We all do know about the various methods of online money transfers. But, what about the economics behind them? Let’s find out!

Decoding The Economics Of Online Bank To Bank Transfers

Once a Clueless Engineer, and now a Chuffed Marketer. Learning the trades of Fintech currently and making it great with Decentro.

Table of Contents

1980s: Banking via Branches

2000s: Banking via Internet

When we flip the pages of banking history, especially online banking, the two decades above have a significant place.

Can we now imagine a walk to the bank nearby to get money? Or for a loan? Thanks to online banking, the way people perceive & avail financial services has changed- a lot for the better.

We all know the basics and essentials of online bank transfers; today, let’s cross the Ts’ and dot the Is’ to understand what goes behind money transfers over the internet.

What is a Bank to Bank Transfer?

Payments are an integral part of every business. Be it a mom & pop store running in your locality or a fully-fledged retail outlet, millions of transactions happen every day across the country.

Bank to bank transfer refers to money flow from one banking account to another on behalf of two transacting persons or businesses. It’s completely online, secure, and easy to track & reconcile.

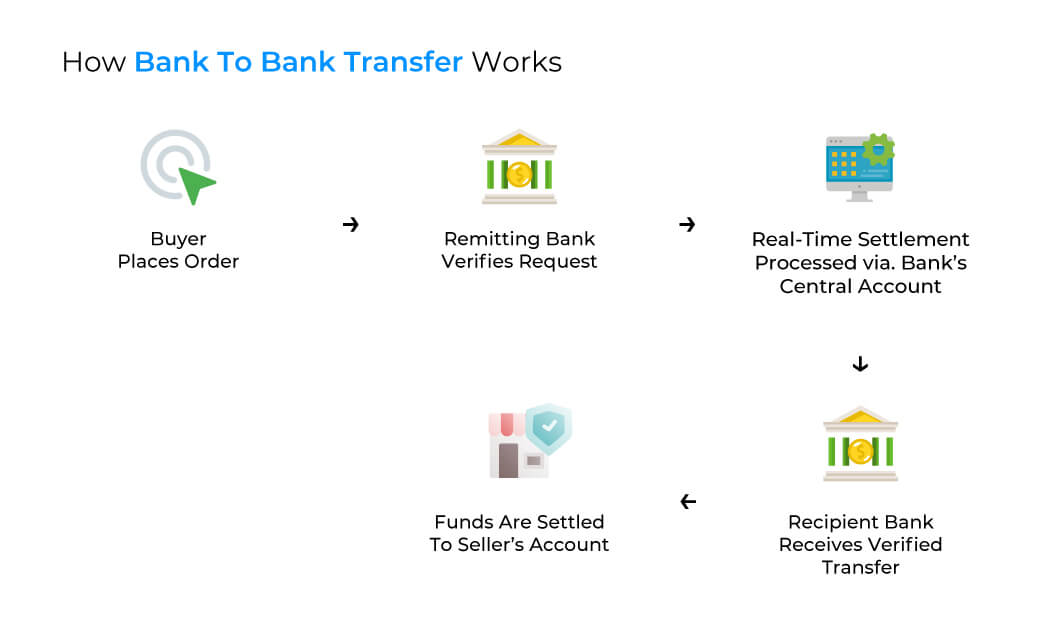

How does bank to bank transfer work?

Let’s understand using an example of a simple B2B payment flow involving a simple online money transfer.

To initiate a transaction, a user most commonly requires the following details:

- Name of the Account holder

- Name of the bank

- IFSC Code

Along with the convenience of getting any service at your fingertips, there are many more advantages of bank to bank transfers. The security provided by online bank transfers makes it a fine alternative to cash and is in comparison a faster alternative to transfer funds. Often, once you set up the payee details on your net banking portal or app, the fund transfer is quick and easy. Furthermore, bank transfers drastically reduce the instances of fraud and counterfeiting and help banking institutions in faster and more efficient payment reconciliation.

What are the Different Types of Bank to Bank Transfers?

RBI has outlined many ways for a user to transfer money from their account to another. Most of these fund transfer methods come with a transaction limit; while some are time/day bound, others are operational 24*7.

NEFT

National Electronic Funds Transfer or NEFT is one of the popular bank transfer methods available across the country. This payment system is owned and operated by RBI and is available round the clock on all days. The essentials for remittance include:

- Beneficiary’s Name

- Beneficiary’s Account Type

- Beneficiary’s Account No.

