Explore the future of insurance in India with these top InsurTech players. Discover how the top InsurTech companies in India are making insurance smarter and more accessible.

Top InsurTech Companies in India

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

A Quick Glance

| Company Name | Value Proposition |

| Fincover | NextGen fintech platform and insurance aggregator |

| BankSathi | A pioneering digital platform that streamlines users’ financial decision-making by offering a comprehensive suite of financial products. |

| Ditto Insurance | Simplified health and term insurance plans with guarantees of no spam calls. |

| PolicyBazaar | India’s topmost insurance marketplace. |

| Digit | Seamless online claim processing |

| Coverfox | Combines digital and human expertise for a streamlined customer experience |

| Paytm Insurance | Policy issuance within 2 minutes |

| TurtleMint | Personalised policy recommendations for every customer |

| Acko General Insurance | Lightning-fast claim processing |

| Pazcare | India’s leading employee benefits platform |

| RenewBuy | Simplifies insurance buying and renewal |

| Toffee Insurance | One of India’s biggest micro-insurance companies |

| OneInsure | Multiple insurance products all under one roof |

| GroMo | A social commerce platform that helps bridge the financial literacy gap |

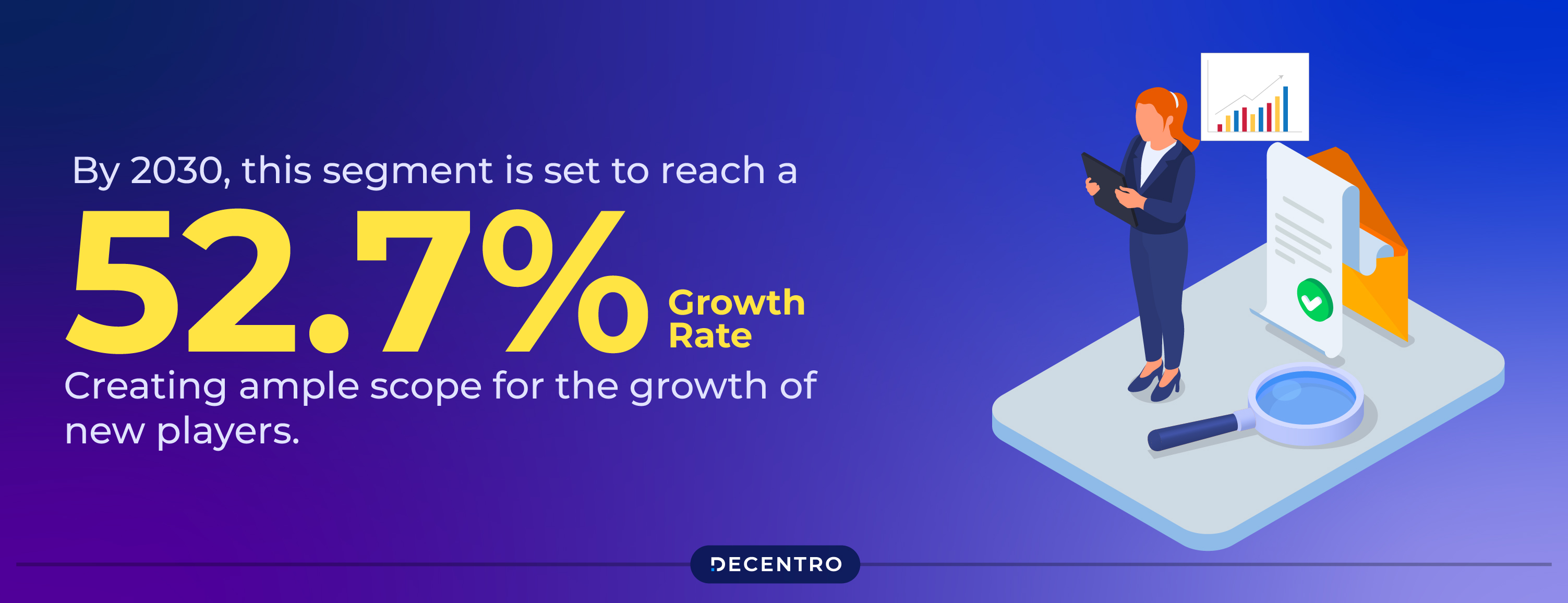

With the increasing adoption of digital technologies by insurance platforms, InsurTech companies are making it big in the Indian market. By 2030, this segment is set to reach a 52.7% growth rate, creating ample scope for the growth of new players.

