront of this revolution. These technologies promise to streamline the debt collection process, making it faster, more cost-effective, and less prone to human error. AI can help predict payment delinquencies, segment borrowers based on risk profiles, and suggest the most effective communication strategies for different segments. On the other hand, automation can handle repetitive tasks such as sending reminders, updating records, and processing payments, freeing human agents to focus on more complex cases.

Fintech companies are set to play a pivotal role in shaping the future of debt collection in India. With their innovative approaches and agile frameworks, these companies are introducing novel solutions that challenge the status quo. From digital platforms facilitating more accessible communication between lenders and borrowers to blockchain-based systems ensuring transparency and security, fintech is at the heart of the industry’s evolution. Moreover, fintech partnerships with traditional banks and financial institutions will likely increase, bringing the best of both worlds to the debt collection ecosystem.

As we look ahead, it’s clear that the future of debt collection in India is not just about improving efficiencies or reducing costs; it’s about creating a more empathetic, transparent, and effective system that benefits lenders and borrowers. With the right blend of technology, innovation, and regulatory support, India is on the cusp of setting a global benchmark in how debt collection can be reimagined for the better.