- Beneficiary’s Branch IFSC

- Beneficiary’s Bank Name (Auto-filled via IFSC)

- Beneficiary’s Branch Name (Auto-filled via IFSC)

In most cases, the remitter receives an SMS or email notification upon successful completion of the transaction. In addition to fund transfers, it finds extensive use in credit card payments, loan repayments, EMIs, and more! The NEFT system processes and transfers funds as batches every half an hour currently.

There are no upper limits set on NEFT, although each bank sets its own limits typically around ₹10 lacs. Similarly, although there are no charges levied on NEFT by RBI, the individual banks may do the same. More about that in the coming sections.

Note: For online money transfers outside India, NEFT supports Nepal under the Indo-Nepal Remittance Scheme.

RTGS

Real Time Gross Settlement or RTGS is an online money transfer system where a continuous and real-time fund transfer & settlement occurs. If we break down the name, Real Time signifies the processing of payments starts right after the request comes in while Gross Settlement denotes these settlements occur individually upon the request.

Once completed, it is not possible to revert an RTGS transaction. Similar to NEFT, there’s no upper limit on transactions and the system is available round the clock, every day! On the other hand, the transaction charges have been capped by RBI and each transaction has legal backing.

IMPS

For any form of online money transfer, users were heavily dependent on NEFT & RTGS. Keeping this in mind, National Payments Corporation of India (NPCI) conducted a pilot study with leading banks in the country to understand the mechanics driving the mobile payment system.

Soon after in November 2010, NPCI introduced IMPS or Immediate Payment Service for transferring funds in real-time and around the clock. Until recently, the upper limit for IMPS was 2 Lakh. Now, RBI has raised it to ₹5 Lakh for channels other than SMS & IVRS (interactive voice response system) enabling easy and instant transfer of large sums of money.

While NEFT & RTGS fall under RBI, IMPS is managed by NPCI.

UPI

Just like the case of IMPS, NPCI set out on yet another quest to dig deep into payments and construct a unified system that brings multiple bank accounts under a single roof. UPI has single-handedly changed the very map of the Indian Payments space.

Don’t just take our word for it. According to an article penned by Mint, UPI transactions more than doubled over a year, touching 2.73 billion in March 2021 as compared to 1.25 billion in 2020.

Why is UPI raging?

- Enables a user to connect and use multiple bank accounts in a single application

- Instantaneous money transfer, anywhere & anytime

- There is no need to enter any sensitive banking data to initiate a transaction

- Two-step authentication and security while retaining seamless usage

- Option to share money by just using phone numbers or QR codes

Although the per transaction limit for UPI can vary from bank to bank, the current limit is ₹1 Lakh.

NACH/e-NACH/e-mandate

National Automated Clearing House or NACH is a payment system that aims to clear high-volume transactions from one bank to another that are recurring and happen at regular intervals.

An improvement to the Electronic Clearing System(ECS), NACH enables same-day setting up while ECS easily takes days together just to get started. The electronic/online counterpart e-NACH takes consent from the user to debit a set amount periodically and is a faster alternative as compared to ECH.

e-NACH and e-Mandates have the same functionalities- facilitating automation of recurring payments. While e-NACH is a standard managed by NPCI, e-mandates are taken care of by individual banks. Offline mandates could take at least 21 days for processing and requires a physical mandate form to set up. On the other hand, a user can set up e-mandates, the online counterpart, in real-time through the net banking services of the bank.

What are the Economics for Different Bank Transfer Methods?

Now that the different kinds of bank transfers, let’s understand the charges involved for each method and draw a comparative study.

NEFT Charges

As of January 2019, RBI has instructed banks to not levy charges on online NEFT to encourage digital transactions. On the other hand, banks like HDFC have the following charges levied if a user initiates a NEFT transfer via a physical branch instead of an online money transfer.

- Upto ₹1,00,000 → ₹2 + Applicable GST

- Above ₹1,00,000 → ₹10 + Applicable GST

These charges are purely for the sending bank to earn as a fee for their services that they provide to their customers, while the recipient bank will not debit anything from the owner’s bank account.

RTGS Charges

With effect from 1st July, 2019, RBI has waived the processing charges levied by it for RTGS transactions, and the same is passed by banks to customers. But, to rationalize the service charges levied by banks, RBI has outlined a broad framework. Similar to NEFT, the economics here are only the service fees by the remitting bank.

- Inward transactions → Free of charge

- Outward transactions

- ₹2 Lakh- to 5 Lakh → Not Exceeding ₹24.50 + Tax

- Above ₹5 Lakh → Not Exceeding ₹49.50 + Tax

The individual banks have the freedom to charge a lower rate; however not above the prescribed amounts by RBI. Similar to NEFT, these charges levied purely serve as a fee for their services.