Check out India’s top InsurTech companies and this segment’s future prospects.

Traditionally, the Indian insurance industry has lacked transparency. Earlier, people had to rely mainly on agents for information on their policies, and they needed help to compare different schemes, check their features and benefits, and select one that best suited their needs.

Insurance technology, or InsurTech, has changed the game by bridging the gap between insurance companies and their customers. Policy seekers can now check out the entire product range online and decide the type of cover they wish to choose from the comfort of their smartphones.

Meanwhile, insurance providers can leverage AI and ML models to solve customer queries, integrate insurance CRM systems, use automation to digitally generate policies, and big data to get a better idea of their clients’ risk profiles.

Besides online aggregation, InsurTech has also led to the rise of various segments like underwriting, analytics services, specialised insurance, and more.

In this regard, here are the top InsurTech companies in India:

Fincover

Fincover is a fintech startup, existing from 2020. It is a one-stop platform for all things to finance, leveraging the power of technology. Fincover provides a platform that enables the user to search and locate the best financial products suited to their needs and wants. They have partnered with India’s leading insurers (23 insurance), 50+ banks and NBFCs, and 35 + Mutual Fund companies to distribute their products. Insurance products offered include:

- Health Insurance

- Life Insurance

- Travel Insurance

- Motor Insurance

- Home Insurance

- Fire Insurance

- Marine Insurance

Within a year from inception, they have disbursed more than Rs. 100 crore secured and unsecured loan amount from various banks and NBFCs in the last financial year and over 10000+ Insurance policies.

The company is targeting a 5X growth in the upcoming year and aims to cross Rs. 500 crore annualized disbursal run rate. Point of Sales persons (PoSP) can use their App or Web portal to assist customers in their financial journey.

Pros:

- Partnered with India’s leading Insurers (23 insurance)

- Over 10000+ Insurance policies in Last Financial year

- Point of Sales persons (PoSP) can use their App or Web portal & Earn 1 lakh per month

BankSathi

BankSathi is a digital platform designed to simplify users’ financial decision-making. It offers a range of financial products, including:

- Credit Cards

- Loans

- Savings Accounts

Empowering Financial Advisors:

BankSathi provides financial advisors with powerful tools to recommend the most suitable financial products to their clients, enhancing their advisory services and ensuring clients make informed decisions.

Ditto Insurance

Ditto Insurance was founded in 2021 by Pawan Kumar Rai, Shrehith Karkera, Bhanu Harish Gurram, and Lokesh Gurram (a group of four friends), attempting to simplify insurance for the world. Ditto offers a platform where its clients can get free and unbiased consultation on insurance products and receive guidance about the best insurance plans in the market, according to their customised financial goals, requirements, and premium payment bandwidth.

The company primarily deals with 2 types of insurance products –

- Health Insurance Plans

- Term Insurance Policies

Within 3 years of its inception, the brand had over 3 lakh customers who had opted for its free consultation services and offered glowing reviews across social media platforms. This brand is among the top LinkedIn startups and has notably disrupted the insurance industry with its no-spam policy and an expert team of advisors who are more keen on educating you and guiding you towards the right insurance plan rather than making a sale.

You can simply visit their website and book your free consultation (call-back) based on availability or request for their WhatsApp service.

Pros:

- No spam calls

- Free consultation calls

- Expert insurance advisory group to guide you for the best insurance plan that suits your financial requirement

- Expert guidance to help you with your claims

- No pressure to purchase policies

- Reach out via the website to book calls or WhatsApp services

PolicyBazaar

Incepted in 2008, PolicyBazaar is one of India’s largest and most popular insurance websites. It is a pioneer of the InsurTech sector and occupies a 90% share in online insurance sales. This platform lets individuals compare and purchase various insurance policies and investment options, including:

- Health Insurance

- Life Insurance

- Travel Insurance

- Auto Insurance

Additionally, it offers numerous advanced features like policy renewal reminders, a premium calculator, and dedicated claims assistance.

The platform is powered by AI chatbots that can resolve customer queries 24/7.

In 2018, PolicyBazaar became a part of the unicorn club after raising over $200 million. For the company’s expansion plan in the Middle East and UAE, about $75 million was raised.

Pros:

- Extensive network offering 250+ policies from 50+ insurers

- A comprehensive approach to scheme comparisons

- User-friendly interface with AI-powered tools

Digit Insurance

Developed in 2016, Digit Insurance is on a mission to simplify the process of availing insurance. Its USP is its paperless claim settlement approach, enabling customers to process claims online, thus significantly reducing turnaround time.

The company’s data-driven approach also allows it to analyse customers’ risk profiles and offer tailored insurance solutions. This results in optimised policy pricing, which enhances affordability without compromising coverage quality.

Furthermore, Digit has a vast portfolio of

- Cars and Commercial Vehicle Insurance

- Property Insurance

- Travel Insurance

- Health Insurance

Since 2017, the company has raised more than $280 million from InsureTech. Digit is the first brand to join the unicorn club (in 2021).

Pros:

- Paperless claim settlement for quick processing

- Diverse portfolio covering multiple insurance categories

- Compensation for flight delays over 75 minutes

- ‘Pay As You Drive’ scheme is ideal for those who drive less

Coverfox

Established in 2013, Coverfox is a new-age InsurTech platform that combines technology and human expertise to provide a top-notch customer experience. Individuals can check out various policies from multiple providers, including products like:

- Home Insurance

- Health Insurance

- Term Life Insurance

- Travel Insurance

- Car and Bike Insurance

Meanwhile, the platform’s AI-powered recommendation engine assesses the customer’s profile and suggests policies that cater to their needs. Coverfox’s insurance experts also guide customers through the buying journey, from purchasing a policy to claiming settlement.

Pros:

- Comprehensive tools for policy suggestion

- The platform is quite user-friendly

- Dedicated team for customer support

Paytm Insurance

Launched in 2022, Paytm Insurance is an online marketplace where customers can compare and buy insurance policies from India’s leading insurers. It offers a vast range of insurance products that include:

- Term Insurance

- Health Insurance

- Bike Insurance

- Taxi Insurance

Paytm facilitates its policy issuance within 2 minutes. The process is entirely paperless, and the claim settlement team is available 24/7 to handle all queries.

Despite being a newcomer in the industry, the company secured ₹920 crore in funding from Swiss Re before its ₹18,300 crore IPO, with ₹397 crore already received.

Pros:

- Quick policy issuance within 2 minutes

- Best price guarantee and top deals

- Completely paperless process

TurtleMint

TurtleMint is a leading Indian InsurTech platform launched in 2015 to simplify insurance buying and its associated service processes. The platform’s intuitive user interface allows customers to seamlessly compare policies from multiple providers and choose one that best suits their needs.

Apart from the advanced AI and data analytics tools TurtleMint offers, a dedicated team guides individuals through the claim settlement process. The policies provided by them include:

- Life Insurance

- Health Insurance

- Car Insurance

Apart from this, TurtleMint is playing a huge role in financial inclusion, extending its services to underserved regions through its partnership with several leading insurance providers. The company has secured over $120 million in funding from investors such as Amansa Capital, Jungle Ventures, and Nexus Venture Partners.

Pros:

- Personalised insurance advice through algorithm-driven suggestions

- Access over 40 insurers for diverse coverage options

- Dedicated assistance throughout the claims process

Acko General Insurance

Acko General Insurance is another stalwart on the list of top InsurTech companies in India. It has revolutionised insurance buying by adopting a digital-first approach. The platform leverages artificial intelligence and data analytics to assess customers’ risk profiles and suggest personalised solutions. The products include:

- Mobile Insurance

- Bike, Car, and Cab Insurance

- Health Insurance

Thanks to its user-friendly mobile app, Acko offers lightning-fast claim processing and quicker settlements, enabling customers to track the entire claim settlement process.

Furthermore, Acko promotes financial inclusion by offering the rural population comprehensive plans and micro-insurance schemes. The company attained unicorn status by raising $255 million at a valuation of $1.1 billion in a fundraising round on October 27, 2021.