In addition, in both RTGS and NEFT, the entire chunk of the cost is taken up by the recipient bank since there isn’t a third party involved in this case like NPCI that acts as a switch!

IMPS Charges

The IMPS charges vary from one bank to another. Let’s take the examples of some of the well-known banks in the country to see how the charges vary.

- SBI has levied off all charges on IMPS transfer.

- HDFC offers inward IMPS free of cost. With effect from 15th March 2021, IMPS Fund Transfer Service is free for all Imperia & Preferred HDFC Customers. On the other hand, for outward charges,

- 0 – ₹1000 → ₹3.50 + Applicable GST

- ₹1001 – ₹1,00,000 → ₹5 + Applicable GST

- >₹100000 → ₹15 + Applicable GST

- Similarly, Axis Bank also has a free Inward IMPS money transfer. However, for outward IMPS, (exclusive of taxes, if any), the bank charges per transaction the following fees.

- Upto ₹1000 → ₹ 2.50

- ₹1,000 to ₹1,00,000 → ₹5

- ₹1,00,000 to ₹2,00,000 → ₹10

Here, the economics get interesting, as there is a third party (NPCI) involved in the transaction, and they typically take a flat fee (approximately ₹0.5 per transaction for the first slab), that goes up in value based on the amount.

So now when an API provider charges say ₹2 for an IMPS transaction, this is how the breakdown looks like –

- ₹0.5 gets taken by the API provider for the resilient tech infrastructure, convenience and automatically reconciled ledger that it brings to the table.

- ₹1.5 gets taken by the underlying processing (remitting) bank for its service fees for enabling instant money transfers.

- And, out of the above ₹1.5, further ₹0.5 or more get taken by NPCI that acts as the switch to map this transaction’s destination to the desired bank account in the country.

As you can see, it is no mean feat to enable instant money transfer with so many bank accounts and the key parties involved with each having a very crucial role in this entire process!

UPI Charges

Currently, UPI is free of charge, in an attempt to prompt more user transactions!

Right? Or, so you thought.

While RBI has waived any fee tied to UPI for users, the actual cost that comes with any form of online money transfer is borne by the individual banks. If we were to break down the cost just like the case above, a portion of the cost goes to the API service provider for their tech stack and resilient infrastructure provided. For the rest, the banks take care of the charges internally, and thus the Govt is subsidizing all UPI payments.

e-NACH/e-mandate Charges

For NACH, NPCI charges a very nominal amount from banks & other financial institutions as a service fee. This charge depends on the transaction volume and isn’t usually visible from the point of view of individuals. However, for bulk business transactions, this charge may shoot up significantly.

- ACH 306 (Migrated), ACH Pungrain, ACH Debit → ₹0.20

Further, when it comes to e-mandates, in most cases, the financial & banking institutions don’t charge a fee for enrolling and setting up the same. However, the bank poses a penalty fee in case the user doesn’t have sufficient funds in their account during the time of auto-debit. For example, SBI levies a penalty fee of ₹250 in case of insufficient funds.

How Can Decentro Power-up Your Bank to Bank Payments Stack?

From a consumer point of view, the charges behind each online money transfer may not look troublesome. However, when we look at it from a business kaleidoscope, the view shifts drastically.

Our API banking platform’s pursuit is the very same- the help businesses out there to set up not just a dependable and study payments stack but also to empower them to reduce the added expenditure that comes with each transaction.

UPI: Our Payments APIs help you to employ any of the wire transfer methods we’ve discussed above in addition to UPI and QR codes. Furthermore, your business can brand and white-label these UPI IDs that are tied to each virtual account. Simplify money transfers for your customers and streamline your bookkeeping process while keeping the ledgers up-to-date, all in real-time.

QR Codes: In addition to UPI payments, you can also employ static/dynamic scannable QR codes, and share it with customers for easy payments.

Payment Links for Collections: If your business is struggling with payment collections, this would also be the right time to bid adieu. Share payment links in real-time with your customers via social channels like WhatsApp and reduce collection costs by 5X!

On a Concluding Note

Stay tuned. Why?

We’re also bringing you UPI deep linking and Recurring Payments automation via UPI & ENACH!

Oh, we almost forgot! If you are using a payment gateway and paying a hefty service fee to them for each transaction, we help you remove that expense from the equation as well. Launch your own payments infrastructure with our APIs, within weeks(instead of months that is usually the case for any financial integration) and at over 90% reduced overheads. Don’t just take our word for it- join the likes of our customers like Zoozle, Workflexi, Saveo, & North Loop.

Sounds like an investment your business needs? Let us help you! How does a virtual coffee chat sound? We’re always up at hello@decentro.tech!

Until we see you next time.

Cheers!