Pros:

- Unique microinsurance for cab passengers

- Customised pricing streamlines the insurance process

Pazcare

Founded in 2009, Pazcare is a leading InsurTech and employee benefits platform that makes it easier for employers to provide insurance coverage to their workforce. Its product portfolio includes:

- Group Term Life Insurance

- Group Health Insurance

- Group Personal Accident Insurance

Additionally, companies can handpick which benefits they want for their employees and digitally monitor claim status and benefits usage, which saves a lot of time.

According to the latest post-round ownership report as of June 27, 2022, Pazcare holds 45.10% ownership with a net worth of INR 166 crore.

Pros:

- Employee benefits and wellness solutions

- User-friendly dashboard for the HRs

RenewBuy

Founded in 2015, RenewBuy simplifies insurance buying and renewal by providing a user-friendly platform. There, customers can compare various policies, get instant quotes, and choose one that best suits their needs.

The company’s product portfolio includes:

- Health Insurance

- Life Insurance

- Commercial Vehicles Insurance

- Private Cars Insurance

- Two-Wheeler Insurance

Securing a notable $40 million in funding validates the market’s confidence in their model. They boast an imposing testimonials section.

Pros:

- Swift policy issuance through digital optimisation

- Varied insurance portfolio

- 24/7 customer care service for continuous support

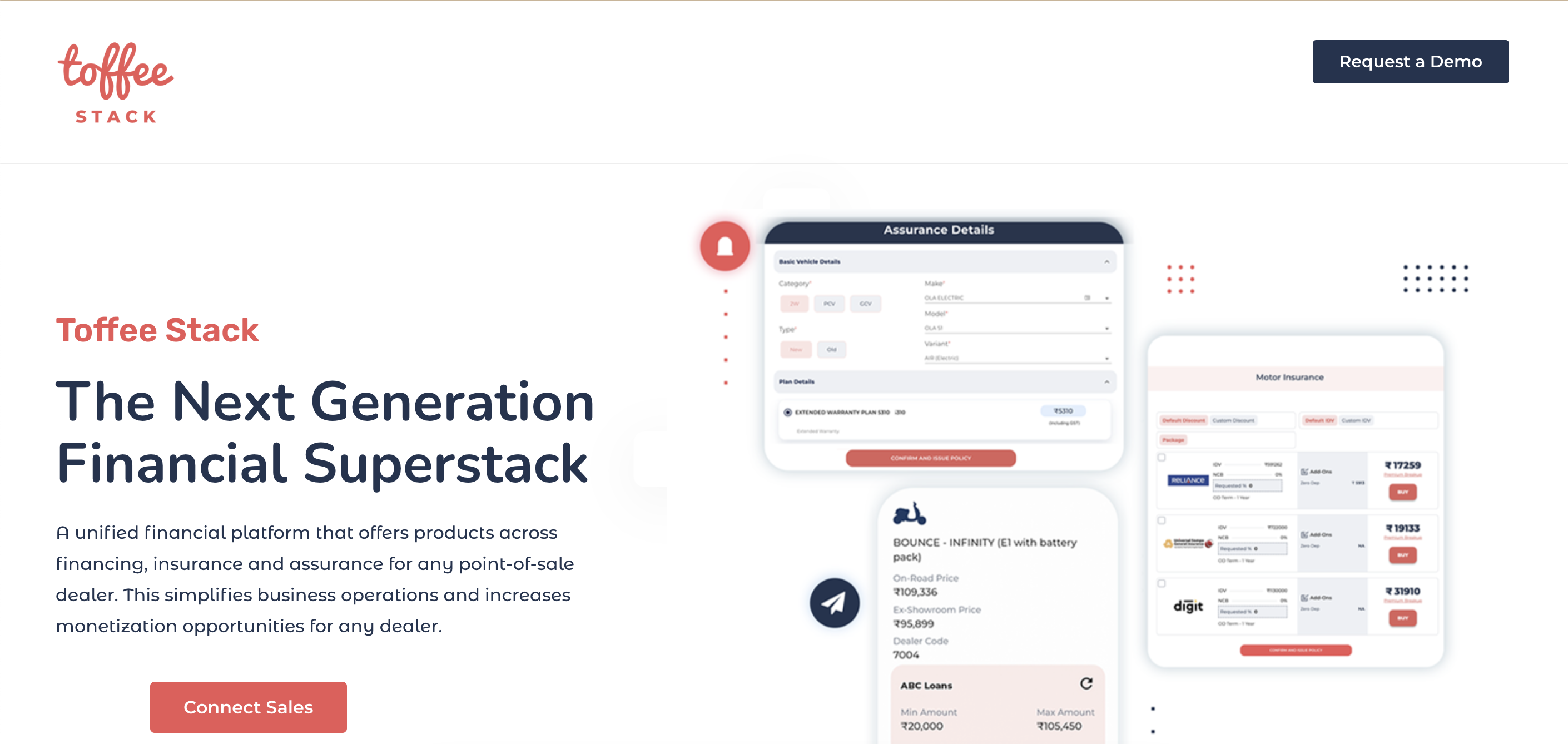

Toffee Insurance

Incepted in 2017, Toffee Insurance is a micro-insurance platform that offers a unique variety of insurance products like coverage for:

- Electric Vehicles

- Cycles

- EdTech

- On-Site Services

- Pets

- One-Click Purchases

- Online Appointments

Toffee Insurance has a pan-India team of agents that processes and handles claims. The company also offers insurance packages for corporates and has raised funding exceeding $5.5 million from investors such as Accion Venture Lab, Omidyar Network, and Kalaari Capital.

Pros:

- Coverage for bicycle or backpack damages

- Protection against injuries at the gym or during daily commutes

- Insurance against mosquito-borne illnesses

OneInsure

Incepted in 2011, OneInsure enables customers to check out various insurance plans all under one roof. They include:

- Health Insurance

- Life Insurance

- Two-Wheeler Insurance

- Car Insurance

The platform leverages advanced algorithms that simplify claim processing and facilitate faster settlements, reducing turnaround time.

Pros:

- Wide range of products

- Convenient comparison and purchase platform

- Established expertise since 2011

GroMo

Gromo is a social platform dedicated to financial products and instruments. Its mission is simple and powerful: financial inclusion of the country’s underserved population. In this pursuit, this financial product aggregator platform empowers micro-entrepreneurs by enabling them to serve millions of customers. Above all, Gromo’s underlying partnerships with Banks, NBFCs, and the like help them to create a seamless pipeline of financial products such as insurance, loans, and cards.

Recently, the fintech startup received an Insurance Broking License (General & Life) from the Insurance Regulatory and Development Authority of India (IRDAI).

Interestingly, we at Decentro have been part of Gromo’s account validation journey. When we chatted with Darpan Khurana, Gromo’s co-founder, here is what he had to say.

Great work by Team Decentro. Happy to be one of the early Customers, and it has been seamlessly good so far. Using penny drop APIs to validate bank account details of thousands of our Agents to ensure a timely future payout.

Darpan Khurana, Co-founder, Gromo

User-Friendly Experience:

With a focus on convenience and efficiency, BankSathi’s platform is designed to be intuitive and easy to navigate, making it simple for users to explore and choose the best financial solutions.

The Future of InsurTech Companies in India

In the future, InsurTech companies can offer much more than just insurance policies. They can transform into platforms where customers can find related services like health consultations, asset management, etc.

Moreover, insurers can leverage AI and data analytics to monitor customer health metrics, behaviour, and other external factors to recommend personalised policy. The insurance segment can also expand into several niches, like digital asset cover, event-specific coverage, pet insurance, and more.

Thus, there is ample room for new companies to enter and expand their business in this industry. However, to become one of the top InsurTech companies in India, partnering with a reliable feature-rich payment platform is a must.

Decentro’s payment solutions and APIs can be a perfect choice.

Our Multi-Collect solution enables your business to create custom virtual accounts for all your customers and collect funds seamlessly through various methods like UPI/NEFT/RTGS/IMPS.

Moreover, our e-NACH and UPI Autopay APIs allow you to automate recurring payment collection with a single click!

With our KYC & Onboarding APIs, you can perform real-time KYC verifications, thus significantly reducing customer drop-offs.

What else can we do to help start your InsurTech company?

Frequently Asked Questions

India’s InsurTech market is estimated to be around $339 billion.

To start an InsurTech company in India, you must make a Form IRDA/R1 application, the business’s certificate of incorporation, and other necessary documents.

The InsurTech segment can be divided into Home, Auto, Travel, Specialty, Business, and Others.